Global Chromatography Reagents Market

Market Size in USD Billion

CAGR :

%

USD

4.97 Billion

USD

7.80 Billion

2025

2033

USD

4.97 Billion

USD

7.80 Billion

2025

2033

| 2026 –2033 | |

| USD 4.97 Billion | |

| USD 7.80 Billion | |

|

|

|

|

Chromatography Reagents Market Size

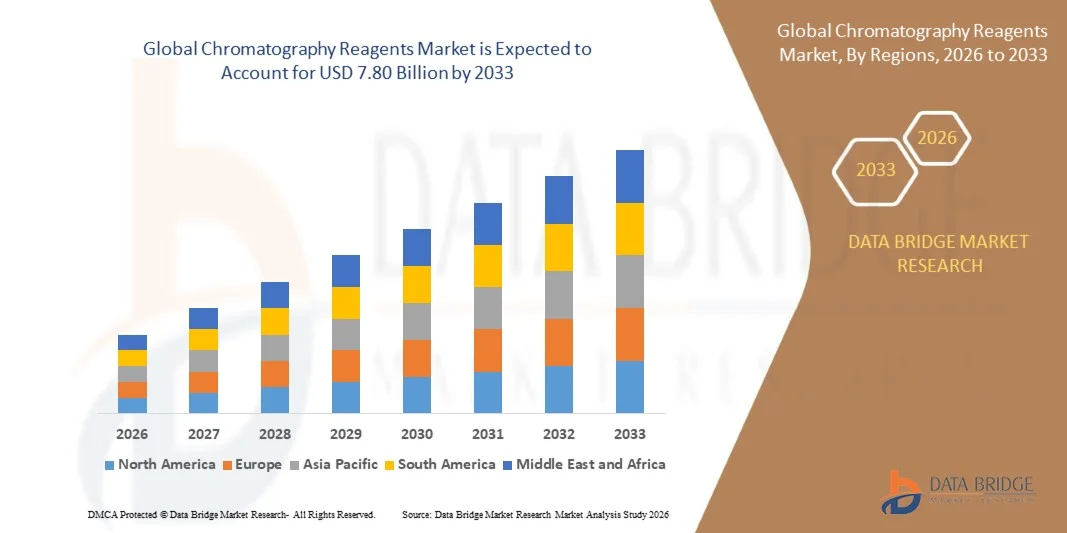

- The global chromatography reagents market size was valued at USD 4.97 billion in 2025 and is expected to reach USD 7.80 billion by 2033, at a CAGR of 5.80% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced analytical and separation techniques across pharmaceuticals, biotechnology, and chemical industries, leading to a higher demand for reliable chromatography reagents

- Furthermore, rising regulatory compliance requirements for purity, quality, and safety of drugs and chemicals are driving the use of high-quality chromatography reagents. For instance, companies such as Merck KGaA and Thermo Fisher Scientific are witnessing growing demand due to stringent pharmacopeia standards, thereby significantly boosting the industry’s growth

Chromatography Reagents Market Analysis

- Chromatography reagents, including solvents, buffers, and standards, are essential for accurate separation, identification, and quantification of compounds in research, quality control, and industrial applications, making them critical in laboratory and industrial workflows

- The escalating demand for chromatography reagents is primarily fueled by the growth of pharmaceutical and biotechnology sectors, increasing R&D activities, and rising emphasis on analytical testing for food, environmental, and clinical applications

- North America dominated the chromatography reagents market with a share of 35.4% in 2025, due to high adoption of advanced analytical techniques in pharmaceutical, biopharmaceutical, and food testing laboratories

- Asia-Pacific is expected to be the fastest growing region in the chromatography reagents market during the forecast period due to rising pharmaceutical manufacturing, biopharmaceutical R&D, and food and environmental testing in countries such as China, Japan, and India

- Solvents segment dominated the market with a market share of 41.7% in 2025, due to its essential role in dissolving analytes and facilitating separation across all chromatographic techniques. Solvents offer high purity, consistent composition, and compatibility with diverse detection systems, making them indispensable in routine and high-precision analyses. Pharmaceutical, food, and environmental laboratories rely on high-grade solvents to ensure reproducibility and accuracy of results. Their widespread use in sample preparation, mobile phases, and gradient elution contributes significantly to market demand. The segment also benefits from continuous innovation in low-toxicity and environmentally friendly solvent options

