Global Clinical Communication And Collaboration Software Market

Market Size in USD Billion

CAGR :

%

USD

2.34 Billion

USD

6.19 Billion

2024

2032

USD

2.34 Billion

USD

6.19 Billion

2024

2032

| 2025 –2032 | |

| USD 2.34 Billion | |

| USD 6.19 Billion | |

|

|

|

|

Clinical Communication and Collaboration Software Market Size

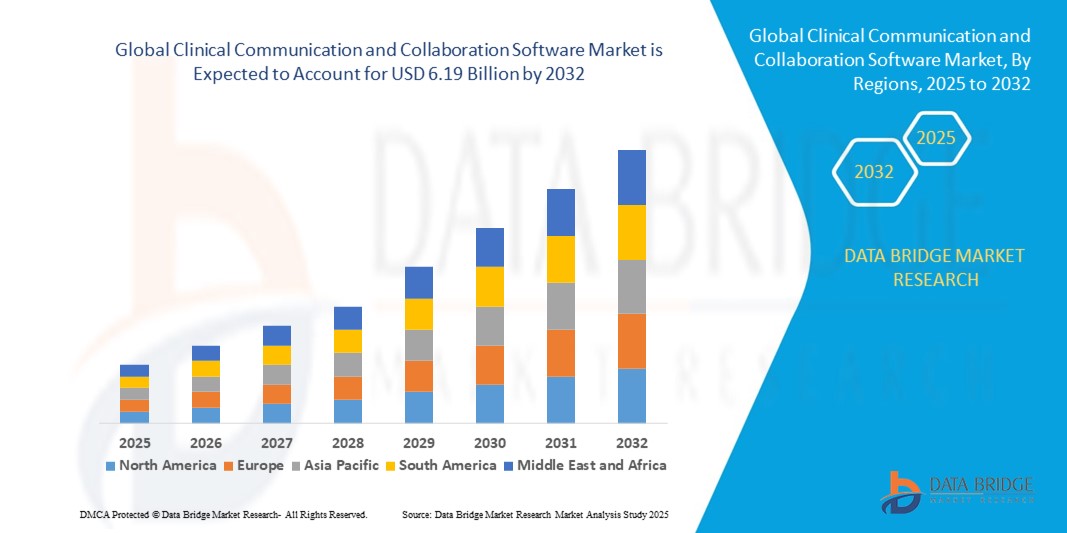

- The global clinical communication and collaboration software market size was valued at USD 2.34 billion in 2024 and is expected to reach USD 6.19 billion by 2032, at a CAGR of 12.90% during the forecast period

- The market growth is largely fuelled by the rising need for efficient communication among healthcare teams, increasing adoption of digital health solutions, and the growing demand for real-time patient data sharing to improve clinical outcomes

- Additional factors driving growth include the integration of advanced technologies such as AI, cloud computing, and mobile platforms, which enable seamless coordination among healthcare providers across multiple settings

Clinical Communication and Collaboration Software Market Analysis

- The market is witnessing strong adoption in hospitals, outpatient care centers, and telehealth services, where real-time messaging, alerts, and care coordination are critical

- Furthermore, the increasing integration of mobile applications and wearable devices is enabling healthcare providers to monitor patients remotely and respond promptly to critical health events

- North America dominated the clinical communication and collaboration software market with the largest revenue share of 42% in 2024, driven by the high adoption of digital health technologies, advanced IT infrastructure, and increasing focus on improving patient care through real-time communication

- Asia-Pacific region is expected to witness the highest growth rate in the global clinical communication and collaboration software market, driven by increasing healthcare investments, expanding telehealth adoption, and rising demand for interoperable cloud-based communication solutions across hospitals, clinics, and remote care settings

- The solutions segment held the largest market revenue share in 2024, driven by the adoption of advanced software platforms that enable secure messaging, real-time alerts, and workflow integration across healthcare settings. These solutions help improve patient care, streamline clinical operations, and ensure regulatory compliance, making them the preferred choice for hospitals and multi-specialty clinics

Report Scope and Clinical Communication and Collaboration Software Market Segmentation

|

Attributes |

Clinical Communication and Collaboration Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Clinical Communication and Collaboration Software Market Trends

