Global Chlorine Market

Market Size in USD Billion

CAGR :

%

USD

34.32 Billion

USD

60.90 Billion

2024

2032

USD

34.32 Billion

USD

60.90 Billion

2024

2032

| 2025 –2032 | |

| USD 34.32 Billion | |

| USD 60.90 Billion | |

|

|

|

|

Chlorine Market Size

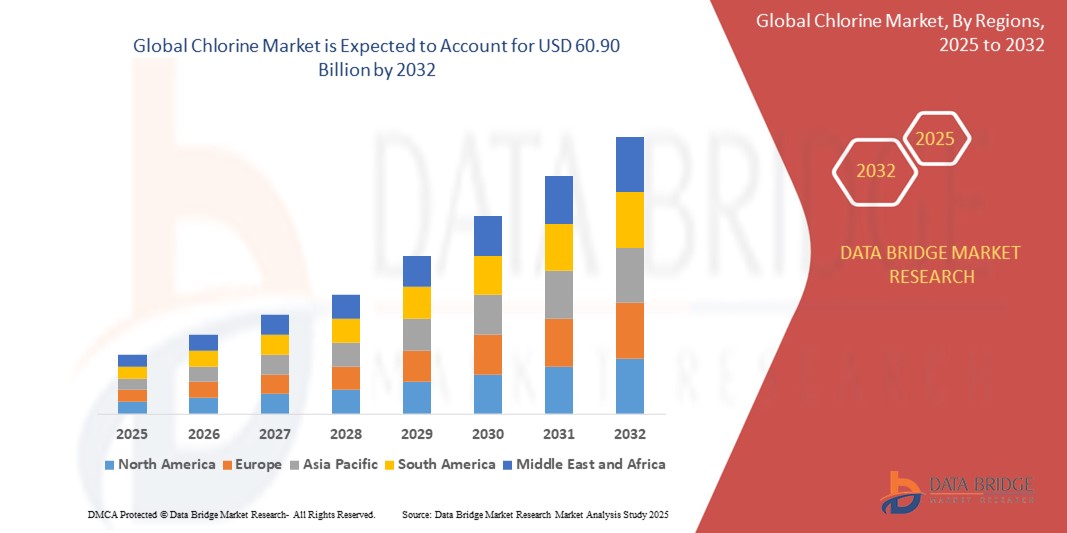

- The global chlorine market size was valued at USD 34.32 billion in 2024 and is expected to reach USD 60.90 billion by 2032, at a CAGR of 7.43% during the forecast period

- This growth is driven by growing chemical industry in developed nations, expanding end-user sectors, more manufacturing facilities, increased demand from the pharmaceutical industry, and increased demand from water treatment facilities

Chlorine Market Analysis

- Chlorine are critical materials used across a wide range of industries including electronics, medical devices, automotive, aerospace, and energy, due to their superior thermal resistance, electrical insulation, biocompatibility, and mechanical strength

- The demand for these materials is significantly driven by technological advancements, the rise in electric vehicle production, and growing adoption in semiconductor and medical applications

- Asia-Pacific is expected to dominate the chlorine market with the largest market share of 49.11%, driven by robust industrial base, expanding chemical manufacturing sector, and high demand from end-use industries such as water treatment, textiles, plastics, and pharmaceuticals

- North America is expected to witness the fastest growth in the chlorine market, driven by increasing demand in water treatment, pharmaceuticals, and the production of disinfectants and PVC-based products

- The EDC or PVC segment is expected to dominate the Chlorine market with the largest share of 34.27% in 2025 due to due to the rising demand for polyvinyl chloride in construction, automotive, and electrical applications, especially in emerging economies

Report Scope and Chlorine Market Segmentation

|

Attributes |

Chlorine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chlorine Market Trends

“Rising Use of Chlorine in Pharmaceutical Intermediates”

- The pharmaceutical sector is increasingly relying on chlorine-based intermediates for synthesizing antibiotics, antiseptics, and various active pharmaceutical ingredients (APIs).

- Chlorine’s reactivity and ability to form stable compounds make it ideal for producing high-purity chemicals required in drug manufacturing.

- The push for localized API production and pandemic-driven investments in healthcare infrastructure is boosting chlorine demand.

- For instance, in August 2023, BASF expanded its chlorine-based chemical production facilities in Germany to cater to rising pharmaceutical-grade intermediate demand.

- As global health concerns persist and pharma production scales up, chlorine usage in pharmaceutical synthesis is expected to grow steadily, particularly in Europe and Asia-Pacific

Chlorine Market Dynamics

Driver

“Rising Demand for Clean Water and Sanitation”

- Chlorine is a cornerstone in municipal water treatment due to its efficacy in killing pathogens and ensuring safe drinking water

- Rapid urbanization and population growth in developing countries are driving the expansion of public water systems using chlorine

- Government mandates for wastewater treatment and sanitation standards are further bolstering chlorine consumption

- For instance, in October 2023, the Indian government launched new initiatives under its Jal Jeevan Mission, significantly increasing the use of chlorine-based disinfectants in rural water systems

- With sustainability and hygiene at the forefront, chlorine’s role in global water safety infrastructure is expected to remain indispensable

Opportunity

“Surge in PVC Production for Infrastructure Projects”

- Polyvinyl chloride (PVC), made using chlorine, is widely used in piping, window frames, and insulation for both residential and industrial projects

- Massive investments in smart cities, affordable housing, and energy grid modernization are pushing PVC demand

