Global Chlorfenapyr Market

Market Size in USD Million

CAGR :

%

USD

346.19 Million

USD

543.51 Million

2025

2033

USD

346.19 Million

USD

543.51 Million

2025

2033

| 2026 –2033 | |

| USD 346.19 Million | |

| USD 543.51 Million | |

|

|

|

|

Chlorfenapyr Market Size

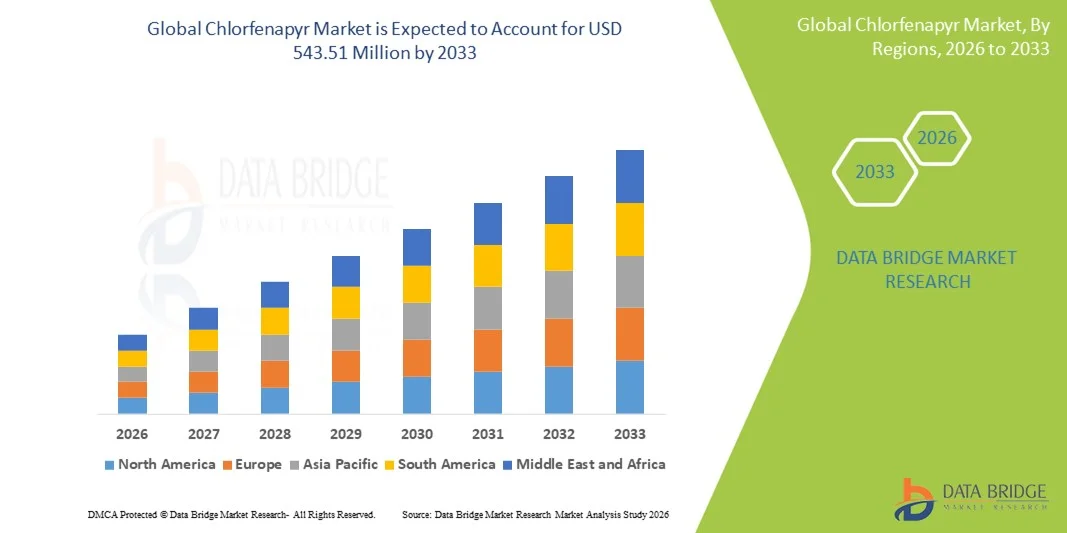

- The global chlorfenapyr market size was valued at USD 346.19 million in 2025 and is expected to reach USD 543.51 million by 2033, at a CAGR of 5.80% during the forecast period

- The market growth is largely fueled by the increasing demand for effective crop protection solutions to enhance yields, manage pest resistance, and support sustainable agricultural practices across large-scale and high-value crops

- Furthermore, rising adoption of modern farming techniques, integrated pest management practices, and government initiatives promoting high-efficacy pesticides are establishing chlorfenapyr as a preferred choice for growers. These converging factors are accelerating the uptake of chlorfenapyr-based products, thereby significantly boosting the industry's growth

Chlorfenapyr Market Analysis

- Chlorfenapyr, offering broad-spectrum activity against resistant pests and compatibility with multiple crop types, is increasingly vital for both conventional and high-value crop cultivation due to its proven efficacy, residual activity, and regulatory approvals in key regions

- The escalating demand for chlorfenapyr is primarily fueled by the growing need for reliable pest management solutions, expanding agricultural activities in emerging economies, and increasing awareness among farmers regarding safe and efficient pesticide usage

- Asia-Pacific dominated the chlorfenapyr market with a share of around 50% in 2025, due to expanding agricultural activities, increasing demand for crop protection solutions, and a strong presence of major pesticide manufacturers

- North America is expected to be the fastest growing region in the chlorfenapyr market during the forecast period due to rising demand for effective pest control in large-scale and high-value crops

- Active ingredient type 0.95 segment dominated the market with a market share of 61.9% in 2025, due to its widespread use in conventional agricultural practices and its effectiveness against a broad spectrum of pests. Farmers often prefer the 0.95 formulation due to its proven efficacy and compatibility with existing pesticide application equipment. The segment also benefits from regulatory approvals in multiple regions, making it a reliable choice for large-scale farming operations. In addition, the moderate concentration ensures a balance between pest control efficiency and environmental safety, contributing to its continued dominance