Report Scope and Chromatography Reagents Market Segmentation

|

Attributes |

Chromatography Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chromatography Reagents Market Trends

“Rising Use of Automated Chromatography Systems”

- The adoption of automated chromatography systems is increasing rapidly as laboratories and manufacturing facilities seek higher efficiency, accuracy, and throughput in analytical and purification processes. Automation minimizes human error, enhances reproducibility, and accelerates workflows, making it a preferred choice across industries such as pharmaceuticals, life sciences, and food testing

- For instance, Agilent Technologies, Inc. introduced its 1290 Infinity II LC system equipped with advanced automation capabilities that enable users to perform unattended operation and simultaneous analysis of multiple samples. This has allowed laboratories to significantly improve testing speed and data consistency in large-scale applications

- The integration of automation with chromatography processes supports enhanced process control and data management. Automated systems equipped with sensors and digital interfaces facilitate real-time monitoring of parameters such as flow rate, pressure, and solvent composition, improving the reliability and accuracy of analytical results

- Rapid growth in biopharmaceutical production has further accelerated the shift toward fully automated chromatography systems for downstream purification. These systems ensure the consistent isolation of target biomolecules such as monoclonal antibodies and proteins while reducing contamination risks and manual labor requirements

- In addition, automation allows better reagent utilization and waste reduction, contributing to overall cost efficiency and sustainability in laboratory operations. This is increasingly critical as laboratories seek eco-friendly solutions and reduced solvent consumption during analysis

- The continued evolution of automated chromatography platforms is reshaping laboratory efficiency and reagent consumption patterns. As manufacturers incorporate IoT connectivity and AI-based optimization, the reliance on automated chromatography systems for high-throughput, reproducible results will continue to expand globally

Chromatography Reagents Market Dynamics

Driver

“Growing Demand for High-Purity Reagents in Pharma and Biotech”

- The increasing focus on precision and quality assurance in pharmaceutical and biotechnology applications is driving the demand for high-purity chromatography reagents. Pure reagents ensure accurate separation, detection, and quantification of molecular components, which is essential for both research and commercial-scale production processes

- For instance, Merck KGaA has significantly expanded its range of LC-MS-grade solvents and reagents to support drug discovery and quality control laboratories. These high-purity reagents enable reliable chromatographic separation with minimal interference, meeting the stringent quality requirements of Good Manufacturing Practice (GMP) environments

- The rising prevalence of biologics and complex drug formulations has intensified the need for reagents that provide consistent performance and compatibility with sensitive detection systems. Reagents manufactured under controlled conditions are ensuring reproducible results essential for regulatory compliance and product validation

- Global expansion of pharmaceutical R&D facilities and increasing outsourcing of analytical testing services are also stimulating reagent demand. Contract research organizations and biopharma laboratories are prioritizing high-quality chemicals to improve process consistency and analytical accuracy

- As a result, continuous investment in purification technologies and controlled manufacturing environments is advancing the supply of ultra-pure chromatography reagents. This trend is expected to strengthen as the pharmaceutical sector continues expanding globally and demands higher analytical precision across drug development and production workflows

Restraint/Challenge

“High Cost of Premium Reagents”

- The high cost associated with premium chromatography reagents poses a significant challenge to market growth, particularly in cost-sensitive regions and small-scale laboratories. These reagents often require complex purification steps and stringent quality validation, contributing to higher production and retail costs

- For instance, companies such as Thermo Fisher Scientific and Agilent Technologies have faced pricing pressures as laboratories in emerging markets seek affordable alternatives without compromising analytical quality. The premium pricing of high-purity solvents and customized reagents limits accessibility for smaller research institutions and academic laboratories

- In addition, the volatility in raw material costs for high-purity chemicals, coupled with stringent regulatory testing and certification, further increases reagent prices. This cost barrier can discourage routine use of advanced chromatography reagents in general testing or low-budget research projects

