Global Clinical Decision Support Systems Market

Market Size in USD Billion

CAGR :

%

USD

6.81 Billion

USD

25.44 Billion

2024

2032

USD

6.81 Billion

USD

25.44 Billion

2024

2032

| 2025 –2032 | |

| USD 6.81 Billion | |

| USD 25.44 Billion | |

|

|

|

|

Clinical Decision Support Systems Market Size

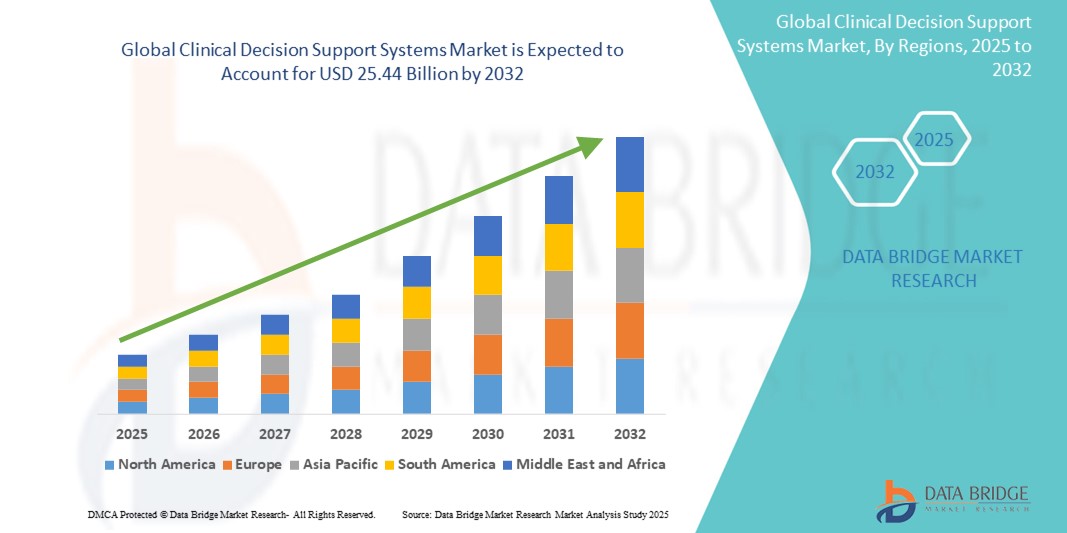

- The global clinical decision support systems market size was valued at USD 6.81 billion in 2024 and is expected to reach USD 25.44 billion by 2032, at a CAGR of 17.9% during the forecast period

- The market growth for clinical decision support systems (CDSS) solutions is largely fueled by the growing adoption and technological progress within healthcare IT and digital health, leading to increased digitalization in both clinical and administrative settings

- Furthermore, rising demand for enhanced diagnostic accuracy, improved patient outcomes, and streamlined clinical workflows is establishing CDSS as a modern healthcare intelligence system of choice. These converging factors are accelerating the uptake of Clinical Decision Support Systems solutions, thereby significantly boosting the industry's growth

Clinical Decision Support Systems Market Analysis

- Clinical Decision Support Systems (CDSS), offering evidence-based insights and alerts to healthcare professionals, are increasingly vital components of modern healthcare information technology in both clinical and administrative settings due to their enhanced diagnostic accuracy, improved patient safety, and seamless integration with electronic health records (EHRs).

- The escalating demand for CDSS is primarily fueled by the widespread adoption of digital health technologies, growing complexity of medical data, and a rising preference for data-driven, personalized patient care

- North America dominates the clinical decision support systems market with the largest revenue share of 46.2% in 2024, primarily due to advanced healthcare infrastructure, high adoption of electronic health records (EHRs), and strong regulatory support for healthcare IT integration

- Asia-Pacific is expected to be the fastest growing region in the clinical decision support systems market during the forecast period, driven by increasing urbanization, rising disposable incomes leading to higher healthcare spending, and rapid technological advancements in countries

- Services segment dominates the clinical decision support systems market, with a market share of 43.18% of the market share in 2024 attributed to the increasing demand for implementation, training, and maintenance services that ensure the effective deployment and utilization of CDSS solutions across healthcare settings

Report Scope and Clinical Decision Support Systems Market Segmentation

|

Attributes |

Clinical Decision Support Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Clinical Decision Support Systems Market Trends

