Global Coated Ducts Market

Market Size in USD Million

CAGR :

%

USD

578.20 Million

USD

949.75 Million

2024

2032

USD

578.20 Million

USD

949.75 Million

2024

2032

| 2025 –2032 | |

| USD 578.20 Million | |

| USD 949.75 Million | |

|

|

|

|

Coated Ducts Market Size

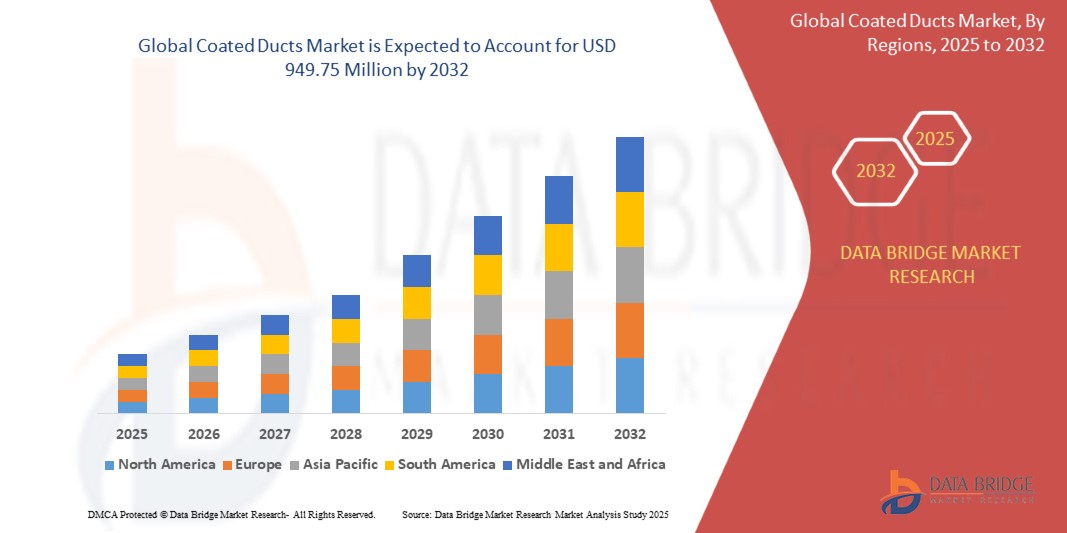

- The global coated ducts market size was valued at USD 578.20 million in 2024 and is expected to reach USD 949.75 million by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is primarily driven by increasing demand for corrosion-resistant, durable, and high-performance ducting solutions across industries such as semiconductor manufacturing, pharmaceuticals, and oil & gas

- Rising awareness of the benefits of coated ducts, including enhanced durability, chemical resistance, and improved airflow efficiency, is further propelling market demand in both industrial and commercial applications

Coated Ducts Market Analysis

- The coated ducts market is experiencing consistent growth due to the increasing need for advanced ducting solutions that offer resistance to harsh environmental conditions and chemical exposure

- Growing adoption in high-tech industries, such as semiconductor manufacturing and pharmaceuticals, is encouraging manufacturers to innovate with advanced coating materials such as ETFE and ECTFE for superior performance

- North America dominates the coated ducts market with the largest revenue share of 43.1% in 2024, driven by a robust industrial base, stringent regulatory standards, and high demand for corrosion-resistant ducting systems

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, expanding semiconductor and pharmaceutical sectors, and increasing infrastructure development in countries such as China, India, and Japan

- The ETFE coating segment dominated the largest market revenue share of 45% in 2024, driven by its superior chemical resistance, thermal stability, and lightweight properties, making it ideal for semiconductor and pharmaceutical applications

Report Scope and Coated Ducts Market Segmentation

|

Attributes |

Coated Ducts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Coated Ducts Market Trends

Increasing Integration of Advanced Coating Technologies

- The global coated ducts market is experiencing a significant trend toward the integration of advanced coating technologies

- These coatings provide superior chemical resistance, thermal stability, and durability, enabling ducts to withstand harsh industrial environments, including exposure to corrosive chemicals and extreme temperatures

