Global Climate Control Equipment For Poultry Market

Market Size in USD Billion

CAGR :

%

USD

7.44 Billion

USD

10.74 Billion

2024

2032

USD

7.44 Billion

USD

10.74 Billion

2024

2032

| 2025 –2032 | |

| USD 7.44 Billion | |

| USD 10.74 Billion | |

|

|

|

|

Climate Control Equipment for Poultry Market Size

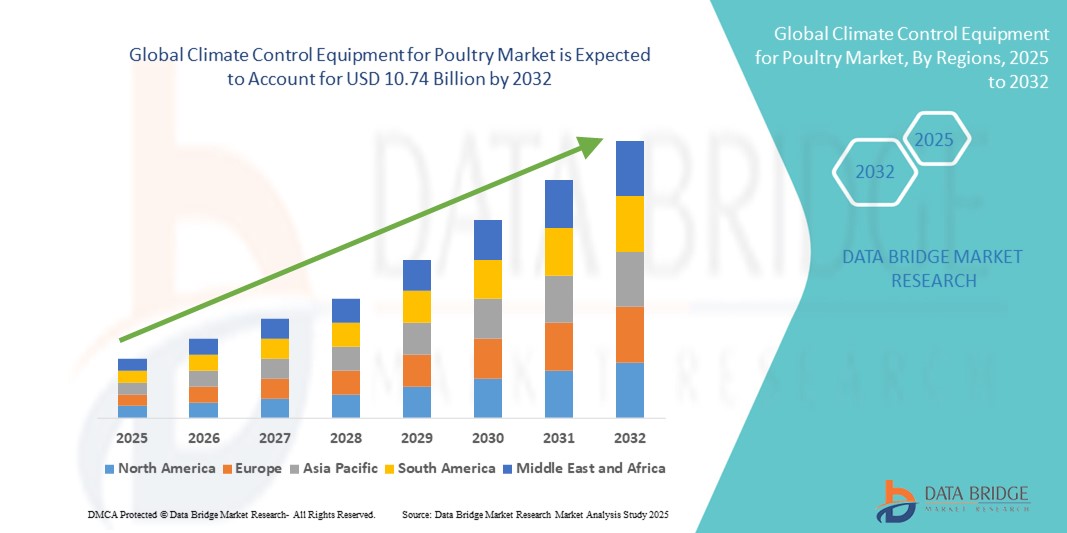

- The global climate control equipment for poultry market size was valued at USD 7.44 billion in 2024 and is expected to reach USD 10.74 billion by 2032, at a CAGR of 4.70% during the forecast period

- The market growth is largely fueled by the increasing modernization of poultry farming operations and rapid adoption of automated climate control technologies to ensure optimal bird health, productivity, and welfare in varying environmental conditions

- Furthermore, rising concerns over poultry mortality, disease prevention, and feed efficiency are driving demand for integrated, sensor-based solutions that provide precise control over temperature, ventilation, humidity, and air quality. These converging factors are accelerating the deployment of advanced systems, significantly boosting the industry's growth

Climate Control Equipment for Poultry Market Analysis

- Climate control equipment for poultry includes automated systems designed to regulate environmental conditions such as temperature, ventilation, humidity, and lighting within poultry houses, ensuring consistent performance across broiler and layer production

- The growing emphasis on animal welfare, biosecurity, and sustainable farming—combined with rising demand for poultry products—is driving the need for intelligent, energy-efficient solutions that enable real-time monitoring, remote access, and optimized farm management

- Asia-Pacific dominated the climate control equipment for poultry market with a share of 42.2% in 2024, due to the region’s extensive poultry farming operations, rapid modernization of livestock facilities, and rising demand for poultry products in densely populated economies

- North America is expected to be the fastest growing region in the climate control equipment for poultry market during the forecast period due to increasing demand for automation in poultry farming, growing focus on biosecurity, and the need to reduce dependency on manual labor

- Chicken segment dominated the market with a market share of 67.9% in 2024, due to its dominance in global poultry production and consumption. Chickens are highly sensitive to temperature and ventilation changes, which necessitates reliable and efficient climate control equipment to ensure optimal health and performance

Report Scope and Climate Control Equipment for Poultry Market Segmentation

|

Attributes |

Climate Control Equipment for Poultry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Climate Control Equipment for Poultry Market Trends

Growth in Integrated Farm Management Systems

- The market is witnessing increasing adoption of integrated farm management systems that combine climate control equipment with automated feeding, lighting, and monitoring technologies to optimize poultry health and productivity

- For instance, companies such as Big Dutchman, Vencomatic Group BV, and Ziggity Systems provide smart climate control solutions integrated with IoT sensors and farm management software enabling real-time environmental monitoring and automated adjustments for temperature, ventilation, and humidity

- Rising adoption of precision agriculture and smart farming practices in poultry operations drives demand for equipment that supports energy efficiency, reduces maintenance, and enhances bird comfort, contributing to better yield and animal welfare

- Technological innovations such as automated ventilation systems, misting for cooling, and heating with energy-efficient controls help growers maintain stable conditions despite external climate variability and rising global temperatures

