Global Clutch Spring Wires Market

Market Size in USD Billion

CAGR :

%

USD

92.41 Billion

USD

185.50 Billion

2024

2032

USD

92.41 Billion

USD

185.50 Billion

2024

2032

| 2025 –2032 | |

| USD 92.41 Billion | |

| USD 185.50 Billion | |

|

|

|

|

What is the Global Clutch Spring Wires Market Size and Growth Rate?

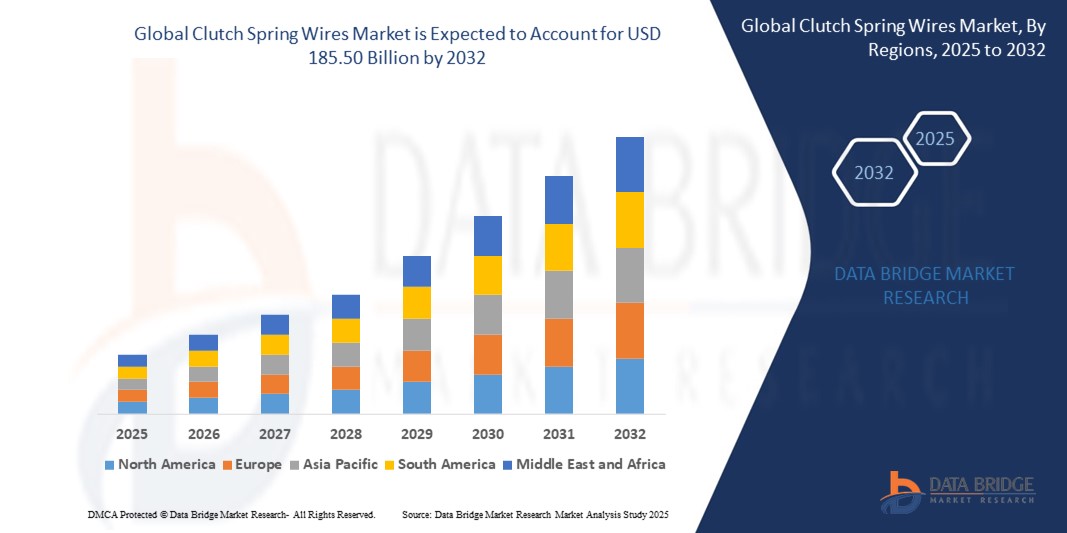

- The global clutch spring wires market size was valued at USD 92.41 billion in 2024 and is expected to reach USD 185.50 billion by 2032, at a CAGR of 9.10% during the forecast period

- Clutch spring wires market is advancing with innovative alloys such as silicon-chrome steel, enhancing durability and performance. The latest methods integrate advanced manufacturing techniques, ensuring precise spring properties

- Technologies focus on optimizing wire drawing and heat treatment processes for superior strength and fatigue resistance. Growth is driven by automotive sector demands for high-performance clutch systems, fostering market expansion globally

What are the Major Takeaways of Clutch Spring Wires Market?

- The automotive industry's global expansion, especially in emerging markets such as India and Brazil, significantly boosts the demand for clutch spring wires. As these regions experience rapid urbanization and rising disposable incomes, the demand for vehicles increases, necessitating more efficient and durable automotive components

- This trend underscores a growing market for clutch spring wires, essential for improving vehicle performance and meeting the demands of a burgeoning automotive market

- North America dominated the clutch spring wires market with the largest revenue share of 38.7% in 2024, driven by the presence of a robust automotive manufacturing base and significant investments in performance vehicle components

- Asia-Pacific is expected to grow at the fastest CAGR of 13.3% from 2025 to 2032, led by rising vehicle production, increasing demand for affordable transportation, and the growing adoption of manual and semi-automatic transmissions in China, India, and Southeast Asia

- The stainless steel segment dominated the market with the largest revenue share of 38.5% in 2024, owing to its superior strength, corrosion resistance, and wide applicability across automotive and industrial clutch systems

Report Scope and Clutch Spring Wires Market Segmentation

|

Attributes |

Clutch Spring Wires Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Clutch Spring Wires Market?

