Global Cloud Gaming Market

Market Size in USD Billion

CAGR :

%

USD

2.28 Billion

USD

62.43 Billion

2024

2032

USD

2.28 Billion

USD

62.43 Billion

2024

2032

| 2025 –2032 | |

| USD 2.28 Billion | |

| USD 62.43 Billion | |

|

|

|

|

Cloud Gaming Market Size

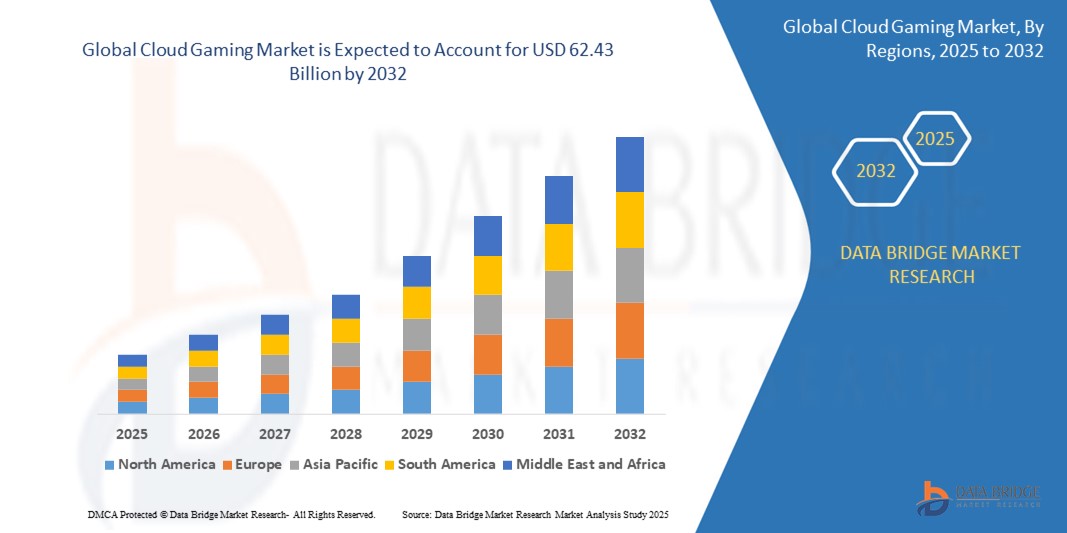

- The global cloud gaming market size was valued at USD 2.28 billion in 2024 and is expected to reach USD 62.43 billion by 2032, at a CAGR of 51.22% during the forecast period

- The market growth is largely fueled by the widespread availability of high-speed internet, including 5G, and increasing smartphone penetration, enabling seamless access to high-performance gaming without dedicated hardware

- Furthermore, rising consumer demand for affordable, flexible, and on-demand gaming experiences is establishing cloud gaming as a preferred model across casual and hardcore gamers. These converging factors are accelerating platform subscriptions and content consumption, thereby significantly boosting the industry's growth

Cloud Gaming Market Analysis

- Cloud gaming is a technology that allows users to stream video games over the internet without needing powerful hardware, such as high-end consoles or gaming PCs. The games are run on remote servers in data centers, and the video and audio are streamed to the player's device, whether it's a smartphone, tablet, or computer. This eliminates the need for downloads, installations, or physical game copies, offering instant access to a wide library of games. Services such as Google Stadia, NVIDIA GeForce Now, and Cloud Gaming Xbox are instances of platforms leveraging cloud gaming to offer a seamless gaming experience

- The escalating demand for cloud gaming is primarily fueled by the expansion of high-speed internet infrastructure, increasing mobile and smart device penetration, and growing consumer interest in flexible, on-demand gaming services across diverse platforms

- Asia-Pacific dominated the cloud gaming market with a share of 45.5% in 2024, due to a rapidly growing gaming population, widespread smartphone usage, and increasing internet penetration

- Europe is expected to be the fastest growing region in the cloud gaming market during the forecast period due to increasing demand for cross-platform gaming experiences and broader availability of 5G networks

- Video streaming segment dominated the market with a market share of 54.5% in 2024, due to its ability to deliver instant gameplay without installation or download, thus offering a highly accessible and convenient user experience. This model is ideal for users with limited device storage and those seeking quick entry into gaming sessions. Cloud providers are increasingly optimizing video compression algorithms and adaptive bitrate streaming to ensure consistent quality over variable internet conditions

Report Scope and Cloud Gaming Market Segmentation

|

Attributes |

Cloud Gaming Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Cloud Gaming Market Trends

