Global Coal Bed Methane Market

Market Size in USD Billion

CAGR :

%

USD

20.94 Billion

USD

30.86 Billion

2024

2032

USD

20.94 Billion

USD

30.86 Billion

2024

2032

| 2025 –2032 | |

| USD 20.94 Billion | |

| USD 30.86 Billion | |

|

|

|

|

Coal Bed Methane Market Size

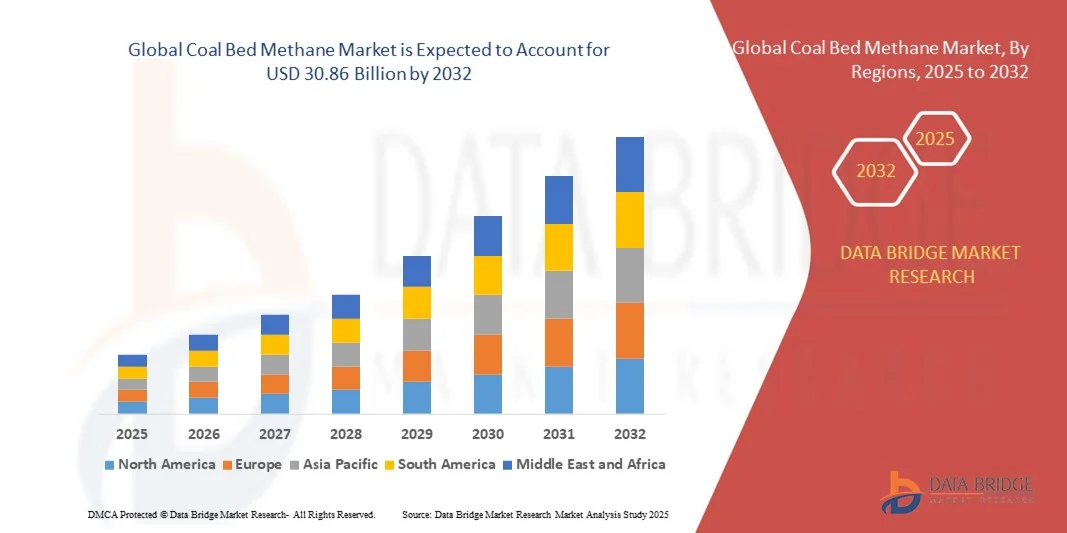

- The global coal bed methane market size was valued at USD 20.94 billion in 2024 and is expected to reach USD 30.86 billion by 2032, at a CAGR of 4.97% during the forecast period

- The market growth is largely fuelled by the increasing demand for cleaner energy alternatives, rising natural gas consumption, and advancements in coal bed methane extraction technologies

- Growing government initiatives and favorable policies promoting unconventional gas exploration are further supporting market expansion

Coal Bed Methane Market Analysis

- Increasing adoption of coal bed methane as a sustainable energy source is driving investments in exploration and production activities

- Technological innovations in drilling, hydraulic fracturing, and gas recovery are enhancing efficiency and reducing operational costs

- Asia-Pacific dominated the coal bed methane (CBM) market with the largest revenue share in 2024, driven by the region’s rising energy demand, abundant coal reserves, and growing focus on cleaner energy alternatives

- North America region is expected to witness the highest growth rate in the global coal bed methane market, driven by rising natural gas demand, expansion of CBM projects, and favorable policies promoting low-emission energy sources

- The hydraulic fracturing segment held the largest market revenue share in 2024, driven by its ability to efficiently extract methane from deep and low-permeability coal seams. Hydraulic fracturing enables higher gas recovery rates and is widely adopted in regions with extensive coal reserves, making it a preferred method for commercial-scale CBM production

Report Scope and Coal Bed Methane Market Segmentation

|

Attributes |

Coal Bed Methane Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

Here’s the list with hyperlinks added to the top 5 companies only, keeping the countries plain and unchanged:

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Coal Bed Methane Market Trends

Increasing Adoption of Coal Bed Methane as a Cleaner Energy Source

- The growing focus on cleaner energy solutions is transforming the coal bed methane (CBM) market by enabling the extraction of methane from coal seams with reduced environmental impact. The availability of CBM as a low-emission alternative to conventional fossil fuels supports energy diversification and sustainability initiatives. In addition, increased government emphasis on reducing carbon footprints and global climate targets is further encouraging CBM exploration and production

