Global Chromatography Equipment Market

Market Size in USD Million

CAGR :

%

USD

10,839.10 Million

USD

16,888.58 Million

2021

2029

USD

10,839.10 Million

USD

16,888.58 Million

2021

2029

| 2022 –2029 | |

| USD 10,839.10 Million | |

| USD 16,888.58 Million | |

|

|

|

|

Chromatography Equipment Market Analysis and Size

According to Centre for Disease Control and Prevention (CDC) updates from July 2021, illnesses caused by mosquito, tick, and flea bites have increased, and nine new vector-borne diseases have been discovered. As chromatography columns are used to purify the product in downstream processing for drug development, the rise in various illnesses and chronic diseases is expected to increase demand for chromatography equipment.

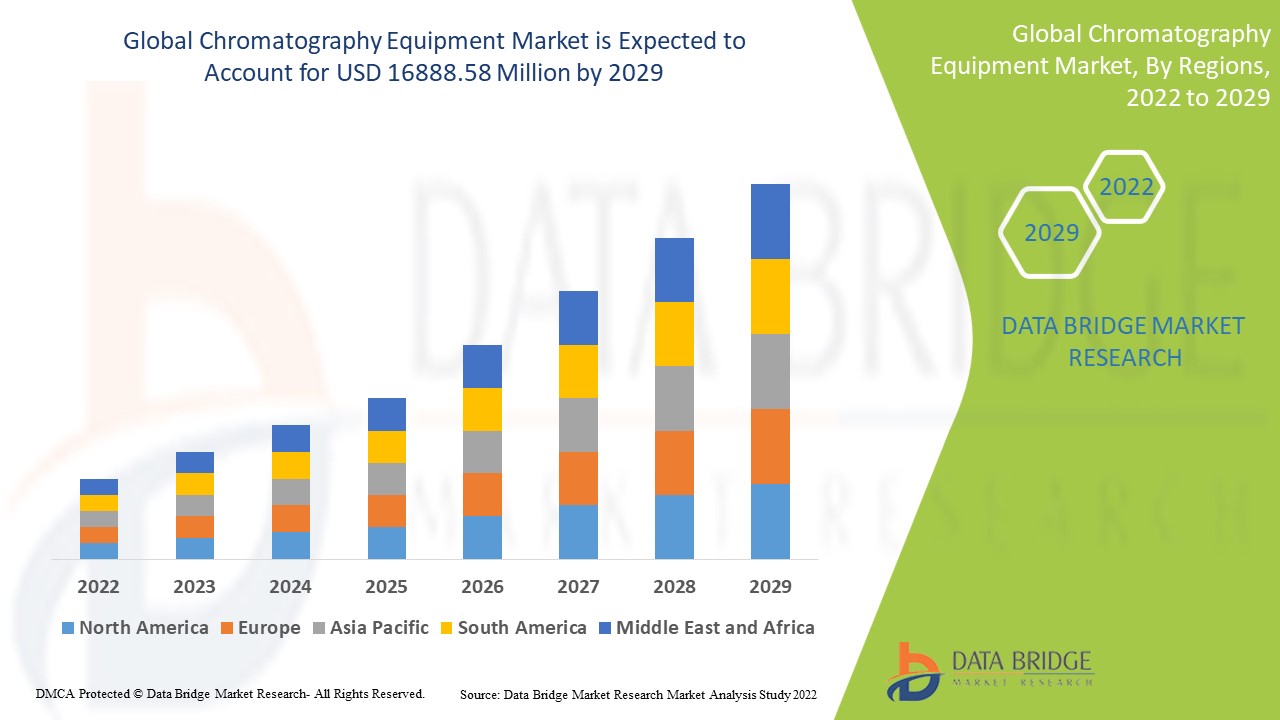

Data Bridge Market Research analyses that the chromatography equipment market which was USD 10839.10 million in 2021, would rocket up to USD 16888.58 million by 2029, and is expected to undergo a CAGR of 5.70% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Chromatography Equipment Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Liquid Chromatography, Gas Chromatography, Thin-layer Chromatography, Others), Product (Instruments, Accessories), End User (Academic and Research Institutes, Pharmaceutical and Biotechnology Company, Food and Beverages Testing, Clinical Research Organizations, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Advanced Chemistry Development (Canada), Bio-Rad Laboratories, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Bruker (U.S.), DataApex spol. s r.o. (U.S.), Gilson Incorporated (U.S.), JASCO (Japan), Justice Laboratory Software (U.S.), PerkinElmer Inc. (U.S.), Shimadzu Corporation (Japan), SRI Instruments (Germany), Thermo Fisher Scientific Inc. (U.S.), Waters Corporation (U.S.), Dionex (U.S.), Hitachi High-Tech Corporation (Japan) |

