Global Cleanroom Led Lighting Market

Market Size in USD Million

CAGR :

%

USD

829.84 Million

USD

1,363.10 Million

2024

2032

USD

829.84 Million

USD

1,363.10 Million

2024

2032

| 2025 –2032 | |

| USD 829.84 Million | |

| USD 1,363.10 Million | |

|

|

|

|

Cleanroom LED Lighting Market Size

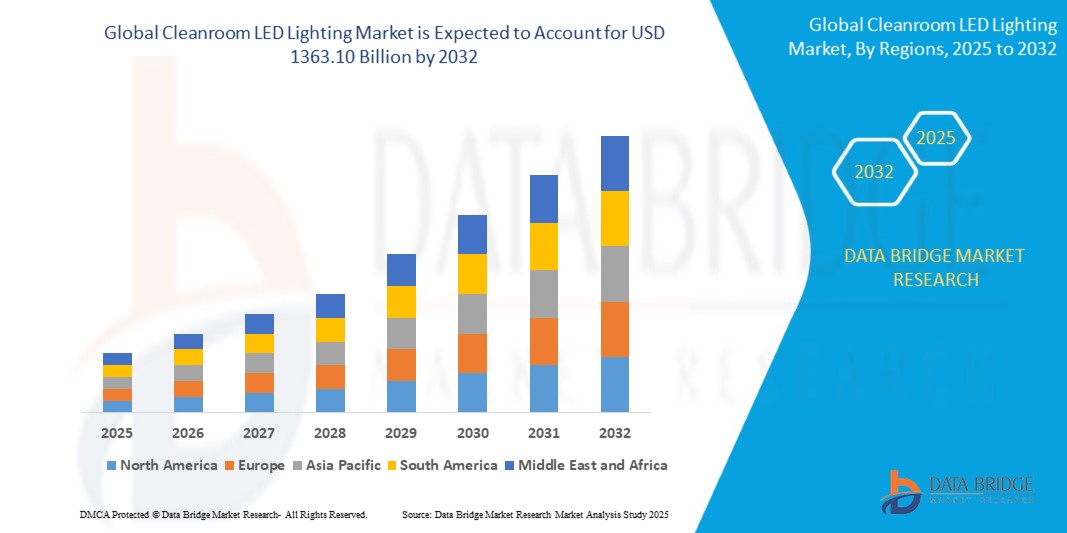

- The global cleanroom LED lighting market size was valued at USD 829.84 million in 2024 and is expected to reach USD 1363.10 million by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely fueled by the increasing demand for contamination-controlled environments across pharmaceuticals, biotechnology, electronics, and semiconductor industries, driving the adoption of specialized cleanroom LED lighting solutions that meet stringent ISO and GMP standards

- Furthermore, rising emphasis on energy efficiency, reduced operational costs, and advanced illumination technologies such as glare-free optics, high CRI, and smart control systems is accelerating the replacement of conventional lighting with LED systems, thereby significantly boosting the industry’s growth

Cleanroom LED Lighting Market Analysis

- Cleanroom LED lighting refers to specialized luminaires designed to maintain strict cleanliness, low particle emission, and precise illumination in controlled environments such as pharmaceutical plants, semiconductor fabs, hospitals, and research labs. These fixtures are engineered for easy cleaning, high ingress protection, and compliance with international cleanroom classifications

- The escalating demand for cleanroom LED lighting is primarily fueled by the rapid expansion of contamination-sensitive manufacturing sectors, stricter regulatory compliance requirements, and the growing preference for sustainable, low-maintenance, and long-lasting lighting solutions in industries where precision and hygiene are critical

- Asia-Pacific dominated the cleanroom LED lighting market with a share of 32.5% in 2024, due to the rapid expansion of pharmaceutical, biotechnology, and semiconductor manufacturing facilities across the region

- North America is expected to be the fastest growing region in the cleanroom LED lighting market during the forecast period due to expanding semiconductor fabs, pharmaceutical manufacturing, and medical device production

- Surface mounted segment dominated the market with a market share of 50.5% in 2024, due to its versatility in installation and ability to be retrofitted into existing facilities without extensive structural changes. Surface mounted LEDs are particularly in demand for upgrading older cleanrooms, offering enhanced illumination while meeting hygiene and contamination control standards. They also provide easy access for maintenance and replacement, which is a critical advantage in high-usage cleanroom environments. Their lower initial installation costs compared to recessed systems make them attractive for cost-conscious projects in emerging economies

Report Scope and Cleanroom LED Lighting Market Segmentation

|

Attributes |

Cleanroom LED Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Cleanroom LED Lighting Market Trends

