Global Chromatography Resin Market

Market Size in USD Billion

CAGR :

%

USD

2.81 Billion

USD

4.63 Billion

2024

2032

USD

2.81 Billion

USD

4.63 Billion

2024

2032

| 2025 –2032 | |

| USD 2.81 Billion | |

| USD 4.63 Billion | |

|

|

|

|

Chromatography Resin Market Size

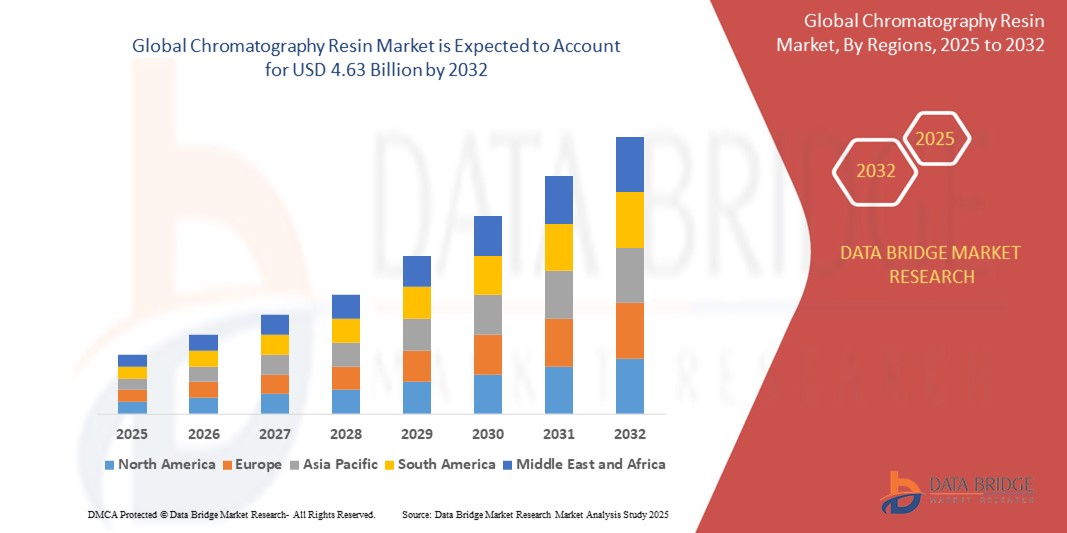

- The global chromatography resin market size was valued at USD 2.81 billion in 2024 and is expected to reach USD 4.63 billion by 2032, at a CAGR of 6.4% during the forecast period

- The market growth is largely fuelled by the rising demand for biopharmaceuticals, increasing investments in R&D activities, and the growing adoption of chromatography techniques in drug discovery, food safety testing, and environmental monitoring

- In addition, advancements in chromatography technologies and the expansion of the pharmaceutical and biotechnology sectors across emerging economies are further accelerating market expansion

Chromatography Resin Market Analysis

- The chromatography resin market is witnessing consistent growth due to its rising use in separating and purifying complex mixtures across pharmaceutical and biotechnology industries

- Increasing adoption of chromatography in food testing, environmental analysis, and academic research is further supporting the market’s steady expansion

- North America dominated the chromatography resin market with the largest revenue share in 2024, propelled by increasing investments in biopharmaceutical research and advancements in chromatography-based purification processes

- Asia-Pacific region is expected to witness the highest growth rate in the global chromatography resin market, driven by rapid expansion of biopharmaceutical manufacturing, increasing government support for life sciences research, and rising demand for biosimilars and vaccines across countries such as China and India

- The natural segment accounted for the largest market revenue share in 2024, primarily due to its biocompatibility, widespread use in protein purification, and ease of modification for selective binding. Natural resins, such as agarose and cellulose, remain a preferred choice for many pharmaceutical applications because of their established safety profiles and performance consistency across varying conditions

Report Scope and Chromatography Resin Market Segmentation

|

Attributes |

Chromatography Resin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chromatography Resin Market Trends

“Rising Demand for Pre-packed Chromatography Columns”

- The demand for pre-packed chromatography columns is growing due to their ease of use, reduced setup time, and minimal risk of human error, making them ideal for contract manufacturing setups such as Lonza's biomanufacturing facilities

- These columns are increasingly used in monoclonal antibody purification processes, with companies such as Roche utilizing them for faster development in oncology therapeutics

- Vaccine developers adopt pre-packed columns to enhance efficiency in downstream processing, as seen in their widespread application during COVID-19 vaccine production by Moderna

- They support automation and scalability, which are critical for high-throughput environments in modern biopharmaceutical manufacturing and regulatory compliance

- Industry leaders such as GE Healthcare and Merck are expanding their portfolios of pre-packed columns to cater to growing demand in clinical and commercial purification workflows

