Global Coal Power Generation Market

Market Size in USD Billion

CAGR :

%

USD

424.27 Billion

USD

570.00 Billion

2025

2033

USD

424.27 Billion

USD

570.00 Billion

2025

2033

| 2026 –2033 | |

| USD 424.27 Billion | |

| USD 570.00 Billion | |

|

|

|

|

Global Coal Power Generation Market Size

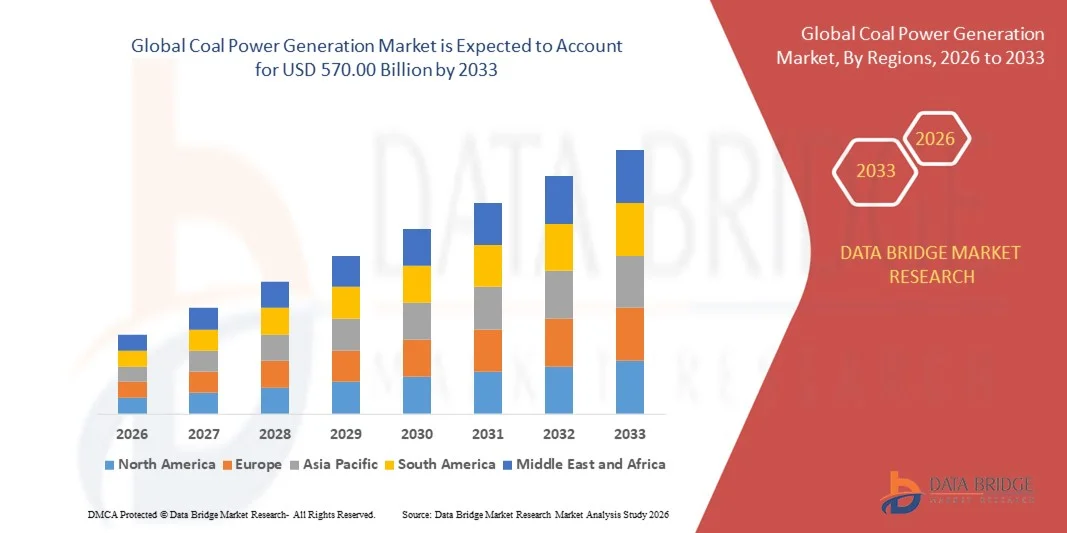

- The global Coal Power Generation Market size was valued at USD 424.27 billion in 2025 and is expected to reach USD 570.00 billion by 2033, at a CAGR of 3.76% during the forecast period.

- The market growth is primarily driven by increasing global energy demand, coupled with the continued reliance on coal as a stable and affordable energy source across emerging and developed economies.

- Furthermore, advancements in clean coal technologies and efficiency improvements in coal-fired power plants are encouraging investment in the sector. These factors, along with supportive government policies in coal-dependent regions, are propelling market expansion and strengthening the industry's growth trajectory.

Global Coal Power Generation Market Analysis

- Coal-fired power plants, generating electricity through the combustion of coal, remain critical components of the global energy mix in both emerging and developed economies due to their reliability, scalability, and ability to provide base-load power.

- The escalating demand for coal power is primarily fueled by growing global electricity consumption, industrialization, and the ongoing reliance on coal as a cost-effective and abundant energy source.

- Asia-Pacific dominated the Global Coal Power Generation Market with the largest revenue share of 34.5% in 2025, characterized by established energy infrastructure, technological advancements in clean coal solutions, and a strong presence of key industry players, with the U.S. experiencing substantial growth in high-efficiency coal-fired plants driven by innovations in emission control and plant optimization technologies.

- North America is expected to be the fastest-growing region in the Global Coal Power Generation Market during the forecast period due to rapid industrialization, urbanization, and increasing electricity demand in countries such as China and India.

- The pulverized coal systems segment dominated the market with the largest revenue share of 43.2% in 2025, driven by its established efficiency, scalability, and widespread adoption in modern coal-fired power plants.

