Global Chlordane Market

Market Size in USD Million

CAGR :

%

USD

490.60 Million

USD

970.41 Million

2024

2032

USD

490.60 Million

USD

970.41 Million

2024

2032

| 2025 –2032 | |

| USD 490.60 Million | |

| USD 970.41 Million | |

|

|

|

|

Chlordane Market Size

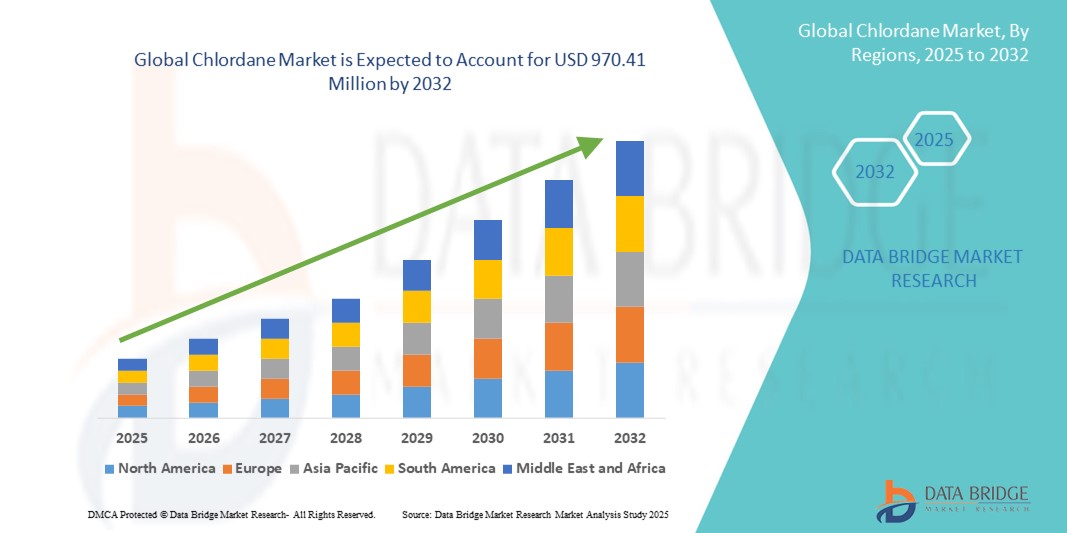

- The global chlordane market size was valued at USD 490.60 million in 2024 and is expected to reach USD 970.41 million by 2032, at a CAGR of 8.9% during the forecast period

- The market growth is largely fueled by the continued use of legacy pesticides in developing regions, where pest pressure remains high and regulatory enforcement is limited, enabling the ongoing application of persistent chemicals such as chlordane in agriculture and structural pest control

- Furthermore, rising demand for long-lasting pest management solutions in termite-infested areas and ongoing remediation efforts in contaminated sites are sustaining niche applications for chlordane. These converging factors are contributing to the market’s residual presence, particularly in select rural and industrial zones

Chlordane Market Analysis

- Chlordane is a chlorinated hydrocarbon insecticide known for its long residual activity, historically used for termite control and soil insect management in crops. Despite being banned or restricted in most countries, it persists in certain markets due to legacy stockpiles, enforcement gaps, and continued demand in localized applications such as structural pest treatments and environmental remediation

- The residual demand for chlordane is primarily driven by the need for cost-effective, broad-spectrum pest control in high-infestation areas, especially where access to newer alternatives is limited or unaffordable. The compound’s durability and long-term effectiveness continue to support its use in select non-food and industrial contexts

- Asia-Pacific dominated the chlordane market with a share of 25.2% in 2024, due to the region’s large agricultural base, high pest prevalence, and continued use of legacy pesticides in certain developing economies

- Europe is expected to be the fastest growing region in the chlordane market during the forecast period due to stringent regulatory bans, yet minor usage persists in niche applications such as structural pest control under controlled conditions

- Sprays segment dominated the market with a market share of 46.7% in 2024, due to its widespread use in both agricultural and structural pest control applications. Sprays allow for quick, even distribution over crops and soil, making them the preferred form for large-scale farming operations and perimeter treatments in residential and commercial settings. The adaptability of spray-based applications across diverse terrains and pest types further reinforces their dominance

Report Scope and Chlordane Market Segmentation

|

Attributes |

Chlordane Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chlordane Market Trends

“Technological Advancements in Farming Practices”

- The chlordane market remains influenced by evolving agricultural pest management practices, with some developing regions continuing use due to affordability and limited access to newer eco-friendly alternatives

- For instance, legacy manufacturers such as Velsicol Chemical Corporation historically supplied chlordane for agricultural and termite control use globally, and current demand in developing countries relies on established suppliers providing legacy stocks or reference materials such as Orkin LLC and AccuStandard

