Global Chromium Market

Market Size in USD Billion

CAGR :

%

USD

15.83 Billion

USD

20.85 Billion

2024

2032

USD

15.83 Billion

USD

20.85 Billion

2024

2032

| 2025 –2032 | |

| USD 15.83 Billion | |

| USD 20.85 Billion | |

|

|

|

|

Chromium Market Size

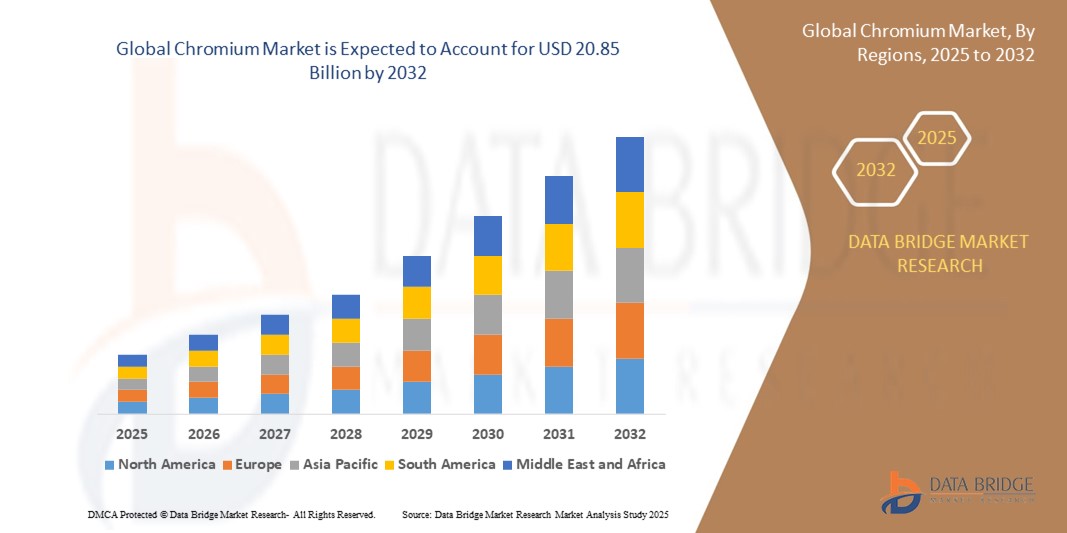

- The global chromium market size was valued at USD 15.83 billion in 2024 and is expected to reach USD 20.85 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is largely fueled by rising demand for stainless steel and high-performance alloys across construction, automotive, and industrial sectors, driven by rapid infrastructure development, urbanization, and increased manufacturing output globally

- Furthermore, technological advancements in ferrochrome production and growing investments in downstream beneficiation, particularly in emerging economies, are strengthening supply chains and enhancing cost efficiency, thereby significantly boosting the industry's growth

Chromium Market Analysis

- Chromium is a hard, corrosion-resistant metal widely used in the production of stainless steel, specialty alloys, electroplating, pigments, and chemical intermediates across diverse industrial applications

- The escalating demand for chromium is primarily fueled by the expanding stainless-steel industry, increased usage of trivalent chromium for environmentally compliant processes, and continued growth in developing economies with high construction and manufacturing activity

- Asia-Pacific dominated the chromium market with a share of 51.2% in 2024, due to robust stainless-steel production and extensive use of ferrochromium in the region’s booming construction, automotive, and manufacturing sectors

- Europe is expected to be the fastest growing region in the chromium market during the forecast period due to stringent environmental regulations and the increasing shift from hexavalent to trivalent chromium in industrial applications

- Metallurgical grade segment dominated the market with a market share of 92.9% in 2024, due to its critical role in stainless steel and high-strength alloy production. The metallurgical grade is preferred for its high chromium content and low impurity levels, supporting high-temperature resistance and strength in steelmaking. Global infrastructure development, especially in emerging economies, is further accelerating the consumption of metallurgical-grade chromium

Report Scope and Chromium Market Segmentation

|

Attributes |

Chromium Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chromium Market Trends

“Growing Demand for Environmentally Friendly Chromium Compounds”

- A significant and accelerating trend in the global chromium market is the increasing demand for environmentally friendly chromium compounds, particularly in applications such as coatings, pigments, and specialty chemicals

- For instance, major companies such as Glencore PLC, Kermas Group Ltd., and Samancor Chrome are investing in the development and commercialization of less toxic, sustainable chromium products to comply with tightening environmental regulations and meet customer preferences for green materials

- The shift toward eco-friendly chromium compounds is also driven by regulatory pressures in regions such as North America and Europe, where industries are seeking alternatives to traditional hexavalent chromium due to its toxicity and environmental impact

- Advances in extraction and processing technologies are enabling the production of high-purity, low-impact chromium compounds for use in electronics, renewable energy, and high-performance alloys, further supporting this trend

- This move toward sustainability is fundamentally reshaping supply chains and product portfolios, with companies such as Assmang Proprietary Limited and Odisha Mining Corporation focusing on R&D and process innovation to maintain competitiveness in a changing regulatory landscape

