Global Cleanroom Molded Pulp Packaging Trays Market

Market Size in USD Million

CAGR :

%

USD

160.00 Million

USD

420.25 Million

2024

2032

USD

160.00 Million

USD

420.25 Million

2024

2032

| 2025 –2032 | |

| USD 160.00 Million | |

| USD 420.25 Million | |

|

|

|

|

Cleanroom Molded Pulp Packaging Trays Market Size

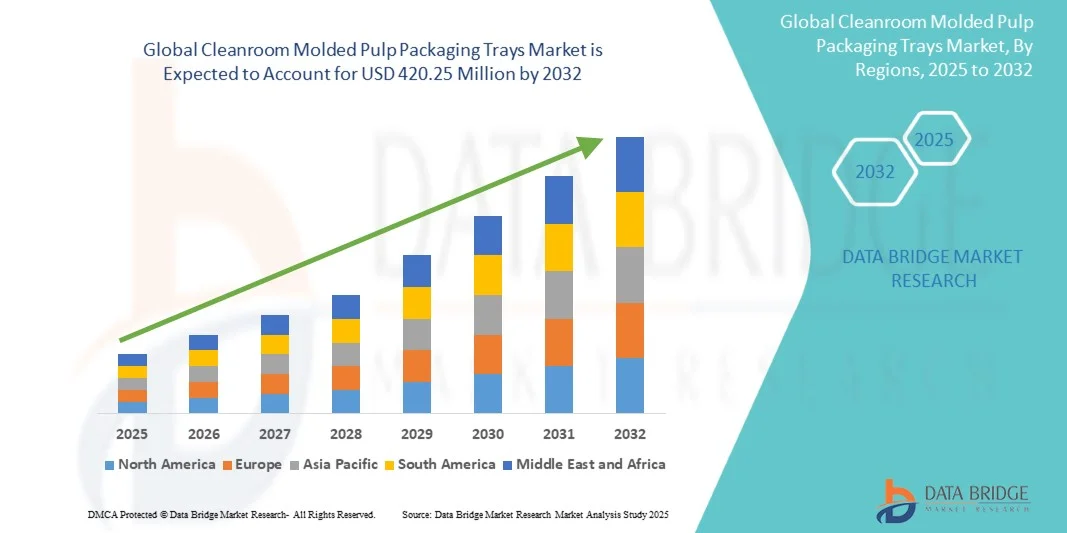

- The global cleanroom molded pulp packaging trays market size was valued at USD 160.00 million in 2024 and is expected to reach USD 420.25 million by 2032, at a CAGR of 12.83% during the forecast period

- The market expansion is driven by the increasing demand for sustainable, biodegradable, and contamination-free packaging solutions in cleanroom environments, particularly across semiconductor, medical device, and pharmaceutical manufacturing sectors

- In addition, the growing emphasis on eco-friendly alternatives to plastic packaging, coupled with stringent cleanroom compliance requirements and the rise in precision manufacturing, is accelerating the adoption of molded pulp trays globally positioning them as a preferred solution for clean, safe, and sustainable packaging applications

Cleanroom Molded Pulp Packaging Trays Market Analysis

- Cleanroom molded pulp packaging trays, designed to provide eco-friendly, particle-free, and contamination-controlled protection, are increasingly being adopted in semiconductor, pharmaceutical, biotechnology, and medical device industries for the safe handling of sensitive components and sterile products

- The rising demand for sustainable and biodegradable packaging materials, along with regulatory pressures to reduce plastic waste, is driving the rapid transition toward molded pulp trays in cleanroom environments

- North America dominated the cleanroom molded pulp packaging trays market with the largest revenue share of 39.2% in 2024, supported by strong pharmaceutical and semiconductor manufacturing bases, stringent packaging standards, and the growing preference for environmentally compliant packaging solutions

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, registering the highest CAGR, driven by the expansion of cleanroom manufacturing facilities in China, Japan, and South Korea, and the increasing emphasis on sustainable industrial packaging

- The thermoformed pulp segment accounted for the largest market share of 42% in 2024, attributed to its smooth surface finish, precise dimensions, and suitability for high-purity cleanroom applications, making it the preferred choice for contamination-sensitive industries

Report Scope and Cleanroom Molded Pulp Packaging Trays Market Segmentation

|

Attributes |

Cleanroom Molded Pulp Packaging Trays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cleanroom Molded Pulp Packaging Trays Market Trends

