Global Coagulationhemostasis Analyzer Market

Market Size in USD Billion

CAGR :

%

USD

6.68 Billion

USD

11.74 Billion

2024

2032

USD

6.68 Billion

USD

11.74 Billion

2024

2032

| 2025 –2032 | |

| USD 6.68 Billion | |

| USD 11.74 Billion | |

|

|

|

|

Coagulation/Hemostasis Analyzer Market Size

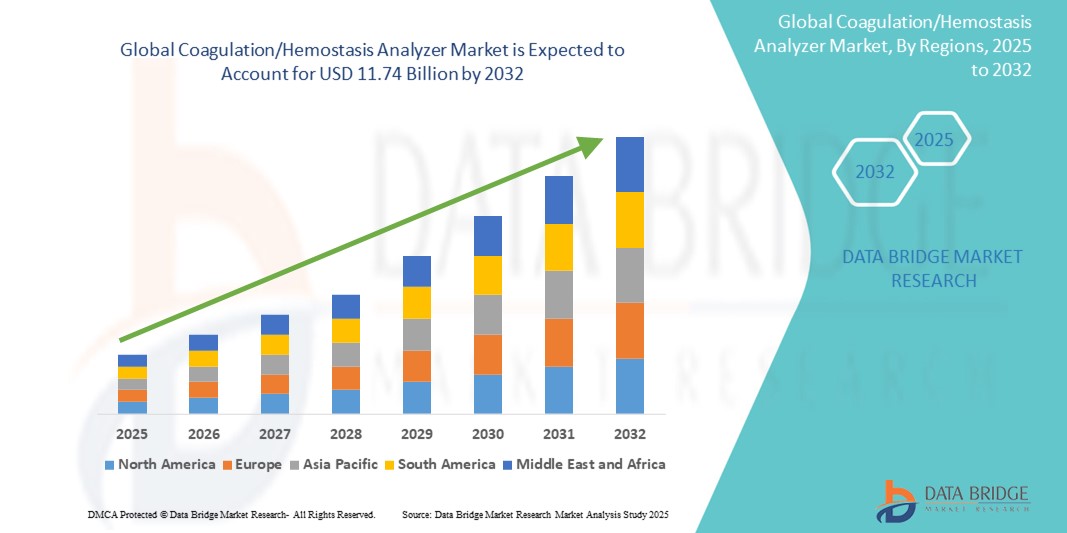

- The global Coagulation/Hemostasis Analyzer market was valued at USD 6.68 billion in 2024 and is expected to reach USD 11.74 billion by 2032, at a CAGR of 7.3%, during the forecast period

- The rising prevalence of coronary artery disease and the growing preference for minimally invasive cardiovascular procedures are driving demand for Coagulation/Hemostasis Analyzers globally. Additionally, increasing awareness about the benefits of early intervention with stent implantation, along with advancements in stent technology—such as drug-eluting and bioresorbable stents—is further propelling market growth.

Coagulation/Hemostasis Analyzer Market Analysis

- Coagulation/Hemostasis Analyzers play a critical role in managing patients undergoing cardiovascular procedures, particularly those involving coronary stents—small, expandable mesh tubes used to restore blood flow in blocked arteries. These analyzers help monitor and manage blood clotting parameters, reducing the risk of complications such as thrombosis and restenosis, and ultimately improving patient outcomes and long-term cardiovascular health.

- North America emerges as a leading region in the Global Coagulation/Hemostasis Analyzer Market, driven by a highly developed healthcare infrastructure, strong awareness of cardiovascular disease management, and favorable reimbursement policies for diagnostic and interventional cardiology procedures.

- The region's continued investment in advanced cardiovascular technologies, including bioresorbable stents and next-generation drug-eluting stents, along with an aging population and high prevalence of coronary artery disease, is further accelerating demand for accurate and efficient coagulation testing solutions.

Report Scope and Coagulation/Hemostasis Analyzer Segmentation

|

Attributes |

Coagulation/Hemostasis Analyzer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Coagulation/Hemostasis Analyzer Market Trends

“Growing Preference for Minimally Invasive and Targeted Therapies”

- A key trend in the global Coagulation/Hemostasis Analyzer market is the increasing preference for minimally invasive and targeted cardiovascular interventions, which require precise coagulation monitoring to ensure patient safety and procedural success.

