Global Cleanroom Compatible Adhesive Transfer Market

Market Size in USD Million

CAGR :

%

USD

230.00 Million

USD

611.87 Million

2024

2032

USD

230.00 Million

USD

611.87 Million

2024

2032

| 2025 –2032 | |

| USD 230.00 Million | |

| USD 611.87 Million | |

|

|

|

|

Cleanroom-Compatible Adhesive Transfer Market Size

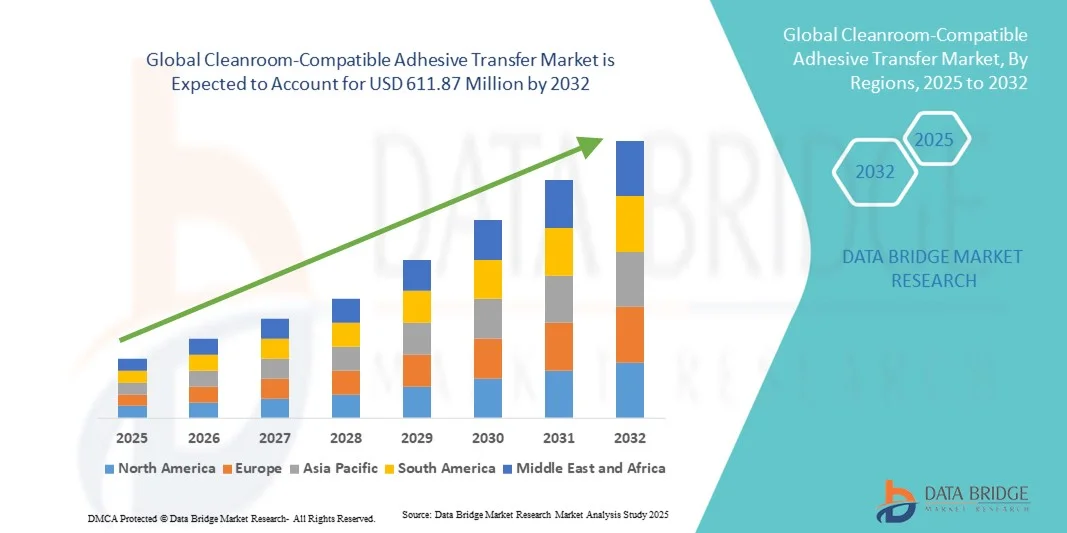

- The global cleanroom-compatible adhesive transfer market size was valued at USD 230 million in 2024 and is expected to reach USD 611.87 million by 2032, at a CAGR of 13.01% during the forecast period

- The market growth is largely fueled by the increasing adoption of cleanroom technologies across pharmaceutical, biotechnology, electronics, and semiconductor industries, leading to higher demand for contamination-free adhesive transfer solutions

- Furthermore, rising regulatory standards for contamination control, coupled with the need for precision assembly in sensitive manufacturing processes, are driving the uptake of cleanroom-compatible adhesive transfer products

Cleanroom-Compatible Adhesive Transfer Market Analysis

- Cleanroom-Compatible Adhesive Transfer solutions are increasingly vital components in modern manufacturing and laboratory settings due to their ability to provide contamination-free bonding, precision handling, and reliable performance in controlled environment

- The escalating demand for cleanroom-compatible adhesive transfer is primarily fueled by the growing adoption of advanced manufacturing processes, strict quality standards, and rising requirements in industries such as pharmaceuticals, electronics, and biotechnology

- North America dominated the cleanroom-compatible adhesive transfer market with the largest revenue share of 44.2% in 2024, characterized by well-established pharmaceutical and semiconductor industries, high adoption of advanced manufacturing technologies, and strong R&D investments. The U.S. experienced substantial growth in adoption due to stringent cleanroom regulations and increased use in biotech and electronics production.