Report Scope and Global Coal Power Generation Market Segmentation

|

Attributes |

Coal Power Generation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Coal Power Generation Market Trends

Enhanced Efficiency Through Digitalization and Automation

- A significant and accelerating trend in the global Coal Power Generation Market is the increasing integration of digital technologies and automation systems within coal-fired power plants. This includes advanced monitoring, predictive maintenance, and AI-driven optimization, which collectively enhance operational efficiency and reduce downtime.

- For instance, some modern coal power plants utilize AI-based control systems to optimize combustion processes, improve boiler efficiency, and minimize fuel consumption. Similarly, predictive maintenance platforms can analyze equipment data to anticipate potential failures, reducing unplanned outages and maintenance costs.

- AI and automation integration in coal power plants enables features such as real-time performance monitoring, dynamic load balancing, and intelligent emission control. For example, certain plants employ AI algorithms to optimize coal feed and combustion patterns, improving energy output while reducing greenhouse gas emissions.

- The seamless integration of digital control systems with plant-wide operations facilitates centralized management of generation, distribution, and environmental compliance. Through a single interface, operators can monitor boiler performance, turbine efficiency, and emission levels, ensuring more reliable and sustainable operations.

- This trend towards smarter, data-driven, and automated coal power generation is fundamentally reshaping operational standards and expectations in the industry. Consequently, companies such as NTPC Limited and China Huaneng Group are investing heavily in AI-enabled plant management systems to maximize efficiency and meet stricter environmental regulations.

- The demand for digitally optimized coal power plants is growing rapidly across both emerging and developed markets, as utilities prioritize operational efficiency, cost reduction, and regulatory compliance in a competitive energy landscape.

Global Coal Power Generation Market Dynamics

Driver

Growing Demand Driven by Rising Energy Needs and Industrialization

- The increasing global demand for electricity, coupled with rapid industrialization in emerging economies, is a significant driver for the heightened demand for coal-based power generation.

- For instance, in 2025, India’s NTPC Limited announced expansions in high-efficiency coal-fired power plants to meet surging electricity requirements, highlighting strategic investments by key companies that are expected to drive market growth during the forecast period.

- As nations pursue reliable and cost-effective energy solutions to support residential, commercial, and industrial consumption, coal power plants offer consistent base-load electricity and established infrastructure, making them a preferred choice in many regions.

- Furthermore, the growing industrial sector and urbanization in Asia-Pacific and Africa are fueling the need for large-scale power generation, sustaining coal’s role despite the rise of renewable energy sources.

- The ability of modern coal power plants to integrate efficiency-improving technologies, such as supercritical and ultra-supercritical boilers, flue gas desulfurization, and emission control systems, enhances operational reliability and environmental compliance, further supporting adoption in both developed and developing markets.

Restraint/Challenge

Environmental Regulations and High Operational Costs

- Increasingly stringent environmental regulations, such as carbon emission limits and air quality standards, pose a significant challenge to coal power generation, pressuring operators to adopt cleaner technologies or face penalties.

- For instance, stricter emission norms in the U.S. and Europe have led some older coal plants to retrofit with costly pollution control equipment or face early decommissioning.

- Addressing these regulatory challenges through the adoption of clean coal technologies, carbon capture and storage (CCS), and ultra-efficient boilers is crucial for maintaining competitiveness. Companies such as China Huaneng Group and NTPC Limited are investing heavily in such solutions to meet compliance while sustaining output.

- Additionally, high operational and maintenance costs, fluctuating coal prices, and competition from lower-cost renewable energy sources can deter new investments in coal-based generation capacity.

- While technological advancements are gradually improving efficiency and reducing costs, the perceived economic and environmental challenges can slow the growth of coal power, especially in regions prioritizing green energy transition.

- Overcoming these challenges through technological innovation, strategic fuel sourcing, and balancing coal with renewable integration will be vital for sustaining market growth in the coming years.

Global Coal Power Generation Market Scope

Coal power generation market is segmented on the basis of technology and application.

