Global Clinical Data Exchange Market

Market Size in USD Billion

CAGR :

%

USD

2.31 Billion

USD

5.36 Billion

2025

2033

USD

2.31 Billion

USD

5.36 Billion

2025

2033

| 2026 –2033 | |

| USD 2.31 Billion | |

| USD 5.36 Billion | |

|

|

|

|

Clinical Data Exchange Market Size

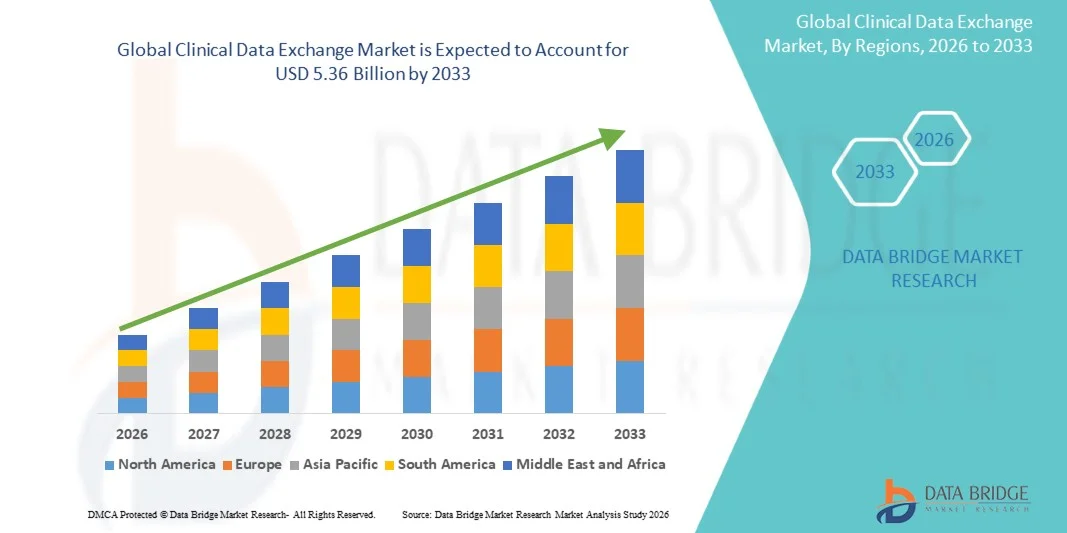

- The global clinical data exchange market size was valued at USD 2.31 billion in 2025 and is expected to reach USD 5.36 billion by 2033, at a CAGR of 11.10% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital health solutions, interoperability initiatives, and the rising demand for secure, efficient, and real-time data exchange across healthcare providers, payers, and patients

- Furthermore, growing focus on value-based care, electronic health record (EHR) integration, and regulatory mandates promoting data standardization and health information exchange are accelerating the uptake of Clinical Data Exchange solutions, thereby significantly boosting the industry's growth

Clinical Data Exchange Market Analysis

- Clinical Data Exchange platforms, enabling secure, standardized, and real-time sharing of patient health information across healthcare providers, hospitals, clinics, and laboratories, are increasingly vital components of modern healthcare systems due to their role in improving care coordination, reducing medical errors, and enhancing operational efficiency

- The escalating demand for Clinical Data Exchange solutions is primarily fueled by the growing adoption of electronic health records (EHRs), increasing need for interoperability between healthcare systems, rising focus on value-based care, and stringent data privacy and compliance regulations

- North America dominated the clinical data exchange market with the largest revenue share of approximately 40% in 2025, supported by advanced healthcare infrastructure, high adoption of EHR systems, stringent data privacy regulations, and growing investments in health information technology by hospitals and healthcare providers. The U.S. leads the region due to strong integration of clinical data exchange platforms in large hospital networks, increased focus on value-based care, and government initiatives promoting interoperability

- Asia-Pacific is projected to be the fastest-growing region in the clinical data exchange market during the forecast period, with rapid adoption of digital health technologies, expanding hospital infrastructure, rising healthcare IT investments, and growing initiatives to improve patient data accessibility in countries such as China, India, Japan, and South Korea

- Adults accounted for the largest market revenue share of 48.2% in 2025, driven by higher prevalence of chronic diseases, hospitalizations, and long-term care requirements