Chromatography Resin Market Dynamics

Driver

“Rising Demand for Biopharmaceuticals Driving Chromatography Resin Utilization”

- The chromatography resin market is being driven by rising global demand for biopharmaceuticals, which include monoclonal antibodies, vaccines, hormones, and therapeutic proteins used for complex disease treatments

- These biologics require intricate purification processes to ensure safety and efficacy, where chromatography resins play a vital role, particularly in downstream processing

- Growing chronic disease rates and aging populations are increasing healthcare needs, resulting in expanded investments in biopharmaceutical production by major firms such as Pfizer and Roche

- To support rising demand, chromatography resin manufacturers are innovating high-capacity resins that enhance throughput and reduce operational costs for large-scale bioprocessing

- The expanding market for biosimilars and personalized medicines continues to increase the need for precise purification platforms, establishing chromatography resins as essential tools in modern drug development and manufacturing

Restraint/Challenge

“High Production Cost and Regulatory Complexity”

- The chromatography resin market faces restraints due to high production costs and complex regulatory requirements associated with biopharmaceutical manufacturing processes

- Resins used in affinity and ion-exchange chromatography are made from specialized raw materials and require precision engineering, making them expensive to produce

- These costs are often transferred across the supply chain, increasing the price of drug development and placing a financial burden on smaller biotech firms and manufacturers

- Regulatory bodies such as the U.S. Food and Drug Administration and the European Medicines Agency enforce strict standards, demanding extensive validation and quality assurance

- In regions with limited bioprocessing infrastructure, the challenge of regulatory compliance and consistent resin performance restricts broader adoption of chromatography solutions in drug production

Chromatography Resin Market Scope

The chromatography resin market is segmented on the basis of type, technique, and end-user.

- By Type

On the basis of type, the chromatography resin market is segmented into natural, synthetic, and inorganic media. The natural segment accounted for the largest market revenue share in 2024, primarily due to its biocompatibility, widespread use in protein purification, and ease of modification for selective binding. Natural resins, such as agarose and cellulose, remain a preferred choice for many pharmaceutical applications because of their established safety profiles and performance consistency across varying conditions.

The synthetic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior chemical stability, mechanical strength, and compatibility with harsh cleaning and operating conditions. Synthetic resins are especially suited for industrial-scale bioprocessing, where robustness and longevity are essential for repeated cycles of purification, thus reducing operational costs and improving efficiency.

- By Technique

On the basis of technique, the chromatography resin market is segmented into ion exchange, affinity, hydrophobic interaction, size exclusion, and multimodal. The ion exchange segment held the largest revenue share in 2024, driven by its broad applicability in separating charged biomolecules such as proteins, peptides, and nucleic acids. Ion exchange chromatography offers high resolution and capacity, making it a go-to method for both research and manufacturing environments, particularly in biopharmaceutical purification.

The affinity segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its highly specific interactions that result in efficient purification of biomolecules such as monoclonal antibodies and enzymes. This technique is extensively utilized in the production of therapeutic proteins, where purity and yield are critical.

- By End-User

On the basis of end-user, the chromatography resin market is segmented into pharmaceutical and biotechnology, food and beverages, and others. The pharmaceutical and biotechnology segment dominated the market in 2024, owing to the high demand for resins in drug development, quality control, and large-scale purification processes. The rapid growth of the biologics sector, along with increasing investments in personalized medicine, continues to bolster this segment’s expansion.

The food and beverages segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing use of chromatography techniques in quality assurance, flavor compound analysis, and removal of contaminants. As consumers and regulators demand higher product safety and transparency, chromatography resins are becoming indispensable in food processing and ingredient validation workflows.

Chromatography Resin Market Regional Analysis

- North America dominated the chromatography resin market with the largest revenue share in 2024, propelled by increasing investments in biopharmaceutical research and advancements in chromatography-based purification processes

- The region benefits from a well-established pharmaceutical industry, with significant demand for high-performance resins in drug development and quality control

- This growth is further supported by strong funding for life sciences, a robust biotechnology sector, and rising demand for monoclonal antibodies and vaccine production, making chromatography resins a critical component in downstream processing

U.S. Chromatography Resin Market Insight

The U.S. chromatography resin market captured the largest revenue share within North America in 2024, driven by the country’s leadership in biotechnology and pharmaceutical innovation. Ongoing research in therapeutic proteins, cell therapies, and biosimilars boosts the need for specialized resins that can deliver high yield and purity. Moreover, collaborations between academia and industry, along with investments in research infrastructure, continue to accelerate the adoption of advanced chromatographic techniques across diverse applications

