Global Chiral Chemical Market

Market Size in USD Billion

CAGR :

%

USD

70.83 Billion

USD

140.10 Billion

2025

2033

USD

70.83 Billion

USD

140.10 Billion

2025

2033

| 2026 –2033 | |

| USD 70.83 Billion | |

| USD 140.10 Billion | |

|

|

|

|

Chiral Chemical Market Size

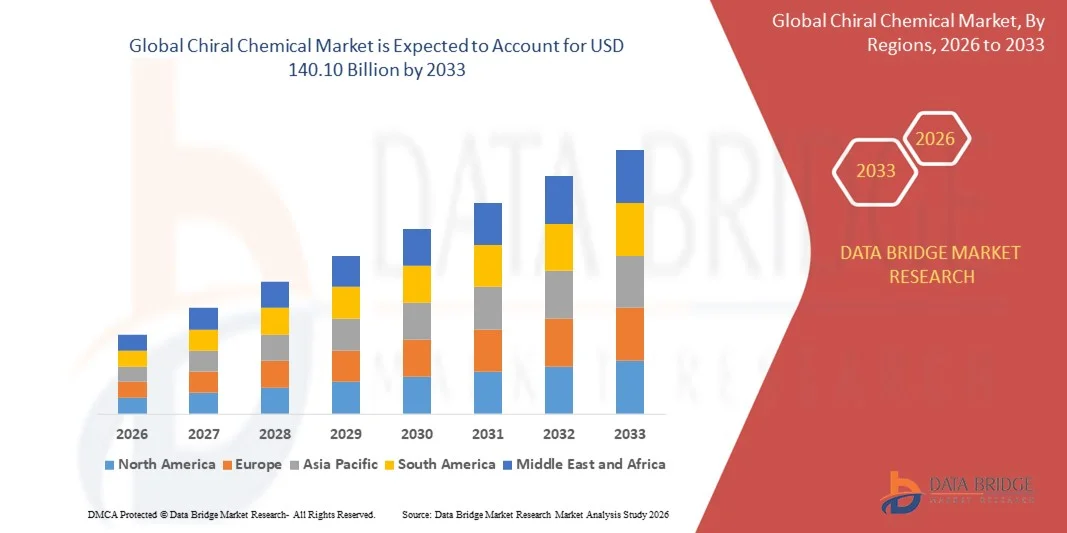

- The global chiral chemical market size was valued at USD 70.83 billion in 2025 and is expected to reach USD 140.10 billion by 2033, at a CAGR of 8.90% during the forecast period

- The market growth is largely fuelled by the increasing demand for enantiomerically pure compounds in pharmaceutical and agrochemical industries, as well as the growing adoption of chiral chemicals in advanced materials and specialty chemicals

- The rising focus on drug development with higher efficacy and lower side effects is driving the need for chiral intermediates and catalysts

Chiral Chemical Market Analysis

- The market is witnessing strong growth due to technological advancements in asymmetric synthesis and biocatalysis, which are improving yield, purity, and cost-efficiency of chiral compounds

- Increasing R&D investments in pharmaceuticals, along with stringent regulatory requirements for enantiomerically pure drugs, are creating significant demand for chiral chemicals

- North America dominated the chiral chemical market with the largest revenue share in 2025, driven by the presence of major pharmaceutical and specialty chemical manufacturers, strong R&D infrastructure, and high adoption of advanced chemical synthesis technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global chiral chemical market, driven by rapid industrialization, rising pharmaceutical and agrochemical demand, and investments in advanced chiral synthesis and biocatalysis technologies

- The Asymmetric Preparation Method segment held the largest market revenue share in 2025, driven by its high efficiency, selectivity, and ability to produce enantiomerically pure compounds. This method is widely preferred in pharmaceutical and specialty chemical industries due to its precision and compliance with stringent regulatory requirements

Report Scope and Chiral Chemical Market Segmentation

|

Attributes |

Chiral Chemical Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chiral Chemical Market Trends

