Global Cloud Analytics Market

Market Size in USD Billion

CAGR :

%

USD

36.06 Billion

USD

232.00 Billion

2024

2032

USD

36.06 Billion

USD

232.00 Billion

2024

2032

| 2025 –2032 | |

| USD 36.06 Billion | |

| USD 232.00 Billion | |

|

|

|

|

Cloud Analytics Market Size

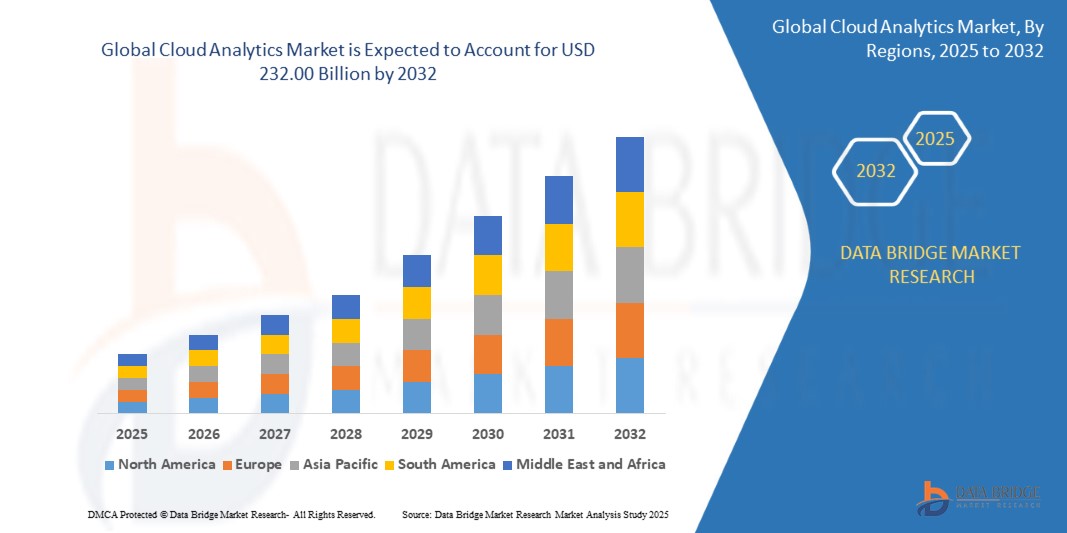

- The global cloud analytics market size was valued at USD 36.06 billion in 2024 and is expected to reach USD 232.00 billion by 2032, at a CAGR of 26.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of cloud computing and advanced analytics technologies across enterprises, leading to enhanced data-driven decision-making and operational efficiency in multiple industries

- Furthermore, rising demand for real-time insights, predictive analytics, and AI-powered business intelligence solutions is driving organizations to implement cloud analytics platforms. These converging factors are accelerating the adoption of cloud analytics, thereby significantly boosting the industry’s growth

Cloud Analytics Market Analysis

- Cloud analytics platforms enable organizations to collect, process, and analyze structured and unstructured data from multiple sources in real time. These platforms provide actionable insights for sales, marketing, customer service, finance, HR, and R&D, helping enterprises optimize operations and improve strategic decision-making

- The escalating demand for cloud analytics is primarily driven by digital transformation initiatives, the need for cost-effective and scalable data solutions, and growing reliance on AI, machine learning, and big data technologies to enhance competitiveness across industries

- North America dominated the cloud analytics market with a share of 38.5% in 2024, due to strong adoption of big data solutions, AI-driven analytics, and the widespread presence of major cloud service providers

- Asia-Pacific is expected to be the fastest growing region in the cloud analytics market during the forecast period due to increasing digitalization, government initiatives, and growing investment in cloud technologies across China, India, and Japan

