Global Choke And Kill Manifold Market

Market Size in USD Billion

CAGR :

%

USD

2.12 Billion

USD

3.06 Billion

2024

2032

USD

2.12 Billion

USD

3.06 Billion

2024

2032

| 2025 –2032 | |

| USD 2.12 Billion | |

| USD 3.06 Billion | |

|

|

|

|

Choke and Kill Manifold Market Size

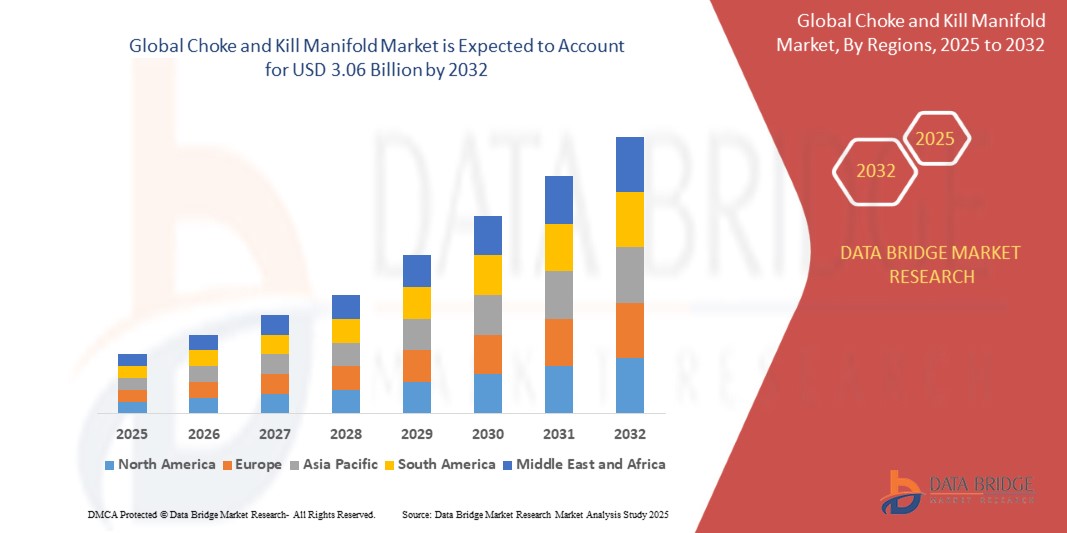

- The global choke and kill manifold market size was valued at USD 2.12 billion in 2024 and is expected to reach USD 3.06 billion by 2032, at a CAGR of 4.7% during the forecast period

- The market growth is largely fueled by the increasing demand for advanced pressure control systems in oil and gas exploration and production activities, particularly in high-pressure, high-temperature (HPHT) drilling environments where safety and operational efficiency are critical

- Furthermore, rising investments in offshore drilling projects and the growing need for reliable equipment to manage well control during kick and blowout scenarios are establishing choke and kill manifolds as essential components in drilling operations, thereby significantly boosting the industry's growth

Choke and Kill Manifold Market Analysis

- Choke and kill manifolds are critical well control systems used to regulate pressure and flow during drilling, particularly in managing kick situations and preventing blowouts. These systems are vital in both onshore and offshore drilling operations to ensure safe and efficient pressure control

- The growing adoption of automated and remotely operable manifolds, advancements in material durability for high-stress applications, and the push for improved safety standards in oilfield operations are driving the expansion of the choke and kill manifold market across global upstream sectors

- North America dominated the choke and kill manifold market with a share of 38.7% in 2024, due to the high concentration of oil and gas drilling operations and advanced well control infrastructure

- Asia-Pacific is expected to be the fastest growing region in the choke and kill manifold market during the forecast period due to increasing exploration and production investments in countries such as China, India, Indonesia, and Malaysia

- Onshore segment dominated the market with a market share of 69.2% in 2024, due to the concentration of global drilling operations on land-based rigs and the comparatively lower operational complexity and cost. Choke and kill manifolds are widely used in onshore oilfields for their reliability in pressure control and blowout prevention, particularly in regions with established hydrocarbon infrastructure such as North America and the Middle East