- Budget constraints in public research laboratories and smaller analytical facilities often lead to dependence on standard-grade reagents, which may compromise testing accuracy. The cost disparity between regular and ultra-pure reagents widens operational gaps between large pharmaceutical enterprises and small laboratories

- Addressing this challenge requires innovation in cost-efficient production technologies and supply chain optimization strategies. The development of scalable purification processes and expanded local manufacturing capacities will be essential for improving affordability and ensuring broader adoption of high-quality chromatography reagents worldwide

Chromatography Reagents Market Scope

The market is segmented on the basis of technology, type, separation mechanism, and end user.

• By Technology

On the basis of technology, the chromatography reagents market is segmented into liquid chromatography, gas chromatography, thin-layer chromatography, supercritical fluid chromatography, and other technologies. The liquid chromatography segment dominated the market with the largest revenue share in 2025, driven by its widespread application in pharmaceutical, food, and environmental testing. The high precision, reproducibility, and versatility of liquid chromatography reagents make them the preferred choice for complex sample analyses. Researchers and laboratory professionals favor liquid chromatography for its compatibility with a wide range of detectors and its ability to handle both small and large molecules efficiently. Continuous advancements in column technology and reagent formulations further enhance its analytical performance and reliability. The segment also benefits from extensive industrial adoption due to its integration into automated and high-throughput systems.

The supercritical fluid chromatography segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in pharmaceutical and biopharmaceutical industries for environmentally friendly and efficient separations. Supercritical fluid reagents reduce solvent consumption, offer faster analysis times, and are ideal for thermally sensitive compounds. Innovations in supercritical CO₂-based reagents and system automation are accelerating its market penetration. In addition, regulatory encouragement for green chemistry and sustainable laboratory practices supports the rising demand for this technology in R&D and production environments.

• By Type

On the basis of type, the chromatography reagents market is segmented into solvents, buffers, derivatization reagents, ion pair reagents, and others. The solvents segment dominated the market with the largest revenue share of 41.7% in 2025, driven by its essential role in dissolving analytes and facilitating separation across all chromatographic techniques. Solvents offer high purity, consistent composition, and compatibility with diverse detection systems, making them indispensable in routine and high-precision analyses. Pharmaceutical, food, and environmental laboratories rely on high-grade solvents to ensure reproducibility and accuracy of results. Their widespread use in sample preparation, mobile phases, and gradient elution contributes significantly to market demand. The segment also benefits from continuous innovation in low-toxicity and environmentally friendly solvent options.

Derivatization reagents are expected to witness the fastest CAGR from 2026 to 2033, fueled by their growing importance in enhancing detection sensitivity and selectivity for complex analytes. These reagents are widely applied in pharmaceutical, forensic, and environmental testing to convert poorly detectable compounds into easily measurable derivatives. Rising R&D activities, coupled with regulatory emphasis on accurate trace-level detection, drive demand for innovative derivatization chemistries. Their integration with advanced chromatographic methods ensures improved accuracy and faster analysis times, supporting laboratory efficiency.

• By Separation Mechanism

On the basis of separation mechanism, the chromatography reagents market is segmented into adsorption chromatography, partition chromatography, ion-exchange chromatography, size-exclusion chromatography, affinity chromatography, and other separation mechanisms. The ion-exchange chromatography segment dominated the market with the largest revenue share in 2025, driven by its effectiveness in separating charged biomolecules such as proteins, peptides, and nucleotides. Ion-exchange reagents provide high selectivity, reproducibility, and scalability for both analytical and preparative applications. Pharmaceutical and biopharmaceutical industries heavily rely on ion-exchange reagents for purification and quality control, making it a critical component in downstream processing workflows. The consistent performance, compatibility with automated systems, and broad application spectrum further support its market leadership.

Affinity chromatography is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for highly specific separation of biomolecules in pharmaceutical and biotechnological research. Affinity reagents enable precise isolation of target molecules such as antibodies, enzymes, and nucleic acids, ensuring high purity and yield. Technological advancements in ligand design, immobilization techniques, and customizable matrices drive adoption in R&D and production settings. Rising focus on biologics, vaccines, and personalized medicine further enhances demand for affinity-based separations.

