Global Coal Tar Market

Market Size in USD Billion

CAGR :

%

USD

16.54 Billion

USD

20.47 Billion

2024

2032

USD

16.54 Billion

USD

20.47 Billion

2024

2032

| 2025 –2032 | |

| USD 16.54 Billion | |

| USD 20.47 Billion | |

|

|

|

|

Coal Tar Market Size

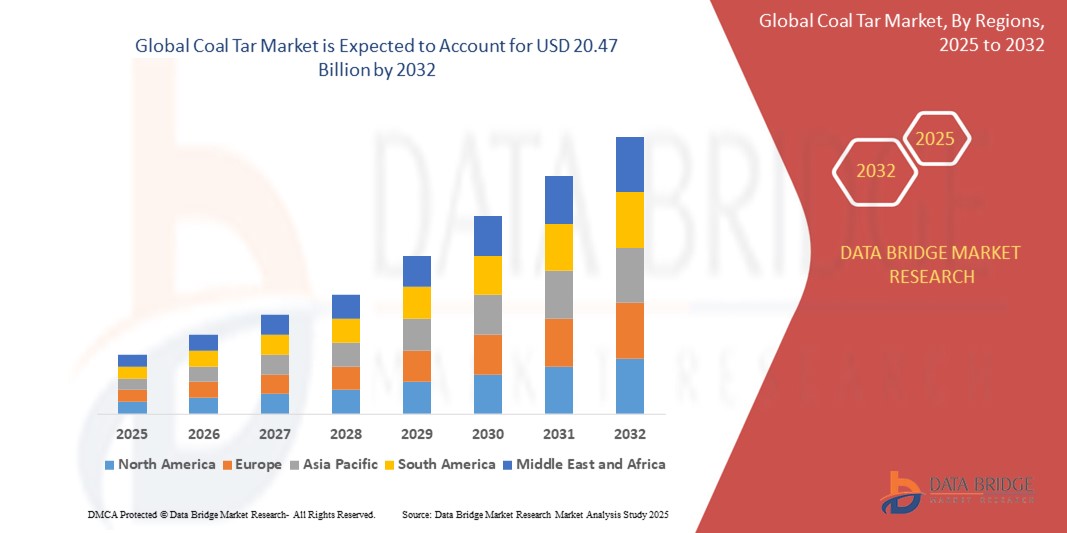

- The global coal tar market size was valued at USD 16.54 billion in 2024 and is expected to reach USD 20.47 billion by 2032, at a CAGR of 2.70% during the forecast period

- The market growth is largely fueled by increasing industrial demand for coal tar derivatives, particularly in aluminum smelting, steel production, and graphite electrode manufacturing, driven by ongoing infrastructure expansion and urbanization across emerging economies

- Furthermore, the growing focus on high-performance carbon materials in sectors such as aerospace, automotive, and electronics is accelerating innovation and investment in coal tar processing and distillation, thereby significantly boosting the industry's growth

Coal Tar Market Analysis

- Coal tar is a by-product of the coking process in steel manufacturing, widely used in producing coal tar pitch, which serves as a key binder in aluminum anodes, graphite electrodes, and high-grade refractories

- The demand for coal tar is primarily driven by the growth in aluminum and steel industries, the shift toward electric arc furnace steelmaking, and increasing adoption of carbon-rich materials in renewable energy systems, electric vehicles, and industrial applications

- Asia-Pacific dominated the coal tar market with a share of 52.5% in 2024, due to extensive aluminum production, growing steel output, and the presence of major coal tar distillation facilities

- North America is expected to be the fastest growing region in the coal tar market during the forecast period due to growing investments in graphite electrodes, carbon fiber components, and aluminum smelting

