Global Chocolate Biscuit Market

Market Size in USD Billion

CAGR :

%

USD

17.14 Billion

USD

28.15 Billion

2024

2032

USD

17.14 Billion

USD

28.15 Billion

2024

2032

| 2025 –2032 | |

| USD 17.14 Billion | |

| USD 28.15 Billion | |

|

|

|

|

Chocolate Biscuit Market Size

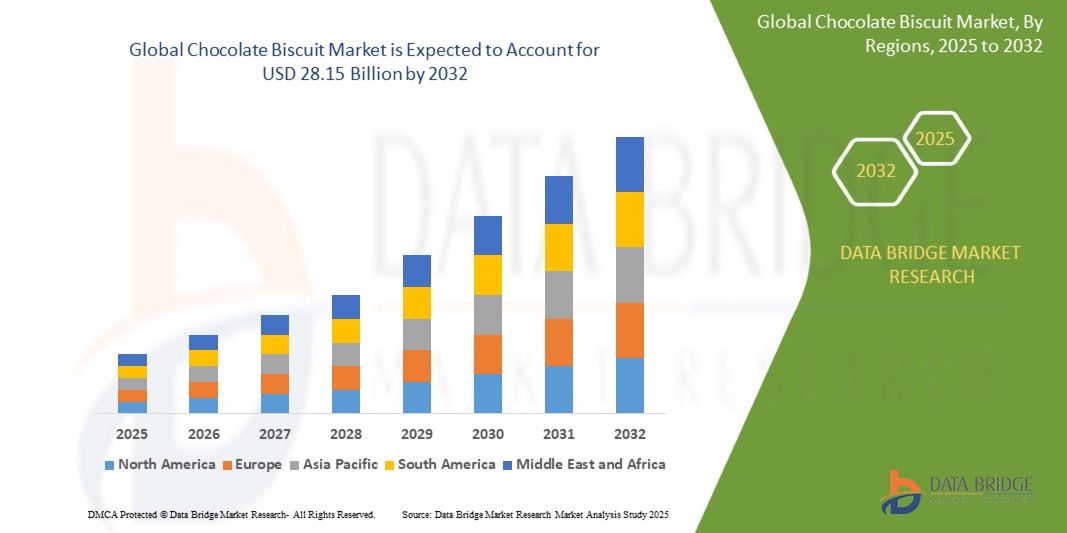

- The global chocolate biscuit market size was valued at USD 17.14 billion in 2024 and is expected to reach USD 28.15 billion by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely fueled by rising consumer demand for convenient and indulgent snack options, along with increasing availability through expanding retail and online channels across both developed and emerging markets

- Furthermore, innovation in product flavors, healthier formulations, and attractive packaging is enhancing consumer appeal, while marketing efforts targeting lifestyle trends and premiumization are driving higher consumption rates, significantly boosting market growth

Chocolate Biscuit Market Analysis

- Chocolate biscuits are snack products combining biscuit bases with chocolate coatings or fillings, offering a blend of texture and flavor that appeals to a broad consumer base across age groups and regions

- The escalating demand for chocolate biscuits is primarily fueled by growing consumer preference for convenient, indulgent snacks, increasing penetration of modern retail and e-commerce platforms, and ongoing product innovations in flavors and healthier options

- North America dominated the chocolate biscuit market in 2024, due to high consumer spending power, extensive retail penetration, and strong demand for both indulgent and health-conscious chocolate biscuit variants

- Europe is expected to be the fastest growing region in the chocolate biscuit market during the forecast period due to rising consumer inclination towards premium, artisanal, and organic products

- Milk segment dominated the market with a market share of 56.2% in 2024, due to its creamy, sweet taste that appeals to a wide consumer base including children and families. Milk chocolate biscuits are widely regarded as comfort snacks, with established brands continuously innovating by adding nuts, caramel, and fruit bits to diversify their offerings. Their affordability and smooth flavor profile sustain strong demand across multiple regions

Report Scope and Chocolate Biscuit Market Segmentation

|

Attributes |

Chocolate Biscuit Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chocolate Biscuit Market Trends

Rising Demand for Healthier and Premium Chocolate Biscuit Variants

- The market is experiencing notable growth in demand for healthier and premium chocolate biscuit products, with consumers favoring options containing high-quality cocoa, reduced sugar, organic ingredients, and functional additives such as protein or fiber enrichment

- For instance, manufacturers such as Nestlé, Mondelez, and Pladis are diversifying portfolios with chocolate biscuits featuring clean labels, gluten-free formulations, vegan-friendly options, and premium fillings, leveraging novel flavors and attractive packaging to appeal to health- and quality-conscious shoppers

- Product innovations focus on incorporating ethically sourced cocoa and sustainable packaging to meet evolving ethical and environmental preferences of modern consumers