Report Scope and Clinical Data Exchange Market Segmentation

|

Attributes |

Clinical Data Exchange Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Clinical Data Exchange Market Trends

“Rising Adoption of Interoperable Digital Health Platforms”

- A key trend in the global clinical data exchange market is the increasing adoption of interoperable digital health platforms that enable seamless, real-time sharing of patient data across hospitals, clinics, diagnostic centers, and other care facilities

- Healthcare providers are shifting toward cloud-based and blockchain-enabled solutions to facilitate secure and efficient data exchange while reducing operational delays

- For instance, in January 2023, Cerner Corporation launched its new “Health Data Exchange Cloud” platform, enabling over 5,000 U.S. hospitals to securely share patient information in real time while integrating with telehealth and AI-based analytics tools, exemplifying the trend toward interoperable digital health systems

- Integration with telemedicine, remote patient monitoring, and population health management platforms is becoming more common, allowing better patient tracking and care coordination

- Healthcare organizations are investing in standardized protocols such as HL7 FHIR and CDA to improve compatibility across disparate systems, enabling smooth data transfer

- Artificial intelligence and analytics tools are being embedded in clinical data exchange platforms to provide actionable insights from patient data and improve clinical decision-making

- Patient-centric care models and value-based healthcare are driving hospitals and clinics to adopt solutions that reduce duplicate tests, prevent errors, and improve patient outcomes

- There is a rising focus on multi-institutional collaborations, such as data sharing among hospitals, research centers, and public health agencies, to enhance epidemiological studies and clinical trials

- Cloud adoption and software-as-a-service (SaaS) models are trending, allowing healthcare facilities to access scalable, low-maintenance data exchange platforms without heavy upfront investments

- Growing investments in digital health initiatives, especially post-pandemic, are accelerating adoption across developed and emerging markets

- As healthcare systems continue to prioritize efficiency, interoperability, and patient safety, Clinical Data Exchange solutions are expected to remain a critical trend shaping the market through 2033

Clinical Data Exchange Market Dynamics

Driver

“Growing Need Due to Increasing Healthcare Digitalization and Data Interoperability”

- The rapid digital transformation in healthcare systems worldwide is driving demand for efficient Clinical Data Exchange solutions. Increasing adoption of electronic health records (EHRs) and interoperable health IT systems is fueling the need for secure, seamless, and real-time data sharing across healthcare providers

- For instance, in March 2024, Epic Systems expanded its interoperability platform to enable faster and more secure sharing of patient records among hospitals, clinics, and diagnostic centers

- The growing prevalence of chronic diseases and complex patient care pathways is necessitating the exchange of accurate clinical data across multiple healthcare settings

- Healthcare providers rely on Clinical Data Exchange solutions to optimize workflows, support clinical decision-making, and enhance patient monitoring

- Implementation of standardized protocols such as HL7 FHIR is making data sharing more efficient and secure, accelerating adoption globally

- Rising government initiatives, such as the U.S. ONC Cures Act Final Rule and the European eHealth Digital Services Act, are mandating seamless data interoperability, boosting market demand

- Integration into telemedicine and remote monitoring services contributes to market growth

- Enhanced analytics capabilities of Clinical Data Exchange platforms help providers gain actionable insights, reduce errors, and optimize operational efficiency

- Cost-effectiveness, improved care coordination, and reduced hospital readmissions further drive adoption

- The demand for patient-centric, interoperable healthcare systems ensures sustained growth for Clinical Data Exchange solutions

Restraint/Challenge

“Concerns Regarding Data Security, Privacy, and Implementation Costs”

- Adoption of Clinical Data Exchange solutions faces challenges due to potential data breaches, cybersecurity threats, and concerns around patient privacy

- Compliance with regulations such as HIPAA, GDPR, and other regional data privacy laws increases implementation complexity and costs

- Reports of ransomware attacks on hospitals in 2023 highlighted the need for robust cybersecurity, making some providers hesitant

- High initial costs for secure, interoperable platforms—including licensing, hardware, and staff training—can limit adoption, particularly in small or budget-constrained facilities

- Inconsistent standards and lack of universal protocols across healthcare IT systems hinder seamless data exchange

- Resistance from staff due to learning curves may delay implementation and reduce productivity initially