- Advanced coatings, such as antimicrobial and anti-static variants, enhance air quality and cleanliness, particularly in sensitive applications such as semiconductor manufacturing and pharmaceuticals

- For instance, companies are developing coated ducts with AI-driven monitoring systems to predict maintenance needs, optimize performance, and reduce downtime in critical environments such as cleanrooms

- This trend enhances the functionality and longevity of coated ducts, making them increasingly attractive to industries prioritizing efficiency, sustainability, and regulatory compliance

- These advanced coatings can address a wide range of operational challenges, including corrosion, contamination, and residue buildup, improving system reliability and reducing maintenance costs

Coated Ducts Market Dynamics

Driver

Rising Demand for High-Performance Ducting Solutions in Critical Industries

- The increasing demand for high-purity, corrosion-resistant, and durable ducting systems in industries such as semiconductor manufacturing, pharmaceuticals, and oil & gas is a major driver for the global coated ducts market

- Coated ducts, particularly those with ETFE and ECTFE coatings, provide essential features such as chemical resistance, ease of cleaning, and compliance with stringent cleanroom and safety standards

- Government regulations, such as Good Manufacturing Practices (GMP) in pharmaceuticals and environmental standards in North America and Europe, are pushing the adoption of coated ducts to ensure contamination control and operational safety

- The rapid expansion of IoT and smart manufacturing technologies is enabling real-time monitoring and optimization of coated duct systems, further driving their adoption in high-tech industries

- Manufacturers are increasingly offering customized coated duct solutions, tailored to specific industrial needs, enhancing their appeal across diverse applications

Restraint/Challenge

High Initial Costs and Regulatory Compliance Issues

- The high initial costs associated with the development, application, and integration of advanced coatings such as ETFE and ECTFE can be a significant barrier to adoption, particularly in cost-sensitive markets such as small-scale industries or developing regions

- The complexity of applying specialized coatings, such as powder or liquid forms, and ensuring compatibility with materials such as ceramic, metallic, or polymeric coatings increases installation and maintenance expenses

- Data security and environmental compliance concerns pose additional challenges, as coated ducts must adhere to strict regulations regarding material safety, emissions, and biocompatibility, especially in pharmaceuticals and semiconductor manufacturing

- The fragmented regulatory landscape across regions, particularly between North America (the dominating region) and Asia-Pacific (the fastest-growing region), creates complexities for manufacturers in ensuring compliance with varying environmental and safety standards

- These factors can deter adoption in regions with high cost sensitivity or limited awareness of the long-term benefits of coated ducts, potentially slowing market growth

Coated Ducts Market Scope

The market is segmented on the basis of coating type, type, end-use industry, material, insulation type, duct size, and shape.

- By Coating Type

On the basis of coating type, the coated ducts market is segmented into ETFE, ECTFE, and others. The ETFE coating segment dominated the largest market revenue share of 45% in 2024, driven by its superior chemical resistance, thermal stability, and lightweight properties, making it ideal for semiconductor and pharmaceutical applications.

The ECTFE coating segment is expected to witness the fastest growth rate from 2025 to 2032, with a CAGR of 5.2%, due to its excellent durability and performance in aggressive chemical environments, particularly in high-tech manufacturing industries such as semiconductors and chemical processing.

- By Type

On the basis of type, the coated ducts market is segmented into powder and liquid coatings. The powder coating segment accounted for the largest market revenue share of 60% in 2024, attributed to its durability, cost-effectiveness, and environmental benefits, such as zero VOC emissions, aligning with sustainability standards in regions such as Asia-Pacific.

The liquid coating segment is anticipated to experience the fastest growth rate of 5.5% from 2025 to 2032, driven by advancements in application techniques and increasing demand for precise, high-performance coatings in specialized industrial applications.

- By End-use Industry

On the basis of end use industry, the coated ducts market is segmented into semiconductor manufacturing, pharmaceutical, oil & gas, and others. The semiconductor manufacturing segment dominated with a 40% market revenue share in 2024, driven by stringent requirements for contamination control and corrosion-resistant ducting in cleanroom environments.

