Global Cloud Native Storage Market

Market Size in USD Billion

CAGR :

%

USD

16.92 Billion

USD

91.56 Billion

2024

2032

USD

16.92 Billion

USD

91.56 Billion

2024

2032

| 2025 –2032 | |

| USD 16.92 Billion | |

| USD 91.56 Billion | |

|

|

|

|

Cloud Native Storage Market Size

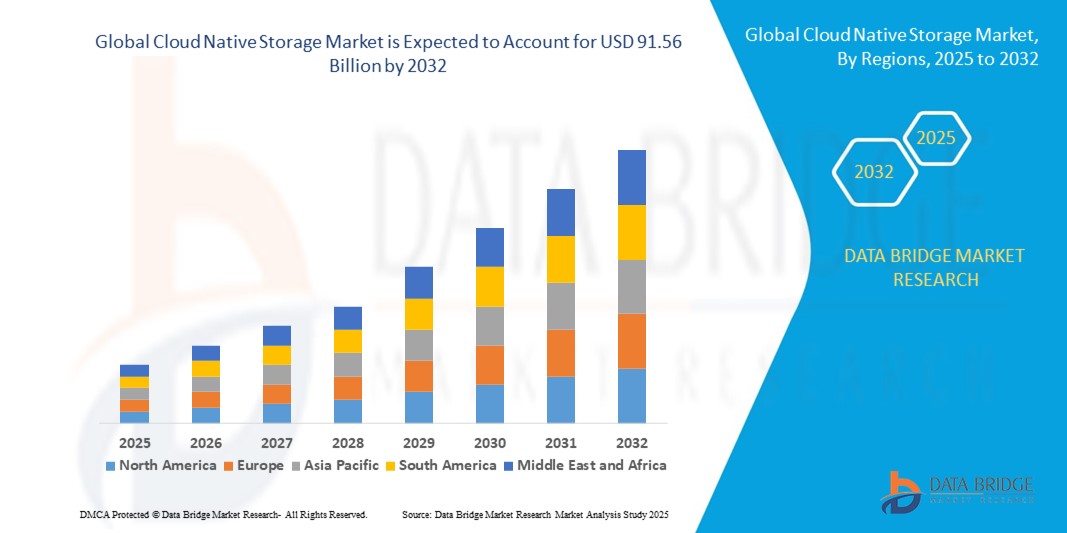

- The global cloud native storage market size was valued at USD 16.92 billion in 2024 and is expected to reach USD 91.56 billion by 2032, at a CAGR of 23.50% during the forecast period

- The market growth is primarily driven by the increasing adoption of cloud-native technologies, rising demand for scalable and flexible storage solutions, and the need for efficient data management in modern enterprise applications

- Growing awareness of the benefits of cloud-native storage, such as seamless integration with containerized environments and enhanced data resilience, is further propelling market demand across various industries

Cloud Native Storage Market Analysis

- The cloud native storage market is experiencing robust growth due to the rising popularity of containerization, microservices, and DevOps practices, which require agile and scalable storage solutions

- The demand for cloud-native storage is increasing across both large enterprises and SMEs, driven by the need for cost-effective, high-performance storage that supports dynamic workloads

- North America dominates the cloud native storage market with the largest revenue share of 38.5% in 2024, fueled by a mature IT infrastructure, widespread adoption of cloud technologies, and the presence of key market players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by rapid digital transformation, increasing cloud adoption, and growing investments in IT infrastructure in countries such as China, India, and Singapore

- The solutions segment dominated the largest market revenue share of 65.3% in 2024. This dominance is attributed to the scalability, flexibility, and automation capabilities of cloud-native storage solutions, which seamlessly integrate with containerized applications and orchestration platforms such as Kubernetes

Report Scope and Cloud Native Storage Market Segmentation

|

Attributes |

Cloud Native Storage Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Cloud Native Storage Market Trends

Increasing Integration of AI and Big Data Analytics

- The global cloud native storage market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into data management, access patterns, and storage optimization needs

- AI-powered cloud native storage solutions facilitate proactive problem-solving, identifying potential performance bottlenecks or security risks before they impact operations

- For instance, several companies are developing AI-driven platforms that optimize data placement across hybrid and multi-cloud environments or predict storage demands based on usage patterns

