Global Cloud Discovery Market

Market Size in USD Billion

CAGR :

%

USD

1.65 Billion

USD

5.78 Billion

2024

2032

USD

1.65 Billion

USD

5.78 Billion

2024

2032

| 2025 –2032 | |

| USD 1.65 Billion | |

| USD 5.78 Billion | |

|

|

|

|

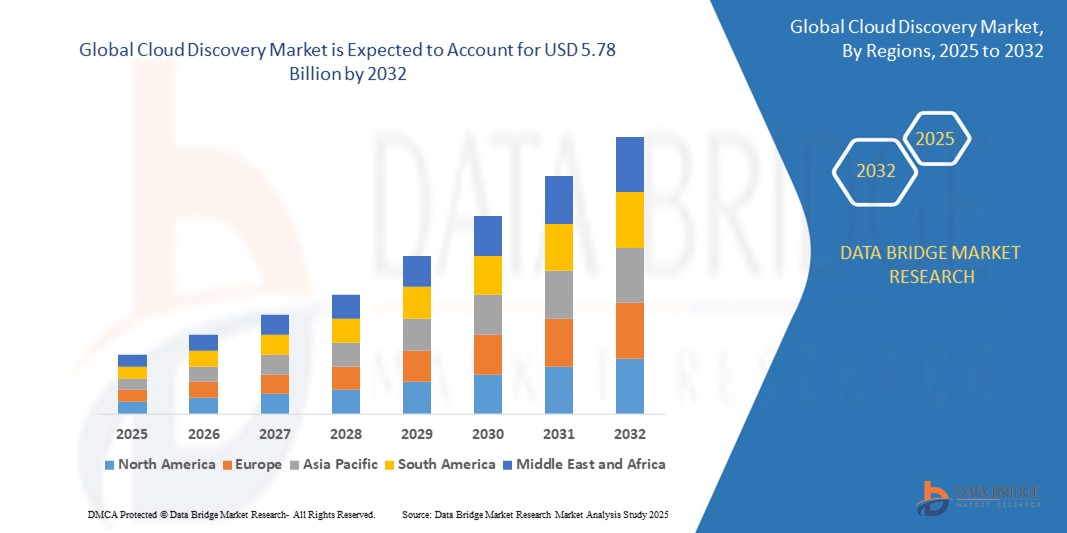

What is the Global Cloud Discovery Market Size and Growth Rate?

- The global cloud discovery market size was valued at USD 1.65 billion in 2024 and is expected to reach USD 5.78 billion by 2032, at a CAGR of 16.90% during the forecast period

- The cloud discovery market is experiencing significant growth, driven by the adoption of advanced methods and technologies that enhance visibility and control over cloud assets. One of the latest methods is the integration of AI and machine learning algorithms that automate the discovery of cloud resources across multi-cloud environments

- These technologies allow businesses to identify shadow IT, reduce security risks, and optimize cloud usage by providing real-time insights into cloud consumption patterns

What are the Major Takeaways of Cloud Discovery Market?

- The growth in hybrid and multi-cloud strategies further fuels the demand for comprehensive cloud discovery solutions. In addition, the rise of remote work and digital transformation initiatives is driving organizations to seek more sophisticated tools to manage their cloud environments

- As a result, the cloud discovery market is projected to expand rapidly, with companies increasingly investing in technologies that offer deeper visibility, enhanced security, and greater operational efficiency. This trend is expected to continue, with market growth driven by ongoing innovations in AI-driven cloud management solutions

- North America dominated the global cloud discovery market, accounting for the largest revenue share of 41.2% in 2024, driven by advanced cloud infrastructure, high enterprise cloud adoption, and the growing need for visibility into shadow IT environments

- Asia-Pacific cloud discovery market is forecast to grow at the fastest CAGR of 18.5% from 2025 to 2032, driven by accelerated cloud adoption, rising cybersecurity awareness, and government-led digital initiatives across countries such as China, India, Japan, and Southeast Asia

- The Solutions segment dominated the cloud discovery market with the largest market revenue share of 61.3% in 2024, driven by increasing enterprise demand for comprehensive tools that provide real-time visibility into cloud environments, shadow IT detection, and regulatory compliance

Report Scope and Cloud Discovery Market Segmentation

|

Attributes |

Cloud Discovery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cloud Discovery Market?

