Global Chlorides Market

Market Size in USD Billion

CAGR :

%

USD

4.11 Billion

USD

5.45 Billion

2024

2032

USD

4.11 Billion

USD

5.45 Billion

2024

2032

| 2025 –2032 | |

| USD 4.11 Billion | |

| USD 5.45 Billion | |

|

|

|

|

What is the Global Chlorides Market Size and Growth Rate?

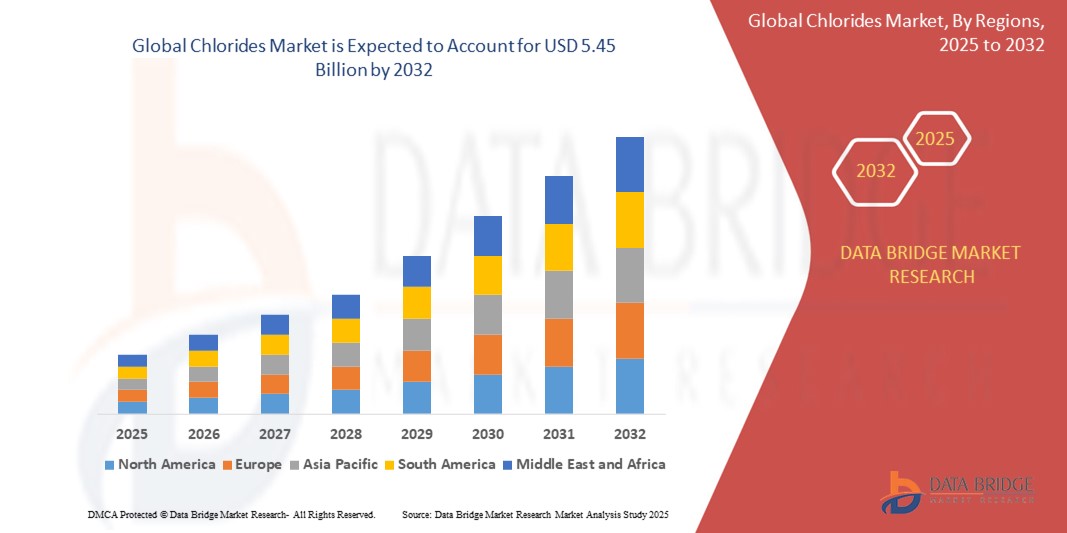

- The global chlorides market size was valued at USD 4.11 billion in 2024 and is expected to reach USD 5.45 billion by 2032, at a CAGR of 3.60% during the forecast period

- The chlorides market involves a diverse array of chemical compounds characterized by the presence of chlorine combined with other elements or groups. This category includes widely recognized substances such as sodium chloride, potassium chloride, calcium chloride, and magnesium chloride, among others

- These chlorides serve essential functions across various industrial and consumer applications, making them a vital component in several sectors. In the food processing industry, chlorides play a role in food preservation, flavor enhancement, and various processing applications.

What are the Major Takeaways of Chlorides Market?

- The increasing global emphasis on ensuring clean and safe drinking water significantly drives the demand for chlorides in water treatment processes. Chlorides, particularly sodium chloride and calcium chloride, play a crucial role in disinfection and purification systems

- They are used in processes such as chlorination, which helps to eliminate pathogens and contaminants from water sources. As water scarcity and quality concerns rise, municipalities and industries are investing more in advanced water treatment technologies that utilize chlorides to ensure safe, potable water for communities

- Asia-Pacific dominated the chlorides market with the largest revenue share of 43.5% in 2024, driven by the extensive use of chlorides in industries such as textiles, chemicals, oil and gas, and agriculture

- Middle East & Africa chlorides market is projected to grow at the fastest CAGR of 20.2% during 2025 to 2032, driven by increasing demand in oilfield services, water treatment, and chemical processing

- The Sodium Chloride (NaCl) segment dominated the chlorides market with the largest market revenue share of 39.7% in 2024, owing to its wide-ranging applications in food, de-icing, water treatment, and chemical manufacturing

Report Scope and Chlorides Market Segmentation

|

Attributes |

Chlorides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Chlorides Market?