“Growing Adoption of 5G Technology”

- A significant and accelerating trend in the global cloud gaming market is the expanding adoption of 5G technology, which offers low latency, high bandwidth, and enhanced reliability for streaming games directly from the cloud without lag or performance drops

- For instance, NVIDIA’s GeForce NOW and Microsoft’s Xbox Cloud Gaming are leveraging 5G networks to deliver console-quality gaming experiences on smartphones and tablets. These platforms now support real-time multiplayer and high-resolution gameplay, enabled by the ultra-fast data speeds of 5G

- The rollout of 5G networks in key markets such as the U.S., China, South Korea, and parts of Europe is unlocking new user segments by enabling smooth gameplay even in mobile-first and previously underserved regions

- Furthermore, telecom providers are forming strategic alliances with cloud gaming platforms to offer bundled services, such as Verizon's partnership with Xbox Cloud Gaming and SK Telecom’s collaboration with Boosteroid. These joint ventures are helping both industries capitalize on the growing demand

- As a result, users can experience immersive gaming across various genres—FPS, MMO, racing, and more—without requiring dedicated hardware. This trend is reshaping the gaming landscape by promoting accessibility and convenience across devices

- The demand for cloud gaming services supported by 5G is increasing rapidly across both casual and hardcore gamer segments, as users seek seamless gaming experiences with minimal setup, regardless of device or location

Cloud Gaming Market Dynamics

Driver

“Growing Internet Penetration”

- The increasing penetration of high-speed internet, particularly in developing regions, is a major driver fueling demand for cloud gaming services across diverse user demographics

- For instance, countries such as India and Brazil are witnessing a surge in affordable internet access, encouraging mobile gaming through cloud platforms without the need for high-end hardware

- As broadband and fiber networks expand globally, more users can enjoy real-time streaming of graphically intense games on everyday devices such as smartphones, laptops, and smart TVs

- Furthermore, the rising adoption of smart devices and Wi-Fi-enabled households contributes to consistent user engagement across cloud gaming services, facilitating an ecosystem of accessible, hardware-agnostic entertainment

- The convenience of instant gameplay without downloads, automatic updates, and multi-device compatibility is attracting a growing number of users toward cloud gaming platforms. The flexibility to game anytime, anywhere is becoming a core value proposition, especially for younger and on-the-go audiences

Restraint/Challenge

“Competition and Market Saturation”

- The growing number of players entering the cloud gaming space, including major tech companies and startups, is intensifying competition and creating challenges around differentiation and user retention

- For instance, platforms such as GeForce NOW, Xbox Cloud Gaming, Amazon Luna, and Shadow are competing for similar customer bases, leading to pricing pressure and the need for exclusive content

- Despite technological advancements, the lack of unique content offerings or inconsistent performance across networks can impact user satisfaction and brand loyalty, especially in fragmented markets

- Addressing these challenges through exclusive partnerships, differentiated gaming libraries, and optimized performance infrastructure will be critical. In addition, strategic pricing models such as freemium access or subscription bundles are being explored to capture and retain users

- While demand for cloud gaming is growing, market saturation could hinder growth for new entrants or less-resourced providers unless they offer compelling value or niche specialization. As users become more selective, companies must innovate to stand out in a crowded marketplace

Cloud Gaming Market Scope

The market is segmented on the basis of offering, device type, solution type, gamer type, deployment, and gaming system.

• By Offering

On the basis of offering, the cloud gaming market is segmented into Infrastructure and Gaming Platform Services. The Gaming Platform Services segment dominated the market in 2024, accounting for the largest revenue share due to the rising demand for immersive gaming experiences without the need for high-end hardware. These platforms offer low-latency streaming, seamless access to large game libraries, and cross-device compatibility, attracting a vast user base across various demographics. Major service providers continue to invest in expanding their platform capabilities and exclusive game portfolios, further strengthening this segment's dominance.

The Infrastructure segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing investments in edge computing, content delivery networks (CDNs), and 5G deployment. These infrastructural advancements significantly reduce latency and improve the responsiveness of cloud gaming services, enabling real-time interactivity and enhancing the quality of experience for end-users.

• By Device Type

On the basis of device type, the market is categorized into Smartphones, Tablets, Gaming Consoles, Personal Computers and Laptops, Smart Televisions, and Head-Mounted Displays. Smartphones accounted for the largest revenue share in 2024, fueled by the widespread penetration of mobile devices, growing mobile internet usage, and rising popularity of freemium gaming models. The convenience of gaming on-the-go and enhanced mobile processors support high-quality streaming experiences, making smartphones the preferred choice for casual and mid-core gamers.