Rising Demand for Enantiomerically Pure Compounds

- The increasing preference for enantiomerically pure chiral chemicals is transforming the chiral chemical market by enabling the production of high-efficacy and low-side-effect pharmaceuticals. The precision and selectivity of these compounds allow drug manufacturers to develop safer and more effective medications, improving therapeutic outcomes. In addition, the rise in chronic diseases and personalized medicine is further driving demand for enantiomerically pure intermediates, as they offer enhanced drug performance and patient safety

- The growing adoption of chiral chemicals in agrochemicals, fine chemicals, and specialty materials is accelerating market growth. These compounds are particularly important in the synthesis of herbicides, insecticides, and advanced functional chemicals, where purity and stereochemistry impact performance. Moreover, increasing investments in green chemistry and sustainable manufacturing methods are encouraging the use of chiral catalysts and intermediates across industries

- The versatility and wide applicability of chiral chemicals in pharmaceuticals, food additives, and cosmetic formulations are making them attractive for R&D and industrial applications. Manufacturers benefit from improved product differentiation and regulatory compliance, boosting market penetration. In addition, the ongoing trend toward natural and high-value specialty chemicals is creating new opportunities for enantiomerically pure compounds

- For instance, in 2023, several pharmaceutical companies in Europe reported higher yields and reduced side effects in drug production after incorporating enantiomerically pure chiral intermediates supplied by leading chemical manufacturers. These compounds helped optimize drug formulations, reduce waste, and comply with stricter regulatory standards, reflecting the strategic importance of chiral chemicals in modern drug development

- While chiral chemicals are driving innovation and product quality, their impact depends on advancements in asymmetric synthesis, biocatalysis, and cost-effective manufacturing. Companies must focus on scalable production and process optimization to fully capitalize on growing market demand. Emerging technologies, such as flow chemistry and enzyme engineering, are also expected to enhance process efficiency and support broader adoption

Chiral Chemical Market Dynamics

Driver

Increasing Pharmaceutical R&D and Focus on Enantiomerically Pure Drugs

- The surge in pharmaceutical R&D is pushing manufacturers to prioritize chiral chemicals as essential intermediates for developing novel drugs. The demand for safer, more effective medications with reduced adverse effects is driving the use of enantiomerically pure compounds. In addition, the expansion of biologics and targeted therapies is encouraging companies to adopt chiral intermediates to meet precision and efficacy requirements

- Regulatory frameworks and guidelines emphasizing stereospecific drug approval have accelerated adoption in the pharmaceutical industry. Companies are investing heavily in chiral synthesis and catalysis technologies to meet these requirements. The introduction of stricter global standards for drug purity, along with patent protections for stereoisomers, further incentivizes investment in chiral chemical development

- The growing focus on specialty chemicals, agrochemicals, and fine chemicals requiring high-purity chiral compounds is further boosting market growth. These chemicals enhance product performance and meet stringent quality standards. In addition, rising demand for environmentally friendly chemical processes and green chemistry applications is creating further opportunities for chiral chemical utilization

- For instance, in 2022, several European and North American pharmaceutical firms adopted advanced chiral synthesis techniques, increasing production efficiency and improving drug purity, positively impacting the overall chiral chemical market. These efforts also helped reduce production costs, optimize supply chains, and improve scalability for large-volume drug manufacturing

- While rising R&D investments and regulatory support are driving demand, continued innovation, cost reduction, and scalable production remain critical for long-term market expansion. Emerging collaborative R&D initiatives and partnerships with academic institutions are also helping accelerate the development of advanced chiral synthesis methods

Restraint/Challenge

High Production Costs and Complex Manufacturing Processes

- The high cost of advanced chiral synthesis and purification processes limits accessibility for smaller manufacturers. Sophisticated equipment, reagents, and skilled personnel are required, increasing operational expenses and market entry barriers. In addition, energy-intensive production steps and the need for high-purity solvents further contribute to overall costs, discouraging adoption by price-sensitive manufacturers

- In many regions, lack of technical expertise and infrastructure for asymmetric synthesis and biocatalysis restricts widespread adoption. Complex process control and quality assurance are necessary to maintain enantiomeric purity, posing challenges for manufacturers. Limited availability of trained professionals in emerging markets also slows the implementation of chiral production technologies

