Global Chromatographic Silica Resins Market

Market Size in USD Billion

CAGR :

%

USD

1.69 Billion

USD

2.34 Billion

2025

2033

USD

1.69 Billion

USD

2.34 Billion

2025

2033

| 2026 –2033 | |

| USD 1.69 Billion | |

| USD 2.34 Billion | |

|

|

|

|

Chromatographic Silica Resins Market Size

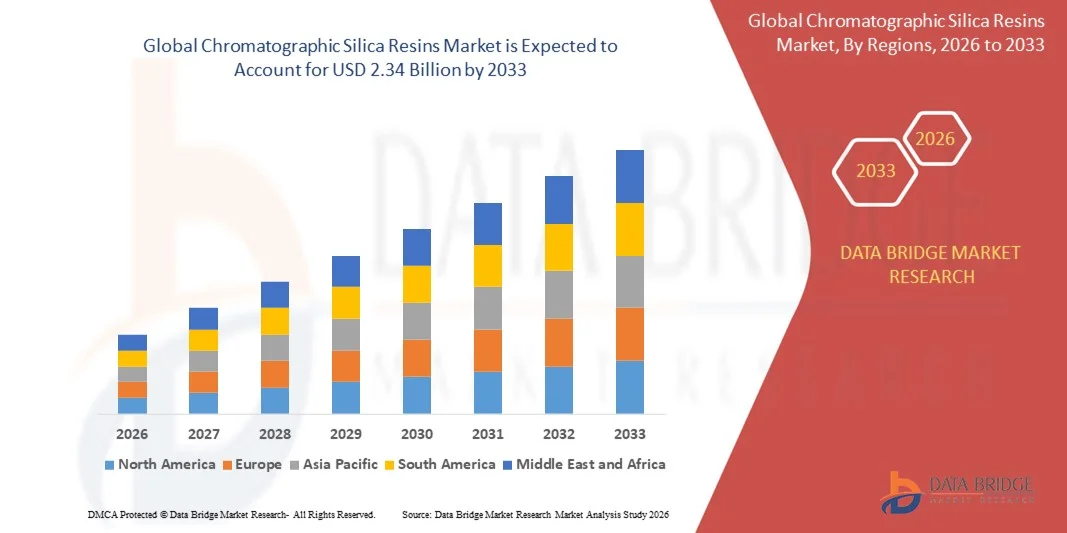

- The global chromatographic silica resins market size was valued at USD 1.69 billion in 2025 and is expected to reach USD 2.34 billion by 2033, at a CAGR of 4.10% during the forecast period

- The market growth is largely driven by the expanding pharmaceutical, biotechnology, and chemical industries, where chromatographic silica resins are widely used for separation, purification, and analytical processes, leading to increased adoption across research and manufacturing environments

- Furthermore, rising investments in drug discovery, biopharmaceutical production, and quality control testing are reinforcing the demand for high-performance and high-purity chromatographic materials. These combined factors are accelerating the utilization of chromatographic silica resins, thereby supporting steady market expansion

Chromatographic Silica Resins Market Analysis

- Chromatographic silica resins, serving as essential stationary phases in analytical, preparative, and process chromatography, play a critical role in achieving accurate separation and purification of complex chemical and biological compounds across pharmaceutical, biotechnology, and industrial applications

- The increasing demand for chromatographic silica resins is primarily supported by advancements in chromatographic techniques, stricter regulatory requirements for product purity, and the growing need for reliable and reproducible separation solutions in research and large-scale manufacturing processes

- North America dominated the chromatographic silica resins market with a share of around 40% in 2025, due to strong demand from pharmaceutical and biotechnology industries and the presence of advanced analytical laboratories

- Asia-Pacific is expected to be the fastest growing region in the chromatographic silica resins market during the forecast period due to rapid expansion of pharmaceutical manufacturing, biotechnology research, and chemical industries

- 100-200 mesh segment dominated the market with a market share of 44% in 2025, due to its balanced surface area and particle size, which ensures optimal resolution and flow rate in various chromatographic processes. Laboratories and industrial users prefer 100-200 mesh resins for their versatility across analytical, preparative, and process chromatography applications. Their consistent packing efficiency and high mechanical strength contribute to stable performance and reproducibility of results

Report Scope and Chromatographic Silica Resins Market Segmentation

|

Attributes |

Chromatographic Silica Resins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chromatographic Silica Resins Market Trends

Growing Demand for High-Purity Silica Resins

- A prominent trend in the chromatographic silica resins market is the increasing demand for high-purity and ultrapure silica materials, driven by the rising complexity of pharmaceutical and biopharmaceutical separation processes. High-purity silica resins are becoming essential to achieve accurate separation, higher yields, and consistent performance in analytical and preparative chromatography