- High temperature coal tar pitch segment dominated the market with a market share of 53.1% in 2024, due to its widespread use in the aluminium and graphite industries due to superior carbon content and thermal resistance. Its high softening point and excellent binding properties make it an essential material in the production of carbon anodes for aluminium smelting and graphite electrodes. Moreover, the increasing global demand for aluminium in automotive and construction sectors is significantly contributing to the sustained dominance of this segment

Report Scope and Coal Tar Market Segmentation

|

Attributes |

Coal Tar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Coal Tar Market Trends

“Rising Demand for Aluminum Smelting”

- A significant and accelerating trend in the coal tar market is the surge in demand from the aluminum smelting sector, where coal tar pitch is a critical binder for carbon anodes used in primary aluminum production

- For instance, companies such as Rain Carbon Inc., Koppers Inc., and Himadri Speciality Chemical Ltd. are expanding their coal tar pitch production capacities to supply major aluminum producers such as Alcoa, Rio Tinto, and China Hongqiao Group, who are ramping up smelting operations to meet demand from automotive, aerospace, packaging, and construction industries

- The shift toward lightweight, recyclable materials—especially for electric vehicles and green infrastructure—has led to significant investments in new smelters and capacity expansions, particularly in North America and Asia-Pacific, directly increasing consumption of coal tar pitch

- The trend is further supported by rising infrastructure development, urbanization, and the push for energy-efficient manufacturing, which are driving sustained demand for aluminum and, consequently, coal tar products

- Companies are also investing in technological improvements for pitch processing to enhance product performance and align with evolving environmental regulations, ensuring continued relevance in industrial applications

Coal Tar Market Dynamics

Driver

“Rising Demand for Carbon Black”

- The growing demand for carbon black, a key material used in tires, rubber goods, plastics, and inks, is a major driver for the coal tar market

- For instance, producers such as OCI Company Ltd., Phillips Carbon Black Limited, and Birla Carbon are increasing their procurement of coal tar derivatives to supply tire manufacturers such as Bridgestone, Michelin, and Goodyear, who require high-performance carbon black for automotive and industrial applications

- The expansion of the automotive and construction sectors, particularly in emerging economies, is fueling the need for carbon black, which in turn drives demand for coal tar as a primary feedstock

- Technological advancements and investments in new carbon black production facilities are further supporting market growth, as manufacturers seek consistent, high-quality raw materials to meet stringent industry standards

- The market is also benefiting from increased use of carbon black in specialty applications, such as conductive polymers and renewable energy systems, broadening the end-use landscape for coal tar-based products

Restraint/Challenge

“Volatile Raw Material Prices”

- Volatile raw material prices present a significant challenge for the coal tar market, impacting production costs and profit margins for both suppliers and end users

- For instance, companies such as Rain Carbon Inc. and Koppers Inc. face fluctuations in coal tar prices due to supply disruptions, refinery outages, and shifting demand dynamics in the steel and aluminum industries

- Environmental regulations and emissions compliance requirements can further influence costs, as manufacturers are compelled to invest in emission control systems and adapt to stricter handling protocols, particularly in North America and Europe

- The balance between limited supply and steady demand, especially during periods of refinery maintenance or geopolitical tension, can lead to price spikes and supply chain uncertainties, affecting downstream industries such as aluminum smelting and carbon black production

- To mitigate these challenges, companies are focusing on strategic sourcing, long-term supply agreements, and research into alternative feedstocks and process efficiencies to stabilize costs and ensure reliable supply

Coal Tar Market Scope

The market is segmented on the basis of type, grade, and applications.

- By Type

On the basis of type, the coal tar market is segmented into medium temperature coal tar pitch, high temperature coal tar pitch, low temperature coal tar pitch, and others. The high temperature coal tar pitch segment dominated the largest market revenue share of 53.1% in 2024, owing to its widespread use in the aluminium and graphite industries due to superior carbon content and thermal resistance. Its high softening point and excellent binding properties make it an essential material in the production of carbon anodes for aluminium smelting and graphite electrodes. Moreover, the increasing global demand for aluminium in automotive and construction sectors is significantly contributing to the sustained dominance of this segment.

