Global Chipboard Packaging Market

Market Size in USD Billion

CAGR :

%

USD

14.11 Billion

USD

28.12 Billion

2024

2032

USD

14.11 Billion

USD

28.12 Billion

2024

2032

| 2025 –2032 | |

| USD 14.11 Billion | |

| USD 28.12 Billion | |

|

|

|

|

What is the Global Chipboard Packaging Market Size and Growth Rate?

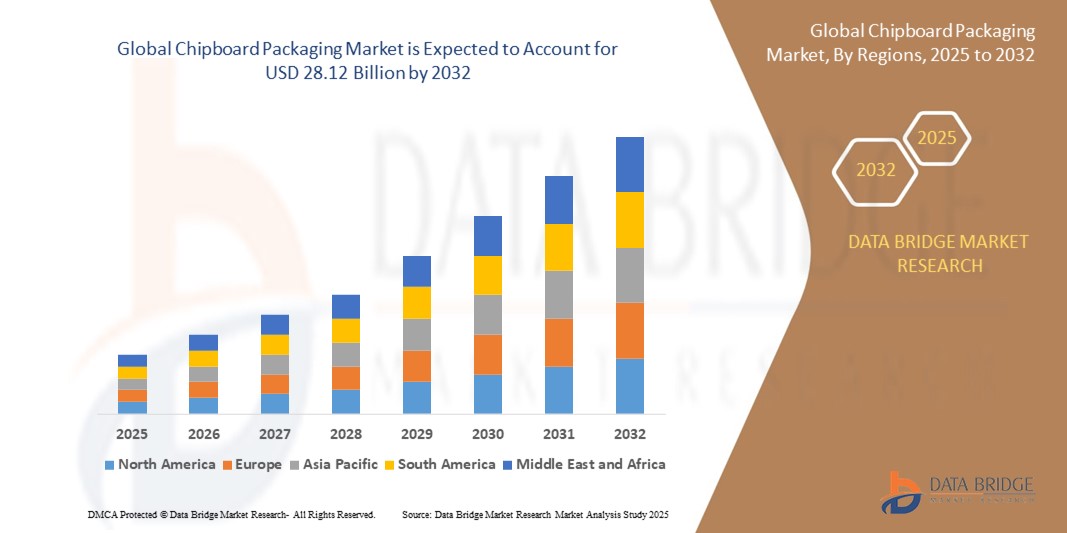

- The global chipboard packaging market size was valued at USD 14.11 billion in 2024 and is expected to reach USD 28.12 billion by 2032, at a CAGR of 9.00% during the forecast period

- The chipboard packaging market serves diverse industries, including pharmaceuticals, electronics, jewellery, household and decorative items, food and beverage, and more. In pharmaceuticals, chipboard boxes ensure the safe transportation of medicine

- Electronics relies on chipboard packaging to protect delicate components during shipping. Jewellery packaging often utilizes chipboard materials for elegant presentation

- Similarly, household items and decorative products benefit from chipboard packaging for protection and aesthetics, reflecting the market's versatility and widespread application

What are the Major Takeaways of Chipboard Packaging Market?

- Consumers and businesses asuch as are prioritizing sustainable packaging options to reduce environmental impact. Chipboard packaging, made from recycled materials and biodegradable components, aligns with these preferences

- As companies seek to enhance their sustainability profiles and meet regulatory requirements, the demand for chipboard packaging continues to rise, driving innovation and market expansion in eco-friendly packaging

- North America dominated the chipboard packaging market with the largest revenue share of 42.01% in 2024, fueled by the booming e-commerce sector, growing demand for sustainable packaging, and a strong focus on consumer-ready retail packaging

- Asia-Pacific chipboard packaging market is projected to grow at the fastest CAGR of 9.24% from 2025 to 2032, driven by rising urbanization, growing middle-class consumption, and a shift toward eco-conscious packaging in countries such as China, India, and Japan

- The brown chipboard segment dominated the market with the largest revenue share of 61.4% in 2024, driven by its cost-effectiveness, recyclability, and widespread use in secondary and tertiary packaging

Report Scope and Chipboard Packaging Market Segmentation

|

Attributes |

Chipboard Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Chipboard Packaging Market?