- For instance, Merck KGaA offers high-purity silica-based chromatography resins under its life science portfolio that are widely used in pharmaceutical quality control and bioprocessing applications. These materials support precise separations and reduce contamination risks, reinforcing their importance in regulated environments

- The adoption of high-purity silica resins is expanding in biopharmaceutical manufacturing where protein purification and peptide separation require materials with low metal content and uniform particle size distribution. This trend is supporting improved reproducibility and scalability in downstream processing workflows

- Analytical laboratories are increasingly prioritizing silica resins that provide stable performance across repeated runs, supporting long-term reliability in research and testing activities. The preference for standardized and validated chromatographic materials is strengthening demand for premium-grade silica resins

- Research institutions and contract research organizations are incorporating advanced silica resins to support complex compound characterization and method development. This trend is enhancing analytical accuracy and supporting innovation in pharmaceutical and chemical research

- The growing emphasis on regulatory compliance and data integrity is reinforcing the transition toward high-purity chromatographic silica resins. This trend is positioning these materials as critical enablers of precision, consistency, and compliance across chromatography-based applications

Chromatographic Silica Resins Market Dynamics

Driver

Expansion of Pharmaceutical and Biotechnology Industries

- The expansion of pharmaceutical and biotechnology industries is a key driver of the chromatographic silica resins market, as chromatography remains a core technique for drug discovery, development, and manufacturing. Increasing production of small-molecule drugs and biologics is directly supporting demand for reliable separation materials

- For instance, Thermo Fisher Scientific supplies chromatographic silica resins that are extensively used in pharmaceutical development and bioprocessing workflows. These materials enable efficient purification and analytical testing, supporting the growing scale of drug manufacturing activities

- The rise in biologics and biosimilars production is increasing reliance on preparative and process chromatography, where silica resins play a critical role in purification and quality assurance. This is strengthening long-term demand from biopharmaceutical manufacturers

- Pharmaceutical companies are expanding quality control and validation activities to meet stringent regulatory requirements, driving consistent consumption of chromatographic materials. Silica resins are essential in ensuring batch-to-batch consistency and compliance with global standards

- Increasing investments in biotechnology research and clinical development are further reinforcing this driver. The continued expansion of pharmaceutical pipelines is sustaining steady growth in the chromatographic silica resins market

Restraint/Challenge

Dependence on High-Quality Raw Silica Supply

- The chromatographic silica resins market faces challenges due to its dependence on consistent availability of high-quality raw silica, which is critical for producing resins with uniform particle size and purity. Variations in raw material quality can directly impact chromatographic performance

- For instance, manufacturers such as W R Grace & Co Conn rely on controlled raw silica sourcing and processing to maintain consistent resin quality. Any disruption in raw material supply can affect production stability and delivery timelines

- The processing of high-grade silica requires advanced purification and manufacturing techniques, which increases production complexity and cost pressures for resin manufacturers. These factors can limit pricing flexibility and affect supply chain efficiency

- Fluctuations in raw material availability and energy costs can influence manufacturing economics, creating challenges in maintaining consistent output while meeting growing demand. This places pressure on producers to optimize sourcing and production strategies

- The ongoing need to balance resin performance, cost efficiency, and supply reliability continues to challenge market participants. This restraint emphasizes the importance of raw material control in sustaining long-term growth of the chromatographic silica resins market

Chromatographic Silica Resins Market Scope

The market is segmented on the basis of mesh size, purity, application, and end-use.

- By Mesh Size

On the basis of mesh size, the Chromatographic Silica Resins market is segmented into 30-60, 60-100, 100-200, and above 200. The 100-200 mesh size segment dominated the market with the largest revenue share of 44% in 2025, driven by its balanced surface area and particle size, which ensures optimal resolution and flow rate in various chromatographic processes. Laboratories and industrial users prefer 100-200 mesh resins for their versatility across analytical, preparative, and process chromatography applications. Their consistent packing efficiency and high mechanical strength contribute to stable performance and reproducibility of results. Moreover, the segment benefits from widespread availability and compatibility with standard chromatographic columns, making it a preferred choice among researchers and manufacturers. The ease of integration with automated chromatography systems further reinforces its market dominance.

The above 200 mesh segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand in high-resolution analytical and preparative chromatography applications. Finer mesh resins provide superior separation efficiency, particularly in complex biochemical and pharmaceutical compounds, enhancing purity and yield. Companies are investing in advanced manufacturing techniques to produce uniform ultra-fine particles that minimize column backpressure and improve flow consistency. Rising adoption in biotechnology research and precision drug development is also driving market growth.