|

Market Opportunities |

|

Market Definition

Chromatography is a technique for separating a mixture using both organic and inorganic components. The combination is put through this process by being passed through a suspension or solution and into a medium where the particles are moving at different rates. The expansion of chromatography applications across numerous sectors of the food and beverage and pharmaceutical industries is the main factor fuelling the market for chromatograpy equipment.

Global Chromatography Equipment Market Dynamics

Drivers

- Rising popularity of hyphenated chromatography techniques

Hyphenated procedures often start with chromatographic separation, peak identification with a conventional detector such as UV, and additional identification using a mass spectrometer, an IR or an NMR spectrometer. Hyphenated chromatography methods include LC-MS, GC-MS, LC-NMR, and LC-FTIR. Modern hyphenated chromatography techniques have several benefits, including greater reproducibility and a shorter analytical time than traditional procedures. This will boost the market growth.

- Usage of chromatographic equipment

The chromatography market is being driven by an increase in the use of chromatography in a variety of industries, including the pharmaceutical, chemical, and food industries, environmental testing labs, forensic science, and the drug development process. This will boost the market growth.

Opportunities

- Advancement in gas chromatography columns for petrochemical applications

Gas chromatography continues to be the most popular analytical method in the petroleum sector, due to its excellent sensitivity to volatile chemicals. Specialized gas chromatography columns are frequently used in the study of petroleum, and the industry is constantly looking for improved columns to enhance both analytical performance and chromatographic efficiency. The technology to detect both finished items and in-process samples has also improved to modern gas chromatographic techniques.

Restraints/Challenges

- High cost

The high cost of chromatography equipment will obstruct the market's growth rate. The dearth of skilled professionals and lack of healthcare infrastructure in developing economies will challenge the chromatography equipment market.

- Safety standards

The high safety standards in pharmaceuticals and food and beverage industries may be a restrain for the market in the forecast period.

This chromatography equipment market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the chromatography equipment market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Chromatography Equipment Market

The COVID-19 pandemic has upended an unlimited number of lives and businesses. The manufacturing and supply chain of the analytical instrumentation industry is hampered by problems with timely product delivery to customers and uneven demand for goods and services. The chromatography equipment market is also enduring a negative growth, which can be attributed to elements like a decline in product demand from significant end-users, limited operations in the majority of industries, insufficient funding for research and academic institutions, the temporary closure of key academic institutions, disrupted supply chains, and difficulties in providing necessary/post-sales services.

Recent Development

- In June 2020, Waters Corporation will launch its new high-performance liquid chromatography (HPLC) system, the Waters Arc HPLC System. The company stated that the new liquid chromatography system could be used for routing testing in a variety of end-use industries, including food and beverage, pharmaceutical, academic, and materials markets.

Global Chromatography Equipment Market Scope

The chromatography equipment market is segmented on the basis of type, product, end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Liquid Chromatography

- High-pressure Liquid Chromatography

- Ultra- pressure Liquid Chromatography

- Flash Chromatography

- Others

- Gas Chromatography

- Thin-layer Chromatography

- Others

Product

- Instruments

- Consumables

- Columns

- Syringe Filters

- Vials

- Tubing

- Others

- Accessories

- Detectors

- Autosamplers

- Pumps and flow meters

- Fraction Collectors

- Others

End User

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Company

- Food and Beverages Testing

- Clinical Research Organizations

- Others

Chromatography Equipment Market Regional Analysis/Insights

The chromatography equipment market is analysed and market size insights and trends are provided by country, type, product, end user as referenced above.

The countries covered in the chromatography equipment market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the chromatography equipment market due to the largest market size. It is because of the increase in the funding for R&D activities and environmental testing.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 due growth of the food industry and R&D activities in developing countries.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The chromatography equipment market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for chromatography equipment market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the chromatography equipment market. The data is available for historic period 2010-2020.

Competitive Landscape and Chromatography Equipment Market Share Analysis

The chromatography equipment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to chromatography equipment market.