Europe Chromatography Resin Market Insight

The Europe chromatography resin market is expected to witness the fastest growth rate from 2025 to 2032, primarily supported by strict regulatory standards and the increasing adoption of bioseparation technologies. Rising focus on biopharma manufacturing and an uptick in clinical trials throughout countries such as Germany, the U.K., and France are contributing to increased resin consumption. The market is also benefiting from sustainability initiatives and green chemistry adoption, prompting innovation in resin materials and production processes

U.K. Chromatography Resin Market Insight

The U.K. chromatography resin market is expected to witness the fastest growth rate from 2025 to 2032, fueled by ongoing developments in precision medicine and biosimilar production. Government support for research and increasing demand for biologics across therapeutic areas are boosting adoption in both academic and industrial labs. In addition, the presence of advanced healthcare systems and strong university research networks enhances demand for high-efficiency resin solutions

Germany Chromatography Resin Market Insight

The Germany chromatography resin market is expected to witness the fastest growth rate from 2025 to 2032, driven by the nation’s pharmaceutical manufacturing excellence and rising demand for bioprocessing solutions. Germany’s emphasis on quality, automation, and innovation in life sciences is encouraging the adoption of resins that offer reliability and scalability. Increased investment in biomanufacturing capacity and R&D initiatives further amplify the demand for advanced chromatography technologies across end-user industries

Asia-Pacific Chromatography Resin Market Insight

The Asia-Pacific chromatography resin market is expected to witness the fastest growth rate from 2025 to 2032, due to expanding pharmaceutical production and rising biologics demand in countries such as China, India, and South Korea. The region’s cost-effective manufacturing, rising clinical research activities, and government initiatives supporting biotech development are key factors driving adoption. As multinational companies expand operations in APAC, local resin manufacturing and supply chains are also strengthening, contributing to greater accessibility and lower costs

Japan Chromatography Resin Market Insight

The Japan chromatography resin market is expected to witness the fastest growth rate from 2025 to 2032 with the country’s growing investments in regenerative medicine and biologics research. Japan’s focus on quality and innovation encourages the use of premium chromatography technologies in pharmaceutical and academic sectors. In addition, government initiatives promoting advanced healthcare solutions and support for life sciences R&D are expected to fuel the growth of resin demand

China Chromatography Resin Market Insight

The China chromatography resin market held the largest revenue share in Asia Pacific in 2024, supported by rapid growth in biopharma manufacturing and increasing research capabilities. China’s expanding middle class and rising healthcare expenditure are spurring demand for biologics and biosimilars, leading to greater use of chromatography in purification workflows. The presence of strong local resin producers, combined with government backing for biotech development and smart healthcare solutions, continues to drive robust market expansion

Chromatography Resin Market Share

The Chromatography Resin industry is primarily led by well-established companies, including:

- Danaher Corporation (U.S.)

- Bio-Rad Laboratories Inc. (U.S.)

- Merck KGaA (Germany)

- Tosoh Corporation (Japan)

- BioWorks Technologies AB (Sweden)

- Purolite (U.S.)

- W. R. Grace & Co.-Conn. (U.S.)

- Mitsubishi Chemical Holdings Corporation (Japan)

- Agilent Technologies (U.S.)

- GE Healthcare (U.S.)

- Waters Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Pall Corporation (U.S.)

- Perkin Elmer Inc. (U.S.)

- Kaneka Corporation (Japan)

- Shimadzu Corporation (Japan)

- Knauer GmbH (Germany)

- Avantor Performance Materials Inc. (U.S.)

- JSR Micro Inc. (U.S.)

- Sartorius AG (Germany)

- Repligen Corporation (U.S.)

- JNC Corporation (China)

Latest Developments in Global Chromatography Resin Market

- In April 2023, Mitsubishi Chemical announced the implementation of commercial polycarbonate (PC) resin recycling. This development aims to establish a full-scale recycling system by 2030 with an annual processing target of 10,000 tons. The initiative supports environmental sustainability and aligns with global circular economy goals. By integrating advanced recycling technologies, the company is expected to significantly reduce plastic waste and promote eco-friendly resin production. This move strengthens Mitsubishi Chemical’s position in the sustainable materials market and is likely to encourage broader adoption of recycled resins across industries

- In June 2022, Bio-Rad Laboratories, Inc. introduced the CHT prepacked Foresight Pro Columns, designed to support process-scale chromatography applications in various stages of biological drug development and manufacturing. This launch enhances efficiency in downstream bioprocessing by offering ready-to-use solutions that minimize preparation time. The innovation is anticipated to streamline workflows, improve reproducibility, and address growing demand for scalable purification methods, thereby contributing positively to the chromatography resin market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chromatography Resin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chromatography Resin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chromatography Resin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.