Global Coal Handling Equipment Market

Market Size in USD Billion

CAGR :

%

USD

28.05 Billion

USD

28.50 Billion

2025

2033

USD

28.05 Billion

USD

28.50 Billion

2025

2033

| 2026 –2033 | |

| USD 28.05 Billion | |

| USD 28.50 Billion | |

|

|

|

|

What is the Global Coal Handling Equipment Market Size and Growth Rate?

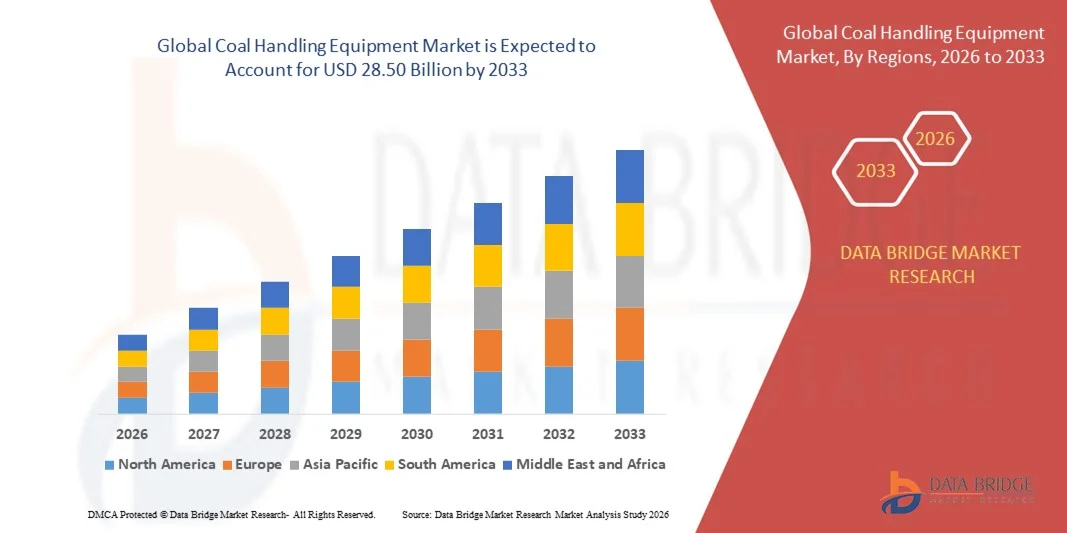

- The global coal handling equipment market size was valued at USD 28.05 billion in 2025 and is expected to reach USD 28.50 billion by 2033, at a CAGR of 0.20% during the forecast period

- The growing demand for power generation in emerging economies, electrification of mining equipment, increasing number of developments in carbon capture and storage (CCU), increasing use of automation in coal mining to improve productivity and efficiency of mining operations, rising number of population along with rapid industrialization and urbanization across the globe are some of the major as well as important factors which will likely to augment the growth of the coal handling equipment market

What are the Major Takeaways of Coal Handling Equipment Market?

- Surging levels of investment on research and development activities along with smoothening handling operations with an aim to minimize wastage, diminish cost, and reduce handling time which will further contribute by generating massive opportunities that will lead to the growth of the coal handling equipment market in the above mentioned projected timeframe

- Increasing need of high capital investment along with availability of alternative fuel sources such as natural gas which will likely to act as market restraints factor for the growth of the coal handling equipment

- The Asia-Pacific region dominated the coal handling equipment market with the largest revenue share of 43.2% in 2025, driven by rapid industrialization, rising energy demand, and large-scale mining and power generation projects across countries such as China, India, and Australia

- The North America region is projected to witness the fastest CAGR of 8.9% during 2026–2033, driven by modernization of mining operations, expansion of thermal power plants, and increased adoption of automated coal handling solutions

- The conveyor segment dominated the market with the largest revenue share of 38.6% in 2025, owing to its essential role in transporting bulk coal efficiently across mines, power plants, and ports

Report Scope and Coal Handling Equipment Market Segmentation

|

Attributes |

Coal Handling Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Coal Handling Equipment Market?

