Global Clinical Trial Supplies Market

Market Size in USD Billion

CAGR :

%

USD

3.82 Billion

USD

7.29 Billion

2024

2032

USD

3.82 Billion

USD

7.29 Billion

2024

2032

| 2025 –2032 | |

| USD 3.82 Billion | |

| USD 7.29 Billion | |

|

|

|

|

Clinical Trial Supplies Market Size

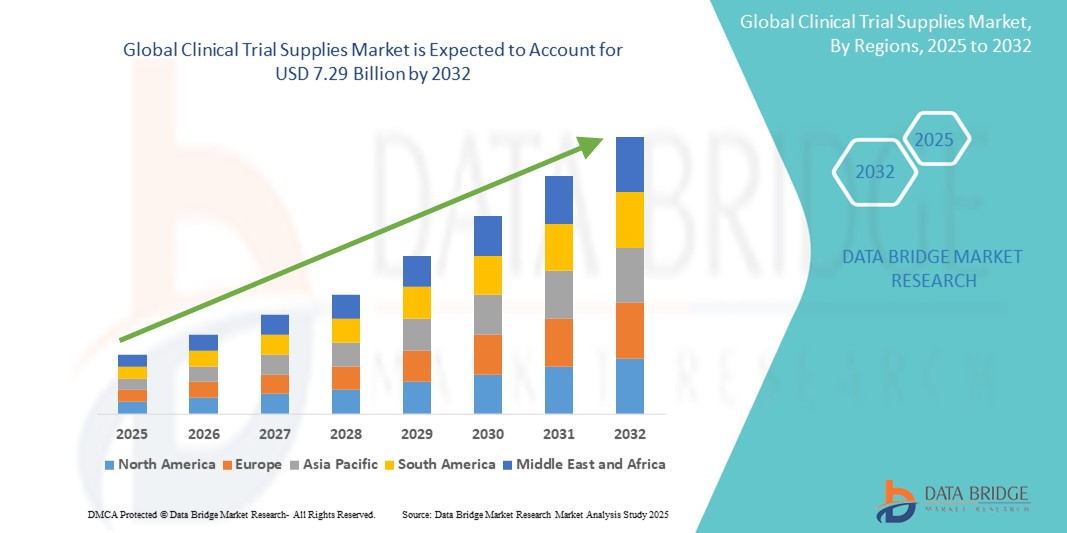

- The global clinical trial supplies market size was valued at USD 3.82 billion in 2024 and is expected to reach USD 7.29 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fueled by the increasing number and complexity of clinical trials and the rising R&D expenditure within the pharmaceutical and biotechnology sectors, leading to greater demand for efficient supply chain management

- Furthermore, the globalization of clinical trials and the growth in biologics and personalized medicine necessitate sophisticated logistical solutions, establishing clinical trial supplies as a critical component of drug development. These converging factors are accelerating the demand for robust clinical trial supply services, thereby significantly boosting the industry's growth

Clinical Trial Supplies Market Analysis

- Clinical trial supplies, encompassing investigational medicinal products, comparators, and ancillary materials, are essential for conducting clinical research across pharmaceutical and biotechnology industries, ensuring the integrity and accuracy of trial outcomes

- The increasing demand for clinical trial supplies is primarily fueled by the growing volume and complexity of clinical trials globally, driven by the development of novel therapeutics and the rising prevalence of chronic diseases

- North America dominates the clinical trial supplies market with the largest revenue share of 43.88% in 2025, characterized by a strong biopharmaceutical industry, stringent regulatory requirements, and a high volume of clinical trial activities. The U.S. is a major contributor, driven by extensive research and development in innovative therapies

- Asia-Pacific is expected to be the fastest growing region in the clinical trial supplies market with a CAGR of 7.6% during the forecast period due to increasing clinical trial outsourcing, growing pharmaceutical manufacturing, and rising healthcare investments