Report Scope and Chlorfenapyr Market Segmentation

|

Attributes |

Chlorfenapyr Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chlorfenapyr Market Trends

Rising Adoption of High-Efficacy and Environmentally Safe Pesticides

- A significant trend in the chlorfenapyr market is the increasing adoption of high-efficacy and environmentally safe pesticides across conventional and high-value crop cultivation. Farmers and agribusinesses are focusing on solutions that manage resistant pest populations while minimizing environmental impact, which is elevating the role of chlorfenapyr as a key crop protection agent

- For instance, UPL’s launch of ten new products including chlorfenapyr formulations in Brazil in August 2025 highlights the industry’s focus on providing advanced pest control solutions that are both effective and environmentally responsible. These product introductions strengthen pest management capabilities in large-scale farming and support sustainable agricultural practices

- The integration of chlorfenapyr into integrated pest management programs is gaining momentum, especially in regions cultivating vegetables, cotton, and cereals, where resistance management is critical. This is positioning chlorfenapyr as a preferred pesticide for growers aiming to optimize yield and maintain regulatory compliance

- Increasing investments in research and formulation improvements are driving the development of more targeted, low-residue, and high-purity chlorfenapyr products. Such innovations enhance its application efficiency and broaden its adoption across diverse geographies

- The growing awareness among farmers and agrochemical distributors regarding safe pesticide use and regulatory adherence is further accelerating adoption. This trend is particularly strong in Asia-Pacific and North America, where governments and agribusinesses emphasize sustainable agriculture

- The market is witnessing strong growth as companies expand production and registration of chlorfenapyr formulations to meet rising global demand. Regulatory approvals in major markets such as the U.S. EPA registration of Newfarm’s chlorfenapyr series in November 2025 reinforce confidence in its safety and effectiveness

Chlorfenapyr Market Dynamics

Driver

Increasing Demand for Effective Pest Management in High-Value Crops

- The growing need to protect high-value crops such as fruits, vegetables, and cotton from resistant and hard-to-control pests is driving the demand for chlorfenapyr. Its broad-spectrum activity, long residual effect, and proven efficacy make it a critical tool for growers aiming to maximize yield and reduce crop losses

- For instance, BASF’s launch of Sankei Kotetsu bait insecticide in Japan in March 2021 demonstrates how chlorfenapyr-based solutions are being applied to specialty crops, supporting precise pest control while maintaining crop quality. Such applications reinforce chlorfenapyr’s position as an essential component of integrated pest management programs

- The adoption of chlorfenapyr is being further accelerated by rising awareness of resistance management and the need for reliable, consistent pest control in both large-scale and greenhouse cultivation

- Technological improvements in formulation and delivery methods are enabling more efficient and targeted application of chlorfenapyr, reducing chemical usage and environmental impact while improving pest control outcomes

- The expanding global demand for high-quality and export-ready agricultural produce continues to drive chlorfenapyr adoption, as growers seek reliable solutions to maintain both yield and quality

Restraint/Challenge

Regulatory Restrictions and Compliance Requirements

- The chlorfenapyr market faces challenges due to stringent regulatory frameworks and the need for compliance with safety, environmental, and residue limits across multiple countries. Meeting these requirements involves extensive testing, registration procedures, and adherence to labeling and application guidelines, which can delay product launches and increase costs

- For instance, the registration and regulatory approval process by the U.S. EPA for Newfarm’s chlorfenapyr series formulations in November 2025 highlights the time and investment needed to ensure compliance in major agricultural markets. Such regulatory processes can restrict market entry for smaller players or slow down expansion

- Compliance with local environmental regulations, including permissible residue levels and application restrictions, necessitates careful formulation and field trial management. These constraints require manufacturers to maintain high-quality standards and adapt to evolving regulations

- Global variations in pesticide approval policies add complexity for multinational companies aiming to distribute chlorfenapyr products internationally, often requiring separate submissions and certifications for different regions

- The combined effect of high compliance costs, lengthy approval processes, and the need for rigorous monitoring limits rapid scaling and poses a challenge to market growth, despite rising demand