“Sustainability and Eco-Friendly Packaging Solutions”

- A defining trend in the global chipboard packaging market is the growing emphasis on sustainable, recyclable, and biodegradable packaging solutions. With mounting environmental concerns and increasing pressure from regulatory bodies, manufacturers are turning to eco-friendly chipboard materials that reduce carbon footprints without compromising durability

- For instance, WestRock Company has launched fiber-based packaging innovations using 100% recycled content, offering an alternative to plastic and reducing landfill waste

- Advances in water-based coatings and biodegradable adhesives have further enhanced chipboard packaging’s ability to replace conventional packaging in food, personal care, and electronics sectors

- Many companies now integrate FSC-certified materials and prioritize circular economy models to align with green mandates and consumer demand for sustainable choices

- Leading brands such as Graphic Packaging International are investing in R&D to create lightweight chipboard packaging that maintains structural strength while minimizing resource use

- As consumer preference continues to shift toward ethical and eco-conscious products, the sustainability trend is expected to transform how companies innovate and differentiate their packaging solutions in the coming years

What are the Key Drivers of Chipboard Packaging Market?

- The surge in e-commerce and the increasing need for cost-effective, lightweight, and durable packaging are major drivers of the chipboard packaging market. Its excellent printability, recyclability, and cushioning ability make it ideal for consumer goods, food & beverage, and retail packaging

- In June 2024, Mayr-Melnhof Karton AG announced an expansion in chipboard production capacity across Europe, driven by increased demand from online retail packaging and food-grade applications

- Moreover, the shift away from plastic packaging, driven by bans and sustainability goals, has accelerated the adoption of chipboard as a viable green packaging material

- Its compatibility with high-speed packaging lines, custom die-cut shapes, and branding elements enhances product shelf appeal and marketing impact

- The growing preference for compact, protective, and aesthetic packaging among SMEs and premium brands is boosting chipboard packaging deployment across diverse industries

- With the rising trend of ready-to-eat meals, subscription boxes, and personalized product packaging, chipboard solutions are increasingly favored for their versatility and environmental profile

Which Factor is challenging the Growth of the Chipboard Packaging Market?

- Despite its benefits, the chipboard packaging market faces challenges due to moisture sensitivity and limited structural strength compared to corrugated or plastic-based alternatives. This can restrict its use in heavy-duty or moisture-prone applications, especially in cold chain logistics or bulk packaging

- For instance, food exporters in Asia have reported limitations in chipboard's performance under high-humidity shipping conditions, prompting a continued reliance on laminated or plastic-coated options

- Additionally, fluctuating raw material prices—particularly recycled paper and pulp—can increase production costs, affecting affordability for small manufacturers

- While advancements in barrier coatings and moisture-resistant treatments are improving chipboard utility, these enhancements often come at an added cost, reducing price competitiveness

- Another hurdle is lack of awareness among end-users in emerging markets about chipboard’s environmental benefits, leading to continued preference for cheaper, conventional materials

- Overcoming these challenges through material innovation, strategic pricing, and industry education will be essential for expanding chipboard packaging’s global footprint

How is the Chipboard Packaging Market Segmented?

The market is segmented on the basis of category, product, and application.

- By Category

On the basis of category, the chipboard packaging market is segmented into brown and white. The brown chipboard segment dominated the market with the largest revenue share of 61.4% in 2024, driven by its cost-effectiveness, recyclability, and widespread use in secondary and tertiary packaging. Brown chipboard is primarily made from recycled fibers, making it an environmentally preferred option across food, beverage, and general retail packaging. Its strong durability and low production cost make it a top choice for manufacturers seeking sustainable and budget-friendly solutions.