Rising Demand for Sustainable, Automated, and High-Efficiency Coal Handling Equipment

- The coal handling equipment market is witnessing a major transformation driven by the growing focus on sustainability, automation, and operational efficiency. Mining companies and power plants are increasingly adopting energy-efficient and environmentally friendly handling systems to reduce carbon emissions and operational costs

- For instance, thyssenkrupp and FLSmidth have introduced automated coal conveyors, stackers, and reclaimers with low-energy drive systems, reducing energy consumption and improving material handling accuracy. These solutions also minimize dust generation and improve worker safety, reflecting the broader industry shift toward eco-conscious and high-performance equipment

- Advanced systems such as fully automated stacking, real-time monitoring sensors, and predictive maintenance technologies are gaining traction in regions with strict environmental and safety regulations. Adoption of such smart solutions ensures operational reliability while meeting compliance standards for emissions and dust control

- Manufacturers are integrating IoT-enabled sensors, SCADA systems, and automated control units to enhance operational efficiency, real-time performance monitoring, and predictive maintenance. These technologies improve throughput while minimizing downtime and resource wastage

- Growing emphasis on modular, low-maintenance, and environmentally friendly CHE solutions is prompting companies to explore corrosion-resistant materials, optimized conveyor designs, and dust-suppression systems. Metso, for instance, offers energy-efficient belt conveyors and eco-optimized stackers aligned with sustainability goals

- As environmental regulations tighten and operational efficiency becomes a competitive priority, the shift toward automated, sustainable, and high-efficiency coal handling equipment will remain a defining trend influencing technology development, manufacturing strategies, and capital investments across the global mining and power sectors

What are the Key Drivers of Coal Handling Equipment Market?

- Increasing global coal-based power generation and mining activities are the primary growth drivers for the coal handling equipment market. Rising energy demand and industrial expansion are fueling investments in efficient material handling systems

- For instance, in 2025, FLSmidth reported increased orders for automated coal conveyors and stacker-reclaimer systems in Asia-Pacific and North America, reflecting rising demand from large-scale thermal power plants and coal mines

- The push for energy-efficient and low-maintenance equipment is motivating manufacturers to develop eco-optimized CHE systems with reduced downtime, longer lifespans, and minimal environmental impact

- Stricter environmental regulations regarding dust control, noise reduction, and energy consumption are encouraging the adoption of closed conveyors, dust extraction systems, and low-emission equipment. Companies are investing in research to align performance with compliance standards

- Technological integration such as IoT monitoring, automated controls, and predictive maintenance enables better performance tracking, reduces operational risk, and increases uptime, enhancing the overall value proposition of modern CHE systems

- As global mining and thermal power sectors expand and environmental compliance becomes mandatory, the demand for high-efficiency, automated, and eco-friendly coal handling equipment will continue to strengthen. Innovation in design, sustainability, and smart operations will play a pivotal role in shaping long-term market growth

Which Factor is Challenging the Growth of the Coal Handling Equipment Market?

- High capital expenditure and complex installation requirements pose significant challenges in the coal handling equipment market. Advanced automated and sustainable systems require heavy upfront investment, which may not be feasible for small or medium-scale operations

- For instance, regional coal mines in South-East Asia and Africa often face difficulty in financing the procurement of automated CHE solutions, limiting adoption and scalability

- Fluctuations in raw material costs—especially steel, motors, and high-grade alloys—can impact manufacturing costs, delaying project deployment and affecting pricing strategies

- Continuous changes in environmental and safety regulations require equipment redesigns, certification updates, and compliance monitoring, which add logistical and financial burdens on manufacturers and end-users

- Limited standardization in equipment specifications across regions increases complexity for global suppliers, leading to operational inefficiencies and higher procurement costs

- To mitigate these challenges, market players are focusing on modular and scalable equipment designs, strategic partnerships, and investment in advanced manufacturing technologies. Over time, adoption of standardized components, digital monitoring, and energy-efficient designs is expected to lower costs and improve market accessibility for emerging and established players asuch as

How is the Coal Handling Equipment Market Segmented?

The market is segmented on the basis of type, product type, end use, and application.

- By Product Type

On the basis of product type, the coal handling equipment market is segmented into stackers, reclaimers, stacker cum reclaimers, conveyors, ship loaders and unloaders, wagon tipplers and loaders, feeders, and others. The conveyor segment dominated the market with the largest revenue share of 38.6% in 2025, owing to its essential role in transporting bulk coal efficiently across mines, power plants, and ports. Conveyors offer continuous operation, reduced labor dependence, and adaptability to different terrains, making them highly preferred for large-scale coal handling operations.

Stacker cum reclaimers are anticipated to witness the fastest CAGR from 2026 to 2033, driven by their dual functionality of stacking and reclaiming, optimizing space and improving material handling efficiency. Technological advancements such as automated control systems, dust suppression mechanisms, and energy-efficient drives are further accelerating adoption of stacker cum reclaimers across modern mining and thermal power facilities globally.