Report Scope and Choke and Kill Manifold Market Segmentation

|

Attributes |

Choke and Kill Manifold Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Choke and Kill Manifold Market Trends

“Rising Oil and Gas Exploration”

- The market is expanding rapidly as global investments in oil and gas exploration continue to rise—especially in deepwater, ultra-deepwater, and high-pressure drilling environments. These operations require advanced well control infrastructure, particularly choke and kill manifolds, which are critical for managing pressure during emergencies and maintaining operational integrity

- For instance, industry leaders such as Schlumberger, Weatherford International, and National Oilwell Varco (NOV) are seeing rising demand for high-performance choke and kill manifold systems from offshore drilling projects in the Middle East, North Sea, and West Africa. These companies are enhancing their product portfolios to cater to HPHT wells with high corrosion resistance and remote-control capabilities

- National energy strategies—such as Saudi Vision 2030 and UAE’s ADNOC offshore expansion—are also contributing to a surge in upstream activity and infrastructure development, fueling demand for well safety and pressure management equipment

- Stricter safety regulations are prompting both national oil companies and independent operators to adopt state-of-the-art well control systems, enhancing operational resilience against potential blowouts or overpressurization

- Growing demand for safer, environmentally compliant oilfield processes is pushing manufacturers to integrate emissions-reducing designs and digital monitoring tools into their manifold systems—turning safety tools into smart, sustainable assets

Choke and Kill Manifold Market Dynamics

Driver

“Rising Integration of Digital Technologies”

- The industry is witnessing rapid adoption of digital innovations—automation, IoT sensors, and real-time diagnostics—within manifold systems, enhancing operational reliability and worker safety in hazardous drilling settings

- For instance, companies such as Baker Hughes, Halliburton, and Schlumberger have released digitally enabled manifolds with remote monitoring and automation capabilities, allowing for secure management of drilling operations from central control rooms

- Digital twins and predictive analytics are increasingly used to simulate drilling scenarios and anticipate maintenance needs, minimizing unplanned downtime and boosting operational efficiency

- Cloud platforms now enable integration of manifold system data into broader asset management environments, improving decision-making and workflow automation

- The digital shift is helping operators adhere to stricter safety regulations and optimize resource allocation, solidifying digital integration as a market growth driver

Restraint/Challenge

“Fluctuating Oil Prices”

- The volatility of global oil prices significantly influences investment by exploration and production firms, with downturns often prompting project delays and limiting demand for new choke and kill manifold installations

- For instance, both Weatherford International and NOV have reported inconsistent order volumes and shifting procurement schedules, directly linked to recent fluctuations in oil market prices and investor sentiment

- High upfront and maintenance costs for advanced manifold systems, especially those with automated and digital features, make financial returns more sensitive to market conditions

- The complexity of operating and maintaining cutting-edge manifold equipment requires skilled personnel, which can challenge adoption in regions or projects facing workforce constraints

- Shifting regulations, trade restrictions, and geopolitical uncertainties further complicate long-term planning and procurement for both manufacturers and end-users

Choke and Kill Manifold Market Scope

The market is segmented on the basis of commodity, application, and end user.

• By Commodity

On the basis of commodity, the choke and kill manifold market is segmented into oil and gas. The oil segment dominated the largest market revenue share in 2024, primarily driven by the extensive deployment of choke and kill systems in high-pressure drilling environments to maintain well integrity and control formation pressure. As global demand for crude oil continues to rise, particularly in emerging economies, upstream exploration and development activities have surged, bolstering the need for dependable pressure management equipment such as choke and kill manifolds. The widespread use of these systems in both conventional and unconventional oil extraction has further solidified the segment’s dominance.

The gas segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing number of deep and ultra-deepwater natural gas projects and the growing transition towards cleaner energy alternatives. With natural gas seen as a transitional fuel in global decarbonization efforts, drilling activities for gas reserves are increasing, especially in regions such as the Middle East and Asia-Pacific. This is leading to greater investments in high-performance manifolds capable of withstanding the challenging pressures and operational dynamics of gas well control.