Increasing Integration of IoT-Enabled Cleanroom Lighting

- Cleanroom LED lighting systems are increasingly adopting IoT-enabled technologies and advanced digital controls, which allow precise adjustment of illumination, automatic monitoring, and integration with building automation platforms, improving compliance and operational efficiency for regulated industries such as pharmaceuticals, biotechnology, and semiconductor manufacturing

- For instance, leading suppliers including Signify, Kenall Manufacturing, and Wipro Lighting are offering smart LED solutions featuring occupancy sensors, real-time energy use analytics, and predictive maintenance alerts that help facilities achieve strict ISO 14644 and GMP requirements by maintaining high levels of cleanliness and reducing manual intervention

- Energy-efficient LED fixtures are rapidly replacing traditional fluorescent lighting in cleanrooms due to benefits such as reduced heat emission, longer lifespan, flicker-free operation, and sealed designs that minimize particulate release and limit electromagnetic interference, supporting contamination control

- LED smart lighting systems with features such as daylight harvesting, instant dimming, and remote diagnostics enable facility managers to optimize illumination intensity, conserve energy, and extend fixture lifecycles in high-precision cleanroom environments

- The increased use of sealed panel and modular troffer luminaires facilitates uniform coverage, minimizes ledges that trap dust, and supports lean manufacturing by shortening maintenance cycles and simplifying upgrades

- IoT integration with cleanroom LED lighting aligns with Industry 4.0 initiatives, supporting centralized data collection, compliance auditing, and resource optimization, driving greater adoption in expanding pharmaceutical, healthcare, and electronics sectors globally

Cleanroom LED Lighting Market Dynamics

Driver

Energy Efficiency Regulations

- Strict energy efficiency standards and sustainability mandates from governments and industry bodies are accelerating the replacement of conventional fluorescent fixtures with LED-based cleanroom lighting, which provides measurable reductions in power consumption, maintenance costs, and carbon footprint

- For instance, regulatory frameworks such as the EU EcoDesign ban on inefficient lighting technologies and increased enforcement of standards by bodies such as the FDA and ISO are compelling manufacturers, laboratories, and healthcare facilities to upgrade to smart LED luminaires capable of meeting modern energy and sterility benchmarks

- The transition to LED enables seamless compliance with ISO cleanliness classifications and hazardous-location requirements, as fixtures can be engineered for dust-proof, waterproof, and continuous-operation capabilities essential to contamination-sensitive environments

- LED adoption aligns with broader market shifts toward environmental stewardship, building owners and managers pursue green certifications and corporate sustainability targets, further boosting cleanroom LED lighting demand

- Ongoing advancements in smart lighting controls make it easier for operators to meet energy audits and optimize consumption dynamically, contributing to regulatory compliance and improved operational economics

Restraint/Challenge

High Initial Costs

- The upfront costs of purchasing and installing certified cleanroom LED fixtures, especially models with advanced IoT functionality and sealed architecture, present a significant financial barrier for small and midsize enterprises or facilities upgrading legacy systems

- For instance, the need for specialized design, third-party certification for ISO/ATEX standards, and skilled installers drives installation and validation expenses higher than those seen with conventional lighting solutions

- Price volatility for LED components and raw materials, including semiconductors and specialty polymers, increases procurement risk and reduces pricing flexibility for manufacturers and end-users

- The return on investment for cleanroom LED conversions is often affected by variable installation costs, slow procurement cycles, and the need for regular recalibration or system updates

- Limited access to skilled technicians for detailed installation and long-term maintenance, particularly in emerging markets, adds further operational challenges, sometimes impacting compliance readiness and facility expansion plans for growing industries

Cleanroom LED Lighting Market Scope

The market is segmented on the basis of mounting type and end-user industry.

• By Mounting Type

On the basis of mounting type, the cleanroom LED lighting market is segmented into recessed and surface mounted. The surface mounted segment dominated the largest market revenue share of 50.5% in 2024, driven by its versatility in installation and ability to be retrofitted into existing facilities without extensive structural changes. Surface mounted LEDs are particularly in demand for upgrading older cleanrooms, offering enhanced illumination while meeting hygiene and contamination control standards. They also provide easy access for maintenance and replacement, which is a critical advantage in high-usage cleanroom environments. Their lower initial installation costs compared to recessed systems make them attractive for cost-conscious projects in emerging economies.

The recessed segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by its ability to provide a flush, seamless integration into ceilings and walls, which minimizes dust accumulation and supports stringent contamination control standards. Recessed fixtures are favored in critical cleanroom environments as they reduce air turbulence and maintain laminar airflow patterns essential for particle-free conditions. Their aesthetic appeal, energy efficiency, and compatibility with modular cleanroom designs also add to their widespread adoption. In industries such as pharmaceuticals and biotechnology, recessed LED lighting ensures compliance with GMP and ISO Class cleanroom requirements, making it the default choice for high-grade facilities.

