Global Closed Funnel Ampoule Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

2.57 Billion

2024

2032

USD

1.20 Billion

USD

2.57 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 2.57 Billion | |

|

|

|

|

Closed Funnel Ampoule Market Size

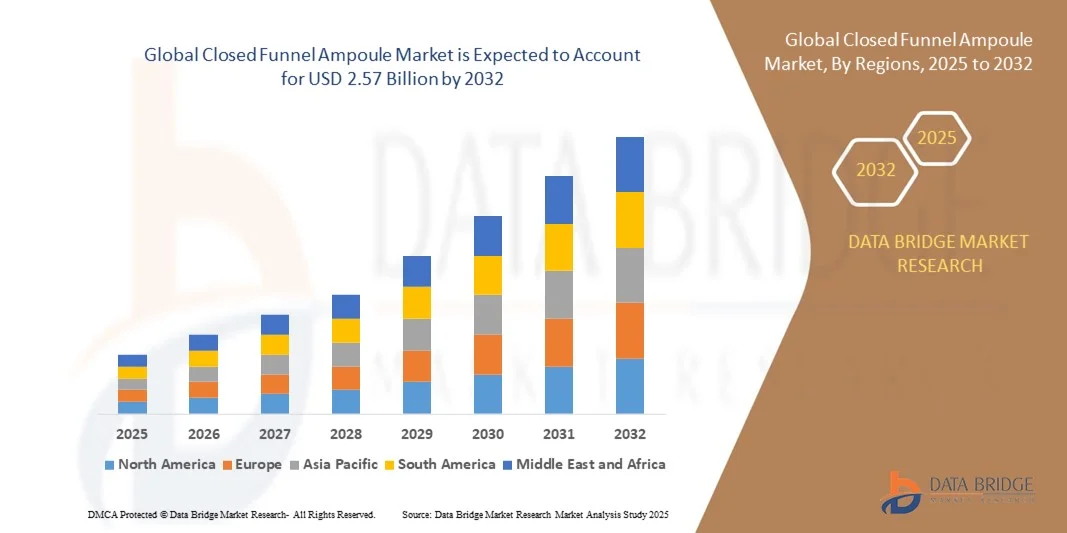

- The global closed funnel ampoule market size was valued at USD 1.20 billion in 2024 and is expected to reach USD 2.57 billion by 2032, at a CAGR of 9.90% during the forecast period

- The market growth is largely fueled by the increasing demand for sterile, single-dose packaging in pharmaceutical and personal care applications, driven by the need for accurate dosing, contamination-free delivery, and enhanced product stability

- Furthermore, rising adoption of injectable drugs, biologics, and high-value cosmetic serums is establishing closed funnel ampoules as the preferred packaging solution for both healthcare and personal care industries. These converging factors are accelerating the uptake of closed funnel ampoules, thereby significantly boosting the industry's growth

Closed Funnel Ampoule Market Analysis

- Closed funnel ampoules, providing tamper-evident, contamination-resistant packaging for liquids and injectables, are becoming essential in pharmaceutical and personal care sectors due to their precision dosing, sterility, and ease of handling

- The escalating demand for closed funnel ampoules is primarily fueled by increasing pharmaceutical production, growing cosmetic and personal care applications, stringent safety and hygiene regulations, and a rising preference for convenient, single-use packaging solutions

- North America dominated the closed funnel ampoule market with a share of over 40% in 2024, due to growing demand for pharmaceutical and personal care ampoules, as well as high standards for product safety and hygiene

- Asia-Pacific is expected to be the fastest growing region in the closed funnel ampoule market during the forecast period due to increasing pharmaceutical production, urbanization, and rising demand for personal care products in countries such as China, Japan, and India

- OPC (One Point Cut) segment dominated the market with a market share of 47.2% in 2024, due to its simplicity, cost-effectiveness, and ease of opening. OPC ampoules allow consumers and healthcare professionals to access the contents with minimal effort while reducing the risk of glass shards or spillage. Manufacturers prefer OPC for large-scale production as it provides consistency and reliability in break performance. The segment is widely adopted across both personal care and pharmaceutical applications, ensuring broad market coverage. Regulatory approvals and standardization of OPC ampoules contribute to their continued market dominance.