- Rising demand for natural gas in power generation and industrial sectors is accelerating the development of CBM extraction projects. CBM is particularly attractive in regions with abundant coal reserves, allowing energy producers to utilize unconventional gas sources while reducing reliance on imported fuels. Growing industrialization and urbanization in emerging economies are further intensifying the need for cleaner and reliable energy sources

- Advances in drilling, hydraulic fracturing, and gas recovery technologies are making CBM extraction more efficient and economically viable. These technological improvements enable higher gas recovery rates and safer operations in both onshore and offshore coalfields. Enhanced monitoring systems and automated recovery techniques are also contributing to reduced operational risks and improved project feasibility

- For instance, in 2023, several energy companies in Australia and the U.S. expanded CBM production projects, resulting in higher gas output and contributing to regional energy security while lowering carbon emissions. In addition, joint ventures with technology providers enabled faster deployment of advanced extraction methods, enhancing overall production efficiency

- While CBM adoption supports cleaner energy and resource optimization, market growth depends on regulatory compliance, cost-effective extraction technologies, and ongoing investment in infrastructure to maximize gas recovery. Strengthening public-private collaborations and ensuring sustainable development practices are also key factors influencing market expansion

Coal Bed Methane Market Dynamics

Driver

Rising Energy Demand and Focus on Low-Emission Alternatives

- The global push for low-carbon energy sources is increasing demand for coal bed methane as a cleaner alternative to coal and oil. Energy producers are investing in CBM projects to meet rising power generation needs while reducing greenhouse gas emissions. In addition, the shift toward decarbonization in industrial processes is boosting CBM utilization across multiple sectors

- Governments and regulatory bodies are promoting CBM development through favorable policies, subsidies, and incentives, encouraging companies to explore unconventional gas sources. This support is strengthening infrastructure and boosting market confidence. Environmental regulations aimed at reducing coal-fired power generation emissions are also incentivizing CBM adoption as a transitional energy source

- Industrial and utility sectors are increasingly adopting CBM for electricity generation, heating, and chemical feedstock, creating consistent demand for extracted methane. Strategic partnerships with coal and energy companies further enhance market growth. Growing awareness of energy security and supply diversification is reinforcing investments in CBM projects globally

- For instance, in 2022, India launched policy initiatives supporting CBM exploration across multiple coalfields, driving domestic production and reducing dependence on imported natural gas. Similar initiatives in China and Australia facilitated project approvals and technology transfer, accelerating regional market development

- While demand growth is significant, sustainable extraction practices, efficient production techniques, and environmental compliance remain critical to fully leverage CBM market opportunities. Integration with renewable energy projects and carbon offset programs could further enhance market appeal

Restraint/Challenge

High Extraction Costs and Operational Challenges in Coal Bed Methane Projects

- The extraction of methane from coal seams requires advanced drilling equipment, hydraulic fracturing techniques, and continuous monitoring, increasing operational costs compared to conventional natural gas. These high costs limit adoption in smaller-scale or low-margin projects. In addition, maintaining safety standards and mitigating environmental impact further adds to operational expenditure

- Many regions face geological complexities, such as low permeability and variable gas content in coal seams, which reduce gas recovery efficiency and increase technical challenges for operators. These factors contribute to inconsistent supply and financial risk. Site-specific feasibility studies and adaptive engineering solutions are essential to address these geological constraints

- Limited infrastructure for CBM collection, processing, and transportation further restricts market penetration, especially in remote or underdeveloped coalfields. Inadequate pipeline networks and storage facilities can lead to production bottlenecks. Moreover, integrating CBM output with existing natural gas distribution systems often requires substantial additional investment

- For instance, in 2023, energy operators in the U.S. reported production slowdowns in several CBM fields due to equipment failures and challenging seam conditions, highlighting operational vulnerabilities. Similar delays were observed in Australia and China, emphasizing the importance of project risk management and contingency planning

- While technological innovations aim to lower costs and improve recovery rates, addressing infrastructure gaps, geological variability, and regulatory constraints remains essential to unlock long-term growth in the coal bed methane market. Investments in automation, remote monitoring, and enhanced recovery techniques could mitigate these challenges and strengthen market resilience

Coal Bed Methane Market Scope

The market is segmented on the basis of extraction technology, fracturing fluids, and application.