- The demand for environmentally friendly chromium compounds is growing rapidly across both established and emerging markets, as end-users in construction, automotive, and electronics increasingly prioritize sustainability and compliance

Chromium Market Dynamics

Driver

“Growing Stainless Steel Demand”

- The rising global demand for stainless steel is a major driver for the chromium market, as chromium is an essential component for imparting corrosion resistance and strength to stainless steel alloys

- For instance, Jindal Stainless, one of the world’s leading stainless-steel producers, announced a major investment plan in 2024 to expand its downstream and melting capabilities, directly boosting chromium consumption and influencing global supply chains

- The expansion of infrastructure, automotive, and construction sectors—especially in Asia-Pacific countries such as China and India—further increases the need for stainless steel, and thus chromium, for use in structural materials, vehicle components, and machinery

- Technological advancements and modernization in manufacturing processes are also driving demand for high-quality chromium alloys in aerospace, defense, and electronics industries

- The convenience and versatility of stainless steel, combined with ongoing urbanization and industrialization, are propelling chromium market growth globally

Restraint/Challenge

“Growing Presence of Substitute Materials”

- The increasing presence of substitute materials, such as alternative alloys and coatings, poses a significant challenge to the chromium market’s growth prospects

- For instance, the development and adoption of nickel-based and titanium alloys in aerospace, automotive, and industrial applications are reducing reliance on chromium-containing materials, especially where enhanced performance or lower toxicity is required

- Companies such as Glencore PLC and Eurasian Natural Resources Corporation face competitive pressure from producers of these substitutes, which may offer cost, weight, or environmental advantages in certain applications

- The availability and advancement of substitute technologies can limit the growth potential of chromium, particularly in markets with strict environmental regulations or where innovation in materials science is rapid

- Overcoming this challenge will require continued investment in product differentiation, process efficiency, and the development of new applications for chromium compounds that cannot be easily replaced by alternatives

Chromium Market Scope

The market is segmented on the basis of type, grade, material, and application.

- By Type

On the basis of type, the chromium market is segmented into trivalent chromium and hexavalent chromium. The trivalent chromium segment dominated the largest market revenue share in 2024, owing to its growing usage as a safer and more environmentally compliant alternative in various industrial applications. Trivalent chromium compounds are widely adopted in decorative plating, tanning, and corrosion-resistant coatings due to their lower toxicity and increasing global regulatory pressure to replace hexavalent chromium in manufacturing. The market is further driven by the shift in end-use industries toward sustainable practices and the expanding research in improving the performance of trivalent-based formulations.

The hexavalent chromium segment, despite facing regulatory restrictions, is expected to show steady demand in niche applications through 2032. Its superior performance in hard chrome plating and corrosion protection continues to support its presence in aerospace, automotive, and heavy machinery industries where alternatives are yet to match its functional properties.

- By Grade

On the basis of grade, the chromium market is segmented into metallurgical grade, refractory and foundry grade, chemical intermediary grade, and others. The metallurgical grade segment held the largest revenue share 92.9% in 2024, primarily driven by its critical role in stainless steel and high-strength alloy production. The metallurgical grade is preferred for its high chromium content and low impurity levels, supporting high-temperature resistance and strength in steelmaking. Global infrastructure development, especially in emerging economies, is further accelerating the consumption of metallurgical-grade chromium.

The chemical intermediary grade is projected to witness the fastest growth rate from 2025 to 2032, fueled by its growing usage in pigments, tanning, metal finishing, and wood preservatives. The segment benefits from rising demand in chemical synthesis and industrial processing, particularly as formulations shift toward more specialized and value-added applications.

- By Material

On the basis of material, the chromium market is segmented into ferrochromium, chromium chemicals, chromium metals, and others. The ferrochromium segment accounted for the highest revenue share of 82.75% in 2024 due to its integral use in the production of stainless and alloyed steels. As ferrochromium is the primary source of chromium in steel manufacturing, its demand is closely tied to trends in construction, automotive, and infrastructure sectors. The continuous expansion of stainless-steel applications across architectural, kitchenware, and transportation industries supports robust demand for this material.

Chromium chemicals are expected to grow at the fastest CAGR from 2025 to 2032, supported by rising demand in plating, pigments, wood preservation, and tanning applications. Market growth is further propelled by the increasing shift toward trivalent chromium-based formulations in response to environmental and occupational health regulations.

- By Application

On the basis of application, the chromium market is segmented into stainless steel production, alloyed steel production, non-ferrous alloy production, refractory additives, and others. The stainless-steel production segment dominated the market in 2024, driven by its high chromium consumption for corrosion resistance and aesthetic appeal. Rapid urbanization, industrialization, and global infrastructure projects are fueling the expansion of stainless-steel applications in construction, household goods, and automotive components.

The non-ferrous alloy production segment is anticipated to grow at the fastest rate during the forecast period, supported by the rising use of chromium in specialized aerospace, defense, and electronics applications. These alloys offer high strength-to-weight ratios and enhanced thermal stability, making them suitable for high-performance engineering components in technologically advanced sectors.