The Smart Televisions segment is expected to register the fastest growth rate through 2032, driven by the increasing availability of integrated cloud gaming apps in smart TVs and consumer preference for large-screen immersive experiences. Partnerships between cloud gaming providers and TV manufacturers are also facilitating plug-and-play gaming experiences without the need for consoles or PCs, accelerating adoption.

• By Solution Type

On the basis of solution type, the market is segmented into Video Streaming and File Streaming. Video Streaming dominated the market with a share of 54.5% in 2024 owing to its ability to deliver instant gameplay without installation or download, thus offering a highly accessible and convenient user experience. This model is ideal for users with limited device storage and those seeking quick entry into gaming sessions. Cloud providers are increasingly optimizing video compression algorithms and adaptive bitrate streaming to ensure consistent quality over variable internet conditions.

The File Streaming segment is projected to grow at the highest CAGR during the forecast period due to its reduced bandwidth consumption and capability to deliver better graphical fidelity by leveraging partial local processing. This approach is gaining traction among users with hybrid setups who prioritize visual quality alongside convenience.

• By Gamer Type

On the basis of gamer type, the market is classified into Casual Gamers, Avid Gamers, Hard-Core Gamers/Professional, and Lifestyle Gamers. Casual Gamers held the largest share in 2024, driven by the accessibility of cloud gaming services on mobile platforms, affordable subscription models, and the appeal of simple gameplay mechanics. The casual segment continues to expand as non-traditional gamers adopt gaming as a form of passive entertainment or stress relief.

The Hard-Core Gamers/Professional segment is expected to witness the fastest growth through 2032, propelled by improvements in latency reduction, availability of AAA titles, and support for peripherals such as gamepads and VR devices. As esports and competitive gaming communities embrace the flexibility of cloud-based gaming systems, this segment is expected to contribute significantly to premium service adoption.

• By Deployment

On the basis of deployment, the market is segmented into Public Cloud, Hybrid Cloud, and Private Cloud. The Public Cloud segment led the market in 2024, driven by its cost-effectiveness, scalability, and ease of access. Public cloud infrastructure supports multi-tenancy, enabling service providers to efficiently cater to a vast user base without the need for dedicated hardware investments.

The Hybrid Cloud segment is forecast to grow at the highest rate between 2025 and 2032 due to its ability to offer better performance and security through a combination of public and private infrastructure. This deployment model is increasingly favored by providers aiming to deliver low-latency experiences while managing sensitive user data securely and efficiently.

• By Gaming System

On the basis of gaming system, the market is segmented into G-Cluster, PlayStation, Stream My Game, Steam In-Home Streaming, Remote Play, and Others. PlayStation accounted for the largest market share in 2024, supported by its strong brand equity, wide range of exclusive titles, and robust online multiplayer infrastructure. Sony's continued focus on integrating PlayStation services with cloud capabilities and expanding PlayStation Now subscriptions contributed significantly to this segment's lead.

Remote Play is anticipated to register the fastest growth over the forecast period due to the increasing preference for flexible gaming experiences across devices. As players seek to extend their console gameplay to mobile, PC, and smart TV environments without losing progress or performance, remote play functionalities are rapidly gaining traction among tech-savvy and cross-platform users.

Cloud Gaming Market Regional Analysis

- Asia Pacific dominated the cloud gaming market with the largest revenue share of 45.5% in 2024, driven by a rapidly growing gaming population, widespread smartphone usage, and increasing internet penetration

- The region benefits from rising disposable incomes, a young digital-savvy demographic, and strong government initiatives supporting 5G deployment and digital infrastructure, which are accelerating cloud gaming adoption across mobile and console platforms

- Furthermore, the presence of major gaming companies and cloud service providers, alongside the growing popularity of esports and subscription-based gaming services, is reinforcing Asia-Pacific’s leading position in the global market

China Cloud Gaming Market Insight

The China cloud gaming market accounted for the highest revenue share in Asia-Pacific in 2024, underpinned by a large and engaged gamer base, aggressive 5G rollout, and the expansion of cloud services by domestic giants such as Tencent and Alibaba. The country's push toward smart cities and cloud infrastructure development is accelerating demand, particularly among mobile-first users. Strong local content development and a well-established esports ecosystem are also major growth enablers.

