Global Cloud Finops Market

Market Size in USD Billion

CAGR :

%

USD

14.75 Billion

USD

33.00 Billion

2025

2033

USD

14.75 Billion

USD

33.00 Billion

2025

2033

| 2026 –2033 | |

| USD 14.75 Billion | |

| USD 33.00 Billion | |

|

|

|

|

Cloud FinOps Market Size

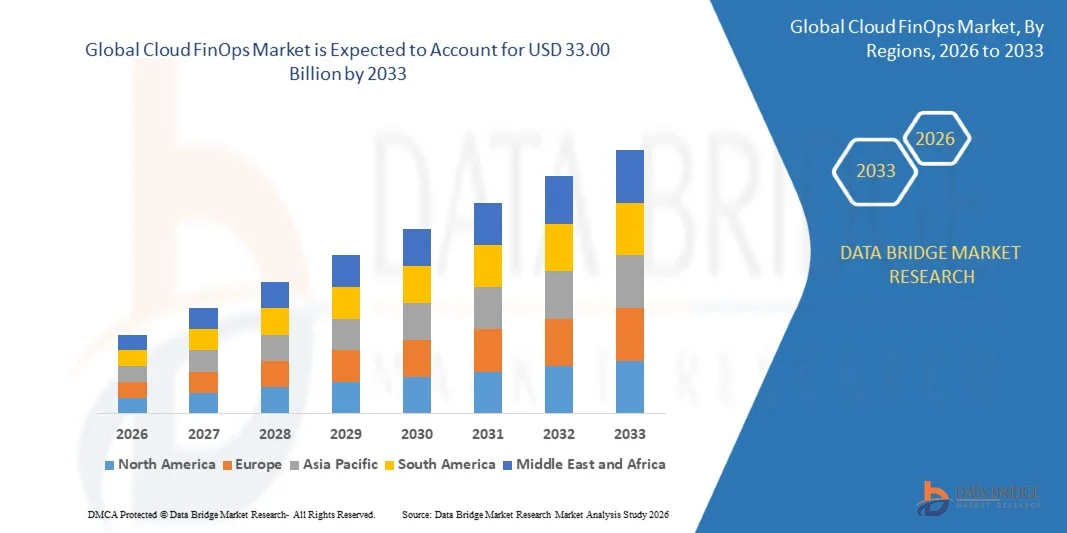

- The global cloud FinOps market size was valued at USD 14.75 billion in 2025 and is expected to reach USD 33.00 billion by 2033, at a CAGR of 10.59% during the forecast period

- The market growth is largely fueled by the increasing adoption of cloud services, multi-cloud strategies, and digital transformation initiatives across enterprises, driving the need for efficient cloud cost management and financial governance

- Furthermore, rising organizational demand for real-time cost visibility, automated budgeting, and optimized resource allocation is establishing Cloud FinOps as an essential practice for managing cloud expenditures. These converging factors are accelerating the adoption of Cloud FinOps solutions, thereby significantly boosting the market’s growth

Cloud FinOps Market Analysis

- Cloud FinOps, providing financial operations management for cloud environments, is becoming a critical component for enterprises to control costs, forecast budgets, and optimize cloud resources across public, private, and hybrid clouds

- The escalating demand for Cloud FinOps is primarily fueled by growing multi-cloud adoption, increasing complexity of cloud expenditures, and the need for improved financial transparency and operational efficiency across organizations

- North America dominated the cloud FinOps market with a share of 38.3% in 2025, due to the increasing adoption of cloud services, multi-cloud strategies, and the need for efficient cloud cost management

- Asia-Pacific is expected to be the fastest growing region in the cloud FinOps market during the forecast period due to rapid cloud adoption, digital transformation initiatives, and increasing multi-cloud deployments in countries such as China, Japan, and India

- Solution segment dominated the market with a market share of 63.5% in 2025, due to the growing need for organizations to optimize cloud costs, automate budgeting, and ensure efficient resource allocation. Cloud FinOps solutions provide comprehensive tools for monitoring cloud expenditure, forecasting budgets, and generating actionable insights, which are critical for enterprises with large-scale cloud deployments. The adoption of these solutions is further fueled by the integration of AI and analytics features, enabling real-time visibility and cost optimization

Report Scope and Cloud FinOps Market Segmentation

|

Attributes |

Cloud FinOps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Cloud FinOps Market Trends

“Rising Adoption of Multi-Cloud and Hybrid Cloud Environments”