- By End Use

On the basis of end use, the coal handling equipment market is segmented into material handling and crushing equipment. The material handling segment dominated the market with the largest revenue share of 61.2% in 2025, supported by the increasing demand for efficient coal transport, storage, and transfer systems in power generation and mining industries. Material handling equipment such as conveyors, stackers, and reclaimers ensure uninterrupted coal supply, reduce operational costs, and improve safety standards, which is critical for large-scale operations.

The crushing equipment segment is expected to register the fastest growth from 2026 to 2033, driven by the rising need to process coal into various sizes for thermal and industrial applications. Innovations in energy-efficient crushers, mobile crushing units, and automated operations are further enhancing productivity and supporting the segment’s rapid adoption in emerging markets with expanding mining activities.

- By Type

On the basis of type, the coal handling equipment market is categorized into material handling equipment and crushing equipment. The material handling equipment segment dominated the market with a revenue share of 63.5% in 2025, as it forms the backbone of coal logistics in power plants, mines, and ports. This segment includes stackers, reclaimers, conveyors, and feeders, offering continuous operation, dust suppression, and energy-efficient handling solutions.

The crushing equipment segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing demand for size reduction, screening, and pulverization of coal to meet thermal power and industrial fuel requirements. Manufacturers are increasingly focusing on innovative designs, automation, and low-maintenance machinery to optimize throughput, reduce downtime, and enhance operational safety, supporting the segment’s rapid adoption globally.

- By Application

On the basis of application, the coal handling equipment market is segmented into surface mining, crushing, pulverizing and screening, dust collection, underground mining, and drills and breakers. The surface mining segment dominated the market with the largest revenue share of 42.8% in 2025, as large-scale open-pit coal mining operations require high-capacity equipment for extraction, handling, and transportation. Conveyors, stackers, and reclaimers are widely deployed in surface mining due to their efficiency and ability to handle bulk material with minimal manual intervention.

The crushing, pulverizing, and screening segment is anticipated to register the fastest growth from 2026 to 2033, driven by the increasing demand for processed coal of specific sizes for power generation and industrial applications. Advanced crushers, screening machines, and automation technologies are being adopted to improve efficiency, reduce energy consumption, and ensure consistent coal quality, supporting strong growth in this segment.

Which Region Holds the Largest Share of the Coal Handling Equipment Market?

- The Asia-Pacific region dominated the coal handling equipment market with the largest revenue share of 43.2% in 2025, driven by rapid industrialization, rising energy demand, and large-scale mining and power generation projects across countries such as China, India, and Australia

- The region benefits from abundant coal reserves, cost-effective manufacturing, and supportive government initiatives promoting infrastructure development and mechanized material handling. Continuous investment in advanced coal handling technologies, including conveyors, stackers, and reclaimers, is improving efficiency and safety in mining and thermal power operations

- China and India are leading adoption due to large-scale mining projects and domestic manufacturing capabilities. Technological innovations, such as automated stacker cum reclaimers, high-capacity conveyors, and energy-efficient crushers, are further strengthening Asia-Pacific’s market leadership and positioning it as a global hub for Coal Handling Equipment solutions.

China Coal Handling Equipment Market Insight

China holds a dominant position within Asia-Pacific, supported by its strong coal production base, large-scale infrastructure projects, and extensive equipment manufacturing capabilities. The country is investing in high-capacity conveyors, stackers, and reclaimers to meet growing energy requirements and export demands. Increasing adoption of automated, dust-suppression, and energy-efficient equipment is driving market expansion. Moreover, government emphasis on clean coal technologies and safety standards is encouraging modernization of coal handling systems. Rising demand from thermal power plants, industrial sectors, and port operations further strengthens China’s leadership within the regional Coal Handling Equipment market.

India Coal Handling Equipment Market Insight

India is witnessing robust growth in coal handling equipment due to expanding mining activities, government-backed industrialization projects, and rising energy demand. Programs such as “Make in India” and investments in thermal power generation are fueling demand for conveyors, stackers, and crushers. Increasing awareness about automation, safety, and efficiency is accelerating the adoption of modern coal handling technologies. Domestic manufacturers are innovating with cost-effective, high-capacity, and environmentally friendly equipment to meet local demand. India’s young workforce, growing industrial infrastructure, and government initiatives supporting mechanized material handling are expected to strengthen long-term market growth in the region.

