Global Clean Coal Technology Market

Market Size in USD Billion

CAGR :

%

USD

5.07 Billion

USD

6.08 Billion

2025

2033

USD

5.07 Billion

USD

6.08 Billion

2025

2033

| 2026 –2033 | |

| USD 5.07 Billion | |

| USD 6.08 Billion | |

|

|

|

|

Clean Coal Technology Market Size

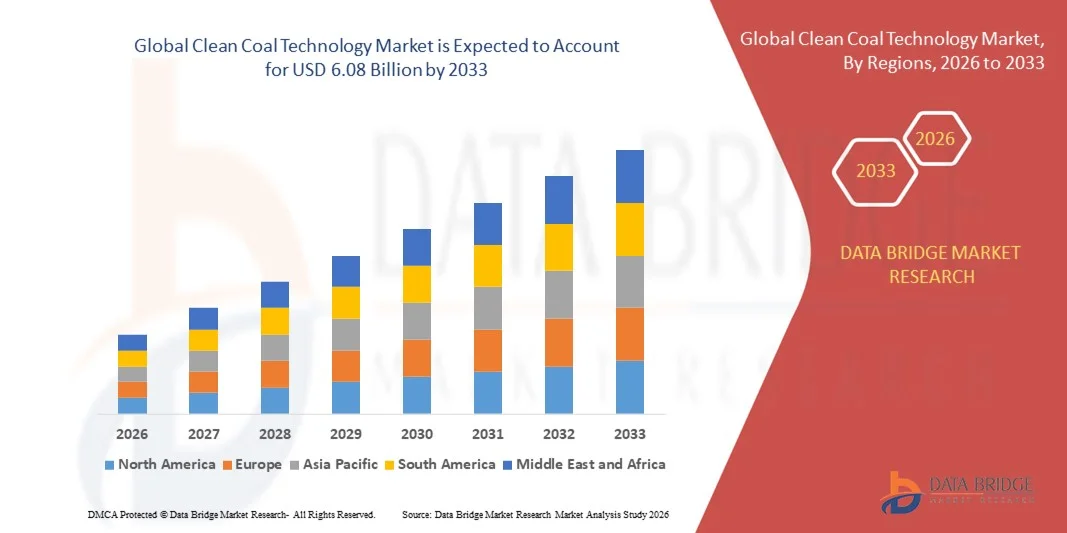

- The global clean coal technology market size was valued at USD 5.07 billion in 2025 and is expected to reach USD 6.08 billion by 2033, at a CAGR of 2.30% during the forecast period

- The market growth is largely fueled by increasing investments in cleaner coal solutions, advanced combustion technologies, and carbon capture, utilization, and storage (CCUS) systems, leading to reduced emissions and improved energy efficiency in coal-fired power plants

- Furthermore, rising governmental regulations for emission reduction, growing demand for low-carbon energy, and adoption of advanced technologies such as supercritical pulverized coal combustion, fluidized bed combustion, and gasification are driving the deployment of clean coal technologies across power generation and industrial sectors. These converging factors are accelerating market adoption, thereby significantly boosting industry growth

Clean Coal Technology Market Analysis

- Clean coal technologies, offering advanced coal combustion and gasification solutions along with emission control and carbon capture capabilities, are increasingly critical for sustainable power generation and industrial operations due to their ability to reduce greenhouse gas emissions while maintaining energy output

- The escalating demand for clean coal technologies is primarily fueled by stricter environmental regulations, rising global energy demand, and increasing focus on decarbonization and sustainable energy solutions. Integration with CCUS systems, hydrogen production, and multipurpose gasification further enhances their adoption across diverse energy and industrial applications

- Asia-Pacific dominated the clean coal technology market with a share of 39.6% in 2025, due to rapid industrialization, increasing energy demand, and strong government support for cleaner coal initiatives

- North America is expected to be the fastest growing region in the clean coal technology market during the forecast period due to investments in clean coal solutions, carbon capture and storage, and retrofitting of coal-fired power plants

- Supercritical pulverised coal combustion segment dominated the market with a market share of 45% in 2025, due to its high efficiency and lower emissions compared with conventional coal combustion methods. Utilities and power generation companies favor supercritical technology for its ability to achieve higher thermal efficiency, reduce fuel consumption, and comply with stringent environmental regulations. The segment also benefits from established infrastructure and operational familiarity, which encourages widespread adoption across large-scale coal-fired power plants

Report Scope and Clean Coal Technology Market Segmentation

|

Attributes |

Clean Coal Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Clean Coal Technology Market Trends