- Asia-Pacific is expected to be the fastest-growing region in the cleanroom-compatible adhesive transfer market during the forecast period, driven by rapid industrialization, expanding pharmaceutical and electronics sectors, and increasing adoption of automation technologies in countries such as China, India, and Japan

- The Electronics & Semiconductors segment dominated the cleanroom-compatible adhesive transfer market with the largest market revenue share of 41.2% in 2024, owing to the increasing demand for miniaturized components, precision assembly, and contamination-free bonding in semiconductor fabrication and electronic devices

Report Scope and Cleanroom-Compatible Adhesive Transfer Market Segmentation

|

Attributes |

Cleanroom-Compatible Adhesive Transfer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cleanroom-Compatible Adhesive Transfer Market Trends

Growing Adoption in High-Precision Manufacturing and Contamination-Control Applications

- A significant trend in the global cleanroom-compatible adhesive transfer market is the increasing adoption of adhesive solutions in highly regulated, contamination-sensitive environments such as semiconductor fabrication, biotechnology, and pharmaceutical manufacturing. These adhesives are engineered to minimize particle generation and resist chemical degradation, ensuring reliable performance in controlled environments

- For instance, in June 2023, a leading adhesive manufacturer launched a low-outgassing, solvent-free adhesive specifically designed for semiconductor cleanrooms, enabling high-precision wafer assembly without compromising contamination standards

- There is also growing demand for temperature- and chemical-resistant adhesive films that can withstand repeated sterilization processes in pharmaceutical and medical device cleanrooms

- Manufacturers are increasingly developing pre-applied adhesive tapes and transfer systems that reduce handling, improve efficiency, and maintain consistent placement accuracy

- In addition, integration of automated dispensing systems with cleanroom-compatible adhesives is gaining traction, allowing for precise material application in high-volume production lines while reducing human contamination risk

- The shift toward miniaturization in electronics and medical devices is further driving the need for adhesives that can perform reliably at micro-scales under stringent cleanliness requirements

Cleanroom-Compatible Adhesive Transfer Market Dynamics

Driver

Rising Demand from Pharmaceutical, Semiconductor, and Electronics Industries

- The expanding pharmaceutical and biotechnology sectors, driven by increased global healthcare demand, are a key driver for cleanroom-compatible adhesives. These industries require adhesives that comply with ISO Class 1–5 cleanroom standards for assembly, packaging, and device bonding

- For instance, in September 2022, a major adhesive company introduced a high-performance medical-grade adhesive film used in assembling disposable diagnostic devices, addressing the need for sterile, low-particulate bonding solutions

- The growth of semiconductor fabrication globally, especially in Asia-Pacific, is fueling demand for adhesives that can withstand high temperatures, vacuum conditions, and chemical exposure while maintaining particle-free performance

- Adoption in electronics assembly, including flexible circuits, sensors, and wearable devices, is further driving market expansion, as these applications require high-precision, low-contamination bonding

- Regulatory compliance and quality assurance standards in pharmaceutical and semiconductor production are increasing adoption, as adhesives must meet stringent certifications such as USP Class VI, ISO 10993, or FDA compliance

- The overall trend toward automation in high-precision manufacturing is also supporting demand for adhesive transfer solutions that are compatible with robotic application systems

Restraint/Challenge

High Material Costs and Stringent Regulatory Requirements

- The relatively high cost of cleanroom-compatible adhesives compared to conventional adhesive products is a key restraint, particularly for small- and medium-scale manufacturers. Specialized formulations and rigorous quality control requirements contribute to elevated pricing

- For instance, in March 2023, a report highlighted that the price of fluoropolymer-based cleanroom adhesives was up to 2–3 times higher than standard industrial adhesives, limiting adoption in cost-sensitive projects

- Stringent regulatory and compliance standards can also pose challenges, as adhesives must meet multiple certifications for medical, pharmaceutical, or semiconductor applications, which can slow product development and increase production lead times

- In addition, limited availability of highly specialized adhesives in emerging markets can restrict adoption in growing manufacturing hubs, requiring companies to invest in local distribution or production capabilities

- Environmental and sustainability concerns, including the need for low VOC content and solvent-free formulations, further add to formulation complexity and cost

- Overcoming these challenges requires innovation in cost-effective formulations, efficient production techniques, and partnerships with local distributors to improve market accessibility

Cleanroom-Compatible Adhesive Transfer Market Scope

The market is segmented on the basis of type, application, and end-user.

