Global Chlorinated Rubber Coatings Market

Market Size in USD Billion

CAGR :

%

USD

1.14 Billion

USD

2.03 Billion

2024

2032

USD

1.14 Billion

USD

2.03 Billion

2024

2032

| 2025 –2032 | |

| USD 1.14 Billion | |

| USD 2.03 Billion | |

|

|

|

|

Chlorinated Rubber Coatings Market Size

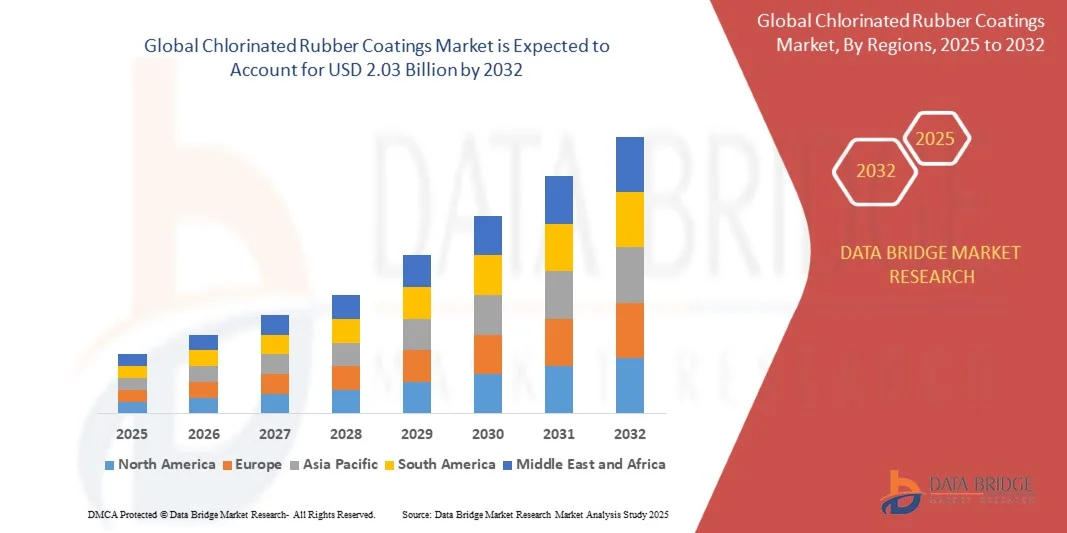

- The global chlorinated rubber coatings market size was valued at USD 1.14 billion in 2024 and is expected to reach USD 2.03 billion by 2032, at a CAGR of 7.5% during the forecast period

- The market growth is largely fueled by the increasing demand for high-performance protective coatings in construction, automotive, and marine industries, driven by the superior chemical resistance, durability, and water-repellent properties of chlorinated rubber coatings

- Furthermore, rising infrastructure development, industrial maintenance activities, and growing adoption of corrosion-resistant coatings in emerging economies are establishing chlorinated rubber coatings as a preferred choice for long-lasting protection. These converging factors are accelerating usage across multiple end-use sectors, thereby significantly boosting the industry’s growth

Chlorinated Rubber Coatings Market Analysis

- Chlorinated rubber coatings are specialized protective coatings derived from chlorinated rubber resins, widely used in paints, adhesives, lacquers, and printing inks for applications requiring water resistance, chemical durability, and quick-drying performance. They are particularly effective in harsh environments, such as marine, automotive, and heavy infrastructure, where long-term protection is essential

- The escalating demand for chlorinated rubber coatings is primarily fueled by rapid urbanization, increasing construction activities, and the rising need for corrosion-resistant and weatherproof coatings in industrial projects. In addition, their versatile applications in architecture, aerospace, and electronics are further propelling market expansion

- Asia-Pacific dominated the chlorinated rubber coatings market with a share of 39.5% in 2024, due to rapid infrastructure development, growing construction activities, and strong demand from marine and industrial sectors. The region benefits from extensive use of protective coatings in bridges, pipelines, and ships, where durability and chemical resistance are critical

- North America is expected to be the fastest growing region in the chlorinated rubber coatings market during the forecast period due to high demand from construction, automotive, and oil & gas industries

- High temperature segment dominated the market with a market share of 59.1% in 2024, due to its strong chemical resistance and ability to withstand harsh environmental conditions. Industries such as marine, oil & gas, and heavy-duty infrastructure prefer high temperature chlorinated coatings for their durability against corrosive environments and long-term protection of steel structures. Their versatility in protecting pipelines, bridges, and offshore platforms makes them a preferred solution where performance and reliability are critical. The segment’s dominance is also driven by increasing investments in infrastructure modernization and industrial equipment maintenance

Report Scope and Chlorinated Rubber Coatings Market Segmentation

|

Attributes |

Chlorinated Rubber Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chlorinated Rubber Coatings Market Trends