“Advancing Patient Care Through AI and Seamless Workflow Integration”

- A significant and accelerating trend in the global clinical decision support systems (CDSS) market is the deepening integration with artificial intelligence (AI), machine learning (ML), and seamless connectivity with existing healthcare IT ecosystems such as Electronic Health Records (EHRs) and Computerized Physician Order Entry (CPOE) systems. This fusion of technologies is significantly enhancing clinical convenience and control over patient care processes

- For instance, advanced CDSS platforms can seamlessly integrate with EHRs, allowing clinicians to receive real-time alerts for drug-drug interactions or abnormal lab results directly within their workflow. Similarly, AI-powered diagnostic support tools can be embedded into imaging systems, offering intelligent insights to aid in the interpretation of medical scans

- AI integration in CDSS enables features such as learning from vast patient data to suggest optimal treatment pathways, identifying potential risks based on patient history, and providing more intelligent alerts based on complex clinical patterns. For instance, some CDSS models utilize AI to improve diagnostic accuracy over time by analyzing patient demographics, symptoms, and test results, and can send intelligent alerts if a patient's condition deviates from expected norms. Furthermore, seamless integration capabilities offer healthcare providers the ease of accessing critical information and recommendations without disrupting their clinical flow, allowing them to make informed decisions efficiently

- The seamless integration of CDSS with EHRs and broader healthcare platforms facilitates centralized control over various aspects of the patient care environment. Through a unified interface, users can manage patient data, view clinical guidelines, receive decision support, and document care plans, creating a cohesive and automated clinical experience

- This trend towards more intelligent, intuitive, and interconnected clinical support systems is fundamentally reshaping healthcare providers' expectations for diagnostic and treatment tools. Consequently, leading healthcare IT companies and innovative startups are developing AI-enabled CDSS with features such as predictive analytics for disease progression, automated risk assessment based on real-time data, and personalized treatment recommendations

- The demand for CDSS that offer seamless AI and workflow integration is growing rapidly across hospitals, diagnostic centers, and ambulatory settings, as healthcare providers increasingly prioritize efficiency, accuracy, and comprehensive patient care functionality

Clinical Decision Support Systems Market Dynamics

Driver

“Increasing Need to Enhance Clinical Outcomes and Patient Safety Amidst Data Complexity”

- The increasing complexity and volume of medical data, coupled with a persistent focus on reducing medical errors and improving patient safety, are significant drivers for the heightened demand for clinical decision support systems (CDSS). As healthcare professionals navigate vast amounts of information, from patient history to research findings, CDSS offers critical support to ensure evidence-based, accurate decision-making

- For instance, the rising incidence of preventable adverse drug events (ADEs) and diagnostic errors has prompted healthcare organizations globally to seek technological solutions. CDSS provides real-time alerts for drug-drug interactions, allergies, and contraindications, significantly mitigating these risks. Initiatives by government bodies and healthcare organizations to mandate and encourage the adoption of Electronic Health Records (EHRs) and improve interoperability further accelerate CDSS integration

- As healthcare providers become more aware of the limitations of manual data processing and seek enhanced methods for diagnostics and treatment, CDSS offers advanced features such as predictive analytics, clinical guideline adherence monitoring, and diagnostic assistance, providing a compelling upgrade over traditional, less integrated workflows

- Furthermore, the growing adoption of digital health technologies and the desire for interconnected healthcare ecosystems are making CDSS an integral component of these systems, offering seamless integration with EHRs, CPOE, and other clinical platforms

- The convenience of instant access to evidence-based knowledge, personalized patient insights, and the ability to streamline complex clinical pathways are key factors propelling the adoption of CDSS in hospitals, diagnostic centers, and ambulatory settings. The trend towards optimizing clinical workflows and the increasing availability of user-friendly CDSS options further contribute to market growth

Restraint/Challenge

“Concerns Regarding Data Privacy, Integration Complexities, and High Implementation Costs”

- Concerns surrounding the data privacy and security vulnerabilities of sensitive patient information, alongside the inherent complexities of integrating CDSS with diverse existing healthcare IT infrastructures, pose a significant challenge to broader market penetration. As CDSS relies on extensive patient data and network connectivity, it is susceptible to cyber threats and data breaches, raising anxieties among healthcare institutions and patients about the confidentiality of their health records

- For instance, high-profile reports of data breaches in healthcare organizations have made some institutions hesitant to rapidly adopt or fully integrate advanced CDSS solutions, fearing exposure of protected health information (PHI). In addition, ensuring compliance with stringent regulations such as HIPAA (U.S.) and GDPR (Europe) requires significant investment and ongoing vigilance

- Addressing these cybersecurity concerns through robust encryption, secure authentication protocols, and regular software updates is crucial for building trust. Leading healthcare IT vendors emphasize their advanced security measures and compliance features in their marketing to reassure potential buyers.