- By Type

On the basis of type, the cleanroom-compatible adhesive transfer market is segmented into acrylic, silicone, rubber-based, epoxy, and others. The acrylic segment dominated the largest market revenue share of 38.7% in 2024, due to its excellent adhesion properties, chemical resistance, and versatility in electronics, pharmaceuticals, and medical device applications. Acrylic adhesives are preferred for cleanroom environments because they ensure high-quality, contamination-free bonding and are compatible with multiple substrates. Their ease of handling, consistent performance, and reliability in high-volume manufacturing processes further reinforce their dominance. Strong adoption in semiconductor fabrication, medical devices, and pharmaceutical packaging contributes to the leading market share. Furthermore, ongoing R&D to improve curing speed, strength, and temperature resistance supports sustained demand. The segment benefits from wide availability, competitive pricing, and trusted performance, making Acrylic the standard choice for cleanroom adhesive applications globally.

The Silicone segment is expected to witness the fastest CAGR of 13.5% from 2025 to 2032, driven by its high-temperature resistance, flexibility, and biocompatibility. Silicone adhesives are increasingly used in aerospace, medical devices, and electronics, where thermal stability, flexibility, and durability are critical. Rising adoption in advanced manufacturing, growing investments in cleanroom-compatible bonding solutions, and emphasis on high-precision assembly accelerate market growth. The expanding healthcare and semiconductor sectors are fueling demand for silicone adhesives that meet stringent performance and contamination standards. Additionally, technological developments enhancing adhesive strength and process efficiency make silicone a preferred choice for specialized applications. Increasing awareness of the advantages of silicone adhesives over traditional options in critical industries also contributes to its rapid growth trajectory.

- By Application

On the basis of application, the cleanroom-compatible adhesive transfer market is segmented into electronics & semiconductors, medical devices, pharmaceuticals, aerospace & defense, automotive, and others. The electronics & semiconductors segment accounted for the largest market revenue share of 41.2% in 2024, owing to the increasing demand for miniaturized components, precision assembly, and contamination-free bonding in semiconductor fabrication and electronic devices. Cleanroom-compatible adhesives are essential in manufacturing chips, sensors, and IoT components where high-precision bonding is critical. The segment benefits from extensive automation in electronics production, growing demand for high-performance devices, and strict contamination control requirements. Ongoing developments in 5G, AI, and smart devices further strengthen its dominance. The preference for adhesives that provide strong, reliable bonds in sensitive electronic applications ensures sustained market leadership. The adoption of Acrylic adhesives in electronics contributes significantly to the revenue share.

The medical devices segment is expected to witness the fastest CAGR of 12.9% from 2025 to 2032, driven by the need for biocompatible, sterilizable adhesives suitable for cleanroom environments. Adhesives are critical in assembling diagnostic equipment, surgical instruments, and implantable devices. Expanding healthcare infrastructure, stringent regulatory requirements, and rising research in medical technology accelerate growth. Increasing adoption of silicone and epoxy adhesives in device manufacturing further fuels market expansion. Growing investment in hospitals, laboratories, and pharmaceutical manufacturing facilities supports the increasing demand. Rising awareness regarding quality and contamination-free assembly in medical devices is a major driver. The segment also benefits from advancements in adhesive formulations that improve durability and performance under sterilization conditions.