- E-commerce channels are expanding market reach, supporting rapid launches of new variants and limited-edition premium products that facilitate direct engagement with consumers

- Seasonal demand and gifting trends drive unique flavor introductions and exclusive premium biscuit offerings, strengthening both brand loyalty and impulse purchase behavior

- The Asia-Pacific region is witnessing robust growth supported by urbanization, westernization of diets, and increased disposable incomes, while Europe and North America maintain significant presence due to entrenched chocolate biscuit consumption and established retail infrastructure

Chocolate Biscuit Market Dynamics

Driver

Consumer Preferences and Taste Trends

- Persistently strong consumer preference for indulgent snacks and evolving taste trends propel demand for chocolate biscuits, especially those blending classic chocolate notes with innovative textures and mix-ins

- For instance, cream-filled chocolate biscuits account for a major market share due to their combination of rich chocolate and smooth fillings, with manufacturers offering a broad array of flavors such as caramel, fruit infusions, or mint to satisfy a diverse range of palates

- Convenience and versatility make chocolate biscuits a favored snack for multiple occasions, from lunchbox treats to dessert accompaniments and on-the-go options

- Growing influence of children’s segment, fueled by appealing shapes, packaging, and brand collaborations, continues to expand market volume, while millennial and Gen Z consumers drive demand for adventurous and premium flavor profiles

- The digitalization of retail and marketing, including influencer collaborations and online product launches, supports rapid scaling and greater visibility of new entries in the chocolate biscuit landscape

Restraint/Challenge

Competition from Healthier Alternatives

- The increasing market penetration of perceived healthier snack alternatives—such as nut bars, protein cookies, oat-based biscuits, and fruit snacks—creates competitive pressure for traditional chocolate biscuits to innovate and reformulate

- For instance, emerging brands with better-for-you propositions and established manufacturers are introducing chocolate biscuits with lower sugar, added nutrients, organic certifications, or free-from claims to address shifting consumer priorities and retain market share

- Price sensitivity and fluctuating raw material costs including cocoa, sugar, and wheat impact profitability and pricing strategies, especially for premium or health-oriented variants

- Regulatory pressures around sugar, trans fats, and labeling requirements force industry adaptation, raising R&D investments and complicating reformulation processes

- Seasonality and macroeconomic factors, such as recessionary impacts or supply chain disruptions, can temper market growth and affect consumer willingness to purchase premium chocolate biscuit products

Chocolate Biscuit Market Scope

The market is segmented on the basis of type, distribution channel, flavor, age group, and price range.

• By Type

On the basis of type, the chocolate biscuit market is segmented into chocolate cookies, chocolate wafers, chocolate sandwich biscuits, and chocolate-filled biscuits. The chocolate cookies segment dominated the largest market revenue share in 2024, supported by its widespread acceptance across age groups and occasions. These cookies offer versatile flavors and textures that cater to a broad consumer base. Their longstanding presence in retail channels and frequent seasonal packaging boosts consistent demand. Established brands continue innovating within this category by introducing health-focused variants and new flavor combinations, maintaining consumer interest. Their affordability and accessibility further cement their leadership in the market.

The chocolate-filled biscuits segment is expected to witness the fastest growth rate from 2025 to 2032. This growth is driven by consumer demand for richer, indulgent experiences with innovative fillings such as molten centers, flavored creams, and multi-layered textures. Younger consumers and premium buyers are particularly attracted to these novel products. The rising trend of artisanal and gourmet biscuits is also fueling innovation and premiumization in this segment, encouraging manufacturers to develop unique, high-value offerings.

• By Distribution Channel

On the basis of distribution channel, the chocolate biscuit market is segmented into B2B and B2C. The B2C segment dominated the largest market revenue share in 2024 due to its extensive retail presence across supermarkets, hypermarkets, convenience stores, and e-commerce platforms. The convenience of easy availability and frequent promotional activities drive impulse purchases and brand loyalty. The rise of online grocery shopping has further expanded the B2C footprint, enabling access to a broader range of products including premium biscuits. Influencer marketing and digital campaigns also boost consumer engagement in this segment, solidifying its leadership.

The B2B segment is projected to witness the fastest CAGR from 2025 to 2032. Growing demand from the hospitality industry, corporate gifting, and institutional catering supports this expansion. Bulk procurement for hotels, airlines, and corporate events is increasing, with businesses opting for premium and customized packaging to create a memorable guest or client experience. The evolving preference for branded gifting solutions and bulk snacks in corporate settings also contributes to the rapid growth of this channel.

• By Flavor

On the basis of flavor, the chocolate biscuit market is segmented into milk, dark, white, and mixed. The milk chocolate segment dominated the largest market share of 56.2% in 2024 owing to its creamy, sweet taste that appeals to a wide consumer base including children and families. Milk chocolate biscuits are widely regarded as comfort snacks, with established brands continuously innovating by adding nuts, caramel, and fruit bits to diversify their offerings. Their affordability and smooth flavor profile sustain strong demand across multiple regions.