- Ongoing maintenance, software updates, and cybersecurity measures add operational costs

- Unclear return on investment or integration challenges with existing EHR systems may slow adoption

- For instance, in July 2022, the University of Vermont Health Network suffered a data breach impacting over 25,000 patient records, leading to temporary suspension of its Clinical Data Exchange interfaces and increased investment in encryption and secure access controls

- Addressing these challenges through encrypted platforms, compliance-driven solutions, cost-effective deployment, and staff training is essential for long-term growth

- Overcoming these barriers allows Clinical Data Exchange solutions to improve patient care, reduce costs, and enable data-driven healthcare decision-making

Clinical Data Exchange Market Scope

The market is segmented on the basis of type, patient population, age group, modality, indication, and end user

• By Type

On the basis of type, the Clinical Data Exchange market is segmented into data integration platforms, interoperability solutions, health information exchanges (HIE), cloud-based solutions, and others. Data integration platforms accounted for the largest market revenue share of 41.5% in 2025, driven by their ability to consolidate patient information from multiple sources, provide a single source of truth for clinicians, and enable real-time clinical decision-making. Hospitals, large healthcare networks, and diagnostic centers rely on these platforms for seamless integration with electronic health records (EHRs), laboratory information systems, and imaging platforms. They reduce duplication of tests, streamline workflows, and improve efficiency. Post-pandemic telehealth demand, remote patient monitoring, and chronic disease management further reinforce adoption. Data integration platforms also support advanced analytics, population health management, and regulatory compliance like HIPAA and GDPR. North America dominates adoption due to strong IT infrastructure, government incentives, and hospital networks. Features like automated reporting, secure data sharing, and AI-assisted insights improve outcomes. Multi-specialty hospitals and tertiary care centers benefit from reduced clinical errors. Integration with clinical trials, research studies, and patient registries enhances segment leadership.

Interoperability solutions are expected to witness the fastest CAGR of 12.3% from 2026 to 2033, driven by the rising need for seamless data sharing across diverse healthcare systems and institutions. Interoperability enables providers to access real-time patient information from multiple sources, supporting coordinated care, reducing errors, and improving patient engagement. Adoption is encouraged by standards like FHIR (Fast Healthcare Interoperability Resources) and government initiatives promoting cross-institutional data exchange. Cloud-based interoperability platforms allow hospitals, clinics, and diagnostic centers to connect securely with external providers. Mobile health apps, telemedicine, and remote monitoring tools rely heavily on these solutions. Emerging markets in Asia-Pacific, Latin America, and the Middle East are witnessing accelerated adoption. Cost-effectiveness, ease of deployment, and modular solutions attract mid-size hospitals. Integration with EHRs, HIEs, and patient portals ensures comprehensive access. Interoperability solutions improve workflow efficiency, support chronic disease programs, and enhance public health initiatives. Collaboration among multi-specialty centers and research networks further boosts adoption.

• By Patient Population

On the basis of patient population, the market is segmented into adult, pediatric, and infant populations. Adults accounted for the largest market revenue share of 48.2% in 2025, driven by higher prevalence of chronic diseases, hospitalizations, and long-term care requirements. Adult care generates large volumes of clinical data, including imaging, lab results, and medication history, which necessitate robust Clinical Data Exchange systems. Hospitals, diagnostic centers, and specialty clinics rely on these platforms to improve care coordination, reduce duplication, and ensure compliance with reporting and reimbursement requirements. Integration with EHRs, telemedicine, and remote monitoring platforms enhances efficiency. North America dominates adoption due to advanced healthcare IT infrastructure. Cloud-based adult data platforms enable seamless access across multiple facilities. Data security, HIPAA compliance, and patient consent management are key adoption drivers. Advanced analytics for risk stratification and personalized treatment reinforce segment dominance. Population health programs benefit from consolidated adult patient data. Adult patient management platforms improve clinical decision-making, operational efficiency, and patient satisfaction.

