Global Chromatography Software Market

Market Size in USD Million

CAGR :

%

USD

596.62 Million

USD

1,120.77 Million

2024

2032

USD

596.62 Million

USD

1,120.77 Million

2024

2032

| 2025 –2032 | |

| USD 596.62 Million | |

| USD 1,120.77 Million | |

|

|

|

|

Chromatography Software Market Size

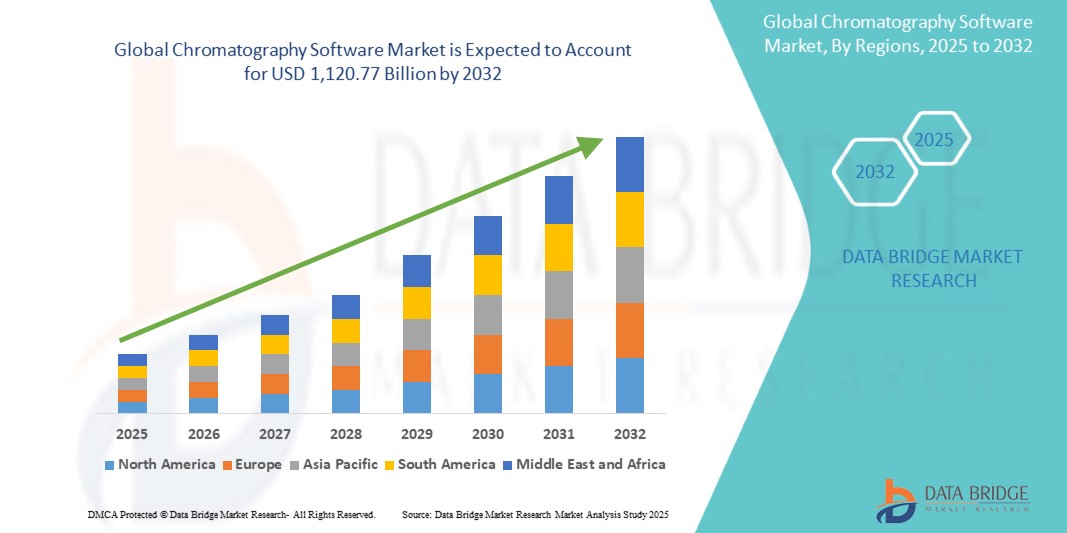

- The global chromatography software market size was valued at USD 596.62 million in 2024 and is expected to reach USD 1,120.77 million by 2032, at a CAGR of 8.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of chromatography techniques across pharmaceutical, biotechnology, food & beverage, and environmental testing industries, where the need for precise, efficient, and automated data analysis has become essential. The transition from manual processes to digital platforms is enhancing workflow efficiency, regulatory compliance, and reproducibility in laboratories worldwide

- Furthermore, rising demand for advanced analytical solutions that can handle complex datasets, integrate seamlessly with laboratory information management systems (LIMS), and support real-time monitoring is establishing chromatography software as a critical component of modern laboratory operations. These converging factors are accelerating the uptake of chromatography software solutions, thereby significantly boosting the industry’s global growth

Chromatography Software Market Analysis

- Chromatography software, designed to collect, analyze, and manage data from chromatography instruments, is an increasingly critical component in modern laboratories across pharmaceutical, biotechnology, food & beverage, environmental testing, and academic research sectors due to its ability to enhance accuracy, compliance, automation, and workflow efficiency

- The escalating demand for chromatography software is primarily fueled by the rising adoption of automation in laboratories, the growing need for regulatory compliance (such as FDA 21 CFR Part 11 and GLP/GMP guidelines), and the increasing complexity of data management in multi-user, multi-instrument laboratory environments

- North America dominated the chromatography software market with the largest revenue share of 39.8% in 2024, attributed to advanced laboratory infrastructure, strong presence of global pharma and biotech companies, and early adoption of digital lab transformation. The U.S. leads this growth, with major expansions in pharmaceutical R&D pipelines and rising integration of cloud-based chromatography data systems (CDS)

- Asia-Pacific is expected to be the fastest-growing region in the chromatography software market during the forecast period (2025–2032), with a projected CAGR of 11.2%, driven by rapid expansion of the pharmaceutical and biotechnology industries in China and India, increasing government investments in healthcare infrastructure, and a surge in food safety and environmental testing requirements