Some of the major players operating in the chromatography equipment market are:

- Advanced Chemistry Development (Canada)

- Bio-Rad Laboratories, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Bruker (U.S.)

- DataApex spol. s r.o. (U.S.)

- Gilson Incorporated (U.S.)

- JASCO (Japan)

- Justice Laboratory Software (U.S.)

- PerkinElmer Inc. (U.S.)

- Shimadzu Corporation (Japan)

- SRI Instruments (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Waters Corporation (U.S.)

- Dionex (U.S.)

- Hitachi High-Tech Corporation (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, BY PRODUCT TYPE

17.1 OVERVIEW

17.2 SYSTEMS

17.2.1 LIQUID CHROMATOGRAPHY SYSTEM

17.2.1.1. BY TYPE

17.2.1.1.1. HPLC SYSTEMS

17.2.1.1.2. HPLC/UHPLC SYSTEMS

17.2.1.1.3. UHPLC/UPLC SYSTEMS

17.2.1.1.4. PURIFICATION SYSTEMS

17.2.1.1.5. SPECIALTY SYSTEMS

17.2.1.1.6. OTHERS

17.2.1.2. BY SYSTEM TECHNOLOGY

17.2.1.2.1. HPLC

17.2.1.2.2. LC-UV

17.2.1.2.3. LC

17.2.1.2.4. OTHERS

17.2.1.3. BY PARTICLE SIZE

17.2.1.3.1. 2.5 - 5 µM

17.2.1.3.2. 3- 5 µM

17.2.1.3.3. OTHERS

17.2.1.4. BY DETECTOR TYPE

17.2.1.4.1. ELSD

17.2.1.4.2. PDA

17.2.1.4.3. OTHERS

17.2.1.5. BY PUMP TYPE

17.2.1.5.1. BINARY

17.2.1.5.2. ISOCRATIC

17.2.1.5.3. QUATERNARY

17.2.1.6. BY MS-COMPATIBILITY

17.2.1.6.1. ION MOBILITY MS

17.2.1.6.2. SINGLE QUADRUPOLE MASS DETECTION

17.2.1.6.3. TANDEM (TRIPLE) QUADRUPOLE MS

17.2.1.6.4. QUADRUPOLE TIME-OF-FLIGHT MS

17.2.2 GAS CHROMATOGRAPHY SYSTEM

17.2.2.1. BY TYPE

17.2.2.1.1. GAS-SOLID CHROMATOGRAPHY (GSC)

17.2.2.1.2. GAS-LIQUID CHROMATOGRAPHY (GLC)

17.2.2.2. BY DETECTOR TYPE

17.2.2.2.1. FID

17.2.2.2.2. TCD

17.2.2.2.3. FPD

17.2.2.2.4. OTHERS

17.2.3 SUPERCRITICAL FLUID CHROMATOGRAPHY SYSTEM

17.2.4 THIN LAYER CHROMATOGRAPHY SYSTEM

17.2.5 OTHERS

17.3 COLUMNS

17.3.1 BY TYPE

17.3.1.1. ANALYTICAL COLUMNS

17.3.1.1.1. REVERSED-PHASE / NORMAL-PHASE / HILIC MODE

17.3.1.1.2. BIOCHROMATOGRAPHY

17.3.1.1.3. CHIRAL CHROMATOGRAPHY

17.3.1.1.4. OTHERS

17.3.1.2. PREPARATIVE COLUMNS

17.3.1.2.1. REVERSED-PHASE / NORMAL-PHASE / CHIRAL / SEC

17.3.1.2.2. EMPTY GLASS COLUMNS

17.3.2 BY CATOGERIES

17.3.2.1. BIOSEPARATIONS COLUMNS

17.3.2.2. GPC/APC COLUMNS

17.3.2.3. HPLC COLUMNS

17.3.2.4. SEC COLUMNS

17.3.2.5. SFC COLUMNS

17.3.2.6. UHPLC COLUMNS

17.3.2.7. UPLC COLUMNS

17.3.2.8. OTHERS

17.3.3 BY COLUMN TYPE