- Growing regulatory emphasis on animal welfare standards and food safety compels poultry farms to adopt climate control systems that ensure consistent, optimal environmental conditions to minimize stress and disease

- Expansion of large-scale and commercial poultry farming operations supported by government subsidies and private investments accelerates demand for advanced climate control equipment capable of supporting scalable and sustainable production

Climate Control Equipment for Poultry Market Dynamics

Driver

Increasing Poultry Consumption Globally

- The swift growth in global poultry meat consumption, favored for its affordability, health benefits, and convenience, significantly fuels the demand for climate control equipment to support intensive farming practices and high-yield operations

- For instance, according to OECD and FAO reports, companies such as Petersime and TECNO POULTRY EQUIPMENT Spa supply climate control solutions tailored for broiler and layer farms to maintain optimal temperature and humidity, directly supporting productivity and meat quality in response to rising global demand

- Increasing modernization of poultry farms across Asia Pacific, Latin America, and Middle East stimulates market growth due to adoption of climate control infrastructure aligned with expanding consumer markets

- Consumer preferences evolving towards high-quality, disease-free poultry meat enhance the need for precise environmental control ensuring the health and welfare of birds throughout production cycles

- Seasonality and climate variability in key poultry producing regions require farms to invest in adaptive climate control technologies to maintain stable indoor conditions year-round, underpinning sustainable production

Restraint/Challenge

High Initial Investment Costs

- Significant upfront capital expenditure on state-of-the-art climate control equipment, especially automated and integrated systems, is a major barrier for small and medium-scale poultry producers, particularly in developing regions

- For instance, manufacturers such as Big Dutchman and Petersime face challenges in making energy-efficient, computerized climate control technology affordable to smaller farms that often rely on traditional ventilation and heating methods

- Complex installation procedures and the requirement for skilled technicians to operate and maintain advanced climate control systems add to the initial cost burden and inhibit wider adoption

- High energy consumption and maintenance costs associated with some climate control solutions can also deter investment despite long-term operational savings

- Price sensitivity among farmers, combined with limited access to financing and subsidies in certain markets, restricts market penetration and slows replacement rates of outdated equipment

Climate Control Equipment for Poultry Market Scope

The market is segmented on the basis of type, poultry type, solutions, and application.

- By Type

On the basis of type, the climate control equipment for poultry market is segmented into broilers and layers. The broilers segment dominated the largest market revenue share in 2024, primarily due to the high commercial demand for meat production and the shorter lifecycle of broilers, which necessitates consistent and optimal environmental conditions for rapid growth. Producers invest heavily in climate control systems to maintain ideal temperature, humidity, and ventilation, ensuring efficient feed-to-meat conversion and minimizing mortality.

The layers segment is projected to register the fastest growth rate from 2025 to 2032, as the global demand for eggs continues to rise across both developed and emerging markets. Sustained productivity in layer hens requires precise thermal management and air quality control over extended periods. Increasing adoption of advanced environmental systems in layer houses to optimize egg production and enhance bird welfare is a key factor accelerating the growth of this segment.

- By Poultry Type

On the basis of poultry type, the market is segmented into chicken, duck, turkey, and other poultry types. The chicken segment accounted for the largest market share of 67.9% in 2024, owing to its dominance in global poultry production and consumption. Chickens are highly sensitive to temperature and ventilation changes, which necessitates reliable and efficient climate control equipment to ensure optimal health and performance.

The duck segment is expected to witness the fastest growth rate during the forecast period, driven by increasing demand for duck meat and eggs in Asia-Pacific countries. Ducks have different environmental requirements compared to chickens, prompting a growing need for specialized climate control systems that cater to their heat and moisture tolerance, especially in large-scale operations.

- By Solutions

On the basis of solutions, the market is segmented into ventilations, openings, heaters, and controls. The ventilation segment held the largest revenue share in 2024, reflecting the critical role of proper air circulation in maintaining air quality, removing excess moisture, and controlling ammonia levels in poultry housing. Ventilation systems are fundamental to disease prevention and performance enhancement, particularly in intensive farming environments.

The controls segment is projected to register the fastest CAGR from 2025 to 2032, supported by growing adoption of automated and sensor-based technologies that allow real-time monitoring and precision control of environmental conditions. These advanced systems offer better energy efficiency, reduced human error, and integration with IoT platforms, making them increasingly appealing to modern poultry operations focused on productivity and sustainability.

- By Application

On the basis of application, the market is segmented into indoor and outdoor. The indoor segment dominated the largest market share in 2024 due to the prevalence of enclosed poultry housing in commercial production, where climate control systems are essential for maintaining consistent internal environments regardless of external weather fluctuations. Indoor setups allow for better disease control, biosecurity, and optimized feeding schedules, thereby improving overall farm performance.

The outdoor segment is anticipated to grow at the fastest rate from 2025 to 2032, spurred by the rising popularity of free-range and organic poultry farming practices. These systems often incorporate hybrid climate control solutions tailored to semi-open environments, where managing natural airflow, temperature changes, and bird exposure to weather elements is crucial. The trend toward ethical and sustainable farming is driving investment in adaptable equipment suited for outdoor poultry applications.

