Global Civil Engineering Market

Market Size in USD Billion

CAGR :

%

USD

11.28 Billion

USD

17.31 Billion

2024

2032

USD

11.28 Billion

USD

17.31 Billion

2024

2032

| 2025 –2032 | |

| USD 11.28 Billion | |

| USD 17.31 Billion | |

|

|

|

|

Civil Engineering Market Size

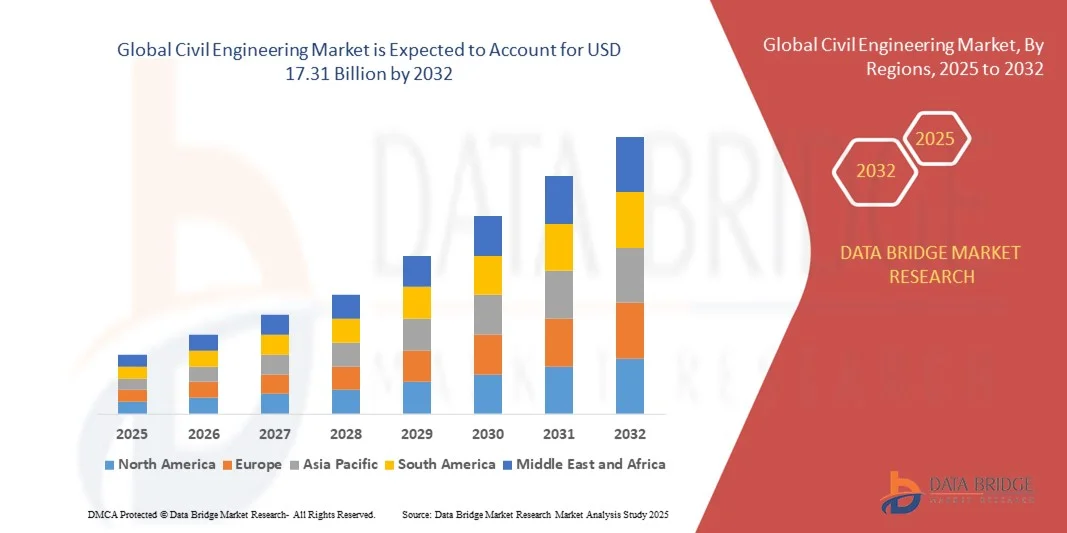

- The global civil engineering market size was valued at USD 11.28 trillion in 2024 and is expected to reach USD 17.31 trillion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fuelled by the rapid pace of urbanization, rising infrastructure investments, and government initiatives focused on sustainable construction practices

- Increasing demand for smart cities, renewable energy infrastructure, and advanced transportation systems is further propelling market expansion

Civil Engineering Market Analysis

- The civil engineering market is experiencing significant growth due to the increasing need for resilient infrastructure and modernization of existing public facilities across both developed and emerging economies

- Technological advancements such as Building Information Modeling (BIM), prefabrication, and automation are transforming construction efficiency, reducing costs, and improving project accuracy

- Asia-Pacific dominated the civil engineering market with the largest revenue share of 42.36% in 2024, driven by rapid urbanization, industrialization, and increasing infrastructure investments across major economies such as China, India, and Japan

- North America region is expected to witness the highest growth rate in the global civil engineering market, driven by modernization of existing infrastructure, investment in renewable energy projects, and growth in urban redevelopment initiatives

- The Government segment held the largest market share in 2024, driven by significant public spending on infrastructure development such as transportation, energy, and water management systems. National programs and public–private partnerships (PPPs) are further supporting long-term growth in this segment

Report Scope and Civil Engineering Market Segmentation

|

Attributes |

Civil Engineering Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• AECOM (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Civil Engineering Market Trends

Rising Adoption of Sustainable and Green Construction Practices

- The growing emphasis on environmental sustainability is transforming the civil engineering industry, with governments and private developers increasingly adopting green building standards and eco-friendly materials. These practices help reduce carbon footprints, minimize waste, and enhance energy efficiency across infrastructure projects, contributing to long-term resilience against climate-related risks and regulatory pressures

