Global Climbing Gym Market

Market Size in USD Billion

CAGR :

%

USD

71.18 Billion

USD

116.92 Billion

2024

2032

USD

71.18 Billion

USD

116.92 Billion

2024

2032

| 2025 –2032 | |

| USD 71.18 Billion | |

| USD 116.92 Billion | |

|

|

|

|

Climbing Gym Market Size

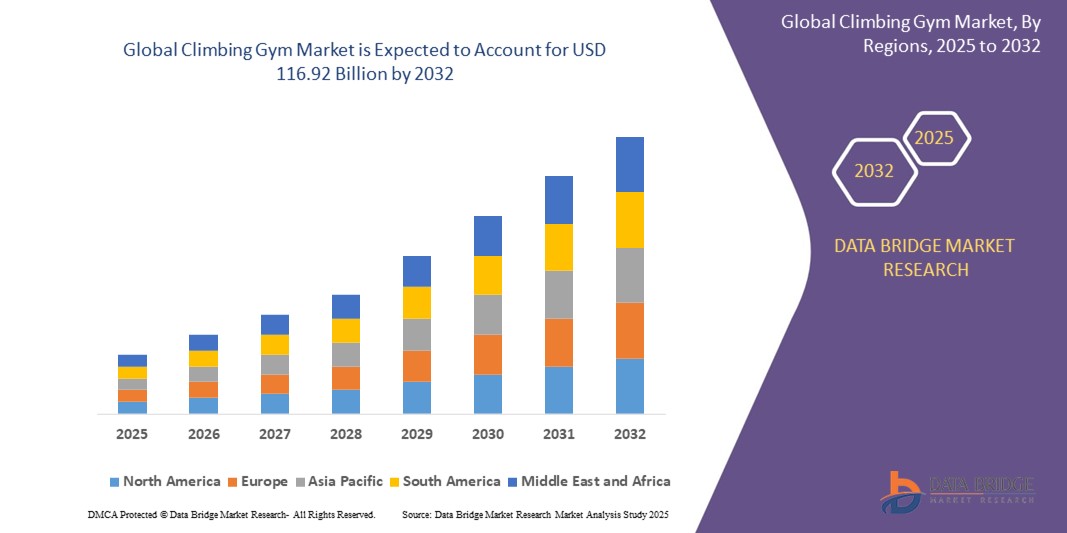

- The global climbing gym market was valued at USD 71.18 billion in 2024 and is expected to reach USD 116.92 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.40 % primarily driven by the increasing popularity of indoor fitness activities and growing interest in adventure sport

- This growth is driven by factors such as rising awareness about physical fitness, urbanization, increased disposable income, and the desire for unique and challenging workout experiences

Climbing Gym Market Analysis

- The climbing gym market has seen significant growth, driven by the increasing demand for alternative fitness activities, with more people looking to try indoor climbing for fitness and fun

- For instances, gyms such as Brooklyn Boulders in New York City offer a combination of climbing and yoga classes, attracting diverse demographics

- More climbing gym facilities are being established globally, with cities such as New York, Tokyo, and London witnessing a surge in the number of indoor climbing venues in the last few years. In 2021, Climb Central opened its doors in Singapore, catering to a growing interest in indoor climbing across Southeast Asia

- Climbing gyms offer a wide range of services, such as fitness classes, training programs, and community events, which have increased their appeal to a broader audience beyond just climbers. Planet Granite in San Francisco

- For instance, hosts regular climbing competitions, fitness training, and social events, creating a sense of community among its members

- Innovative climbing wall designs, such as automated systems and creative features, are attracting new customers and retaining existing ones by keeping the climbing experience fresh and challenging. The Boulderhaus in Germany introduced an automated climbing wall, allowing climbers to compete against themselves or others in real-time

