Global Clinical Trial Packaging And Labelling Market

Market Size in USD Billion

CAGR :

%

USD

854.43 Billion

USD

1,468.07 Billion

2025

2033

USD

854.43 Billion

USD

1,468.07 Billion

2025

2033

| 2026 –2033 | |

| USD 854.43 Billion | |

| USD 1,468.07 Billion | |

|

|

|

|

Clinical Trial Packaging and Labelling Market Size

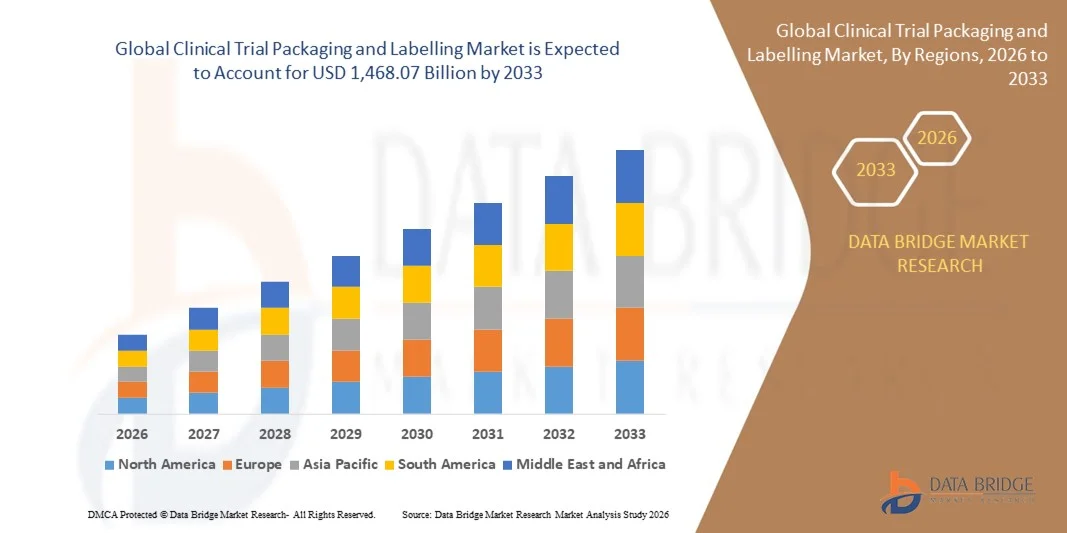

- The global clinical trial packaging and labelling market size was valued at USD 854.43 billion in 2025 and is expected to reach USD 1,468.07 billion by 2033, at a CAGR of 7.00% during the forecast period

- The market growth is largely fuelled by the increasing demand for safe, compliant, and patient-centric packaging solutions in clinical trials, ensuring product integrity and adherence to regulatory standards

- Rising complexity of clinical trials, including biologics and personalized medicines, is driving the need for innovative packaging and labelling solutions that improve trial efficiency and patient compliance

Clinical Trial Packaging and Labelling Market Analysis

- The market is witnessing significant innovations in sustainable and tamper-evident packaging materials, improving environmental compliance and safety standards

- Increasing outsourcing of clinical trial services by pharmaceutical and biotechnology companies is propelling the demand for specialized packaging and labelling providers with advanced capabilities

- North America dominated the clinical trial packaging and labelling market with the largest revenue share in 2025, driven by a growing number of clinical trials, advanced healthcare infrastructure, and increasing adoption of patient-centric packaging solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global clinical trial packaging and labelling market, driven by expanding clinical trial activities, favorable government initiatives, and cost-effective manufacturing and packaging solutions

- The biologic drugs segment held the largest market revenue share in 2025, driven by the increasing development of vaccines, monoclonal antibodies, and cell & gene therapies that require specialized temperature-controlled, tamper-evident, and patient-centric packaging. Biologics packaging often integrates digital monitoring and track-and-trace technologies to ensure product stability and regulatory compliance across multi-site trials