“Rising Adoption of Sustainable and Eco-Friendly Packaging Solutions”

- A key and accelerating trend in the global cleanroom molded pulp packaging trays market is the growing shift from plastic-based trays to biodegradable, recycled, and compostable pulp solutions, driven by environmental regulations and corporate sustainability goals

- For instance, BioPak Cleanroom Trays are manufactured from 100% recycled fiber, offering a fully biodegradable alternative while meeting ISO Class 7–8 cleanliness standards

- Advancements in molding technology allow trays to achieve high-precision geometries, low particle shedding, and moisture resistance, making them suitable for sensitive semiconductor, pharmaceutical, and medical device applications

- The integration of sterilizable and barrier-treated surfaces in molded pulp trays is enhancing their versatility, allowing use in both sterile and non-sterile cleanroom operations without compromising product integrity

- This trend towards environmentally responsible yet high-performance trays is reshaping procurement priorities, with manufacturers increasingly preferring suppliers that combine cleanroom compliance with sustainable materials

- The demand for trays that are customizable, contamination-controlled, and eco-friendly is growing rapidly across semiconductor, pharmaceutical, and biotech sectors, where regulatory compliance and sustainability are equally critical

Cleanroom Molded Pulp Packaging Trays Market Dynamics

Driver

“Increasing Need for Contamination-Free and Regulatory-Compliant Packaging”

- The rising focus on product safety, sterility, and cleanroom compliance is a major driver for the adoption of molded pulp trays in sensitive manufacturing environments

- For instance, Tekni-Plex Cleanroom Packaging launched ISO Class 5 compliant pulp trays for pharmaceutical components, enhancing sterile handling while reducing plastic waste

- Manufacturers are prioritizing low-particle, moisture-resistant, and sterilizable tray solutions to minimize contamination risks in semiconductor wafers, medical devices, and biotech products

- Furthermore, strict regulations on pharmaceutical and medical device packaging are enforcing the use of validated, biocompatible, and traceable packaging materials, supporting market growth

- The convenience of customized tray designs with precise fit for components, stackability, and protective features is propelling adoption in high-value cleanroom manufacturing operations

- Rising awareness about the environmental impact of traditional plastic trays is further driving the transition toward sustainable molded pulp solutions, complementing cleanroom compliance requirements

Restraint/Challenge

“High Production Costs and Material Limitations”

- The relatively higher cost of manufacturing cleanroom-compliant molded pulp trays compared to conventional plastic trays poses a significant market challenge

- For instance, premium thermoformed or coated molded pulp trays with sterilization compatibility cost 20–30% more than standard plastic trays for equivalent volume

- Limitations in mechanical strength, moisture resistance, and customization compared to rigid plastic or polymer alternatives can restrict tray applicability in some high-precision cleanroom operations

- Meeting stringent ISO Class 3–5 standards requires sophisticated molding, surface treatment, and quality validation, which can increase production complexity and cost

- While ongoing innovations are improving durability and cleanroom compatibility, the perceived higher investment for molded pulp trays can slow adoption among price-sensitive manufacturers

- Overcoming these challenges through process optimization, coating technologies, and scalable production methods will be crucial for broader market penetration

Cleanroom Molded Pulp Packaging Trays Market Scope

The market is segmented on the basis of product type, fiber type, modality technology, and end-use industry.

- By Product Type

On the basis of product type, the market is segmented into standard trays, nested trays, assembly trays, conductive trays, sterilizable trays, and custom trays. Standard Trays dominated the market with the largest revenue share in 2024 due to their widespread adoption across pharmaceutical, medical device, and general cleanroom applications. These trays provide a cost-effective solution for the transport and storage of components while ensuring low particulate contamination. Manufacturers prefer standard trays for their ease of stacking, compatibility with automated handling systems, and consistent quality. Standard trays also offer flexibility in accommodating a wide range of component sizes without requiring custom tooling. Their proven track record in cleanroom environments and compliance with ISO Class 6–8 standards further reinforce their market dominance. In addition, their availability from multiple suppliers ensures reliable sourcing for large-scale operations, making them the preferred choice for many OEMs and CMOs.