The pediatric population segment is expected to witness the fastest CAGR of 11.8% from 2026 to 2033, fueled by adoption in specialized pediatric hospitals, NICUs, and outpatient pediatric clinics. Pediatric Clinical Data Exchange solutions facilitate sharing of vaccination records, growth monitoring, chronic disease management, and telehealth services. Cloud-based pediatric platforms enable secure data access for smaller hospitals and clinics. Integration with maternal and perinatal records improves care coordination. Government initiatives and private investments in child healthcare digitization support growth. Mobile health and remote monitoring for children with chronic conditions further accelerate adoption. Real-time data access ensures timely interventions. Multi-specialty collaboration in pediatric cardiology, oncology, and endocrinology drives adoption. Emerging markets increasingly implement pediatric data exchange systems. Analytics for growth tracking, early diagnosis, and preventive care improve outcomes.

• By Age Group

On the basis of age group, the market is segmented into neonates, pediatrics, and adults. Adults held the largest market revenue share of 49.6% in 2025, supported by chronic disease management, hospital network requirements, and EHR integration. Adult patients produce significant data, necessitating centralized exchange systems. Hospitals and diagnostic centers rely on adult-focused platforms for efficient workflows and regulatory compliance. Advanced analytics, telehealth integration, and secure cloud-based access reinforce adoption.

Neonates are expected to witness the fastest CAGR of 12.1% from 2026 to 2033, driven by NICU adoption, specialized monitoring programs, and postnatal care initiatives. Secure neonatal Clinical Data Exchange enables monitoring of growth, nutrition, and critical interventions. Integration with maternal health records and telemedicine accelerates adoption. Smaller hospitals leverage cloud-based neonatal data platforms. Early intervention and critical care programs benefit from real-time access to patient data. Government health programs and emerging market adoption support growth.

• By Modality

On the basis of modality, the Clinical Data Exchange market is segmented into electronic health record (EHR) integration, health information exchange (HIE), and patient portals. EHR integration accounted for the largest market revenue share of 44.3% in 2025, driven by its ability to centralize patient data across hospitals, clinics, and diagnostic centers. EHR integration facilitates improved clinical decision-making, reduces errors, and streamlines workflows by consolidating lab results, imaging, medication records, and patient history. Hospitals and large healthcare networks rely heavily on these platforms for regulatory compliance, including HIPAA and GDPR. Integration with telehealth and remote monitoring platforms further enhances efficiency. EHR systems support chronic disease management, ICU care, and post-operative monitoring, increasing adoption in tertiary care and specialty hospitals. They also provide advanced analytics for risk stratification, population health management, and predictive insights. Cloud-based EHR solutions enable multi-location access while maintaining secure data sharing. North America dominates adoption due to advanced IT infrastructure and government incentives. Training programs and technical support reinforce confidence in implementation. Hospitals benefit from reduced duplication of tests and enhanced patient engagement. EHR integration is also favored for interoperability with clinical trial data and research registries, solidifying its market leadership.

Health information exchange (HIE) is expected to witness the fastest CAGR of 11.9% from 2026 to 2033, driven by the growing need for seamless data sharing across healthcare institutions and regions. HIE solutions facilitate population health management, coordinated care, and telemedicine, allowing providers to access real-time patient information from multiple sources. Adoption is propelled by government initiatives and standardization protocols such as FHIR (Fast Healthcare Interoperability Resources). Cloud-based HIE platforms allow smaller hospitals and clinics in emerging markets to participate efficiently, reducing implementation costs. Integration with EHRs, patient portals, and mobile health applications accelerates adoption. HIE supports chronic disease programs, emergency care, and preventive healthcare initiatives. Hospitals and diagnostic centers benefit from reduced administrative burden and improved care coordination. Multi-specialty networks leverage HIE for research, epidemiology studies, and clinical trials. Real-time alerts, secure data sharing, and interoperability drive higher adoption in North America and Europe. The rising demand for telehealth and remote patient monitoring further fuels growth. Emerging markets show rapid uptake due to cost-effectiveness and cloud-based deployment. Enhanced data security, compliance, and audit capabilities reinforce trust among healthcare providers.