Growth of Carbon Capture and Storage (CCUS) Adoption

- A major trend shaping the clean coal technology market is the accelerating adoption of carbon capture, utilization, and storage (CCUS) systems aimed at reducing greenhouse gas emissions from coal-based power plants. Governments and industry players are increasingly focusing on CCUS as a transitional pathway to achieve net-zero targets while maintaining energy security through existing coal assets

- For instance, in 2024, Mitsubishi Heavy Industries partnered with the U.S. Department of Energy (DOE) to expand its Petra Nova CCUS project in Texas, capturing more than 1.2 million tons of carbon dioxide annually from coal-fired operations. This initiative has set a benchmark for large-scale carbon capture efficiency and commercial viability in the global market

- The growing recognition of CCUS as a critical technology in mitigating climate change has led to rising investments in research, infrastructure development, and pilot demonstration projects across Asia-Pacific, North America, and Europe. Major energy companies are emphasizing integration of CCUS with advanced coal gasification systems to enhance carbon recovery rates and reduce emission footprints

- Integration of CCUS with enhanced oil recovery (EOR) applications is gaining traction as it offers additional economic incentives and enhances resource utilization. Power producers are adopting such models to offset capture costs and strengthen profitability while contributing to long-term carbon management strategies

- Technological advancements are driving improvements in capture efficiency, membrane filtration, and solvent regeneration that are making CCUS systems more scalable and cost-effective. These developments are also facilitating the retrofitting of older power plants with minimal operational disruptions

- The overall trend toward CCUS adoption signifies a structural shift in the coal industry from conventional combustion-based models toward environmentally responsible operations. This transformation positions clean coal technologies as a vital enabler of global decarbonization commitments and sustainable industrial growth

Clean Coal Technology Market Dynamics

Driver

Stricter Emission Regulations Driving Cleaner Energy Solutions

- The tightening of global emission standards and regulatory policies is a major driver for the adoption of clean coal technologies. Governments are increasingly enforcing carbon intensity limits and mandating the use of emission control systems in coal-fired installations, compelling operators to modernize their existing infrastructure

- For instance, in 2024, China’s National Energy Administration (NEA) introduced a regulatory framework that promotes low-emission power generation by mandating flue gas desulfurization and particulate control systems in all new coal plants. Key corporations such as China Energy Investment Corporation have implemented advanced supercritical and ultra-supercritical boilers to comply with these regulatory benchmarks

- The increased focus on reducing sulfur dioxide, nitrogen oxide, and particulate emissions has prompted large-scale integration of scrubbers, gasification units, and electrostatic precipitators in conventional plants. These investments lower emission levels and also improve overall fuel efficiency and heat rate performance

- International climate agreements and national sustainability pledges are encouraging the diversification of energy portfolios with cleaner coal technologies. This transition is ensuring that coal remains part of the global energy mix under environmentally regulated frameworks

- Rising corporate sustainability commitments and the pressure to reduce carbon footprints across industrial sectors are further enhancing the demand for clean coal systems. As a result, clean coal technologies are emerging as a reliable solution to balance energy demand growth with stringent environmental compliance requirements

Restraint/Challenge

High Costs of Advanced Clean Coal Technologies

- The high capital and operational costs associated with implementing advanced clean coal technologies continue to pose significant challenges to market expansion. Cost constraints often limit the adoption of new installations, especially in developing regions where funding access and return on investment concerns are critical considerations

- For instance, the Kemper County energy project in the U.S. faced substantial delays and escalating costs during its coal gasification and carbon capture development phases, leading to financial losses and project restructuring by Southern Company. Such cases highlight the economic barriers to widespread deployment of cutting-edge coal technologies

- Clean coal systems such as integrated gasification combined cycle (IGCC) and supercritical boilers require sophisticated equipment, specialized materials, and skilled operational setups, contributing to higher upfront expenses. Even with government incentives, many utilities face hurdles in financing projects with long payback periods

- Maintenance and retrofit costs for older facilities add further complexity, as many plants require substantial upgrades to align with emission reduction requirements. These challenges discourage smaller power producers from adopting newer technologies at scale

- To ensure the commercial viability of clean coal technologies, cost reduction through modular design, public-private funding models, and scalable deployment strategies will be crucial. Overcoming financial and technical barriers will determine the pace at which clean coal transitions toward broader global acceptance as part of the cleaner energy ecosystem

Clean Coal Technology Market Scope

The market is segmented on the basis of product type, technology type, and application.