- A key trend in the Cloud FinOps market is the rising adoption of multi-cloud and hybrid cloud environments as enterprises seek flexibility, resilience, and workload optimization across multiple cloud providers. This shift is increasing the complexity of cloud financial management and elevating the importance of FinOps practices to maintain cost transparency and accountability across distributed infrastructures

- For instance, Netflix operates workloads across Amazon Web Services and Google Cloud and has publicly discussed the use of internal FinOps practices to manage spending visibility, forecasting, and cost allocation across its multi-cloud environment. Such large-scale deployments highlight how FinOps frameworks are becoming essential to control expenses while supporting scalability and performance requirements

- Enterprises adopting hybrid cloud models are increasingly relying on FinOps to align on-premises investments with cloud expenditure and ensure consistent financial governance. This trend is strengthening demand for unified cost management platforms capable of tracking usage and spend across private data centers and public cloud services

- The growing use of containerization and Kubernetes-based deployments across multiple clouds is further reinforcing this trend, as dynamic resource consumption makes manual cost control ineffective. FinOps tools are being integrated with orchestration platforms to deliver near real-time insights into consumption patterns

- Organizations are also emphasizing cross-functional collaboration between finance, engineering, and operations teams to manage multi-cloud costs more effectively. This cultural shift is positioning FinOps as a strategic function rather than a purely operational cost-control activity

- Overall, the increasing adoption of multi-cloud and hybrid architectures is reinforcing the need for mature FinOps practices that support transparency, optimization, and accountability across diverse cloud ecosystems, driving sustained market growth

Cloud FinOps Market Dynamics

Driver

“Growing Demand for Real-Time Cloud Cost Optimization and Financial Governance”

- The growing demand for real-time cloud cost optimization and financial governance is a major driver of the Cloud FinOps market as enterprises face rapidly fluctuating cloud usage and unpredictable spending patterns. Real-time visibility enables organizations to detect inefficiencies early and align cloud investments with business priorities

- For instance, Dropbox has shared how it leverages FinOps methodologies and tooling to monitor real-time cloud usage and optimize costs after migrating large-scale workloads to Amazon Web Services. This approach supports proactive decision-making and improves budget control across engineering teams

- As cloud-native architectures scale, delayed or retrospective cost analysis is proving insufficient for effective financial management. Organizations are increasingly prioritizing tools that provide immediate insights into spend anomalies, resource underutilization, and cost-saving opportunities

- Regulatory and internal governance requirements are also pushing enterprises to implement stronger financial controls over cloud environments. FinOps frameworks help standardize reporting, chargeback, and showback mechanisms, improving accountability across departments

- Overall, the need for continuous cost optimization and robust financial governance is reinforcing the adoption of FinOps solutions as a core component of enterprise cloud strategies

Restraint/Challenge

“Complexity in Integrating FinOps Practices Across Diverse Cloud Platforms”

- The Cloud FinOps market faces challenges due to the complexity of integrating FinOps practices across diverse cloud platforms, each with distinct pricing models, billing structures, and usage metrics. This fragmentation makes it difficult to achieve unified cost visibility and consistent governance

- For instance, enterprises using Amazon Web Services, Microsoft Azure, and Google Cloud simultaneously must reconcile different discount structures, reserved instance models, and billing reports when implementing FinOps processes. This complexity increases integration effort and operational overhead

- Differences in data granularity and reporting formats across cloud providers limit the effectiveness of standardized FinOps workflows. Organizations often require additional tooling or customization to normalize cost data and enable accurate analysis

- The rapid introduction of new cloud services and pricing options further complicates FinOps implementation, as teams must continuously adapt rules, policies, and optimization strategies. This creates skill and resource constraints, particularly for smaller organizations

- Collectively, these integration and operational challenges can slow FinOps adoption and reduce its immediate effectiveness, posing a restraint on market growth despite strong underlying demand

Cloud FinOps Market Scope

The market is segmented on the basis of component, application, deployment mode, organization size, and end-use.