Rise of Real-Time Digital Communication in Healthcare

- The growing shift toward real-time digital communication is transforming healthcare workflows by enabling instant collaboration among care teams. The speed and accessibility of these platforms allow for immediate clinical decisions, especially in hospitals and multi-specialty clinics where timely coordination is critical. This results in improved patient outcomes and reduced medical errors

- The high demand for integrated communication in remote and under-resourced regions is accelerating the adoption of mobile applications, secure messaging platforms, and cloud-based collaboration tools. These solutions are particularly effective where hospital infrastructure is limited, helping reduce communication delays and ensure timely interventions. The trend is further supported by government and healthcare IT initiatives promoting digital transformation

- The affordability and ease of deployment of modern software solutions are making them attractive for routine clinical coordination, leading to enhanced workflow efficiency. Healthcare providers benefit from streamlined communication without incurring excessive operational costs or logistical hurdles, which ultimately improves overall patient care management

- For instance, in 2023, several regional hospital networks in India reported reduced patient readmission rates after implementing cloud-based clinical messaging platforms. These systems allowed faster communication between nurses, doctors, and lab technicians, improving care coordination while reducing treatment delays and administrative burden

- While digital communication tools are accelerating real-time collaboration and supporting operational efficiency, their impact depends on continuous innovation, staff training, and cybersecurity measures. Vendors must focus on user-friendly interfaces, interoperability, and scalable deployment strategies to fully capitalize on this growing demand

Clinical Communication and Collaboration Software Market Dynamics

Driver

Rising Demand for Efficient Healthcare Communication and Care Coordination

- The increasing need for streamlined communication in hospitals, clinics, and telehealth services is pushing healthcare providers to adopt collaborative software solutions. Efficient messaging, alerts, and shared patient data enable faster clinical decision-making and improve overall care quality

- Healthcare organizations are increasingly aware of the financial and clinical risks associated with poor communication, including medical errors, delayed treatments, and reduced patient satisfaction. This awareness has led to the regular use of integrated communication platforms across hospitals of all sizes

- Public sector efforts and healthcare IT initiatives have strengthened digital infrastructure and interoperability standards. From subsidized adoption programs to nationwide digital health strategies, supportive frameworks are helping providers implement real-time collaboration tools effectively

- For instance, in 2022, the U.S. Department of Health and Human Services promoted the integration of secure messaging platforms across hospital networks, boosting adoption of clinical communication software nationwide

- While awareness and institutional support are driving the market, there is still a need to enhance cybersecurity, ensure software affordability, and integrate platforms seamlessly into existing electronic health record systems to sustain adoption

Restraint/Challenge

High Implementation Costs and Data Security Concerns

- The high price of advanced clinical communication software, including cloud-based and AI-enabled platforms, limits adoption among smaller healthcare providers and clinics. Large hospital systems typically absorb these costs, but smaller facilities may delay implementation due to budget constraints. In addition, ongoing maintenance fees, software updates, and licensing costs add to the financial burden, making it difficult for small clinics to implement comprehensive solutions

- In many healthcare settings, staff lack training on complex digital systems, which can reduce efficiency and delay adoption. Infrastructure gaps, such as poor internet connectivity or outdated IT systems, further hinder effective deployment. This often results in underutilization of software features and increases the risk of errors, reducing the overall return on investment for healthcare organizations

- Market penetration is also affected by stringent data privacy regulations and concerns about patient information security. Providers must comply with HIPAA, GDPR, and other standards, which can increase implementation complexity and cost. Frequent audits, encryption requirements, and secure access management protocols create additional operational challenges, particularly for smaller clinics with limited IT resources

- For instance, in 2023, several small clinics in Sub-Saharan Africa reported limited access to secure clinical communication platforms, citing high costs and inadequate IT infrastructure as major barriers. Many of these clinics continue to rely on manual processes or unsecured messaging channels, which increases the likelihood of delayed communication and medical errors

- While technology continues to advance, addressing cost, training, and security challenges remains critical. Stakeholders must focus on scalable, secure, and user-friendly solutions to bridge the digital communication gap and unlock long-term market potential. Failure to address these challenges could hinder the adoption of innovative solutions, particularly in emerging markets and rural healthcare settings

Clinical Communication and Collaboration Software Market Scope

The market is segmented on the basis of component, deployment, end use, and application.