17.3.3.1. PRE PACKED COLUMNS

17.3.3.2. SELF PACKED COLUMNS

17.3.4 BY APPLICATION

17.3.4.1. AMINO ACID

17.3.4.2. GENE THERAPEUTIC

17.3.4.3. GLYCAN

17.3.4.4. OTHERS

17.3.5 BY SEPARATION MODE

17.3.5.1. APC/SEC/GPC

17.3.5.2. GEL FILTRATION (AQUEOUS)

17.3.5.3. HYDROPHILIC INTERACTION (HILIC)

17.3.5.4. HYDROPHOBIC INTERACTION (HIC)

17.3.5.5. OTHERS

17.3.6 BY PARTICEL SIZE

17.3.6.1. 2.5 - 2.7 µM

17.3.6.2. 3- 5 µM

17.3.6.3. OTHERS

17.3.7 BY PARTICLE TECHNOLOGY

17.3.7.1. BEH

17.3.7.2. CSH

17.3.7.3. OTHERS

17.3.8 BY MATERIAL

17.3.8.1. GLASS OR SILICATE GLASS

17.3.8.1.1. ALUMINA SILICATE GLASS

17.3.8.1.2. BOROSILICATE GLASS

17.3.8.1.3. OTHERS

17.3.8.2. INERT STEEL

17.3.8.3. METAL

17.3.8.4. OTHERS

17.4 AUTO-SAMPLING SYSTEM

17.4.1 BY TYPE

17.4.1.1. LIQUID AUTOSAMPLER

17.4.1.2. HEADSPACE AUTOSAMPLER

17.4.1.3. SPME AUTOSAMPLER

17.4.2 BY WORKING DESIGN

17.4.2.1. THE PUSHED-LOOP DESIGN

17.4.2.2. THE PULLED-LOOP DESIGN

17.4.2.3. THE SPLIT-LOOP DESIGN

17.4.3 OTHERS

17.5 CONSUMABLE AND ACCESSORIES

17.5.1 PUMPS AND FLOW METERS

17.5.1.1. BY TYPE

17.5.1.1.1. BINARY

17.5.1.1.2. ISOCARTIC

17.5.1.1.3. OTHERS

17.5.1.2. BY HEAD MATERIAL

17.5.1.2.1. CERAMICS

17.5.1.2.2. STAINLESS STEEL

17.5.1.2.3. OTHERS

17.5.1.3. FLOW RATE

17.5.1.3.1. 5 ML/MIM

17.5.1.3.2. 10 ML/MIN

17.5.1.3.3. OTHERS

17.5.2 SYRINGE FILTERS

17.5.2.1. BY MEMBRANE MATERIAL

17.5.2.1.1. GLASS FIBER

17.5.2.1.2. CELLULOSE ACETATE

17.5.2.1.3. POLYETHERSULFONE (PES)

17.5.2.1.4. OTHERS

17.5.2.2. BY DIAMETER

17.5.2.2.1. 4MM

17.5.2.2.2. 17MM

17.5.2.2.3. 30MM

17.5.2.2.4. OTHERS

17.5.2.3. BY USABILITY

17.5.2.3.1. STRILE

17.5.2.3.2. NON STERILE

17.5.3 VIALS

17.5.3.1. BY TYPE

17.5.3.1.1. SCREW TOP VIALS

17.5.3.1.2. CRIMP TOP VIALS

17.5.3.1.3. SNAP RING VIALS

17.5.3.1.4. OTHERS

17.5.3.2. BY COLOUR

17.5.3.2.1. CLEAR

17.5.3.2.2. AMBER

17.5.3.3. BY MATERIAL

17.5.3.3.1. BOROSILICATE GLASS

17.5.3.3.2. USP TYPE 1 BOROSILICATE GLASS

17.5.3.3.3. OTHERS

17.5.3.4. BY CAP SIZE

17.5.3.4.1. 8 MM

17.5.3.4.2. 9MM

17.5.3.4.3. OTHERS

17.5.4 DETECTORS

17.5.4.1. BY CHANNELS

17.5.4.1.1. 1

17.5.4.1.2. 2

17.5.4.1.3. 4

17.5.4.1.4. OTHERS

17.5.4.2. BY WAVELENGTH

17.5.4.2.1. 190-500 NM

17.5.4.2.2. 190-700 NM

17.5.4.2.3. OTHERS

17.5.5 FRACTION COLLECTORS

17.5.5.1. BY CAPILLARY CONNECTION

17.5.5.1.1. 1/4”

17.5.5.1.2. 1/8 OR 1/16”