Report Scope and Clinical Trial Packaging and Labelling Market Segmentation

|

Attributes |

Clinical Trial Packaging and Labelling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Clinical Trial Packaging and Labelling Market Trends

Adoption of Advanced and Patient-Centric Packaging Solutions

- The growing emphasis on patient-centric and advanced clinical trial packaging is transforming the pharmaceutical and biotech industries by improving drug safety, traceability, and compliance. Customized packaging solutions help ensure accurate dosing and reduce medication errors, enhancing trial outcomes and patient adherence. Moreover, these solutions support regulatory submissions by maintaining complete documentation and improving accountability in multi-site trials

- Rising demand for temperature-controlled, tamper-evident, and smart packaging systems is accelerating adoption in both early-phase and late-phase clinical trials. These solutions enable real-time monitoring of sensitive investigational products, particularly biologics and vaccines, ensuring integrity throughout the supply chain. In addition, the adoption of cold chain logistics and smart sensors allows sponsors to detect deviations early and reduce the risk of product spoilage

- The integration of digital labeling technologies, including RFID, QR codes, and track-and-trace systems, is improving supply chain transparency and regulatory compliance. Sponsors and CROs benefit from enhanced monitoring capabilities, audit readiness, and minimized risk of product recalls. Furthermore, these technologies facilitate efficient inventory management, reduce manual errors, and streamline reporting for global trials

- For instance, in 2023, several North American and European contract packaging organizations implemented smart labeling solutions for multi-site clinical trials, resulting in improved data integrity, patient safety, and regulatory adherence. These implementations also led to faster shipment processing, better tracking of investigational products, and enhanced compliance with ICH and FDA guidelines

- While adoption of advanced packaging and labeling is rising rapidly, sustained growth depends on innovation, standardization of digital solutions, and cost-effective deployment strategies across diverse clinical trial setups. Sponsors are increasingly focusing on scalable solutions that can adapt to varying trial sizes, therapeutic categories, and geographic locations to maximize efficiency

Clinical Trial Packaging and Labelling Market Dynamics

Driver

Rising Demand for Safe, Compliant, and Efficient Clinical Trial Packaging

- Increasing global clinical trial activities and complex study protocols are driving the need for safe, compliant, and efficient packaging and labeling solutions. Sponsors are seeking reliable systems to maintain drug quality, prevent counterfeiting, and ensure regulatory compliance across regions. In addition, growing emphasis on patient safety and adherence in decentralized trials is further boosting demand for secure, user-friendly packaging

- Growing adoption of biologics, personalized medicines, and investigational therapies requires advanced packaging solutions that offer temperature control, protection from light or moisture, and tamper evidence. These requirements are fueling innovation and investments in specialized packaging formats. Integration with digital monitoring and IoT-based solutions is also enabling real-time product condition tracking and faster corrective actions during transit

- Expanding contract research and packaging organizations, along with partnerships between pharma companies and technology providers, are facilitating access to scalable, high-quality packaging solutions. This enables faster trial initiation and improved product management across multiple sites. Collaborative efforts are also promoting knowledge sharing, technology transfer, and cost optimization in clinical trial supply chains

- For instance, in 2023, the U.S. market witnessed robust adoption of pre-filled syringes and blister packaging solutions in Phase II and III trials, driven by the need for patient safety and trial efficiency. The integration of serialization, tamper-evident seals, and smart labeling further enhanced compliance and reduced logistical errors in complex multi-center trials

- While demand is strong, continued innovation, automation, and integration of digital solutions remain essential for supporting complex trial protocols and global regulatory compliance. The market is also increasingly exploring modular and flexible packaging designs that can accommodate a wide range of product formats and shipment conditions

Restraint/Challenge

High Cost of Specialized Packaging Solutions and Regulatory Complexity

- The high cost of advanced clinical trial packaging, including temperature-controlled, smart, and tamper-evident solutions, limits adoption among smaller biotech firms and early-stage sponsors. Budget constraints often necessitate prioritizing core trial activities over sophisticated packaging investments. In addition, high initial capital requirements for automated equipment and digital labeling systems pose barriers to entry in emerging markets