- This trend enhances the value proposition of cloud native storage systems, making them more appealing to enterprises in sectors such as BFSI and Retail & Consumer Goods

- AI algorithms can analyze extensive data metrics, including access frequency, data growth rates, and compliance requirements, to optimize storage allocation and improve efficiency

Cloud Native Storage Market Dynamics

Driver

Rising Demand for Cloud-Native Applications and Scalable Infrastructure

- The increasing adoption of cloud-native applications, driven by the need for scalable, flexible, and resilient IT infrastructure, is a major driver for the global cloud native storage market

- Cloud native storage solutions support containerized applications and microservices, enabling seamless integration with platforms such as Kubernetes for dynamic data management

- Government initiatives, such as the U.S. "Cloud Smart" strategy, are promoting cloud adoption across sectors such as BFSI, Retail & Consumer Goods, and IT, further boosting demand

- The proliferation of IoT, 5G, and edge computing is expanding the scope of cloud native storage applications, offering faster data processing and lower latency for real-time use cases

- Enterprises are increasingly adopting cloud native storage as a standard component of their digital transformation strategies to meet the demands of modern, data-intensive workloads

Restraint/Challenge

High Implementation Complexity and Data Security Concerns

- The complexity and cost of implementing cloud native storage systems, including integration with containerized environments and orchestration platforms, can be a significant barrier, particularly for small and medium-sized enterprises (SMEs)

- Deploying cloud native storage solutions often requires specialized expertise in Kubernetes, containerization, and hybrid cloud architectures, increasing operational costs

- Data security and privacy concerns are major challenges, as cloud native storage systems handle vast amounts of sensitive data, raising risks of breaches, unauthorized access, or non-compliance with regulations such as GDPR and PCI-DSS

- The fragmented regulatory landscape across regions, particularly regarding data sovereignty and compliance, complicates operations for global service providers

- These factors can deter adoption in cost-sensitive markets or regions with heightened data privacy awareness, limiting market expansion

Cloud Native Storage market Scope

The market is segmented on the basis of offering, deployment mode, application, and vertical.

- By Offering

On the basis of offering, the global cloud native storage market is segmented into solutions and services. The solutions segment dominated the largest market revenue share of 65.3% in 2024. This dominance is attributed to the scalability, flexibility, and automation capabilities of cloud-native storage solutions, which seamlessly integrate with containerized applications and orchestration platforms such as Kubernetes. These solutions enable enterprises to efficiently manage vast data volumes, support microservices architectures, and ensure persistent storage for stateful applications, making them highly appealing to organizations undergoing digital transformation.

The services segment, including consulting, integration, and support services, is expected to register the fastest growth rate from 2025 to 2032, driven by the increasing need for expertise in deploying and optimizing cloud-native storage systems. Services help organizations navigate complex cloud environments, ensure compliance, and enhance operational efficiency through tailored support for hybrid and multi-cloud strategies. The growing adoption of AI-driven analytics and automation in storage management further accelerates demand for specialized services.

- By Deployment Mode

On the basis of deployment mode, the global cloud native storage market is segmented into public and private cloud deployment modes. The public cloud segment accounted for the largest revenue share, driven by its cost-effectiveness, scalability, and ease of adoption for businesses of all sizes. Public cloud-native storage solutions, offered by providers such as AWS, Microsoft Azure, and Google Cloud, enable rapid deployment and dynamic resource allocation, making them ideal for organizations seeking agility and reduced infrastructure costs. The widespread use of public cloud for containerized workloads and DevOps practices further solidifies its dominance.

The private cloud segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by enterprises prioritizing data security, compliance, and control. Private cloud-native storage solutions offer enhanced customization and integration with on-premises infrastructure, appealing to industries such as BFSI and healthcare with stringent regulatory requirements. The rise of hybrid cloud strategies, combining the benefits of public and private clouds, is also driving growth in this segment as organizations seek to balance flexibility with security.

- By Application

On the basis of application, the global cloud native storage market is segmented into backup & recovery and content delivery & distribution applications. The backup & recovery segment held the largest revenue share in 2024, driven by the critical need for data protection, disaster recovery, and business continuity. Cloud-native storage solutions provide fast, scalable, and automated backup and recovery capabilities, minimizing downtime and ensuring data integrity for mission-critical applications. Features such as data replication, snapshots, and encryption further enhance their appeal in industries with high data availability requirements.