- By Extraction Technology

On the basis of extraction technology, the coal bed methane (CBM) market is segmented into hydraulic fracturing, horizontal drilling, and CO2 sequestration. The hydraulic fracturing segment held the largest market revenue share in 2024, driven by its ability to efficiently extract methane from deep and low-permeability coal seams. Hydraulic fracturing enables higher gas recovery rates and is widely adopted in regions with extensive coal reserves, making it a preferred method for commercial-scale CBM production.

The horizontal drilling segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its precision, reduced surface footprint, and ability to access multiple coal seams from a single well. Horizontal drilling enhances extraction efficiency and allows for better resource utilization, making it increasingly popular among energy producers aiming to optimize production while minimizing environmental impact.

- By Fracturing Fluids

On the basis of fracturing fluids, the coal bed methane market is segmented into water requirement, chemical additive requirement, and proppant requirement. The water requirement segment held the largest revenue share in 2024, driven by the widespread use of water-based fracturing fluids in conventional CBM extraction processes. Water is essential for creating fractures in coal seams, allowing efficient gas flow and recovery.

The chemical additive requirement segment is expected to witness the fastest growth from 2025 to 2032, due to the rising adoption of specialized chemicals to enhance permeability, reduce friction, and prevent scaling during extraction. Innovations in environmentally friendly additives are also driving demand, as producers aim to reduce ecological impact.

- By Application

On the basis of application, the coal bed methane market is segmented into power generation, industrial, residential, commercial, and transportation. The power generation segment held the largest market share in 2024, driven by CBM’s use as a low-emission fuel in electricity production. Power plants are increasingly integrating CBM into their fuel mix to reduce carbon intensity while ensuring stable energy supply.

The industrial segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for CBM as a feedstock in chemicals, fertilizers, and other industrial processes. Industrial users benefit from CBM’s cost-effectiveness and lower environmental footprint compared to conventional natural gas.

Coal Bed Methane Market Regional Analysis

- Asia-Pacific dominated the coal bed methane (CBM) market with the largest revenue share in 2024, driven by the region’s rising energy demand, abundant coal reserves, and growing focus on cleaner energy alternatives

- Governments in countries such as China, India, and Australia are promoting CBM exploration through supportive policies, subsidies, and incentives

- The widespread adoption is further supported by technological advancements in hydraulic fracturing, horizontal drilling, and gas recovery, enabling efficient and cost-effective extraction for industrial, power generation, and residential applications

China Coal Bed Methane Market Insight

The China coal bed methane market captured the largest revenue share in 2024 within Asia-Pacific, fueled by the country’s abundant coal reserves, rapid industrialization, and strong government support for low-emission energy sources. Energy producers are prioritizing CBM extraction to diversify gas supplies and reduce reliance on conventional fossil fuels. Investments in advanced drilling technology, gas recovery optimization, and transportation infrastructure are significantly contributing to the market’s expansion

Japan Coal Bed Methane Market Insight

The Japan coal bed methane market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s focus on energy diversification, sustainability, and reducing carbon emissions. Advanced CBM extraction technologies, including hydraulic fracturing and horizontal drilling, are being increasingly adopted. Government incentives for low-emission energy solutions and rising industrial and power generation demand are driving CBM adoption across the country

Europe Coal Bed Methane Market Insight

Europe is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing industrial energy demand, stringent environmental regulations, and the push for low-emission alternatives across the region. Countries such as Germany, Poland, and the U.K. are investing in advanced CBM extraction technologies, including hydraulic fracturing and horizontal drilling, to optimize gas recovery. The widespread adoption is further supported by government incentives, regulatory support, and growing integration of CBM into power generation, industrial, and residential applications, making it a key component of Europe’s transition toward cleaner energy sources

Germany Coal Bed Methane Market Insight

The Germany coal bed methane market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s strong industrial base, environmental regulations, and investments in advanced CBM recovery technologies. The integration of CBM into power generation and industrial applications, alongside regulatory support for low-emission fuels, is supporting market expansion

U.K. Coal Bed Methane Market Insight

The U.K. coal bed methane market is expected to witness the fastest growth rate from 2025 to 2032, fueled by government initiatives promoting low-carbon energy sources and unconventional gas exploration. Rising energy independence concerns and sustainability goals are encouraging CBM project investments. Adoption of advanced extraction technologies and supportive policies are expected to accelerate CBM deployment across industrial and power generation sectors