Report Scope and Closed Funnel Ampoule Market Segmentation

|

Attributes |

Closed Funnel Ampoule Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Closed Funnel Ampoule Market Trends

Growth in Single-Dose Sterile Packaging

- The closed funnel ampoule market is experiencing robust growth driven by increasing demand for single-dose sterile packaging solutions in the pharmaceutical and biotech industries. These ampoules provide superior sterility and contamination protection compared to other packaging formats, making them ideal for injectable and biologic drug delivery. Innovations focus on automation, sustainability, and enhanced drug stability, supporting the growing prevalence of chronic diseases and personalized medicine

- For instance, leading manufacturers such as Gerresheimer, SCHOTT, and Stevanato Group are expanding production capacities and investing in advanced camera-controlled filling and sealing systems that improve throughput while ensuring product safety. Sustainability initiatives are also gaining traction, with eco-friendly glass compositions reducing environmental impact while maintaining protective properties

- The adoption of pre-fillable and ready-to-use ampoules is scaling, streamlining drug manufacturing processes and minimizing handling errors. These factors enhance patient compliance and reduce medical waste, reinforcing the appeal of closed funnel ampoules in hospital and outpatient settings

- Emerging markets in Asia-Pacific and Latin America are showing faster growth due to expanding healthcare infrastructure and rising pharmaceutical consumption. This is creating new opportunities for market penetration beyond the mature markets of Europe and North America

- Rising regulatory emphasis on GMP compliance, safety standards, and quality assurance is driving continuous innovation in materials science and manufacturing technology. The focus is on enhancing barrier properties, breakage resistance, and traceability to meet evolving industry demands

- Overall, the market shift toward sterile, single-dose, and sustainable packaging positions closed funnel ampoules as a cornerstone of modern pharmaceutical delivery systems with strong long-term growth outlook

Closed Funnel Ampoule Market Dynamics

Driver

Rising Demand for Contamination-Free Dosing

- The primary driver for the closed funnel ampoule market is the increasing demand for contamination-free drug dosing and injectable safety. Closed funnel ampoules reduce the risk of microbial contamination during drug administration, making them critical in sensitive therapies including biologics, vaccines, and high-potency medications

- For instance, the rise of pre-fillable ampoules in hospitals and pharmaceutical production lines—offered by companies such as Gerresheimer and SCHOTT—helps streamline aseptic processing and reduce human contact, enhancing product sterility and improving patient safety

- Regulatory agencies are mandating stricter packaging standards to minimize contamination risks, which increases adoption of closed funnel configurations. Their design improves drug stability by preventing contact with air and moisture, extending shelf life and preserving efficacy

- Increased prevalence of chronic diseases and demand for injectable medications globally further fuel consumption. Closed funnel ampoules support precise, single-dose administration, reducing dosing errors and waste in clinical settings

- Technological advancements such as automation, real-time monitoring, and improved quality control systems enable producers to deliver high volumes without compromising package integrity or sterility, catering to growing pharmaceutical manufacturing needs

Restraint/Challenge

High Production Costs and Strict Regulations

- High production costs and stringent regulatory requirements are significant challenges for the closed funnel ampoule market. The need for high precision manufacturing, cleanroom environments, and compliance with global standards such as GMP and USP increases capital and operational expenditures

- For instance, fluctuations in raw material prices, particularly premium pharmaceutical-grade glass, elevate manufacturing costs for companies such as Stevanato Group and Nipro Pharma Packaging. Investments in advanced automation and quality assurance technologies are necessary but costly for sustaining certification and market competitiveness