- The normal version dominated the chromatography software market with a market share of 57.8% in 2024, owing to its widespread use in laboratories for routine workflows. Its cost-effectiveness, quick implementation, and suitability for standard applications make it particularly attractive to small and mid-sized laboratories

Report Scope and Chromatography Software Market Segmentation

|

Attributes |

Chromatography Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chromatography Software Market Trends

Transforming Chromatography Software with AI and Voice Technologies

- A significant and accelerating trend in the global chromatography software market is the integration of artificial intelligence (AI) with voice-enabled digital ecosystems. This advancement is streamlining workflows in laboratories by enabling scientists and technicians to interact with chromatography systems through simple voice commands and AI-powered automation

- For instance, leading chromatography software platforms are being enhanced to work with laboratory assistants and AI-driven digital tools, enabling users to initiate runs, check instrument status, or retrieve reports hands-free, thereby reducing manual intervention and improving productivity

- AI integration is further enabling chromatography software to learn experimental patterns, optimize separation conditions, predict potential errors, and suggest corrective actions. This smart assistance helps researchers achieve higher reproducibility and efficiency in both routine testing and advanced research

- Voice-controlled functionality is also emerging as a critical convenience feature, allowing laboratory professionals to operate equipment, adjust parameters, and access real-time data while multitasking. This hands-free operation minimizes contamination risks in sensitive environments and enhances laboratory safety

- The seamless integration of chromatography software with broader laboratory information management systems (LIMS) and connected digital platforms allows for centralized control over experiments, data storage, and workflow management, creating a more connected and automated research environment

- This trend toward intelligent, intuitive, and interconnected chromatography software solutions is reshaping user expectations across the pharmaceutical, biotechnology, and academic sectors. As a result, companies are actively developing AI-enabled platforms with enhanced analytics, predictive modeling, and compatibility with voice-driven digital assistants to deliver faster, more user-friendly, and accurate research outcomes

- The demand for chromatography software that incorporates AI-driven automation and voice-enabled interaction is rapidly growing, fueled by the increasing complexity of research, rising regulatory requirements, and the need for higher efficiency in laboratory operations

Chromatography Software Market Dynamics

Driver

Growing Need Due to Rising Regulatory Compliance and Laboratory Automation

- The growing demand for regulatory compliance in pharmaceutical, biotechnology, and food safety testing, coupled with the accelerating adoption of laboratory automation, is a significant driver for the heightened demand for chromatography software

- For instance, in March 2024, Waters Corporation introduced Empower Chromatography Data System (CDS) enhancements with advanced compliance-ready features designed to streamline audit trails and facilitate FDA 21 CFR Part 11 adherence. Such product advancements by key players are expected to drive the chromatography software industry growth during the forecast period

- As laboratories face increasing pressure to manage large and complex datasets while adhering to strict regulatory standards, chromatography software provides advanced features such as automated data acquisition, peak integration, and electronic record-keeping, offering a compelling upgrade over traditional manual methods

- Furthermore, the growing popularity of digital and cloud-based laboratory solutions is making chromatography software an integral component of modern lab ecosystems, offering seamless integration with other analytical instruments, Laboratory Information Management Systems (LIMS), and enterprise-level platforms

- The convenience of real-time data access, centralized monitoring of multiple instruments, and the ability to manage and share analytical results across global teams are key factors propelling adoption across pharmaceutical, biotechnology, food & beverage, and environmental testing sectors. The trend toward digital transformation and the increasing availability of user-friendly chromatography software solutions further contribute to market expansion

Restraint/Challenge

Concerns Regarding Data Security and High Initial Deployment Costs

- Concerns surrounding the data security vulnerabilities of connected laboratory systems, including cloud-based chromatography software, pose a significant challenge to broader market penetration. As these solutions rely on digital connectivity, they are susceptible to unauthorized access, data breaches, and compliance risks, raising anxieties among laboratories about safeguarding sensitive R&D information and patient-related datasets

- For instance, several industry reports in 2023 highlighted cybersecurity threats in cloud-based laboratory management systems, making certain organizations hesitant to fully transition from on-premises solutions to cloud platforms

