Global Cloud Professional Services Market

Market Size in USD Billion

CAGR :

%

USD

28.07 Billion

USD

98.90 Billion

2024

2032

USD

28.07 Billion

USD

98.90 Billion

2024

2032

| 2025 –2032 | |

| USD 28.07 Billion | |

| USD 98.90 Billion | |

|

|

|

|

Cloud Professional Services Market Size

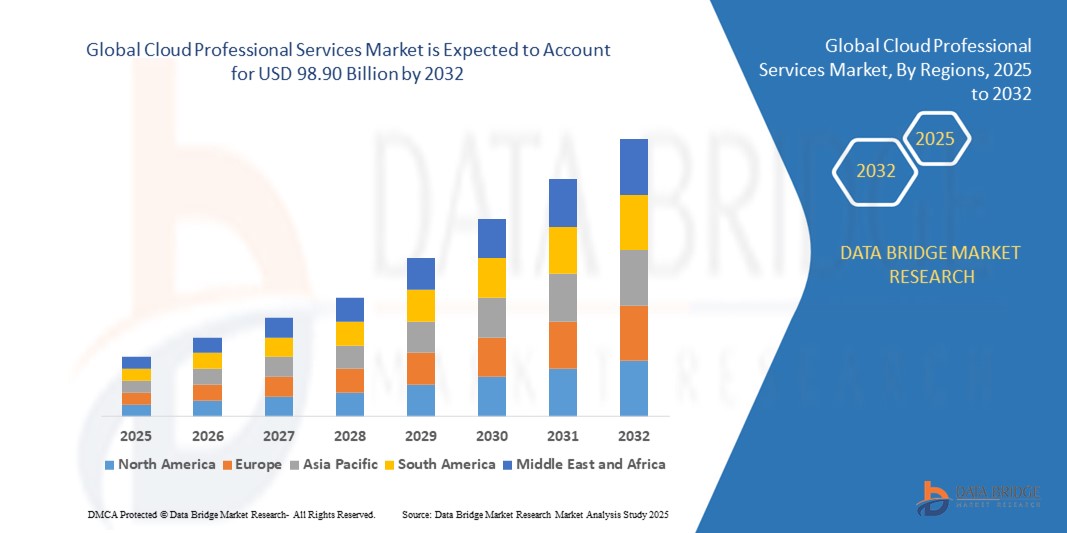

- The global cloud professional services market size was valued at USD 28.07 billion in 2024 and is expected to reach USD 98.90 billion by 2032, at a CAGR of 17.05% during the forecast period

- The market growth is largely fuelled by the increasing adoption of cloud computing across enterprises, a growing need for scalable infrastructure, and the demand for efficient migration, consulting, and optimization services

- The surge in remote work and the need for secure, collaborative, and flexible IT environments have further propelled the demand for cloud professional services, as businesses prioritize resilient and scalable digital infrastructure to support hybrid workforces

Cloud Professional Services Market Analysis

- Cloud professional services are becoming critical enablers for enterprises looking to transition from on-premise IT infrastructure to cloud-based environments. As businesses increasingly embrace hybrid and multi-cloud models, the need for specialized services—such as consulting, implementation, and optimization—has surged

- Organizations across sectors are relying on third-party service providers to ensure seamless cloud adoption, cost optimization, compliance with data regulations, and agile development processes. These services also help minimize disruption and ensure high availability during cloud migration

- North America dominated the cloud professional services market with the largest revenue share in 2024, driven by rapid cloud adoption across industries, a mature IT infrastructure, and the presence of major cloud service providers

- Asia-Pacific region is expected to witness the highest growth rate in the global cloud professional services market, driven by increased cloud spending in emerging economies, rising demand for scalable IT infrastructure, and the growing need for operational efficiency among businesses transitioning from traditional systems to cloud-based environments

- The consulting segment accounted for the largest market revenue share in 2024, supported by increasing demand for expert guidance to devise cloud adoption strategies tailored to business goals. Enterprises rely on consulting firms to evaluate cloud-readiness, ensure regulatory compliance, and formulate cost-effective transformation roadmaps.

