Global Chip Scale Package Csp Led Market

Market Size in USD Billion

CAGR :

%

USD

4.05 Billion

USD

15.22 Billion

2024

2032

USD

4.05 Billion

USD

15.22 Billion

2024

2032

| 2025 –2032 | |

| USD 4.05 Billion | |

| USD 15.22 Billion | |

|

|

|

|

Chip Scale Package (CSP) LED Market Size

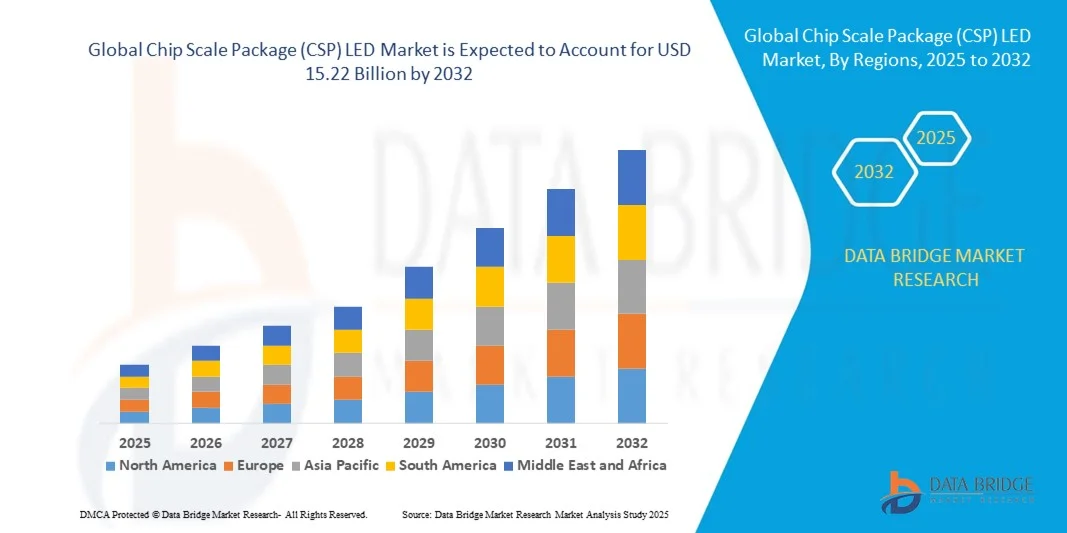

- The global chip scale package (CSP) LED market size was valued at USD 4.05 billion in 2024 and is expected to reach USD 15.22 billion by 2032, at a CAGR of 18.0% during the forecast period

- The market growth is largely fueled by the increasing demand for energy-efficient, compact, and high-performance lighting solutions across industrial, automotive, and consumer electronics applications. Rapid advancements in CSP LED technology, including enhanced luminous efficacy, thermal management, and miniaturization, are enabling broader adoption across diverse sectors

- Furthermore, rising consumer and industrial demand for high-brightness, durable, and reliable LEDs for displays, architectural lighting, and automotive systems is driving market expansion. These converging factors are accelerating the uptake of CSP LEDs, thereby significantly boosting the overall industry growth

Chip Scale Package (CSP) LED Market Analysis

- CSP LEDs are miniature, high-efficiency light-emitting diodes with compact packages that allow for superior thermal performance, low energy consumption, and high luminous output. These LEDs are widely used in display backlighting, automotive lighting, industrial illumination, and general-purpose lighting applications

- The escalating demand for CSP LEDs is primarily fueled by the rapid growth of consumer electronics, increasing adoption of energy-efficient and smart lighting solutions, and the need for compact, high-performance lighting in automotive, industrial, and residential sectors

- North America dominated the chip scale package (CSP) LED market with a share of over 35% in 2024, due to strong demand for energy-efficient lighting, advanced display technologies, and industrial automation applications

- Asia-Pacific is expected to be the fastest growing region in the chip scale package (CSP) LED market during the forecast period due to rapid industrialization, technological advancement, and rising demand for energy-efficient lighting in countries such as China, Japan, and India

- Low and mid-power segment dominated the market with a market share of 58.7% in 2024, due to its extensive use in display backlighting, signage, and small-scale lighting applications. These LEDs are preferred for their compact design, energy efficiency, and ability to deliver consistent illumination in confined spaces. Their compatibility with consumer electronics and flexible integration into various devices further enhances their demand. The segment benefits from widespread adoption in residential and commercial lighting, where lower power LEDs are sufficient for achieving desired brightness while minimizing energy consumption

Report Scope and Chip Scale Package (CSP) LED Market Segmentation

|

Attributes |

Chip Scale Package (CSP) LED Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Chip Scale Package (CSP) LED Market Trends