• By End-user Industry

On the basis of end-user industry, the cleanroom LED lighting market is segmented into healthcare and life sciences, electronics and semiconductor, and food and beverage. The healthcare and life sciences segment held the largest market revenue share in 2024, driven by the growing number of pharmaceutical manufacturing facilities, biotechnology labs, and hospital cleanrooms that require highly controlled environments. LED lighting in this sector supports infection prevention, provides high color rendering for medical procedures, and complies with international cleanroom standards. Increased demand for sterile production in vaccine manufacturing and biopharmaceutical development has further boosted the adoption of LED lighting solutions in this segment.

The electronics and semiconductor segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising production of microchips, sensors, and advanced electronic components that require dust- and static-free manufacturing conditions. Cleanroom LED lighting in this sector ensures precision illumination without heat emission that could disrupt delicate processes. The ongoing miniaturization of electronic devices and growth of semiconductor fabrication plants, particularly in Asia-Pacific, is driving higher investments in contamination-controlled lighting solutions. Meanwhile, the food and beverage segment is also showing steady growth, supported by stricter hygiene regulations, demand for contamination-free production, and the shift toward LED lighting for its energy efficiency and long lifespan, which reduce operational downtime in food processing facilities.

Cleanroom LED Lighting Market Regional Analysis

- Asia-Pacific dominated the cleanroom LED lighting market with the largest revenue share of 32.5% in 2024, driven by the rapid expansion of pharmaceutical, biotechnology, and semiconductor manufacturing facilities across the region

- Increasing government investments in healthcare infrastructure, coupled with strict regulatory compliance for contamination control, are accelerating the adoption of specialized cleanroom lighting systems

- The region’s strong manufacturing base, cost-efficient production capabilities, and rising demand for energy-efficient, low-maintenance lighting are fueling market growth across multiple cleanroom applications

China Cleanroom LED Lighting Market Insight

China held the largest share in the Asia-Pacific cleanroom LED lighting market in 2024, supported by its dominance in global electronics and semiconductor manufacturing, along with large-scale pharmaceutical production facilities. Growing emphasis on ISO-certified cleanroom environments is driving substantial investments in advanced LED lighting solutions. The expansion of vaccine production, biopharmaceutical research, and high-tech electronics plants is increasing the need for high-lumen, low-contamination lighting systems. With a robust domestic supply chain and competitive manufacturing costs, China is a global hub for both standard and customized cleanroom lighting. Integration of smart control systems, motion sensors, and energy-optimization technologies is further enhancing China’s market leadership.

India Cleanroom LED Lighting Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing domestic pharmaceutical manufacturing under the “Pharma Vision 2020” and “Make in India” initiatives. Rising investments in electronics manufacturing clusters and biotechnology parks are creating significant demand for cleanroom-compliant lighting. Government incentives for domestic production, coupled with stricter hygiene and quality standards, are pushing industries to upgrade to LED-based cleanroom lighting. Expansion of vaccine plants, diagnostic labs, and semiconductor facilities is accelerating adoption. Improved accessibility to high-quality lighting solutions through both local suppliers and international collaborations is driving rapid market penetration in Tier 1 and Tier 2 cities.

Europe Cleanroom LED Lighting Market Insight

Europe is a key contributor to the cleanroom LED lighting market, driven by advanced healthcare systems, stringent contamination control regulations, and a strong focus on energy efficiency. The region is home to leading manufacturers offering high-specification, GMP-compliant lighting solutions tailored for pharmaceuticals, food processing, and microelectronics. Countries such as Germany, France, and the U.K. have well-established cleanroom infrastructure supported by continuous modernization initiatives. The increasing adoption of smart lighting with tunable color temperature, dimming controls, and integration into building management systems is shaping the market. Sustainability is also a growing priority, with manufacturers introducing eco-friendly and recyclable lighting components.

Germany Cleanroom LED Lighting Market Insight

Germany’s cleanroom LED lighting market is driven by its strong engineering base, advanced healthcare infrastructure, and leadership in semiconductor and precision manufacturing. High compliance with EU cleanroom standards and investment in R&D are encouraging adoption of innovative lighting solutions with optimized glare control, low particle emission, and high IP ratings. Pharmaceutical majors, biotech firms, and microchip producers are upgrading to advanced lighting systems to ensure process reliability and regulatory compliance. Germany’s emphasis on automation and Industry 4.0 integration is also boosting demand for smart, networked lighting solutions.

