Global Ciprofloxacin Ophthalmic Solution Market

Market Size in USD Billion

CAGR :

%

USD

169.12 Billion

USD

257.59 Billion

2024

2032

USD

169.12 Billion

USD

257.59 Billion

2024

2032

| 2025 –2032 | |

| USD 169.12 Billion | |

| USD 257.59 Billion | |

|

|

|

|

Ciprofloxacin Ophthalmic Solution Market Size

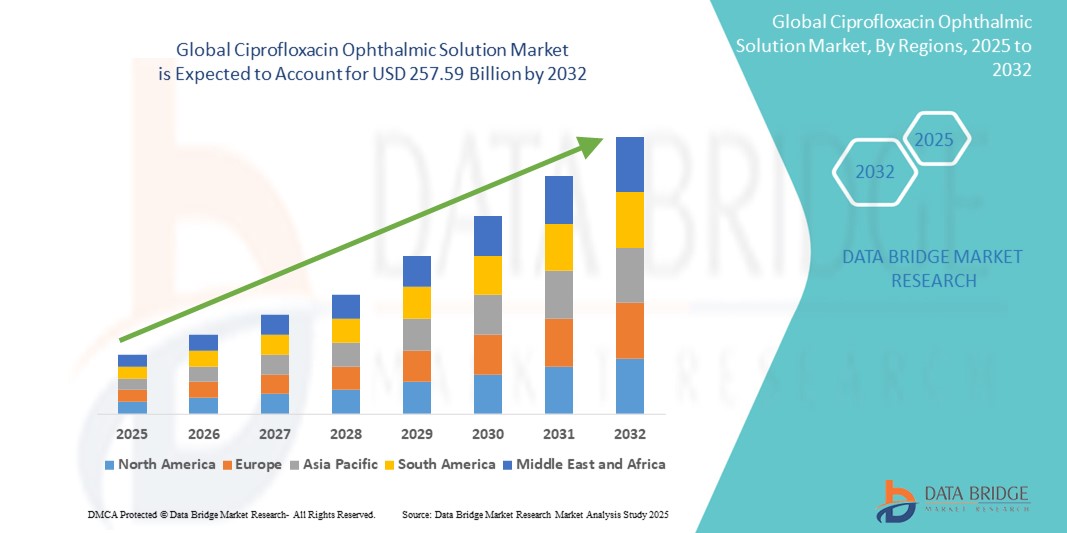

- The global ciprofloxacin ophthalmic solution market size was valued at USD 169.12 billion in 2024 and is expected to reach USD 257.59 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fueled by the rising prevalence of bacterial eye infections such as conjunctivitis, keratitis, and blepharitis, which has led to increased prescriptions of ciprofloxacin ophthalmic solutions as a frontline antibiotic therapy. The expanding geriatric population, particularly in developed economies, is further driving demand due to increased susceptibility to ocular infections

- Furthermore, growing consumer awareness regarding early treatment of eye conditions, along with the increasing availability of generic formulations, is making ciprofloxacin ophthalmic solutions more accessible and affordable. These factors, combined with improvements in ophthalmic drug delivery systems and broader over-the-counter availability, are significantly boosting the market’s growth trajectory

Ciprofloxacin Ophthalmic Solution Market Analysis

- Ciprofloxacin Ophthalmic Solution, a broad-spectrum antibiotic used to treat bacterial eye infections, is increasingly vital in ophthalmology due to its effectiveness in treating conjunctivitis, keratitis, and corneal ulcers. Its fast-acting relief, minimal side effects, and ease of application make it a preferred treatment in both hospital and outpatient settings

- The escalating demand for ciprofloxacin ophthalmic solution is primarily fueled by the growing prevalence of eye infections, increasing awareness of ocular hygiene, and the rising incidence of post-surgical infections. In addition, the aging population and increased frequency of cataract surgeries contribute to the rising demand for prophylactic antibiotic eye drops

- North America dominated the ciprofloxacin ophthalmic solution market with the largest revenue share of 44.3% in 2024, driven by advanced healthcare infrastructure, early diagnosis rates, and a high level of awareness among patients and providers. The U.S. leads this regional growth due to the strong presence of pharmaceutical companies, favorable reimbursement policies, and a high volume of ophthalmic surgeries