Rising Use of CSP LEDs in Automotive and Industrial Lighting

- The adoption of chip scale package (CSP) LEDs is gaining momentum in automotive and industrial lighting applications due to their compact design, high brightness, and superior energy efficiency. These LEDs enable slimmer, more efficient lighting solutions that meet modern design and performance requirements across sectors

- For instance, Lumileds supplies CSP LEDs for automotive headlights that deliver high lumen output with smaller form factors, enabling advanced designs for sleek vehicle lighting. Similarly, Seoul Semiconductor’s CSP solutions are widely used in industrial and automotive segments, providing enhanced brightness and long lifespan

- CSP LEDs are increasingly being applied in automotive headlamps, daytime running lights, and interior illumination due to their thermal efficiency and reliability. These features are critical for supporting the growing demand for high-performance automotive lighting as vehicles become more design-focused and technologically advanced

- In industrial environments, CSP LEDs are used in high bay and factory lighting where energy efficiency, durability, and heat management are essential. Their compact design allows higher light density, facilitating robust illumination in demanding production spaces and warehouses

- CSP LEDs also support advanced features such as adaptive automotive lighting, where compact configurations enable flexible designs and high optical precision. This adaptability makes them increasingly preferred for both safety and aesthetic applications in modern vehicles and other industrial systems

- Overall, the rising integration of CSP LEDs in automotive and industrial lighting demonstrates their transformative role across energy-efficient lighting solutions. Their combination of compactness, brightness, and design flexibility ensures sustained adoption across key end-use industries

Chip Scale Package (CSP) LED Market Dynamics

Driver

Growing Demand for Energy-Efficient, High-Brightness, Compact LEDs

- The global emphasis on energy efficiency, coupled with the need for compact and high-performance lighting solutions, is a major driver for CSP LEDs. Their ability to deliver high lumen output in smaller packages makes them suitable for next-generation applications in automotive, industrial, and consumer electronics

- For instance, Samsung Electronics has developed CSP LED lines that offer superior brightness in compact designs for automotive headlights, backlighting, and industrial solutions. Companies such as OSRAM Opto Semiconductors also provide advanced CSP LEDs tailored for high-demand use cases where efficiency and longevity are critical

- CSP LEDs deliver significant advantages such as reduced power consumption, higher thermal stability, and long operational lifespans. This ensures cost efficiency over extended periods, making them ideal replacements for traditional lighting solutions where sustainability is increasingly valued

- Their high light density and optical control capabilities allow flexible applications ranging from compact displays to robust industrial lighting. Industries are adopting these benefits to enhance energy savings while achieving superior illumination performance across business and consumer use cases

- The rising adoption of CSP LEDs underscores the market’s transition toward compact, efficient, and versatile lighting technologies. Enterprises across automotive, consumer devices, and industrial operations are aligning with CSP LEDs to strengthen product performance and ensure long-term sustainability in their lighting systems

Restraint/Challenge

High Manufacturing and Integration Costs

- The complex manufacturing process of CSP LEDs, which requires advanced materials and precision assembly, contributes to higher production costs compared to conventional LED packages. These costs become particularly challenging for vendors seeking to address price-sensitive markets

- For instance, manufacturers such as Nichia and Cree have highlighted the investment challenges in expanding CSP LED production lines due to the precision and technology required for mass production. Integration into automotive and industrial systems further adds cost burdens associated with heat management and optical design

- The requirement for specialized processes such as wafer-level packaging and enhanced thermal interfaces increases overall costs. These advanced processes are necessary to achieve compactness and performance but restrict production scalability for many small and mid-sized players

- In addition, OEMs face integration challenges as CSP LEDs sometimes demand new system designs and heat dissipation solutions, leading to added development time and resource allocation. This can hinder adoption in industries with stringent cost structures or limited budgets

- Addressing the high cost of CSP LED manufacturing and system integration will require economies of scale, continued process innovation, and cost-reduction efforts by manufacturers. Overcoming this challenge is essential to unlocking broader applications and ensuring future growth in the global CSP LED market

Chip Scale Package (CSP) LED Market Scope

The market is segmented on the basis of application, power range, and end-user.

- By Application

On the basis of application, the CSP LED market is segmented into BLU, General Lighting, Automotive Lighting, Flash Lighting, and Others. The BLU (Backlight Unit) segment dominated the largest market revenue share in 2024, driven by its critical role in display technologies such as smartphones, tablets, laptops, and TVs. CSP LEDs in BLU applications are preferred for their compact size, high luminous efficiency, and ability to deliver uniform brightness across screens. Rising demand for high-resolution and energy-efficient displays further reinforces the segment’s dominance. Moreover, advancements in miniaturized lighting technology and enhanced thermal management in CSP LEDs make them highly compatible with modern electronic devices, strengthening their market position.