North America Coal Handling Equipment Market Insight

The North America region is projected to witness the fastest CAGR of 8.9% during 2026–2033, driven by modernization of mining operations, expansion of thermal power plants, and increased adoption of automated coal handling solutions. The U.S. and Canada are investing in energy-efficient conveyors, stackers, and reclaimers to enhance operational safety, reduce labor dependence, and meet environmental standards. Advanced technological integration, including automation, remote monitoring, and dust suppression, is boosting productivity and compliance. Rising replacement demand for aging equipment in power plants and industrial sectors is further propelling market growth. North America’s focus on sustainable and high-capacity Coal Handling Equipment positions it as a key growth market globally.

Europe Coal Handling Equipment Market Insight

The Europe coal handling equipment market is growing steadily, driven by modernization of coal-fired power plants and mining infrastructure in countries such as Germany, Poland, and the U.K. Investment in high-efficiency conveyors, stackers, and crushers is increasing to meet stricter environmental regulations and safety standards. Germany leads the region due to its strong industrial base and adoption of automated coal handling technologies. Sustainable, dust-controlled, and energy-efficient equipment is gaining preference, supporting market expansion. The U.K. is witnessing growth through refurbishment projects in coal logistics and thermal power sectors, fostering adoption of modern, compliant Coal Handling Equipment solutions.

Latin America Coal Handling Equipment Market Insight

The Latin America coal handling equipment market is expanding due to rising coal production and mining activities in Brazil, Colombia, and Mexico. Investment in conveyors, stackers, and crushers is driven by demand for efficient coal transport, power generation, and industrial applications. Focus on sustainable and high-capacity coal handling solutions is increasing across the region. Growing export activities, infrastructure development, and government initiatives supporting energy and mining sectors are fostering steady market growth in Latin America.

Middle East & Africa Coal Handling Equipment Market Insight

The Middle East & Africa region is in the nascent stages of coal handling equipment adoption, with South Africa and Saudi Arabia being the most progressive markets. Investments in thermal power projects and mechanized coal logistics are gradually increasing demand. Companies are focusing on high-capacity conveyors, stackers, and crushers that comply with safety and operational efficiency standards. Growing industrialization, energy requirements, and interest in modern coal handling technologies are expected to support gradual market development in the next decade.

Which are the Top Companies in Coal Handling Equipment Market?

The coal handling equipment industry is primarily led by well-established companies, including:

- thyssenkrupp AG (Germany)

- FLSmidth & Co. A/S (Denmark)

- Metso Corporation (Finland)

- Kawasaki Heavy Industries Ltd. (Japan)

- IHI Corporation (Japan)

- FAM GmbH (Germany)

- Elecon Engineering Company Limited (India)

- Sumitomo Heavy Industries Material Handling Systems Co., Ltd. (Japan)

- TAKRAF GmbH (Germany)

- FAMUR S.A. (Poland)

- AUMUND Fördertechnik GmbH (Germany)

- TRF Limited (India)

- GMV Engineering (India)

- Atlas Copco (India) Ltd. (India)

- Hitachi Construction Machinery Europe NV (Netherlands)

- Caterpillar Inc. (U.S.)

- Aesha Conveyors and Crushing Equipment (India)

- FAB 3R (Switzerland)

- Dynamic Air Inc. (U.S.)

- Sterling Engineering Co (India)

What are the Recent Developments in Global Coal Handling Equipment Market?

- In April 2025, Adani Ports announced the acquisition of North Queensland Export Terminal in Australia for USD 2.4 billion, securing a deep-water coal export facility with an annual capacity of 50 million tonnes serving 8 major customers across 15 countries, strengthening its position in global coal logistics and export operations

- In January 2025, CONSOL Energy and Arch Resources completed their merger to form Core Natural Resources, creating a consolidated entity with enhanced scale in Appalachian coal production, positioning the company for improved operational efficiency and market competitiveness

- In January 2025, Caterpillar celebrated its centennial at CES 2025, showcasing innovations in autonomy and electrification, including the Cat 972 Wheel Loader hybrid retrofit and 24-hour electrified jobsite simulation, highlighting the company’s leadership in sustainable and advanced mining and material handling solutions

- In October 2024, China Energy Investment Corporation announced a USD 24 billion investment in a coal-to-liquid facility in Xinjiang, expected to produce 4 million tonnes annually starting in 2027, reinforcing China’s strategic expansion in energy production and modern coal processing infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coal Handling Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coal Handling Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coal Handling Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.