- Regulatory complexity across different regions, including labeling requirements, serialization mandates, and electronic record-keeping, increases compliance costs and operational challenges. Sponsors must navigate country-specific standards to avoid delays and penalties. Continuous updates to guidelines by agencies such as FDA, EMA, and PMDA also require ongoing training and system upgrades, adding further financial and operational pressure

- Limited awareness or experience with digital labeling and automated packaging solutions in emerging markets constrains adoption. Trial sponsors may face logistical challenges in remote or underdeveloped regions, affecting product integrity and patient safety. In addition, insufficient local infrastructure for cold chain management and secure transport can further hinder widespread deployment of advanced packaging technologies

- For instance, in 2023, several Southeast Asian markets reported slower adoption of smart packaging technologies due to high costs and regulatory uncertainties, despite growing clinical trial activities. Sponsors often opted for conventional packaging methods to minimize expenditure, impacting product visibility, compliance, and patient-centric features

- While technologies and materials continue to evolve, addressing cost, regulatory compliance, and regional adoption challenges is critical for long-term growth in the global clinical trial packaging and labeling market. Stakeholders are increasingly investing in training, partnerships, and scalable solutions to overcome these barriers and optimize trial efficiency globally

Clinical Trial Packaging and Labelling Market Scope

The clinical trial packaging and labelling market is segmented on the basis of drug type, phase, and therapeutic area.

- By Drug Type

On the basis of drug type, the market is segmented into small-molecule drugs and biologic drugs. The biologic drugs segment held the largest market revenue share in 2025, driven by the increasing development of vaccines, monoclonal antibodies, and cell & gene therapies that require specialized temperature-controlled, tamper-evident, and patient-centric packaging. Biologics packaging often integrates digital monitoring and track-and-trace technologies to ensure product stability and regulatory compliance across multi-site trials.

The small-molecule drugs segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising number of oral solid and liquid formulations in clinical development and the adoption of convenient packaging solutions such as blister packs and unit-dose formats. These solutions improve dosing accuracy, patient adherence, and reduce the risk of contamination, making them increasingly preferred in early- and late-phase studies.

- By Phase

On the basis of phase, the market is segmented into Phase I, Phase II, Phase III, Phase IV, and BA/BE studies. The Phase III segment held the largest revenue share in 2025, owing to the complex study protocols, large patient populations, and stringent regulatory requirements that demand advanced packaging solutions ensuring product safety, traceability, and compliance. Phase III packaging often involves multi-site distribution and requires robust serialization and tamper-evident features.

The Phase I segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing number of early-stage clinical trials and rising demand for patient-centric, flexible, and scalable packaging solutions. These solutions help maintain product integrity, streamline trial logistics, and enhance participant adherence in first-in-human studies.

- By Therapeutic Area

On the basis of therapeutic area, the market is segmented into oncology, neurological and mental disorders, infectious and immune system diseases, digestive system diseases, blood disorders, and other therapeutic areas. The oncology segment held the largest market revenue share in 2025, fueled by the growing number of cancer clinical trials, complex dosing regimens, and high-value investigational drugs that require specialized packaging for safety, temperature control, and regulatory compliance.

The infectious and immune system diseases segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising R&D investments, vaccine development, and biologic therapeutics requiring cold chain and tamper-evident packaging solutions. The adoption of digital labeling and smart monitoring systems further enhances patient safety and trial efficiency in this therapeutic area.