- By Technology

On the basis of technology, the Global Coal Power Generation Market is segmented into pulverized coal systems, coal furnaces, and others. The pulverized coal systems segment dominated the market with the largest revenue share of 43.2% in 2025, driven by its established efficiency, scalability, and widespread adoption in modern coal-fired power plants. Pulverized coal systems offer higher combustion efficiency, better control over emissions, and improved thermal output, making them the preferred choice for new and retrofitted plants globally. Utilities also favor pulverized coal systems due to their compatibility with emission control technologies and ability to meet environmental regulations while maintaining base-load capacity.

The coal furnaces segment is anticipated to witness the fastest CAGR of 21.7% from 2026 to 2033, fueled by increasing adoption in small-to-medium scale power plants and industrial facilities. Coal furnaces offer lower upfront costs and flexible installation options, catering to emerging markets and regions with growing industrial energy demand.

- By Application

On the basis of application, the Global Coal Power Generation Market is segmented into residential and commercial. The commercial segment dominated the market with the largest revenue share of 45.1% in 2025, driven by the extensive use of coal power plants for industrial electricity generation, large-scale infrastructure projects, and utility supply networks. Commercial applications benefit from the reliability and cost-effectiveness of coal-fired power, especially in regions with high energy demand or limited access to renewable sources.

The residential segment is expected to witness the fastest CAGR of 20.8% from 2026 to 2033, fueled by growing electrification needs in suburban and rural areas of emerging economies. Residential consumption is increasingly supported by smaller-scale coal-based cogeneration plants or district-level power plants, providing a stable and affordable electricity supply. The rising demand for uninterrupted power in households, coupled with increasing population and urbanization trends, is boosting the adoption of residential coal power solutions.

Global Coal Power Generation Market Regional Analysis

- Asia-Pacific dominated the Global Coal Power Generation Market with the largest revenue share of 34.5% in 2025, driven by a stable energy infrastructure, high electricity demand, and well-established coal-fired power plants.

- Utilities and industrial consumers in the region rely on coal power for its reliability, consistent base-load generation, and cost-effectiveness compared to alternative energy sources, particularly in areas with legacy coal infrastructure.

- This widespread adoption is further supported by technological advancements in clean coal and efficiency-improving systems, strong regulatory frameworks for energy supply, and significant investments by key market players, establishing coal-fired power as a critical component of North America’s energy mix for both commercial and industrial applications.

U.S. Coal Power Generation Market Insight

The U.S. coal power generation market captured the largest revenue share of 81% in North America in 2025, driven by the country’s established coal-fired infrastructure and the continued reliance on coal for base-load electricity generation. Industrial and commercial sectors increasingly depend on coal for consistent energy supply, while utilities benefit from technological upgrades in emission controls and efficiency optimization. Investments in supercritical and ultra-supercritical coal plants, combined with government incentives for maintaining energy security, further propel market growth. The presence of major coal producers and stable regulatory frameworks supports continued demand in both residential and commercial electricity sectors.

Europe Coal Power Generation Market Insight

The Europe coal power generation market is projected to experience moderate growth over the forecast period, primarily driven by transitional energy needs and ongoing industrial electricity demand. While renewable energy adoption is accelerating, coal remains relevant in countries maintaining legacy coal plants. European governments’ focus on emission reduction and clean coal technology investments encourages modernization of existing facilities. The market sees growth in commercial and industrial applications, particularly in regions balancing energy reliability with environmental compliance.

U.K. Coal Power Generation Market Insight

The U.K. coal power generation market is expected to witness a gradual decline in share during the forecast period due to strict carbon emission regulations and a strong shift towards renewable energy sources. However, coal still plays a role in grid stability and industrial energy supply, particularly in hybrid energy systems combining coal with natural gas or biomass. Upgrades in efficiency and pollution control for existing plants contribute to sustaining operations in specific regions.