Chlorfenapyr Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the Chlorfenapyr market is segmented into Active Ingredient Type 0.95 and Active Ingredient Type 0.98. The Active Ingredient Type 0.95 segment dominated the market with the largest market revenue share of 61.9% in 2025, driven by its widespread use in conventional agricultural practices and its effectiveness against a broad spectrum of pests. Farmers often prefer the 0.95 formulation due to its proven efficacy and compatibility with existing pesticide application equipment. The segment also benefits from regulatory approvals in multiple regions, making it a reliable choice for large-scale farming operations. In addition, the moderate concentration ensures a balance between pest control efficiency and environmental safety, contributing to its continued dominance.

The Active Ingredient Type 0.98 segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand in high-value crops and greenhouse applications. For instance, Syngenta’s high-purity 0.98 formulation has gained traction among commercial greenhouse operators due to its potent activity against resistant insect strains. The higher concentration allows for reduced application frequency, providing cost and labor efficiency for growers. Increased awareness regarding optimized pest management and sustainable practices is further driving adoption. The segment’s growth is also supported by ongoing product innovations focusing on higher efficacy and reduced environmental impact.

- By Application

On the basis of application, the Chlorfenapyr market is segmented into Farmland, Greenhouses, and Others. The Farmland segment dominated the market in 2025, driven by large-scale cultivation of cereals, vegetables, and cotton that require robust pest control solutions. Farmers prioritize Chlorfenapyr for its broad-spectrum activity, residual efficacy, and ability to manage resistant pest populations. The segment also benefits from established distribution networks and government support for crop protection initiatives, ensuring reliable availability. In addition, the ease of integration with standard farming practices and compatibility with multiple crop types reinforces its dominant position in the market.

The Greenhouse segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the rising adoption of controlled-environment agriculture and high-value horticultural crops. For instance, Bayer’s targeted Chlorfenapyr solutions are increasingly used in greenhouse tomato and cucumber cultivation for efficient pest management. Greenhouse operators value the product for its precise application and strong residual control in confined environments. The growth is further supported by the rising demand for year-round production and premium-quality produce. The segment’s expansion is also driven by innovations in safe, low-residue formulations suitable for intensive cultivation systems.

Chlorfenapyr Market Regional Analysis

- Asia-Pacific dominated the chlorfenapyr market with the largest revenue share of around 50% in 2025, driven by expanding agricultural activities, increasing demand for crop protection solutions, and a strong presence of major pesticide manufacturers

- The region’s cost-effective production landscape, rising investments in agrochemical manufacturing, and growing exports of crop protection chemicals are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid adoption of modern farming techniques across developing economies are contributing to increased consumption of Chlorfenapyr in both large-scale and high-value crop cultivation

China Chlorfenapyr Market Insight

China held the largest share in the Asia-Pacific Chlorfenapyr market in 2025, owing to its status as a global leader in agricultural production and pesticide manufacturing. The country's strong industrial base, favorable government policies supporting agrochemical production, and extensive export capabilities for crop protection chemicals are major growth drivers. Demand is also bolstered by ongoing investments in high-efficacy and environmentally safe pesticide formulations for both domestic and international markets.

India Chlorfenapyr Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding agricultural sector, adoption of modern pest management practices, and increasing investments in high-value crop cultivation. Initiatives promoting sustainable agriculture and enhanced crop yields are strengthening the demand for Chlorfenapyr. In addition, growing exports of fruits, vegetables, and cash crops, combined with increasing awareness of pest resistance management, are contributing to robust market expansion.

Europe Chlorfenapyr Market Insight

The Europe Chlorfenapyr market is expanding steadily, supported by stringent regulatory frameworks, rising demand for high-purity and low-toxicity pesticides, and growing investments in sustainable agricultural solutions. The region emphasizes environmentally safe pest control methods, particularly for high-value crops and organic farming. Increasing adoption of integrated pest management (IPM) practices is further enhancing market growth.

Germany Chlorfenapyr Market Insight

Germany’s Chlorfenapyr market is driven by advanced agricultural practices, high-value horticulture production, and strong compliance with EU pesticide regulations. The country has well-established R&D networks and partnerships between research institutions and agrochemical manufacturers, fostering continuous innovation in pest control solutions. Demand is particularly strong for use in controlled crop environments and specialty vegetable cultivation.