- By Component

On the basis of component, the clinical communication and collaboration software market is segmented into solutions and services. The solutions segment held the largest market revenue share in 2024, driven by the adoption of advanced software platforms that enable secure messaging, real-time alerts, and workflow integration across healthcare settings. These solutions help improve patient care, streamline clinical operations, and ensure regulatory compliance, making them the preferred choice for hospitals and multi-specialty clinics.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing demand for managed services, consulting, and integration support. Services such as deployment assistance, staff training, and technical support help healthcare providers optimize the use of communication software, ensuring smooth adoption and better clinical outcomes.

- By Deployment

On the basis of deployment, the market is segmented into cloud and on-premise. The cloud segment held the largest revenue share in 2024, driven by the flexibility, scalability, and cost-effectiveness of cloud-based platforms. Cloud deployment allows healthcare organizations to access secure communication tools from multiple locations and devices, improving collaboration and operational efficiency.

The on-premise segment is expected to witness the fastest growth rate from 2025 to 2032 due to concerns over data security, compliance, and the need for customized solutions that integrate with existing IT infrastructure in large hospital networks.

- By End Use

On the basis of end use, the market is segmented into hospitals, clinical labs, long-term care facilities, and other healthcare providers. The hospitals segment accounted for the largest revenue share in 2024, driven by the critical need for real-time communication, emergency alerts, and efficient care coordination among multidisciplinary teams.

The clinical labs segment is expected to witness the fastest growth rate from 2025 to 2032 due to the increasing requirement for secure and timely lab result sharing with physicians and care teams, helping reduce diagnostic delays and improve patient management.

- By Application

On the basis of application, the market is segmented into lab and radiology communication, nurse communication, patient communication & emergency alerts, and physician communication. The nurse communication segment held the largest market share in 2024, driven by the need for efficient coordination between nurses and physicians for routine patient care and emergency response.

The physician communication segment is expected to witness the fastest growth rate from 2025 to 2032 due to the rising adoption of secure messaging platforms, mobile applications, and telehealth solutions that facilitate rapid consultation and decision-making across departments and facilities.

Clinical Communication and Collaboration Software Market Regional Analysis

- North America dominated the clinical communication and collaboration software market with the largest revenue share of 42% in 2024, driven by the high adoption of digital health technologies, advanced IT infrastructure, and increasing focus on improving patient care through real-time communication

- Healthcare providers in the region value secure messaging, automated alerts, and workflow integration that streamline clinical operations and reduce medical errors

- This widespread adoption is further supported by high healthcare IT spending, favorable government initiatives, and the growing preference for cloud-based and AI-enabled collaboration tools across hospitals, clinics, and long-term care facilities

U.S. Clinical Communication and Collaboration Software Market Insight

The U.S. market captured the largest revenue share in 2024 within North America, fueled by rapid digital transformation in hospitals and healthcare networks. Providers are increasingly prioritizing the integration of secure messaging, mobile applications, and automated alerts to enhance patient care and operational efficiency. The growing use of AI-enabled platforms, interoperability with electronic health records (EHR), and telehealth adoption are further propelling market growth. Government support for digital health solutions and HIPAA-compliant software adoption significantly contributes to market expansion.

Europe Clinical Communication and Collaboration Software Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent healthcare regulations and increasing demand for patient-centered care. Rising investments in hospital IT infrastructure, urbanization, and digital health initiatives are fostering adoption. The region is witnessing significant growth across hospitals, clinics, and long-term care facilities, with solutions enabling efficient nurse-physician coordination, patient alerts, and lab result communication.

U.K. Clinical Communication and Collaboration Software Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of digital healthcare platforms and a focus on improving clinical efficiency. Concerns over patient safety, workflow delays, and the need for real-time communication are motivating healthcare providers to adopt collaborative software. The U.K.’s robust hospital network, telemedicine growth, and e-health initiatives continue to stimulate demand.