Japan Cloud Gaming Market Insight

The Japan cloud gaming market is advancing steadily due to high-speed broadband coverage, widespread adoption of gaming consoles, and a strong affinity for cutting-edge technology. Consumers value low-latency, high-resolution experiences, which are being delivered through partnerships between game publishers and telecom providers. The market is seeing rising interest from casual and hardcore gamers alike, driven by the convenience and flexibility cloud gaming offers.

Europe Cloud Gaming Market Insight

The Europe cloud gaming market is projected to grow at the fastest CAGR during the forecast period, supported by increasing demand for cross-platform gaming experiences and broader availability of 5G networks. The region is witnessing rising consumer interest in subscription-based models and cloud-native games. Regulatory support for digital transformation and a strong focus on data privacy are shaping a favorable environment for cloud gaming services across key markets such as Germany, the U.K., and France.

U.K. Cloud Gaming Market Insight

The U.K. cloud gaming market is set to grow significantly, fueled by widespread internet connectivity, high smartphone and console penetration, and growing demand for accessible gaming. Consumers are increasingly embracing cloud gaming platforms for their affordability, ease of access, and flexibility. The U.K.’s active gaming community and strong media ecosystem also provide fertile ground for new service rollouts.

Germany Cloud Gaming Market Insight

The Germany cloud gaming market is expanding rapidly, supported by investments in digital infrastructure and strong consumer interest in high-performance gaming experiences. The presence of major cloud service providers and a tech-conscious population is propelling demand. Germany's regulatory clarity and high standards for user privacy are attracting global cloud gaming platforms looking to establish or expand their European footprint.

Cloud Gaming Market Share

The cloud gaming industry is primarily led by well-established companies, including:

- NVIDIA Corporation (U.S.)

- Intel Corporation (U.S.)

- Google (U.S.)

- Microsoft (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Advanced Micro Devices, Inc (U.S.)

- Sony Corporation (Japan)

- IBM (U.S.)

- Paperspace, (U.S.)

- Electronic Arts Inc. (U.S.)

- LP Technologies LLC (U.S.)

- Blacknut (France)

- Crunchbase Inc. (U.S.)

- Apple Inc. (U.S.)

- Ubitus K.K. (Taiwan)

- Tencent Cloud. (China)

- Broadmedia Corporation (Japan)

- Unity Technologies (U.S.)

- AT&T (U.S.)

Latest Developments in Global Cloud Gaming Market

- In February 2023, Xsolla, a U.S.-based video game commerce company, launched innovative tools aimed at integrating game developers into the expanding realm of cloud gaming. This new venture seeked to facilitate game development in the cloud environment and also aimed to help developers effectively monetize their creations, thereby enhancing revenue opportunities in the burgeoning cloud gaming market

- In December 2023, Xbox Cloud Gaming expanded its services to the Meta Quest line of VR headsets, enabling users to download the app directly from the Meta Quest Store. This launch allows players to access VR-based games without requiring additional gaming devices. It highlights significant market opportunities for cloud gaming services to thrive across diverse, advanced-compatible devices, catering to a growing audience interested in immersive gaming experiences

- In September 2023, Microsoft announced plans to launch its next Xbox console in 2028, envisioned as an advanced hybrid gaming platform. This innovative console will harness the combined capabilities of the user's device and the cloud to deliver enhanced immersion and entirely new gaming experiences. This development reflects the increasing demand for technological advancements in cloud gaming, providing stakeholders with opportunities to expand their market presence with novel offerings

- In October 2021, Sony introduced a cutting-edge virtual reality (VR) headset for its popular PlayStation cloud gaming 5, featuring advanced eye-tracking technology and vibratory feedback. The headset boasts a 110-degree field of view, 4K HDR resolution of 2000x2040 per eye, and an OLED screen with a 90/120 fps frame rate. In addition, the controllers provide tactile feedback, aiming to deliver a more immersive and realistic gaming experience for players

- In September 2021, NVIDIA Corporation forged a partnership with Electronic Arts Inc. to enrich the gaming portfolio on its GeForce NOW platform. This collaboration allowed Electronic Arts to bring several acclaimed titles to the service, including Mirror's Edge Catalyst, Battlefield 1 Revolution, Dragon Age: Inquisition, Apex Legends, and Unravel Two. This partnership signifies an effort to broaden the gaming experience available through cloud gaming platforms

- In April 2021, Blacknut collaborated with NOS, a communications and entertainment group in Portugal, to deliver an enhanced gaming experience utilizing 5G technology. This partnership aims to offer over 500 games playable through the 5G network, marking a significant advancement in cloud gaming accessibility. The integration of 5G enhances the gaming experience, providing lower latency and improved performance for users across Portugal

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.