- The demand for sustainable construction materials such as recycled concrete, low-carbon cement, and energy-efficient insulation systems is on the rise. This shift is driven by regulatory mandates, investor interest in ESG (Environmental, Social, and Governance) goals, and public demand for climate-resilient infrastructure, resulting in the rapid evolution of product innovation and greener supply chains within the construction ecosystem

- The integration of renewable energy systems and smart design approaches in civil projects is improving operational efficiency and long-term cost savings. Engineers are prioritizing lifecycle sustainability through techniques such as green roofing, water recycling, and passive building designs, which enhance structural longevity while reducing energy dependence and environmental impact

- For instance, in 2023, several European countries implemented strict sustainability guidelines for public infrastructure tenders, mandating the use of low-emission construction materials and renewable energy sources for new projects. These regulations have encouraged contractors to modernize their processes and invest in environmentally responsible technologies, thereby setting new benchmarks in sustainable engineering

- While the adoption of green practices is accelerating, widespread implementation depends on cost feasibility, technical expertise, and policy support. Industry collaboration and innovation in material science will be key to advancing this transition, with emerging trends such as carbon-neutral cement, circular construction, and modular design expected to shape the sector’s future

Civil Engineering Market Dynamics

Driver

Increasing Infrastructure Development and Urbanization Worldwide

- Rapid urbanization and the surge in population across emerging economies are driving the demand for large-scale infrastructure projects such as highways, bridges, railways, and urban transit systems. Governments are investing heavily in expanding and upgrading public infrastructure to support economic growth and improve connectivity, particularly in high-growth regions such as Asia-Pacific and the Middle East

- Smart city initiatives, coupled with housing and industrial development programs, are boosting demand for advanced civil engineering solutions. This has created opportunities for private investments and public–private partnerships (PPPs) in transport and urban infrastructure, promoting innovation and sustainability through data-driven urban planning and resource optimization

- Technological advancements in construction methods, such as Building Information Modelling (BIM), prefabrication, and automation, are enhancing project efficiency, safety, and cost control. These innovations are further supported by digital monitoring systems and IoT-based solutions, allowing for real-time project tracking, predictive maintenance, and reduced operational downtime

- For instance, in 2024, the Indian government announced a major infrastructure expansion program under the “National Infrastructure Pipeline,” which includes over 7,000 projects across transportation, energy, and urban development sectors. This large-scale initiative is expected to generate employment, boost industrial demand, and significantly expand the scope of civil engineering applications across the nation

- While infrastructure growth continues to fuel the market, ensuring sustainable financing, timely project execution, and the adoption of new technologies remains crucial for long-term industry expansion. Collaborative efforts between government bodies, private enterprises, and financial institutions are essential to maintain the momentum and address execution bottlenecks

Restraint/Challenge

Rising Construction Costs and Shortage of Skilled Workforce

- The global construction industry faces rising material and labor costs, driven by supply chain disruptions, inflation, and increasing energy prices. These cost pressures are impacting project timelines, profitability, and overall market stability, with smaller contractors finding it particularly challenging to absorb cost fluctuations in essential materials such as cement and steel

- The shortage of skilled engineers, technicians, and construction workers further exacerbates project delays and affects quality control. The industry struggles to attract new talent due to safety concerns and lack of modernized vocational training programs, leading to skill gaps in advanced engineering methods, digital design tools, and project management systems

- In many regions, inconsistent availability of raw materials such as steel, cement, and asphalt leads to fluctuating prices, complicating project budgeting and resource management. These challenges are particularly significant in developing economies undertaking large-scale infrastructure projects, where logistical constraints and financing issues further limit timely material supply

- For instance, in 2023, the U.S. construction industry reported a 15% rise in project costs due to increased raw material prices and labor shortages, leading several contractors to delay or renegotiate public infrastructure projects. The ripple effects of these cost hikes have also affected downstream sectors such as real estate and industrial development

- While technological adoption and workforce upskilling can mitigate these challenges, addressing structural inefficiencies and promoting digital transformation will be essential to maintaining growth momentum in the civil engineering market. Governments and industry associations must collaborate on education, certification programs, and automation to bridge the skills and cost gap effectively

Civil Engineering Market Scope

The market is segmented on the basis of service type, customer type, and application.