- By Product Type

On the basis of product type, the clean coal technology market is segmented into supercritical pulverised coal combustion, fluidised bed combustion, and gasification. The supercritical pulverised coal combustion segment dominated the market with the largest market revenue share of 45% in 2025, driven by its high efficiency and lower emissions compared with conventional coal combustion methods. Utilities and power generation companies favor supercritical technology for its ability to achieve higher thermal efficiency, reduce fuel consumption, and comply with stringent environmental regulations. The segment also benefits from established infrastructure and operational familiarity, which encourages widespread adoption across large-scale coal-fired power plants.

The fluidised bed combustion segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing focus on reducing sulfur and nitrogen oxide emissions in both industrial and power generation sectors. For instance, companies adopting circulating fluidised bed technology, such as Babcock & Wilcox, are able to burn a wider range of coal types efficiently while minimizing environmental impact. The flexibility, lower operating temperatures, and integration with emission control systems make this product type highly attractive for new installations and retrofitting older plants, driving strong growth in the forecast period.

- By Technology Type

On the basis of technology type, the clean coal technology market is segmented into combustion technology pulverized, coal combustion, fluidized bed combustion, gasification technology, integrated coal gasification, hydrogen from coal process, multipurpose coal gasification, enabling technology, carbon capture and storage technology, and carbon sequestration technology. The coal combustion segment dominated the market in 2025, driven by its mature development, extensive deployment, and proven reliability in large-scale power generation. Power producers prioritize coal combustion technologies due to their operational familiarity, cost-effectiveness, and compatibility with existing coal-fired plants. The segment also benefits from ongoing enhancements in emission control, which improve environmental compliance while sustaining high energy output.

Gasification technology is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the increasing adoption of integrated gasification combined cycle (IGCC) systems for clean energy production. For instance, companies such as Siemens Energy are investing in advanced coal gasification projects to produce syngas and hydrogen with minimal emissions. The technology’s ability to convert coal into cleaner fuels, coupled with potential integration with carbon capture and storage systems, positions it as a highly attractive solution for the transition to low-carbon energy, driving strong market growth.

- By Application

On the basis of application, the clean coal technology market is segmented into desulfurization and denitrification. The desulfurization segment dominated the market with the largest revenue share in 2025, driven by stringent regulations on sulfur oxide emissions in coal-fired power plants and industrial facilities. Utilities prioritize flue gas desulfurization technologies to reduce acid rain-causing emissions while ensuring compliance with environmental standards. The adoption of these systems is further supported by government incentives and policies encouraging cleaner coal utilization and retrofitting of existing plants.

The denitrification segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for nitrogen oxide reduction in industrial and power generation applications. For instance, companies implementing selective catalytic reduction (SCR) technologies, such as Mitsubishi Power, are able to achieve high efficiency in NOx removal while maintaining energy output. The rising focus on air quality improvement, stringent emission regulations, and technological advancements in denitrification systems contribute to rapid adoption, positioning this segment for robust growth in the forecast period.

Clean Coal Technology Market Regional Analysis

- Asia-Pacific dominated the clean coal technology market with the largest revenue share of 39.6% in 2025, driven by rapid industrialization, increasing energy demand, and strong government support for cleaner coal initiatives

- The region’s cost-effective power generation infrastructure, expanding coal-based power plants, and rising investments in emission control technologies are accelerating market expansion

- Availability of skilled labor, favorable policies promoting clean energy, and growing adoption of advanced coal combustion and gasification technologies are contributing to increased consumption across industrial and power sectors

China Clean Coal Technology Market Insight

China held the largest share in the Asia-Pacific clean coal technology market in 2025, owing to its extensive coal-fired power generation capacity, strong industrial base, and active implementation of carbon reduction initiatives. The country’s investments in supercritical and ultra-supercritical coal technologies, coupled with carbon capture and storage projects, are major growth drivers. Demand is further supported by governmental regulations mandating emission reductions and the integration of advanced coal gasification and fluidized bed combustion technologies across power plants.

India Clean Coal Technology Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising electricity demand, expansion of coal-fired power plants, and government initiatives promoting cleaner coal solutions. For instance, the adoption of fluidized bed combustion and integrated gasification systems by power producers is increasing due to their efficiency and lower emissions. In addition, investments under national clean energy missions, rising industrial energy requirements, and policy incentives for emission reduction are contributing to strong market expansion.

Europe Clean Coal Technology Market Insight

The Europe clean coal technology market is expanding steadily, supported by stringent emission regulations, demand for low-sulfur coal solutions, and investments in carbon capture and storage systems. The region emphasizes environmental compliance, energy efficiency, and advanced technology adoption, particularly in power generation and industrial applications. Increasing deployment of supercritical combustion and gasification technologies, coupled with funding for emission reduction research, is further enhancing market growth.