“AI-Driven Automation and Visibility Transforming Multi-Cloud Environments”

- A prominent and accelerating trend in the global cloud discovery market is the integration of Artificial Intelligence (AI) and automation tools to provide comprehensive visibility across complex, multi-cloud environments. Organizations are increasingly adopting AI-powered discovery platforms to automatically detect, map, and monitor cloud resources, ensuring better governance, security, and operational efficiency

- For instance, companies such as IBM and Microsoft are enhancing their Cloud Discovery solutions with AI and machine learning to offer real-time insights into shadow IT, unauthorized cloud usage, and hidden workloads, allowing businesses to minimize risk and improve compliance

- AI is also enabling advanced analytics and predictive capabilities within cloud discovery tools, helping IT teams proactively identify potential security gaps, compliance violations, or cost inefficiencies across hybrid and multi-cloud infrastructures

- Furthermore, integration with automated remediation tools and cloud management platforms allows organizations to act swiftly on discovery insights, reducing manual intervention and operational overhead

- This trend toward AI-enabled, real-time visibility is reshaping enterprise cloud strategies, making cloud discovery solutions an essential component for organizations seeking to manage cloud sprawl, optimize costs, and enhance security in an increasingly distributed IT landscape

- As cloud adoption grows exponentially, AI-powered cloud discovery is becoming central to achieving operational resilience, regulatory compliance, and efficient multi-cloud management globally

What are the Key Drivers of Cloud Discovery Market?

- The growing complexity of IT environments, driven by rapid adoption of multi-cloud and hybrid cloud architectures, is a major driver accelerating the demand for cloud discovery solutions. Organizations need real-time visibility into all cloud assets to enhance security, compliance, and cost management

- For instance, in March 2024, Cisco Systems announced enhancements to its cloud security portfolio with integrated discovery capabilities to help enterprises detect unauthorized cloud usage and improve governance

- The increasing prevalence of shadow IT, where employees deploy unsanctioned cloud applications, poses significant security and compliance risks, making Cloud Discovery tools critical for identifying hidden resources

- In addition, the growing need to comply with stringent data privacy and regulatory frameworks, such as GDPR, CCPA, and regional data sovereignty laws, is fueling demand for automated cloud visibility and inventory management

- Cloud Discovery also plays a key role in cost optimization, as organizations can identify underutilized or redundant cloud resources, helping reduce operational expenses and improve efficiency

- As businesses prioritize secure digital transformation and migrate mission-critical workloads to the cloud, the demand for robust, AI-driven cloud discovery platforms is expected to surge, supporting market growth globally

Which Factor is challenging the Growth of the Cloud Discovery Market?

- The lack of standardized frameworks, integration challenges across diverse cloud platforms, and data privacy concerns remain key barriers to broader adoption of cloud discovery solutions. Managing visibility in highly complex, distributed cloud environments presents technical hurdles for many organizations

- For instance, enterprises using multiple public cloud providers such as AWS, Azure, and Google Cloud often struggle with fragmented discovery tools that lack centralized visibility, increasing operational complexity

- In addition, concerns around data security and unauthorized access to sensitive discovery information raise privacy and compliance issues, especially in regulated industries such as finance or healthcare

- The shortage of skilled IT personnel with expertise in cloud governance and AI-enabled discovery tools further constrains market growth, particularly for small and medium-sized businesses with limited technical resources

- Moreover, high implementation costs for advanced Cloud Discovery platforms, especially those integrated with AI and automation, can deter adoption among budget-conscious enterprises

- Overcoming these challenges will require greater standardization, improved interoperability across cloud platforms, investments in workforce training, and development of scalable, cost-effective cloud discovery solutions tailored to diverse business needs

How is the Cloud Discovery Market Segmented?

The market is segmented on the basis of component, organization size, and vertical.

• By Component

On the basis of component, the cloud discovery market is segmented into Solutions and Services. The Solutions segment dominated the cloud discovery market with the largest market revenue share of 61.3% in 2024, driven by increasing enterprise demand for comprehensive tools that provide real-time visibility into cloud environments, shadow IT detection, and regulatory compliance. Organizations are prioritizing automated solutions to enhance security, optimize costs, and manage complex multi-cloud infrastructures efficiently.