• By Application

On the basis of application, the market is segmented into onshore and offshore. The onshore segment held the largest market share of 69.2% in 2024 due to the concentration of global drilling operations on land-based rigs and the comparatively lower operational complexity and cost. Choke and kill manifolds are widely used in onshore oilfields for their reliability in pressure control and blowout prevention, particularly in regions with established hydrocarbon infrastructure such as North America and the Middle East.

The offshore segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the increasing number of offshore exploration projects and rising investments in subsea oil and gas fields. The growing demand for advanced pressure control equipment capable of functioning in high-risk and high-pressure deepwater environments is fueling the adoption of robust manifold systems. As companies push boundaries to exploit offshore reserves, particularly in Brazil, the Gulf of Mexico, and West Africa, the need for technologically advanced and corrosion-resistant choke and kill manifolds is escalating.

• By End User

On the basis of end user, the market is segmented into oil and gas, power and electricity, construction, and others. The oil and gas segment accounted for the largest revenue share in 2024, primarily due to the integral role choke and kill manifolds play in drilling safety, pressure management, and well control. As upstream operations expand to deeper and more geologically complex reservoirs, the demand for advanced safety-critical components such as choke and kill manifolds continues to rise. The segment also benefits from recurring investments in both exploration and development across major producing nations.

The power and electricity segment is expected to experience the fastest growth from 2025 to 2032, supported by the expansion of thermal and hydroelectric power infrastructure where high-pressure fluid systems are involved. In such environments, choke and kill manifolds provide vital functions in managing fluid pressures and ensuring equipment safety. Increasing focus on energy reliability and operational safety standards in power generation further contributes to the accelerated adoption of these systems across non-oil sectors.

Choke and Kill Manifold Market Regional Analysis

- North America dominated the choke and kill manifold market with the largest revenue share of 38.7% in 2024, driven by the high concentration of oil and gas drilling operations and advanced well control infrastructure

- The region benefits from strong investments in upstream oilfield development, particularly in shale formations and deepwater projects requiring high-pressure management systems

- This dominance is further supported by the presence of key market players, favorable regulatory frameworks for hydrocarbon exploration, and ongoing technological innovation in pressure control systems

U.S. Choke and Kill Manifold Market Insight

The U.S. captured the largest revenue share in 2024 within North America, fueled by consistent drilling activity in shale plays such as the Permian Basin, Bakken, and Eagle Ford, as well as active offshore exploration in the Gulf of Mexico. The market is being propelled by the adoption of advanced pressure control systems capable of handling high-pressure, high-temperature (HPHT) conditions. Increased focus on well integrity, safety mandates, and automation in rig operations is driving steady demand for robust, high-capacity choke and kill manifolds across both land-based and offshore fields.

Europe Choke and Kill Manifold Market Insight

Europe accounted for a notable share of the choke and kill manifold market in 2024, driven by rising investments in offshore E&P activities and a strong focus on regulatory compliance in high-risk drilling zones. The region’s emphasis on maintaining operational safety and preventing environmental hazards has prompted oilfield operators to replace aging systems with advanced manifold solutions. Innovations in compact, corrosion-resistant designs tailored for offshore platforms are gaining traction, particularly for use in mature fields requiring optimized well control systems.

U.K. Choke and Kill Manifold Market Insight

The U.K. market is expected to grow at a significant CAGR during the forecast period, supported by revitalized drilling activity in the North Sea and government initiatives to extend the productive life of offshore fields. The implementation of stringent health and safety regulations is driving the demand for modern, high-reliability manifold systems designed to manage complex well pressures. The move toward digital oilfield technologies is also contributing to the increased deployment of integrated pressure control equipment.

Asia-Pacific Choke and Kill Manifold Market Insight

Asia-Pacific is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing exploration and production investments in countries such as China, India, Indonesia, and Malaysia. The region is experiencing rising energy demand due to industrial expansion and population growth, prompting national oil companies to boost domestic output. This trend is translating into higher adoption of pressure control systems, including choke and kill manifolds, for both onshore and offshore developments. The availability of cost-effective manufacturing and rising government focus on energy independence are further accelerating market growth.