- By End-User

On the basis of end-user, the cleanroom-compatible adhesive transfer market is segmented into hospitals, laboratories, manufacturing units, research centers, semiconductor facilities, and others. The Semiconductor Facilities segment dominated the largest market revenue share of 39.6% in 2024, due to high demand for precision bonding, contamination-free operations, and the proliferation of semiconductor manufacturing in North America, Europe, and Asia-Pacific. Adhesives are critical in cleanroom assembly of chips, sensors, and microelectronic components. Extensive cleanroom infrastructure, automation, and high-precision bonding requirements contribute to the dominance. Strong adoption of Acrylic adhesives, coupled with the increasing number of fabrication plants and semiconductor expansion projects, reinforces market leadership. The segment’s need for thermal and chemical resistance in adhesives ensures sustained growth.

The Laboratories segment is expected to witness the fastest CAGR of 13.2% from 2025 to 2032, driven by growth in biotechnology, pharmaceutical research, and chemical laboratories. Adhesives compatible with cleanroom protocols are increasingly essential for sterile processes, experimental setups, and precision equipment assembly. Rising investments in research infrastructure, government funding for scientific projects, and the expansion of laboratory facilities in emerging economies support growth. Increasing demand for contamination-free processes, adoption of silicone and epoxy adhesives, and the emphasis on consistent performance accelerate market adoption. Rising awareness regarding efficient cleanroom-compatible bonding in research operations contributes to the rapid CAGR.

Cleanroom-Compatible Adhesive Transfer Market Regional Analysis

- North America dominated the cleanroom-compatible adhesive transfer market with the largest revenue share of 44.2% in 2024, driven by the increasing adoption of advanced manufacturing techniques, stringent contamination-control standards, and the presence of key global adhesive manufacturers

- High demand is observed across electronics & semiconductor, pharmaceutical, and medical device industries, where low-contamination adhesive transfer solutions are critical

- This widespread adoption is further supported by a well-established industrial infrastructure, regulatory compliance requirements, and the availability of specialized adhesive types such as acrylic, silicone, and epoxy, catering to diverse cleanroom applications

U.S. Cleanroom-Compatible Adhesive Transfer Market Insight

The U.S. cleanroom-compatible adhesive transfer market captured the largest revenue share in 2024 within North America, fueled by the rapid growth of semiconductor facilities, medical device manufacturing, and pharmaceutical production units. Manufacturers and research centers increasingly prefer adhesives that meet strict ISO cleanroom standards and provide reliable bonding without particle contamination. The presence of multiple adhesive types (acrylic, silicone, rubber-based) allows flexibility for different applications such as electronics assembly, laboratory processes, and pharmaceutical packaging, supporting continued market expansion.

Europe Cleanroom-Compatible Adhesive Transfer Market Insight

The Europe cleanroom-compatible adhesive transfer market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory standards, rising adoption in medical devices, and the growing semiconductor industry. Applications across aerospace & defense, automotive, and pharmaceutical sectors are increasing demand for contamination-free adhesives. Additionally, manufacturers are focusing on multi-type adhesive solutions (epoxy, silicone, acrylic) to meet diverse end-user requirements in hospitals, laboratories, and manufacturing units.

U.K. Cleanroom-Compatible Adhesive Transfer Market Insight

The U.K. cleanroom-compatible adhesive transfer market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the expansion of pharmaceutical and electronics manufacturing sectors. Research centers and laboratories require high-performance adhesive transfer solutions that ensure low particle generation and chemical stability. Adoption of silicone- and acrylic-based adhesives across hospitals, semiconductor facilities, and medical device production units is driving the market growth.

Germany Cleanroom-Compatible Adhesive Transfer Market Insight

The Germany cleanroom-compatible adhesive transfer market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of contamination control and precision manufacturing requirements. Adoption is increasing across automotive, aerospace, and electronics industries, with epoxy and rubber-based adhesives being favored for high-temperature and chemical-resistant applications. Strong research and industrial infrastructure, combined with strict environmental and quality regulations, further support market growth across laboratories, hospitals, and manufacturing units.