- Incremental adoption of integrated pest management (IPM) and biological controls are gradually reducing chlordane use but have not fully replaced it in regions with severe pest infestations or cost constraints

- Emphasis on crop yield optimization and effective termite control sustains niche chlordane demand, particularly in tropical and subtropical areas where pests severely impact agriculture and infrastructure

- While bioscopic and green chemistry options gain traction in many markets, chlordane remains a fallback treatment in some regions due to its persistence and effectiveness

- Heightened regulatory scrutiny in most developed markets has led to bans, but legacy stock usage and importation for specific applications extend its market lifespan in select low-regulation territories

Chlordane Market Dynamics

Driver

“Longer Residual Action”

- Chlordane’s hallmark is its long-lasting residual effectiveness against termites and soil pests, enabling extended protection from a single application, which appeals to users seeking fewer treatments and lower labor costs

- For instance, Velsicol Chemical Corporation’s original formulations were prized for soil and structural pest control in agriculture and building protection due to chlordane’s ability to remain active in soil for years, outperforming many faster-degrading alternatives

- This persistence reduces frequency and cost of reapplications in markets where cost-efficiency and labor reduction are major purchasing factors

- Its broad-spectrum control against a range of soil-dwelling insects and termites supports its preference in regions with high pest pressure and limited alternative options

- Chlordane’s stability under varied environmental conditions allows effective use in diverse climates, supporting continued niche applications in tropical and subtropical agricultural zones

Restraint/Challenge

“Health Risks of Chlordane Usage”

- Serious health and environmental hazards associated with chlordane—including carcinogenicity, neurotoxicity, and environmental persistence—have led to rigorous regulation, bans, and shrinking global market acceptance

- For instance, regulatory findings and legal actions involving Velsicol Chemical Corporation and other legacy producers underscore the link between chlordane exposure and risks such as liver cancer, reproductive disorders, and ecological harm, leading to prohibitions in the U.S., EU, and many developed countries

- Persistent residues accumulate in soils, water, and food chains, presenting risks to human populations and wildlife and necessitating costly clean-up and remediation efforts

- Compliance with stringent environmental regulations and restrictions is increasingly difficult, causing many producers and distributors to withdraw or limit supplies in regulated markets

- Consumer and governmental demand for safer pest control alternatives is driving breakthroughs in biopesticides and integrated management systems, making chlordane less commercially viable despite its historical effectiveness

Chlordane Market Scope

The market is segmented on the basis of crop type, formulation, and form.

- By Crop Type

On the basis of crop type, the Chlordane market is segmented into vegetables and fruits, oilseeds and pulses, cereals and grains, commercial crops, plantation crops, turfs and ornamentals, and others. The vegetables and fruits segment dominated the largest market revenue share in 2024, primarily due to the high susceptibility of these crops to soil-borne insects and pests that Chlordane effectively controls. Farmers rely on its broad-spectrum insecticidal properties to safeguard high-value crops from early-stage infestation, which significantly affects marketable yield and quality. The intensive cultivation of fruits and vegetables in both open fields and greenhouses also contributes to the segment's prominence in overall usage volume.

The commercial crops segment is expected to register the fastest growth rate from 2025 to 2032, driven by the rising demand for pest-resistant cash crops such as cotton and tobacco. Chlordane's residual effectiveness and long-lasting protection make it suitable for large-scale monoculture fields where pest pressure tends to accumulate. With the expansion of commercial agriculture in emerging economies and the increased focus on protecting crop profitability, the adoption of Chlordane in this segment is projected to rise steadily.

- By Formulation

On the basis of formulation, the Chlordane market is segmented into wettable powder, emulsifiable concentrate, suspension concentrate, oil emulsion in water, microencapsulated suspension, granules, and other formulations. The emulsifiable concentrate segment held the largest market share in 2024, attributed to its superior dispersibility and strong residual activity when mixed with water for foliar and soil applications. Emulsifiable formulations are favored in field applications where uniform coverage and deep soil penetration are required, especially in regions prone to heavy pest infestation.

The microencapsulated suspension segment is projected to witness the fastest CAGR from 2025 to 2032, due to its controlled release mechanism and reduced environmental leaching. This formulation allows for gradual pesticide release, reducing the frequency of reapplication while ensuring consistent protection. As regulatory scrutiny tightens around pesticide usage, microencapsulation is gaining traction among producers and applicators seeking to minimize environmental impact and maximize product efficiency.

- By Form

On the basis of form, the Chlordane market is segmented into sprays, baits, and strips. The spray segment accounted for the largest revenue share of 46.7% in 2024, driven by its widespread use in both agricultural and structural pest control applications. Sprays allow for quick, even distribution over crops and soil, making them the preferred form for large-scale farming operations and perimeter treatments in residential and commercial settings. The adaptability of spray-based applications across diverse terrains and pest types further reinforces their dominance.