- Asia-Pacific is expected to be the fastest-growing region in the ciprofloxacin ophthalmic solution market during the forecast period, with a projected CAGR of 7.9%, due to increasing healthcare access, rising disposable incomes, and a high prevalence of untreated or misdiagnosed eye infections in countries such as India and China

- The generic segment dominated the ciprofloxacin ophthalmic solution market with a market share of 68.4% in 2024, attributed to lower costs, widespread availability, and increased prescriptions following patent expirations

Report Scope and Ciprofloxacin Ophthalmic Solution Market Segmentation

|

Attributes |

Ciprofloxacin Ophthalmic Solution Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ciprofloxacin Ophthalmic Solution Market Trends

“Rising Incidence of Ocular Infections and Antimicrobial Resistance Concerns”

- The aging global population is contributing to a higher incidence of eye infections, particularly among individuals with comorbidities such as diabetes, which increases susceptibility to ocular complications requiring antibiotic treatments such as Ciprofloxacin Ophthalmic Solution

- The expanding reach of telemedicine and e-prescription platforms is making it easier for patients to access Ciprofloxacin Ophthalmic Solution, especially in rural and underserved areas, thus broadening the market scope

- Rising healthcare investments in emerging economies are improving diagnostic capabilities and treatment access for eye infections, thereby accelerating the uptake of ophthalmic antibiotics such as ciprofloxacin

- The availability of over-the-counter (OTC) and generic ciprofloxacin eye drops in several regions is improving affordability and accessibility, particularly in cost-sensitive markets, fueling further market penetration

- Hospital and retail pharmacies are increasing their inventory of ophthalmic antibiotics in response to higher outpatient visits for eye infections, with ciprofloxacin remaining one of the most commonly stocked antibiotics due to its clinical reliability

- Advancements in preservative-free and single-dose formulations are enhancing patient compliance and safety, reducing the risk of irritation and contamination—key factors driving product innovation in the ophthalmic antibiotics segment

- Ciprofloxacin is also being studied in combination with anti-inflammatory or steroidal agents to provide dual-action therapies for more severe or recurrent ocular infections, reflecting ongoing R&D

- Ciprofloxacin Ophthalmic Solution Market Dynamics

Driver

“Growing Need Due to Rising Eye Infection Cases and Antibiotic Advancements”

- The increasing prevalence of bacterial eye infections, such as conjunctivitis and keratitis, coupled with rising awareness regarding ocular hygiene, is a significant driver fueling the demand for ciprofloxacin ophthalmic solution globally

- For instance, in April 2024, the World Health Organization (WHO) highlighted a spike in antimicrobial resistance-related eye infections in developing regions, emphasizing the importance of effective, broad-spectrum antibiotics such as Ciprofloxacin. Such developments are expected to bolster the growth of the ciprofloxacin ophthalmic solution market during the forecast period

- As patients and healthcare professionals seek fast-acting, reliable treatments for ocular infections, Ciprofloxacin's broad antimicrobial activity and proven efficacy have made it a staple in ophthalmic care. It offers a compelling solution for managing a wide range of bacterial infections without the need for systemic antibiotics

- Furthermore, the growing popularity of home-based care, rising healthcare access in rural areas, and the availability of Ciprofloxacin in various formulations (eye drops, ointments) are expanding its use in both clinical and non-clinical settings

- The convenience of topical administration, minimal systemic absorption, and fewer side effects compared to oral antibiotics are key factors propelling the adoption of Ciprofloxacin Ophthalmic Solution. The increasing availability of over-the-counter versions in some regions and e-pharmacy distribution further contribute to the market’s expansion

Restraint/Challenge

“Concerns Regarding Antibiotic Resistance and Cost Variability”

- The growing concern around antimicrobial resistance (AMR) presents a significant challenge to the long-term effectiveness of Ciprofloxacin and other fluoroquinolones. Overuse or misuse of antibiotic eye drops may contribute to resistance, making infections harder to treat over time

- For instance, medical journals have reported increasing resistance patterns in Pseudomonas aeruginosa and Staphylococcus aureus, common pathogens causing eye infections, which could limit the efficacy of existing Ciprofloxacin-based therapies

- Addressing these concerns requires controlled prescription practices, patient education on complete dosage compliance, and the development of new combination therapies or next-gen formulations

- Another barrier includes cost variability across regions. While generic Ciprofloxacin formulations are widely available, high-quality branded products or preservative-free versions can be expensive in certain markets, limiting accessibility for low-income populations

- The lack of awareness about early diagnosis and treatment in rural or underserved areas further constrains market reach. Bridging this gap through awareness campaigns, subsidies, and tele-ophthalmology solutions will be essential for sustainable market expansion

Ciprofloxacin Ophthalmic Solution Market Scope

The ciprofloxacin ophthalmic solution market is segmented on the basis of type, dosage, application, end-users, and distribution channel.