- Solutions segment dominated the market with a market share of 62.5% in 2024, due to the widespread adoption of advanced analytics platforms, business intelligence tools, and data visualization solutions. Enterprises increasingly rely on cloud-based solutions to derive actionable insights from large datasets, enabling real-time decision-making and predictive analytics. The growing need for organizations to leverage AI and machine learning-powered analytics for competitive advantage has further strengthened the dominance of the solutions segment

Report Scope and Cloud Analytics Market Segmentation

|

Attributes |

Cloud Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Cloud Analytics Market Trends

Increasing Adoption of AI-Powered Cloud Analytics Solutions

- The integration of artificial intelligence within cloud analytics platforms is transforming how organizations derive insights from growing volumes of data. AI-powered solutions are automating complex processes, improving prediction accuracy, and enhancing decision-making capabilities for enterprises across industries

- For instance, companies such as Snowflake and Google Cloud have embedded AI-driven analytics tools into their platforms, enabling businesses to perform advanced predictive modeling and automate data analysis workflows. These innovations are streamlining processes and expanding the scope of cloud-based insights

- The rise of machine learning algorithms within cloud environments allows organizations to discover hidden patterns in structured and unstructured data. These capabilities drive business outcomes in areas such as fraud detection, customer segmentation, and supply chain optimization, making AI integration indispensable

- In addition, AI-powered cloud analytics is enabling self-service business intelligence. By delivering accessible insights through conversational interfaces and automated dashboards, these solutions empower non-technical users to make informed decisions quickly, enhancing organizational agility

- The growing importance of real-time decision-making is also reinforcing adoption. AI-driven cloud platforms allow organizations to process data streams instantly, supporting mission-critical functions in industries such as finance, healthcare, and retail with immediate and actionable insights

- Altogether, the increasing adoption of AI-powered analytics represents a defining shift in cloud solutions. It underscores the broader market movement towards intelligent, automated, and self-learning platforms that can support scalable and dynamic enterprise requirements globally

Cloud Analytics Market Dynamics

Driver

Rising Demand for Real-Time, Data-Driven Decision-Making

- The shift to real-time analytics is a key driver for the cloud analytics market, as organizations seek to act on immediate insights that can strengthen competitiveness. Cloud solutions provide the scalability and speed required for processing massive data volumes at unprecedented rates

- For instance, Amazon Web Services and Microsoft Azure offer fully managed cloud analytics tools that support real-time data streaming and interactive dashboards. These capabilities enable enterprises to use live data for operational intelligence, customer service, and predictive modeling applications

- The demand for faster, data-driven decisions is being amplified by industries facing high competition and rapid change. From finance to e-commerce, real-time cloud analytics enables companies to respond quickly to consumer needs, supply chain changes, or regulatory requirements

- In addition, real-time decision-making enhances customer experience by enabling organizations to personalize services and proactively address problems. Cloud analytics plays a central role in tailoring offerings and delivering dynamic engagement in consumer-driven industries

- The rising reliance on accurate, near-instant data demonstrates the critical role of cloud-based analytics for modern enterprises. This demand for agility and responsiveness is ensuring sustained market growth as businesses prioritize digital transformation and competitive differentiation

Restraint/Challenge

Data Security and Compliance Concerns in Multi-Cloud Environments

- Security and compliance risks continue to be major challenges for cloud analytics adoption, particularly in multi-cloud frameworks where data moves across various vendors and geographies. Organizations face greater complexity in ensuring compliance with privacy laws and industry standards

- For instance, recent security incidents around misconfigured cloud databases have raised concerns for enterprises about unauthorized access and data leakage. Vendors such as IBM and Oracle emphasize their advanced encryption and compliance frameworks to build trust among heavily regulated industries

- The shared responsibility model in cloud services creates uncertainties around accountability. Enterprises often struggle to manage policies consistently across multiple environments, leading to compliance risks in regions governed by strict data protection laws such as GDPR or CCPA

- In addition, the use of hybrid and multi-cloud strategies amplifies challenges in identity management, access control, and data sovereignty. These risks heighten reluctance among organizations in sectors such as healthcare and banking, where regulatory penalties can be severe

- Addressing these challenges requires stronger interoperability frameworks, unified governance tools, and greater transparency from vendors. Building secure, compliant, and resilient architectures will be vital for enabling the next phase of growth in cloud analytics adoption

Cloud Analytics Market Scope

The market is segmented on the basis of component, organization size, deployment, application, and industry vertical.