- Phase III segment is expected to dominate the clinical trial supplies market with a market share of 53.08% in 2025, driven by the large patient populations, extended durations, and complex logistical requirements inherent in late-stage efficacy and safety trials necessary for regulatory approval

Report Scope and Clinical Trial Supplies Market Segmentation

|

Attributes |

Clinical Trial Supplies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Clinical Trial Supplies Market Trends

“Enhanced Efficiency Through Digitalization and Automation”

- A significant and accelerating trend in the global clinical trial supplies market is the deepening integration with digital platforms and automated systems for supply chain management. This fusion of technologies is significantly enhancing efficiency and control over trial logistics

- For instance, many clinical trial management systems (CTMS) now seamlessly integrate with inventory management modules, allowing for real-time tracking of supplies and automated replenishment triggers. Similarly, robotic dispensing systems in central pharmacies streamline the kitting and labeling processes

- Digital integration in clinical trial supplies enables features such as real-time visibility into inventory levels across multiple sites, potentially suggesting optimal distribution strategies and providing more intelligent alerts based on predicted needs or potential shortages. For instance, some platforms utilize AI to forecast demand based on patient enrollment and treatment protocols and can send automated alerts for timely reordering. Furthermore, automated labeling and packaging equipment reduce manual errors and accelerate the preparation of drug kits

- The seamless integration of clinical trial supply management with broader digital trial platforms facilitates centralized control over various aspects of the clinical investigation. Through a single interface, trial sponsors and CROs can manage drug supplies alongside patient data, monitoring, and other trial activities, creating a unified and transparent operational experience

- This trend towards more intelligent, intuitive, and interconnected supply systems is fundamentally reshaping operational expectations for clinical trials. Consequently, companies are developing AI-enabled supply forecasting tools and digitally integrated platforms with features such as automated temperature monitoring and real-time tracking

- The demand for clinical trial supply solutions that offer seamless digital integration and automation is growing rapidly across pharmaceutical and biotech companies, as sponsors increasingly prioritize efficiency, accuracy, and comprehensive trial oversight

Clinical Trial Supplies Market Dynamics

Driver

“Increasing Complexity and Volume of Clinical Trials”

- The increasing complexity of modern clinical trial designs and the rising global volume of trial activities are significant drivers for the heightened demand for efficient clinical trial supply management

- For instance, the growing number of biologics and personalized medicine trials necessitates specialized handling and temperature control, increasing the logistical demands on supply chains

- As pharmaceutical and biotech companies pursue more sophisticated research protocols and expand their global trial footprints, the need for precise and reliable sourcing, packaging, labeling, and distribution of clinical trial materials becomes paramount.

- Furthermore, the trend towards decentralized clinical trials (DCTs) and direct-to-patient (DTP) shipments adds layers of complexity to the supply chain, requiring specialized expertise and infrastructure to ensure compliance and timely delivery

- The demand for timely and accurate delivery of investigational medicinal products (IMPs), comparators, and ancillary supplies, coupled with stringent regulatory requirements for handling and accountability, are key factors propelling the growth of the clinical trial supplies market. The increasing outsourcing of these activities to specialized providers further contributes to market expansion

Restraint/Challenge

“Complexity of Regulatory Landscape and Supply Chain Disruptions”

- The complex and varying regulatory landscape across different countries, coupled with the potential for significant supply chain disruptions, poses a considerable challenge to the efficient operation of the global clinical trial supplies market

- For instance, differing import/export regulations for investigational medicinal products (IMPs), labeling requirements, and storage conditions across regions can create significant hurdles and delays in getting supplies to trial sites

- Navigating these diverse regulatory requirements demands specialized expertise and meticulous documentation. Furthermore, unforeseen events such as natural disasters, geopolitical instability, or global health crises can severely disrupt the sourcing, manufacturing, and transportation of critical trial materials, potentially jeopardizing trial timelines