- Regulatory demands on traceability, validation, and environmental safety further lengthen product development timelines and require continuous certification investments. Failure to meet these complex requirements can delay product approvals and restrict market access

- Compared to alternative packaging solutions such as pre-filled syringes and vials, closed funnel ampoules have higher manufacturing complexity and cost of ownership, which may limit accessibility in price-sensitive markets or smaller pharmaceutical companies

- To mitigate these challenges, industry players are focusing on innovation in process efficiency, materials science, and sustainable practices to reduce costs while maintaining compliance. Strategic partnerships and regional manufacturing expansions also aim to optimize supply chains and regulatory navigation for long-term growth

Closed Funnel Ampoule Market Scope

The market is segmented on the basis of capacity, end-use industry, and break system.

- By Capacity

On the basis of capacity, the closed funnel ampoule market is segmented into less than 2 ml, 3 ml to 5 ml, 6 ml to 15 ml, 16 ml to 25 ml, and more than 25 ml. The 6 ml to 15 ml segment dominated the market with the largest revenue share in 2024, driven by its optimal volume for both personal care and pharmaceutical applications. This capacity is widely preferred by manufacturers as it balances product dosage and packaging efficiency while minimizing wastage. Consumers often favor ampoules in this range for ease of use, accurate dosing, and convenient handling. Furthermore, the availability of this capacity across various brands enhances its market penetration. The 6 ml to 15 ml size is compatible with standard filling machinery, contributing to streamlined production and cost-effectiveness for manufacturers.

The more than 25 ml segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in healthcare and specialty personal care formulations requiring larger doses. This segment is increasingly used for professional treatments in dermatology clinics and hospitals, where bulk applications are common. The convenience of delivering concentrated active ingredients in a single ampoule boosts its adoption in the professional segment. Growth is further supported by innovations in packaging design that improve storage stability and shelf life. Manufacturers are expanding production capacities to meet the growing bulk volume requirements.

- By End-Use Industry

On the basis of end-use industry, the closed funnel ampoule market is segmented into personal care and healthcare. The healthcare industry dominated the market in 2024 with the largest revenue share, owing to the critical role of ampoules in delivering sterile pharmaceutical solutions. Hospitals, clinics, and laboratories rely on closed funnel ampoules for accurate dosing and contamination-free storage of injectable medicines. The segment’s growth is supported by stringent regulatory requirements for safety and hygiene, ensuring that healthcare providers prioritize ampoules for liquid drug administration. The widespread use of ampoules in vaccines, biologics, and injectable therapies reinforces the dominance of this segment.

The personal care industry segment is expected to witness the fastest growth during the forecast period, driven by increasing demand for single-dose cosmetic treatments, serums, and essential oils. For instance, companies such as L’Oréal and Estée Lauder are increasingly packaging active ingredients in closed funnel ampoules for skincare routines. Consumers are attracted to ampoules for precise dosing, product freshness, and minimal contamination risk. The convenience of one-time-use packaging aligns with rising trends in at-home skincare solutions. Expansion of the anti-aging and professional-grade cosmetic segments also supports accelerated adoption in personal care.

- By Break System

On the basis of break system, the closed funnel ampoule market is segmented into OPC (One Point Cut), CBR (Colour Break Ring), and Score Ring. The OPC segment dominated the market in 2024 with the largest revenue share of 47.2% due to its simplicity, cost-effectiveness, and ease of opening. OPC ampoules allow consumers and healthcare professionals to access the contents with minimal effort while reducing the risk of glass shards or spillage. Manufacturers prefer OPC for large-scale production as it provides consistency and reliability in break performance. The segment is widely adopted across both personal care and pharmaceutical applications, ensuring broad market coverage. Regulatory approvals and standardization of OPC ampoules contribute to their continued market dominance.