- By Service Type

On the basis of service type, the civil engineering market is segmented into Planning and Design, Construction, Maintenance, and Others. The Construction segment held the largest market revenue share in 2024, driven by rapid urbanization, expanding infrastructure projects, and growing government investments in public utilities, transport, and housing developments. Large-scale construction of highways, bridges, and industrial facilities continues to be a primary contributor to market demand.

The Maintenance segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the rising need to renovate aging infrastructure and ensure safety compliance across developed and emerging economies. The growing emphasis on sustainable infrastructure management and the adoption of advanced monitoring technologies are further accelerating demand for civil maintenance services.

- By Customer Type

On the basis of customer type, the civil engineering market is segmented into Government, Private, and Others. The Government segment held the largest market share in 2024, driven by significant public spending on infrastructure development such as transportation, energy, and water management systems. National programs and public–private partnerships (PPPs) are further supporting long-term growth in this segment.

The Private segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to rising investments in residential and commercial real estate projects, as well as increased participation of private entities in large-scale infrastructure ventures. The growing adoption of smart construction technologies and sustainability-driven projects is also boosting private sector engagement.

- By Application

On the basis of application, the civil engineering market is segmented into Real Estate, Infrastructure, and Industrial. The Infrastructure segment dominated the market in 2024, driven by extensive investment in transportation networks, renewable energy facilities, and urban development projects. Government-backed modernization initiatives and smart city programs are key factors supporting this dominance.

The Real Estate segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for residential and commercial buildings in high-growth urban centers. The growing focus on sustainable design, affordable housing, and mixed-use developments is enhancing the scope of civil engineering services across the real estate sector.

Civil Engineering Market Regional Analysis

- Asia-Pacific dominated the civil engineering market with the largest revenue share of 42.36% in 2024, driven by rapid urbanization, industrialization, and increasing infrastructure investments across major economies such as China, India, and Japan

- The region’s governments are actively implementing large-scale infrastructure projects, including highways, bridges, smart cities, and renewable energy systems, to support economic development and population growth

- The demand for sustainable and cost-efficient construction practices, coupled with growing foreign investments and urban development initiatives, has established Asia-Pacific as the global leader in civil engineering activities

China Civil Engineering Market Insight

The China civil engineering market accounted for the largest market share in Asia-Pacific in 2024, supported by massive public infrastructure investments and urban redevelopment programs. The government’s focus on expanding transportation networks, industrial parks, and affordable housing continues to drive sector growth. China’s Belt and Road Initiative (BRI) further fuels demand for engineering services across both domestic and international projects. The rising use of advanced construction technologies, such as prefabrication and smart monitoring systems, enhances project efficiency and sustainability.

Japan Civil Engineering Market Insight

The Japan civil engineering market is expected to witness the fastest growth rate from 2025 to 2032, supported by infrastructure modernization, disaster resilience projects, and renewable energy expansion. The country’s focus on sustainable urban development and smart infrastructure is encouraging innovation in construction technologies and materials. Moreover, government efforts to upgrade aging infrastructure, coupled with initiatives promoting earthquake-resistant structures, are propelling market growth. Japan’s emphasis on precision engineering and automation continues to strengthen its position in the global civil engineering sector.

North America Civil Engineering Market Insight

The North America civil engineering market is expected to witness the fastest growth rate from 2025 to 2032, driven by ongoing infrastructure renewal projects and government funding under programs such as the U.S. Infrastructure Investment and Jobs Act. The demand for smart city solutions, green buildings, and resilient transportation networks is reshaping the regional market. Moreover, private investments in industrial facilities and urban development projects are contributing to steady market growth. The integration of advanced construction technologies, such as Building Information Modelling (BIM) and 3D printing, is further enhancing project outcomes.