• By Type

On the basis of type, the ciprofloxacin ophthalmic solution market is segmented into branded and generic. The generic segment dominated the market with a revenue share of 68.4% in 2024, attributed to lower cost, broad availability, and high prescription volume following patent expirations.

The branded segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2032, supported by physician loyalty, brand recognition, and institutional preferences.

• By Dosage

On the basis of dosage, the market is segmented into 1–2 drops every 2 hours, 2 drops every 15 minutes, and 2 drops every 30 minutes. The 1–2 drops every 2 hours segment held the largest market share of 47.9% in 2024, being the standard regimen for uncomplicated bacterial eye infections.

The 2 drops every 15 minutes segment is projected to grow at the fastest CAGR of 7.4% from 2025 to 2032, due to its use in treating severe corneal ulcers and bacterial keratitis.

• By Application

On the basis of application, the market is segmented into bacterial conjunctivitis and corneal ulcers. The bacterial conjunctivitis segment accounted for the largest revenue share of 61.3% in 2024, supported by its high global prevalence and effective response to fluoroquinolone therapy.

The corneal ulcers segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by increased contact lens usage and trauma-induced ocular infections.

• By End Users

On the basis of end users, the market is segmented into hospitals, homecare, specialty clinics, and others. The hospital segment led with a market share of 42.5% in 2024, driven by strong institutional demand, surgical prophylaxis, and clinical recommendations.

The homecare segment is projected to grow at the fastest CAGR of 8.6% from 2025 to 2032, due to rising self-administration trends and increased OTC product accessibility.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into retail pharmacy, hospital pharmacy, and online pharmacy. The retail pharmacy segment held the highest share of 48.3% in 2024, owing to wide consumer reach and strong pharmacist-led sales.

The online pharmacy segment is anticipated to grow at the fastest CAGR of 9.8% from 2025 to 2032, supported by digital transformation, telemedicine integration, and the convenience of doorstep delivery.

Ciprofloxacin Ophthalmic Solution Market Regional Analysis

- North America dominated the ciprofloxacin ophthalmic solution market with the largest revenue share of 44.3% in 2024, driven by a high prevalence of bacterial eye infections, increasing awareness regarding ocular health, and strong demand for advanced ophthalmic therapeutics. The region's well-established healthcare infrastructure and favorable reimbursement policies further support widespread usage of Ciprofloxacin eye drops across hospitals, clinics, and pharmacies

- Consumers in the region increasingly prefer fast-acting, broad-spectrum antibiotic eye drops, particularly for conditions such as conjunctivitis, keratitis, and post-surgical infections. Strong regulatory approvals and high adoption of branded and generic formulations enhance product availability and accessibility

- The market growth is also supported by rising eye surgeries, increased use of contact lenses, and aging populations, all of which contribute to a greater incidence of eye infections, thus driving demand for ciprofloxacin ophthalmic solutions

U.S. Ciprofloxacin Ophthalmic Solution Market Insight

The U.S. ciprofloxacin ophthalmic solution market captured the largest revenue share of 76.2% in 2024 within North America, propelled by increasing outpatient visits for eye infections and the widespread prescription of antibiotic eye drops in clinical settings. With a robust presence of pharmaceutical giants and continuous product innovation, the U.S. market benefits from both over-the-counter and prescription-based accessibility. The growing elderly population and increased awareness about early treatment of eye infections are additional drivers boosting market expansion.

