Global Cleanroom Technology Market

Market Size in USD Billion

CAGR :

%

USD

33.85 Billion

USD

57.25 Billion

2024

2032

USD

33.85 Billion

USD

57.25 Billion

2024

2032

| 2025 –2032 | |

| USD 33.85 Billion | |

| USD 57.25 Billion | |

|

|

|

|

Cleanroom Technology Market Size

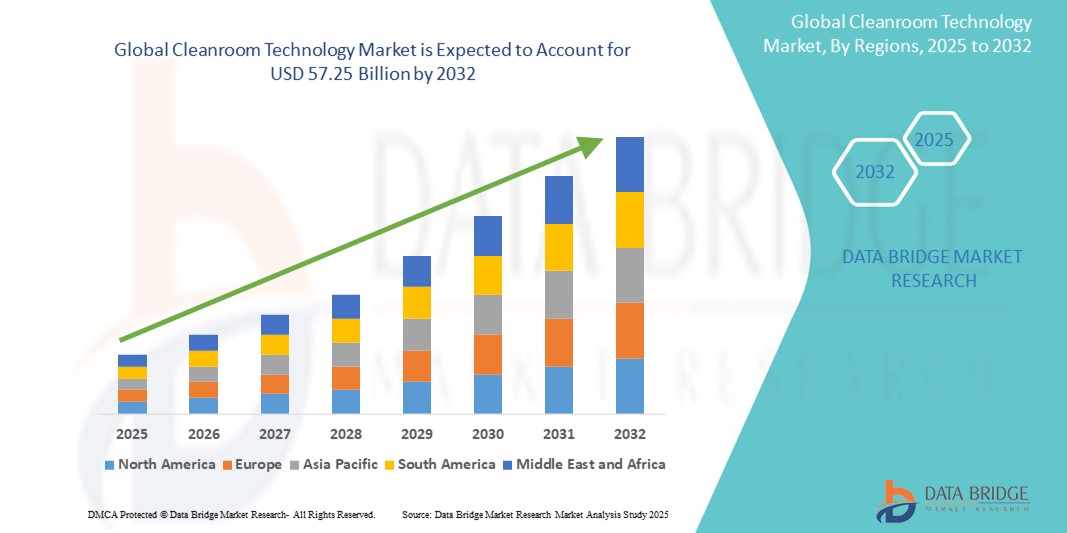

- The global cleanroom technology market size was valued at USD 33.85 billion in 2024 and is expected to reach USD 57.25 billion by 2032, at a CAGR of 6.79% during the forecast period

- This growth is driven by factors such as the stringent regulatory standards, and expansion of healthcare and biopharmaceutical sector

Cleanroom Technology Market Analysis

- Clean room technology is a critical component in various industries, providing controlled environments with low levels of contaminants, essential for manufacturing processes in sectors such as pharmaceuticals, biotechnology, electronics, and medical devices

- The demand for clean room technology is significantly driven by the increasing need for contamination control, stringent regulatory requirements, and the growing focus on product quality and safety in high-precision manufacturing environments

- North America is expected to dominate the cleanroom technology market, with 39.40% market share. This leadership is driven by advanced healthcare infrastructure, stringent regulatory requirements, and the presence of major pharmaceutical and biotechnology companies

- Asia-Pacific is expected to be the fastest-growing region in the cleanroom technology market with a projected CAGR of 6.10%, driven by rapid industrialization, increasing healthcare infrastructure investments, and the expansion of the electronics and pharmaceutical industries

- The consumables segment is expected to dominate the market with a market share of 55.16%, driven by the consistent demand for disposable items such as gloves, wipes, disinfectants, and apparel

Report Scope and Cleanroom Technology Market Segmentation

|

Attributes |

Cleanroom Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cleanroom Technology Market Trends

“Growing Adoption of Modular Cleanroom Systems”

- A prominent trend in cleanroom technology is the growing adoption of modular cleanroom systems. These prefabricated, scalable structures offer flexibility and cost-effectiveness, allowing industries such as pharmaceuticals, biotechnology, and electronics to rapidly deploy and customize cleanroom environments to meet specific operational requirements