U.K. Cleanroom LED Lighting Market Insight

The U.K. market benefits from a strong life sciences sector, expanding biopharmaceutical manufacturing, and high levels of hospital modernization. Post-Brexit industrial strategy is encouraging localized manufacturing of cleanroom equipment, including LED lighting systems. NHS-led investments in sterile facilities, coupled with the growth of food safety and electronics testing labs, are expanding demand. Increasing focus on energy-efficient, low-maintenance lighting that aligns with environmental goals is driving adoption. The market is also seeing interest in customizable designs that combine high lumen output with minimal glare for sensitive operations.

North America Cleanroom LED Lighting Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by expanding semiconductor fabs, pharmaceutical manufacturing, and medical device production. The region benefits from advanced cleanroom construction standards, high spending on R&D, and a strong presence of industry-leading lighting manufacturers. Rising adoption of IoT-enabled and human-centric lighting systems in cleanrooms is shaping market growth. Regulatory bodies such as the FDA and ISO are reinforcing strict compliance requirements, boosting the replacement of conventional lighting with LED alternatives. Sustainability initiatives and demand for operational cost reduction are further strengthening the transition toward cleanroom LED solutions.

U.S. Cleanroom LED Lighting Market Insight

The U.S. accounted for the largest share in the North America cleanroom LED lighting market in 2024, supported by its extensive network of pharmaceutical, biotech, and semiconductor facilities. Strong federal and state investments in healthcare infrastructure, along with the CHIPS Act promoting semiconductor manufacturing, are creating significant opportunities. Manufacturers are introducing advanced features such as anti-microbial coatings, glare-free optics, and adjustable color temperatures to meet diverse cleanroom requirements. The integration of lighting with building automation and environmental monitoring systems is gaining traction, enabling enhanced operational efficiency. With its strong focus on quality, energy efficiency, and innovation, the U.S. remains a key global leader in cleanroom LED lighting adoption.

Cleanroom LED Lighting Market Share

The cleanroom LED lighting industry is primarily led by well-established companies, including:

- Signify Holding (Netherlands)

- Wipro Lighting (India)

- Crompton Greaves Consumer Electricals Limited (India)

- Eaton (Ireland)

- LUG. S.A. (Poland)

- Terra Universal. Inc. (U.S.)

- Solite Europe (U.K.)

- Paramount Industries (U.S.)

- Kenall Manufacturing (U.S.)

- Fagerhults Belysning AB (Sweden)

Latest Developments in Global Cleanroom LED Lighting Market

- In February 2025, Jansen Cleanrooms & Labs introduced a new line of cleanroom construction products, including advanced lighting systems alongside interlock systems, hinged doors, wall panels, and pass boxes. This expansion strengthens the company’s position in the cleanroom infrastructure market by offering an integrated product portfolio aimed at maintaining contamination-free environments for critical operations. The inclusion of cleanroom-specific lighting enhances its competitiveness, catering to pharmaceutical, biotechnology, and semiconductor clients seeking turnkey solutions that meet stringent regulatory standards

- In August 2024, Total Clean Air launched Modulab, a modular cleanroom solution constructed from robust aircraft-grade structural aluminum. Designed for durability, energy efficiency, and a reduced carbon footprint, Modulab offers full customization and supports rapid setup and modifications. The integration of specialized cleanroom lighting within these modular systems expands Total Clean Air’s appeal across multiple sectors, including pharmaceuticals, medical devices, electronics, and aerospace. By combining sustainability with flexibility, the company is well-positioned to capture demand from industries prioritizing both environmental goals and high-performance contamination control

- In November 2023, Kenall Manufacturing unveiled the CSSGI series, a low-profile plenum troffer engineered for cleanrooms and controlled environments such as food processing plants, pharmacies, pharmaceutical manufacturing units, and research facilities. Compatible with ISO Class 3 to 9 and BSL 1 to 4 standards, this cost-effective luminaire strengthens Kenall’s presence in the cleanroom LED lighting segment. The launch expands the company’s SimpleSeal line of sealed enclosure lighting, reinforcing its reputation for IP-rated, contamination-resistant fixtures that meet the demanding requirements of sterile environments while maintaining high energy efficiency

- In December 2022, Current, a U.S.-based energy company, expanded its product portfolio with the Lifeshield brand, offering specialized lighting solutions for healthcare, behavioral health, vandal-resistant, and cleanroom applications. Incorporating high-efficacy 90CRI R90 TriGain technology and SpectraSync color tuning, these lighting solutions deliver enhanced color performance and adaptability to diverse operational needs. This move positioned Current to tap into the growing demand for high-performance, color-accurate lighting in cleanrooms and other sensitive environments, boosting its competitiveness in the professional lighting market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cleanroom Led Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cleanroom Led Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cleanroom Led Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.