Growing Shift Toward Eco-Friendly, Low-VOC Coatings

- The chlorinated rubber coatings market is increasingly witnessing a transition toward environmentally conscious solutions, as industries seek low-VOC formulations to comply with sustainability goals and regulatory frameworks. Demand is shifting from traditional solvent-based coatings to eco-friendly alternatives that balance performance with environmental safety

- For instance, AkzoNobel has introduced low-VOC marine and industrial coatings that comply with stringent emission standards while offering the durability and protection associated with chlorinated rubber solutions. Similarly, Hempel has been investing in sustainable protective coatings tailored for infrastructure and industrial projects where environmental compliance is critical

- Manufacturers are leveraging advanced chemical formulations to create coatings that reduce harmful emissions without compromising on essential attributes such as strong adhesion, chemical resistance, and longevity. These innovations enable industries to adopt eco-friendly practices without sacrificing operational reliability

- End-user industries such as construction, marine, and petrochemicals are increasingly prioritizing coatings that meet both performance and environmental standards. This dual focus is reshaping competitive strategies as companies aim to secure market share by emphasizing eco-compliance alongside product efficiency

- Collaborative projects between material scientists, coating manufacturers, and industry regulators are promoting advancements in greener chlorinated rubber coatings. These partnerships support the development of solutions that align with market demand and upcoming policy standards, creating a robust pathway toward sustainable reformulation

- The rising preference for low-VOC, eco-friendly coatings is gradually redefining industry benchmarks. This trend marks a strategic alignment between regulatory compliance, customer demand, and technological innovation, ensuring that future growth in chlorinated rubber coatings aligns with global sustainability objectives

Chlorinated Rubber Coatings Market Dynamics

Driver

Rising Infrastructure and Industrial Demand

- The expansion of global infrastructure development and industrial projects is a major driver for the chlorinated rubber coatings market. These coatings are widely valued for their strong adhesion to concrete and steel surfaces, offering reliable protection against weathering, chemicals, and abrasion in large-scale applications

- For instance, Jotun has supplied chlorinated rubber protective coatings for industrial plants and infrastructural projects in regions across Asia and the Middle East. Nippon Paint has also emphasized chlorinated rubber-based coatings in areas demanding superior corrosion and water resistance, boosting their demand in construction and petrochemical facilities

- Rapid urbanization and investment in transport networks, ports, and energy facilities across developing regions are fueling significant demand for protective coatings. Chlorinated rubber coatings serve as an economical and efficient solution for extending the durability of structures and equipment

- Industrial operations in segments such as oil and gas, marine, and manufacturing rely heavily on chlorine-based coatings for pipeline stability, ship hull protection, and machinery maintenance. These coatings provide an advantage against chemical corrosion and moisture exposure, which are common in heavy-duty environments

- Growing investment in sustainable infrastructure now requires coatings that balance strong resilience with eco-compliant formulations. The consistent need for durable, versatile solutions ensures chlorinated rubber coatings remain relevant in critical applications, underlining their role as a key industrial material for long-term growth

Restraint/Challenge

Stringent Environmental Regulations

- Strict environmental regulations governing the production and application of chlorinated rubber coatings pose a significant challenge to the market. High VOC content and hazardous emission concerns linked to traditional formulations have placed these products under greater regulatory scrutiny worldwide

- For instance, regulatory authorities in the European Union and North America have imposed stringent restrictions on high-VOC coatings, forcing companies such as Sherwin-Williams and AkzoNobel to reformulate or shift to alternatives. This regulatory pressure is limiting the scalability of conventional chlorinated rubber products in developed markets

- Compliance with evolving legislation requires significant investment in R&D, adding financial and operational burdens for manufacturers. Smaller enterprises, in particular, face challenges in adopting greener formulations due to high reformulation costs and testing requirements for market approval

- The transition toward eco-friendly substitutes, such as waterborne or bio-based coatings, is intensifying the competitive landscape. This substitution risk challenges the long-term market share of traditional chlorinated rubber coatings and compels manufacturers to rethink product strategies to remain competitive

- In conclusion, regulatory challenges around VOC emissions are reshaping industry outlook. Overcoming these barriers demands focused innovation in sustainable formulations, ensuring market resilience while aligning with global environmental priorities and policy compliance for future growth

Chlorinated Rubber Coatings Market Scope

The market is segmented on the basis of type, application, and end users.

• By Type

On the basis of type, the chlorinated rubber coatings market is segmented into high temperature and low temperature coatings. The high temperature segment dominated the largest market revenue share of 59.1% in 2024, owing to its strong chemical resistance and ability to withstand harsh environmental conditions. Industries such as marine, oil & gas, and heavy-duty infrastructure prefer high temperature chlorinated coatings for their durability against corrosive environments and long-term protection of steel structures. Their versatility in protecting pipelines, bridges, and offshore platforms makes them a preferred solution where performance and reliability are critical. The segment’s dominance is also driven by increasing investments in infrastructure modernization and industrial equipment maintenance.