- Addressing these concerns through robust encryption, secure authentication protocols, and continuous software updates is crucial for building trust. Companies such as Thermo Fisher Scientific and Agilent Technologies emphasize their advanced data protection features, offering validated software solutions to reassure laboratories. In addition, the relatively high initial cost of implementing advanced chromatography software platforms—especially those with AI-driven analytics and cloud capabilities—can be a barrier for small and mid-sized laboratories or institutions in developing regions

- While software-as-a-service (SaaS) models and modular deployment strategies are gradually reducing upfront expenses, the perception of high investment requirements can still hinder adoption, particularly for cost-sensitive markets that rely on basic analytical tools

- Overcoming these challenges through enhanced cybersecurity measures, affordable subscription-based models, and comprehensive training programs will be vital for ensuring broader adoption and sustained growth of chromatography software in both developed and emerging markets

Chromatography Software Market Scope

The market is segmented on the basis of software type, deployment, application, type, end user and version.

• By Software Type

On the basis of software type, the chromatography software market is segmented into standalone software and integrated software. The integrated software segment dominated the market in 2024 with a share of around 61.3%, capturing the largest revenue portion due to its ability to provide end-to-end connectivity between instruments, data acquisition systems, and reporting tools. By enabling real-time monitoring, streamlined data flow, and automated compliance tracking, integrated solutions significantly enhance overall laboratory efficiency and minimize errors. These advantages have made integrated solutions the preferred choice for large-scale pharmaceutical companies, biotechnology firms, and academic research institutions managing complex workflows.

In contrast, the standalone software segment is projected to expand at the fastest CAGR of 18.6% from 2025 to 2032, supported by rising adoption among smaller laboratories and specialized organizations. Standalone software is highly valued for its affordability, simple deployment, and targeted functionality, making it ideal for facilities that require reliable solutions without investing in extensive integration.

• By Deployment

On the basis of deployment, the chromatography software market is segmented into web-based, on-premises, and cloud-based. The on-premises segment held the largest market share of approximately 54.8% in 2024, supported by its strong adoption in pharmaceutical, chemical, and biotechnology industries where data protection, regulatory compliance, and security are critical. On-premises deployment allows laboratories to retain full control over sensitive data and system operations, which is essential in highly regulated environments.

However, the cloud-based segment is forecasted to grow at the fastest CAGR of 20.3% from 2025 to 2032, owing to its ability to provide remote accessibility, scalability, and real-time collaboration across global locations. The increasing shift toward digital transformation in laboratories and the demand for flexible, cost-effective solutions are driving the strong momentum of cloud-based deployment.

• By Application

On the basis of application, the chromatography software market is segmented into scientific research, analytical testing, environment testing, and biotechnology. The analytical testing segment accounted for the largest share of 47.6% in 2024, driven by its extensive use in quality assurance, drug validation, and compliance testing across pharmaceuticals, food and beverage, and environmental industries. The precision, reliability, and regulatory compliance supported by chromatography software make it indispensable for product validation and safety assurance.

In contrast, the biotechnology segment is projected to witness the fastest CAGR of 19.7% from 2025 to 2032, fueled by growing investments in biologics, biosimilars, vaccines, and advanced therapies. The increasing complexity of biomolecular analysis and the need for high-throughput solutions are expected to further accelerate the adoption of chromatography software in biotechnology research.

• By Type

On the basis of type, the chromatography software market is segmented into fraction collectors, detectors, auto samplers, and systems. Among these, the systems segment dominated the market in 2024 with a share of about 52.4%, as they form the backbone of chromatography operations by integrating sample injection, separation, detection, and data management into a single automated platform. Their ability to deliver seamless workflow automation, minimize errors, and improve reproducibility makes them essential for high-throughput laboratories and advanced research projects. These systems are widely utilized in pharmaceutical, biotechnology, and academic settings due to their versatility and proven reliability.

On the other hand, the detectors segment is expected to register the fastest CAGR of 17.9% from 2025 to 2032, driven by innovations that enhance sensitivity, speed, and analytical precision. Their role in drug discovery, environmental testing, and advanced molecular analysis is expanding significantly, making detectors a key growth driver within the market.