- Competitive climbing events, such as the inclusion of climbing in the 2020 Tokyo Olympics, have boosted public awareness and interest, leading to more participation and growth in climbing gym memberships. After the Olympics, gyms such as The Cliffs in New York reported a noticeable rise in membership as more people became interested in climbing as a competitive sport

Report Scope and Climbing Gym Market Segmentation

|

Attributes |

Climbing Gym Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Climbing Gym Market Trends

“Increasing Adoption of Smart Climbing Gyms”

- The adoption of smart climbing gyms is growing rapidly, with companies such as ABB and Schneider Electric leading the charge by integrating advanced features such as real-time monitoring and automated fault detection in their devices, helping improve grid stability across various projects, such as the integration of smart grids in Europe

- Smart climbing gyms allow for remote diagnostics, which is particularly useful in critical infrastructure such as hospitals and data centers, where uninterrupted power is crucial

- For instance, the National Health Service (NHS) in the U.K. has incorporated smart climbing gyms in its hospital systems to ensure continuous power supply during emergencies

- These devices enhance energy efficiency by optimizing power distribution in smart buildings

- For instance, the Edge building in Amsterdam, recognized as one of the world’s greenest buildings, utilizes smart climbing gyms to monitor and adjust power usage, reducing energy consumption significantly

- Predictive maintenance is a key feature of smart climbing gyms, helping detect potential issues before they cause downtime. In large industrial plants such as the Tesla Gigafactory in Nevada, these breakers provide early warnings for equipment failures, minimizing costly repairs and operational disruptions

- Smart climbing gyms are also vital for renewable energy integration.

- For instance, in solar farms such as those in California, these breakers ensure grid stability by automatically adjusting to the variable output from solar panels, preventing overloading of the electrical grid during peak production times

Climbing Gym Market Dynamics

Driver

“Increasing Demand for Reliable Power Systems”

- The increasing demand for reliable and safe electrical power systems is a key driver, as industries such as manufacturing and healthcare rely heavily on uninterrupted power to avoid costly disruptions

- For instance, in the National Health Service (NHS) in the UK, where smart climbing gyms are used to ensure reliable power for critical hospital operations, minimizing the risk of power failure during surgeries or emergencies

- As urbanization and industrialization grow worldwide, cities and industrial zones, such as New York and Tokyo, experience more complex and interconnected electrical grids, which necessitate advanced climbing gyms to prevent large-scale outages

- For instance, Con Edison in New York has deployed smart climbing gyms in its smart grid program to enhance reliability and reduce the impact of faults on the city's electrical supply

- Advanced climbing gyms, particularly smart climbing gyms, provide better protection by detecting faults and isolating them automatically, ensuring power supply remains stable even during faults

- For instance, in San Francisco's smart grid project by Pacific Gas and Electric (PG&E), smart climbing gyms have been installed to detect and automatically isolate faults, minimizing downtime and improving grid resilience

- The growing integration of renewable energy sources, such as wind and solar, requires climbing gyms capable of managing fluctuating power loads, for instance, the Roscoe Wind Farm in Texas, one of the largest wind farms in the U.S., relies on advanced climbing gyms to handle the variable energy output and ensure grid stability during high wind generation periods

- As electrical networks evolve with digital monitoring and automation, the climbing gym market is growing, with new technologies enhancing efficiency

- For instance, in Germany's Energiewende project, where digital climbing gyms are being used to facilitate the integration of renewable energy sources such as solar and wind into the power grid without compromising system stability

Opportunity

“Integration with Smart Grids and IoT”

- A major opportunity for the climbing gym market lies in the integration of climbing gyms with smart grids and the Internet of Things (IoT), as these technologies optimize the distribution and use of electricity, allowing for more efficient power management

- For instance, in the U.S., the smart grid project being implemented in cities such as Chicago uses advanced climbing gyms to improve grid reliability and responsiveness through real-time data

- IoT-enabled climbing gyms are becoming essential for remote monitoring and real-time fault detection, enabling quicker responses to issues and reducing downtime