- The integration of smart technologies, including Internet of Things (IoT) sensors and artificial intelligence (AI), is enhancing real-time monitoring and control of critical cleanroom parameters such as temperature, humidity, and particulate levels. These advancements improve contamination control, operational efficiency, and predictive maintenance capabilities

- For instance, Genentech's Vacaville facility in California exemplifies the successful integration of advanced cleanroom technology in pharmaceutical manufacturing. By investing in state-of-the-art air filtration systems, rigorous environmental monitoring, and comprehensive personnel training, the company established a highly controlled environment that significantly mitigated contamination risks. This commitment not only improved product quality and ensured process consistency but also facilitated compliance with stringent regulatory standards, reinforcing Genentech's reputation for manufacturing excellence

- Innovations in construction materials, such as the use of antimicrobial surfaces and energy-efficient systems, are contributing to the development of sustainable cleanroom solutions. These materials help reduce contamination risks and operational costs, aligning with global sustainability goals

Cleanroom Technology Market Dynamics

Driver

“Stringent Regulatory Standards Fueling Cleanroom Adoption”

- The enforcement of rigorous regulatory standards by agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) mandates the use of cleanroom environments in pharmaceutical and biotechnology manufacturing

- Compliance with guidelines such as Good Manufacturing Practices (GMP) and ISO 14644 is essential to ensure product safety and quality, driving the demand for advanced cleanroom technologies

For instance,

- In August 2023, the European Union implemented the revised GMP Annex 1 guidelines, emphasizing Quality Risk Management and requiring a contamination control strategy for sterile medicinal product manufacturing. This update has led to increased demand for advanced cleanroom solutions to meet the new compliance standards

- The need to prevent contamination in the production of sensitive products, such as biologics and medical devices, further propels the adoption of cleanroom solutions across various industries. Research and Markets

Opportunity

“Integration of Smart Technologies Enhancing Cleanroom Efficiency”

- The incorporation of Industry 4.0 technologies, including the Internet of Things (IoT), artificial intelligence (AI), and automation, is revolutionizing cleanroom operations by enabling real-time monitoring and control of environmental parameters

- Smart cleanroom systems can predict maintenance needs, optimize energy consumption, and reduce human error, leading to improved operational efficiency and cost savings

- The development of modular and customizable cleanroom designs allows for scalable solutions that can be tailored to specific industry requirements, offering flexibility and rapid deployment

For instance,

- Mecart, a Canadian cleanroom manufacturer, delivered critical modular isolation rooms to hospitals and healthcare facilities during the COVID-19 pandemic. These prefabricated cleanrooms were rapidly deployed, showcasing the flexibility and efficiency of modern cleanroom solutions. MECART Cleanrooms

- The integration of smart and modular technologies presents significant opportunities to enhance the efficiency and adaptability of cleanroom environments

Restraint/Challenge

“High Implementation and Maintenance Costs Limiting Market Expansion”

- The substantial capital investment required for the design, construction, and maintenance of cleanroom facilities poses a significant barrier, particularly for small and medium-sized enterprises (SMEs)

- Ongoing operational expenses, including energy consumption, specialized equipment, and compliance with evolving regulatory standards, add to the financial burden, potentially deterring adoption

- The complexity of cleanroom customization to meet specific industry needs further escalates costs and can hinder timely implementation

For instance,

- According to Workstation Industries, as of May 2019, the average cost of setting up a modular cleanroom ranged from USD 100 to USD 150 per square foot. This high cost can be prohibitive for smaller companies or those in developing regions, limiting the adoption of cleanroom technologies. Resources

- The high costs associated with cleanroom implementation and maintenance remain a significant challenge, particularly for smaller enterprises and in resource-constrained settings

Cleanroom Technology Market Scope

The market is segmented on the basis of type, construction type, and industry.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Construction Type |

|

|

By Industry |

|

In 2025, the consumables is projected to dominate the market with a largest share in type segment

The consumables segment is expected to dominate the cleanroom technology market with the largest share of 55.16% in 2025, driven by the consistent demand for disposable items such as gloves, wipes, disinfectants, and apparel. These products are essential for maintaining hygiene and preventing contamination in cleanroom environments across various industries. The recurring nature of consumable purchases and strict regulatory requirements, particularly in pharmaceutical and semiconductor manufacturing, further contribute to the segment's dominance.