- By Purity

On the basis of purity, the market is categorized into Pure Silica (up to 97%) and Ultrapure Silica (up to 99%). The Ultrapure Silica segment dominated the market in 2025 due to its high performance in sensitive applications such as pharmaceutical analytics, high-end biotechnology processes, and quality-critical chemical separations. Ultrapure silica provides minimal metal contamination, superior chemical inertness, and consistent particle uniformity, which are critical for achieving reliable chromatographic results. Its compatibility with advanced chromatographic methods, including HPLC and preparative chromatography, reinforces its preference among high-end laboratories.

The Pure Silica segment is expected to witness robust growth from 2026 to 2033, driven by increasing adoption in routine analytical and process chromatography. For instance, companies producing food and chemical products often use pure silica resins due to their cost-effectiveness and acceptable performance in standard separation tasks. Rising demand from emerging markets for affordable chromatography solutions is also contributing to growth.

- By Application

On the basis of application, the market is segmented into Analytical Chromatography, Process Chromatography, Preparative Chromatography, and Gravity Chromatography. Analytical Chromatography dominated the market in 2025, owing to the growing need for precise and reproducible results in pharmaceutical quality control, biotechnology research, and chemical testing. The segment benefits from advancements in high-throughput analytical instruments and regulatory emphasis on accurate compound profiling. Laboratories prefer analytical chromatography for its efficiency in separating complex mixtures and monitoring product consistency.

Preparative Chromatography is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing demand for large-scale purification of active pharmaceutical ingredients and biomolecules. For instance, companies in the biotech sector utilize preparative resins to isolate high-purity proteins and enzymes efficiently. The expansion of biopharmaceutical manufacturing and personalized medicine is further accelerating growth in this segment.

- By End-Use

On the basis of end-use, the market is categorized into Pharmaceutical and Biotechnology, and Food and Chemical industries. The Pharmaceutical and Biotechnology segment dominated the market in 2025 due to the stringent purity and quality requirements of drug development and bioprocessing applications. Chromatographic silica resins are critical for separating active pharmaceutical ingredients, biomolecules, and complex biologics, ensuring regulatory compliance and therapeutic efficacy. Rising R&D investments in drug discovery and biomanufacturing reinforce the segment’s leadership.

The Food and Chemical segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by increasing use in purification, separation, and analysis of food additives, flavors, and specialty chemicals. For instance, companies in the chemical industry employ silica resins for efficient separation of complex chemical mixtures, enhancing product quality and safety. Growing consumer demand for high-quality and safe food and chemical products is also supporting market expansion.

Chromatographic Silica Resins Market Regional Analysis

- North America dominated the chromatographic silica resins market with the largest revenue share of around 40% in 2025, driven by strong demand from pharmaceutical and biotechnology industries and the presence of advanced analytical laboratories

- Manufacturers and research institutions in the region emphasize high-purity and high-performance silica resins to support complex separation and purification processes in drug development and life sciences research

- This dominance is further supported by substantial R&D investments, a well-established biopharmaceutical manufacturing base, and stringent regulatory standards that require precise and reproducible chromatographic solutions, positioning silica resins as a critical component across analytical and process chromatography

U.S. Chromatographic Silica Resins Market Insight

The U.S. chromatographic silica resins market captured the largest revenue share in 2025 within North America, supported by the extensive presence of pharmaceutical companies, contract research organizations, and biotechnology firms. The country’s strong focus on drug discovery, biologics, and quality control testing drives consistent demand for high-purity and ultrapure silica resins. Continuous advancements in chromatographic techniques and increased adoption of preparative and process chromatography further support market growth. Moreover, significant funding for academic and industrial research sustains long-term demand for chromatographic silica resins.

Europe Chromatographic Silica Resins Market Insight

The Europe chromatographic silica resins market is projected to expand at a steady CAGR during the forecast period, primarily driven by strict regulatory requirements for pharmaceutical quality and safety. Growing investments in biotechnology, coupled with increasing use of chromatography in chemical and food analysis, are supporting market expansion. European manufacturers focus on precision, sustainability, and consistency, which encourages the adoption of high-quality silica resins. The region is witnessing rising usage across pharmaceutical manufacturing, academic research, and industrial separation processes.

U.K. Chromatographic Silica Resins Market Insight

The U.K. chromatographic silica resins market is expected to grow at a notable CAGR during the forecast period, driven by expanding pharmaceutical research activities and a strong academic research ecosystem. Increasing emphasis on analytical testing, drug validation, and process optimization is supporting demand for reliable chromatographic materials. The presence of leading research universities and biopharmaceutical firms further accelerates market adoption. Growth in contract research and manufacturing services also contributes to rising consumption of silica resins.