- For instance, in the city of New York, Con Edison has integrated IoT-enabled climbing gyms into its smart grid, allowing for the detection of faults and the ability to isolate affected areas, improving overall power system reliability

- These smart climbing gyms can also provide valuable data on power consumption patterns, system health, and predictive maintenance, which can prevent failures before they happen

- For instance, Pacific Gas and Electric (PG&E) in California has been using IoT-enabled climbing gyms to enhance the management of their grid and ensure uninterrupted power supply to both residential and industrial sectors

- The increasing integration of renewable energy sources such as solar and wind into the grid calls for advanced climbing gyms to manage the fluctuations in power generation

- For instance, the Roscoe Wind Farm in Texas relies on climbing gyms that can handle rapid shifts in energy output from wind power, ensuring grid stability

- The growing global demand for smart grid infrastructure, driven by government-backed initiatives in countries such as Germany and China, presents a significant opportunity for manufacturers in the climbing gym market. By aligning products with the needs of smart grid systems, manufacturers can tap into new markets and ensure long-term growth through smarter, more efficient power distribution solutions

Restraint/Challenge

“High Initial Investment”

- A significant restraint to the growth of the climbing gym market is the high initial investment involved in adopting advanced climbing gyms, especially in regions with older infrastructure

- For instance, in developing regions such as Africa, where electrical grids are still being modernized, the upfront costs of upgrading to smart climbing gyms can be a major barrier, limiting investments in grid improvements

- Traditional climbing gyms are relatively simple and inexpensive to install, while smart climbing gyms require a significant investment in both hardware and software, such as in the case of projects such as Con Edison’s smart grid upgrade in New York, where the transition to advanced climbing gyms involves high initial costs and complex system integration

- For many small and medium-sized enterprises (SMEs), the cost of upgrading to advanced climbing gyms may be prohibitive, particularly when compared to the costs of maintaining existing systems.

- For instance, small manufacturing plants in emerging economies may struggle to justify the high initial costs of smart climbing gyms, preferring to stick with cheaper, traditional options

- The integration of advanced climbing gyms into existing electrical networks requires specialized expertise and training, adding to both the financial and operational burden

- For instance, implementing smart climbing gyms in industrial sectors such as those in India’s power sector often requires significant workforce training and the engagement of highly specialized technicians, which adds to project timelines and expenses

- While smart climbing gyms offer long-term benefits, such as reduced maintenance costs and increased energy efficiency, the return on investment may not be immediate. This delayed ROI can deter decision-makers from adopting advanced technologies, as seen in large-scale projects such as those in rural areas of Brazil, where immediate financial returns from infrastructure upgrades are not always visible

Climbing Gym Market Scope

The market is segmented on the basis of category, type, course, application, and end user

|

Segmentation |

Sub-Segmentation |

|

By Category |

|

|

By Type |

|

|

By Course |

|

|

By Application |

|

|

By End User |

|

Climbing Gym Market Regional Analysis

“North America is the Dominant Region in the Climbing Gym Market”

- North America dominates the global climbing gym market due to significant advancements in climbing gym design, equipment, and technology

- Innovative features, such as automated climbing walls and interactive tracking systems, are enhancing the indoor climbing experience and attracting more participants

- Gyms such as The Cliffs in New York lead the way with state-of-the-art technology, including real-time competition features and training modules

- These technological innovations appeal to both beginners and experienced climbers, boosting engagement and participation across the region

- The combination of cutting-edge gym features and a well-established fitness culture ensures North America's continued dominance in the global climbing gym market

“Europe is Projected to Register the Highest Growth Rate”

- Europe is the fastest-growing region in the climbing gym market, driven by a strong outdoor climbing tradition and the rising interest in indoor climbing as a supplement to outdoor experiences

- Countries such as Germany, France, and the UK, with their rich rock-climbing history, are seeing this culture transition seamlessly into the indoor climbing scene

- Gyms such as Boulderwelt in Munich have gained significant popularity by combining outdoor climbing passion with modern indoor gym experiences, attracting a growing number of climbers

- The increasing number of climbing gyms opening across major European cities is contributing to the region's rapid growth in the climbing gym market

- As more people embrace indoor climbing, Europe's climbing gym market is expected to continue its fast-paced expansion in the coming years

Climbing Gym Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Boulderklub Kreuzberg (Germany)

- Brooklyn Boulders (U.S.)