The white chipboard segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the rising demand for high-end, printable surfaces used in retail displays, cosmetic boxes, and premium consumer goods. The superior printability and smooth finish of white chipboard appeal to branding and aesthetic-driven industries.

- By Product

On the basis of product, the chipboard packaging market is segmented into folding cartons, rigid boxes, inserts and dividers, display packaging, specialized packaging, and chipboard pads. The folding cartons segment held the largest revenue share of 34.6% in 2024, driven by its versatility, lightweight structure, and compatibility with various printing technologies. Folding cartons are widely used in food, beverage, pharmaceutical, and personal care applications due to their customizable design and space-efficient storage.

The display packaging segment is expected to witness the fastest growth from 2025 to 2032, attributed to the increasing demand for eye-catching retail solutions that enhance shelf presence and consumer engagement. Display packaging is increasingly adopted by consumer electronics, cosmetics, and promotional product manufacturers aiming to stand out in competitive retail environments.

- By Application

On the basis of application, the chipboard packaging market is segmented into food and beverage, pharmaceuticals, electronics, jewellery, cosmetics, personal care, household and decorative, and others. The food and beverage segment dominated the market with the largest revenue share of 38.9% in 2024, driven by the rising demand for sustainable packaging in ready-to-eat meals, bakery products, and beverage cartons. The recyclability and food-safe characteristics of chipboard make it a preferred material for environmentally conscious food brands.

The cosmetics and personal care segment is projected to grow at the fastest CAGR from 2025 to 2032, as luxury brands increasingly shift toward eco-friendly yet visually appealing packaging options. Chipboard packaging offers customizable finishes and structural integrity, supporting premium unboxing experiences and brand storytelling in the beauty sector.

Which Region Holds the Largest Share of the Chipboard Packaging Market?

- North America dominated the chipboard packaging market with the largest revenue share of 42.01% in 2024, fueled by the booming e-commerce sector, growing demand for sustainable packaging, and a strong focus on consumer-ready retail packaging

- Brands across the region are adopting eco-friendly chipboard solutions for folding cartons, point-of-sale displays, and retail boxes due to increasing environmental awareness and regulatory pressure

- The dominance is supported by advanced recycling infrastructure, consumer preference for paper-based alternatives, and innovations in packaging design, positioning chipboard packaging as a preferred choice across industries

U.S. Chipboard Packaging Market Insight

The U.S. chipboard packaging market dominated of North America’s revenue share in 2024, driven by increased adoption in consumer electronics, personal care, and food & beverage sectors. The surge in demand for customizable and lightweight packaging, combined with a shift away from plastic, is boosting market penetration. Additionally, the rise in subscription-based product deliveries and shelf-ready packaging formats further supports market growth in the country.

Europe Chipboard Packaging Market Insight

The Europe chipboard packaging market is anticipated to grow at a strong CAGR during the forecast period, led by sustainability-focused policies, a surge in retail-ready packaging, and rising consumer demand for biodegradable materials. Urbanization and the boom in organic and luxury food products are driving chipboard demand across retail and food sectors. The integration of recycled fiber content into chipboard materials is also gaining momentum among packaging manufacturers.

U.K. Chipboard Packaging Market Insight

The U.K. chipboard packaging market is expected to register healthy growth, backed by the retail sector’s expansion, rising e-commerce activities, and the government’s push for single-use plastic alternatives. The market is witnessing a steady rise in folding cartons and luxury packaging, particularly in cosmetics and electronics. Consumer demand for premium yet sustainable packaging is further strengthening the market outlook.

Germany Chipboard Packaging Market Insight

The Germany chipboard packaging market is set to grow steadily due to the country’s emphasis on green packaging solutions, strong manufacturing base, and support for recyclable materials. Germany’s packaging industry is investing heavily in fiber-based substrates and low-carbon production techniques, aligning with EU sustainability targets. Increased adoption in beverage cartons, pharmaceutical packaging, and industrial applications is expanding the market presence.