- ·Addressing these challenges requires robust regulatory compliance strategies, the establishment of resilient and diversified supply chains, and proactive risk management planning to mitigate potential disruptions. While experienced Contract Research Organizations (CROs) and specialized logistics providers offer expertise in these areas, the inherent complexities and unpredictability remain significant hurdles

- Overcoming these challenges through harmonization of regulatory standards, the adoption of advanced supply chain management technologies, and the development of contingency plans will be vital for ensuring the smooth and timely conduct of global clinical trials

Clinical Trial Supplies Market Scope

The market is segmented on the basis of services, clinical phase, therapeutic uses, and end user

- By Services

On the basis of services, the clinical trial supplies market is segmented into storage, manufacturing, packaging and labelling, and distribution. The distribution segment held a significant market revenue share due to the fundamental need to transport supplies to trial sites globally, a complex and often costly aspect of clinical trials. The manufacturing segment is also crucial, representing the core of producing the investigational medicinal products

The packaging and labelling segment is anticipated to witness a robust growth rate, driven by increasingly stringent regulatory requirements for accurate and compliant labelling across different regions and the need for specialized packaging to maintain drug integrity, especially for temperature-sensitive biologics.

- By Clinical Phase

On the basis of clinical phase, the clinical trial supplies market is segmented into Phase III, Phase II, Phase IV, and Phase I. The phase III segment is expected to command the largest market revenue share of 53.08%, driven by the large patient populations, extended trial durations, and complex logistical demands associated with late-stage efficacy and safety studies crucial for regulatory approval

The Phase I segment is anticipated to witness a rapid growth rate, fueled by the increasing number of novel drug candidates entering early-stage human trials and the growing focus on innovative therapies

- By Therapeutic Uses

On the basis of therapeutic uses, the clinical trial supplies market is segmented into oncology, cardiovascular diseases, dermatology, metabolic disorders, infectious diseases, respiratory diseases, CNS and mental disorders, blood disorders, and others. The oncology segment accounted for the largest market revenue share due to the high volume and complexity of cancer clinical trials globally, driven by the significant unmet medical needs and extensive research in this area

The CNS and mental disorders segment is expected to witness substantial growth, driven by increasing research into neurological and psychiatric conditions and the development of novel treatments for these often challenging diseases

- By End User

On the basis of end user, the clinical trial supplies market is segmented into contract research organizations (CROs) and pharmaceutical and biotechnology companies. The pharmaceutical and biotechnology companies segment likely represents the largest market revenue share as these entities directly sponsor and fund the majority of clinical trials, thus being the primary consumers of clinical trial supplies

The contract research organizations (CROs) segment is anticipated to experience significant growth, driven by the increasing trend of pharmaceutical and biotech companies outsourcing their clinical trial operations, including the management and procurement of clinical trial supplies

Clinical Trial Supplies Market Regional Analysis

- North America dominates the clinical trial supplies market with the largest revenue share of 43.88% in 2024, driven by strong biopharmaceutical industry, stringent regulatory requirements, and a high volume of clinical trial activities

- The region benefits from stringent regulatory standards that necessitate comprehensive and high-quality clinical trial supplies management, as well as significant investment in pharmaceutical research and development

- This dominant position is further supported by the presence of numerous leading pharmaceutical and biotechnology companies and sophisticated logistics infrastructure, establishing North America as a key region for clinical trial operations and associated supply services

U.S. Clinical Trial Supplies Market Insight

The U.S. clinical trial supplies market captured a substantial revenue share within North America in 2025, fueled by its robust biopharmaceutical industry and the high volume of innovative clinical research. The presence of major pharmaceutical companies and leading academic research institutions drives significant demand for comprehensive clinical trial supply services. Furthermore, stringent regulatory requirements and a focus on high-quality trial data necessitate sophisticated and reliable supply chain management.