- CityROCK (South Africa)

- Climb So iLL (U.S.)

- Glasgow Climbing Centre (U.K.)

- Go Nature H.K. Ltd. (Hong Kong)

- High Point (U.S.)

- Latitude Climbing LLC (U.S.)

- Momentum Indoor Climbing (U.S.)

- Movement (U.S.)

- Sender One Climbing LLC (U.S.)

- Sputnik Climbing SL (Spain)

- The Castle Climbing Centre (U.K.)

- The Cliffs (U.S.)

- The Gravity Vault (U.S.)

- Uprising Climbing Walls Ltd. (U.K.)

- Vertical Endeavors (U.S.)

- Vertical World, Inc. (U.S.)

- Climbing Centre Group Ltd. (U.K.)

- Sharma Climbing SL (Spain)

Latest Developments in Global Climbing Gym Market

- In January 2024, a new indoor climbing gym, Climb Moab, opened in Moab, Utah. Known for its outdoor climbing spots such as Indian Creek and Wall Street, Moab now offers a dedicated indoor space for local climbers. The gym was started by local climbers Britt Zale and Kaya Lindsay, with the support of an investor, Justin Beitler. The facility offers bouldering, top-roping, and climbing-specific training equipment such as Kilter boards and treadwalls. The founders aimed to create not just a gym, but a community space where climbers can gather, train, and form friendships. With support from local organizations, the gym has hosted events such as movie nights and climbing parties. Community response has exceeded expectations, with many climbers enjoying both the training and social aspects of the gym

- In November 2023, Movement Climbing, Yoga, and Fitness announced its acquisition of The Cliffs Climbing + Fitness gyms, expanding its presence on the East Coast. The acquisition includes The Cliffs' prominent locations in New York and Pennsylvania, notably the largest climbing facility in Pennsylvania, The Cliffs at Callowhill in Philadelphia. The Cliffs gyms feature state-of-the-art climbing walls, fitness centers, and specialized training equipment. The Gowanus location in New York is particularly large, offering 36,000 square feet of climbing space and a variety of amenities, including a rooftop deck with views of Manhattan and Brooklyn. This acquisition strengthens Movement's position as a leading climbing gym network in the U.S.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CLIMBING GYM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CLIMBING GYM MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.10 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL CLIMBING GYM MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6. PRODUCTION CAPACITY OUTLOOK