The CBR (Colour Break Ring) segment is projected to witness the fastest growth from 2025 to 2032, fueled by its visual guidance and ease of identification during high-volume usage. For instance, pharmaceutical companies such as Pfizer utilize color-coded ampoules for differentiation between products and dosages. The CBR system enhances user safety by clearly indicating the breaking point and reducing handling errors. Growing adoption in premium personal care products and specialty healthcare treatments further accelerates its market growth. Design innovations in CBR ampoules improve aesthetics and functionality, boosting consumer preference.

Closed Funnel Ampoule Market Regional Analysis

- North America dominated the closed funnel ampoule market with the largest revenue share of over 40% in 2024, driven by growing demand for pharmaceutical and personal care ampoules, as well as high standards for product safety and hygiene

- Consumers and healthcare providers in the region prioritize sterile, single-dose packaging for accurate dosing and contamination-free use

- This widespread adoption is further supported by advanced manufacturing infrastructure, strong regulatory frameworks, and rising awareness of professional-grade personal care treatments, establishing closed funnel ampoules as a preferred packaging solution in both healthcare and cosmetic applications

U.S. Closed Funnel Ampoule Market Insight

The U.S. closed funnel ampoule market captured the largest revenue share in 2024 within North America, fueled by increasing pharmaceutical production and the growing trend of injectable treatments in healthcare and personal care industries. Healthcare facilities and cosmetic brands are prioritizing sterile, single-dose solutions for both patient safety and product effectiveness. The rising preference for high-precision dosing, combined with innovations in ampoule design and packaging, further propels market growth. Moreover, integration of closed funnel ampoules in at-home personal care kits and clinical settings is significantly expanding the market footprint.

Europe Closed Funnel Ampoule Market Insight

The Europe closed funnel ampoule market is projected to expand at a substantial CAGR throughout the forecast period, driven by strict regulations for pharmaceutical packaging and the increasing demand for high-quality, sterile solutions. The rise in cosmetic and healthcare applications is fostering adoption across residential and clinical settings. European consumers and healthcare providers are drawn to ampoules for precise dosing, contamination-free use, and enhanced product stability. The market is witnessing growth in new production facilities and technological upgrades to meet safety standards, making closed funnel ampoules a preferred choice in both personal care and medical sectors.

U.K. Closed Funnel Ampoule Market Insight

The U.K. closed funnel ampoule market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased adoption in healthcare and professional skincare industries. Concerns regarding product integrity, sterility, and precise dosing are encouraging manufacturers and consumers to adopt ampoule-based packaging. The country’s advanced pharmaceutical and cosmetic sectors, coupled with strong retail and e-commerce networks, are expected to continue supporting market expansion. Growing awareness about single-dose convenience and contamination-free packaging is further boosting adoption rates.

Germany Closed Funnel Ampoule Market Insight

The Germany closed funnel ampoule market is expected to expand at a considerable CAGR during the forecast period, fueled by high standards for pharmaceutical safety and rising demand in personal care treatments. Germany’s robust healthcare infrastructure, focus on innovation, and emphasis on eco-friendly, high-quality packaging solutions are promoting the adoption of closed funnel ampoules. The integration of ampoules in clinical treatments, beauty therapies, and laboratory applications continues to gain traction, with manufacturers innovating to meet both regulatory and consumer expectations.

Asia-Pacific Closed Funnel Ampoule Market Insight

The Asia-Pacific closed funnel ampoule market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing pharmaceutical production, urbanization, and rising demand for personal care products in countries such as China, Japan, and India. The region’s growing adoption of injectable medications and single-dose cosmetic ampoules, supported by government initiatives promoting healthcare and personal care innovation, is driving market growth. In addition, APAC’s emergence as a manufacturing hub for ampoule packaging is enhancing affordability and accessibility, expanding the market to a wider consumer and industrial base.