Clinical Trial Packaging and Labelling Market Regional Analysis

- North America dominated the clinical trial packaging and labelling market with the largest revenue share in 2025, driven by a growing number of clinical trials, advanced healthcare infrastructure, and increasing adoption of patient-centric packaging solutions

- Healthcare providers and contract research organizations (CROs) in the region highly value advanced, compliant, and track-and-trace enabled packaging solutions that improve patient safety, regulatory adherence, and supply chain efficiency

- This widespread adoption is further supported by strong pharmaceutical R&D investments, regulatory frameworks supporting innovative packaging, and the growing preference for digital labeling and serialization solutions across clinical trials

U.S. Clinical Trial Packaging and Labelling Market Insight

The U.S. clinical trial packaging and labelling market captured the largest revenue share in 2025 within North America, fueled by the increasing number of ongoing clinical trials and high adoption of advanced packaging technologies. Sponsors are emphasizing patient-centric solutions, including tamper-evident, temperature-controlled, and smart packaging systems. The growing trend of decentralized and multi-site trials, coupled with integration of digital solutions such as RFID, QR codes, and track-and-trace systems, is significantly contributing to market expansion.

Europe Clinical Trial Packaging and Labelling Market Insight

The Europe clinical trial packaging and labelling market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent regulatory requirements and increasing demand for secure, compliant packaging solutions. The rise in clinical trials across oncology, neurology, and other therapeutic areas is fostering the adoption of specialized packaging formats. European CROs and pharmaceutical companies are also adopting smart and patient-centric packaging to enhance trial efficiency and data integrity.

U.K. Clinical Trial Packaging and Labelling Market Insight

The U.K. clinical trial packaging and labelling market is expected to witness the fastest growth rate from 2026 to 2033, driven by the expanding clinical research ecosystem and focus on patient safety and compliance. Regulatory emphasis on serialization, tamper-evidence, and digital labeling is encouraging adoption. In addition, the U.K.’s robust healthcare infrastructure and technological adoption in clinical trials support increased deployment of automated and smart packaging solutions.

Germany Clinical Trial Packaging and Labelling Market Insight

The Germany clinical trial packaging and labelling market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising clinical trial activities, strong pharmaceutical R&D, and the demand for advanced, eco-friendly, and compliant packaging solutions. Germany’s emphasis on digitalization, supply chain transparency, and patient-centric approaches promotes the integration of smart labeling technologies in multi-phase trials.

Asia-Pacific Clinical Trial Packaging and Labelling Market Insight

The Asia-Pacific clinical trial packaging and labelling market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing clinical trial investments, rising pharmaceutical R&D, and growing awareness of advanced packaging technologies in countries such as China, Japan, and India. The region's expanding CRO network, coupled with cost-effective packaging solutions and supportive regulatory frameworks, is accelerating market adoption.

Japan Clinical Trial Packaging and Labelling Market Insight

The Japan clinical trial packaging and labelling market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s advanced healthcare system, technological adoption, and focus on patient safety. The increasing number of biologics and personalized medicine trials, combined with smart packaging integration for temperature-sensitive and sensitive investigational products, is driving market growth.

China Clinical Trial Packaging and Labelling Market Insight

The China clinical trial packaging and labelling market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s growing pharmaceutical R&D, rapid increase in clinical trials, and adoption of digital labeling and track-and-trace technologies. The push for smart, compliant, and patient-centric packaging solutions, along with strong domestic manufacturing capabilities, is propelling the market in China.

Clinical Trial Packaging and Labelling Market Share

The Clinical Trial Packaging and Labelling industry is primarily led by well-established companies, including:

• Sharp (U.K.)

• PCI Pharma Services (U.S.)

• MYODERM (U.K.)

• Clinigen Group plc (U.K.)

• KLIFO (U.K.)

• CLINICAL SUPPLIES MANAGEMENT HOLDINGS, INC. (U.S.)

• Parexel International Corporation (U.S.)

• Alium Medical Limited (U.K.)

• Ancillare, LP (U.S.)

• Movianto (U.K.)

• Bionical Ltd. (U.K.)

• Thermo Fisher Scientific Inc. (U.S.)

• Catalent, Inc. (U.S.)

• Almac Group (U.K.)

• Biocair (U.K.)

• SIRO Clinpharm Private Limited (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Clinical Trial Packaging And Labelling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Clinical Trial Packaging And Labelling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Clinical Trial Packaging And Labelling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.