• By End Use

On the basis of end use, the chromatography software market is segmented into scientific research institutions, testing institutions, and others. The scientific research institutions segment led the market with a 49.1% share in 2024, supported by increasing global funding, academic collaborations, and government-led initiatives in areas such as genomics, proteomics, metabolomics, and drug discovery. Chromatography software helps researchers handle complex datasets, automate analytical procedures, and improve accuracy, making it integral to modern research infrastructure.

In contrast, the testing institutions segment is projected to grow at the fastest CAGR of 18.2% from 2025 to 2032, as industries including pharmaceuticals, food, and environmental safety increasingly outsource testing to third-party laboratories for regulatory compliance, quality assurance, and certification. This outsourcing trend, driven by cost-efficiency and access to advanced testing capabilities, is accelerating demand in this segment.

• By Version

On the basis of version, the chromatography software market is segmented into normal and customized. The normal version accounted for the largest market share of 57.8% in 2024, owing to its widespread use in laboratories for routine workflows. Its cost-effectiveness, quick implementation, and suitability for standard applications make it particularly attractive to small and mid-sized laboratories.

However, the customized version is forecasted to grow at the fastest CAGR of 19.1% from 2025 to 2032, driven by rising demand for tailored solutions that cater to specific workflow requirements. Customized software offers advanced features such as LIMS integration, sophisticated data analytics, and workflow automation designed for specialized research or industrial use. The demand for customization is especially strong in high-end pharmaceutical R&D and cutting-edge biotechnology, where workflow optimization and precision are critical.

Chromatography Software Market Regional Analysis

- North America dominated the chromatography software market with the largest revenue share of 39.8% in 2024, attributed to advanced laboratory infrastructure, a strong presence of global pharmaceutical and biotechnology companies, and early adoption of digital lab transformation

- The U.S. accounted for the majority share within North America, supported by growing pharmaceutical R&D pipelines, increasing clinical trials, and a rising focus on integrating cloud-based Chromatography Data Systems (CDS)

- In addition, regulatory emphasis on data integrity and compliance with FDA 21 CFR Part 11 has accelerated software adoption, making the U.S. the largest contributor to the regional market growth

U.S. Chromatography Software Market Insight

The U.S. chromatography software market captured the largest share within North America in 2024, driven by the rapid adoption of advanced digital solutions across pharma and biotech sectors. Expanding R&D investments, coupled with increasing deployment of cloud-enabled CDS platforms for real-time monitoring, compliance, and data integration, are fueling growth. Furthermore, the presence of major industry leaders such as Thermo Fisher Scientific, Agilent Technologies, and Waters Corporation positions the U.S. as a global hub for innovation in chromatography software solutions.

Europe Chromatography Software Market Insight

The Europe chromatography software market is expected to witness significant growth throughout the forecast period, supported by stringent regulatory frameworks such as EMA and GDPR, which mandate high data accuracy and security. Growing demand for advanced analytical testing in pharmaceuticals, environmental monitoring, and food safety is fueling adoption across laboratories. Countries such as Germany, the U.K., and France are leading this growth, with a strong emphasis on software integration for automation, compliance, and workflow efficiency.

U.K. Chromatography Software Market Insight

The U.K. chromatography software market is anticipated to grow at a robust CAGR during the forecast period, driven by a surge in pharmaceutical R&D activities, increasing focus on clinical trials, and heightened investments in digital lab transformation. Government-backed healthcare initiatives and the growing use of chromatography in drug discovery and personalized medicine are further boosting demand for advanced data management software solutions.

Germany Chromatography Software Market Insight

The Germany chromatography software market is projected to grow steadily, supported by the country’s leadership in technological innovation and strong pharmaceutical and chemical industries. Germany’s focus on eco-conscious and sustainable laboratory practices, coupled with digitalization initiatives, is driving adoption of cloud-based and integrated chromatography systems. The market is also benefiting from high demand in research institutions and industrial testing labs, with emphasis on precision and regulatory compliance.

Asia-Pacific Chromatography Software Market Insight

The Asia-Pacific chromatography software market is expected to grow at the fastest CAGR of 11.2% during 2025–2032, fueled by the rapid expansion of the pharmaceutical and biotechnology industries in China and India. Increasing government investments in healthcare infrastructure, rising demand for food safety and environmental testing, and the presence of cost-efficient CROs and CMOs are driving adoption. Cloud-based deployment models are gaining traction due to their scalability and affordability, making APAC a key growth hub for the industry.