7. PRICING ANALYSIS

8. BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS

8.2 PRODUCT VS BRAND OVERVIEW

9. IMPACT OF ECONOMIC SLOWDOWN

9.1 IMPACT ON PRICES

9.2 IMPACT ON SUPPLY CHAIN

9.3 IMPACT ON SHIPMENT

9.4 IMPACT ON DEMAND

9.5 IMPACT ON STRATEGIC DECISIONS

10. SUPPLY CHAIN ANALYSIS

10.1 OVERVIEW

10.2 LOGISTIC COST SCENARIO

10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

11. GLOBAL CLIMBING GYM MARKET, BY TYPE, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 INDOOR CLIMBING GYMS

11.2.1 INDOOR CLIMBING GYMS, BY CATEGORY

11.2.1.1. BOULDERING

11.2.1.2. LEAD CLIMBING

11.2.1.3. TOP ROPE CLIMBING

11.2.1.4. TRAD CLIMBING

11.2.1.5. AID CLIMBING

11.2.1.6. SPEED CLIMBING

11.2.1.7. OTHERS

11.3 OUTDOOR CLIMBING GYMS

11.3.1 OUTDOOR CLIMBING GYMS, BY CATEGORY

11.3.1.1. BOULDERING

11.3.1.2. LEAD CLIMBING

11.3.1.3. TOP ROPE CLIMBING

11.3.1.4. TRAD CLIMBING

11.3.1.5. AID CLIMBING

11.3.1.6. SPEED CLIMBING

11.3.1.7. OTHERS

12. GLOBAL CLIMBING GYM MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 BOULDERING

12.3 LEAD CLIMBING

12.4 TOP ROPE CLIMBING

12.5 TRAD CLIMBING

12.6 AID CLIMBING

12.7 SPEED CLIMBING

12.8 OTHERS

13. GLOBAL CLIMBING GYM MARKET, BY FACILITY SIZE, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 SMALL-SCALE CLIMBING GYMS