“Growing Demand for High-Performance and Lightweight Alloys”

- A prominent trend in the global clutch spring wires market is the rising preference for high-performance materials, particularly lightweight alloy wires that offer enhanced durability, corrosion resistance, and fatigue strength. These advanced materials help improve clutch responsiveness and overall fuel efficiency in automotive and industrial applications

- For instance, Suzuki Garphyttan AB has been developing oil-tempered and patented wire grades tailored for performance-driven applications in hybrid and electric vehicles, where temperature stability and lightweight design are critical

- Another innovation trend is the shift toward micro-alloyed wires and advanced coating technologies that enhance resistance to harsh environments, ensuring longer service life in high-load clutch systems

- Growing sustainability initiatives are also driving interest in recyclable and environmentally friendly wire production processes, pushing manufacturers to adopt eco-efficient wire drawing and treatment methods

- These developments are aligning with stricter emission standards and the ongoing electrification of vehicles, reshaping material strategies in the automotive component industry.

- As a result, automakers and Tier-1 suppliers are increasingly collaborating with wire producers to co-develop custom clutch spring wires that meet stringent performance and regulatory requirements

What are the Key Drivers of Clutch Spring Wires Market?

- The increasing demand for lightweight and fuel-efficient vehicles, particularly in the passenger and commercial vehicle segments, is a major driver of the clutch spring wires market. These wires play a crucial role in transmission systems, where optimized performance and durability are essential

- For instance, in June 2023, POSCO announced investments in its wire rod facilities to cater to the rising demand for high-tensile spring wires from automotive OEMs focusing on hybrid and EV powertrains

- The rise of automated manual transmissions (AMTs) and dual-clutch systems in modern vehicles also necessitates precision-engineered clutch spring wires with enhanced resilience and stress tolerance

- Industrial applications in sectors such as construction, agriculture, and heavy machinery continue to support demand due to the wires’ robust performance in high-vibration and high-load environments

- The increased focus on reliability, safety, and performance across automotive systems is encouraging OEMs to prefer premium-quality clutch spring wires, driving demand for specialty grades and surface-treated variants

Which Factor is challenging the Growth of the Clutch Spring Wires Market?

- A significant challenge in the clutch spring wires market is the volatile pricing and supply of raw materials, particularly specialty steel and alloy components. Fluctuations in prices of nickel, chromium, and vanadium can impact production costs and margins for manufacturers

- For instance, in early 2024, rising energy prices and geopolitical instability contributed to a global surge in steel input costs, affecting procurement strategies across wire manufacturing firms

- Another challenge is the increasing shift towards EVs, which may reduce the overall use of traditional clutch systems in the long term, especially as many electric drivetrains do not utilize standard mechanical clutches

- Compliance with stringent quality certifications, including ISO/TS and AISI standards, also presents operational hurdles for smaller players looking to compete with global manufacturers

- To remain competitive, companies are investing in advanced metallurgical R&D, automating wire drawing processes, and forming strategic partnerships with OEMs to ensure long-term supply chain stability and innovation alignment

- Overcoming these barriers will require robust procurement planning, continued material innovation, and alignment with evolving drivetrain technologies

How is the Clutch Spring Wires Market Segmented?

The market is segmented on the basis of material type, clutch spring type, and vehicle type.

• By Material Type

On the basis of material type, the clutch spring wires market is segmented into stainless steel, alloy steel, aluminium, and others. The stainless steel segment dominated the market with the largest revenue share of 38.5% in 2024, owing to its superior strength, corrosion resistance, and wide applicability across automotive and industrial clutch systems. The material’s durability under high-stress environments makes it the preferred choice among OEMs and tier-1 suppliers.

The aluminium segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the global push for vehicle lightweighting and enhanced fuel efficiency. Aluminium’s excellent strength-to-weight ratio, coupled with ease of recyclability, makes it increasingly favorable for next-gen vehicle platforms, especially in electric and hybrid models.

• By Clutch Spring Type

On the basis of clutch spring type, the market is segmented into diaphragm spring, central spring, and others. The diaphragm spring segment accounted for the largest market revenue share of 47.3% in 2024, primarily due to its widespread usage in passenger vehicles and light commercial vehicles. Diaphragm springs are known for their consistent pressure characteristics and compact design, making them ideal for modern clutch assemblies.

The central spring segment is projected to grow at the highest CAGR during the forecast period, driven by its increasing use in heavy-duty applications where high torque transmission and durability are crucial. Demand is particularly growing in commercial vehicles and agricultural machinery, where robust clutch performance is essential.

• By Vehicle Type

On the basis of vehicle type, the clutch spring wires market is segmented into passenger car, light commercial vehicle, and heavy commercial vehicle. The passenger car segment held the largest market revenue share of 51.6% in 2024, driven by the massive production volume and continual technological advancements in passenger vehicle transmission systems. The segment also benefits from rising consumer demand for smoother clutch engagement and better fuel economy.