Which Region is the Fastest Growing Region in the Chipboard Packaging Market?

Asia-Pacific chipboard packaging market is projected to grow at the fastest CAGR of 9.24% from 2025 to 2032, driven by rising urbanization, growing middle-class consumption, and a shift toward eco-conscious packaging in countries such as China, India, and Japan. Rapid growth in organized retail, online shopping, and government-backed environmental initiatives are accelerating the demand for chipboard packaging. Moreover, increasing regional production and cost-effective supply chains are making chipboard packaging more accessible to manufacturers.

Japan Chipboard Packaging Market Insight

The Japan chipboard packaging market is gaining traction due to the country’s strong inclination toward minimalist, premium, and recyclable packaging designs. The market is expanding in personal care, electronics, and food sectors, with chipboard packaging used for both functional and aesthetic appeal. Rising demand for compact, durable, and brand-enhancing boxes is driving innovation in the Japanese packaging industry.

China Chipboard Packaging Market Insight

The China chipboard packaging market led the Asia-Pacific region in revenue share in 2024, propelled by the expansion of domestic manufacturing, growth of the e-commerce sector, and increasing government push for biodegradable alternatives. With a booming retail economy and investments in smart and sustainable packaging, China is becoming a key player in chipboard material innovation. High demand from electronics, fashion, and FMCG brands continues to boost production and application diversity.

Which are the Top Companies in Chipboard Packaging Market?

The chipboard packaging industry is primarily led by well-established companies, including:

- RTS Packaging, LLC (U.S.)

- All Packaging Services, LLC (U.S.)

- WestRock Company (U.S.)

- Marion Paper Box Company (U.S.)

- Multicell Packaging Inc. (U.S.)

- PakFactory (Canada)

- REID PACKAGING (U.S.)

- Canpaco Inc. (Canada)

- Imperial Printing & Paper Box Mfg. Co. (U.S.)

- DS Smith (U.K.)

- Ameripak (U.S.)

- Riverside Paper Co. Inc. (U.S.)

- Romiley Board Mill (U.K.)

- Carton Service (U.S.)

- P.J Packaging Inc. (U.S.)

- Peek Packaging (U.S.)

- Mankato Packaging (U.S.)

- Mayr-Melnhof Karton AG (Austria)

- Graphic Packaging International, LLC (U.S.)

What are the Recent Developments in Global Chipboard Packaging Market?

- In May 2025, a leading extrusion coating specialist in Turkey unveiled ENZYCOMPST, a coated paper and paperboard solution made using BASF's Ecovio 70 PS14H6 biopolymer, specifically designed for food packaging. This breakthrough biopolymer enhances barrier protection against grease, oil, liquids, and mineral oil residues. This development marks a significant advancement in sustainable food packaging with improved functional performance

- In June 2024, global packaging solution leader MeadWestvaco partnered with Interpress Technologies to launch a next-generation snack container, engineered with a 50% weight reduction. This innovation aids recycling efforts while maintaining structural integrity for custom food packaging. The joint launch reflects a growing trend toward lightweight, eco-conscious packaging in the snacks segment

- In January 2024, Ansa Folding Carton (AFC) acquired a strategic equity stake in Rich Printers Private Limited (RPL) for INR 117 crore (USD 14.01 million). The merger aims to operate five paper conversion plants across India, creating one of the largest pharmaceutical folding carton networks in the country. This acquisition strengthens AFC’s position in the Indian packaging industry and expands its manufacturing footprint

- In November 2023, Edward Enterprises, a prominent commercial printer based in Hawaii, expanded into the folding carton space by installing a Heidelberg Speedmaster CX 104, a six-color press with UV curing, replacing two older units. This strategic investment marks Edward Enterprises’ transition into high-efficiency, value-added packaging production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chipboard Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chipboard Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chipboard Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.