The Automotive Lighting segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by growing adoption in automotive interior and exterior lighting solutions. CSP LEDs provide enhanced brightness, energy efficiency, and longer operational lifespans, making them suitable for headlamps, tail lamps, and ambient lighting in vehicles. Increasing consumer demand for aesthetically appealing, safer, and energy-efficient automotive lighting systems drives the rapid adoption of CSP LEDs in this sector. In addition, stringent automotive regulations regarding energy consumption and lighting performance further propel market growth.

- By Power Range

On the basis of power range, the CSP LED market is segmented into Low and Mid-Power and High-Power. The Low and Mid-Power segment dominated the market with a share of 58.7% in 2024, attributed to its extensive use in display backlighting, signage, and small-scale lighting applications. These LEDs are preferred for their compact design, energy efficiency, and ability to deliver consistent illumination in confined spaces. Their compatibility with consumer electronics and flexible integration into various devices further enhances their demand. The segment benefits from widespread adoption in residential and commercial lighting, where lower power LEDs are sufficient for achieving desired brightness while minimizing energy consumption.

The High-Power segment is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding applications in automotive, industrial, and outdoor lighting. High-power CSP LEDs offer superior luminous output and thermal performance, making them ideal for applications that require intense illumination. Rapid urbanization, infrastructure development, and increasing focus on energy-efficient street and industrial lighting are major growth drivers. Technological advancements enabling better heat dissipation and longer operational life also contribute to accelerating adoption of high-power CSP LEDs.

- By End User

On the basis of end user, the CSP LED market is segmented into Industrial, Residential, and Commercial. The Industrial segment dominated the largest market revenue share in 2024, owing to the increasing deployment of CSP LEDs in factory automation, machine vision systems, and high-intensity task lighting. Industrial applications require reliable, high-performance, and long-lasting lighting solutions, all of which CSP LEDs provide. Their compact form factor, energy efficiency, and superior thermal management make them highly suitable for industrial environments. Moreover, growing investments in smart factories and automated production systems are further driving the dominance of industrial applications.

The Commercial segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by rising adoption in retail, hospitality, and office lighting. CSP LEDs offer attractive design flexibility, higher energy savings, and enhanced lighting quality, which appeal to commercial establishments aiming to reduce operational costs and improve ambiance. Increasing emphasis on sustainable and energy-efficient building solutions further propels the market. In addition, integration with smart lighting controls and IoT-enabled systems boosts the rapid adoption of CSP LEDs in commercial environments.

Chip Scale Package (CSP) LED Market Regional Analysis

- North America dominated the chip scale package (CSP) LED market with the largest revenue share of over 35% in 2024, driven by strong demand for energy-efficient lighting, advanced display technologies, and industrial automation applications

- Consumers and businesses in the region prioritize high-performance, compact, and reliable lighting solutions, fueling adoption in residential, commercial, and industrial sectors

- This widespread demand is further supported by a technologically advanced population, high disposable incomes, and strong industrial and electronics manufacturing presence, establishing CSP LEDs as a preferred solution for diverse applications

U.S. CSP LED Market Insight

The U.S. CSP LED market captured the largest revenue share in 2024 within North America, fueled by rapid adoption in consumer electronics, automotive lighting, and industrial applications. Increasing demand for compact, high-brightness, and energy-efficient LEDs drives growth, alongside the expanding trend of smart devices and high-resolution displays. The integration of CSP LEDs in smartphones, tablets, laptops, and automotive systems further propels market expansion. Moreover, rising industrial automation and lighting modernization initiatives in commercial and residential sectors are supporting the U.S. market’s dominance.

Europe CSP LED Market Insight

The Europe CSP LED market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing industrial automation, automotive LED adoption, and energy-efficient lighting initiatives. Rising urbanization, coupled with regulatory mandates for sustainable and low-power lighting solutions, is fostering adoption across residential, commercial, and industrial applications. European consumers are increasingly favoring high-efficiency, compact lighting solutions for displays and lighting, contributing to the growth of CSP LEDs in the region.

U.K. CSP LED Market Insight

The U.K. CSP LED market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for energy-efficient and compact lighting solutions in commercial, residential, and automotive applications. Concerns over energy consumption, coupled with government incentives for sustainable lighting, encourage adoption. The U.K.’s advanced electronics and display sector, alongside growing smart device usage, continues to support market expansion.

