Global Cloud Ai Market

Market Size in USD Billion

CAGR :

%

USD

103.93 Billion

USD

931.02 Billion

2025

2033

USD

103.93 Billion

USD

931.02 Billion

2025

2033

| 2026 –2033 | |

| USD 103.93 Billion | |

| USD 931.02 Billion | |

|

|

|

|

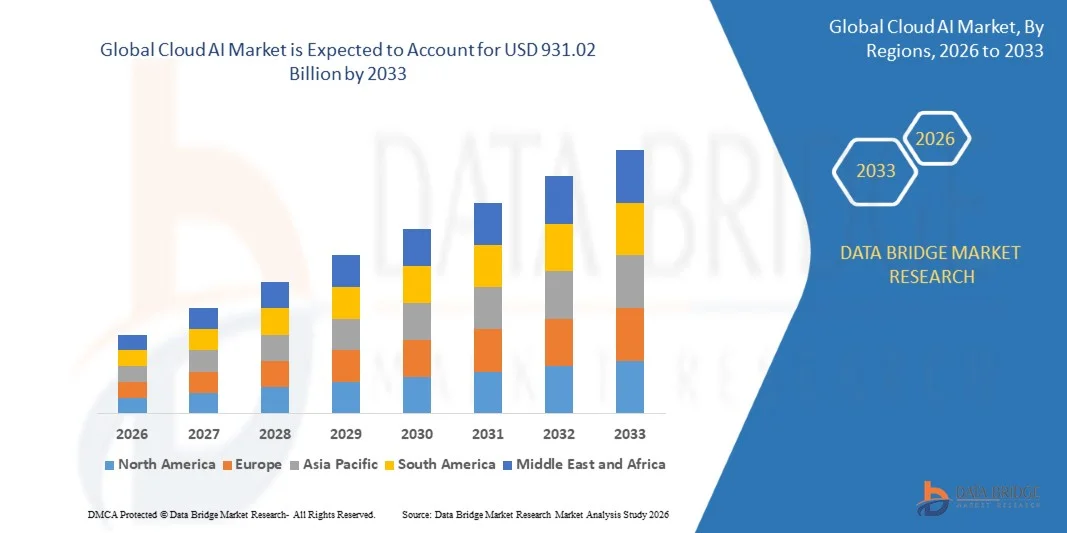

What is the Global Cloud AI Market Size and Growth Rate?

- The global cloud AI market size was valued at USD 103.93 billion in 2025 and is expected to reach USD 931.02 billion by 2033, at a CAGR of31.53% during the forecast period

- Rising adoption of cloud-based AI solutions across enterprises, increasing deployment of machine learning and deep learning applications, growing need for real-time data analytics, and proliferation of IoT devices and smart applications are key factors such asly to drive the growth of the cloud AI market

What are the Major Takeaways of Cloud AI Market?

- Growing demand for AI-powered analytics, virtual assistants, and automation solutions across healthcare, BFSI, retail, and manufacturing sectors is generating significant opportunities for the Cloud AI market

- Expansion of cloud infrastructure, coupled with increased enterprise digital transformation initiatives, is boosting market adoption globally

- Lack of skilled AI professionals, high deployment costs, and integration challenges with legacy systems may act as restraints, limiting the full potential of market growth

- North America dominated the cloud AI market with a 36.32% revenue share in 2025, driven by rapid adoption of cloud-based AI platforms, strong semiconductor innovation, embedded system development, and the presence of major IT and technology hubs across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.14% from 2026 to 2033, fueled by rapid expansion of cloud infrastructure, strong IT service ecosystems, growing enterprise digitalization, and rising AI adoption across China, Japan, India, South Korea, and Southeast Asia

- The Deep Learning segment dominated the market with a 42.5% share in 2025, driven by the widespread adoption of convolutional neural networks, recurrent neural networks, and advanced image recognition and computer vision applications across healthcare, automotive, and industrial automation

Report Scope and Cloud AI Market Segmentation

|

Attributes |

Cloud AI Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cloud AI Market?

“Increasing Adoption of Cloud-Based, Scalable, and AI-Driven Solutions”

- The cloud AI market is witnessing strong adoption of cloud-native AI platforms, machine learning services, and scalable infrastructure designed to support real-time analytics, predictive modeling, and intelligent automation

- Vendors are introducing AI-as-a-Service (AIaaS) offerings, pre-trained models, and low-code/no-code development platforms to accelerate deployment across enterprises and developers

- Growing demand for cost-efficient, flexible, and secure cloud AI platforms is driving usage across IT departments, R&D centers, healthcare, finance, and retail

- For instance, companies such as Microsoft, Google, IBM, and AWS have enhanced their cloud AI solutions with automated machine learning, GPU-accelerated computing, and advanced NLP tools

- Increasing need for real-time insights, predictive analytics, and AI-powered decision-making is accelerating the shift toward cloud-integrated AI ecosystems

- As businesses continue digital transformation, Cloud AI solutions remain vital for scalable, real-time, and intelligent operations

What are the Key Drivers of Cloud AI Market?