• By Component

On the basis of component, the cloud analytics market is segmented into solutions and services. The solutions segment accounted for the largest market revenue share of 62.5% in 2024, driven by the widespread adoption of advanced analytics platforms, business intelligence tools, and data visualization solutions. Enterprises increasingly rely on cloud-based solutions to derive actionable insights from large datasets, enabling real-time decision-making and predictive analytics. The growing need for organizations to leverage AI and machine learning-powered analytics for competitive advantage has further strengthened the dominance of the solutions segment.

The services segment is expected to register the fastest growth from 2025 to 2032, fueled by rising demand for consulting, integration, training, and managed services that help enterprises optimize cloud analytics implementation. Companies are seeking expert guidance to overcome challenges in data migration, governance, and scalability, which is driving strong service adoption. The shift toward pay-as-you-go and subscription-based models also enhances demand for ongoing support services, particularly among SMEs that lack in-house IT expertise.

• By Organization Size

On the basis of organization size, the market is segmented into large enterprises and small & medium-sized enterprises (SMEs). Large enterprises dominated the segment in 2024 due to their substantial IT budgets and the need to process complex datasets from multiple global operations. These organizations adopt cloud analytics to streamline operations, strengthen customer insights, and drive digital transformation strategies at scale. The ability to integrate analytics with AI, IoT, and big data infrastructure has made cloud analytics indispensable for large enterprises.

The SME segment is projected to experience the fastest CAGR from 2025 to 2032, supported by the rising affordability and flexibility of cloud-based solutions. SMEs increasingly turn to cloud analytics for customer profiling, sales forecasting, and resource optimization without heavy infrastructure investments. The proliferation of scalable and subscription-driven models allows SMEs to adopt analytics tools tailored to their size, driving faster uptake. In addition, SMEs are embracing digital platforms for e-commerce and customer engagement, further boosting the need for advanced analytics solutions.

• By Deployment

On the basis of deployment, the market is segmented into public cloud, private cloud, and hybrid cloud. The public cloud segment dominated the market in 2024, as enterprises widely leveraged its cost-effectiveness, scalability, and simplified deployment. Public cloud platforms provide access to advanced analytics without significant upfront investments, making them especially attractive for organizations seeking rapid time-to-market. The strong ecosystem of providers offering AI-powered analytics and integration with popular SaaS applications further strengthens the segment’s leadership.

The hybrid cloud segment is anticipated to record the fastest growth rate between 2025 and 2032, driven by enterprises’ growing preference for flexible deployment models that balance security, compliance, and scalability. Hybrid cloud enables organizations to keep sensitive data on private infrastructure while using public cloud for analytics-driven workloads, offering the best of both worlds. As data privacy regulations become stricter across industries, demand for hybrid cloud models in BFSI, healthcare, and government sectors is accelerating. This dual approach allows enterprises to innovate while ensuring compliance.

• By Application

On the basis of application, the cloud analytics market is segmented into sales and marketing, research & development, customer service, accounting & finance, human resource, and others. Sales and marketing dominated the segment in 2024, driven by rising adoption of analytics for customer segmentation, campaign optimization, and sales forecasting. Organizations rely on real-time insights into consumer behavior to enhance targeting and maximize ROI on marketing spend. The integration of AI with cloud analytics is enabling predictive models that significantly improve lead conversion and customer retention strategies.