- The demand for advanced analyzers is rising alongside the adoption of therapies such as percutaneous coronary intervention (PCI), where real-time coagulation assessment is critical to minimizing bleeding and thrombotic complications.

- For instance, next-generation coagulation analyzers with integrated features—such as multi-parameter testing, automated sample handling, and rapid turnaround times—are supporting personalized treatment strategies and improving clinical outcomes.

- The trend is further supported by innovations in point-of-care (POC) testing devices, allowing faster diagnosis and monitoring at the bedside or in emergency settings, reducing treatment delays and enhancing patient care.

- Additionally, the integration of digital connectivity, data management, and remote monitoring capabilities is streamlining workflow efficiency and supporting evidence-based decision-making in hospitals and laboratories.

- This shift toward patient-centric, real-time coagulation assessment is reshaping clinical diagnostics and driving growth and innovation in the global Coagulation/Hemostasis Analyzer market.

Coagulation/Hemostasis Analyzer Market Dynamics

Driver

“Increasing Global Prevalence of Cardiovascular and Bleeding Disorders”

- Rising incidences of coronary artery disease (CAD), atrial fibrillation, deep vein thrombosis, and inherited bleeding disorders are driving the need for precise coagulation monitoring.

- Aging populations and lifestyle-related risk factors such as diabetes, obesity, and hypertension further contribute to increased demand for coagulation testing in clinical practice.

- Early diagnosis and perioperative coagulation management are becoming standard in cardiovascular procedures, creating sustained demand for advanced hemostasis analyzers.

For instance,

- According to the World Health Organization (WHO, 2023), cardiovascular diseases cause 17.9 million deaths annually, with a large portion requiring coagulation management during interventions or long-term care.

- According to The Centers for Disease Control and Prevention (CDC) reported in 2024 that over 6 million people in the U.S. are living with atrial fibrillation, a major risk factor for stroke that demands continuous coagulation monitoring.

Opportunity

“Advancements in Stent Technologies and Delivery Systems”

- Growing investment in AI-powered analyzers, compact devices, and cloud-based data integration is improving test speed, accuracy, and clinical decision-making.

- The rise of point-of-care coagulation devices supports real-time monitoring in emergency, critical care, and remote settings, broadening market accessibility.

- Expanding telemedicine and personalized medicine trends offer significant opportunities for home-based and decentralized testing models.

For instance,

- In 2024, Siemens Healthineers launched the Atellica® VTLi, a POC analyzer offering cardiac and coagulation biomarker testing with lab-level precision at the bedside

- Roche Diagnostics and Werfen have integrated cloud-based remote monitoring and AI analytics into their newer coagulation platforms, supporting telehealth models and improving clinical workflow.

- Innovations in diagnostic technologies, such as AI-driven analysis, compact point-of-care (POC) devices, and smart connectivity, are revolutionizing how coagulation is monitored—making testing faster, more accurate, and more accessible.

Restraint/Challenge

“High Equipment Costs and Limited Access in Resource-Constrained Settings”

- Advanced coagulation analyzers and their consumables involve high capital and operational costs, limiting adoption in low- and middle-income countries (LMICs).

- Infrastructure requirements, maintenance, and need for trained personnel also present barriers to market penetration in underdeveloped healthcare systems.

- Limited reimbursement policies for diagnostic testing in certain regions further restrict uptake.

For instance,

- A 2023 GlobalData report estimated that high-end coagulation analyzers cost between USD 30,000 and USD 100,000, with annual maintenance and reagent costs adding USD 10,000–30,000, making widespread adoption difficult in LMICs

- A 2024 Lancet Global Health study noted that many rural hospitals in Africa and Southeast Asia rely on outdated manual clotting tests, lacking access to real-time, automated diagnostic tools.

Coagulation/Hemostasis Analyzer Market Scope

The market is segmented on the product, technology, patient care setting.