- Rising demand for AI-powered analytics, automation, and predictive decision-making across enterprises and SMEs is driving market growth

- For instance, in 2025, leading companies such as Microsoft, Google, and IBM expanded cloud AI offerings with NLP, computer vision, and machine learning APIs to support advanced analytics

- Growing adoption of IoT, big data, robotics, autonomous systems, and digital platforms is boosting demand for cloud AI services across North America, Europe, and Asia-Pacific

- Advancements in GPU-based processing, distributed cloud infrastructure, and AI model optimization enhance scalability, performance, and deployment efficiency

- Increasing use of AI models for healthcare diagnostics, finance risk management, retail personalization, and industrial automation is fueling adoption of cloud AI solutions

- Supported by rising enterprise digital transformation, government AI initiatives, and continuous R&D investments, the Cloud AI market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Cloud AI Market?

- High implementation costs, infrastructure requirements, and subscription fees for enterprise-grade cloud AI platforms restrict adoption among small businesses

- For instance, during 2024–2025, complexity in AI model deployment, lack of skilled AI engineers, and concerns over data privacy increased operational challenges for several organizations

- Integrating cloud AI with legacy IT systems, ensuring data security, and managing regulatory compliance adds technical and operational complexity

- Limited awareness in emerging markets regarding cloud AI capabilities, model optimization, and service integration slows adoption

- Competition from on-premises AI solutions, open-source frameworks, and hybrid cloud platforms creates pricing pressure and limits differentiation

- To address these challenges, companies are focusing on cost-effective deployment, training programs, model automation, and cloud-native integrations to increase global adoption of Cloud AI

How is the Cloud AI Market Segmented?

The market is segmented on the basis of technology, type, and vertical.

• By Technology

On the basis of technology, the Cloud AI market is segmented into Deep Learning, Machine Learning, Natural Language Processing (NLP), and Others. The Deep Learning segment dominated the market with a 42.5% share in 2025, driven by the widespread adoption of convolutional neural networks, recurrent neural networks, and advanced image recognition and computer vision applications across healthcare, automotive, and industrial automation. Deep Learning frameworks provide high-accuracy predictive analytics, AI-powered decision-making, and enhanced model training capabilities, making them essential for enterprises pursuing intelligent automation and cloud-scale AI deployment.

The NLP segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by the rising demand for AI-powered chatbots, voice assistants, sentiment analysis, and language translation tools across IT, BFSI, and e-commerce verticals. Increasing deployment of AI-driven conversational platforms and text-mining solutions is accelerating adoption of NLP technologies globally.

• By Type

On the basis of type, the Cloud AI market is segmented into Solution and Services. The Solution segment dominated the market with a 47.1% share in 2025, supported by widespread integration of AI models, pre-trained frameworks, and cloud-based platforms across enterprise IT infrastructure. Cloud AI solutions offer end-to-end automation, predictive insights, and advanced analytics capabilities that help organizations improve efficiency, reduce operational costs, and scale AI applications.

The Services segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of AI consulting, model deployment services, training, and maintenance offerings. Managed AI services and AI-as-a-Service (AIaaS) models are increasingly helping small and medium businesses leverage advanced analytics without heavy upfront investment. Continuous growth in digital transformation initiatives, cloud migration, and AI adoption fuels demand for cloud AI services across multiple regions.

• By Vertical

On the basis of vertical, the Cloud AI market is segmented into Healthcare, Retail, BFSI, IT & Telecommunication, Government, Manufacturing, Automotive & Transportation, and Others. The Healthcare segment dominated the market with a 40.3% share in 2025, driven by extensive use of AI for diagnostics, medical imaging, patient monitoring, drug discovery, and personalized treatment planning. Cloud AI enables scalable processing of large healthcare datasets, accelerates research and development, and supports real-time clinical decision-making.

The Retail segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by the adoption of AI-driven demand forecasting, personalized marketing, inventory optimization, and customer sentiment analysis. Increasing investment in AI-powered e-commerce solutions, chatbots, and recommendation engines is driving rapid deployment across global retail organizations, enhancing consumer engagement and operational efficiency.

Which Region Holds the Largest Share of the Cloud AI Market?

- North America dominated the cloud AI market with a 36.32% revenue share in 2025, driven by rapid adoption of cloud-based AI platforms, strong semiconductor innovation, embedded system development, and the presence of major IT and technology hubs across the U.S. and Canada. Rising enterprise investments in AI infrastructure, digital transformation initiatives, and high-performance computing continue to fuel Cloud AI deployment across healthcare, BFSI, retail, and automotive sectors

- Leading companies in North America are offering advanced cloud AI solutions with integrated machine learning frameworks, deep learning model support, and AI-as-a-Service (AIaaS) capabilities, reinforcing the region’s technological advantage. Continuous investments in IoT, edge AI, and analytics platforms further drive long-term market expansion

- High concentration of engineering talent, extensive R&D centers, and robust innovation ecosystems strengthen regional leadership in cloud AI adoption and service development

U.S. Cloud AI Market Insight

The U.S. is the largest contributor in North America, supported by strong enterprise AI adoption, government and private sector AI initiatives, and extensive cloud infrastructure. Rapid deployment of AI-driven analytics, deep learning applications, and AIaaS models across healthcare, retail, BFSI, and IT sectors intensifies demand. Presence of major technology providers, high R&D spending, and advanced AI ecosystems further boost market growth.