13.3 MEDIUM-SCALE CLIMBING GYMS

13.4 LARGE-SCALE CLIMBING GYMS

14. GLOBAL CLIMBING GYM MARKET, BY PRICE RANGE, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 STANDARD

14.3 PREMIUM

15. GLOBAL CLIMBING GYM MARKET, BY OWNERSHIP TYPE, 2022-2031 (USD MILLION)

15.1 OVERVIEW

15.2 INDEPENDENT CLIMBING GYMS

15.3 FRANCHISE CLIMBING GYMS

16. GLOBAL CLIMBING GYM MARKET, BY CUSTOMER DEMOGRAPHICS, 2022-2031 (USD MILLION)

16.1 OVERVIEW

16.2 BEGINNER CLIMBERS

16.3 INTERMEDIATE CLIMBERS

16.4 ADVANCED CLIMBERS

17. GLOBAL CLIMBING GYM MARKET, BY REVENUE SOURCE, 2022-2031 (USD MILLION)

17.1 OVERVIEW

17.2 MEMBERSHIP FEES

17.3 DAY PASSES

17.4 EQUIPMENT RENTALS

17.5 MERCHANDISE SALES

17.6 TRAINING PROGRAMS

17.7 OTHERS

18. GLOBAL CLIMBING GYM MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

18.1 OVERVIEW

18.2 RESIDENTIAL

18.2.1 RESIDENTIAL, BY GYM TYPE

18.2.1.1. INDOOR CLIMBING GYMS

18.2.1.1.1. INDOOR CLIMBING GYMS, BY CATEGORY

18.2.1.1.1.1 BOULDERING

18.2.1.1.1.2 LEAD CLIMBING

18.2.1.1.1.3 TOP ROPE CLIMBING

18.2.1.1.1.4 TRAD CLIMBING

18.2.1.1.1.5 AID CLIMBING

18.2.1.1.1.6 SPEED CLIMBING

18.2.1.1.1.7 OTHERS

18.2.1.2. OUTDOOR CLIMBING GYMS

18.2.1.2.1. OUTDOOR CLIMBING GYMS, BY CATEGORY

18.2.1.2.1.1 BOULDERING

18.2.1.2.1.2 LEAD CLIMBING

18.2.1.2.1.3 TOP ROPE CLIMBING

18.2.1.2.1.4 TRAD CLIMBING

18.2.1.2.1.5 AID CLIMBING

18.2.1.2.1.6 SPEED CLIMBING

18.2.1.2.1.7 OTHERS

18.3 COMMERCIAL

18.3.1 COMMERCIAL, BY CATEGORY

18.3.1.1. MALLS / GAMING ARCADES

18.3.1.2. MOUNTAIN CLIMBING TRAINING CENTERS & GYMS

18.3.1.3. RESORTS

18.3.1.4. ENTERTAINMENT PARKS

18.3.1.5. OTHERS

18.3.2 COMMERCIAL, BY GYM TYPE

18.3.2.1. INDOOR CLIMBING GYMS

18.3.2.1.1. INDOOR CLIMBING GYMS, BY CATEGORY

18.3.2.1.1.1 BOULDERING

18.3.2.1.1.2 LEAD CLIMBING

18.3.2.1.1.3 TOP ROPE CLIMBING

18.3.2.1.1.4 TRAD CLIMBING

18.3.2.1.1.5 AID CLIMBING

18.3.2.1.1.6 SPEED CLIMBING

18.3.2.1.1.7 OTHERS

18.3.2.2. OUTDOOR CLIMBING GYMS

18.3.2.2.1. OUTDOOR CLIMBING GYMS, BY CATEGORY

18.3.2.2.1.1 BOULDERING

18.3.2.2.1.2 LEAD CLIMBING

18.3.2.2.1.3 TOP ROPE CLIMBING

18.3.2.2.1.4 TRAD CLIMBING

18.3.2.2.1.5 AID CLIMBING

18.3.2.2.1.6 SPEED CLIMBING

18.3.2.2.1.7 OTHERS

19. GLOBAL CLIMBING GYM MARKET, BY END USER, 2022-2031 (USD MILLION)

19.1 OVERVIEW

19.2 ADULTS

19.2.1 MALE

19.2.2 FEMALE

19.3 TEENAGERS

19.4 CHILDREN

19.5 FAMILIES

19.6 CORPORATE GROUPS

19.7 SCHOOLS AND EDUCATIONAL INSTITUTIONS

19.8 OTHERS

20. GLOBAL CLIMBING GYM MARKET, BY GEOGRAPHY , 2022-2031 (USD MILLION)

20.1 GLOBAL CLIMBING GYM MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.2 NORTH AMERICA

20.2.1 U.S.

20.2.2 CANADA

20.2.3 MEXICO

20.3 EUROPE

20.3.1 GERMANY

20.3.2 U.K.

20.3.3 ITALY

20.3.4 FRANCE

20.3.5 SPAIN

20.3.6 RUSSIA

20.3.7 SWITZERLAND

20.3.8 TURKEY

20.3.9 BELGIUM

20.3.10 NETHERLANDS

20.3.11 LUXEMBURG

20.3.12 REST OF EUROPE

20.4 ASIA-PACIFIC

20.4.1 JAPAN

20.4.2 CHINA

20.4.3 SOUTH KOREA

20.4.4 INDIA

20.4.5 SINGAPORE

20.4.6 THAILAND

20.4.7 INDONESIA

20.4.8 MALAYSIA

20.4.9 PHILIPPINES

20.4.10 AUSTRALIA

20.4.11 NEW ZEALAND

20.4.12 REST OF ASIA-PACIFIC

20.5 SOUTH AMERICA

20.5.1 BRAZIL

20.5.2 ARGENTINA

20.5.3 REST OF SOUTH AMERICA

20.6 MIDDLE EAST AND AFRICA

20.6.1 SOUTH AFRICA

20.6.2 EGYPT

20.6.3 SAUDI ARABIA

20.6.4 UNITED ARAB EMIRATES

20.6.5 ISRAEL

20.6.6 REST OF MIDDLE EAST AND AFRICA

21. GLOBAL CLIMBING GYM MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21.5 MERGERS AND ACQUISITIONS

21.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