Climate Control Equipment for Poultry Market Regional Analysis

- Asia-Pacific dominated the climate control equipment for poultry market with the largest revenue share of 42.2% in 2024, driven by the region’s extensive poultry farming operations, rapid modernization of livestock facilities, and rising demand for poultry products in densely populated economies

- Strong government support for agricultural automation, coupled with increasing investments in large-scale poultry infrastructure and climate-resilient technologies, is accelerating market adoption

- Furthermore, the presence of key equipment manufacturers, expanding contract farming models, and rising awareness of livestock welfare are contributing to the growing demand for automated climate control systems

China Climate Control Equipment for Poultry Market Insight

China held the largest share in the Asia-Pacific climate control equipment market in 2024, propelled by its vast poultry farming base, rapid industrialization of agriculture, and strong government backing for smart farming practices. Demand is further driven by the need to reduce mortality rates and improve productivity in large-scale poultry operations.

India Climate Control Equipment for Poultry Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, supported by the growing consumption of poultry meat and eggs, rapid expansion of commercial poultry farms, and increasing awareness about livestock health and biosecurity. Rising temperatures and climate variability are also pushing demand for efficient environmental control solutions.

Europe Climate Control Equipment for Poultry Market Insight

The Europe climate control equipment for poultry market is expected to grow steadily, supported by strict animal welfare regulations, high levels of farm mechanization, and growing emphasis on sustainable poultry production. Western Europe, in particular, leads in the adoption of advanced control systems to ensure compliance and improve efficiency.

Germany Climate Control Equipment for Poultry Market Insight

Germany’s market is expanding due to the country's strong regulatory framework, focus on animal health, and established poultry industry. The use of automated, sensor-driven ventilation and heating systems is growing, especially in integrated farming operations that prioritize sustainability and energy efficiency.

U.K. Climate Control Equipment for Poultry Market Insight

The U.K. market is driven by increasing investments in poultry infrastructure upgrades, consumer demand for ethically raised poultry, and the need for climate adaptation in farming. The shift toward energy-saving systems and government incentives for modernizing livestock facilities are shaping market dynamics.

North America Climate Control Equipment for Poultry Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, fueled by increasing demand for automation in poultry farming, growing focus on biosecurity, and the need to reduce dependency on manual labor. Integration of smart technologies and IoT-based environmental controls is rapidly gaining traction across commercial operations.

U.S. Climate Control Equipment for Poultry Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by its large-scale poultry production facilities, rising demand for meat exports, and focus on animal health optimization. Technological innovation, coupled with strong R&D capabilities and the presence of major solution providers, is boosting adoption across both broiler and layer farms.

Climate Control Equipment for Poultry Market Share

The climate control equipment for poultry industry is primarily led by well-established companies, including:

- Ziggity Systems, Inc. (U.S.)

- Kishore Farm Equipments Pvt Ltd (India)

- A.P. POULTRY EQUIPMENTS (India)

- TECNO POULTRY EQUIPMENT Spa (Italy)

- Big Dutchman (Germany)

- Jansen Poultry Equipment (Netherlands)

- Vencomatic Group B.V. (Netherlands)

- HARTMANN GROUP (Germany)

- TEXHA PA LLC (Ukraine)

- Petersime (Belgium)

- GARTECH (India)

- LUBING Maschinenfabrik Ludwig Bening GmbH & Co. KG (Germany)

- Salmet (Germany)

- Henan Jinfeng Poultry Equipment Co,.Ltd. (China)

Latest Developments in Global Climate Control Equipment for Poultry Market

- In December 2024, Tecno Poultry Equipment, as part of the new Grain and Protein Technologies Group, positioned itself for sustained growth by aligning with a focused expansion strategy. This move is expected to strengthen its support for the evolving egg industry, reinforcing its presence and adaptability in the global poultry equipment market

- In November 2023, SKA expanded its presence in the poultry sector through the acquisition of ISA, a company specializing in the design, production, and installation of poultry and animal houses. This vertical integration enhances SKA’s capabilities across the full value chain, offering comprehensive solutions that are expected to improve client satisfaction and bolster its competitiveness in integrated poultry farming systems

- In October 2023, Officine Facco acquired Sperotto to strengthen its position in international markets and enhance its internal manufacturing capabilities. By incorporating Sperotto’s expertise in carpentry and prefabricated steel constructions, the company aims to broaden its infrastructure solutions for poultry and industrial applications, thereby increasing its production efficiency and market reach

- In November 2022, Munters, a leading global company based in Sweden specializing in climate and energy-efficient air treatment technologies, completed the acquisition of Hygromedia LLC and Rotor Source Inc. This strategic acquisition strengthens Munters' position as a top provider of advanced desiccant dehumidification systems for various industrial applications. By integrating Hygromedia LLC and Rotor Source Inc., Munters enhances its market presence and creates a stronger channel to better serve its customers

- In October 2022, Roxell launched the Fortena chain feeding system for broiler breeders during the production phase, completing its comprehensive poultry feeding portfolio. This innovation contributes to Roxell’s integrated farm equipment offering, enhancing its competitiveness by providing poultry farmers with advanced, all-in-one feeding and climate control solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.