17.5.5.2. BY FLOW RATE

17.5.5.2.1. 25 ML / MIN

17.5.5.2.2. 100 ML/MIN

17.5.5.2.3. OTHERS

17.5.6 TUBING

17.5.6.1. BY LENGTH

17.5.6.1.1. 1 FEET

17.5.6.1.2. 100 FEET

17.5.6.1.3. OTHERS

17.5.6.2. BY MATERIAL

17.5.6.2.1. BOROSILICATE GLASS

17.5.6.2.2. DEACTIVATED SILICA

17.5.6.2.3. COPPER

17.5.7 OTHER ACCESSORIES

18 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, BY PRICE RANGE

18.1 OVERVIEW

18.2 STANDARD SYSTEM

18.3 PREMIUM SYSTEM

19 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, BY USABILITY

19.1 OVERVIEW

19.2 SINGLE-USE BATCH CHROMATOGRAPHY SYSTEMS

19.3 MULTI-USE BATCH CHROMATOGRAPHY SYSTEMS

19.4 INTENSIFIED AND CONTINUOUS CHROMATOGRAPHY SYSTEM

19.5 HIGH-PERFORMANCE CHROMATOGRAPHY SYSTEMS

20 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, BY MODE

20.1 OVERVIEW

20.2 SEMI-AUTOMATIC

20.3 FULLY-AUTOMATIC

21 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, BY MODALITY

21.1 OVERVIEW

21.2 PORTABLE

21.3 BENCHTOP

22 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, BY APPLICATIONS

22.1 OVERVIEW

22.2 ANALYTICAL

22.3 PREPARATIVE

22.4 OTHERS

23 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, BY END USER

23.1 OVERVIEW

23.2 HOSPITALS

23.3 ACADEMIC AND RESEARCH INSTITUTES

23.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANY

23.5 FOOD AND BEVERAGES TESTING

23.6 CLINICAL RESEARCH ORGANIZATIONS

23.7 DIAGNOSTIC CENTERS

23.8 FORENSIC LABS

23.9 OTHERS

24 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

24.1 OVERVIEW

24.2 DIRECT TENDER

24.3 RETAIL SALES

24.4 OTHERS

25 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, SWOT AND DBMR ANALYSIS

26 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, COMPANY LANDSCAPE

26.1 COMPANY SHARE ANALYSIS: GLOBAL

26.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

26.3 COMPANY SHARE ANALYSIS: EUROPE

26.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

26.5 MERGERS & ACQUISITIONS

26.6 NEW PRODUCT DEVELOPMENT & APPROVALS

26.7 EXPANSIONS

26.8 REGULATORY CHANGES

26.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

27 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, BY REGION

GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

27.1 NORTH AMERICA

27.1.1 U.S.

27.1.2 CANADA

27.1.3 MEXICO

27.2 EUROPE

27.2.1 GERMANY

27.2.2 U.K.

27.2.3 ITALY

27.2.4 FRANCE

27.2.5 SPAIN

27.2.6 RUSSIA

27.2.7 SWITZERLAND

27.2.8 TURKEY

27.2.9 BELGIUM

27.2.10 NETHERLANDS

27.2.11 DENMARK

27.2.12 SWEDEN

27.2.13 POLAND

27.2.14 NORWAY

27.2.15 FINLAND

27.2.16 REST OF EUROPE

27.3 ASIA-PACIFIC

27.3.1 JAPAN

27.3.2 CHINA

27.3.3 SOUTH KOREA

27.3.4 INDIA

27.3.5 SINGAPORE