• By Component

On the basis of component, the Cloud FinOps market is segmented into Solution and Services. The Solution segment dominated the market with the largest revenue share of 63.5% in 2025, driven by the growing need for organizations to optimize cloud costs, automate budgeting, and ensure efficient resource allocation. Cloud FinOps solutions provide comprehensive tools for monitoring cloud expenditure, forecasting budgets, and generating actionable insights, which are critical for enterprises with large-scale cloud deployments. The adoption of these solutions is further fueled by the integration of AI and analytics features, enabling real-time visibility and cost optimization. Organizations increasingly rely on solution platforms to enforce governance policies and enhance financial accountability for cloud consumption. Cloud FinOps solutions also help in simplifying the complex multi-cloud environment and provide standardized reporting across departments. The widespread adoption of native cloud cost management tools and third-party platforms reinforces the dominance of this segment.

The Services segment is expected to witness the fastest growth from 2026 to 2033, driven by the rising demand for professional and managed services that support the deployment, configuration, and ongoing management of Cloud FinOps frameworks. For instance, companies such as Accenture provide tailored consulting and managed services to help enterprises implement cost optimization strategies, integrate FinOps practices, and achieve long-term financial governance. Services offer the advantage of expert guidance in navigating complex cloud architectures and optimizing multi-cloud expenditures. Businesses often prefer managed services for continuous monitoring, reporting, and cost-saving recommendations, which reduces internal resource burdens. The increasing complexity of cloud operations across industries fuels the adoption of services, particularly in organizations lacking dedicated FinOps teams.

• By Application

On the basis of application, the Cloud FinOps market is segmented into Cost Management & Optimization, Resource Allocation & Planning, Budgeting & Forecasting, Billing & Chargeback, and Others. The Cost Management & Optimization segment dominated the market with the largest revenue share in 2025, driven by organizations’ increasing focus on controlling cloud expenditure while maximizing performance. Cloud FinOps platforms enable businesses to identify cost anomalies, forecast consumption trends, and recommend actionable optimization strategies. Real-time cost tracking and predictive analytics help enterprises prevent overspending, particularly in complex multi-cloud environments. The segment benefits from adoption across sectors such as IT, BFSI, and retail, where cloud utilization is rapidly scaling. Cost Management & Optimization also enhances transparency across departments, enabling better financial governance and accountability.

The Budgeting & Forecasting segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising demand for predictive financial planning and scenario-based budgeting in cloud environments. For instance, Apptio provides advanced forecasting tools that allow enterprises to anticipate cloud costs, set budget thresholds, and align expenditure with business priorities. Forecasting applications help organizations allocate resources efficiently, plan future cloud investments, and reduce financial risks. Businesses increasingly seek automated tools to simplify complex forecasting processes and integrate them with operational dashboards. The growing emphasis on strategic cloud financial planning supports the expansion of this segment.

• By Deployment Mode

On the basis of deployment mode, the Cloud FinOps market is segmented into Public Cloud, Private Cloud, and Hybrid Cloud. The Public Cloud segment dominated the market with the largest revenue share in 2025, driven by the rapid adoption of public cloud services from providers such as AWS, Microsoft Azure, and Google Cloud. Public cloud deployments enable enterprises to scale resources dynamically, but they also introduce cost management challenges that FinOps solutions address effectively. Organizations leverage Cloud FinOps tools to optimize expenditure across compute, storage, and network services, ensuring efficient utilization. The flexibility and pay-as-you-go pricing models of public cloud services further reinforce the need for financial governance. Public cloud adoption is accelerated by digital transformation initiatives and remote work trends, which increase cloud reliance across enterprises.

The Hybrid Cloud segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the increasing adoption of hybrid cloud strategies that combine private and public environments for greater flexibility and data security. For instance, IBM provides hybrid cloud FinOps solutions that allow enterprises to manage costs across multi-cloud environments seamlessly. Organizations adopting hybrid cloud models require advanced analytics to track consumption, forecast expenses, and optimize workloads across platforms. The growing demand for hybrid strategies in regulated industries such as BFSI and healthcare supports the rapid adoption of FinOps in this deployment mode. Hybrid cloud enables enterprises to balance operational efficiency with compliance requirements, driving segment growth.

• By Organization Size

On the basis of organization size, the Cloud FinOps market is segmented into SMEs and Large Enterprises. Large enterprises dominated the market with the largest revenue share in 2025, driven by their substantial cloud spend and complex multi-cloud architectures. These organizations face significant challenges in monitoring cloud costs, managing budgets, and implementing governance policies at scale. Cloud FinOps solutions help large enterprises streamline financial operations, improve cost transparency, and optimize resource utilization across departments. Enterprises increasingly adopt FinOps practices to reduce wasteful spending, improve financial accountability, and gain competitive advantage. Large-scale deployment of cloud services across global operations further strengthens the dominance of this segment.