Custom Trays are expected to witness the fastest growth from 2025 to 2032, driven by the increasing need for precision packaging in semiconductor, electronics, and high-value medical components. Custom trays allow for component-specific pocketing, improved protection, and contamination control, which are critical for sensitive parts. The growth of high-tech manufacturing and biotech industries fuels the demand for tailored tray solutions that meet exact dimensional and cleanroom requirements. Customization also supports ESD protection, sterilization compatibility, and specialized coatings, enhancing functionality in advanced cleanroom environments. As manufacturers increasingly seek optimized packaging for automation and robotic handling, custom trays are gaining traction. Their adoption is further accelerated by OEM partnerships and co-development initiatives with cleanroom packaging suppliers.

- By Fiber Type

On the basis of fiber type, the market is segmented into recycled fiber, virgin fiber, blended fiber, barrier-treated pulp, and surface-treated pulp. Virgin Fiber dominated the market with the largest revenue share in 2024, primarily because of its high purity, low particulate shedding, and superior mechanical strength. Cleanroom operations, particularly in pharmaceutical and semiconductor industries, prefer virgin fiber for its consistent quality and sterilization compatibility. Virgin fiber trays also provide better surface finish and dimensional stability, which are critical in high-precision cleanrooms. Manufacturers value virgin fiber for its lower extractables and reduced risk of contamination, aligning with strict ISO and GMP standards. The material is widely available in industrial-grade formulations that meet ISO Class 5–7 cleanliness requirements. Its reliability and compliance with regulatory standards ensure continued dominance across sensitive end-use industries.

Barrier-Treated Pulp is expected to witness the fastest growth from 2025 to 2032, driven by the rising demand for moisture-resistant, oil-resistant, and sterilizable trays in pharmaceutical, medical, and biotech applications. These trays are engineered with surface coatings or lamination, enhancing their ability to protect sensitive components from environmental factors. Growth is fueled by stringent regulatory requirements for component safety, which necessitate additional barriers to maintain sterility and product integrity. The expansion of global pharmaceutical and biotech manufacturing hubs further accelerates adoption. Manufacturers also prefer barrier-treated trays for high-value and temperature-sensitive products, ensuring safe transport and storage. Increased environmental awareness has prompted the development of eco-friendly barrier coatings, making these trays sustainable while functional.

- By Modality Technology

On the basis of modality technology, the market is segmented into transfer molding, thick-wall molding, thermoformed pulp, and processed pulp. Thermoformed Pulp dominated the market with the largest revenue share of 42% in 2024 due to its smooth surface finish, precise tolerances, and suitability for high-purity cleanroom applications. Thermoformed trays are widely adopted in semiconductor wafer handling, electronic components, and sterile medical parts. The technology allows for complex shapes and uniform wall thickness, improving protection and stability. Manufacturers value thermoformed pulp for low particle generation and enhanced sterilization compatibility, which are critical for ISO Class 5–7 cleanrooms. Thermoformed trays also integrate custom pocketing and ESD protection, meeting the increasing demands of sensitive electronic and medical components. Their versatility and reliability ensure continued dominance in high-precision industries.

Processed Pulp is expected to witness the fastest growth from 2025 to 2032, driven by the increasing adoption of wet and dry pulp forming techniques for cost-effective, lightweight, and customizable trays. Processed pulp enables manufacturers to produce bulk trays efficiently while maintaining compliance with cleanroom standards. The growth is also supported by the demand for sustainable alternatives to plastic trays in pharmaceutical and medical device sectors. Enhanced molding methods allow for moisture control, stackability, and dimensional flexibility, making them suitable for diverse applications. Expansion of biotech, semiconductor, and electronics manufacturing facilities in Asia-Pacific and Europe further accelerates demand. In addition, processed pulp supports barrier treatments and surface coatings, enhancing functionality without compromising eco-friendliness.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into semiconductor & microelectronics, medical devices & pharmaceuticals, electronics & automotive electronics, biotechnology & life sciences, and optics & precision instruments. Semiconductor & Microelectronics dominated the market with the largest revenue share in 2024 due to the high precision and contamination-sensitive nature of semiconductor components. Molded pulp trays are preferred for wafer transport, IC handling, and ESD-sensitive parts, ensuring minimal particle generation. The dominance is supported by rapid semiconductor production growth in Asia-Pacific and North America, where cleanroom standards are stringent. Trays for this sector require ISO Class 3–5 compliance, dimensional accuracy, and ESD protection, which are critical for product yield. The demand is also fueled by OEM partnerships with packaging suppliers to develop trays tailored for automated assembly lines. Continued expansion of advanced electronics manufacturing facilities maintains strong adoption of molded pulp solutions in this segment.