• By End User

On the basis of end user, the chromatography reagents market is segmented into pharmaceutical companies, biopharmaceutical companies, research & academic laboratories, food & beverage industry, hospitals & clinical testing laboratories, environmental testing laboratories, forensic testing laboratories, petrochemical industry, and other end users. Pharmaceutical companies dominated the market with the largest revenue share in 2025, driven by extensive use of chromatography reagents in drug development, quality control, and regulatory compliance. The high demand for precise, reproducible, and validated analytical results in drug discovery and manufacturing ensures continuous consumption of reagents. Pharmaceutical R&D laboratories prioritize reagents that enable sensitive detection of impurities, metabolites, and active pharmaceutical ingredients. Continuous innovations in chromatography chemistries and growing investments in new drug pipelines further support market dominance.

Research & academic laboratories are expected to witness the fastest growth rate from 2026 to 2033, fueled by expanding research activities, government funding, and increased focus on high-throughput and multidisciplinary studies. Academic and institutional labs require versatile reagents for teaching, method development, and experimental validation. Rising collaborations between universities, research institutes, and industry players contribute to reagent demand. In addition, adoption of modern chromatographic techniques for proteomics, metabolomics, and environmental studies drives growth.

Chromatography Reagents Market Regional Analysis

- North America dominated the chromatography reagents market with the largest revenue share of 35.4% in 2025, driven by high adoption of advanced analytical techniques in pharmaceutical, biopharmaceutical, and food testing laboratories

- Laboratories in the region prioritize high-quality reagents for precise, reproducible, and regulatory-compliant analyses, supporting widespread usage across multiple industries

- Strong R&D infrastructure, high investment in pharmaceutical development, and increasing demand for quality control solutions are further fueling the adoption of chromatography reagents in both commercial and academic laboratories

U.S. Chromatography Reagents Market Insight

The U.S. chromatography reagents market captured the largest revenue share in 2025 within North America, propelled by rapid advancements in liquid and gas chromatography techniques. Pharmaceutical and biopharmaceutical companies are increasingly relying on high-purity reagents for drug discovery, development, and quality control. Rising government and private R&D investments, coupled with adoption of automated and high-throughput analytical systems, are accelerating market growth. In addition, the integration of chromatography reagents in environmental, food, and clinical testing further expands their application base in the country.

Europe Chromatography Reagents Market Insight

The Europe chromatography reagents market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent regulatory compliance in pharmaceuticals, increasing quality testing requirements, and growing investments in biotechnology research. Rising adoption of advanced analytical methods and expansion of pharmaceutical and food testing laboratories contribute to market growth. Countries such as Germany, France, and Switzerland are witnessing increased integration of chromatography reagents into R&D workflows, supporting precision, reproducibility, and efficiency.

U.K. Chromatography Reagents Market Insight

The U.K. chromatography reagents market is expected to grow at a noteworthy CAGR during the forecast period, supported by the country’s robust pharmaceutical and academic research sectors. Increasing demand for reliable analytical methods for drug development, food safety, and environmental monitoring is driving reagent consumption. In addition, the country’s adoption of advanced laboratory technologies and high emphasis on quality standards are expected to sustain market expansion.

Germany Chromatography Reagents Market Insight

The Germany chromatography reagents market is projected to expand at a considerable CAGR, fueled by the country’s strong pharmaceutical and biotechnology industries and well-established analytical testing infrastructure. German laboratories prioritize high-purity and specialized reagents for complex separations and quality control. The emphasis on innovation, sustainability, and compliance with regulatory standards further encourages the adoption of advanced chromatography reagents across research and industrial applications.

Asia-Pacific Chromatography Reagents Market Insight

The Asia-Pacific chromatography reagents market is poised to grow at the fastest CAGR during 2026 to 2033, driven by rising pharmaceutical manufacturing, biopharmaceutical R&D, and food and environmental testing in countries such as China, Japan, and India. Rapid urbanization, increasing laboratory infrastructure, and government initiatives promoting scientific research are boosting demand for chromatography reagents. In addition, APAC’s emergence as a manufacturing hub for high-quality reagents ensures affordability and wider accessibility, fueling adoption across commercial, clinical, and academic laboratories.