Canada Cloud AI Market Insight

Canada contributes significantly to regional growth, driven by expanding cloud adoption, government-backed AI initiatives, and enterprise digital transformation. Increasing deployment of machine learning, deep learning, and NLP-based AI solutions across healthcare, finance, and e-commerce sectors strengthens market adoption. Skilled workforce availability and supportive innovation programs accelerate AI integration across enterprises.

Asia-Pacific Cloud AI Market

Asia-Pacific is projected to register the fastest CAGR of 9.14% from 2026 to 2033, fueled by rapid expansion of cloud infrastructure, strong IT service ecosystems, growing enterprise digitalization, and rising AI adoption across China, Japan, India, South Korea, and Southeast Asia. Increasing AI deployment in consumer electronics, automotive, healthcare, and manufacturing drives regional demand for cloud-based AI solutions. Growth in 5G, IoT, and edge computing further accelerates adoption of scalable AI platforms and analytics tools.

China Cloud AI Market Insight

China is the largest contributor in Asia-Pacific, driven by government-supported AI initiatives, world-class cloud infrastructure, and significant enterprise adoption. Rising development of deep learning models, NLP applications, and AIaaS platforms supports large-scale AI integration. Local cloud providers and competitive pricing further expand market penetration.

Japan Cloud AI Market Insight

Japan shows steady growth, supported by advanced IT infrastructure, precision manufacturing, and strong enterprise AI adoption. Focus on AI-driven automation, predictive analytics, and digital transformation in manufacturing and services reinforces long-term market expansion.

India Cloud AI Market Insight

India is emerging as a key growth hub, driven by cloud migration, startup activity, and government-backed AI programs. Rapid adoption of AI solutions in BFSI, healthcare, IT, and e-commerce sectors fuels regional market growth, supported by rising R&D investments and digital infrastructure expansion.

South Korea Cloud AI Market Insight

South Korea contributes significantly due to strong enterprise demand for AI-powered analytics, deep learning, and cloud computing solutions. High adoption in consumer electronics, automotive, and industrial automation sectors supports sustained regional market growth.

Which are the Top Companies in Cloud AI Market?

The cloud AI industry is primarily led by well-established companies, including:

- Apple Inc. (U.S.)

- Google Inc. (U.S.)

- IBM Corporation (U.S.)

- Intel Corporation (U.S.)

- Microsoft (U.S.)

- MicroStrategy Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- Oracle Corporation (U.S.)

- Qlik Technologies Inc. (U.S.)

- Salesforce.com Inc. (U.S.)

- ZTE Corp. (China)

What are the Recent Developments in Global Cloud AI Market?

- In September 2024, Salesforce expanded its partnership with Google Cloud to launch Agentforce Agents, enabling secure collaboration across Salesforce Customer 360 and Google Workspace apps. This update enhances existing integrations, allowing mutual customers to deploy autonomous agents seamlessly within their daily apps while ensuring strong privacy and user data protection, strengthening enterprise AI productivity

- In August 2024, IBM and Intel announced a collaboration to deploy Intel Gaudi 3 AI accelerators as a service on IBM Cloud, with a launch scheduled for early 2025. This partnership aims to help enterprises scale AI initiatives efficiently while maintaining high reliability and security. Gaudi 3 will integrate into IBM Watson’s AI and data platform, making IBM Cloud the first provider to offer Gaudi 3 for both hybrid and on-premises environments, enhancing cloud AI capabilities

- In July 2024, AWS introduced AWS GenAI Lofts, a global initiative to foster innovation in generative AI. Temporary spaces in key AI hubs worldwide provide developers, enterprises, and enthusiasts opportunities to create, interact, and learn. The program features workshops, informal talks, and hands-on sessions led by AI experts, community groups, and AWS partners such as Anthropic, Cerebral Valley, and Weights & Biases, driving generative AI adoption globally

- In May 2024, IBM launched the AI Gateway for IBM API Connect, available in June 2024. This functionality enables users to access AI services from a single control point, securely connecting internal applications with external AI APIs. It also monitors AI API usage and provides actionable insights for selecting optimal large language models (LLMs), improving AI deployment efficiency across enterprises

- In April 2024, NVIDIA acquired Run: AI, an Israeli company specializing in Kubernetes for AI infrastructure. Run: AI’s technology enhances GPU utilization for AI workloads, expanding NVIDIA’s ecosystem, improving AI operational efficiency, and advancing Kubernetes integration in cloud-native AI architecture, strengthening NVIDIA’s leadership in AI infrastructure solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.