27.3.6 THAILAND

27.3.7 INDONESIA

27.3.8 MALAYSIA

27.3.9 PHILIPPINES

27.3.10 AUSTRALIA

27.3.11 NEW ZEALAND

27.3.12 VIETNAM

27.3.13 TAIWAN

27.3.14 REST OF ASIA-PACIFIC

27.4 SOUTH AMERICA

27.4.1 BRAZIL

27.4.2 ARGENTINA

27.4.3 REST OF SOUTH SOUTH AMERICA

27.5 MIDDLE EAST AND AFRICA

27.5.1 SOUTH AFRICA

27.5.2 EGYPT

27.5.3 BAHRAIN

27.5.4 UNITED ARAB EMIRATES

27.5.5 KUWAIT

27.5.6 OMAN

27.5.7 QATAR

27.5.8 SAUDI ARABIA

27.5.9 REST OF MEA

27.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

28 GLOBAL CHROMATOGRAPHY EQUIPMENT MARKET, COMPANY PROFILE

28.1 BIO-RAD LABORATORIES, INC

28.1.1 COMPANY OVERVIEW

28.1.2 REVENUE ANALYSIS

28.1.3 GEOGRAPHIC PRESENCE

28.1.4 PRODUCT PORTFOLIO

28.1.5 RECENT DEVELOPMENTS

28.2 AGILENT TECHNOLOGIES, INC.

28.2.1 COMPANY OVERVIEW

28.2.2 REVENUE ANALYSIS

28.2.3 GEOGRAPHIC PRESENCE

28.2.4 PRODUCT PORTFOLIO

28.2.5 RECENT DEVELOPMENTS

28.3 BRUKER

28.3.1 COMPANY OVERVIEW

28.3.2 REVENUE ANALYSIS

28.3.3 GEOGRAPHIC PRESENCE

28.3.4 PRODUCT PORTFOLIO

28.3.5 RECENT DEVELOPMENTS

28.4 GILSON INCORPORATED

28.4.1 COMPANY OVERVIEW

28.4.2 REVENUE ANALYSIS

28.4.3 GEOGRAPHIC PRESENCE

28.4.4 PRODUCT PORTFOLIO

28.4.5 RECENT DEVELOPMENTS

28.5 JASCO

28.5.1 COMPANY OVERVIEW

28.5.2 REVENUE ANALYSIS

28.5.3 GEOGRAPHIC PRESENCE

28.5.4 PRODUCT PORTFOLIO

28.5.5 RECENT DEVELOPMENTS

28.6 SHIMADZU CORPORATION

28.6.1 COMPANY OVERVIEW

28.6.2 REVENUE ANALYSIS

28.6.3 GEOGRAPHIC PRESENCE

28.6.4 PRODUCT PORTFOLIO

28.6.5 RECENT DEVELOPMENTS

28.7 THERMO FISHER SCIENTIFIC INC

28.7.1 COMPANY OVERVIEW

28.7.2 REVENUE ANALYSIS

28.7.3 GEOGRAPHIC PRESENCE

28.7.4 PRODUCT PORTFOLIO

28.7.5 RECENT DEVELOPMENTS

28.8 WATERS

28.8.1 COMPANY OVERVIEW

28.8.2 REVENUE ANALYSIS

28.8.3 GEOGRAPHIC PRESENCE

28.8.4 PRODUCT PORTFOLIO

28.8.5 RECENT DEVELOPMENTS

28.9 DH LIFE SCIENCES, LLC

28.9.1 COMPANY OVERVIEW

28.9.2 REVENUE ANALYSIS

28.9.3 GEOGRAPHIC PRESENCE

28.9.4 PRODUCT PORTFOLIO

28.9.5 RECENT DEVELOPMENTS

28.1 PERKINELMER INC.

28.10.1 COMPANY OVERVIEW

28.10.2 REVENUE ANALYSIS

28.10.3 GEOGRAPHIC PRESENCE

28.10.4 PRODUCT PORTFOLIO

28.10.5 RECENT DEVELOPMENTS

28.11 GL SCIENCES INC.

28.11.1 COMPANY OVERVIEW

28.11.2 REVENUE ANALYSIS

28.11.3 GEOGRAPHIC PRESENCE

28.11.4 PRODUCT PORTFOLIO

28.11.5 RECENT DEVELOPMENTS

28.12 TOSOH BIOSCIENCE GMBH (TOSOH CORPORATION)

28.12.1 COMPANY OVERVIEW

28.12.2 REVENUE ANALYSIS

28.12.3 GEOGRAPHIC PRESENCE

28.12.4 PRODUCT PORTFOLIO

28.12.5 RECENT DEVELOPMENTS

28.13 KNAUER WISSENSCHAFTLICHE GERÄTE GMBH

28.13.1 COMPANY OVERVIEW

28.13.2 REVENUE ANALYSIS

28.13.3 GEOGRAPHIC PRESENCE

28.13.4 PRODUCT PORTFOLIO

28.13.5 RECENT DEVELOPMENTS