Asia-Pacific Cleanroom-Compatible Adhesive Transfer Market Insight

The Asia-Pacific cleanroom-compatible adhesive transfer market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, expanding semiconductor manufacturing, and increasing pharmaceutical and medical device production in countries such as China, Japan, and India. The region’s growing adoption of cleanroom standards, along with a wide range of adhesive types (acrylic, silicone, epoxy, rubber-based), is enabling applications across electronics, aerospace, and healthcare sectors. The emergence of APAC as a manufacturing hub for adhesive transfer systems is enhancing affordability and accessibility for hospitals, laboratories, and production facilities.

Japan Cleanroom-Compatible Adhesive Transfer Market Insight

The Japan cleanroom-compatible adhesive transfer market is gaining momentum due to the country’s high-tech manufacturing culture and strict contamination-control regulations. Electronics, semiconductor, and pharmaceutical industries are driving demand for multi-type adhesive solutions, particularly silicone- and epoxy-based adhesives. Hospitals, research centers, and semiconductor facilities are increasingly utilizing these adhesives to maintain cleanroom standards while supporting precision assembly processes.

China Cleanroom-Compatible Adhesive Transfer Market Insight

The China cleanroom-compatible adhesive transfer market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the expanding middle class, rapid industrialization, and high adoption of cleanroom manufacturing practices. Applications in electronics & semiconductors, pharmaceuticals, and medical devices are growing rapidly. The availability of diverse adhesive types (acrylic, silicone, rubber-based, epoxy) and strong domestic manufacturing capabilities are key factors propelling market growth, enabling usage across hospitals, laboratories, research centers, and manufacturing units.

Cleanroom-Compatible Adhesive Transfer Market Share

The cleanroom-compatible adhesive transfer industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Lohmann (Germany)

- CHEMENCE (U.S.)

- UltraTape (U.S.)

- CleanMark Group Inc. (U.S.)

- Valutek Inc. (U.S.)

- The Tape Lab Inc. (U.S.)

- Bristol Tape Corporation (U.S.)

- PLITEK (U.S.)

- Blue Thunder Technologies, Inc. (U.S.)

- Tesa SE (Germany)

- Berry Global (U.S.)

- MacTac (U.S.)

- Flexcon Company, Inc. (U.S.)

- Adhesives Applications, Inc. (U.S.)

Latest Developments in Global Cleanroom-Compatible Adhesive Transfer Market

- In July 2021, UltraTape, a division of Delphon and a leading global supplier of cleanroom tape and label products, announced the launch of its new 1161 premium-grade Electrical Tape. This all-weather vinyl insulating tape features an aggressive pressure-sensitive rubber-based adhesive, providing moisture-tight electrical and mechanical protection with minimal bulk

- In March 2025, Lintec, a global manufacturer of specialty adhesives, developed a hot-melt adhesive that can be applied even in low-temperature environments as cold as -5°C. This adhesive allows labels to be repeatedly removed and reapplied, making it suitable for a wide range of applications, including food, daily necessities, and industrial goods

- In September 2025, GCS, a company specializing in cleanroom infrastructure, launched an advanced automated cleanroom panel manufacturing line in the United States. This new line expands GCS's U.S. manufacturing capability for custom panels and cleanroom doors, established in 2024. With this launch, GCS has the capacity to produce over 2 million square feet of cleanroom paneling annually, supporting accelerated project timelines and precision manufacturing across the pharmaceutical, biotechnology, semiconductor, and advanced manufacturing industries

- In September 2025, ATP Adhesives announced plans to establish its first U.S. solvent-free adhesive manufacturing facility in Columbia, South Carolina. The company is investing USD70 million in the project and creating 130 new jobs. This facility will focus on developing and producing solvent-free adhesive technologies, aligning with the growing demand for environmentally friendly and low-emission adhesives in cleanroom applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.