Report Scope and Cloud Professional Services Market Segmentation

|

Attributes |

Cloud Professional Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Accenture (Ireland) • HPE (U.S.) |

|

Market Opportunities |

• Rising Adoption of Multi-Cloud and Hybrid Cloud Strategies |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Cloud Professional Services Market Trends

Surge in Demand for Multi-Cloud and Hybrid Cloud Architectures

- The increasing shift toward multi-cloud and hybrid cloud environments is reshaping the cloud professional services landscape, as enterprises aim to avoid vendor lock-in, enhance resilience, and improve performance by distributing workloads across platforms

- Businesses are actively investing in consulting and optimization services to strategically design hybrid infrastructures that align with operational goals and compliance requirements, particularly in regulated sectors such as healthcare and finance

- The demand for seamless integration across public and private clouds is pushing service providers to develop advanced interoperability solutions, enabling efficient data flow and unified management across environments

- For instance, in 2023, a U.S.-based financial services firm collaborated with a global cloud service provider to deploy a hybrid architecture integrating Microsoft Azure and on-premise systems, improving service continuity and data governance

- As enterprises seek greater control, flexibility, and cost optimization, hybrid and multi-cloud strategies are becoming central to digital transformation efforts, creating long-term opportunities for tailored cloud professional service offerings

Cloud Professional Services Market Dynamics

Driver

Rising Need for Digital Transformation and Scalable IT Infrastructure

• Organizations across sectors are accelerating digital transformation initiatives to remain competitive in a rapidly evolving technological landscape. Cloud adoption is at the core of these efforts, providing scalable, agile, and cost-effective infrastructure

• Cloud professional services are critical in enabling seamless transitions from legacy systems to cloud-native platforms through consulting, migration, and application modernization. These services reduce complexity, minimize downtime, and improve system efficiency

• Companies also seek to enhance customer experience and operational agility through cloud-based solutions such as data analytics, artificial intelligence, and Internet of Things (IoT), further driving demand for expert implementation and integration services

• For instance, in 2022, a leading European retail chain partnered with cloud consultants to migrate its e-commerce operations to a scalable platform on Amazon Web Services (AWS), resulting in reduced latency, better data analytics, and improved customer engagement

• The growing reliance on digital infrastructure across industries, supported by government and private sector cloud adoption mandates, is propelling the cloud professional services market toward sustained growth

Restraint/Challenge

Complexity in Cloud Integration and Security Compliance

• The increasing adoption of diverse cloud platforms and tools often leads to fragmented IT environments, making integration a major challenge for enterprises. Ensuring seamless interaction between legacy systems, public cloud services, and private infrastructure requires highly customized solutions and advanced technical expertise

• Regulatory compliance and data security concerns also restrain the adoption of cloud professional services. Sectors handling sensitive information, such as banking and healthcare, must ensure adherence to frameworks such as GDPR, HIPAA, and ISO standards, which complicates cloud deployments

• Lack of internal expertise and skilled personnel can further delay migration projects or lead to misconfigured systems, increasing vulnerability to breaches and inefficiencies

• For instance, in 2023, a healthcare provider in Southeast Asia faced integration delays due to incompatible legacy systems and unmet compliance benchmarks, highlighting the need for highly tailored consulting and managed service support

• As cloud complexity rises, service providers must prioritize secure, compliant, and modular service offerings to address enterprise-specific integration and regulatory needs across global markets

Cloud Professional Services Market Scope

The market is segmented on the basis of service type, service model, deployment model, organization size, and vertical.

- By Service Type

On the basis of service type, the cloud professional services market is segmented into consulting, integration & optimization, implementation & migration, and application development & modernization. The consulting segment accounted for the largest market revenue share in 2024, supported by increasing demand for expert guidance to devise cloud adoption strategies tailored to business goals. Enterprises rely on consulting firms to evaluate cloud-readiness, ensure regulatory compliance, and formulate cost-effective transformation roadmaps.