21.7 EXPANSIONS

21.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

22. SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

23. GLOBAL CLIMBING GYM MARKET- COMPANY PROFILE

23.1 BOULDERKLUB KREUZBERG GMBH

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 RECENT UPDATES

23.2 BROOKLYN BOULDERS LLC

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT UPDATES

23.3 CITYROCK

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 RECENT UPDATES

23.4 CLIMB SO ILL

23.4.1 COMPANY SNAPSHOT

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT UPDATES

23.5 GLASGOW CLIMBING CENTRE

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT UPDATES

23.6 GO NATURE H.K. LTD.

23.6.1 COMPANY SNAPSHOT

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 RECENT UPDATES

23.7 HIGH POINT

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT UPDATES

23.8 LATITUDE CLIMBING LLC

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT UPDATES

23.9 MOMENTUM INDOOR CLIMBING

23.9.1 COMPANY SNAPSHOT

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 RECENT UPDATES

23.10 MOVEMENT

23.10.1 COMPANY SNAPSHOT

23.10.2 REVENUE ANALYSIS

23.10.3 PRODUCT PORTFOLIO

23.10.4 RECENT UPDATES

23.11 SENDER ONE CLIMBING LLC

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT UPDATES

23.12 SPUTNIK CLIMBING SL

23.12.1 COMPANY SNAPSHOT

23.12.2 REVENUE ANALYSIS

23.12.3 PRODUCT PORTFOLIO

23.12.4 RECENT UPDATES

23.13 THE CASTLE CLIMBING CENTRE

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT UPDATES

23.14 THE CLIFFS

23.14.1 COMPANY SNAPSHOT

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT UPDATES

23.15 THE GRAVITY VAULT INDOOR ROCK GYMS

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT UPDATES

23.16 UPRISING CLIMBING WALLS LTD.

23.16.1 COMPANY SNAPSHOT

23.16.2 REVENUE ANALYSIS

23.16.3 PRODUCT PORTFOLIO

23.16.4 RECENT UPDATES

23.17 VERTICAL ENDEAVORS

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT UPDATES

23.18 VERTICAL WORLD INC.

23.18.1 COMPANY SNAPSHOT

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT UPDATES

23.19 CLIMBING CENTRE GROUP LTD.

23.19.1 COMPANY SNAPSHOT

23.19.2 REVENUE ANALYSIS

23.19.3 PRODUCT PORTFOLIO

23.19.4 RECENT UPDATES

23.20 SHARMA CLIMBING SL

23.20.1 COMPANY SNAPSHOT

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT UPDATES

23.21 BERTABLOCK BOULDERHALLE GMBH

23.21.1 COMPANY SNAPSHOT

23.21.2 REVENUE ANALYSIS

23.21.3 PRODUCT PORTFOLIO

23.21.4 RECENT UPDATES

23.22 BETA BOULDERS

23.22.1 COMPANY SNAPSHOT

23.22.2 REVENUE ANALYSIS

23.22.3 PRODUCT PORTFOLIO

23.22.4 RECENT UPDATES

23.23 DAV CLIMBING AND BOULDERING CENTRE OF MUNICH

23.23.1 COMPANY SNAPSHOT

23.23.2 REVENUE ANALYSIS

23.23.3 PRODUCT PORTFOLIO

23.23.4 RECENT UPDATES

23.24 EDINBURGH INTERNATIONAL CLIMBING AREA

23.24.1 COMPANY SNAPSHOT

23.24.2 REVENUE ANALYSIS

23.24.3 PRODUCT PORTFOLIO

23.24.4 RECENT UPDATES

23.25 KLATTERCENTRET

23.25.1 COMPANY SNAPSHOT

23.25.2 REVENUE ANALYSIS

23.25.3 PRODUCT PORTFOLIO

23.25.4 RECENT UPDATES

23.26 METROROCK

23.26.1 COMPANY SNAPSHOT

23.26.2 REVENUE ANALYSIS

23.26.3 PRODUCT PORTFOLIO

23.26.4 RECENT UPDATES

23.27 THE KEGEL GMBH

23.27.1 COMPANY SNAPSHOT

23.27.2 REVENUE ANALYSIS

23.27.3 PRODUCT PORTFOLIO

23.27.4 RECENT UPDATES

23.28 WALLTOPIA

23.28.1 COMPANY SNAPSHOT

23.28.2 REVENUE ANALYSIS

23.28.3 PRODUCT PORTFOLIO

23.28.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

24. RELATED REPORTS

25. QUESTIONNAIRE

26. CONCLUSION

27. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.