Medical Devices & Pharmaceuticals is expected to witness the fastest growth from 2025 to 2032, driven by the increasing regulatory emphasis on sterile and biocompatible packaging. Molded pulp trays offer custom pocketing for surgical instruments, vials, and sensitive components, ensuring safe handling in ISO Class 5–7 environments. Growth is fueled by the expansion of pharmaceutical manufacturing and biotech facilities worldwide, particularly in North America, Europe, and Asia-Pacific. Rising awareness of sustainable packaging alternatives to plastic trays further accelerates adoption. These trays also support sterilization methods such as gamma, e-beam, and EtO, making them highly suitable for compliance-driven industries. Customization, contamination control, and eco-friendliness position this segment as the fastest-growing end-use market.

Cleanroom Molded Pulp Packaging Trays Market Regional Analysis

- North America dominated the cleanroom molded pulp packaging trays market with the largest revenue share of 39.2% in 2024, supported by strong pharmaceutical and semiconductor manufacturing bases, stringent packaging standards, and the growing preference for environmentally compliant packaging solutions

- Manufacturers in the region prioritize sustainable, biodegradable, and ISO-compliant packaging solutions, ensuring contamination-free handling of sensitive components

- The widespread adoption is further supported by stringent regulatory requirements, advanced cleanroom infrastructure, and increasing demand for eco-friendly alternatives to plastic trays, establishing molded pulp trays as a preferred solution for high-purity manufacturing environments

U.S. Cleanroom Molded Pulp Packaging Trays Market Insight

The U.S. cleanroom molded pulp packaging trays market captured the largest revenue share of 82% in 2024 within North America, driven by the concentration of pharmaceutical, medical device, and semiconductor manufacturing facilities. Manufacturers are increasingly prioritizing ISO-compliant, sterilizable, and eco-friendly tray solutions for contamination-sensitive applications. The growing adoption of automated cleanroom handling systems and high-value component packaging further propels the market. Moreover, stringent regulatory standards and sustainability mandates are accelerating the replacement of traditional plastic trays with molded pulp alternatives. The expansion of biotech and semiconductor industries in the U.S. also contributes to the consistent demand for high-precision molded pulp trays.

Europe Cleanroom Molded Pulp Packaging Trays Market Insight

The Europe cleanroom molded pulp packaging trays market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict regulatory requirements for cleanroom packaging and the rising focus on sustainable manufacturing. The increase in pharmaceutical and medical device production, coupled with the demand for contamination-free, biodegradable packaging, is fostering adoption. European manufacturers are also drawn to the cost-effectiveness and compliance benefits of molded pulp trays. The market is experiencing significant growth across residential biotech, commercial medical device, and industrial semiconductor applications, with trays being incorporated into both new facilities and retrofitting projects.

U.K. Cleanroom Molded Pulp Packaging Trays Market Insight

The U.K. cleanroom molded pulp packaging trays market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating demand for sustainable and contamination-free packaging in pharmaceutical and biotech manufacturing. In addition, concerns regarding product integrity, sterility, and regulatory compliance are encouraging manufacturers to adopt molded pulp trays over conventional plastic alternatives. The U.K.’s emphasis on sustainability, alongside its strong life sciences and semiconductor sectors, is expected to continue stimulating market growth. Adoption in both new manufacturing setups and renovation of existing cleanrooms further supports expansion.

Germany Cleanroom Molded Pulp Packaging Trays Market Insight

The Germany cleanroom molded pulp packaging trays market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of sustainable packaging and contamination control in medical, biotech, and semiconductor industries. Germany’s well-established industrial infrastructure, combined with its focus on innovation and regulatory compliance, promotes the adoption of molded pulp trays. Integration with automated cleanroom systems and preference for eco-friendly, sterilizable, and precise tray solutions is becoming increasingly prevalent. The country’s emphasis on high-quality, sustainable manufacturing aligns with the requirements of ISO-classified cleanroom operations.