The pharmaceutical Industry is expected to account for the largest share during the forecast period in industry market

In 2025, The pharmaceutical industry is expected to dominate the market with the largest share of approximately 43.9%. This dominance is driven by stringent regulatory requirements for drug manufacturing and testing, where cleanrooms are vital to ensure product safety and efficacy. The increasing demand for new drugs and medical devices, fueled by the surge in diseases, further accelerates the adoption of cleanroom technologies within this sector.

Cleanroom Technology Market Regional Analysis

“North America Holds the Largest Share in the Cleanroom Technology Market”

- North America dominates the cleanroom technology market, accounting for 39.40% of the global market share. This leadership is driven by advanced healthcare infrastructure, stringent regulatory requirements, and the presence of major pharmaceutical and biotechnology companies

- U.S. is a significant contributor to the region's market share, holding approximately 81.6% of North America's cleanroom technology market. The country's robust semiconductor manufacturing, pharmaceutical production, and aerospace industries, coupled with strict FDA guidelines, fuel the demand for advanced cleanroom systems

- The availability of well-established reimbursement policies and growing investments in research & development by leading medical device companies further strengthen the market

- In addition, the increasing number of high-precision manufacturing processes and the adoption of modular and flexible cleanrooms are fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Cleanroom Technology Market”

- Asia-Pacific is expected to witness the highest growth rate in the cleanroom technology market, with a projected CAGR of 6.10%. This growth is driven by rapid industrialization, increasing healthcare infrastructure investments, and the expansion of the electronics and pharmaceutical industries

- Countries such as China, India, and Japan are emerging as key markets due to the growing aging population and the need for stringent cleanliness standards in production processes.

- Japan, with its advanced medical technology and strong emphasis on research and development, remains a crucial market for cleanroom technology, particularly in semiconductor manufacturing and precision engineering

- India is projected to register the highest CAGR of 8.4% in the region, fueled by its emerging manufacturing sector, particularly in electronics and pharmaceuticals, and government initiatives to promote domestic manufacturing

Cleanroom Technology Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AES Clean Technology (U.S.)

- DuPont (U.S.)

- Clean Air Products (U.S.)

- Clean Room Depot (U.S.)

- Integrated Cleanroom Technologies Pvt. Ltd. (India)

- Hemair (India)

- AIRTECH JAPAN, Ltd. (Japan)

- Lennox (India)

- Colandis (Germany

- ABN Cleanroom Technology (Belgium)

- Nicos Group, Inc. (U.S.)

- GALVANI S.R.L. (Italy)

- ANSELL LTD. (Australia)

- Ardmac (Ireland)

- Azbil Corporation (Japan)

- Helapet Ltd. (U.K.)

- KCWW (U.S.)

- Camfil (Sweden)

- Labconco (U.S.)

- Taikisha Ltd. (Japan)

- Terra Universal, Inc. (U.S.)

- Lindner SE (Germany)

Latest Developments in Global Cleanroom Technology Market

- In April 2025, AES Clean Technology introduced the CleanLock Module, a modular airlock solution designed to enhance cleanliness and efficiency in cleanroom environments. The CleanLock Module integrates AES' proprietary cleanroom finishes, patented lighting, predictable airflow patterns, and advanced door controls to create a highly controlled environment that can be seamlessly integrated into any facility without delay

- In October 2024, EAZER Maintenance, ABN Cleanroom Technology, and Hasselt University collaborated to develop CleanAR, a digital tool utilizing augmented reality to guide cleanroom cleaning. This innovative solution aims to improve cleaning precision and ensure adherence to cleanliness standards, enhancing the overall efficiency and effectiveness of cleanroom maintenance processes

- In April 2024, Micron announced plans to construct four semiconductor fabrication facilities (fabs) in Clay, New York, each with 600,000 square feet of cleanroom space, totaling 2.4 million square feet. This development represents the largest amount of cleanroom space ever announced in the United States, underscoring the growing demand for cleanroom technologies in semiconductor manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.