Germany CSP LED Market Insight

The Germany CSP LED market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s emphasis on industrial automation, energy-efficient lighting, and high-tech display manufacturing. Germany’s strong focus on innovation, sustainability, and advanced manufacturing infrastructure promotes CSP LED adoption across industrial, automotive, and commercial sectors. Increasing integration of CSP LEDs in high-performance lighting and electronics solutions further strengthens market growth.

Asia-Pacific CSP LED Market Insight

The Asia-Pacific CSP LED market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid industrialization, technological advancement, and rising demand for energy-efficient lighting in countries such as China, Japan, and India. The region’s booming consumer electronics and automotive sectors are major growth drivers, alongside government initiatives promoting energy-efficient infrastructure and smart cities. In addition, APAC’s role as a manufacturing hub for LED components ensures affordability and widespread availability of CSP LEDs.

Japan CSP LED Market Insight

The Japan CSP LED market is gaining momentum due to the country’s high-tech electronics sector, growing automotive applications, and increasing adoption of energy-efficient lighting solutions. Japanese consumers and businesses favor compact, high-performance, and reliable LEDs, driving growth in industrial, automotive, and display applications. Integration with smart electronics, high-resolution displays, and advanced automotive lighting systems further supports market expansion.

China CSP LED Market Insight

The China CSP LED market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding industrial and consumer electronics sectors, and rising demand for energy-efficient lighting. The country’s large manufacturing base, strong domestic LED producers, and government initiatives supporting smart cities and sustainable infrastructure contribute to robust adoption. CSP LEDs are increasingly utilized across automotive, industrial, and display applications, further solidifying China’s position as the regional market leader.

Chip Scale Package (CSP) LED Market Share

The chip scale package (CSP) LED industry is primarily led by well-established companies, including:

- Lumileds Holding B.V. (Netherlands)

- OSRAM Opto Semiconductors GmbH. (Germany)

- SAMSUNG Semiconductor Co., Ltd. (South Korea)

- LG INNOTEK (South Korea)

- NICHIA CORPORATION (Japan)

- Cree, Inc. (U.S.)

- Genesis Photonics Inc. (Taiwan)

- SEMILEDS CORPORATION (Taiwan)

- Lumens Co., Ltd. (South Korea)

- Lextar Electronics Corporation (Taiwan)

- Shenzhen MTC (China)

- Unistars (China)

- Plessey (U.K.)

- ShenZhen Dpower Opto-electronic Co.,Ltd (China)

- Hongli Zhihui Group Co.,LTD. (China)

- Bridgelux, Inc. (U.S.)

- ProLight Opto Technology Corporation (Taiwan)

- EVERLIGHT ELECTRONICS CO., LTD. (Taiwan)

Latest Developments in Global Chip Scale Package (CSP) LED Market

- In August 2024, Samsung Electronics introduced the LM101B, a 1W-class mid-power LED, and LH231B, a 5W-class high-power LED, both built with enhanced CSP technology. These new LED packages offer industry-leading efficacy and reliability for spotlights and high-bay lighting applications. The development is expected to drive adoption in commercial and industrial lighting sectors, where energy efficiency, compact design, and long operational life are highly valued

- In August 2024, Cree LED launched the XLamp XE-G CSP LEDs, delivering improved energy efficiency and higher light output with lower forward voltage compared to previous models. The LEDs are suitable for applications including architectural lighting, indoor directional lighting, and aftermarket automotive lighting. Their enhanced performance is likely to boost demand among designers and manufacturers seeking high-efficiency solutions for new installations and retrofit projects

- In June 2024, Nichia unveiled the NFSWL11A-D6 white LED, designed to achieve horizontal light distribution using advanced phosphor and LED technologies. This innovation produces soft, low-glare illumination and enables thinner, lighter lighting fixtures. The development is expected to expand CSP LED adoption in residential and commercial environments where visual comfort, aesthetics, and energy efficiency are increasingly prioritized

- In May 2024, Empower Semiconductor introduced the EC1005P, the largest silicon capacitor in its ECAP product family, featuring 16.6µF capacitance and ultra-low impedance up to 1GHz. This compact CSP design with sub-1pH ESL and sub-3mΩ ESR enhances voltage stability in high-performance SoCs, making it ideal for HPC and AI applications. Its integration into CSP LED modules is expected to improve driver performance and reliability, supporting advanced electronic and industrial applications

- In February 2024, Nichia launched Cube Direct Mountable Chip CSP LEDs with side-emitting capabilities, providing ultra-wide light distribution. This technology allows for thinner, lighter luminaires with reduced glare and improved uniformity, making it especially suitable for architectural lighting, signage, and other space-constrained applications. The development is likely to drive CSP LED adoption where efficient, diffuse lighting is critical

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chip Scale Package Csp Led Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chip Scale Package Csp Led Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chip Scale Package Csp Led Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.