The research & development segment is projected to grow at the fastest CAGR from 2025 to 2032, as enterprises increasingly harness cloud analytics for innovation and product development. R&D teams are leveraging big data analytics to identify emerging trends, test prototypes, and optimize designs with greater efficiency. Industries such as healthcare, automotive, and technology are investing in cloud-driven R&D to shorten innovation cycles and reduce costs. The ability of cloud analytics to handle massive datasets for simulations and predictive modeling makes it indispensable for future research initiatives.

• By Industry Vertical

On the basis of industry vertical, the market is segmented into BFSI, IT & telecommunication, manufacturing, healthcare & life sciences, government, energy & utilities, and others. The BFSI sector held the largest share in 2024, as financial institutions adopted cloud analytics for fraud detection, risk management, and personalized customer services. Real-time analytics enables banks and insurers to analyze transaction patterns and detect anomalies, ensuring enhanced security and compliance. Moreover, cloud analytics empowers BFSI firms to deliver tailored financial products and improve customer engagement.

The healthcare & life sciences sector is forecast to witness the fastest growth from 2025 to 2032, driven by the rising need for advanced analytics in patient care, clinical trials, and drug discovery. Healthcare providers are increasingly using cloud analytics to improve diagnostic accuracy, predict disease outbreaks, and manage population health data. Pharmaceutical companies also depend on cloud-based analytics for accelerating R&D and regulatory compliance. With growing emphasis on telemedicine and personalized healthcare, the healthcare & life sciences segment is set to be the fastest-expanding adopter of cloud analytics.

Cloud Analytics Market Regional Analysis

- North America dominated the cloud analytics market with the largest revenue share of 38.5% in 2024, driven by strong adoption of big data solutions, AI-driven analytics, and the widespread presence of major cloud service providers

- Enterprises across industries are leveraging analytics for operational optimization, customer engagement, and digital transformation initiatives

- The region’s growth is further supported by high technology penetration, strong investments in cloud infrastructure, and early adoption of advanced business intelligence tools. Increasing demand for real-time insights, regulatory compliance, and integration of cloud analytics with IoT and AI systems are positioning North America as a leader in this market

U.S. Cloud Analytics Market Insight

The U.S. cloud analytics market captured the largest revenue share in 2024 within North America, fueled by rapid digitization across BFSI, healthcare, and retail sectors. Organizations are increasingly prioritizing data-driven decision-making, leading to high demand for AI- and ML-powered analytics platforms. The growing trend of remote work, combined with cloud-native application adoption and regulatory compliance requirements, is further accelerating growth. The strong ecosystem of providers such as AWS, Microsoft, Google, and IBM enhances the U.S. market’s leadership position.

Europe Cloud Analytics Market Insight

The Europe cloud analytics market is projected to expand at a notable CAGR throughout the forecast period, driven by the increasing emphasis on digital transformation, strict data security regulations, and growing adoption of cloud-based intelligence solutions. Businesses are leveraging analytics to gain insights into customer behavior, streamline supply chains, and enhance operational efficiency. The rise in cloud migration initiatives, combined with Europe’s strong focus on GDPR compliance and sustainable IT infrastructure, is fueling growth across industries including BFSI, government, and manufacturing.

U.K. Cloud Analytics Market Insight

The U.K. cloud analytics market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the nation’s strong fintech ecosystem, growing e-commerce sector, and emphasis on AI adoption. Enterprises are leveraging analytics for customer insights, fraud detection, and financial optimization, while government initiatives promoting digital innovation further accelerate uptake.

Germany Cloud Analytics Market Insight

The Germany cloud analytics market is expected to expand at a substantial CAGR during the forecast period, driven by strong industrial digitization initiatives and the adoption of Industry 4.0 practices. German enterprises are increasingly relying on analytics to optimize manufacturing processes, supply chain management, and energy efficiency. Strict adherence to data protection laws and demand for secure cloud infrastructure are shaping the market dynamics in Germany.