Germany Chromatographic Silica Resins Market Insight

The Germany chromatographic silica resins market is anticipated to expand at a considerable CAGR, supported by the country’s strong chemical and pharmaceutical manufacturing base. Germany’s emphasis on precision engineering and high-quality production drives demand for consistent and high-performance chromatographic resins. Increasing use of chromatography in industrial chemical separations and pharmaceutical quality control further supports growth. The integration of advanced analytical technologies in research and manufacturing continues to enhance market prospects.

Asia-Pacific Chromatographic Silica Resins Market Insight

The Asia-Pacific chromatographic silica resins market is expected to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid expansion of pharmaceutical manufacturing, biotechnology research, and chemical industries. Rising investments in healthcare infrastructure and increasing adoption of advanced analytical techniques are accelerating demand across the region. The growing role of Asia-Pacific as a global hub for drug manufacturing and active pharmaceutical ingredient production further boosts market growth. Improving access to cost-effective chromatographic materials also supports wider adoption.

Japan Chromatographic Silica Resins Market Insight

The Japan chromatographic silica resins market is gaining traction due to strong pharmaceutical R&D capabilities and a high focus on analytical accuracy and quality control. Japanese companies emphasize precision separation technologies, supporting steady demand for high-purity silica resins. The growth of biotechnology research and increasing use of chromatography in life sciences and chemical analysis are driving market expansion. Continuous innovation in analytical instrumentation further reinforces silica resin consumption.

China Chromatographic Silica Resins Market Insight

The China chromatographic silica resins market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid growth in pharmaceutical production, expanding biotechnology research, and strong government support for domestic drug development. China’s increasing role as a global supplier of active pharmaceutical ingredients drives high demand for process and preparative chromatography. The availability of locally manufactured, cost-competitive silica resins and the expansion of research laboratories further contribute to sustained market growth.

Chromatographic Silica Resins Market Share

The chromatographic silica resins industry is primarily led by well-established companies, including:

- W. R. Grace & Co.-Conn (U.S.)

- OSAKA SODA Co., Ltd. (Japan)

- SiliCycle Inc. (Canada)

- Sorbead India – Silica Gel (India)

- Sepax Technologies, Inc. (U.S.)

- AGC Inc. (Japan)

- Sisco Research Laboratories Pvt. Ltd. (India)

- Merck KGaA (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Purolite Corporation (U.S.)

- Macherey-Nagel GmbH & Co. KG (Germany)

- YMC Co., Ltd. (Japan)

- Daicel Corporation (Japan)

Latest Developments in Global Chromatographic Silica Resins Market

- In November 2025, Merck KGaA launched a new line of high-performance chromatography resins tailored for biopharmaceutical applications, a development that is strengthening its position in the chromatographic silica resins market by addressing rising demand for advanced and efficient purification solutions. This launch enhances Merck’s competitive edge by enabling biopharmaceutical manufacturers to achieve higher purity levels and improved process efficiency, reinforcing the company’s role as a key supplier for high-value separation technologies

- In October 2025, Thermo Fisher Scientific Inc. formed a collaboration with a leading biotechnology firm to develop customized chromatography solutions, a move that is expected to accelerate innovation within the chromatographic silica resins market. This partnership supports Thermo Fisher’s strategy of co-development, allowing it to deliver application-specific resins that align with evolving bioprocessing requirements and strengthen long-term customer relationships

- In September 2025, Agilent Technologies Inc. expanded its chromatography manufacturing capabilities in Asia, directly impacting the chromatographic silica resins market by improving supply responsiveness and regional availability. This expansion positions Agilent to better serve the fast-growing Asia-Pacific demand, reduce lead times, and enhance its competitive standing in emerging pharmaceutical and biotechnology hubs

- In August 2025, Bio-Rad Laboratories Inc. introduced an upgraded portfolio of silica-based chromatography resins focused on higher binding capacity and improved reproducibility, contributing to market advancement by supporting more efficient analytical and preparative workflows. This product enhancement enables customers to optimize separation performance while reducing operational variability, reinforcing Bio-Rad’s presence in research-driven end-use segments

- In July 2025, Purolite Corporation increased its investment in R&D for next-generation chromatographic silica resins aimed at bioprocess and industrial separations, a step that is positively influencing the market through innovation-led differentiation. This focus on advanced resin development supports the growing need for scalable, high-performance purification materials, strengthening Purolite’s competitive positioning across pharmaceutical and chemical applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chromatographic Silica Resins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chromatographic Silica Resins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chromatographic Silica Resins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.