The medium temperature coal tar pitch segment is projected to witness the fastest growth rate from 2025 to 2032, driven by growing application in specialized industrial processes such as corrosion-resistant coatings and impregnating materials for refractory products. Its balanced thermal and chemical stability, coupled with lower environmental impact compared to high temperature variants, is making it a preferred choice in applications requiring moderate performance with regulatory compliance.

- By Grade

On the basis of grade, the coal tar market is categorized into aluminium grade, binder and impregnating grade, and special grade. The aluminium grade segment held the largest revenue share in 2024 due to its critical role in manufacturing carbon anodes used in aluminum smelting. The rise in global aluminum production, driven by lightweighting trends in automotive and packaging industries, is sustaining high demand for this grade. Its favorable characteristics such as low ash content, high coking value, and consistent quality make it essential in maintaining operational efficiency in smelting processes.

The special grade segment is expected to register the fastest CAGR from 2025 to 2032, fueled by its expanding use in niche applications such as advanced composites, high-performance refractories, and carbon-carbon composites. The growing emphasis on high-end industrial materials across aerospace, defense, and electronics sectors is boosting the need for tailored coal tar derivatives with unique thermal, electrical, and structural properties.

- By Applications

On the basis of applications, the coal tar market is segmented into aluminium smelting, graphite electrodes, roofing, carbon fiber, refractories, and other applications. The aluminium smelting segment dominated the market share in 2024, underpinned by coal tar pitch's indispensable use in anode production for the Hall-Héroult process. With aluminum consumption rising steadily across construction, transportation, and consumer goods, the demand for high-grade coal tar pitch in smelting operations continues to rise.

The carbon fiber segment is anticipated to witness the fastest growth from 2025 to 2032, supported by increasing demand for lightweight and high-strength materials in automotive, aerospace, and wind energy sectors. Coal tar-derived precursors provide an economical and efficient route for producing carbon fibers, offering superior thermal stability and conductivity. This growing adoption is further driven by ongoing R&D advancements and the global shift toward fuel efficiency and structural optimization.

Coal Tar Market Regional Analysis

- Asia-Pacific dominated the coal tar market with the largest revenue share of 52.5% in 2024, driven by extensive aluminum production, growing steel output, and the presence of major coal tar distillation facilities

- The region’s rapid industrialization, rising infrastructure investments, and strong demand for graphite electrodes in electric arc furnaces are fueling consumption of coal tar derivatives

- Moreover, favorable government policies, availability of raw materials, and increasing R&D in advanced carbon products are accelerating market penetration in both domestic and export-focused industries

China Coal Tar Market Insight

The China coal tar market accounted for the largest share in Asia-Pacific in 2024, supported by its dominance in steel production and aluminum smelting industries. With a vast domestic demand for anodes and graphite electrodes, the country continues to be a key consumer of high temperature coal tar pitch. Local manufacturers are expanding production capacity and investing in environmentally compliant distillation technologies to meet rising demand from construction, automotive, and energy sectors.

India Coal Tar Market Insight

India’s coal tar market is expanding due to increasing investments in infrastructure, growing steel production via electric arc furnaces, and rising demand for aluminium in transportation and packaging. The country is witnessing a steady rise in carbon electrode usage, supported by the government's push for self-sufficiency in metals manufacturing. Domestic availability of coal as a by-product of coking processes further supports the market's upstream supply dynamics.

Europe Coal Tar Market Insight

Europe coal tar market is projected to grow at a moderate CAGR during the forecast period, driven by demand for high-quality pitch in graphite, refractory, and advanced composite applications. The region’s strong environmental policies are influencing a shift toward cleaner production techniques and sustainable sourcing of coal tar derivatives. Growing adoption of carbon-based materials in electric vehicles, renewable energy, and aerospace sectors is further boosting market opportunities across Western and Central Europe

Germany Coal Tar Market Insight

Germany’s coal tar market is supported by its advanced chemical industry, high production standards, and a focus on sustainable processing technologies. Demand is driven by the country's leading role in producing specialty carbon materials, high-grade refractories, and automotive lightweight components. Innovation in recycling by-products from steel plants and development of cleaner distillation units is enhancing the competitiveness of German coal tar processors.