The Services segment is projected to witness the fastest CAGR during the forecast period, supported by the growing need for managed services, consulting, and technical support to help organizations implement, integrate, and maintain cloud discovery platforms. The rapid pace of cloud adoption and the shortage of in-house expertise are fueling demand for service providers who can ensure effective deployment and ongoing management of cloud discovery tools.

• By Organization Size

On the basis of organization size, the cloud discovery market is segmented into Large Enterprises and Small and Medium-Sized Enterprises (SMEs). The Large Enterprises segment dominated the market with the largest revenue share of 69.8% in 2024, owing to their complex IT infrastructures, higher cloud adoption rates, and stringent governance requirements. Large organizations are investing heavily in advanced Cloud Discovery solutions to manage sprawling cloud environments, ensure compliance, and mitigate security risks.

The Small and Medium-Sized Enterprises (SMEs) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing affordability of cloud-based solutions, rising awareness of shadow IT risks, and growing demand for simplified, scalable Cloud Discovery tools. SMEs are adopting these platforms to gain visibility, improve security, and optimize cloud costs without the need for extensive IT resources.

• By Vertical

On the basis of vertical, the cloud discovery market is segmented into Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, Telecommunications and ITes, Retail and Consumer Goods, Government and Public Sector, Media and Entertainment, Manufacturing, Transportation and Logistics, and Others. The BFSI segment dominated the market with the largest revenue share of 27.4% in 2024, driven by the sector's stringent regulatory requirements, high security needs, and rapid adoption of digital banking and financial platforms. Financial institutions are leveraging Cloud Discovery to detect shadow IT, enhance compliance, and mitigate cloud security risks.

The Healthcare and Life Sciences segment is anticipated to witness the fastest CAGR during the forecast period, fueled by the sector's increasing adoption of cloud infrastructure for electronic health records, telemedicine, and research applications. With rising concerns over data privacy and regulatory compliance such as HIPAA, healthcare organizations are turning to Cloud Discovery solutions to gain visibility, ensure security, and manage complex cloud ecosystems effectively.

Which Region Holds the Largest Share of the Cloud Discovery Market?

- North America dominated the global cloud discovery market, accounting for the largest revenue share of 41.2% in 2024, driven by advanced cloud infrastructure, high enterprise cloud adoption, and the growing need for visibility into shadow IT environments

- Enterprises in the region are prioritizing real-time discovery, compliance monitoring, and cloud security, supported by mature IT ecosystems and strict regulatory requirements

- The region's leadership is reinforced by strong investments in cybersecurity, widespread use of hybrid and multi-cloud architectures, and the presence of leading cloud discovery providers, positioning North America at the forefront of market growth and innovation

U.S. Cloud Discovery Market Insight

The U.S. cloud discovery market held the largest revenue share within North America in 2024, driven by rapid digital transformation, complex multi-cloud environments, and rising security concerns across industries. Organizations across sectors such as BFSI, healthcare, and government are increasingly adopting cloud discovery solutions to manage cloud sprawl, improve compliance, and mitigate risks associated with shadow IT. The regulatory environment and emphasis on data privacy further fuel demand for robust cloud discovery tools, particularly among large enterprises managing sensitive data.

Europe Cloud Discovery Market Insight

The Europe cloud discovery market is projected to grow steadily, driven by strict data protection laws, including GDPR, and a growing emphasis on cybersecurity and cloud visibility. Organizations across industries are adopting cloud discovery platforms to improve governance, reduce risks, and comply with evolving regulations. The region's focus on digital sovereignty and increasing cloud adoption in sectors such as finance, healthcare, and public services is accelerating market growth, with significant demand for automated, scalable cloud discovery solutions.

U.K. Cloud Discovery Market Insight

U.K. cloud discovery market is expected to expand at a healthy CAGR during the forecast period, fueled by rising adoption of hybrid cloud environments and growing regulatory compliance needs. The U.K.’s position as a major financial hub, combined with its strong cybersecurity focus, drives increased demand for cloud discovery platforms among enterprises seeking to control shadow IT, enhance data governance, and meet regulatory standards.

Germany Cloud Discovery Market Insight

Germany cloud discovery market is witnessing steady growth, supported by the country’s focus on data privacy, cloud security, and technological innovation. German enterprises are adopting cloud discovery solutions to gain visibility into cloud assets, prevent data leakage, and ensure compliance with national and EU regulations. Increasing digitalization in manufacturing, finance, and public sectors further contributes to market expansion.

