Global Clinical Trial Consumables Market

Market Size in USD Billion

CAGR :

%

USD

2.42 Billion

USD

4.61 Billion

2024

2032

USD

2.42 Billion

USD

4.61 Billion

2024

2032

| 2025 –2032 | |

| USD 2.42 Billion | |

| USD 4.61 Billion | |

|

|

|

|

Clinical Trial Consumables Market Size

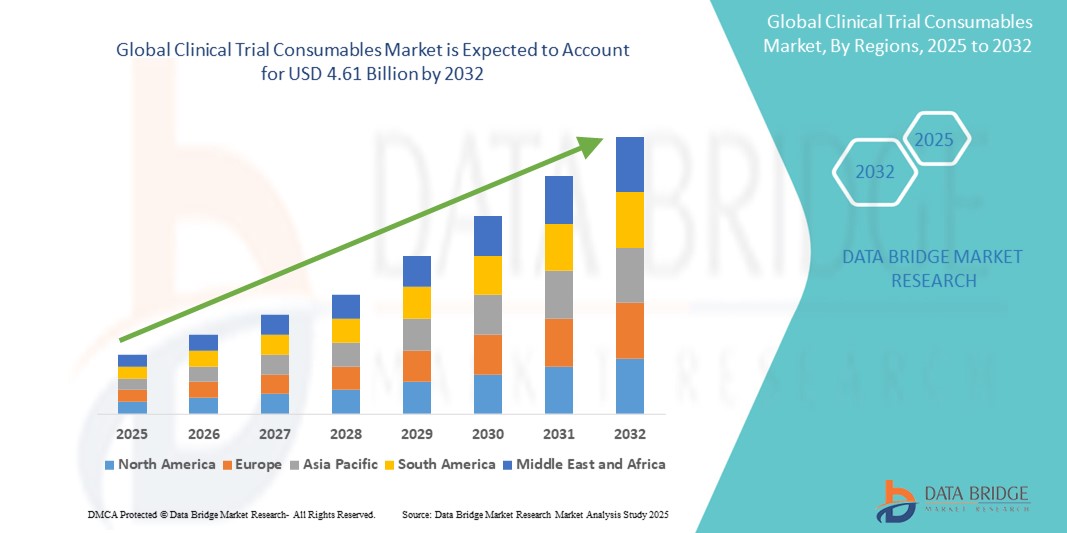

- The global clinical trial consumables market size was valued at USD 2.42 billion in 2024 and is expected to reach USD 4.61 billion by 2032, at a CAGR of 8.40% during the forecast period

- This growth is driven by factors such as the increasing number of clinical trials worldwide, rising investment in pharmaceutical and biotechnology research, advancements in clinical trial technologies, growing prevalence of chronic diseases, and the expanding demand for personalized medicine

Clinical Trial Consumables Market Analysis

- The global clinical trial consumables market is growing as more clinical studies need reliable materials for accurate results. For instance, late-stage trials use many consumables to ensure patient safety and data quality

- Advances in manufacturing and materials are making consumables safer and more efficient and new products improve compatibility with complex trial protocols, supporting market growth

- North America is expected to dominate the clinical trial consumables market with market share of 43.88% primarily due to its advanced healthcare infrastructure and significant investments in research and development

- Asia-pacific is expected to be the fastest growing region in the clinical trial consumables market during the forecast period due to increasing clinical research activities and a large patient population

- The phase III segment is expected to dominate the clinical trial consumables market with the largest share of 53.08% in 2025 due to high number of participants involved, extended trial duration, and increased volume of consumables required for large-scale safety and efficacy assessments before regulatory approval

Report Scope and Clinical Trial Consumables Market Segmentation

|

Attributes |

Clinical Trial Consumables Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Clinical Trial Consumables Market Trends

“Rising Demand for Single-Use Clinical Materials”

- The clinical trial consumables market is currently experiencing a rising trend in the use of single-use materials across all phases of trials

- This shift is driven by the growing demand for faster setup and reduced contamination risks in clinical environments

- Single-use consumables are increasingly preferred for their convenience and ability to streamline workflow efficiency

- The trend supports the need for more agile and cost-effective clinical operations as trial complexity continues to increase

- In conclusion, this growing reliance on single-use consumables highlights a significant shift in the market, making them a central component of modern clinical trial practices

Clinical Trial Consumables Market Dynamics

Driver

“Growing Volume of Clinical Trials Worldwide”

- The rise in global clinical trials is increasing the demand for consumables used in data collection and patient care

- Consumables such as vials, swabs, and tubes are essential in large-scale trials, for instance, the RECOVERY trial in the United Kingdom

- Chronic and infectious disease studies need consistent supplies across phases, as seen in intensive oncology research protocols

- Regulatory demands require sterile, high-grade materials, for instance, in mRNA vaccine trials by Moderna and Pfizer-BioNTech

- Suppliers are expanding and innovating product lines to meet rising complexity and volume in clinical research

- Consumables now play a central role in ensuring trial precision, safety, and efficiency across the research landscape

Opportunity

“Increasing Adoption of Decentralized Clinical Trials”

- The growing use of decentralized clinical trials allows patients to participate from home or local care centers, increasing the need for specialized consumables

- These trials require remote-friendly tools such as at-home sampling kits and easy-to-ship packaging, for instance, the COVID-19 diagnostic trials by LabCorp used home collection kits

- Manufacturers now design consumables that support safe transport and remote data capture, such as saliva collection devices used in Alzheimer’s research studies

- Advanced consumables with tech features such as RFID tracking and temperature monitoring are being explored for real-time sample handling