The baits segment is anticipated to grow at the fastest pace from 2025 to 2032, propelled by increasing demand for targeted pest control methods in both agricultural and urban environments. Baits reduce non-target exposure and deliver Chlordane in a controlled manner directly to pest colonies, enhancing efficacy and minimizing runoff. This approach aligns with evolving user preferences for environmentally conscious pest control and improved safety in sensitive crop zones.

Chlordane Market Regional Analysis

- Asia-Pacific dominated the chlordane market with the largest revenue share of 25.2% in 2024, driven by the region’s large agricultural base, high pest prevalence, and continued use of legacy pesticides in certain developing economies

- The demand for soil-applied and long-residual insecticides such as chlordane remains strong in countries facing persistent termite and rootworm issues in key crops

- Expanding crop acreage, limited enforcement of global bans in some rural markets, and cost-sensitive farming practices are contributing to sustained product use across select regions of Southeast Asia and South Asia

China Chlordane Market Insight

China accounted for the largest revenue share within Asia-Pacific in 2024, driven by its expansive agricultural landscape and continued application of persistent organochlorines in targeted pest management, despite global restrictions. Some rural regions still rely on legacy stocks for pest-prone crops such as corn and vegetables. Demand is also maintained through illegal imports and stockpiled reserves used in non-food or industrial settings. However, increasing regulatory scrutiny and government-led pesticide reform efforts may gradually phase out usage in line with international standards.

India Chlordane Market Insight

India’s chlordane market remains active in specific agricultural and construction-related applications, particularly in termite control and root pest management. The prevalence of soil-borne pests across oilseeds and pulses, combined with challenges in pest resistance, supports occasional use in certain regions. While officially banned, enforcement gaps and legacy stock availability have enabled limited ongoing usage. As integrated pest management (IPM) practices gain momentum, the market is gradually shifting toward regulated alternatives with safer profiles.

Europe Chlordane Market Insight

Europe chlordane market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by stringent regulatory bans, yet minor usage persists in niche applications such as structural pest control under controlled conditions. The region’s strong commitment to environmental safety and chemical regulation under REACH and other frameworks has significantly curbed demand. However, historical contamination, soil remediation efforts, and monitoring programs continue to drive government and institutional procurement in certain areas, indirectly impacting the residual market footprint.

U.K. Chlordane Market Insight

The U.K. market for chlordane is virtually phased out due to firm regulatory compliance and widespread adoption of eco-friendly alternatives. Nonetheless, the legacy of prior usage remains a consideration in environmental management and brownfield redevelopment. Focus is now on soil detoxification technologies and tracking residual pollutants in older agricultural or construction zones, where chlordane contamination once prevailed.

Germany Chlordane Market Insight

Germany’s chlordane market is characterized by stringent restrictions and nearly complete market elimination. The country has been at the forefront of adopting safe pest control alternatives and enforcing EU-level bans. Any residual market activity is largely limited to research, soil decontamination, or monitoring operations. Germany’s emphasis on sustainable agriculture and pesticide safety has effectively curtailed chlordane usage across all sectors.

North America Chlordane Market Insight

North America continues to account for a measurable portion of the global chlordane market due to historical usage patterns, particularly in construction and termite control. While banned in the U.S. and Canada for decades, residual stocks and legacy contamination in older buildings and soils sustain niche demand for testing, monitoring, and cleanup operations. In addition, structural pest control services occasionally encounter remnants of prior chlordane applications, necessitating specialized treatment protocols.

U.S. Chlordane Market Insight

The U.S. holds the dominant share in the North American chlordane market in 2024, largely linked to environmental remediation efforts and structural inspections. Although chlordane is no longer legally marketed or used, significant legacy contamination exists in older homes, industrial sites, and former agricultural lands. The Environmental Protection Agency (EPA) continues to monitor and manage these legacy issues, driving demand for analytical tools, cleanup services, and regulatory reporting systems.

Chlordane Market Share

The chlordane industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- ChemChina Petrochemicals Corporation (China)

- FMC Corporation (U.S.)

- Corteva (U.S.)

- Nufarm (Australia)

- UPL (India)

- Sumitomo Chemical Co., Ltd. (Japan)

- ADAMA India Private Limited (India)

- American Vanguard Corporation (U.S.)

- Syngenta AG (Switzerland)

- Cheminova A/S (Denmark)

- Monsanto Company (U.S.)

- Makhteshim Agan Industries (Israel)

- Rainbow Agro (India)

- NANJING RED SUN CO., LTD. (China)

- Oxon Italia S.p.A (Italy)

- Nissan Chemical Corporation (Japan)

- Arysta Lifesciences (U.S.)

- Marrone Bio Innovations (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.