Europe Clinical Trial Supplies Market Insight

The European clinical trial supplies market is projected to expand at a considerable CAGR throughout the forecast period, primarily driven by stringent regulatory standards and a strong emphasis on clinical research across various therapeutic areas. Increasing collaboration between research institutions and pharmaceutical companies, coupled with a growing number of multinational clinical trials, fosters the adoption of advanced clinical trial supply solutions. The region experiences significant activity in both early and late-phase trials, contributing to sustained market growth.

U.K. Clinical Trial Supplies Market Insight

The U.K. clinical trial supplies market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by its well-established pharmaceutical sector and active participation in international clinical trials. A strong regulatory framework and the presence of leading contract research organizations (CROs) contribute to the demand for efficient and compliant clinical trial supply management services. The UK's focus on innovation in drug development further stimulates market growth.

Germany Clinical Trial Supplies Market Insight

The German clinical trial supplies market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing investment in pharmaceutical research and development and a strong focus on high-quality clinical data. Germany's robust healthcare infrastructure and significant contributions to clinical trials across various therapeutic areas drive the demand for reliable and efficient clinical trial supply solutions. The integration of advanced technologies in clinical trial management further supports market expansion.

Asia-Pacific Clinical Trial Supplies Market Insight

The Asia-Pacific clinical trial supplies market is poised to grow at the fastest CAGR of 7.6% in 2025, driven by increasing clinical trial outsourcing, a growing pharmaceutical manufacturing base, and rising healthcare investments in countries such as China, Japan, and India. The region's expanding participation in global clinical trials and the rising number of domestic pharmaceutical companies conducting research are key factors propelling the adoption of clinical trial supply services. Furthermore, increasing regulatory harmonization efforts are facilitating market growth.

India Clinical Trial Supplies Market Insight

The India clinical trial supplies market is expected to witness the highest compound annual growth rate (CAGR) in the clinical trial supplies market due to the region's expanding participation in global clinical trials and the rising number of domestic pharmaceutical companies conducting research are key factors propelling the adoption of clinical trial supply services.

China Clinical Trial Supplies Market Insight

The China clinical trial supplies market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country's rapidly expanding pharmaceutical industry, increasing investment in clinical research, and a large patient pool. China's growing participation in global multi-center trials and the development of a robust domestic CRO sector are key factors driving the demand for comprehensive clinical trial supply solutions. The government's support for pharmaceutical innovation further fuels market expansion.

Clinical Trial Supplies Market Share

The clinical trial supplies industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Catalent, Inc. (U.S.)

- Almac Group (U.K.)

- PAREXEL International (MA) Corporation (U.S.)

- United Parcel Service of America, Inc. (U.S.

- Piramal Pharma Limited (India)

- DCC plc (Ireland)

- PCI Pharma Services (U.S.)

- Myonex (U.S.)

- Clinigen Limited (U.K.)

- Deutsche Post AG (Germany)

- FedEx (U.S.)

- Owens & Minor (U.S.)

- Biocair (U.K.)

- KLIFO (Denmark)

- Walgreens Boots Alliance, Inc. (U.S.)

- Eurofins Scientific (Luxembourg)

- ICON plc (Ireland)

- IQVIA Inc. (U.S.)

- Cencora, Inc. (U.S.)

Latest Developments in Global Clinical Trial Supplies Market

- In April 2025, DHL Supply Chain announced an expansion of its temperature-controlled logistics network in Southeast Asia to support the growing demand for clinical trial shipments in the region. This initiative aims to enhance the secure and timely delivery of temperature-sensitive investigational drugs

- In March 2024, Myonex, a leading global clinical trial supply company, announced an agreement to acquire Creapharm Group's clinical and commercial packaging and distribution business, as well as its bioservices. Creapharm is headquartered in Reims, France, with additional sites in France and Georgia, USA.

- In September 2022, Parexel, a leading global clinical research organization (CRO), announced the opening of a new clinical trial supplies and logistics depot in Suzhou, China. This strategically located facility will provide local and international biopharmaceutical companies conducting clinical trials in the region with timely access to necessary supplies and investigative treatments for distribution to clinical sites and patients worldwide.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.