- In addition, the relatively high initial cost of implementing some advanced CDSS systems, including infrastructure upgrades, software licensing, and extensive training, can be a significant barrier to adoption for price-sensitive healthcare organizations, particularly smaller clinics or those in developing regions. While some basic CDSS functionalities are increasingly integrated into EHRs, comprehensive, AI-powered systems often come with a substantial price tag

- While the long-term return on investment (ROI) from improved patient outcomes and efficiency is recognized, the perceived premium for advanced healthcare IT solutions and the challenges of seamlessly integrating them into complex, often legacy, IT environments can still hinder widespread adoption, especially for those who face immediate budget constraints or workflow disruptions

Clinical Decision Support Systems Market Scope

The market is segmented on the basis of component, delivery mode, product, application, model, type, level of interactivity, and patient care setting.

- By Component

On the basis of component, the clinical decision support systems market is segmented into services, software, and hardware. Services segment dominated the market, with a market share of 43.18% of the market share in 2024 attributed to the increasing demand for implementation, training, and maintenance services that ensure the effective deployment and utilization of CDSS solutions across healthcare settings.

The services segment is also anticipated to witness the fastest growth rate for 2025 to 2032, fueled by the increasing complexity of CDSS implementation, the need for ongoing maintenance and support, and the demand for customization and integration services. Healthcare organizations often require expert assistance for deployment, training, and optimizing CDSS to fit their specific workflows, contributing to the rapid growth of the services sector.

- By Delivery Mode

On the basis of delivery mode, the clinical decision support systems market is segmented into web-based, on-premise, and cloud-based. the cloud-based segment held the largest market revenue share in 2024, driven by its benefits such as lower upfront costs, scalability, remote accessibility, and ease of deployment. Cloud-based CDSS solutions enable healthcare providers to access critical decision support tools from anywhere with an internet connection, facilitating telemedicine and distributed care models.

The cloud-based segment is also expected to witness the fastest CAGR for 2025 to2032, driven by its inherent flexibility and the growing trend of healthcare organizations migrating to cloud infrastructure for data storage and application hosting. This trend is fueled by increased data security measures in the cloud and the ability to rapidly scale resources up or down based on demand.

- By Product

On the basis of product, the clinical decision support systems market is segmented into standalone CDSS, integrated CPOE with CDSS, integrated EHR with CDSS, and integrated CDSS with CPOE and EHR. The integrated EHR with CDSS segment held the largest market revenue share in 2024, driven by the widespread adoption of EHRs and the critical need for seamless integration of decision support directly into physician workflows. This integration enhances efficiency, reduces alert fatigue, and provides context-sensitive guidance.

The Integrated CDSS with CPOE and EHR segment is anticipated to witness the fastest CAGR 2025 to 2032, favored for its comprehensive capabilities that combine electronic prescribing with robust decision support and patient records management. This complete integration offers a holistic approach to patient care, optimizing medication safety and clinical outcomes across multiple touchpoints.

- By Application

On the basis of application, the clinical decision support systems market is segmented into advanced cdss, conventional cdss, drug-drug interactions, drug allergy alerts, clinical reminders, clinical guidelines, and drug dosing support. The drug-drug interactions segment accounted for the largest market revenue share, driven by the critical importance of medication safety and the high incidence of adverse drug events in healthcare.

The Advanced CDSS segment is expected to witness the fastest CAGR 2025 to 2032, driven by the increasing demand for sophisticated, AI-driven insights beyond basic rule-based alerts. This segment focuses on more complex decision-making, risk stratification, and patient outcome prediction.

- By Model

On the basis of model, the clinical decision support systems market is segmented into knowledge based and non-knowledge based. the knowledge based segment held the largest market revenue share in 2024, driven by its reliance on explicit medical knowledge, such as clinical guidelines, expert rules, and best practices. This model is well-established and widely accepted for its transparency and adherence to established medical protocols.