“Sustainable Sourcing and Eco-Friendly Applications”

- A dominant trend shaping the global chlorides market is the rising shift toward sustainable sourcing and environmentally friendly applications, driven by regulatory pressure and growing corporate ESG commitments. Industries such as aviation, textiles, leather, and oil & gas are increasingly opting for low-impact chloride compounds

- Chlorides-based de-icing agents are gaining preference in countries with stringent environmental norms, offering low corrosion rates and high biodegradability. For instance, in 2024, several European airports adopted chloride formulations over traditional salts to reduce runoff toxicity

- In the leather tanning sector, Chlorides is used as a greener buffering agent, replacing ammonia-based chemicals. In 2024, TFL Ledertechnik launched a chrome-free tanning solution featuring Chlorides to meet REACH and EPA standards

- Bio-based production methods are emerging as a key innovation, with manufacturers exploring formic acid sourced from biomass to develop renewable Chlorides aligned with circular economy models

- Chlorides is becoming a preferred chemical building block due to its biodegradability, low toxicity, and regulatory compliance, helping industries advance sustainability goals across operations

- The trend is particularly visible in Europe and North America, where Chlorides adoption is rising in line with green certification systems and eco-conscious procurement strategies, reshaping industrial chemistry landscapes

What are the Key Drivers of Chlorides Market?

- The growing need for non-corrosive and eco-friendly de-icing agents, especially in the aviation and transportation sectors, is a leading driver of Chlorides market growth. Its low environmental footprint and operational efficiency are key differentiators

- In February 2024, Clariant AG expanded its production of Chlorides-based de-icers in response to demand from Scandinavian rail and airport authorities prioritizing chloride-free, sustainable solutions

- Chlorides also finds strong application in leather and textile processing as a pH buffer, supporting manufacturers in meeting REACH and EPA environmental compliance with minimal performance trade-offs

- In the oil and gas industry, Chlorides is a critical ingredient in high-density, low-toxicity drilling fluids, especially valued in offshore drilling operations in ecologically sensitive areas where minimizing impact is essential

- The compound’s versatility across sectors—de-icing, leather tanning, textile dyeing, oilfield services, and chemical synthesis—along with its environmental attributes, is driving widespread demand, especially in countries with green manufacturing mandates

Which Factor is challenging the Growth of the Chlorides Market?

- A key challenge for the chlorides market is the volatility in raw material prices, particularly the dependency on formic acid and sodium hydroxide. Price fluctuations in these base chemicals can significantly impact production economics

- For instance, a formic acid supply disruption in China in late 2023 due to facility shutdowns triggered a price surge, which temporarily slowed Chlorides output and affected supplier margins worldwide

- Limited distribution infrastructure in developing countries further impedes Chlorides market penetration. Users in such regions may opt for readily available yet less eco-friendly alternatives, stunting global adoption

- In addition, cost-competitive alternatives such as sodium acetate or calcium chloride often challenge Chlorides, particularly in markets where cost concerns outweigh environmental priorities

- Overcoming these challenges will require localized manufacturing, better supply chain resilience, and increased awareness of Chlorides’s long-term operational benefits in regulated and eco-sensitive applications

How is the Chlorides Market Segmented?

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the chlorides market is segmented into Sodium Chloride (NaCl), Calcium Chloride (CaCl₂), Potassium Chloride (KCl), Magnesium Chloride (MgCl₂), Ammonium Chloride (NH₄Cl), Barium Chloride (BaCl₂), Zinc Chloride (ZnCl₂), Lithium Chloride (LiCl), Cobalt (II) Chloride (CoCl₂), and Ferric Chloride (FeCl₃). The Sodium Chloride (NaCl) segment dominated the Chlorides market with the largest market revenue share of 39.7% in 2024, owing to its wide-ranging applications in food, de-icing, water treatment, and chemical manufacturing. Its abundance, low cost, and high solubility make it the most commonly used chloride compound globally.

The Zinc Chloride (ZnCl₂) segment is anticipated to witness the fastest CAGR from 2025 to 2032, propelled by its growing utilization in battery electrolytes, galvanizing processes, and chemical synthesis. Demand for high-purity chlorides in electronics and energy storage sectors is fueling its growth trajectory.

• By Application

On the basis of application, the chlorides market is segmented into Food, Preservation, De-icing, Desiccant, Fertilizer, Supplement, Dust Control, Battery, Industrial, Chemicals, Flux, Preservative, Air Conditioning, Absorbent, Indicator, Catalyst, Water Treatment, and Etching. The Industrial segment held the largest market revenue share of 31.2% in 2024, driven by Chlorides’ diverse use in metal processing, dyeing, fluxing agents, and chemical manufacturing. Its properties as buffers, catalysts, and reactants make it essential for various heavy industrial applications.

The Battery segment is projected to register the fastest CAGR from 2025 to 2032, supported by rising investments in electric vehicles and energy storage. Chloride-based compounds such as Zinc Chloride and Lithium Chloride are increasingly employed in electrolyte solutions for high-performance batteries, driving this segment forward.

Which Region Holds the Largest Share of the Chlorides Market?