• By Indication

On the basis of indication, the market is segmented into chronic diseases, acute care, and preventive care. Chronic disease management held the largest market revenue share of 46.7% in 2025, driven by the increasing prevalence of diabetes, cardiovascular diseases, cancer, and other long-term conditions. Clinical Data Exchange platforms enable continuous monitoring, remote consultation, and personalized care, improving patient outcomes and reducing hospital readmissions. Hospitals, clinics, and diagnostic centers rely on these systems to track medication adherence, lab results, and disease progression. Integration with EHRs, telemedicine platforms, and wearable devices enhances real-time patient monitoring. Government health programs and insurance reimbursement initiatives further support adoption. Hospitals benefit from reduced administrative burden, improved care coordination, and enhanced population health management. Cloud-based platforms allow multi-location access and data sharing across departments. Advanced analytics provide insights for risk stratification and preventive interventions. Chronic disease management platforms are increasingly adopted in North America and Europe due to IT infrastructure and healthcare expenditure. Patient engagement tools, alerts, and reporting dashboards improve compliance. Partnerships with remote monitoring device providers drive further growth.

Preventive care is expected to witness the fastest CAGR of 10.8% from 2026 to 2033, fueled by wellness programs, early disease detection initiatives, and integration of wearable health devices. Platforms consolidating preventive care data enable healthcare providers to monitor lifestyle factors, screenings, and immunizations efficiently. Cloud-based preventive care solutions allow small clinics, diagnostic centers, and telehealth providers to participate in population health initiatives. Preventive care adoption is further accelerated by government health campaigns, employer wellness programs, and increasing patient awareness. Data exchange supports early intervention, risk assessment, and personalized health recommendations. Integration with patient portals, mobile apps, and EHRs enables real-time feedback and monitoring. Providers benefit from reduced disease burden, improved patient engagement, and lower long-term healthcare costs. Emerging markets are adopting preventive care solutions to reduce healthcare system strain. Advanced analytics allow predictive modeling and outcome tracking. Remote monitoring and telehealth programs increase access to preventive care. Regulatory compliance and data security maintain trust among users. Digital platforms facilitate coordinated care across multiple providers.

• By End User

On the basis of end user, the market is segmented into hospitals, clinics, diagnostic centers, and others. Hospitals accounted for the largest market revenue share of 61.5% in 2025, due to advanced infrastructure, high patient volumes, and the ability to manage complex workflows. ICU units, specialty care departments, and multi-location hospital networks rely on centralized Clinical Data Exchange for data consolidation, regulatory compliance, and workflow optimization. Hospitals benefit from reduced clinical errors, improved patient engagement, and enhanced care coordination. Integration with EHRs, telemedicine, and remote monitoring platforms enhances operational efficiency. Hospitals also leverage advanced analytics for risk stratification, chronic disease management, and post-operative monitoring. Tertiary and multi-specialty hospitals dominate adoption due to high IT investment, trained personnel, and structured protocols. North America leads due to strong healthcare IT infrastructure and regulatory incentives. Cloud-based deployment supports multi-facility management. Hospitals benefit from audit readiness, reporting capabilities, and seamless research integration. Partnerships with technology vendors improve training, support, and updates.

Clinics and diagnostic centers are expected to witness the fastest CAGR of 9.5% from 2026 to 2033, driven by the increasing use of outpatient services, subscription-based cloud platforms, and affordable SaaS models. Small and mid-sized clinics adopt Clinical Data Exchange systems to manage patient records efficiently, support telehealth consultations, and streamline pre-authorization workflows. Diagnostic centers benefit from faster reporting, reduced duplication of tests, and enhanced data sharing with referring physicians. Cloud-based solutions lower upfront investment costs and simplify deployment. Integration with wearable devices, lab systems, and imaging platforms drives adoption. Emerging markets contribute to growth due to increasing outpatient and preventive care facilities. Mobile-enabled platforms support real-time access, patient engagement, and remote consultation. Interoperability with hospitals and specialists enhances referral management. Analytics help track patient trends, outcomes, and service utilization. Compliance with local regulations ensures trust and adoption. Clinics leverage these platforms to improve operational efficiency, quality of care, and patient satisfaction.

Clinical Data Exchange Market Regional Analysis

- North America dominated the clinical data exchange market with the largest revenue share of approximately 40% in 2025

- Supported by advanced healthcare infrastructure, high adoption of EHR systems, stringent data privacy regulations, and growing investments in health information technology by hospitals and healthcare providers

- The market leads the region due to strong integration of clinical data exchange platforms in large hospital networks, increased focus on value-based care, and government initiatives promoting interoperability

U.S. Clinical Data Exchange Market Insight

The U.S. clinical data exchange market accounted for the largest revenue share in North America in 2025, driven by widespread EHR adoption, robust digital health initiatives, and increasing investments in interoperability solutions. Hospitals and large healthcare networks are actively implementing platforms for secure and efficient clinical data sharing to improve patient outcomes, optimize workflow, and support telehealth services.