The non-knowledge based segment is anticipated to witness the fastest CAGR 2025 to 2032, fueled by its ability to learn from vast amounts of data, identify complex patterns, and provide insights that might not be explicitly programmed. This model is gaining traction for its potential in predictive analytics and personalized medicine.

- By Type

On the basis of type, the clinical decision support systems market is segmented into therapeutic and diagnostic. the diagnostic segment held the largest market revenue share in 2024, driven by the crucial role of CDSS in aiding accurate and timely disease identification. This includes support for interpreting lab results, imaging studies, and patient symptoms to arrive at a precise diagnosis.

The therapeutic segment is anticipated to witness the fastest CAGR 2025 to 2032, fueled by the increasing focus on optimizing treatment plans, medication management, and adherence to clinical guidelines. This segment provides support for selecting appropriate therapies, adjusting dosages, and monitoring treatment efficacy.

- By Level of Interactivity

On the basis of level of interactivity, the clinical decision support Systems market is segmented into active and passive. The active segment held the largest market revenue share in 2024, driven by its ability to provide real-time, unsolicited alerts, reminders, and recommendations directly within the user's workflow. This proactive approach significantly enhances safety and guideline adherence.

The active segment is also anticipated to witness the fastest CAGR 2025 to2032, fueled by the growing demand for highly impactful and intrusive decision support that can prevent errors and guide clinicians toward optimal decisions without requiring explicit user initiation.

- By Patient Care Setting

On the basis of patient care setting, the clinical decision support systems market is segmented into in-patient and ambulatory care settings. The in-patient segment held the largest market revenue share in 2024, driven by the high volume of complex patient cases, frequent medication changes, and the critical need for continuous monitoring and decision support in hospital environments.

The ambulatory care settings segment is anticipated to witness the fastest CAGR 2025 to 2032, fueled by the shift towards outpatient care, the increasing adoption of EHRs in clinics, and the growing demand for CDSS to manage chronic diseases, preventive care, and medication adherence in non-hospital environments.

Clinical Decision Support Systems Market Regional Analysis

- North America dominates the clinical decision support systems market with the largest revenue share of 46.2% in 2024, driven by a growing demand for enhanced clinical efficiency and patient safety, as well as increased adoption of digital health technologies

- Healthcare providers in the region highly value the diagnostic accuracy, improved patient outcomes, and seamless integration offered by CDSS with Electronic Health Records and other clinical systems

- This widespread adoption is further supported by high healthcare expenditure, a technologically advanced medical infrastructure, and the growing preference for data-driven personalized medicine, establishing CDSS as a favored solution for both hospital and ambulatory care settings

U.S. Clinical Decision Support Systems Market Insight

The U.S. clinical decision support systems market captured the largest revenue share of 46.7% in 2024. this dominance is fueled by the swift uptake of Electronic Health Records (EHRs) and the expanding trend of digital health adoption across various healthcare settings. Healthcare providers are increasingly prioritizing the enhancement of patient care and efficiency through intelligent, data-driven systems. The growing preference for integrated digital health solutions, combined with robust demand for advanced analytics and mobile application integration, further propels the Clinical Decision Support Systems industry. Moreover, the increasing integration of interoperable healthcare technologies and federal initiatives promoting health IT are significantly contributing to the market's expansion.

Europe Clinical Decision Support Systems Market Insight

The Europe clinical decision support Systems market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent healthcare regulations and the escalating need for enhanced patient safety and efficiency in hospitals and clinics. The increase in digitalization of healthcare, coupled with the demand for integrated clinical workflows, is fostering the adoption of CDSS. European healthcare providers are also drawn to the improvements in patient outcomes and cost-efficiency these systems offer. The region is experiencing significant growth across various healthcare applications, with CDSS being incorporated into both new healthcare IT infrastructure and modernization projects.

U.K. Clinical Decision Support Systems Market Insight

The U.K. clinical decision support systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of digital transformation in the National Health Service (NHS) and a desire for heightened clinical accuracy and operational efficiency. In addition, concerns regarding medical errors and patient safety are encouraging healthcare providers to choose data-driven decision support solutions. The UK’s embrace of advanced healthcare IT, alongside its robust digital infrastructure, is expected to continue to stimulate market growth.