U.S. Civil Engineering Market Insight

The U.S. civil engineering market is expected to witness the fastest growth rate from 2025 to 2032, supported by major public and private investments in transportation, energy, and housing infrastructure. The country’s focus on sustainable construction, coupled with the modernization of existing infrastructure, is driving consistent demand for engineering services. The growing adoption of digital tools, modular construction, and renewable energy systems is transforming project execution across sectors. In addition, rising government emphasis on climate-resilient and green infrastructure is accelerating long-term growth opportunities.

Europe Civil Engineering Market Insight

The Europe civil engineering market is projected to witness considerable growth from 2025 to 2032, fuelled by the European Union’s investments in sustainable infrastructure and energy-efficient building programs. The region’s focus on reducing carbon emissions and promoting green construction materials aligns with its long-term climate goals. Increasing renovation activities in aging infrastructure and the development of smart mobility networks are strengthening market expansion. Moreover, cross-border collaborations and advancements in automation are enhancing project quality and productivity across the continent.

Germany Civil Engineering Market Insight

The Germany civil engineering market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong investments in transportation, renewable energy, and industrial construction projects. Germany’s emphasis on sustainability and innovation promotes the use of eco-friendly materials and smart technologies in civil projects. The government’s focus on upgrading digital infrastructure and expanding green urban spaces further contributes to market development. In addition, the rising demand for energy-efficient commercial and residential buildings aligns with the country’s environmental policies.

U.K. Civil Engineering Market Insight

The U.K. civil engineering market is expected to witness the fastest growth rate from 2025 to 2032, supported by government-led infrastructure programs and investments in housing, transport, and renewable energy. Initiatives such as High Speed 2 (HS2) and the National Infrastructure Strategy are key drivers of market expansion. The push toward carbon-neutral construction and digital innovation in engineering processes is further enhancing the sector’s competitiveness. The integration of smart design systems and data-driven project management tools continues to improve efficiency and reduce operational costs across the U.K. market.

Civil Engineering Market Share

The Civil Engineering industry is primarily led by well-established companies, including:

• AECOM (U.S.)

• Tetra Tech, Inc. (U.S.)

• Vinci Construction (France)

• Royal BAM Group (Netherlands)

• Hochtief Aktiengesellschaft (Germany)

• TechnipFMC plc (U.K.)

• SNC-Lavalin Group (Canada)

• Hyundai E&C (South Korea)

• Power Construction Corporation of China (China)

• HDR (U.S.)

• Saipem (Italy)

• STRABAG SE (Austria)

• Jacobs (U.S.)

• Fluor Corporation (U.S.)

• GALFAR ENGINEERING & CONTRACTING SAOG (Oman)

• ACS Actividades de Construcción y Servicios, S.A (Spain)

• Skanska (Sweden)

• Balfour Beatty (U.K.)

• United States Army Corps of Engineers (U.S.)

• Bouygues Construction SA (France)

• Kiewit Corporation (U.S.)

• LAING O’ROURKE (U.K.)

• Bechtel Corporation (U.S.)

Latest Developments in Global Civil Engineering Market

- In January 2024, AECOM, through its joint venture Vermont Corridor Partners (VCP), initiated a major planning and environmental development project for the Vermont Transit Corridor in Los Angeles. The project focuses on a comprehensive Bus Rapid Transit (BRT) and rail improvement plan, enhancing mobility, accessibility, and community equity. This initiative is expected to significantly improve urban transit efficiency and strengthen AECOM’s leadership in large-scale infrastructure planning

- In December 2023, Jacobs entered a strategic partnership with the non-profit organization Bridges to Prosperity to construct a suspended footbridge across a river, ensuring safe and reliable connectivity for local communities. The project involved full-scale development activities from design to construction, highlighting Jacobs’ commitment to sustainable engineering and social impact projects

- In December 2023, Fluor Corporation secured a major construction contract from Dow to build the world’s first Net-Zero Scope 1 and Scope 2 Integrated Ethylene Cracker and Derivatives Complex in Fort Saskatchewan, Canada. This initiative aims to advance low-emission industrial development and expand Fluor’s presence in the sustainable infrastructure sector, setting a benchmark for environmental responsibility in construction

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Civil Engineering Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Civil Engineering Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Civil Engineering Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.