The dark chocolate segment is expected to witness the fastest growth rate from 2025 to 2032. This growth is driven by increasing consumer awareness about the health benefits associated with dark chocolate, such as antioxidants and lower sugar content. Urban and premium consumers prefer the richer, more intense cocoa flavors found in dark chocolate biscuits. In addition, the rising popularity of organic and sugar-free variants supports the expansion of this segment. Dark chocolate’s positioning as a premium and health-conscious choice is attracting a growing segment of adult consumers.

• By Age Group

On the basis of age group, the chocolate biscuit market is segmented into children, adults, and geriatric. The children’s segment dominated the largest revenue share in 2024, fueled by high consumption frequency and strong brand loyalty. Attractive packaging with cartoons, collectibles, and limited editions effectively capture children’s attention, encouraging repeat purchases. Marketing campaigns targeting fun and interactive experiences sustain the popularity of chocolate biscuits in this segment. These products are commonly included in school snacks and lunchboxes, ensuring consistent demand.

The adult segment is anticipated to witness the fastest CAGR from 2025 to 2032. Adults increasingly prefer healthier and premium chocolate biscuit options, such as dark chocolate, reduced sugar, and fortified varieties. This demographic values balanced indulgence, combining taste with nutritional benefits, which has led manufacturers to introduce artisanal and wellness-oriented products. The growing trend toward mindful snacking and premiumization supports rapid growth in this segment.

• By Price Range

On the basis of price range, the chocolate biscuit market is segmented into economy, mid-range, and premium. The mid-range segment dominated the largest market revenue share in 2024, as it offers an optimal balance between affordability and quality. This segment appeals to middle-income families and price-sensitive consumers who seek reliable taste and trusted brands. Multi-pack options and regular promotional offers contribute to consistent sales. The segment’s broad appeal across demographics and retail channels reinforces its leading market position.

The premium segment is projected to witness the fastest growth rate from 2025 to 2032. Increasing consumer interest in artisanal, gourmet, and exotic flavor combinations is driving demand. Premium biscuits are often positioned as luxury snacks or gifting options, with appealing packaging and limited-edition releases. Rising disposable incomes and evolving consumer preferences for high-quality indulgence support rapid expansion. Collaborations with gourmet chocolatiers and innovative product launches further accelerate growth in this segment.

Chocolate Biscuit Market Regional Analysis

- North America dominated the chocolate biscuit market with the largest revenue share in 2024, driven by high consumer spending power, extensive retail penetration, and strong demand for both indulgent and health-conscious chocolate biscuit variants

- Consumers in the region value product variety, convenience, and innovative flavors, supported by well-established distribution networks including supermarkets, convenience stores, and growing e-commerce platforms

- The presence of major manufacturers and aggressive marketing campaigns, alongside a rising preference for premium and fortified products, has further propelled market growth across the U.S. and Canada

U.S. Chocolate Biscuit Market Insight

The U.S. chocolate biscuit market captured the largest revenue share in North America in 2024, driven by increasing consumer preference for indulgent snacks and premium flavors. The rise in on-the-go consumption, coupled with an expanding base of health-conscious consumers seeking fortified and reduced-sugar options, supports steady growth. Online retail channels and convenience stores have enhanced accessibility, while marketing campaigns targeting millennials and families boost brand engagement. The demand for limited-edition and seasonal offerings further fuels market expansion. In addition, collaborations with popular confectionery brands and diversified flavor portfolios strengthen the market position.

Asia-Pacific Chocolate Biscuit Market Insight

The Asia-Pacific chocolate biscuit market accounted for a significant share in 2024 and is poised for steady growth, supported by rising urbanization, increasing disposable incomes, and expanding retail infrastructure in countries such as China, India, Japan, and Australia. The region’s young population and growing snacking culture drive demand for innovative chocolate biscuit varieties. In addition, government initiatives promoting packaged food safety and modernization of supply chains contribute to market expansion. Online sales channels and expanding organized retail formats facilitate wider product availability.

China Chocolate Biscuit Market Insight

China holds the largest revenue share within Asia-Pacific in 2024, backed by rapid urbanization and a growing middle class with increasing preference for indulgent snacks. The rise of e-commerce platforms has greatly enhanced consumer access to both local and international biscuit brands. Domestic manufacturers are innovating with unique flavors and healthier options to meet evolving tastes. Urban consumers seek convenient, on-the-go snacks, while gifting occasions and festive seasons create spikes in demand.