The light commercial vehicle segment is anticipated to register the fastest CAGR from 2025 to 2032. This growth is attributed to the increasing adoption of LCVs in logistics and last-mile delivery services, which require robust and responsive clutch systems for frequent stop-start driving cycles and varied load conditions.

Which Region Holds the Largest Share of the Clutch Spring Wires Market?

- North America dominated the clutch spring wires market with the largest revenue share of 38.7% in 2024, driven by the presence of a robust automotive manufacturing base and significant investments in performance vehicle components

- The region’s high consumption of light and heavy commercial vehicles enhances demand for high-performance clutch systems utilizing durable spring wires

- The market benefits from the rising trend of vehicle electrification and the integration of advanced transmission systems, which require enhanced spring wire solutions for clutch assemblies. In addition, strong aftermarket demand and stringent quality standards are pushing manufacturers to adopt innovative and corrosion-resistant wire materials

U.S. Clutch Spring Wires Market Insight

The U.S. captured the largest revenue share in 2024 within North America, owing to the country’s well-established automotive and industrial manufacturing sectors. Continuous innovation in vehicle drivetrain components and strong OEM presence are fueling demand. Furthermore, the increasing emphasis on lightweight, high-strength materials for clutch systems in passenger and commercial vehicles positions the U.S. as a critical market for clutch spring wire suppliers.

Europe Clutch Spring Wires Market Insight

The Europe clutch spring wires market is projected to grow at a steady pace throughout the forecast period, driven by the growing adoption of fuel-efficient manual transmissions and hybrid systems. The region's stringent emission norms are encouraging automakers to integrate lightweight clutch components supported by durable spring wires. Countries such as Germany, France, and the U.K. are investing in R&D for advanced transmission systems, which is expected to support market expansion.

U.K. Clutch Spring Wires Market Insight

The U.K. market is anticipated to register a notable CAGR during the forecast period, attributed to the shift towards high-efficiency vehicle components and increased demand in the replacement market. The rise of electric and hybrid vehicles has also prompted innovations in clutch design, particularly in transitional hybrid powertrains that still require clutching mechanisms supported by spring wires.

Germany Clutch Spring Wires Market Insight

The Germany clutch spring wires market is expanding steadily due to its automotive engineering leadership and strong export-oriented vehicle production. With key OEMs and tier-1 suppliers headquartered in the country, demand for precision-grade spring wires for clutch applications is high. Germany’s focus on high-performance and energy-efficient drivetrains continues to be a significant growth catalyst.

Which Region is the Fastest Growing Region in the Clutch Spring Wires Market?

Asia-Pacific is expected to grow at the fastest CAGR of 13.3% from 2025 to 2032, led by rising vehicle production, increasing demand for affordable transportation, and the growing adoption of manual and semi-automatic transmissions in China, India, and Southeast Asia. Government initiatives promoting industrialization and local automotive manufacturing are further propelling demand for clutch spring wires in both OEM and aftermarket sectors. In addition, growing two-wheeler and light commercial vehicle markets significantly contribute to the region’s rapid growth.

Japan Clutch Spring Wires Market Insight

The Japan market is witnessing moderate growth supported by advancements in transmission systems and high precision manufacturing. While EVs are rising, hybrid vehicles with clutch mechanisms still dominate the market, ensuring continued demand for clutch spring wires. Japan’s automotive giants focus on developing lightweight yet strong spring wires for compact and efficient clutch systems.

China Clutch Spring Wires Market Insight

China accounted for the largest share in the Asia-Pacific market in 2024, fueled by high-volume vehicle production, especially in the economy and mid-tier passenger car segments. The country’s robust automotive supply chain, growing exports, and rising demand for replacement parts support strong demand for clutch spring wires. Local manufacturers are increasingly investing in advanced materials and automation, strengthening their global competitiveness.

Which are the Top Companies in Clutch Spring Wires Market?

The clutch spring wires industry is primarily led by well-established companies, including:

- Suzuki Garphyttan AB (Sweden)

- KOBE STEEL, LTD. (Japan)

- POSCO (South Korea)

- Neturen America Corporation (U.S.)

- China BaoWu Steel Group Corporation Limited (China)

- Sinosteel Zhengzhou Research Institute of Steel Wire Products Co., Ltd. (China)

- Bekaert (Belgium)

- Joh. Pengg AG (Austria)

- NIPPON STEEL SG WIRE CO., LTD. (Japan)

- Jackson Spring & Mfg. Co. Inc. (U.S.)

- Tata Wiron (India)

- SMALLEY (U.S.)

- Ampex Metal Products (U.S.)

- Connecticut Spring & Stamping (U.S.)

- POHL SPRING WORKS (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.