Europe Clinical Data Exchange Market Insight

The Europe clinical data exchange market is projected to expand at a significant CAGR during the forecast period, driven by strong regulatory support for patient data interoperability, increased adoption of digital health solutions, and modernization of hospital IT infrastructure. The region is witnessing growing implementation of centralized and federated data exchange models to streamline healthcare delivery and enhance patient data accessibility.

U.K. Clinical Data Exchange Market Insight

The U.K. clinical data exchange market is anticipated to grow steadily, fueled by government-led digital health programs, high adoption of NHS-wide EHR systems, and a growing focus on patient-centric care. The expansion of secure messaging systems and web-based clinical portals is enhancing data integration across primary and secondary healthcare providers.

Germany Clinical Data Exchange Market Insight

The Germany clinical data exchange market is expected to expand at a healthy CAGR, supported by ongoing hospital digitalization projects, stringent GDPR compliance requirements, and increasing investments in AI-enabled data exchange platforms. Hospitals and research centers are adopting advanced solutions to facilitate seamless sharing of clinical data across networks.

Asia-Pacific Clinical Data Exchange Market Insight

The Asia-Pacific clinical data exchange market is poised to grow at the fastest CAGR during the forecast period, driven by rapid adoption of digital health technologies, expanding hospital infrastructure, rising healthcare IT investments, and government initiatives promoting health data interoperability in countries such as China, India, Japan, and South Korea.

Japan Clinical Data Exchange Market Insight

The Japan clinical data exchange market is gaining momentum due to the country’s focus on healthcare modernization, aging population, and government-driven interoperability programs. Hospitals and diagnostic centers are increasingly leveraging cloud-based and AI-enabled platforms to improve data accessibility and clinical decision-making.

China Clinical Data Exchange Market Insight

The China clinical data exchange market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to government initiatives supporting digital health, growing hospital networks, rapid adoption of electronic medical records, and strong investments in health IT infrastructure. The market growth is further supported by the increasing need for secure patient data exchange and telehealth services across urban and semi-urban regions.

Clinical Data Exchange Market Share

The Clinical Data Exchange industry is primarily led by well-established companies, including:

- Orion Health (New Zealand)

- Oracle (U.S.)

- IBM (U.S.)

- MEDITECH (U.S.)

- Epic Systems Corporation (U.S.)

- InterSystems Corporation (U.S.)

- NextGen Healthcare (U.S.)

- Mirth Corporation (U.S.)

- Optum (U.S.)

- Health Catalyst (U.S.)

- Intersystems TrakCare (U.S.)

- Philips Healthcare (Netherlands)

- Siemens Healthineers (Germany)

- Oracle Health Sciences (U.S.)

- McKesson Corporation (U.S.)

- GE Healthcare (U.S.)

- eClinicalWorks (U.S.)

- Cognizant Technology Solutions (U.S.)

- QlikTech International (U.S.)

Latest Developments in Global Clinical Data Exchange Market

- In August 2023, KMS Healthcare launched its CONNECT Interoperability Platform, an extensible solution designed to simplify healthcare data exchange and integration by providing pre‑tested FHIR APIs and robust HL7 conversion tools that enable faster application development and real‑time access to records from multiple EHR systems

- In February 2025, MEDITECH partnered with major tech leaders including Google Cloud, Microsoft, Commure, DrFirst, Health Gorilla, and Suki to showcase advancements in EHR interoperability at the HIMSS 2025 conference, demonstrating new integration capabilities across its Expanse platform to improve clinical workflows

- In February 2025, MEDITECH launched its Traverse Exchange interoperability network, a nationwide platform built on FHIR standards to support secure health information exchange (HIE) and real‑time data sharing among compliant health systems and providers

- In February 2025, Secure Exchange Solutions (SES) expanded its clinical data exchange capabilities through deeper participation in the MEDITECH Alliance, driving improved referral management, health event notifications, and integrated care management across the MEDITECH provider ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.