North America Coal Bed Methane Market Insight

The North America coal bed methane market is expected to witness the fastest growth rate from 2025 to 2032, driven by high energy demand, abundant coal reserves, and established CBM infrastructure. Favorable government regulations, investment in advanced drilling and gas recovery technologies, and a focus on cleaner energy alternatives are boosting market growth across industrial, power generation, and residential applications

U.S. Coal Bed Methane Market Insight

The U.S. coal bed methane market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing energy requirements and policies promoting low-emission fuels. Investments in advanced CBM extraction technologies, infrastructure development, and strategic collaborations with energy producers are significantly contributing to market expansion

Coal Bed Methane Market Share

The Coal Bed Methane industry is primarily led by well-established companies, including:

• Reliance Industries Limited (India)

• Essar (India)

• Halliburton (U.S.)

• BP p.l.c. (U.K.)

• Weatherford (U.S.)

• Arrow Energy Pty Ltd (Australia)

• Sino Oil And Gas Holdings Limited (China)

• ConocoPhillips Company (U.S.)

• Santos Ltd (Australia)

• CNOOC International Ltd. (China)

• Royal Dutch Shell plc (U.K.)

• IGas Energy plc (U.K.)

• Origin Energy Limited (Australia)

• GEECL (India)

• Petroliam Nasional Berhad (PETRONAS) (Malaysia)

• Fortune Oil (U.K.)

• Metgasco (Australia)

• Bow Energy (Australia)

• Black Diamond Energy, Inc. (U.S.)

• G3 Exploration Ltd (Canada)

• Senex Energy Limited (Australia)

Latest Developments in Global Coal Bed Methane Market

- In August 2025, Shanxi CBM Development Co. launched an IPO on the Shanghai Stock Exchange to raise capital for CBM exploration and production. The IPO supports expansion plans and increases investor confidence in the CBM sector

- In July 2025, Senex Energy signed a CBM supply agreement with Origin Energy for long-term deliveries from the Surat Basin. This ensures reliable gas supply and supports market growth in Australia

- In May 2025, Essar Oil and Gas raised USD 150 million to expand its Raniganj CBM operations. The investment aims to double production capacity, ensuring stable supply and reinforcing competitiveness in the Indian CBM market

- In April 2025, PetroChina secured a government contract to supply CBM to the Beijing-Tianjin-Hebei region. The agreement enhances clean energy use, improves regional air quality, and boosts market confidence in CBM as a low-emission fuel

- In February 2025, ONGC and Coal India Limited formed a joint venture to explore and develop CBM blocks in eastern India. The initiative is expected to increase domestic gas production and support cleaner energy adoption

- In January 2025, Arrow Energy began drilling 50 new CBM wells in Queensland, Australia. The drilling campaign expands production capacity, meeting rising domestic gas demand and strengthening market presence

- In November 2024, Huabei Oilfield (CNPC) launched a new CBM production facility in the Qinshui Basin, China. The facility targets a 20% increase in annual output, boosting regional gas supply and supporting low-emission energy initiatives

- In October 2024, GAIL (India) Limited appointed a new CEO to oversee CBM and natural gas expansion. The leadership change aims to accelerate new project investments, increase production, and enhance India’s energy security

- In August 2024, Essar Oil and Gas signed a long-term CBM supply contract with Adani Power. The agreement ensures a steady CBM supply for cleaner power generation and supports market stability and energy transition initiatives

- In July 2024, Arrow Energy received government approval to expand its Surat Gas Project in Queensland, Australia. The expansion includes new CBM wells and infrastructure to increase domestic gas supply, supporting regional energy security and market growth

- In May 2024, Sinopec entered a strategic partnership with PetroChina to jointly develop CBM resources in Shanxi province. The collaboration focuses on technology sharing and infrastructure investment, accelerating CBM output and strengthening China’s domestic gas supply, benefiting the energy market

- In April 2024, Essar Oil and Gas Exploration and Production Ltd. commissioned India’s largest coal bed methane (CBM) gas compressor station in Durgapur, West Bengal. The facility is designed to boost CBM production, enhance supply to industrial customers, and promote cleaner fuel adoption, positively impacting the Indian CBM market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coal Bed Methane Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coal Bed Methane Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coal Bed Methane Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.