Germany Coal Power Generation Market Insight

The Germany coal power generation market is anticipated to contract gradually, reflecting the country’s energy transition plan and emphasis on renewable energy adoption. Nonetheless, coal-fired power plants remain operational to provide reliable base-load electricity and support industrial sectors. Investments in clean coal technology, emission reduction systems, and co-firing with biomass maintain coal’s relevance in a controlled, regulated framework.

Asia-Pacific Coal Power Generation Market Insight

The Asia-Pacific coal power generation market is poised to grow at the fastest CAGR of 24% from 2026 to 2033, driven by rising energy demand, rapid urbanization, and industrialization in countries such as China, India, and Indonesia. Coal-fired power plants continue to serve as a primary source of electricity, supporting large-scale industrial operations and residential consumption. Government initiatives promoting energy security and investment in high-efficiency plants fuel adoption.

Japan Coal Power Generation Market Insight

The Japan coal power generation market is witnessing steady growth, driven by the need for reliable base-load electricity in an energy-constrained environment. High technological standards enable modern coal plants to achieve greater efficiency and lower emissions. Coal generation is often integrated with combined-cycle and hybrid systems to stabilize the grid while supporting industrial and commercial energy demand.

China Coal Power Generation Market Insight

The China coal power generation market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s heavy industrial base, urbanization, and continued reliance on coal for electricity. China is investing in ultra-supercritical and high-efficiency coal plants to meet growing energy demand while addressing environmental concerns. Domestic coal production, government support, and the integration of advanced technologies enable China to maintain coal as a cornerstone of its energy mix, supporting residential, commercial, and industrial consumption.

Global Coal Power Generation Market Share

The Coal Power Generation industry is primarily led by well-established companies, including:

• China Energy Investment Corporation (China)

• China Huaneng Group (China)

• China Datang Corporation (China)

• Tata Power (India)

• Adani Power (India)

• NTPC Limited (India)

• KEPCO – Korea Electric Power Corporation (South Korea)

• Mitsubishi Power (Japan)

• J-Power (Japan)

• Enel Group (Italy)

• EDF Group (France)

• American Electric Power (U.S.)

• Dynegy (U.S.)

• Texas Utilities / Vistra Energy (U.S.)

• Peabody Energy (U.S.)

• GE Power (U.S.)

• Engie (France)

• RWE Power (Germany)

• Vattenfall (Sweden)

• Posco Energy (South Korea)

What are the Recent Developments in Global Coal Power Generation Market?

- In April 2024, China Energy Investment Corporation, a leading coal-based power producer, commissioned a 1,320 MW ultra-supercritical coal-fired power plant in Inner Mongolia, aimed at meeting the growing electricity demand in northern China. The project emphasizes the company’s focus on improving efficiency, reducing emissions, and supporting regional industrial growth, reinforcing its position in the rapidly expanding global coal power generation market.

- In March 2024, Tata Power launched an advanced coal-fired combined heat and power (CHP) plant in Maharashtra, India, specifically designed to provide reliable electricity and steam for industrial applications. The initiative highlights Tata Power’s commitment to sustainable coal technologies and delivering uninterrupted energy to support economic development and commercial operations.

- In March 2024, Mitsubishi Power completed the upgrade of the Hekinan Thermal Power Station in Japan, integrating high-efficiency boilers and emission control systems. This modernization project enhances operational efficiency, reduces environmental impact, and demonstrates Mitsubishi’s dedication to advancing coal power technology in line with clean energy standards.

- In February 2024, GE Power signed a strategic partnership with Indonesia’s PLN to implement advanced coal plant monitoring and digital optimization solutions for several coal-fired facilities. The collaboration aims to improve plant performance, reliability, and environmental compliance, underscoring GE Power’s commitment to innovation in coal power generation.

- In January 2024, Korea Electric Power Corporation (KEPCO) inaugurated the Samcheok Green Coal Power Plant, featuring ultra-supercritical technology and state-of-the-art emission reduction systems. The plant is designed to deliver high efficiency and low environmental impact, reflecting KEPCO’s focus on modernizing coal power infrastructure and supporting sustainable energy supply in South Korea.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coal Power Generation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coal Power Generation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coal Power Generation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.