The pharmaceutical segment is expected to witness the fastest growth rate from 2025 to 2032, with a CAGR of 6.0%, fueled by increasing regulatory compliance, such as Good Manufacturing Practices (GMP), and the need for antimicrobial and anti-static coated ducts to maintain cleanroom standards.

- By Material

On the basis of material, the coated ducts market is segmented into ceramic coatings, metallic coatings, and polymeric coatings. The polymeric coatings segment held the largest market revenue share of 50% in 2024, owing to their versatility, chemical resistance, and widespread use in industries such as semiconductors and pharmaceuticals.

The ceramic coatings segment is projected to grow at the fastest rate from 2025 to 2032, with a CAGR of 5.8%, driven by their high thermal stability and durability in extreme operating conditions, particularly in oil & gas and chemical processing applications.

- By Insulation Type

On the basis of insulation type, the coated ducts market is segmented into double wall and single wall. The single wall segment accounted for the largest market revenue share of 65% in 2024, due to its cost-effectiveness and widespread use in less demanding environments.

The double wall segment is expected to witness the fastest growth rate of 5.4% from 2025 to 2032, driven by the increasing need for enhanced insulation and energy efficiency in high-performance applications, such as semiconductor manufacturing and pharmaceutical cleanrooms.

- By Duct Size

On the basis of duct size, the coated ducts market is segmented into large (>400mm), medium (200-400mm), and small (<200mm). The medium (200-400mm) segment held the largest market revenue share of 42% in 2024, driven by its versatility and widespread use across various industries, including semiconductor manufacturing and oil & gas.

The small (<200mm) segment is anticipated to grow at the fastest rate from 2025 to 2032, with a CAGR of 5.6%, due to increasing demand for compact, high-precision duct systems in pharmaceutical and high-tech manufacturing environments.

- By Shape

On the basis of shape, the coated ducts market is segmented into rectangular, round, and spiral. The round segment dominated with a 48% market revenue share in 2024, attributed to its efficiency in airflow and widespread use in industrial applications.

The spiral segment is expected to witness the fastest growth rate of 5.7% from 2025 to 2032, driven by its aesthetic appeal, structural strength, and increasing adoption in modern HVAC systems for sustainable building practices.

Coated Ducts Market Regional Analysis

- North America dominates the coated ducts market with the largest revenue share of 43.1% in 2024, driven by a robust industrial base, stringent regulatory standards, and high demand for corrosion-resistant ducting systems

- Consumers prioritize coated ducts for their durability, corrosion resistance, and ability to maintain ultra-clean conditions, especially in regions with stringent environmental and safety standards

- Growth is supported by advancements in coating technologies, such as fluoropolymer-based ETFE and ECTFE coatings, alongside increasing adoption in both new installations and retrofit projects across various industries

U.S. Coated Ducts Market Insight

The U.S. coated ducts market captured the largest revenue share of 87.8% in 2024 within North America, fueled by strong demand in the semiconductor and pharmaceutical sectors. The trend toward high-purity ventilation systems and growing awareness of energy efficiency and low maintenance costs boost market expansion. The integration of coated ducts in cleanroom facilities and compliance with strict regulatory standards further support market growth.

Europe Coated Ducts Market Insight

The Europe coated ducts market is expected to witness significant growth, supported by a focus on regulatory compliance and environmental sustainability. Consumers demand ducts with advanced coatings such as ETFE and ECTFE for chemical resistance and thermal stability. The market sees prominent uptake in countries such as Germany and France, driven by increasing industrial applications and infrastructure development.

U.K. Coated Ducts Market Insight

The U.K. market for coated ducts is expected to witness rapid growth, driven by demand for corrosion-resistant and energy-efficient ventilation systems in industrial and pharmaceutical settings. Increased awareness of contamination control and regulatory requirements for cleanroom environments encourages adoption. The balance between performance and compliance with safety standards shapes consumer preferences.