Asia-Pacific Cleanroom Molded Pulp Packaging Trays Market Insight

The Asia-Pacific cleanroom molded pulp packaging trays market is poised to grow at the fastest CAGR of 25% during the forecast period of 2025 to 2032, driven by rapid expansion of semiconductor, pharmaceutical, and electronics manufacturing in countries such as China, Japan, and India. The region’s growing inclination toward sustainable and contamination-controlled packaging, supported by government initiatives promoting environmental compliance, is driving adoption. Furthermore, Asia-Pacific’s emergence as a manufacturing hub for high-precision cleanroom trays increases both affordability and accessibility, expanding usage across residential biotech, commercial medical device, and industrial electronics applications.

Japan Cleanroom Molded Pulp Packaging Trays Market Insight

The Japan cleanroom molded pulp packaging trays market is gaining momentum due to the country’s advanced manufacturing culture, high cleanroom standards, and focus on precision packaging. The adoption is driven by the increasing number of ISO-classified cleanrooms in semiconductor, electronics, and medical device industries. Integration of molded pulp trays with automated systems enhances efficiency, contamination control, and component protection. Moreover, Japan’s emphasis on eco-friendly and sterilizable solutions is fueling growth in both commercial and high-tech residential cleanroom applications.

India Cleanroom Molded Pulp Packaging Trays Market Insight

The India cleanroom molded pulp packaging trays market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding pharmaceutical and electronics manufacturing, and growing adoption of sustainable cleanroom practices. India is emerging as a key market for ISO-compliant and biodegradable molded pulp trays, driven by both domestic and multinational manufacturers. The push towards smart factories, environmental regulations, and government-supported cleanroom initiatives is further propelling adoption. Availability of cost-effective solutions and growing domestic production capacity also supports increased usage in residential biotech, commercial pharmaceutical, and industrial electronics sectors.

Cleanroom Molded Pulp Packaging Trays Market Share

The Cleanroom Molded Pulp Packaging Trays industry is primarily led by well-established companies, including:

- UFP Technologies, Inc. (U.S.)

- Sonoco Products Company (U.S.)

- EnviroPAK (U.S.)

- Keiding Inc. (U.S.)

- BonitoPak (U.S.)

- Otarapack (U.S.)

- Molded Pulp Packaging (U.S.)

- APTARGROUP, INC. (U.S.)

- Orcon Industries (U.S.)

- Shenzhen Pakoro Packaging Co;Ltd (U.S.)

- Hartmann Packaging A/S (Denmark)

- Hefei Sumkoka Environmental Technology Co.,Ltd. (China)

- Dongguan Kinyi Environmental Technology Co. (China)

- Guangzhou Yuhe Biopak Co., Ltd. (China)

- HMPS (Australia)

- Henry Molded Products Inc. (U.S.)

- Green Bay Packaging Inc. (U.S.)

- Ecologic (U.S.)

- Weatherchem Corporation (U.S.)

What are the Recent Developments in Global Cleanroom Molded Pulp Packaging Trays Market?

- In August 2025, Graphic Packaging expanded its food packaging portfolio by adding the PaperSeal Pressed Modified Atmosphere Packaging (MAP) tray. This addition underscores the company's commitment to providing sustainable and efficient packaging solutions in the food industry

- In August 2025, Solenis unveiled its Contour™ technology, designed to impart oil and grease resistance to molded pulp products such as plates, bowls, tubs, and trays. This innovation offers a cost-competitive and easy-to-implement solution without intentionally added PFAS, enhancing the functionality of molded pulp packaging in low- to mid-temperature applications

- In September 2024, international technology group ANDRITZ and Swedish pioneer PulPac AB announced a strategic partnership to offer complete Dry Molded Fiber lines. This collaboration combines PulPac’s innovative fiber-molding process with ANDRITZ’s expertise in turnkey pulp mills, web forming, converting, and recycling technologies. The partnership aims to provide an eco-friendly alternative to single-use plastics by offering fully integrated Dry Molded Fiber production lines, expanding ANDRITZ’s portfolio of sustainable solutions

- In January 2024, Sealed Air Corporation (SEE) introduced a compostable protein packaging tray at the International Production & Processing Expo (IPPE). Made from biobased, food-contact grade resin, this tray offers an alternative to traditional expanded polystyrene (EPS) trays, aligning with sustainability goals in the food packaging sector

- In November 2023, BonitoPak launched eco-friendly plant-based molded pulp trays designed to protect products during shipping. These durable, stackable trays are ideal for electronics, candles, and retail packaging, offering a sustainable alternative to traditional packaging materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.