The integration & optimization segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising complexity in managing hybrid and multi-cloud environments. Businesses are seeking integration services to unify disparate systems and optimize workloads for scalability, performance, and cost-efficiency. Demand is also propelled by the need to improve interconnectivity among applications and services in heterogeneous cloud architectures.

- By Service Model

On the basis of service model, the market is segmented into Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS). The SaaS segment dominated the market in 2024 due to widespread adoption of cloud-based productivity tools, customer relationship management (CRM) platforms, and collaboration suites by businesses of all sizes. The pay-as-you-go model, quick deployment, and low upfront costs have driven rapid SaaS adoption.

The PaaS segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its critical role in accelerating application development and DevOps processes. Organizations increasingly leverage PaaS to streamline coding, testing, and deployment workflows, particularly in agile and cloud-native environments.

- By Deployment Model

Based on deployment model, the market is segmented into public cloud and private cloud. The public cloud segment held the largest revenue share in 2024, backed by growing acceptance of shared infrastructure among cost-conscious enterprises and startups. Public cloud services offer scalability, reduced maintenance, and high availability at a lower total cost of ownership.

The private cloud segment is expected to witness the fastest growth rate from 2025 to 2032, driven by heightened focus on data security, customization, and regulatory compliance in industries such as healthcare, finance, and government. The private model allows organizations to maintain full control over infrastructure while still benefiting from cloud capabilities.

- By Organization Size

On the basis of organization size, the cloud professional services market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment dominated the market in 2024 due to extensive digital transformation initiatives and significant budgets allocated to modernize IT infrastructure. These organizations often partner with service providers to design complex, enterprise-scale cloud strategies.

The SMEs segment is expected to witness the fastest growth rate from 2025 to 2032, as small businesses increasingly turn to cloud services to improve agility, reduce operational costs, and compete with larger firms. Cloud professional services help SMEs with affordable migration, scalable solutions, and ongoing support.

- By Vertical

By vertical, the market is segmented into banking, financial services & insurance (BFSI), retail & consumer goods, IT & ITES, telecommunications, healthcare & life sciences, manufacturing, energy & utilities, government & defense, and others. The BFSI segment led the market in 2024, supported by increasing reliance on cloud for digital banking, fraud detection, and secure data management. Financial institutions seek professional services to ensure compliance, data privacy, and infrastructure scalability.

The healthcare & life sciences segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the need for secure and scalable cloud systems to handle electronic health records (EHRs), telehealth, and clinical data analytics. Cloud services enable healthcare providers to enhance patient care, reduce IT overheads, and support remote services.

Cloud Professional Services Market Regional Analysis

• North America dominated the cloud professional services market with the largest revenue share in 2024, driven by rapid cloud adoption across industries, a mature IT infrastructure, and the presence of major cloud service providers

• Enterprises in the region are embracing hybrid and multi-cloud strategies, fueling the demand for consulting, migration, and optimization services

• The growing reliance on cloud-native applications, increased investment in digital transformation, and demand for customized professional services continue to strengthen the regional market

U.S. Cloud Professional Services Market Insight

The U.S. cloud professional services market held the largest revenue share within North America in 2024, owing to the widespread integration of cloud platforms across healthcare, banking, retail, and government sectors. Enterprises are accelerating cloud deployments to enhance agility, scalability, and innovation. The strong ecosystem of cloud-native startups, managed service providers, and system integrators supports continued market growth. In addition, the push for digital modernization, especially in federal and state agencies, is boosting demand for cloud consulting and migration services.

Europe Cloud Professional Services Market Insight

The Europe cloud professional services market is expected to witness the fastest growth rate from 2025 to 2032, driven by data sovereignty requirements, GDPR compliance, and increased cloud adoption across key verticals. As companies modernize legacy systems and embrace remote work, demand for cloud transformation strategies is rising. Government initiatives encouraging cloud adoption and the rise of digital-first businesses are contributing to the region’s growing need for professional support in architecture, integration, and deployment.