The content delivery & distribution segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the exponential growth of digital content, streaming services, and e-commerce platforms. Cloud-native storage enables efficient content delivery through scalable object storage and integration with content delivery networks (CDNs), ensuring low-latency access and seamless user experiences. The increasing demand for real-time analytics and AI-driven content personalization further drives adoption in this segment.

- By Vertical

On the basis of vertical, the global cloud native storage market is segmented into BFSI and retail & consumer goods verticals. The BFSI segment dominated with the largest revenue share 20% in 2024, attributed to its stringent requirements for data security, compliance, and scalability. Cloud-native storage solutions in BFSI support high-volume transactions, real-time fraud detection, and compliance with regulations such as GDPR, PCI-DSS, and Basel III. These solutions offer encryption, access controls, and seamless integration with digital banking platforms, enabling BFSI organizations to enhance operational efficiency and customer trust.

The retail & consumer goods segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the rapid expansion of e-commerce and the need for scalable, customer-centric storage solutions. Cloud-native storage supports retail platforms by enabling efficient management of vast customer data, personalized marketing, and seamless omnichannel experiences. The integration of AI and machine learning for predictive analytics and inventory management further accelerates demand in this vertical, as retailers aim to optimize operations and enhance customer engagement.

Cloud Native Storage Market Regional Analysis

- North America dominates the cloud native storage market with the largest revenue share of 38.5% in 2024, fueled by a mature IT infrastructure, widespread adoption of cloud technologies, and the presence of key market players

- Consumers and enterprises prioritize cloud native storage for its scalability, flexibility, and ability to support modern applications such as backup & recovery and content delivery & distribution, particularly in data-intensive industries

- Growth is supported by advancements in containerization and orchestration technologies, such as Kubernetes, alongside increasing demand in both public and private deployment modes across BFSI and retail & consumer goods sectors

U.S. Cloud Native Storage Market Insight

The U.S. cloud native storage market captured the largest revenue share of 77.4% in 2024 within North America, fueled by strong demand for scalable storage solutions and widespread adoption of containerized applications. The trend toward digital transformation, coupled with growing investments in AI and machine learning workloads, further boosts market expansion. Enterprises’ focus on secure and efficient storage for backup & recovery and content delivery & distribution complements the growth of solutions and services in both OEM and aftermarket segments.

Europe Cloud Native Storage Market Insight

The Europe cloud native storage market is expected to witness significant growth, supported by regulatory emphasis on data sovereignty and compliance with standards such as GDPR. Enterprises seek storage solutions that enhance data management and integration with Kubernetes for applications such as backup & recovery and content delivery & distribution. The growth is prominent in countries such as Germany and France, driven by increasing adoption in BFSI and retail & consumer goods sectors and the rise of hybrid cloud architectures.

U.K. Cloud Native Storage Market Insight

The U.K. market for cloud native storage is expected to witness rapid growth, driven by demand for scalable and secure storage solutions in urban business hubs. Enterprises prioritize solutions that support real-time analytics and content delivery & distribution while ensuring compliance with data protection regulations. Increased interest in cloud-native technologies and the integration of AI-driven storage management in BFSI and retail sectors further encourage adoption.

Germany Cloud Native Storage Market Insight

Germany is expected to witness a high growth rate in the cloud native storage market, attributed to its advanced IT infrastructure and strong focus on data efficiency and security. Enterprises prefer technologically advanced storage solutions that support backup & recovery and content delivery & distribution, contributing to operational efficiency. The integration of cloud native storage in BFSI and retail & consumer goods sectors, along with robust adoption of public and private cloud deployments, supports sustained market growth.

Asia-Pacific Cloud Native Storage Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid digital transformation, expanding IT infrastructure, and rising adoption of cloud solutions in countries such as China, India, and Japan. Increasing demand for scalable storage for applications such as backup & recovery and content delivery & distribution, coupled with government initiatives promoting digital economies, boosts market growth. The BFSI and retail & consumer goods sectors are key contributors to this expansion.