Germany Coated Ducts Market Insight

Germany is expected to witness rapid growth in the coated ducts market, attributed to its advanced manufacturing sector and high consumer focus on energy efficiency and durability. German industries prefer technologically advanced coatings such as ECTFE for their ability to withstand harsh chemical environments. The integration of coated ducts in high-tech manufacturing and aftermarket solutions supports sustained market growth.

Asia-Pacific Coated Ducts Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization, urbanization, and infrastructure development in countries such as China, India, and Japan. Increasing demand for high-purity and corrosion-resistant duct systems in semiconductor and pharmaceutical industries boosts market growth. Government initiatives promoting energy efficiency and environmental regulations further encourage the adoption of advanced coated ducts.

Japan Coated Ducts Market Insight

Japan’s coated ducts market is expected to witness rapid growth due to strong consumer preference for high-quality, chemically resistant duct systems that enhance operational efficiency and safety. The presence of major semiconductor manufacturers and the integration of coated ducts in OEM applications accelerate market penetration. Rising interest in retrofit projects also contributes to growth.

China Coated Ducts Market Insight

China holds the largest share of the Asia-Pacific coated ducts market, propelled by rapid urbanization, expanding industrial sectors, and increasing demand for contamination-free ventilation systems. The country’s growing focus on high-tech manufacturing and competitive pricing of coated ducts enhance market accessibility. Strong domestic manufacturing capabilities and government support for energy-efficient solutions drive market growth.

Coated Ducts Market Share

The coated ducts industry is primarily led by well-established companies, including:

- Kenyon Pte Ltd. (Singapore),

- Exyte Group (Germany),

- Acesian Partners Limited (Singapore)

- Sigma Roto Lining Pvt. Ltd. (India)Viron International (US),

- Spiral Manufacturing Co., Inc. (US)

- ChenFull International Co., Ltd (Taiwan)

- Junhao Co., Ltd. (China)

- LBF Technik (Germany)

- SEBO MEC (South Korea)

- Epiroc Mining India Limited (India)

What are the Recent Developments in Global Coated Ducts Market?

- In October 2024, Eyte Group rebranded its Technology & Services division as Exentec, marking a strategic shift to better serve high-tech industries such as life sciences, semiconductor manufacturing, and advanced technology facilities. The new brand identity reflects a commitment to delivering innovative, client-centric solutions and positions Exentec to meet the evolving demands of global markets. As part of Eyte’s “Next Level” growth strategy, Exentec will unify its global subsidiaries under one name starting in early 2025, enhancing visibility and reinforcing its role as a leader in cleanroom and production environment technologies

- In April 2024, Eyte Group (operating as Exyte) announced its acquisition of Kinetics Group, a globally recognized provider of installation services, equipment, and technical facility management. The deal officially closed on October 15, 2024, after receiving all necessary regulatory approvals. This strategic move strengthens Exyte’s Technology & Services division, expanding its capabilities in semiconductor, biopharma, and battery sectors. The acquisition also marks Exyte’s entry into technical facility management, enabling it to support clients beyond construction and into operational phases

- In May 2024, Acesian Partners Limited incorporated a wholly owned subsidiary in Singapore named Acesian Technologies Solutions Pte. Ltd. (ATS). The new entity was established with an initial issued and paid-up share capital of SGD 100, comprising 100 ordinary shares. ATS focuses on the sales and distribution of coated and uncoated stainless-steel ductworks and other specialized exhaust system components, primarily targeting overseas markets. This move aligns with Acesian’s strategic plan for international expansion and was funded through internal resources. The incorporation is not expected to materially impact the Group’s earnings or net tangible assets for the financial year ending 31 December 2024

- In March 2024, Eyte Group (operating as Exyte) expanded its U.S. footprint with two of its subsidiaries—Diversified Fluid Solutions (DFS) and NEHP—establishing new facilities in Nampa, Idaho. This strategic move is part of Exyte’s “follow-the-client” approach, aimed at supporting semiconductor projects across the country. The new production and office spaces will span over 300,000 square feet and are expected to create more than 250 full-time jobs in the Treasure Valley region. These facilities will enhance Exyte’s capabilities in delivering modular systems and fluid solutions for high-tech industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coated Ducts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coated Ducts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coated Ducts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.