Germany Clinical Decision Support Systems Market Insight

The Germany clinical decision support systems market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of data-driven medicine and the demand for technologically advanced, high-quality healthcare solutions. Germany’s well-developed healthcare infrastructure, combined with its emphasis on innovation and robust public health initiatives, promotes the adoption of CDSS, particularly in hospitals and research institutions. The integration of CDSS with advanced analytics and AI is also becoming increasingly prevalent, with a strong preference for secure, privacy-focused solutions aligning with local regulatory and consumer expectations.

Asia-Pacific Clinical Decision Support Systems Market Insight

The Asia-Pacific clinical decision support systems market is poised to grow at the fastest CAGR of 13.2% during the forecast period, driven by increasing urbanization, rising disposable incomes leading to higher healthcare spending, and rapid technological advancements in countries such as China, Japan, and India. The region's growing inclination towards digital healthcare, supported by government initiatives promoting health IT and universal healthcare coverage, is driving the adoption of CDSS. Furthermore, as APAC emerges as a significant hub for healthcare technology innovation and manufacturing, the affordability and accessibility of CDSS solutions are expanding to a wider healthcare provider base.

Japan Clinical Decision Support Systems Market Insight

The Japan clinical decision support systems market is gaining momentum with a projected CAGR of approximately 13.6% to 13.9% from 2025 to 2030, due to the country’s high-tech culture, rapid advancements in medical technology, and demand for clinical efficiency. The Japanese market places a significant emphasis on patient safety and quality of care, and the adoption of CDSS is driven by the increasing digitalization of hospitals and connected healthcare ecosystems. The integration of CDSS with other IoT medical devices, such as remote monitoring systems and diagnostic equipment, is fueling growth. Moreover, Japan's aging population is likely to spur demand for data-driven, precise medical care solutions in both hospital and long-term care sectors.

China Clinical Decision Support Systems Market Insight

The China clinical decision support systems market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding healthcare expenditure, rapid urbanization, and high rates of technological adoption in healthcare. China stands as one of the largest and fastest-growing markets for digital health solutions, and CDSS is becoming increasingly popular in large hospitals, regional medical centers, and emerging private clinics. The push towards smart hospitals and digital health initiatives, coupled with strong domestic manufacturers, are key factors propelling the market in China.

Clinical Decision Support Systems Market Share

The clinical decision support systems industry is primarily led by well-established companies, including:

- Oracle (U.S.)

- Siemens Healthineers AG (Germany)

- MCKESSON CORPORATION (U.S.)

- Epic Systems Corporation (U.S.)

- Medical Information Technology, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Wolters Kluwer N.V. (Netherlands)

- Hearst Communications, Inc. (U.S.)

- Optum Inc. (U.S.)

- VisualDx (U.S.)

- GIDEON Informatics, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- EBSCO Industries, Inc. (U.S.)

- 3M (U.S.)

- ProMantra, Inc. (U.S.)

Latest Developments in Global Clinical Decision Support Systems Market

- In March 2025, EvidenceCare acquired Agathos to enhance physician enablement and reduce clinical variation. This acquisition is set to integrate Agathos's analytics capabilities into EvidenceCare's platform, providing more personalized, data-driven insights for clinicians. This move reflects the growing trend towards leveraging advanced analytics to streamline workflows and improve clinical decision-making

- In March 2025, Elsevier enhanced its ClinicalKey platform by integrating AI-powered decision support with Epic EHR and DrFirst's iPrescribe. This update, alongside a new mobile app and CME/MOC tracking, aims to streamline clinician workflows and improve care delivery. This development underscores the increasing focus on seamless integration of AI into existing electronic health record (EHR) systems to provide real-time, actionable insights at the point of care

- In October 2024, VitalHub Corp. acquired MedCurrent Corporation. This acquisition by the US-based healthcare technology company aims to expand VitalHub's offerings in the clinical decision support space. While specific financial details were not disclosed, this move highlights the consolidation and strategic growth within the CDSS market as companies seek to bolster their capabilities and market presence

- In May 2024, Radiometer and Etiometry entered into an agreement to assist caregivers in critical care areas. This collaboration focuses on integrating patient data and AI on a unified platform to help clinicians make appropriate decisions and enhance workflow. This initiative emphasizes the increasing importance of combining real-time patient data with artificial intelligence to optimize decision-making and improve patient outcomes in high-acuity settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.