- Companies offering remote-use consumables in complex areas such as oncology and rare diseases are gaining market advantage, as seen in decentralized trials by Medable and Science 37

- The shift to decentralized trials is opening lasting opportunities for consumables tailored to remote and digital-first research models

Restraint/Challenge

“Regulatory Complexity in Consumables Approval”

- The clinical trial consumables market faces challenges in meeting complex global regulatory requirements for product approval and compliance

- Trials across multiple countries require region-specific certifications, increasing approval time and cost, for instance, a test kit cleared in the European Union may need extra validation for the United States

- Variations in labeling, sterility, and documentation standards between jurisdictions create barriers for consistent product rollout

- Smaller suppliers often lack the resources to keep up with evolving regulations, making it harder to scale globally

- Regular updates to compliance norms and post-market monitoring add pressure to continuously adapt production and quality systems

- Without strong regulatory strategies, even top-quality consumables risk delays, limiting their availability for high-demand clinical trials

Clinical Trial Consumables Market Scope

The market is segmented on the basis of service, phase, therapeutic area, end user, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Service |

|

|

By Phase |

|

|

By Therapeutic Area |

|

|

By End User

|

|

|

By Distribution Channel

|

|

In 2025, the phase III segment is projected to dominate the market with a largest share in phase segment

The phase III segment is expected to dominate the Clinical Trial Consumables market with the largest share of 53.08% in 2025 due to high number of participants involved, extended trial duration, and increased volume of consumables required for large-scale safety and efficacy assessments before regulatory approval.

The oncology segment is expected to account for the largest share during the forecast period in therapeutic area segment

In 2025, the oncology segment is expected to dominate the market with the largest market due to rising prevalence of cancer, increased number of oncology-focused clinical trials, and the high demand for specialized consumables required for complex and long-duration cancer studies.

Clinical Trial Consumables Market Regional Analysis

“North America Holds the Largest Share in the Clinical Trial Consumables Market”

-

North America holds the largest share in the global clinical trial consumables market, with Market share of 43.88% primarily due to its advanced healthcare infrastructure and significant investments in research and development

- The presence of major pharmaceutical and biotechnology companies, along with a high number of ongoing clinical trials, contributes to the region's dominance

- Regulatory support and streamlined approval processes facilitate quicker initiation and execution of clinical trials, enhancing the demand for consumables

- The adoption of innovative technologies and digital solutions in clinical research further propels the market growth in this region

- Collaborations between academic institutions and industry players in North America also play a crucial role in advancing clinical research activities

“Asia-Pacific is Projected to Register the Highest CAGR in the Clinical Trial Consumables Market”

- The Asia-Pacific region is experiencing rapid growth in the clinical trial consumables market, due to increasing clinical research activities and a large patient population

- Countries such as China and India are becoming preferred destinations for clinical trials due to cost-effective operations and favorable regulatory reforms

- Government initiatives and investments in healthcare infrastructure are enhancing the region's capacity to conduct large-scale clinical studies

- The rise in chronic diseases and the need for innovative treatments are boosting the demand for clinical trials and associated consumables

- Improved logistics and supply chain management systems are supporting the efficient distribution of clinical trial consumables across the region

Clinical Trial Consumables Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Almac Group (U.K.)

- Catalent, Inc. (U.S.)

- Parexel International (MA) Corporation (U.S.)

- Agilent Technology (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

- SHARP CORPORATION (U.K.)

- Biocair (U.K.)

- Movianto (U.K.)

- KLIFO (Denmark)

- Bellco Glass (U.S.)

- Crystalgen, Inc. (U.S.)

- Camlab Ltd (U.K.)

- Reagecon Diagnostics Ltd. (Ireland)

- Sartorius AG (Germany)

- Spectrum Chemical (U.S.)

- Inizio (Ireland)

- Piramal Enterprises Ltd. (India)

- VITLAB GmbH (Germany)

Latest Developments in Global Clinical Trial Consumables Market

- In July 2023, Almac Group opened a custom-built GMP warehouse and dispatch hub in the UK. The facility aimed to support all the manufacturing and laboratory activities of API from drug development to commercialization. Such expansion strengthened broadened company’s offerings in the market.

- In February 2023, Catalent completed a USD 2.2 million expansion of its clinical supply facility in Singapore. This expansion has enlarged the site's footprint to 31,000 square feet, providing room for installing 35 new freezers dedicated to ultra-low temperature (ULT) storage, thereby strengthening the company’s operational capabilities in the supply chain management.

- In January 2023, ASLAN Pharmaceuticals partnered with Thermo Fisher Scientific to manufacture a high-concentration formulation of Eblasakimab for forthcoming studies. Through this partnership, Thermo Fisher Scientific contributes its expertise in biologic manufacturing and scale-up capacity to manage a clinical supply of Eblasakimab for the anticipated Phase 3 studies

- In July 2023, Almac Sciences unveiled a custom-built GMP warehouse and dispatch hub at the Almac Group's global headquarters in Craigavon, UK. This new facility is designed to support the entire manufacturing and laboratory activities related to Active Pharmaceutical Ingredients, from development through to commercialization

- In February 2023, Catalent announced the completion of a $2.2 million expansion of its clinical supply facility in Singapore. This enhancement increased the facility's footprint to 31,000 square feet, allowing for the installation of 35 new freezers specifically designed for ultra-low temperature (ULT) storage. This strategic expansion not only boosts capacity but also strengthens Catalent's ability to meet the growing demand for clinical trial materials requiring precise storage conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.