Japan Chromatography Reagents Market Insight

The Japan chromatography reagents market is gaining momentum due to the country’s advanced analytical research environment, emphasis on precision testing, and high pharmaceutical R&D activity. Laboratories prioritize the use of reliable, high-purity reagents for complex separations and biomolecule analysis. Increasing demand for automated and high-throughput chromatography systems further supports market expansion across pharmaceutical, environmental, and food testing applications.

China Chromatography Reagents Market Insight

The China chromatography reagents market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid growth in pharmaceutical manufacturing, environmental monitoring, and food safety testing. The expanding middle class, growing scientific research infrastructure, and increasing adoption of liquid and gas chromatography techniques are key growth drivers. Strong domestic production capabilities and government focus on laboratory modernization further enhance the market’s growth potential.

Chromatography Reagents Market Share

The chromatography reagents industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Waters Corporation (U.S.)

- Danaher Corporation (U.S.)

- GFS Chemicals Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Restek Corporation (U.S.)

- Tedia Company Inc. (U.S.)

- Concord Technology Co. Ltd. (China)

- Spectrochem (India)

- Merck KGaA (Germany)

- Agilent Technologies Inc. (U.S.)

- Chiron AS (Norway)

- Regis Technologies Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Spectrum Chemical Mfg. Corp. (U.S.)

- ITW Reagents Division (Spain)

- Thomas Baker (Chemicals) Pvt. Ltd. (India)

- Columbus Chemical Industry (U.S.)

- Avantor Inc. (U.S.)

- Bio-Rad Laboratories Inc. (U.S.)

- Loba Chemie (India)

- Tokyo Chemical Industry Co. Ltd. (Japan)

- Santa Cruz Biotechnology Inc. (U.S.)

- Kanto Kagaku (Japan)

- Tosoh Corporation (Japan)

- Alpha Laboratories Ltd. (U.K.)

Latest Developments in Global Chromatography Reagents Market

- In July 2024, Repligen Corporation announced an agreement to acquire Tantti Laboratory Inc., a Taiwanese innovator with macroporous chromatography bead technology for purification of viral vectors, nucleic acids, and other large-molecule biologics. This acquisition strengthens Repligen’s chromatography reagents and resin portfolio, enabling the company to address emerging biologics modalities, thereby accelerating reagent demand for downstream bioprocessing and signaling further consolidation in the market

- In February 2024, Thermo Fisher Scientific Inc. launched the Dionex Inuvion Ion Chromatography (IC) system, a configurable platform aimed at food & beverage, industrial, environmental, and pharmaceutical labs for ion analysis. The introduction of this advanced system expands demand for high-purity reagents, columns, and consumables in ion-exchange and related chromatography workflows, improving the reagent market’s growth potential in analytical applications

- In March 2023, Avantor, Inc. received the “Best Bioprocessing Company – Chromatography” award at the Asia-Pacific Bioprocessing Excellence Awards (ABEA) for its innovative chromatography instruments, chemicals, and consumables. This recognition highlights Avantor’s strong capabilities and market positioning in chromatography reagents, reinforcing competitive pressure, encouraging further innovation, and validating premium reagent solutions in the region

- In December 2022, Tokyo Chemical Industry Co., Ltd. (TCI) discontinued the sale of HPLC columns and related chromatography products. While TCI continues to sell chromatography-related reagents, this exit from column manufacturing may shift demand toward specialized reagent suppliers and drive consolidation or specialization of reagent business segments in the market

- In February 2022, Thermo Fisher Scientific launched its SureSTART portfolio of chromatography and mass spectrometry consumables, including vials, inserts, kits, and well plates compatible with LC, GC, and LC-MS systems. Although not strictly a chromatography reagent, these consumables support chromatography workflows, enhance sample integrity, and indirectly bolster reagent demand while strengthening supplier relevance in complete analytical workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chromatography Reagents Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chromatography Reagents Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chromatography Reagents Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.