U.K. Chlorfenapyr Market Insight

The U.K. market is supported by modern farming techniques, growing focus on sustainable agriculture, and demand for high-efficacy crop protection chemicals. With increasing attention to integrated pest management and organic-compatible solutions, the market for Chlorfenapyr remains significant. Investments in agricultural R&D and partnerships between agrochemical companies and growers are encouraging adoption of advanced formulations.

North America Chlorfenapyr Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for effective pest control in large-scale and high-value crops. Technological adoption in precision agriculture, increasing focus on pest resistance management, and investments in R&D for sustainable pesticide solutions are boosting demand. In addition, regulatory support for safe and high-efficacy crop protection chemicals is contributing to market expansion.

U.S. Chlorfenapyr Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by extensive large-scale agricultural operations, strong R&D infrastructure, and significant investment in crop protection manufacturing. The country’s focus on innovation, regulatory compliance, and sustainable pest management practices is encouraging the adoption of Chlorfenapyr. Presence of key agrochemical players and a mature distribution network further solidify the U.S.'s leading position in the region.

Chlorfenapyr Market Share

The chlorfenapyr industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Triveni Interchem Private Limited (Group of Triveni Chemicals) (India)

- Nanjing Gaozheng Agricultural Chemical Co., Ltd. (China)

- Kaifeng Bokai Biochemistry (China)

- Qingdao Echemi Technology Co., Ltd. (China)

- Hunan Dejia Biochemical Tech (China)

- Fabchem China Limited (China)

- Yinguang Group Gansu Yinguang Juyin Chemical Industry Co., Ltd. (China)

- Chem-Tac, Inc. (U.S.)

- Zhejiang Rayfull Chemicals Co., Ltd. (China)

- Syngenta Crop Protection AG (Switzerland)

- Shandong A&Fine Agrochemicals Group (China)

- Hebei Guanlong Agrochemical Co., Ltd. (China)

- Jiangsu Fengshan Group Co., Ltd. (China)

- Atticus LLC (U.S.)

Latest Developments in Global Chlorfenapyr Market

- In November 2025, Newfarm’s chlorfenapyr series formulations were officially registered by the U.S. Environmental Protection Agency (EPA) and are scheduled for launch in 2026, marking a critical regulatory milestone that significantly expands the product’s availability in North America. This development strengthens grower confidence in the safety and efficacy of chlorfenapyr-based solutions, supports adoption across large-scale farming operations, and is expected to drive substantial market growth in the U.S. and neighboring regions

- In September 2025, BASF introduced a new chlorfenapyr-based herbicide in Indonesia to assist rice farmers in effectively managing resistant weeds, a launch that enhances crop yields and strengthens pest management strategies. The introduction reinforces BASF’s presence in Southeast Asia, stimulates demand for high-efficacy agrochemicals, and is likely to accelerate adoption of chlorfenapyr in regions with intensive rice cultivation

- In August 2025, UPL launched ten new agrochemical products in Brazil, including chlorfenapyr formulations, setting a record for annual product introductions. This aggressive expansion strategy addresses emerging pest resistance and diversifies product offerings, thereby increasing UPL’s market share. The launch also stimulates competitive dynamics in Latin America and provides farmers with more effective pest control options, reinforcing chlorfenapyr’s role in large-scale agricultural applications

- In May–September 2025, Chinese regulatory authorities approved over 77 new chlorfenapyr formulation registrations, reflecting a significant surge in regulatory approvals. This expansion enables broader formulation options and enhances product penetration in China, one of the world’s largest agricultural markets. The approvals support widespread adoption across multiple crop types, improve supply chain availability, and drive overall market growth in Asia-Pacific

- In March 2021, BASF launched Sankei Kotetsu® bait insecticide in Japan to support spinach farmers, demonstrating the effectiveness of chlorfenapyr in high-value vegetable crops. The product enhanced localized pest management strategies, encouraged adoption in specialty agriculture, and reinforced chlorfenapyr’s reputation for efficacy and safety in sensitive crop environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.