28.14 HITACHI, LTD.

28.14.1 COMPANY OVERVIEW

28.14.2 REVENUE ANALYSIS

28.14.3 GEOGRAPHIC PRESENCE

28.14.4 PRODUCT PORTFOLIO

28.14.5 RECENT DEVELOPMENTS

28.15 SARTORIUS AG

28.15.1 COMPANY OVERVIEW

28.15.2 REVENUE ANALYSIS

28.15.3 GEOGRAPHIC PRESENCE

28.15.4 PRODUCT PORTFOLIO

28.15.5 RECENT DEVELOPMENTS

28.16 AXCEND

28.16.1 COMPANY OVERVIEW

28.16.2 REVENUE ANALYSIS

28.16.3 GEOGRAPHIC PRESENCE

28.16.4 PRODUCT PORTFOLIO

28.16.5 RECENT DEVELOPMENTS

28.17 SCION INSTRUMENTS (TECHCOMP GROUP)

28.17.1 COMPANY OVERVIEW

28.17.2 REVENUE ANALYSIS

28.17.3 GEOGRAPHIC PRESENCE

28.17.4 PRODUCT PORTFOLIO

28.17.5 RECENT DEVELOPMENTS

28.18 TELEDYNE MONITOR LABS (TML) (TELEDYNE TECHNOLOGIES)

28.18.1 COMPANY OVERVIEW

28.18.2 REVENUE ANALYSIS

28.18.3 GEOGRAPHIC PRESENCE

28.18.4 PRODUCT PORTFOLIO

28.18.5 RECENT DEVELOPMENTS

28.19 GL SCIENCES INC.

28.19.1 COMPANY OVERVIEW

28.19.2 REVENUE ANALYSIS

28.19.3 GEOGRAPHIC PRESENCE

28.19.4 PRODUCT PORTFOLIO

28.19.5 RECENT DEVELOPMENTS

28.2 RESTEK CORPORATION.

28.20.1 COMPANY OVERVIEW

28.20.2 REVENUE ANALYSIS

28.20.3 GEOGRAPHIC PRESENCE

28.20.4 PRODUCT PORTFOLIO

28.20.5 RECENT DEVELOPMENTS

28.21 XYLEM INC.

28.21.1 COMPANY OVERVIEW

28.21.2 REVENUE ANALYSIS

28.21.3 GEOGRAPHIC PRESENCE

28.21.4 PRODUCT PORTFOLIO

28.21.5 RECENT DEVELOPMENTS

28.22 QUADREX

28.22.1 COMPANY OVERVIEW

28.22.2 REVENUE ANALYSIS

28.22.3 GEOGRAPHIC PRESENCE

28.22.4 PRODUCT PORTFOLIO

28.22.5 RECENT DEVELOPMENTS

28.23 CDS ANALYTICAL LLC (CETAC TECHNOLOGIES)

28.23.1 COMPANY OVERVIEW

28.23.2 REVENUE ANALYSIS

28.23.3 GEOGRAPHIC PRESENCE

28.23.4 PRODUCT PORTFOLIO

28.23.5 RECENT DEVELOPMENTS

28.24 YMC CO., LTD

28.24.1 COMPANY OVERVIEW

28.24.2 REVENUE ANALYSIS

28.24.3 GEOGRAPHIC PRESENCE

28.24.4 PRODUCT PORTFOLIO

28.24.5 RECENT DEVELOPMENTS

28.25 CAMAG (CHEMIE-ERZEUGNISSE UND ADSORPTIONSTECHNIK MUTTENZ AG)

28.25.1 COMPANY OVERVIEW

28.25.2 REVENUE ANALYSIS

28.25.3 GEOGRAPHIC PRESENCE

28.25.4 PRODUCT PORTFOLIO

28.25.5 RECENT DEVELOPMENTS

28.26 MALVERN PANALYTICAL LTD IS A SPECTRIS COMPANY

28.26.1 COMPANY OVERVIEW

28.26.2 REVENUE ANALYSIS

28.26.3 GEOGRAPHIC PRESENCE

28.26.4 PRODUCT PORTFOLIO

28.26.5 RECENT DEVELOPMENTS

28.27 BIOBASE GROUP

28.27.1 COMPANY OVERVIEW

28.27.2 REVENUE ANALYSIS

28.27.3 GEOGRAPHIC PRESENCE

28.27.4 PRODUCT PORTFOLIO

28.27.5 RECENT DEVELOPMENTS

28.28 REPLIGEN CORPORATION

28.28.1 COMPANY OVERVIEW

28.28.2 REVENUE ANALYSIS

28.28.3 GEOGRAPHIC PRESENCE

28.28.4 PRODUCT PORTFOLIO

28.28.5 RECENT DEVELOPMENTS

29 RELATED REPORTS

30 CONCLUSION

31 QUESTIONNAIRE

32 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.