Germany Clinical Communication and Collaboration Software Market Insight

The Germany market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising awareness of healthcare IT solutions and demand for technologically advanced, secure communication platforms. Hospitals and clinics are adopting software for nurse and physician coordination, emergency alerts, and lab result sharing. Germany’s strong IT infrastructure, focus on innovation, and compliance with EU data privacy regulations encourage widespread adoption.

Asia-Pacific Clinical Communication and Collaboration Software Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding healthcare infrastructure, rising investments in digital health, and increasing adoption of cloud-based communication platforms in countries such as China, Japan, and India. Government initiatives supporting healthcare digitization, combined with rising demand for remote patient monitoring and telehealth services, are accelerating market growth.

Japan Clinical Communication and Collaboration Software Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032 due to its tech-driven healthcare system, aging population, and focus on operational efficiency in hospitals. The adoption of real-time messaging platforms, nurse and physician communication tools, and emergency alert systems is increasing. Integration with IoT devices and electronic health records further fuels growth, while government support for smart hospital initiatives enhances adoption across clinical settings.

China Clinical Communication and Collaboration Software Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, driven by expanding hospital networks, increasing digital health investments, and high adoption of mobile communication solutions. Real-time collaboration platforms are being implemented across hospitals, clinics, and long-term care facilities to improve patient outcomes. The government’s push toward smart hospitals, combined with the availability of affordable cloud-based solutions, is propelling market growth.

Clinical Communication and Collaboration Software Market Share

The Clinical Communication and Collaboration Software industry is primarily led by well-established companies, including:

- Epic Systems Corporation (U.S.)

- Cerner Corporation (U.S.)

- Allscripts Healthcare Solutions (U.S.)

- Medtronic (Ireland)

- NantHealth (U.S.)

- Teladoc Health (U.S.)

- VSee (U.S.)

- Qventus (U.S.)

- Cisco Systems (U.S.)

- Amwell (U.S.)

- Microsoft (U.S.)

- Siemens Healthineers (Germany)

- IBM Watson Health (U.S.)

- Luma Health (U.S.)

Latest Developments in Global Clinical Communication and Collaboration Software Market

- In November 2024, in a strategic move to revolutionize customer experiences in health assessments, Canara HSBC Life Insurance (CHLI) has partnered with Fedo.ai, a leader in AI-powered health-tech solutions. The collaboration integrates Fedo's advanced facial scan technology with CHLI’s insurance expertise, offering a cutting-edge, non-invasive approach to health assessments. This innovation enables customers to complete essential health checks in just 14 seconds, without the need for hospital visits or invasive procedures

- In November 2024, WellSky, a leader in healthcare technology, has unveiled SkySense, a new suite of artificial intelligence-powered tools designed to improve clinical operations and increase provider efficiency. SkySense aims to streamline documentation processes and reduce errors by automating data extraction, transcription, and summarization, ultimately enhancing patient-provider interactions and improving overall care delivery

- In June 2024, Keragon, an AI-powered, HIPAA-compliant automation platform for healthcare, has officially launched out of stealth with a USD 3 million funding boost. Positioned as the first no-code workflow automation platform specifically designed for the U.S. healthcare industry, Keragon is already supporting a wide range of users from small clinics to large hospitals and digital health startups across all 50 states. Keragon seamlessly integrates with various popular healthcare software, such as EHRs, healthcare CRMs, and appointment scheduling systems, empowering healthcare professionals without technical backgrounds to automate workflows efficiently

- In January 2023, CenTrak has launched WorkflowRT, a scalable, cloud-based platform designed to automate clinical workflows and communications, addressing the challenge of manual documentation in healthcare settings. The platform integrates real-time location system (RTLS) technology with built-in reporting tools to help healthcare teams monitor and optimize patient flow. By leveraging historical metrics, WorkflowRT enables process improvements that have resulted in reduced patient wait times, increased care time, and higher satisfaction among both patients and staff

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Clinical Communication And Collaboration Software Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Clinical Communication And Collaboration Software Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Clinical Communication And Collaboration Software Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.