The SMEs segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing cloud adoption among small and medium businesses seeking cost efficiency and scalability. For instance, startups and mid-sized companies use platforms such as CloudHealth by VMware to manage budgets, monitor consumption, and optimize cloud resources without extensive in-house expertise. SMEs benefit from the affordability and automation offered by FinOps solutions, which reduce operational overheads. The rising digitalization of SMEs and reliance on public cloud platforms fuels segment growth, providing smaller organizations with enterprise-grade financial management capabilities.

• By End-Use

On the basis of end-use, the Cloud FinOps market is segmented into Government, Consumer Goods and Retail, Healthcare, BFSI, IT and Telecom, Manufacturing, and Others. The IT and Telecom segment dominated the market with the largest revenue share in 2025, driven by high cloud adoption across data centers, SaaS applications, and telecom operations. Cloud FinOps solutions help IT and telecom companies manage large-scale cloud expenditures, optimize infrastructure usage, and align financial planning with operational goals. The sector benefits from advanced analytics, automated reporting, and cost optimization features that enhance profitability and resource allocation. Rapid digital transformation and adoption of cloud-native services reinforce the dominance of this segment.

The BFSI segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing cloud deployment for digital banking, insurance platforms, and fintech services. For instance, JPMorgan Chase leverages FinOps practices to manage multi-cloud spending, forecast costs, and implement governance frameworks efficiently. BFSI organizations require stringent cost tracking and compliance measures due to regulatory mandates and high-value transactions. Cloud FinOps adoption enables them to improve operational efficiency, optimize resource allocation, and reduce financial risks. The growing shift toward digital financial services supports rapid FinOps adoption in this sector.

Cloud FinOps Market Regional Analysis

- North America dominated the cloud FinOps market with the largest revenue share of 38.3% in 2025, driven by the increasing adoption of cloud services, multi-cloud strategies, and the need for efficient cloud cost management

- Organizations in the region prioritize visibility, cost optimization, and governance of cloud expenditures to improve operational efficiency and financial accountability

- The widespread adoption is further supported by high cloud maturity, robust IT infrastructure, and a strong presence of cloud service providers, establishing Cloud FinOps as a critical practice across enterprises

U.S. Cloud FinOps Market Insight

The U.S. captured the largest revenue share in North America in 2025, fueled by rapid cloud adoption and the integration of advanced FinOps tools for budgeting, forecasting, and cost management. Organizations increasingly focus on optimizing cloud expenditure while maintaining high operational performance. The demand for automated cost tracking, predictive analytics, and multi-cloud governance is boosting the market. Moreover, enterprises are leveraging FinOps platforms to align cloud spending with business priorities, ensuring transparency and financial control across departments.

Europe Cloud FinOps Market Insight

The Europe Cloud FinOps market is projected to grow at a substantial CAGR during the forecast period, driven by stringent regulatory requirements, increasing cloud adoption, and the need for financial accountability in cloud operations. Organizations are adopting FinOps to manage multi-cloud expenditures, optimize budgets, and forecast future costs accurately. The rise in digital transformation initiatives and cloud-based enterprise applications is fostering adoption. European enterprises are also focused on operational efficiency, cost transparency, and governance, driving growth across the region.

U.K. Cloud FinOps Market Insight

The U.K. market is expected to grow at a noteworthy CAGR, supported by increased cloud adoption and a focus on cost optimization and financial governance. Businesses are adopting FinOps practices to manage cloud budgets, forecast expenses, and gain better visibility into cloud consumption. The region’s strong IT infrastructure and digital maturity, combined with the rise of multi-cloud deployments, are stimulating market growth. Organizations are also emphasizing automation and integration of FinOps tools with existing IT and finance systems to enhance operational efficiency.

Germany Cloud FinOps Market Insight

The Germany Cloud FinOps market is anticipated to expand at a considerable CAGR, driven by the country’s emphasis on innovation, digitalization, and operational efficiency. Enterprises are implementing FinOps practices to control cloud costs, improve budget forecasting, and enhance resource allocation. The growing adoption of hybrid and multi-cloud environments, along with the integration of cloud governance frameworks, supports market growth. Germany’s focus on data security and compliance further encourages the adoption of FinOps solutions across industries.