Germany Clean Coal Technology Market Insight

Germany’s clean coal technology market is driven by its focus on high-efficiency power generation, strong industrial base, and leadership in environmental compliance. The country leverages advanced coal combustion, gasification, and carbon capture technologies, supported by well-established R&D networks and government incentives. Demand is particularly strong for retrofitting existing power plants with cleaner coal solutions and developing sustainable energy alternatives.

U.K. Clean Coal Technology Market Insight

The U.K. market is supported by regulatory frameworks for emission reduction, investments in sustainable energy solutions, and modernization of coal-fired power plants. With growing focus on carbon capture, advanced coal gasification, and fluidized bed combustion technologies, the U.K. continues to play a significant role in promoting cleaner coal initiatives. Industrial adoption and academic-industry collaboration for innovation in emission control further strengthen the market.

North America Clean Coal Technology Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by investments in clean coal solutions, carbon capture and storage, and retrofitting of coal-fired power plants. A strong emphasis on reducing greenhouse gas emissions, improving energy efficiency, and developing hydrogen and multipurpose coal gasification processes is boosting demand. In addition, collaborations between energy companies and technology providers for low-emission coal utilization are supporting rapid market expansion.

U.S. Clean Coal Technology Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by advanced coal-fired power infrastructure, robust R&D capabilities, and federal incentives for clean energy technologies. The country’s focus on integrating carbon capture, gasification, and fluidized bed combustion solutions to achieve emission reduction targets is driving adoption. Presence of leading technology providers, strong industrial demand, and policy support for sustainable coal utilization further solidify the U.S.’s leading position in the region.

Clean Coal Technology Market Share

The clean coal technology industry is primarily led by well-established companies, including:

- Clean Coal Technologies, Inc. (U.S.)

- GENERAL ELECTRIC (U.S.)

- Alstom (France)

- Siemens AG (Germany)

- Exxon Mobil Corporation (U.S.)

- Royal Dutch Shell plc (Netherlands)

- LANZATECH (U.S.)

- KBR Inc. (U.S.)

- Cortus AB (Sweden)

- Chiyoda Corporation (Japan)

Latest Developments in Global Clean Coal Technology Market

- In July 2025, Canada invested CAD 21.5 million (USD 15.8 million) in Alberta’s Open Access Wabamun Hub to expand CO₂ transport and storage capacity. This investment is expected to significantly enhance the country’s carbon capture, utilization, and storage (CCUS) infrastructure, enabling larger-scale deployment of clean coal and low-emission energy projects. The expanded transport and storage capacity will facilitate greater adoption of CO₂ mitigation technologies, supporting Canada’s long-term emission reduction targets and stimulating market growth in carbon management solutions

- In June 2025, IHI and GE Vernova successfully completed large-scale combustion facilities designed to test 100% ammonia turbine firing by 2030. This milestone demonstrates the feasibility of using ammonia as a zero-carbon fuel in coal and gas-fired turbines, potentially transforming the energy and clean coal market. Adoption of ammonia firing technology could accelerate the decarbonization of power generation, drive demand for retrofitting existing plants, and create opportunities for integration with hydrogen and CCUS systems

- In May 2025, BKV Corporation and Copenhagen Infrastructure Partners launched a USD 500 million CCUS joint venture across multiple U.S. gas fields. The initiative is poised to strengthen the deployment of carbon capture and storage infrastructure in North America, supporting low-emission operations in both power generation and industrial sectors. By facilitating large-scale CO₂ capture and storage, the venture enhances market confidence in CCUS technologies and encourages further investment in clean coal and low-carbon energy solutions

- In March 2025, Diversified Energy, FuelCell Energy, and TESIAC established a platform targeting 360 MW of off-grid data center power using coal mine methane. This development highlights the potential for utilizing coal-derived methane for decentralized, low-emission power generation, providing an alternative energy source for energy-intensive applications. The initiative is expected to boost adoption of coal-to-energy technologies, reduce greenhouse gas emissions from coal operations, and support market growth in renewable-integrated clean coal solutions

- In January 2025, the U.S. Department of Energy allocated USD 100 million to pilot carbon-conversion technologies that transform captured CO₂ into value-added products. This funding is anticipated to accelerate research and commercialization of carbon utilization pathways, creating new revenue streams for clean coal and CCUS projects. By incentivizing innovative CO₂ conversion methods, the program supports market expansion, fosters technological advancements, and promotes sustainable deployment of carbon capture solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Clean Coal Technology Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Clean Coal Technology Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Clean Coal Technology Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.