Japan Chromatography Software Market Insight

The Japan chromatography software market is gaining momentum due to the country’s advanced technological ecosystem, high focus on R&D, and growing demand for precision-based pharmaceutical research. Increasing use of chromatography for environmental testing, coupled with government support for life sciences innovation, is strengthening market growth. In addition, integration of software solutions with automated systems and AI-driven analytics is gaining popularity among Japanese laboratories.

China Chromatography Software Market Insight

The China chromatography software market accounted for the largest share within Asia-Pacific in 2024, driven by the rapidly expanding pharmaceutical sector, rising drug approvals, and the country’s growing focus on food safety regulations. The presence of a large number of generic drug manufacturers and CROs, coupled with government initiatives promoting digital transformation in laboratories, is boosting demand. Affordable software solutions from both global and domestic vendors are accelerating adoption across academic, research, and industrial applications.

Chromatography Software Market Share

The chromatography software industry is primarily led by well-established companies, including:

- Axel Semrau GmbH (Germany)

- Bruker (U.S.)

- Cecil Instrumentation Services Ltd. (U.K.)

- GE Healthcare (U.S.)

- Hitachi High-Tech Corporation (Japan)

- JASCO Corporation (Japan)

- KNAUER Wissenschaftliche Geräte GmbH (Germany)

- SEDERE (France)

- Sykam GmbH (Germany)

- Waters Corporation (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Scion Instruments (Netherlands)

- Gilson Incorporated (U.S.)

- PerkinElmer (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Restek Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

Latest Developments in Global Chromatography Software Market

- In November 2021, Shimadzu introduced LabSolutions BiX v2.0, publishing a detailed brochure that highlighted its upgraded capabilities for seamlessly connecting analytical instruments, laboratory workflows, and enterprise systems. This release marked a significant step forward in chromatography informatics, providing users with improved data accessibility, cloud-enabled features, and streamlined integration for digital laboratories

- In March 2022, Waters released the Empower Driver Pack 2022 R1 for its Empower Chromatography Data Software (CDS). This update expanded instrument control, driver compatibility, and integration with newer laboratory technologies, enabling users to operate a wider range of chromatographic systems with greater efficiency. Although incremental, the release represented an important milestone in maintaining Empower’s versatility as a widely adopted CDS solution

- In May 2023, Thermo Scientific issued the SII for OpenLab 1.0 Release Notes (dated May 9, 2023), formally documenting the availability and interoperability of Thermo’s chromatography software components within Agilent’s OpenLab environment. This marked an important development for labs using multi-vendor systems, as it enabled enhanced cross-platform instrument connectivity, streamlined workflows, and improved compliance support

- In February 2024, Waters published the Empower 3.8.0.2 Cumulative Security Updates (document dated Feb 26, 2024). These updates focused on critical security patches, stability enhancements, and compliance alignment, reinforcing Empower’s reliability as one of the most trusted chromatography data systems. This release underscored Waters’ commitment to ongoing maintenance, safeguarding user data integrity, and meeting regulatory expectations

- In June 2024, Waters and Scitara jointly announced a strategic collaboration to connect Waters’ chromatography software ecosystem—including Empower and NuGenesis—with Scitara’s DLX data connectivity platform. This integration aimed to enhance digital lab interoperability, enabling seamless data exchange, workflow automation, and connectivity across hybrid laboratory environments. The partnership represented a major advancement in driving digital transformation for modern laboratories

- In June 2025, Sartorius announced the extended integration of its Ambr bioreactor platforms with Thermo Scientific Chromeleon 7.4 CDS. This development facilitated more seamless transfer and synchronization of process data from upstream bioreactor systems into chromatography workflows. By bridging bioprocessing and analytical informatics, the integration improved data handling, efficiency, and compliance for biopharmaceutical research and production

- In July 2025, Agilent released OpenLab CDS 2.8 (Release Notes edition dated 07/2025), which documented new and enhanced capabilities tailored for both regulated and research laboratories. The update introduced improved calibration management, data integrity controls, and usability enhancements, further strengthening OpenLab CDS as a comprehensive solution for managing chromatography data in compliance-driven environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.