Asia-Pacific Cloud FinOps Market Insight

The Asia-Pacific Cloud FinOps market is poised to grow at the fastest CAGR during the forecast period, driven by rapid cloud adoption, digital transformation initiatives, and increasing multi-cloud deployments in countries such as China, Japan, and India. The region’s expanding IT infrastructure and focus on operational efficiency are accelerating the adoption of FinOps practices. Enterprises are implementing cloud cost management, budgeting, and forecasting tools to optimize expenditure and achieve financial accountability. Government initiatives promoting digitalization and smart infrastructure are further boosting market growth.

Japan Cloud FinOps Market Insight

The Japan market is growing due to high cloud adoption, digital transformation, and a focus on efficiency and governance. Organizations are increasingly deploying FinOps solutions to optimize cloud spend, forecast budgets, and manage multi-cloud environments. The integration of FinOps tools with enterprise IT systems is supporting adoption. In addition, enterprises are leveraging automation and predictive analytics to enhance decision-making and reduce operational costs.

China Cloud FinOps Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid cloud adoption, multi-cloud strategies, and the rising need for cost optimization. Enterprises are implementing FinOps solutions to monitor cloud usage, forecast expenses, and enforce governance across departments. The country’s expanding middle-class enterprises, high digital adoption, and focus on operational efficiency are key factors fueling growth. Moreover, the availability of domestic cloud service providers and affordable FinOps solutions is accelerating adoption across industries.

Cloud FinOps Market Share

The cloud FinOps industry is primarily led by well-established companies, including:

- HCL Technologies (India)

- Google, Inc. (U.S.)

- Flexera (U.S.)

- IBM Corporation (U.S.)

- Nordcloud Oy (Finland)

- Hitachi (Japan)

- Microsoft Corporation (U.S.)

- Datadog (U.S.)

- Lumen Technologies (U.S.)

- Apptio, Inc. (U.S.)

- ServiceNow (U.S.)

- Amazon Web Services, Inc. (U.S.)

- VMware (U.S.)

- Oracle Corporation (U.S.)

- Nagarro (Germany)

Latest Developments in Global Cloud FinOps Market

- In April 2025, CoreStack announced collaborations with major cloud providers to integrate advanced FinOps solutions into their platforms. This initiative strengthens CoreStack’s position in the Cloud FinOps market by enabling seamless cost management, governance, and optimization across multi-cloud environments. The integration allows enterprises to gain better visibility into cloud spending, improve budgeting accuracy, and reduce wastage, driving adoption of advanced FinOps practices in both large enterprises and SMEs

- In March 2025, Flexera completed the acquisition of Spot from NetApp, significantly enhancing its Cloud Financial Management offerings. The acquisition incorporates AI-powered FinOps technologies, including Spot Eco, Ocean, Elastigroup, and CloudCheckr, into Flexera’s portfolio. This expanded suite allows organizations and managed service providers to automate billing, optimize container workloads, and manage cloud financial commitments effectively, addressing the growing challenges of cloud cost control in AI-driven and multi-cloud environments. This strategic move positions Flexera as a stronger competitor in the Cloud FinOps market

- In March 2025, Harness released a report projecting $44.5 billion in infrastructure cloud waste for 2025 due to disconnects between FinOps and development teams. This finding underscores the critical need for better integration between financial management and engineering operations, highlighting market opportunities for FinOps platforms that can bridge these gaps. Organizations are increasingly motivated to adopt advanced FinOps solutions to reduce waste, improve resource allocation, and enhance cloud ROI, indicating strong growth potential for providers addressing these inefficiencies

- In December 2024, AWS introduced Custom Billing Views within its Billing and Cost Management suite. This feature enables organizations to provide stakeholders, such as application or business unit owners, with tailored cost and usage views without granting full account access. By allowing filtering by cost allocation tags or specific accounts and sharing views via AWS Resource Access Manager, this innovation enhances decentralized cloud cost management and transparency. The development supports wider adoption of FinOps practices in organizations with complex multi-account AWS environments

- In January 2024, CloudBolt announced the launch of its Augmented FinOps capabilities, leveraging AI and machine learning to provide real-time cost insights, automate cloud spending decisions, and unify control across public and private clouds. This advancement shifts organizations from a “Cloud First” to a “Cloud Right” approach, optimizing cloud ROI throughout the resource lifecycle. The move strengthens CloudBolt’s market presence and encourages adoption of AI-driven FinOps tools, particularly in enterprises seeking comprehensive cost management solutions across hybrid cloud deployments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.