- Supply chain limitations for key raw materials and catalysts further constrain production, impacting timely delivery and scalability. Market penetration is restricted in regions with underdeveloped chemical manufacturing infrastructure. Fluctuations in raw material prices, import dependencies, and geopolitical risks also add uncertainty to supply chain reliability

- For instance, in 2023, several small-scale chemical manufacturers in Asia reported delays and higher costs due to limited availability of high-purity chiral catalysts and reagents, affecting production schedules. This disruption impacted timely delivery of pharmaceutical intermediates and specialty chemicals, highlighting vulnerabilities in regional supply chains

- While technological advancements are ongoing, addressing cost, process complexity, and supply chain limitations is essential for broader adoption and sustainable growth in the chiral chemical market. Investments in automation, process optimization, and local sourcing strategies are expected to mitigate these challenges and enhance market resilience

Chiral Chemical Market Scope

The market is segmented on the basis of technology and application.

- By Technology

On the basis of technology, the chiral chemical market is segmented into Traditional Separation Method, Asymmetric Preparation Method, Biological Separation Method, and Other Separation Methods. The Asymmetric Preparation Method segment held the largest market revenue share in 2025, driven by its high efficiency, selectivity, and ability to produce enantiomerically pure compounds. This method is widely preferred in pharmaceutical and specialty chemical industries due to its precision and compliance with stringent regulatory requirements.

The Biological Separation Method segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing adoption of biocatalysis and enzyme-based synthesis for sustainable and environmentally friendly production. These methods are particularly valued for their high selectivity, lower energy consumption, and compatibility with green chemistry practices, making them a preferred choice for modern chemical manufacturers.

- By Application

On the basis of application, the chiral chemical market is segmented into Pharmaceuticals, Agrochemicals, Fragrances, and Other applications. The Pharmaceuticals segment held the largest market revenue share in 2025, driven by the rising demand for enantiomerically pure drug intermediates and active pharmaceutical ingredients (APIs). Pharmaceutical manufacturers increasingly rely on chiral chemicals to improve drug efficacy, reduce side effects, and comply with regulatory standards.

The Agrochemicals segment is expected to witness the fastest growth rate from 2026 to 2033, owing to the growing demand for high-purity chiral intermediates in herbicides, insecticides, and fungicides. The need for safer and more effective crop protection solutions, along with stringent environmental regulations, is encouraging the adoption of chiral chemicals in the agrochemical industry.

Chiral Chemical Market Regional Analysis

- North America dominated the chiral chemical market with the largest revenue share in 2025, driven by the presence of major pharmaceutical and specialty chemical manufacturers, strong R&D infrastructure, and high adoption of advanced chemical synthesis technologies

- Companies in the region highly value the precision, purity, and enantiomeric specificity offered by chiral chemicals, which are essential for developing high-efficacy drugs and specialty chemicals

- This widespread adoption is further supported by stringent regulatory standards, robust healthcare infrastructure, and growing demand for safer pharmaceuticals, establishing North America as a key market for chiral chemical applications

U.S. Chiral Chemical Market Insight

The U.S. chiral chemical market captured the largest revenue share in North America in 2025, fueled by increasing pharmaceutical R&D activities and a strong focus on producing enantiomerically pure drugs. Companies are prioritizing advanced asymmetric synthesis and biocatalysis methods to meet regulatory requirements and enhance drug efficacy. In addition, the growing demand for specialty chemicals and agrochemicals is propelling market growth, while well-established manufacturing and supply chain networks support efficient distribution and adoption.

Europe Chiral Chemical Market Insight

The Europe chiral chemical market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising pharmaceutical R&D investments, strict quality regulations, and increasing demand for high-purity intermediates. European companies are focusing on innovative chiral synthesis techniques, sustainable production processes, and expanding applications in pharmaceuticals and fine chemicals. The region is also experiencing growth in specialty chemical production and research collaborations, boosting overall market adoption.