Europe Ciprofloxacin Ophthalmic Solution Market Insight

The Europe ciprofloxacin ophthalmic solution market is projected to expand at a substantial CAGR throughout the forecast period, owing to strict regulatory guidelines around infection control, and rising awareness of eye health. The increasing number of ophthalmic surgical procedures, coupled with growing antimicrobial resistance concerns, is accelerating the preference for broad-spectrum antibiotics such as Ciprofloxacin. Moreover, strong support from public health institutions and initiatives promoting early treatment and prevention of ocular infections are contributing to the market’s upward trajectory.

U.K. Ciprofloxacin Ophthalmic Solution Market Insight

The U.K. ciprofloxacin ophthalmic solution market is anticipated to grow at a noteworthy CAGR throughout the forecast period, driven by the rising burden of bacterial eye diseases and the national health system's strong emphasis on infection control. The market is supported by both NHS prescriptions and private healthcare use, with growing public awareness and ophthalmologist recommendations fueling consistent demand. Increased eye surgeries and post-operative antibiotic requirements further add to the product uptake.

Germany Ciprofloxacin Ophthalmic Solution Market Insight

The Germany ciprofloxacin ophthalmic solution market is expected to expand at a considerable CAGR during the forecast period, due to increasing awareness of antibiotic stewardship, widespread usage in ophthalmic practices, and strong pharmaceutical distribution networks. Germany’s focus on high-quality healthcare solutions and strict product quality standards promotes the use of proven, effective treatments such as Ciprofloxacin. In addition, the aging population and growing incidence of chronic eye conditions are supporting sustained demand.

Asia-Pacific Ciprofloxacin Ophthalmic Solution Market Insight

The Asia-Pacific ciprofloxacin ophthalmic solution market is poised to grow at the fastest CAGR of 7.9% from 2025 to 2032, driven by the rising incidence of eye infections, rapid urbanization, and improved healthcare access in countries such as China, India, and Japan. Government-led health initiatives, increasing surgical volumes, and awareness campaigns for ocular health are significantly boosting regional growth. Moreover, the rise of generic manufacturers in APAC is making Ciprofloxacin-based treatments more affordable and widely accessible across urban and rural areas asuch as .

Japan Ciprofloxacin Ophthalmic Solution Market Insight

The Japan ciprofloxacin ophthalmic solution market is gaining traction due to the country’s advanced healthcare system and high public awareness regarding eye hygiene. The demand is particularly strong among the aging population and patients undergoing cataract and LASIK surgeries, where prophylactic antibiotic use is standard practice. Regulatory efficiency and domestic production support consistent availability of quality ophthalmic solutions.

China Ciprofloxacin Ophthalmic Solution Market Insight

The China ciprofloxacin ophthalmic solution market held the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, a rising middle class, and high patient volume for eye care services. Ciprofloxacin Ophthalmic Solution is widely used in both public hospitals and retail pharmacies, with the market further benefiting from strong local manufacturing capabilities. Government investments in healthcare infrastructure and the national push toward preventing antibiotic resistance are reinforcing product demand.

Ciprofloxacin Ophthalmic Solution Market Share

The ciprofloxacin ophthalmic solution industry is primarily led by well-established companies, including:

- Akorn Operating Company LLC (U.S.)

- Novartis AG (Switzerland)

- Wellona Pharma (India)

- Beye, LLC (U.S.)

- Symwell Pharmaceuticals (India)

- SAINTROY LIFESCIENCE (India)

- Cirondrugs (U.S.)

- Zuche Pharmaceuticals (India)

- Henry Schein, Inc (U.S.)

- Systochem Laboratories Ltd. (India)

- Sentiss (India)

- Amanta Healthcare (India)

- Focus Lab (India)

Latest Developments in Global Ciprofloxacin Ophthalmic Solution Market

- In August 2023, the U.S. FDA continued to support the widespread use of Ciprofloxacin Ophthalmic Solution in pediatric patients following a comprehensive safety review spanning data from 1990 to 2023. The analysis found no new safety concerns in children under 17, reinforcing the drug's safety and efficacy in treating bacterial eye infections in pediatric populations. Additionally, multiple generic versions of Ciprofloxacin Ophthalmic Solution—manufactured by companies such as Altaire Pharmaceuticals, FDC Ltd., Rising, Rubicon, and Watson Labs—remain available in the U.S. market, with FDA approvals ranging from 2004 to 2018. This robust generic presence supports treatment accessibility and affordability across healthcare settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.