By Product (Clinical Laboratory Analyzers, Systems Point-Of-Care and Testing Analyzers), Test (Prothrombin Time Testing, Fibrinogen Testing, Activated Clotting Time Testing, Activated Partial Thromboplastin Time Testing, D-Dimer Testing, Platelet Function Tests, Anti-Factor Xa Tests, Heparin and Protamine Dose Response Tests for ACT and Other Coagulation Tests), Technology (Optical Technology, Mechanical Technology, Electrochemical Technology and Other Technologies), Patient Care Setting (Clinical Laboratories, Point-Of-Care Testing and Other End Users)

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Technology |

|

|

By Patient Care Setting |

|

In 2025, the Clinical Laboratory Analyzers is Projected to Dominate the Market with the Largest Share in the product Segment

The Clinical Laboratory Analyzers segment is expected to dominate the Global Coagulation/Hemostasis Analyzer Market in 2025, accounting for the largest market share of approximately 68.7%. This leadership is primarily driven by high test volumes in hospitals and diagnostic labs, along with increasing demand for automated, high-throughput systems.

In 2025, the Optical Technology are Expected to Account for the Largest Share During the Forecast Period in Technology segment

In 2025, Optical Technology is projected to dominate the Global Coagulation/Hemostasis Analyzer Market, accounting for the largest market share of approximately 61.3%. This dominance is attributed to its high accuracy, rapid result delivery, and minimal sample handling requirements. The growing use of optical technology in hospitals and diagnostic labs for real-time coagulation analysis, along with its efficiency in detecting critical parameters, makes it the preferred choice. Additionally, the increasing incidence of coagulation disorders and heightened focus on early diagnosis and personalized treatment are fueling its market growth.

Coagulation/Hemostasis Analyzer Market Regional Analysis

“North America is the Dominant Region in the Global Coagulation/Hemostasis Analyzer Market”

- North America leads the global Coagulation/Hemostasis Analyzer market, driven by its advanced healthcare infrastructure, high procedural volumes of percutaneous coronary interventions (PCI), and widespread availability of cutting-edge coagulation monitoring technologies.

- The United States holds the largest market share due to the high prevalence of cardiovascular diseases (CVD), an aging population, and increasing lifestyle-related risk factors such as obesity, hypertension, and diabetes.

- Favorable reimbursement policies, extensive healthcare coverage, and strong government initiatives for cardiovascular health programs significantly contribute to the region’s dominance.

- Furthermore, the presence of key players such as Abbott, Siemens, and Sysmex, along with ongoing investments in research and development, drives technological advancements and widespread product adoption across North America.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to register the highest growth rate in the Coagulation/Hemostasis Analyzer market, driven by the rising prevalence of cardiovascular diseases, improving healthcare access, and increasing adoption of interventional cardiology procedures.

- Countries such as China, India, and Japan are emerging as key markets due to their large patient populations, growing demand for minimally invasive procedures, and government-led initiatives aimed at addressing the cardiovascular health crisis.

- Japan is leading in adopting advanced coagulation testing systems, bolstered by a well-developed medical infrastructure and an aging population.

- In China and India, expanding healthcare investments, increasing cardiac care centers, and greater public awareness of cardiovascular disease management are fueling the market's growth.

- Additionally, the rise of domestic stent manufacturers and cost-effective solutions, coupled with supportive regulatory reforms, positions the region as a key driver of growth for the global Coagulation/Hemostasis Analyzer market.

Coagulation/Hemostasis Analyzer Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott Laboratories

- Siemens Healthineers

- Sysmex Corporation

- Werfen (Instrumentation Laboratory)

- Roche Diagnostics

- Beckman Coulter, Inc.

- HemoSonics

- Medtronic

- bioMérieux

- F. Hoffmann-La Roche Ltd.

Latest Developments in Global Coagulation/Hemostasis Analyzer

- In February 2023, Siemens Healthineers announced a global OEM agreement with Sysmex Corporation focused on hemostasis products. This collaboration allows companies to supply diagnostic products for blood clotting disorders and anticoagulant therapy monitoring under their respective brands. With over 25 years of partnership, the agreement aims to enhance its extensive hemostasis product portfolios, addressing the growing demand for diverse testing solutions. Both companies are committed to improving access to effective hemostasis testing worldwide, ultimately benefiting patient outcomes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.