U.K. Chiral Chemical Market Insight

The U.K. chiral chemical market is expected to witness significant growth from 2026 to 2033, driven by advanced pharmaceutical research, increasing investments in R&D, and strong government support for chemical innovation. Growing awareness of the benefits of enantiomerically pure compounds for drug development is encouraging manufacturers to adopt cutting-edge chiral synthesis and separation technologies. In addition, collaborations between academic institutions and chemical companies are further stimulating market expansion in both pharmaceutical and agrochemical sectors.

Germany Chiral Chemical Market Insight

The Germany chiral chemical market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of biocatalysis, asymmetric synthesis, and sustainable chemical processes. Germany’s strong chemical and pharmaceutical industry infrastructure, combined with regulatory compliance and emphasis on high-quality production, supports the growth of chiral chemicals. The integration of advanced technologies for chiral separation and high-purity compound production is creating opportunities for both domestic and international market expansion.

Asia-Pacific Chiral Chemical Market Insight

The Asia-Pacific chiral chemical market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising pharmaceutical and agrochemical manufacturing, increasing R&D investments, and the expansion of chemical production capabilities in countries such as China, Japan, and India. Government initiatives promoting pharmaceutical innovation, coupled with low production costs and availability of skilled labor, are enhancing market adoption. In addition, growing domestic demand for high-purity drugs and specialty chemicals is boosting regional market growth.

Japan Chiral Chemical Market Insight

The Japan chiral chemical market is expected to witness significant growth from 2026 to 2033 due to the country’s high focus on pharmaceutical R&D, technological advancements in asymmetric synthesis, and demand for high-efficacy drugs. Japanese manufacturers are increasingly leveraging biocatalysis and innovative separation methods to produce enantiomerically pure compounds. Furthermore, collaborations with global chemical and pharmaceutical companies are enhancing production efficiency and product availability across multiple sectors, including pharmaceuticals, fragrances, and specialty chemicals.

China Chiral Chemical Market Insight

The China chiral chemical market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly expanding pharmaceutical and chemical manufacturing industry, increasing R&D investments, and high adoption of advanced chiral synthesis techniques. China is emerging as a key hub for producing enantiomerically pure compounds, with government support for chemical innovation and a strong domestic manufacturing base. In addition, rising demand for high-purity drugs, agrochemicals, and specialty chemicals is driving market expansion across both domestic and international markets.

Chiral Chemical Market Share

The Chiral Chemical industry is primarily led by well-established companies, including:

- Johnson Matthey (U.K.)

- DuPont (U.S.)

- BASF SE (Germany)

- Akzo Nobel N.V (Netherlands)

- Bayer AG (Germany)

- Henkel Adhesives Technologies India Private Limited (India)

- Solvay (Belgium)

- PPG Industries (U.S.)

- Albermarle Corporation (U.S.)

- H.B Fuller Company (U.S.)

- Ashland (U.S.)

- Rhodia Specialty Chemicals India Pvt Ltd (India)

- Dymax Corporation (U.S.)

- Ferro Corporation (U.S.)

- Huntsman International LLC (U.S.)

- Chemtura Corporation (U.S.)

- Uniseal Inc (U.S.)

- CHIRAL TECHNOLOGIES (U.S.)

- Codexis (U.S.)

Latest Developments in Global Chiral Chemical Market

- In July 2024, Chiracon GmbH, Research & Development Initiative, Introduced a Groundbreaking Eco-Friendly Approach for Synthesizing High-Value Chiral Chemicals. This innovation aims to improve efficiency, reduce environmental impact, and optimize production processes. The strategy is expected to enhance the company’s competitive position and set new benchmarks in sustainable chemical manufacturing, positively influencing the global chiral chemical market

- In March 2024, W. R. Grace & Co.-Conn, Capacity Expansion, Expanded Its Fine Chemical CDM Facility in South Haven to Increase Production Capabilities. The expansion enables the company to meet growing customer demand, improve delivery timelines, and support large-scale manufacturing projects. This move strengthens its market presence and contributes to the overall growth and supply reliability in the chiral chemical industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chiral Chemical Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chiral Chemical Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chiral Chemical Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.