The low temperature segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by rising applications in regions with extreme cold weather and in industries requiring coatings that cure effectively at lower temperatures. These coatings are gaining traction in construction, automotive refinishing, and architectural projects where quick drying and strong adhesion under colder conditions are vital. Their adaptability in indoor and outdoor applications enhances usability across diverse end-use cases. With growing demand for coatings that minimize downtime and offer consistent performance in challenging climates, the low temperature segment is set to expand rapidly.

• By Application

On the basis of application, the chlorinated rubber coatings market is segmented into paints, lacquers, adhesives, and printing inks. The paints segment held the largest revenue share in 2024, owing to its extensive use in protective coatings for marine vessels, industrial machinery, and infrastructure projects. Chlorinated rubber-based paints are valued for their water resistance, fast-drying properties, and superior adhesion on metal and concrete surfaces, making them indispensable in anticorrosive applications. Their demand is also reinforced by urban development projects and growing infrastructure renovation activities across emerging economies.

The adhesives segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing usage in industrial bonding, construction materials, and automotive assembly. Chlorinated rubber-based adhesives provide strong binding strength, flexibility, and chemical resistance, making them suitable for demanding applications. Industries are adopting these adhesives for their ability to maintain performance under high stress and adverse environmental conditions. Growing demand for lightweight vehicles and durable construction solutions is further accelerating adoption of chlorinated rubber adhesives in multiple sectors.

• By End Users

On the basis of end users, the chlorinated rubber coatings market is segmented into architecture, automotive, aerospace, electronics, and others. The architecture segment dominated the largest market share in 2024, as chlorinated rubber coatings are widely used in construction for waterproofing, protective exterior coatings, and concrete sealing. Rapid urbanization, coupled with government-led infrastructure projects, is driving demand for durable and weather-resistant coatings in residential and commercial construction. Their ease of application, cost-effectiveness, and strong resistance to chemicals and water contribute to their continued dominance in architectural use.

The automotive segment is projected to record the fastest growth from 2025 to 2032, fueled by the rising need for coatings that offer corrosion resistance, durability, and aesthetic appeal. Chlorinated rubber coatings are increasingly used in underbody protection, refinishing, and adhesive bonding within automotive manufacturing. With growing vehicle production and the shift towards longer-lasting protective finishes, demand for these coatings in the automotive sector is accelerating. In addition, sustainability trends in the industry are encouraging the adoption of coatings that balance high performance with regulatory compliance, further supporting market growth.

Chlorinated Rubber Coatings Market Regional Analysis

- Asia-Pacific dominated the chlorinated rubber coatings market with the largest revenue share of 39.5% in 2024, driven by rapid infrastructure development, growing construction activities, and strong demand from marine and industrial sectors. The region benefits from extensive use of protective coatings in bridges, pipelines, and ships, where durability and chemical resistance are critical

- Cost-effective raw material availability, expanding manufacturing hubs, and supportive government initiatives for industrial growth are fueling market expansion

- Rising investments in automotive and construction industries, coupled with increasing urbanization and industrialization, are contributing to higher adoption of chlorinated rubber coatings across the region

China Chlorinated Rubber Coatings Market Insight

China held the largest share in the Asia-Pacific chlorinated rubber coatings market in 2024, owing to its position as a global manufacturing hub with strong demand across construction, automotive, and marine applications. The country’s large-scale infrastructure projects, such as highways, bridges, and ports, drive consistent consumption of protective coatings. Government initiatives supporting industrial modernization, coupled with strong export capabilities in paints and adhesives, further strengthen China’s market leadership.

India Chlorinated Rubber Coatings Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by booming construction activities, rapid urbanization, and rising investments in industrial infrastructure. The "Make in India" initiative is accelerating domestic production of coatings and related applications, enhancing market prospects. Increasing automotive manufacturing and strong demand for affordable, high-performance coatings in both urban and rural projects are also boosting adoption.

Europe Chlorinated Rubber Coatings Market Insight

The Europe market is expanding steadily, supported by stringent environmental standards, rising demand for protective and marine coatings, and advancements in eco-friendly coating formulations. High investment in sustainable infrastructure projects and emphasis on corrosion resistance are key growth factors. European industries, particularly in aerospace and automotive, are adopting chlorinated rubber coatings for their durability and compliance with quality standards.