Japan Closed Funnel Ampoule Market Insight

The Japan closed funnel ampoule market is gaining momentum due to the country’s advanced healthcare system, high adoption of personal care innovations, and focus on product safety. The market emphasizes precision dosing and sterile packaging, supporting both healthcare and cosmetic applications. Integration of ampoules with at-home skincare and professional treatments is driving adoption. Moreover, Japan’s aging population is likely to increase demand for easy-to-use, secure packaging solutions in residential and clinical settings.

China Closed Funnel Ampoule Market Insight

The China closed funnel ampoule market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, a growing middle class, and rising pharmaceutical and personal care production. China is a key market for both clinical and cosmetic ampoules, driven by high demand for sterile, single-dose packaging. Government initiatives supporting healthcare infrastructure and domestic manufacturing capabilities, coupled with competitive pricing, are key factors propelling the market. The increasing trend toward smart and professional-grade packaging solutions further strengthens market growth in China.

Closed Funnel Ampoule Market Share

The closed funnel ampoule industry is primarily led by well-established companies, including:

- Gerresheimer AG (Germany)

- Stevanato Group (Italy)

- SANNER (Germany)

- James Alexander Corporation (U.S.)

- Bisio Progetti (Italy)

- Pin Mao Packaging (Taiwan)

- Lameplast (Italy)

- Catalent, Inc. (U.S.)

- Farabi Medical Industry (Saudi Arabia)

- Nirmala Industries (India)

- Kishore Group (India)

- B. Braun Medical Ltd (Germany)

- AAPL Solutions (India)

- Merck KGaA (Germany)

- RACHANA PLASTICS (India)

- Syrian Company for Cans & Metal Caps (Syria)

- DEMO SA (Switzerland)

- Europack (Italy)

- NIPRO PHARMA CORPORATION (Japan)

- Otsuka Pharmaceutical Factory, Inc. (Japan)

- James Alexander Corporation (U.S.)

Latest Developments in Global Closed Funnel Ampoule Market

- In April 2025, SCHOTT Pharma inaugurated a new glass ampoule production facility in Jagodina, Serbia, significantly strengthening its regional manufacturing footprint and securing its supply‑chain position for injectable drug containment solutions. This investment provides European pharmaceutical customers with a local source of closed‑funnel ampoules, reducing dependency on distant suppliers and boosting overall production capacity and competitiveness in the ampoule market

- In January 2025, Gerresheimer and Bormioli Pharma made their first joint appearance at Pharmapack 2025, showcasing an expanded portfolio of containment solutions including ampoules. By presenting this combined offering, the firms signalled a strategic alignment in their product development and market approach, accelerating innovation in closed‑funnel ampoule formats and facilitating more integrated packaging solutions for pharmaceutical and personal‑care customers

- In December 2024, Gerresheimer AG completed the acquisition of Bormioli Pharma Group (via Blitz LuxCo Sarl), thereby expanding its primary‑packaging glass product portfolio and production footprint across Europe. This acquisition allows Gerresheimer to broaden its range of closed‑funnel ampoule offerings, achieve economies of scale in pharmaceutical glass packaging, and enhance its global competitive position in the ampoule market

- In November 2024, Akums Drugs & Pharmaceuticals Ltd. in India announced the expansion of its glass ampoule capacity, adding FFS (fill‑finish sealed) ampoule lines and lyophilization facilities. This expansion enables the company to meet growing domestic demand for sterile, single‑dose closed‑funnel ampoules, supporting both pharmaceutical and personal care applications and strengthening its market presence in the Asia-Pacific region

- In October 2024, Stevanato Group invested in upgrading its advanced glass ampoule manufacturing lines to include improved closed‑funnel designs and automated inspection systems. This initiative enhances production efficiency, ensures higher product quality, and positions the company as a preferred supplier for pharmaceutical and biotech companies seeking reliable, tamper-evident ampoule solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Closed Funnel Ampoule Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Closed Funnel Ampoule Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Closed Funnel Ampoule Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.