U.K. Cloud Professional Services Market Insight

The U.K. cloud professional services market is expected to witness the fastest growth rate from 2025 to 2032, fueled by accelerated digital transformation across both private and public sectors. Financial institutions, in particular, are adopting cloud to ensure data resilience and regulatory compliance. The U.K.'s focus on cybersecurity, data governance, and agile delivery methods is increasing demand for expert consulting and tailored cloud solutions. The country’s dynamic tech ecosystem and openness to emerging technologies are reinforcing its position in the European market.

Germany Cloud Professional Services Market Insight

The Germany cloud professional services market is expected to witness the fastest growth rate from 2025 to 2032, supported by strong industrial digitization efforts and initiatives such as Industry 4.0. German enterprises are investing in cloud to optimize manufacturing operations, improve customer experience, and enhance data analytics capabilities. The need for specialized services in cloud integration and workload migration is growing, particularly among mid-sized enterprises modernizing their infrastructure. Strict data privacy laws also fuel demand for local cloud expertise.

Asia-Pacific Cloud Professional Services Market Insight

The Asia-Pacific cloud professional services market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing cloud investments in economies such as China, India, Japan, and Australia. The expansion of SMEs, digitalization of public services, and cloud-native innovation across financial, retail, and healthcare sectors are key growth drivers. Government-led digital initiatives and the rise of hyperscale data centers are further supporting the demand for cloud strategy, deployment, and management services.

Japan Cloud Professional Services Market Insight

The Japan cloud professional services market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s growing demand for operational efficiency, data security, and cloud-based innovation. Enterprises are leveraging professional services to move mission-critical systems to the cloud, ensuring performance and compliance. The rise of AI, IoT, and 5G in Japan is pushing organizations to seek advanced cloud consulting and integration capabilities. In addition, the government’s focus on digital transformation is reinforcing enterprise cloud adoption.

China Cloud Professional Services Market Insight

The China cloud professional services market accounted for the largest revenue share in Asia-Pacific in 2024, supported by a thriving tech industry, strong public-private cloud investments, and digital-first business models. Companies in China are rapidly migrating to the cloud to scale operations, enhance agility, and harness big data. Domestic cloud providers and local system integrators play a critical role in offering customized consulting, implementation, and optimization services across industries, including e-commerce, telecom, and financial services.

Cloud Professional Services Market Share

The Cloud Professional Services industry is primarily led by well-established companies, including:

• Accenture (Ireland)

• IBM (U.S.)

• Deloitte (U.K.)

• EY (U.K.)

• PwC (U.K.)

• HPE (U.S.)

• HCLTech (India)

• Wipro (India)

• TCS (India)

• Capgemini (France)

Latest Developments in Global Cloud Professional Services Market

- In February 2023, IBM acquired NS1, a network automation software-as-a-service provider, to enhance agility within hybrid cloud environments. This move supports IBM’s strategy to streamline network performance and automate complex cloud operations, strengthening its hybrid cloud services portfolio and expanding customer reach across enterprise IT infrastructures

- In December 2022, EY formed a strategic alliance with Software AG to help organizations accelerate digital transformation through advanced business process management, Internet of Things, and integration solutions. This collaboration aims to enhance operational efficiency and enable real-time data connectivity, reinforcing EY’s role in enterprise modernization initiatives

- In September 2022, Accenture acquired Sentia’s business in the Netherlands, Belgium, and Bulgaria to expand its Cloud First capabilities. The acquisition strengthens Accenture’s presence in Europe and enhances its ability to deliver cloud infrastructure services across public, private, and sovereign environments, supporting clients’ end-to-end digital transformation

- In September 2022, PwC entered into an alliance with HighRadius to deliver autonomous finance technology for transforming accounting and finance operations. This partnership focuses on streamlining workflows, improving accuracy, and reducing costs, offering organizations a pathway to intelligent financial process automation

- In December 2021, Deloitte completed the acquisition of BIAS Corporation, a leader in Oracle Cloud Infrastructure services. This acquisition bolsters Deloitte’s cloud offerings by deepening its Oracle expertise, enabling comprehensive cloud migration and application modernization solutions for enterprise clients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.