Asia-Pacific Cloud Analytics Market Insight

The Asia-Pacific cloud analytics market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, fueled by increasing digitalization, government initiatives, and growing investment in cloud technologies across China, India, and Japan. Rising internet penetration, expanding e-commerce, and a booming startup ecosystem are boosting adoption of cloud analytics in the region. The growing demand for customer-centric strategies, combined with the expansion of 5G networks and IoT ecosystems, is accelerating the integration of cloud analytics across multiple sectors.

Japan Cloud Analytics Market Insight

The Japan cloud analytics market is gaining momentum due to the country’s advanced technology infrastructure, widespread adoption of IoT, and focus on smart city initiatives. Japanese enterprises are increasingly integrating analytics into R&D and customer engagement strategies, with healthcare, automotive, and manufacturing industries driving demand.

China Cloud Analytics Market Insight

The China cloud analytics market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid digital transformation, strong government initiatives for smart cities, and the dominance of domestic cloud providers such as Alibaba Cloud, Tencent Cloud, and Huawei Cloud. Enterprises are investing heavily in analytics to optimize operations, enhance consumer targeting, and expand digital services, positioning China as a key growth hub.

Cloud Analytics Market Share

The cloud analytics industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Hexaware Technologies Limited (India)

- Oracle Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Alphabet Inc. (Google LLC) (U.S.)

- Salesforce.com, Inc. (U.S.)

- TIBCO Software Inc. (U.S.)

- SAS Institute Inc. (U.S.)

- Teradata Corporation (U.S.)

- MicroStrategy Incorporated (U.S.)

- The Hewlett Packard Enterprise Company (U.S.)

- SAP SE (Germany)

- Sisense (U.S.)

- Atos (France)

- Cloudera, Inc. (U.S.)

- Hitachi Vantara Corporation (U.S.)

Latest Developments in Cloud Analytics Market

- In October 2024, Oracle Corporation introduced Oracle Analytics Intelligence for Life Sciences, an AI-driven cloud-based platform tailored for healthcare and pharmaceutical sectors. This launch is expected to significantly impact the market by accelerating insights generation from multidisciplinary datasets, enhancing collaboration, and enabling advanced research capabilities. By integrating seamlessly with Oracle Health and Life Sciences applications, the solution positions Oracle to strengthen its foothold in life sciences analytics while supporting precision medicine and next-generation healthcare innovation

- In December 2023, Salesforce announced major enhancements to its Einstein 1 Platform, featuring Einstein Copilot Search and the Data Cloud Vector Database. This advancement is poised to reshape the cloud analytics landscape by unifying structured and unstructured data sources, such as emails, PDFs, and transcripts, with CRM data. The ability to leverage AI prompts without requiring complex modifications to large language models (LLMs) enhances productivity and operational efficiency. These innovations reinforce Salesforce’s competitive advantage in delivering AI-driven business insights, expanding its influence across customer engagement and data analytics markets

- In May 2023, SAP SE and Google Cloud expanded their strategic partnership through the launch of an Open Data offering powered by SAP Datasphere and Google Cloud. This collaboration impacts the cloud analytics market by simplifying complex enterprise data environments, enabling organizations to consolidate data into a unified ecosystem. By offering real-time visibility and greater data value realization, the partnership empowers enterprises to maximize ROI from both SAP software and cloud analytics. This development strengthens the position of SAP and Google Cloud as key enablers of enterprise-wide digital transformation

- In June 2023, CloudZero Inc. introduced Analytics, a business intelligence tool designed to automate the delivery of cloud cost intelligence. The solution impacts the market by addressing the rising need for financial transparency in multi-cloud environments, helping enterprises better allocate resources across AWS, Azure, GCP, and Snowflake. By organizing application stack costs into actionable insights, CloudZero’s innovation supports cost optimization and promotes data-driven decision-making, making it highly relevant as enterprises increasingly prioritize FinOps within their cloud strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.