Chromium Market Regional Analysis

- Asia-Pacific dominated the chromium market with the largest revenue share of 51.2% in 2024, driven by robust stainless-steel production and extensive use of ferrochromium in the region’s booming construction, automotive, and manufacturing sectors

- Major economies such as China and India lead the demand due to their expansive industrial base, strong infrastructure investments, and increasing exports of chromium-intensive products

- The region’s abundant chromite reserves, combined with a cost-effective workforce and expanding downstream processing capabilities, reinforce Asia-Pacific’s dominance in global chromium consumption

China Chromium Market Insight

The China chromium market captured the largest revenue share in Asia-Pacific in 2024, fueled by the country’s high-volume stainless-steel manufacturing and rapid infrastructure growth. Strong government support for industrial output, coupled with growing domestic demand for durable, corrosion-resistant materials, continues to drive chromium usage. China’s leading position in ferrochromium smelting and its extensive mining activities further boost the market’s strength.

India Chromium Market Insight

The India chromium market is witnessing substantial growth, supported by rising urbanization, infrastructure modernization, and demand from the construction and automotive industries. India’s rich chromite ore reserves and ongoing capacity expansions in ferroalloy production are strengthening its position in the global supply chain. Government initiatives aimed at boosting domestic steel production are also expected to elevate chromium consumption over the forecast period.

Europe Chromium Market Insight

Europe is projected to expand at the fastest CAGR from 2025 to 2032, primarily driven by stringent environmental regulations and the increasing shift from hexavalent to trivalent chromium in industrial applications. The demand for chromium is growing in aerospace, automotive, and high-performance alloy segments as the region pushes toward energy-efficient and sustainable material use. Ongoing investments in green steel production, combined with strong innovation ecosystems in countries such as Germany and France, are fueling the region’s rapid market expansion

Germany Chromium Market Insight

The Germany chromium market is anticipated to grow at a notable CAGR due to the country’s advanced metallurgical industries and push toward eco-friendly manufacturing processes. Rising demand for high-quality stainless steel and specialty alloys in automotive and machinery sectors is supporting chromium consumption. Germany’s leadership in material innovation and emphasis on circular economy practices are expected to further enhance market growth.

France Chromium Market Insight

The France chromium market is experiencing steady growth with increasing application in aerospace components and specialty metal production. The country’s focus on lightweight, high-strength materials for defense and transportation, alongside strict regulations promoting the use of safer chromium grades, supports demand for trivalent chromium and high-purity alloys.

Chromium Market Share

The chromium industry is primarily led by well-established companies, including:

- Al Tamman Indsil FerroChrome L.L.C (Oman)

- Assmang Proprietary Limited (South Africa)

- CVK Madencilik (Turkey)

- Glencore (Switzerland)

- Hernic Ferrochrome (Pty) Ltd (Hernic) (South Africa)

- International Ferro Metals (IFM) (South Africa)

- Kermas Investment Group (U.K.)

- MVC Holdings LLC (U.S.)

- Odisha Mining Corporation Ltd (India)

- Tenaris (Luxembourg)

- YILDIRIM Group of Companies (Turkey)

Latest Developments in Global Chromium Market

- In June 2023, the Indian government-imposed export restrictions on chromium ores and concentrates, which are critical inputs for stainless steel production and other industrial applications. This regulatory shift, requiring exporters to obtain a license from the Directorate General of Foreign Trade (DGFT), is expected to reduce outbound supply and prioritize domestic value addition. The move may tighten global supply, particularly impacting major importers such as China, and could influence pricing and sourcing dynamics in the international chromium market

- In June 2023, a scientific breakthrough introduced the ion enrichment chip–laser-induced breakdown spectroscopy (IEC-LIBS) method, enhancing the detection of chromium in different oxidation states in soil and water. This innovation offers a simplified, eco-friendly, and field-deployable solution for monitoring chromium contamination, aligning with growing environmental regulations. The advancement is likely to improve compliance and monitoring capabilities across industrial and environmental sectors, potentially influencing demand for safer chromium variants such as trivalent chromium

- In May 2023, African Chrome Fields announced the near completion of a USD 40 million aluminothermic smelting facility in Zimbabwe, designed to produce ferrochrome without external power sources. The adoption of proprietary reduction technology positions the plant as a sustainable and cost-effective producer, strengthening regional beneficiation efforts. This development is expected to increase Zimbabwe’s output of high-quality ferrochrome, enhance supply chain efficiency, and support growing demand from South African and international stainless-steel manufacturers

- In November 2022, Yildirim Group finalized the acquisition of Elementis plc's chromium business for USD 170 million. This acquisition includes Elementis Chromium's assets such as production facilities in Corpus Christi (TX) and Castle Hayne (NC), along with additional facilities in Amarillo (TX), Dakota (NE), and Milwaukee (WI)

- In June 2022, Tenaris announced a USD 29 million investment in its Dalmine steel shop to enhance production capacity for specialty steels high in chromium, such as chromium 13. The investment, slated for completion by early 2023, involves upgrades across three stages of the production process

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Chromium Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Chromium Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Chromium Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.