Germany Chlorinated Rubber Coatings Market Insight

Germany’s market is driven by its leadership in automotive manufacturing, strong construction sector, and innovation in specialty coatings. The country’s advanced industrial base, combined with R&D in chemical technologies, enhances the application of chlorinated rubber coatings in both protective and performance-driven uses. Export-oriented growth and demand from high-value infrastructure projects further support its position.

U.K. Chlorinated Rubber Coatings Market Insight

The U.K. market is supported by a strong construction and marine sector, along with increasing focus on sustainable infrastructure and coating technologies. Efforts to localize supply chains post-Brexit, coupled with investments in innovative protective coatings, are shaping market expansion. The demand for high-quality, durable coatings in both commercial and residential applications remains a key driver.

North America Chlorinated Rubber Coatings Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by high demand from construction, automotive, and oil & gas industries. The region emphasizes advanced protective coatings for corrosion prevention and durability, particularly in large-scale infrastructure and industrial applications. Reshoring of manufacturing and a strong focus on sustainable and high-performance coatings are enhancing market expansion.

U.S. Chlorinated Rubber Coatings Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by its extensive construction activities, large automotive base, and strong marine industry demand. Advanced R&D capabilities, rising investments in industrial maintenance, and the presence of key market players strengthen the country’s dominance. Increasing adoption of high-performance coatings for long-term protection in infrastructure projects further fuels growth.

Chlorinated Rubber Coatings Market Share

The chlorinated rubber coatings industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Dieffenbacher GmbH Maschinen- und Anlagenbau (Germany)

- JNC Corp (Japan)

- Dow (U.S.)

- Koninklijke DSM N.V. (Netherlands)

- 3M Co (U.S.)

- Heubach Color (Germany)

- The Magni Group (U.S.)

- Wacker Chemie AG (Germany)

- SK Formulations India (India)

- Bluechem Group (Germany)

- Ancatt Inc. (U.S.)

- S.M. Adhesives (India)

- Renner Herrmann S.A. (Brazil)

- PPG Industries, Inc. (U.S.)

- AkzoNobel N.V. (Netherlands)

- The Sherwin-Williams Company (U.S.)

- Axalta Coating Systems Ltd (U.S.)

- Kingfa Science & Technology (India) Limited (India)

- Owens Corning (U.S.)

- Toray Industries, Inc. (Japan)

- Momentive (U.S.)

- LANXESS (Germany)

- SABIC (Saudi Arabia)

- Avient Corporation (U.S.)

- Daicel Corporation (Japan)

Latest Developments in Chlorinated Rubber Coatings Market

- In October 2024, Sudarshan Chemical’s acquisition of Heubach Group strengthened its pigment portfolio and global footprint. This move directly impacts the chlorinated rubber coatings market by ensuring a more reliable and diverse pigment supply chain, which is critical for coatings that require specific colors and durability standards. The acquisition enhances cost efficiency and innovation in pigments, enabling coating manufacturers to develop advanced chlorinated rubber formulations that meet evolving customer demands in industrial and architectural applications

- In July 2024, Axalta Coating Systems acquired The CoverFlexx Group for approximately $285 million, expanding its presence in automotive and aftermarket coatings. While not exclusive to chlorinated rubber, this acquisition highlights consolidation in the coatings industry and accelerates technology transfer across coating types. For the chlorinated rubber coatings market, it translates into greater opportunities for adoption in automotive underbody protection, refinishing, and specialty applications due to Axalta’s broader R&D capabilities and strengthened global distribution network

- In May 2024, the Bureau of Indian Standards (BIS) initiated a public consultation on the revised standard for chlorinated rubber (IS 13467) in protective paints and coatings. This regulatory update is expected to bring significant changes in formulation requirements, safety protocols, and quality compliance. Its impact on the chlorinated rubber coatings market lies in pushing manufacturers to innovate towards more standardized, environmentally aligned, and high-performance coatings, especially for infrastructure and industrial use in India’s rapidly growing construction sector

- In 2024, Goa Paints launched multiple chlorinated rubber coating products such as Galaxy CR Finish 7590, Galaxy CR HB MIO 6554, and Galaxy CR Primer 3580. These new product introductions expand the range of protective coatings for marine, industrial, and architectural applications. Their launch strengthens the company’s competitive positioning in South Asia and boosts the availability of region-specific formulations tailored to withstand corrosion, harsh climates, and long-term structural protection, thereby broadening adoption across end-user industries

- In 2023, Azelis announced the acquisition of CPS Chemicals (Coatings) in South Africa to strengthen its footprint in specialty coatings distribution. For the chlorinated rubber coatings market, this development enhances access to raw materials and intermediates in Africa, supporting market expansion in regions with rising demand for protective coatings in infrastructure and industrial projects. The move also positions Azelis to leverage its global network to improve supply reliability and technical support for chlorinated rubber coating customers in emerging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chlorinated Rubber Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chlorinated Rubber Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chlorinated Rubber Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.