- Chlorine manufacturers stand to gain from the resilient demand for PVC in infrastructure sectors across emerging economies

- For instance, in July 2023, Formosa Plastics announced capacity expansion in Texas to meet rising PVC and chlorine derivative demand from the U.S. and Latin America

- As global construction rebounds, chlorine’s use in PVC production will continue to offer a strong growth avenue

Restraint/Challenge

“Environmental Regulations and Safety Concerns”

- The production and use of chlorine can result in harmful byproducts, such as dioxins and organochlorines, which pose environmental and health risks

- Increasingly stringent environmental and occupational safety regulations, particularly in the U.S. and Europe, are adding compliance costs

- Public pressure and NGO-led campaigns against chlorine-based products in packaging and consumer goods also challenge market perception

- For instance, in 2023, Greenpeace called for a global ban on PVC due to concerns over chlorine byproducts in consumer plastics

- Addressing regulatory hurdles and developing greener chlorine technologies will be essential for long-term market stability

Chlorine Market Scope

The market is segmented on the basis of application and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Application

|

|

|

By End-User

|

|

In 2025, the EDC or PVC is projected to dominate the market with a largest share in application type segment

The EDC or PVC segment is expected to dominate the Chlorine market with the largest share of 34.27% in 2025 due to due to the rising demand for polyvinyl chloride in construction, automotive, and electrical applications, especially in emerging economies.

The water treatment is expected to account for the largest share during the forecast period in end-user segment

In 2025, the water treatment segment is expected to dominate the market with the largest market share of 23.31% due to the increasing global focus on safe drinking water, expanding municipal water treatment infrastructure, and stringent government regulations on wastewater discharge.

Chlorine Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Chlorine Market”

- Asia-Pacific is expected to dominate the Chlorine market with the largest market share of 49.11%, driven by robust industrial base, expanding chemical manufacturing sector, and high demand from end-use industries such as water treatment, textiles, plastics, and pharmaceuticals

- China and India lead the regional growth due to increasing urbanization, rising population, and growing demand for PVC (polyvinyl chloride), which uses chlorine as a key feedstock

- The region benefits from cost-effective labor, favorable government policies for industrial development, and the presence of major chlorine manufacturers expanding their capacities

- Continuous investments in infrastructure, coupled with rising environmental awareness and water sanitation initiatives, further boost chlorine consumption across Asia-Pacific

“North America is Projected to Register the Highest CAGR in the Chlorine Market”

- North America is expected to witness the fastest growth in the chlorine market, driven by increasing demand in water treatment, pharmaceuticals, and the production of disinfectants and PVC-based products

- The U.S. plays a pivotal role due to strong industrial infrastructure, high regulatory standards for water sanitation, and growing use of chlorine in the healthcare and construction sectors

- Ongoing technological advancements, rising environmental concerns, and federal investments in clean water programs are further accelerating market growth across the region

- Strategic capacity expansions, R&D in green chlor-alkali production, and increasing exports of chlorine derivatives position North America as a key growth hub in the coming years

Chlorine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Akzo Nobel N.V. (Netherlands)

- Formosa Plastics Corporation (Taiwan)

- Hanwha Solutions Chemical Division Corporation (Korea)

- Ineos Group Limited (U.K.)

- Occidental Petroleum Corporation (U.S.)

- Olin Corporation. (U.S.)

- PPV AG (Germany)

- Tata Chemicals Ltd. (India)

- DOW (U.S.)

- Tosoh Corporation (Japan)

- Chlorine Specialties, Inc. (U.S.)

- SEATEX LLC. (U.S.)

- Ercros S.A (Spain)

- Fluid Metering Inc. (U.S.)

- The STUTZ Company (U.S.)

- AquaPhoenix Scientific Inc. (U.S.)

- BASF SE (Germany)

- Westlake Chemical Corporation. (U.S.)

- PACKED CHLORINE LTD. (U.K.)

- Aditya Birla Chemicals (India)

- Jana Overseas (India)

- Vynova Group (Belgium)

- Nouryon (Nethelands)

- BONDALTI (Portugal)

- Kemira (Finland)

- Vinnolit GmbH & Co. KG (Germany)

- INOVYN (U.K.)

- Gujarat Alkalies and Chemical Limited. (India)

- BENGAL Gases (India)

Latest Developments in Global Chlorine Market

- In April 2024, the City of Laredo Utilities Department announced the completion of its natural chlorine conversion process, stating that chloramines formed by combining ammonia and chlorine were successfully integrated into the system

- In February 2024, INEOS Inovyn introduced its newly developed Ultra Low Carbon (ULC) range of chlor-alkali products, which includes caustic potash, caustic soda, and chlorine. This innovation offers up to a 70% reduction in carbon footprint compared to industry norms and aligns with the company’s sustainability goals

- In January 2023, a joint venture between Covestro AG and LANXESS was established to produce more environmentally friendly raw materials by reducing CO₂ emissions by up to 120,000 tons annually. As part of the initiative, Covestro’s ISCC PLUS-certified facilities in Leverkusen and Krefeld-Uerdingen will supply LANXESS with chlorine, caustic soda, and hydrogen

- In August 2022, Occidental Petroleum Corporation’s chlor-alkali production unit requested USD 1.1 billion for a chemical upgrade and technology expansion. The development, which began in 2023, supports the continued production of chlorine and caustic soda

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chlorine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chlorine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chlorine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.