China Choke and Kill Manifold Market Insight

China accounted for the largest revenue share in the Asia-Pacific choke and kill manifold market in 2024, supported by aggressive onshore and offshore drilling campaigns. The country’s commitment to energy self-sufficiency, alongside massive investments in high-pressure well infrastructure, is fueling demand for advanced manifold systems. Domestic OEMs and service providers are also contributing to market expansion by offering localized, cost-effective solutions tailored to complex drilling environments.

India Choke and Kill Manifold Market Insight

India is emerging as a high-potential market, with increased exploration activity in both mature and frontier basins, including the Krishna-Godavari and Mumbai offshore regions. The government’s emphasis on reducing oil import dependence and enhancing upstream capabilities is driving investments in high-integrity pressure control equipment. Adoption of choke and kill manifolds is being further supported by safety compliance measures and the modernization of drilling assets across public and private oilfield operators.

Choke and Kill Manifold Market Share

The choke and kill manifold industry is primarily led by well-established companies, including:

- Schlumberger Limited (U.S.)

- Halliburton Company (U.S.)

- Baker Hughes Company (U.S.)

- National Oilwell Varco, Inc. (U.S.)

- TechnipFMC plc (U.K.)

- Weatherford International plc (U.S.)

- The Weir Group PLC (U.K.)

- Uztel S.A. (Romania)

- AXON Pressure Products (U.S.)

- SRI Energy, Inc. (U.S.)

- Forum Energy Technologies Inc. (U.S.)

- Worldwide Oilfield Machine (U.S.)

- Lake Petro (China)

Latest Developments in Global Choke and Kill Manifold Market

- In January 2025, Ditch Witch unveiled its advanced JT21 directional drilling system, delivering a 40% increase in downhole horsepower compared to the JT20. With 21,000 lbs of pullback force and high torque, this innovation significantly enhances productivity across diverse soil conditions. The development reflects a broader industry trend toward more powerful and efficient drilling systems, which in turn drives increased demand for compatible pressure control equipment, including choke and kill manifolds, to handle elevated flow and pressure levels in complex drilling environments

- In November 2024, NOV’s Tuboscope division introduced a breakthrough internal coating technology for tubular components, engineered to minimize thermal conductivity and withstand extreme subsurface conditions. This innovation extends the operational lifespan of downhole tools by reducing heat-induced wear and enhancing corrosion resistance. For the choke and kill manifold market, this advancement supports longer-lasting and more reliable system components, especially in high-temperature, high-pressure (HPHT) applications where performance durability is critical

- In July 2024, Helmerich & Payne (HP) completed the USD 2 billion acquisition of KCA Deutag, expanding its footprint in the Middle East—a key region for global oil and gas production. By integrating KCA Deutag’s onshore and offshore drilling expertise, HP enhances its service portfolio and gains access to major upstream projects. This expansion is expected to fuel demand for high-performance choke and kill manifolds and related well control systems to support increased drilling operations in complex, high-pressure reservoirs

- In April 2024, Schlumberger announced the acquisition of ChampionX in a strategic all-stock deal worth USD 7.75 billion. This acquisition significantly enhances Schlumberger’s capabilities in production optimization and chemical solutions. The integration strengthens its portfolio of pressure and flow control technologies, positioning the company to deliver more comprehensive solutions that include choke and kill manifold systems optimized for enhanced safety and efficiency across global drilling operations

- In January 2024, Italian energy major Eni finalized its USD 4.9 billion acquisition of Neptune Energy, securing a diversified asset base across Western Europe, North Africa, Australia, and Southeast Asia. This acquisition supports Eni’s upstream expansion strategy, bringing new offshore and onshore projects into its portfolio. The increased drilling activity and operational scale are expected to drive demand for advanced pressure management systems, including choke and kill manifolds, particularly in HPHT and deepwater environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.