Japan Cloud Native Storage Market Insight

Japan’s cloud native storage market is expected to witness rapid growth due to strong consumer and enterprise preference for high-quality, scalable storage solutions that enhance data management and application performance. The presence of major technology firms and the integration of cloud native storage in BFSI and retail & consumer goods sectors accelerate market penetration. Rising interest in automation and AI-driven storage solutions also contributes to growth.

China Cloud Native Storage Market Insight

China holds the largest share of the Asia-Pacific cloud native storage market, propelled by rapid digitalization, increasing enterprise data volumes, and strong demand for solutions and services in public and private cloud deployments. The country’s growing focus on smart infrastructure and data-driven decision-making supports the adoption of cloud native storage for backup & recovery and content delivery & distribution. Competitive domestic cloud providers and investments in IT infrastructure enhance market accessibility.

Cloud Native Storage Market Share

The cloud native storage industry is primarily led by well-established companies, including:

- Microsoft (U.S.)

- IBM (U.S.)

- AWS (U.S.)

- Google (U.S.)

- Alibaba Cloud (China)

- VMWare (U.S.)

- Huawei (China)

- Citrix (U.S.)

- Tencent Cloud (China)

- Scality (U.S.)

- Splunk (U.S.)

- Linbit (U.S.)

- Rackspace (U.S.)

- Robin.Io (U.S.)

- MayaData (U.S.)

What are the Recent Developments in Global Cloud Native Storage Market?

- In February 2025, IBM announced its intent to acquire DataStax, a leading provider of scalable, high-performance data infrastructure solutions. This strategic move is aimed at strengthening IBM’s watsonx AI portfolio by integrating DataStax’s expertise in NoSQL and vector databases, particularly AstraDB and DataStax Enterprise, which are built on Apache Cassandra®. The acquisition supports IBM’s goal of powering AI agents that require fast, reliable access to vast volumes of unstructured enterprise data, a critical component for generative AI applications. It also reinforces IBM’s commitment to open-source innovation and enterprise-grade data management.

- In November 2023, Qumulo, Inc. announced the launch of Cloud Native Qumulo (CNQ), a fully cloud-native platform designed to manage unstructured data such as images, videos, and logs. Built for deployment on Amazon Web Services (AWS), CNQ offers multi-protocol support, elastic scalability, and high-performance access to data, addressing the growing demands of digital content across industries. With features such as intelligent cache management, S3 intelligent tiering, and deployment within Virtual Private Clouds (VPCs), CNQ enables enterprises to handle massive data volumes efficiently while reducing infrastructure costs. This innovation underscores Qumulo’s commitment to simplifying and modernizing data management

- In August 2023, Microsoft enhanced its Azure Elastic SAN service by introducing private endpoint support and enabling volume sharing through SCSI (Small Computer System Interface) Persistent Reservation. These updates significantly improve security, network isolation, and multi-client access for clustered workloads. Private endpoints allow secure connections over Azure’s private backbone, eliminating exposure to the public internet. Meanwhile, SCSI Persistent Reservation enables multiple virtual machines to access shared volumes reliably, even across reboots—ideal for applications such as SQL Failover Clusters. These features reinforce Azure Elastic SAN’s position as a scalable, cloud-native alternative to traditional on-premises SAN systems

- In July 2023, Google LLC introduced Cloud Storage FUSE and Parallelstore, two advanced cloud storage solutions tailored for AI workloads. Cloud Storage FUSE allows developers to mount Google Cloud Storage buckets as local file systems, enabling seamless access to training data and models without refactoring code. Parallelstore, built on Intel’s DAOS architecture, is a high-performance parallel file system designed to keep GPUs saturated with data, minimizing idle time and maximizing throughput. These innovations deliver low latency, high bandwidth, and scalable performance, streamlining AI pipeline integration and accelerating model development and training

- In May 2023, IBM introduced IBM Hybrid Cloud Mesh, a Software as a Service (SaaS) solution designed to simplify the management of hybrid multi-cloud infrastructure. Built around an application-centric connectivity model, Hybrid Cloud Mesh automates the configuration, observability, and control of application networking across public and private clouds. It enables secure, scalable, and seamless connectivity, helping IT teams regain control over increasingly complex and distributed environments. This launch underscores IBM’s commitment to empowering enterprises with tools that accelerate deployment, enhance performance, and reduce operational overhead in multi-cloud ecosystems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cloud Native Storage Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cloud Native Storage Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cloud Native Storage Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.