Which Region is the Fastest Growing Region in the Cloud Discovery Market?

Asia-Pacific Cloud Discovery market is forecast to grow at the fastest CAGR of 18.5% from 2025 to 2032, driven by accelerated cloud adoption, rising cybersecurity awareness, and government-led digital initiatives across countries such as China, India, Japan, and Southeast Asia. The region’s growing digital economy, coupled with increased hybrid and multi-cloud deployments, is creating strong demand for Cloud Discovery solutions to manage security, compliance, and operational complexity.

Japan Cloud Discovery Market Insight

The Japan cloud discovery market is expanding, driven by the country's advanced technology infrastructure, focus on data security, and increasing use of cloud services across enterprises. Companies are adopting cloud discovery platforms to control shadow IT, ensure regulatory compliance, and enhance visibility across complex IT environments, particularly in critical sectors such as finance and healthcare.

China Cloud Discovery Market Insight

The China cloud discovery market captured the largest revenue share in Asia-Pacific in 2024, fueled by rapid digital transformation, growing enterprise cloud adoption, and strong government policies promoting cybersecurity and cloud governance. Chinese organizations across industries are leveraging cloud discovery solutions to improve asset visibility, manage risks, and comply with evolving data protection laws, supporting continued market expansion.

Which are the Top Companies in Cloud Discovery Market?

The cloud discovery industry is primarily led by well-established companies, including:

- AO Kaspersky Lab (Russia)

- ASG Technologies (U.S.)

- AT&T Intellectual Property (U.S.)

- BlueCat Networks (U.S.)

- BMC Software Inc. (U.S.)

- Certero (U.K.)

- Cisco Systems Inc. (U.S.)

- IBM Corporation (U.S.)

- Lookout Inc. (U.S.)

- McAfee LLC. (U.S.)

- Microsoft (U.S.)

- Netskope Inc. (U.S.)

- Nippon Telegraph and Telephone Corporation (Japan)

- Palo Alto Networks (U.S.)

- Puppet Inc. (U.S.)

- Qualys Inc. (U.S.)

- ServiceNow (U.S.)

- TechNEXA Technologies Private Limited (India)

- Virima Inc. (U.S.)

- Zscaler. Inc. (U.S.)

What are the Recent Developments in Global Cloud Discovery Market?

- In February 2025, Tencent Cloud announced the launch of its first data center in the Middle East, located in Saudi Arabia. The facility, equipped with two availability zones, is designed to enhance the resilience and performance of cloud services across the region. This initiative supports Saudi Arabia's Vision 2030 plan to advance its digital infrastructure and reflects Tencent's commitment to global expansion. This move is expected to significantly boost local cloud capabilities and promote regional digital transformation

- In August 2024, Amazon Web Services, a subsidiary of Amazon.com, Inc., introduced the AWS Parallel Computing Service, a new managed solution to help organizations deploy and operate high-performance computing (HPC) clusters on AWS. This service aims to accelerate scientific research and engineering workloads by providing scalable virtual computing environments. This development enhances AWS's position as a leader in cloud services for data-intensive industries

- In September 2023, NVIDIA partnered with Jio Platforms to develop cloud-based AI infrastructure to power some of India's most significant AI projects. The collaboration focuses on accelerating advancements in areas such as drug discovery, climate research, AI chatbots, and more. This partnership is set to play a vital role in strengthening India's AI ecosystem and supporting large-scale innovation initiatives

- In February 2023, Google Cloud entered into a partnership with Accenture to assist retailers in modernizing their operations by integrating Google Cloud's AI, product discovery, and data analytics capabilities into Accenture's RETAIL platform. The collaboration includes joint marketing strategies and aims to improve store operations and business optimization for retailers. This initiative is expected to empower retailers with AI-driven tools for improved efficiency and competitiveness

- In October 2022, Wipro collaborated with Outokumpu, a leading global stainless steel manufacturer, to accelerate the company’s cloud transformation journey. The partnership focuses on building a Microsoft Azure-based platform, modernizing applications, and implementing an agile, DevSecOps-driven IT model to improve availability and reduce downtime. This project aligns with Outokumpu's vision of becoming a more agile, data-driven, and sustainability-oriented organization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.