Japan Chocolate Biscuit Market Insight

The Japan chocolate biscuit market is witnessing growth driven by a mature consumer base with a penchant for premium and specialty biscuits. The emphasis on quality, texture, and packaging aesthetics attracts discerning consumers. Integration of traditional flavors with modern chocolate varieties fuels innovation. The aging population also demands softer, easy-to-consume biscuits fortified with health benefits, broadening the market scope. Convenience store channels and online sales remain important distribution points.

Europe Chocolate Biscuit Market Insight

The Europe chocolate biscuit market is projected to grow at the fastest CAGR throughout the forecast period, driven by rising consumer inclination towards premium, artisanal, and organic products. Increasing health consciousness among European consumers is fostering demand for dark chocolate and sugar-reduced biscuits. Strict food quality regulations and sustainability concerns are pushing manufacturers to innovate with cleaner labels and ethically sourced ingredients. Urbanization and higher disposable incomes are expanding the consumer base for indulgent snacks across both Western and Eastern Europe. Countries such as the U.K., Germany, and France are key contributors, with rising e-commerce adoption supporting market accessibility. The focus on gifting culture and festive packaging also propels demand.

U.K. Chocolate Biscuit Market Insight

The U.K. chocolate biscuit market is expected to register significant growth during the forecast period, led by the popularity of premium and specialty biscuits. Consumers are increasingly drawn to products featuring high-quality ingredients, unique flavor combinations, and ethical sourcing certifications. The growing trend of gifting and seasonal promotions further supports sales. Online grocery shopping and health-driven snacking habits enhance market penetration. Brand loyalty and frequent product innovations in texture and fillings keep the market competitive.

Germany Chocolate Biscuit Market Insight

The Germany chocolate biscuit market is anticipated to expand steadily, fueled by consumer preference for organic and sugar-reduced biscuits. Increasing awareness about health and wellness is driving demand for products fortified with fiber, vitamins, and functional ingredients. Germany’s well-developed retail channels and strong presence of artisanal biscuit manufacturers promote market growth. Sustainable packaging and locally sourced ingredients are becoming important purchasing factors, aligning with consumer values.

Chocolate Biscuit Market Share

The chocolate biscuit industry is primarily led by well-established companies, including:

- pladis global (U.K.)

- Danish Speciality Foods Aps (Denmark)

- Tatawa Industries(M) Sdn. Bhd. (Malaysia)

- Balocco S.p.A (Italy)

- Mondelez International (U.S.)

- Mars, Incorporated (U.S.)

- PepsiCo (Walkers) (U.K.)

- Ferrero Group (Italy)

- Lotus Bakeries (Belgium)

- Patanjali Ayurved (India)

- Sunfeast (ITC Ltd.) (India)

- Duchess (U.K.)

- Nestlé S.A. (Switzerland)

- Hershey's (U.S.)

- Unilever (Ben & Jerry's) (U.K./Netherlands)

- McVitie's (U.K.)

- Bahlsen (Germany)

- Bisk Farm (India)

- Bourbon (Britannia) (Japan/India)

Latest Developments in Global Chocolate Biscuit Market

- In June 2024, Mondelēz International partnered with Lotus Bakeries to manufacture and distribute Biscoff biscuits in India. Leveraging Mondelēz’s extensive local production and distribution network, this collaboration aims to significantly expand market reach within India’s growing chocolate biscuit sector. The partnership is likely to accelerate product availability and consumer access, supporting both companies’ growth objectives by capitalizing on the increasing demand for premium biscuit varieties in the Indian market

- In November 2023, Fox's Burton launched a multi-million-dollar marketing campaign for its Maryland Cookies brand. This comprehensive initiative, which included revamped packaging and an extensive advertising strategy, is aimed at enhancing customer loyalty and increasing brand awareness. The campaign is expected to strengthen Maryland Cookies’ market position by attracting new consumers and reinforcing the brand’s identity in a competitive biscuit market, thereby driving higher sales and expanding market share

- In February 2023, The Hershey Company launched limited-edition chocolate bars to commemorate International Women’s Day. This strategic move signals a growing trend toward seasonal and thematic product launches, which can drive consumer engagement and boost sales through targeted marketing efforts. Such initiatives, if mirrored in the biscuit segment, could encourage biscuit manufacturers to explore thematic releases, thereby stimulating demand and differentiating their product offerings in a crowded market

- In November 2022, specialty delivery coordination service Next Bite partnered with Nestlé to deliver fresh-baked Toll House cookies across the U.S. This partnership addresses the rising consumer demand for convenient, fresh, and on-demand snack options, enhancing Nestlé’s distribution capabilities and market penetration. By integrating delivery services, Nestlé is positioned to tap into evolving consumer behaviors favoring quick access to fresh products, thereby strengthening its foothold in the competitive U.S. biscuit and cookie market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chocolate Biscuit Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chocolate Biscuit Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chocolate Biscuit Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.