North America Coal Tar Market Insight

North America is anticipated to grow at a steady pace from 2025 to 2032, backed by growing investments in graphite electrodes, carbon fiber components, and aluminum smelting. The region's focus on decarbonizing the steel sector through electric arc furnaces is generating consistent demand for high-grade coal tar pitch. Increasing use of specialty carbon products in aerospace, defense, and electronics sectors is also contributing to market expansion.

U.S. Coal Tar Market Insight

The U.S. held the largest share in the North American coal tar market in 2024, driven by the strong presence of aluminum and steel producers and demand for high-purity carbon materials. Regulatory pressure on environmental compliance is pushing refiners to adopt cleaner distillation technologies. Moreover, growth in electric vehicle production and domestic demand for synthetic graphite and anodes are key factors supporting market growth.

Coal Tar Market Share

The coal tar industry is primarily led by well-established companies, including:

- JFE Holdings, Inc. (Japan)

- POSCO (South Korea)

- voestalpine AG (Austria)

- Himadri Specialty Chemical Ltd. (India)

- ArcelorMittal (Luxembourg)

- Lone Star Specialities, LLC (U.S.)

- NIPPON STEEL Chemical & Material Co., Ltd. (Japan)

- Severstal (Russia)

- Stella-Jones (Canada)

- Tata Steel (India)

- Bathco Ltd. (U.K.)

- Bilbaína de Alquitranes, S.A. (Spain)

- Coopers Creek Chemical Corporation (U.S.)

- Crowley Chemical Company, Inc. (U.S.)

- DEZA a. s. (Czech Republic)

- Hengshui Zehao Chemicals Co., Ltd. (China)

- Koppers Inc. (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Zauba Technologies & Data Services Private Limited (India)

- Rain Carbon Inc. (U.S.)

- Shandong Weijiao Holding Group Co., Ltd. (China)

Latest Developments in Global Coal Tar Market

- In July 2023, Indian Oil Corporation Limited (IOCL) commenced commercial production of coal tar pitch at its Barauni refinery in Bihar. The new facility boasts a capacity of 10,000 tonnes per annum, strategically positioned to address the rising demand for coal tar pitch within India. This initiative aligns with the country’s focus on enhancing domestic production capabilities and reducing reliance on imports for this essential industrial material

- In January 2021, Aluminium is poised to transform the electric vehicle (EV) sector due to its significant weight advantages. Every kilogram of aluminium used in vehicle construction reduces the overall weight by an equivalent amount, improving efficiency. Notably, a reduction of 100 kg in an electric vehicle can enhance its driving range by 10-15%. This advancement highlights aluminium's crucial role in boosting EV performance and sustainability

- In October 2021, Sichuan Longhao Flight Training Co. made a significant commitment by ordering 20 Cessna Skyhawk piston aircraft, with delivery scheduled by the end of 2022. This acquisition underscores the growing demand for pilot training resources in China, reflecting a broader trend towards enhancing aviation capabilities. The Cessna Skyhawk's reputation for reliability and efficiency positions it as an ideal choice for flight training programs

- In December 2020, The Aviation Industry Corporation of China (AVIC) launched the AC332, a versatile multi-purpose helicopter aimed at the civilian market. Designed to meet diverse operational needs, this helicopter enhances China's capabilities in various sectors, including emergency services, logistics, and tourism. The introduction of the AC332 marks a significant advancement in Chinese aviation technology, contributing to the growth and modernization of the country's aerospace industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coal Tar Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coal Tar Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coal Tar Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.