- Asia-Pacific dominated the chlorides market with the largest revenue share of 43.5% in 2024, driven by the extensive use of chlorides in industries such as textiles, chemicals, oil and gas, and agriculture. Rapid industrialization, a strong manufacturing base, and rising demand for de-icing agents in cold regions such as Northern China and Japan further boost market expansion

- The region benefits from abundant raw material availability, cost-effective production, and a robust export infrastructure, making it a key supplier in the global chlorides value chain

- In addition, growing investment in wastewater treatment, construction, and food preservation enhances chloride usage across multiple sectors, reinforcing Asia-Pacific's market leadership

China Chlorides Market Insight

The China chlorides market accounted for 62% of Asia-Pacific’s revenue share in 2024, owing to its strong presence in chemical manufacturing, leather tanning, and electronics. China's cost-competitive production and extensive use of chlorides in de-icing, textile processing, and food preservation drive domestic and export demand. Government initiatives to enhance industrial sustainability and water treatment processes are encouraging the adoption of high-purity chloride variants.

India Chlorides Market Insight

The India chlorides market is expected to grow at a robust CAGR during the forecast period, fueled by expanding agriculture, textile, and chemical sectors. The increasing need for water treatment chemicals and de-icing agents in northern states during winter months is contributing to higher chloride consumption. Government-backed infrastructure projects and rising demand for industrial chemicals are also propelling the market forward.

Which Region is the Fastest Growing Region in the Chlorides Market?

Middle East & Africa (MEA) chlorides market is projected to grow at the fastest CAGR of 20.2% during 2025 to 2032, driven by increasing demand in oilfield services, water treatment, and chemical processing. Chlorides are widely used in the form of brines and drilling fluids for high-temperature oil and gas exploration in the region. In addition, rising investment in desalination plants and industrial development, particularly in countries such as Saudi Arabia and the U.A.E., is supporting the uptake of chloride-based solutions.

Saudi Arabia Chlorides Market Insight

The Saudi Arabia chlorides market is expanding rapidly due to its strategic importance in the petrochemical and oilfield services industries. Chloride-based brines are essential for high-pressure drilling operations, while the country's focus on industrial diversification under Vision 2030 supports broader chemical adoption. In addition, water treatment initiatives to combat water scarcity are boosting chloride demand in municipal and industrial sectors.

Which are the Top Companies in Chlorides Market?

The chlorides industry is primarily led by well-established companies, including:

- Dupont (U.S.)

- SOLVAY (Belgium)

- DAIKIN (Japan)

- Dow (U.S.)

- Halocarbon, LLC (U.S.)

- Freudenberg SE (Germany)

- The Chemours Company (U.S.)

- Metalubgroup (Israel)

- M&I Materials Limited (U.K)

- Nye Lubricants, Inc. (U.S.)

- Lubrilog (France)

- ECCO Gleittechnik GmbH (Germany)

- HUSK-ITT Corporation (U.S.)

- Setral Chemie GmbH (Germany)

- IKV Tribology Ltd (Germany)

What are the Recent Developments in Global Chlorides Market?

- In December 2024, Goyal Salt Limited revealed its plan to invest INR 80 crore (approximately USD 9.2 million) in setting up a new manufacturing facility in India, intended to expand its production capacity and market presence. This move supports the company’s strategy to cater to growing demand from industries such as food processing, pharmaceuticals, and industrial applications. The expansion is poised to significantly strengthen Goyal Salt’s footprint in both domestic and international markets

- In September 2024, QatarEnergy announced the formation of a joint venture to establish an industrial salt production facility valued at USD 275 million, with an annual output capacity of 1 million tons in Qatar. The plant will produce both table and industrial-grade salt to serve multiple sectors and aims to boost the country’s self-sufficiency in salt production. This strategic development is expected to reduce Qatar’s reliance on imports while supporting national industrial growth

- In March 2023, INOVYN, a U.K.-based chemical firm, introduced a sustainable, bio-based version of allyl chloride, addressing growing environmental concerns in the chemical industry. The eco-friendly variant meets the rising demand for greener chemical alternatives in various downstream applications. This launch reinforces INOVYN’s commitment to sustainability and innovation in the specialty chemicals segment

- In January 2022, the U.S. FDA approved B. Braun’s pharmaceutical manufacturing plant located in Daytona Beach, Florida, for the production of 0.9 percent sodium chloride injection solutions. The facility will produce 1,000 ml and 500 ml Excel Plus IV bags, with distribution managed from Bethlehem, Pennsylvania. This approval enhances B. Braun Medical’s supply capabilities for critical injectable solutions across healthcare facilities in the U.S

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chlorides Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chlorides Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chlorides Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.