Global Coated Fabric Market

Market Size in USD Billion

CAGR :

%

USD

30.81 Billion

USD

46.18 Billion

2024

2032

USD

30.81 Billion

USD

46.18 Billion

2024

2032

| 2025 –2032 | |

| USD 30.81 Billion | |

| USD 46.18 Billion | |

|

|

|

|

Coated Fabric Market Size

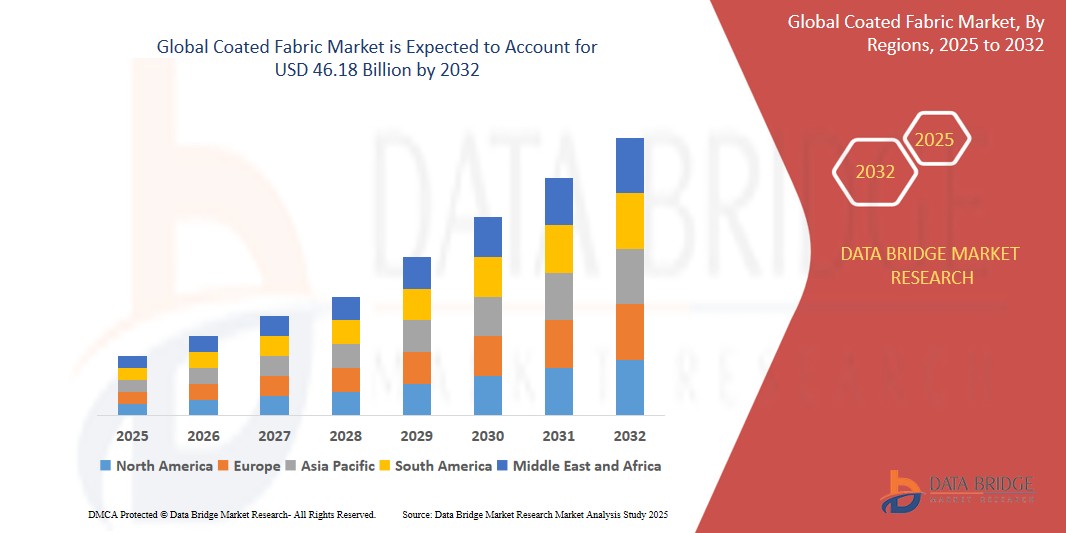

- The Global Coated Fabric Market size was valued at USD 30.81 billion in 2024 and is expected to reach USD 46.18 billion by 2032, at a CAGR of 4.6% during the forecast period

- The market growth is largely fueled by demand for durable, high-performance materials in automotive and industrial sectors

- Furthermore, the coated fabric is widely used in industrial sectors such as construction, oil and gas, and manufacturing due to their durability and resistance to harsh conditions including heat, chemicals, and abrasion are further anticipated to propel the growth of the Coated fabric market

Coated Fabric Market Analysis

- The current coated fabric market is witnessing significant traction due to its extensive use in industrial applications where high performance, durability, and resistance to harsh environments are essential

- Coated fabric is being increasingly adopted across sectors like transportation, protective clothing, and industrial machinery as they resist chemicals, abrasion, and extreme weather conditions

- North America dominates the coated fabric market with the largest revenue share of 39.8% in 2025, characterized by heightened demand across automotive, industrial, and protective clothing sectors.

- Asia-Pacific is expected to be the fastest growing region in the Coated fabric market during the forecast period due to rapid industrialization, infrastructure development, and expanding automotive industries in China, India, and Southeast Asia

- Polymer-coated fabrics segment is expected to dominate the coated fabric market with a market share of 46.2% in 2025, driven by its wide use across transportation, protective clothing, and industrial applications

Report Scope and Coated fabric market Segmentation

|

Attributes |

Coated fabric Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Coated Fabric Market Trends

“Sustainability and Eco-Friendly Coatings Gaining Momentum”

- There is a growing trend toward the adoption of environmentally friendly coated fabrics, driven by increasing consumer awareness and stricter environmental regulations.

- Manufacturers are innovating by using water-based coatings, bio-based polymers, and non-toxic additives to reduce the environmental impact of coated fabrics.

- This shift not only meets regulatory requirements but also aligns with consumer demand for sustainable products across automotive, furniture, and industrial sectors.

- The sustainability trend is prompting companies to invest in R&D for recyclable and biodegradable coated fabrics, opening new avenues for market expansion.

Coated fabric market Dynamics

Driver

“Growing Demand for Smart Home Applications and Enhanced User Convenience”

- The increasing prevalence of smart home devices and the accelerating adoption of AI-driven ecosystems are significant drivers for the heightened demand for coated fabrics.

- As consumers become more aware of the benefits of smart home technologies, coated fabrics offer advanced features such as integration with AI systems, providing a compelling upgrade over traditional materials.

- Furthermore, the growing popularity of smart home devices and the desire for interconnected living spaces are making coated fabrics an integral component of these systems, offering seamless integration with other smart devices and platforms.

- The convenience of voice-controlled environments and the ability to manage settings through smartphone applications are key factors propelling the adoption of coated fabrics in both residential and commercial sectors.

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Concerns surrounding the cybersecurity vulnerabilities of connected devices, including those integrated with coated fabrics, pose a significant challenge to broader market penetration.

- As these systems rely on network connectivity and software, they are susceptible to hacking attempts and data breaches, raising anxieties among potential consumers about the security of their homes and data.

- Addressing these cybersecurity concerns through robust encryption, secure authentication protocols, and regular software updates is crucial for building consumer trust.

- Additionally, the relatively high initial cost of some advanced coated fabric systems compared to traditional materials can be a barrier to adoption for price-sensitive consumers, particularly in developing regions or for budget-conscious homeowners.

- Overcoming these challenges through enhanced cybersecurity measures, consumer education on security best practices, and the development of more affordable coated fabric options will be vital for sustained market growth.

Coated Fabric Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the coated fabric market is segmented into polymer-coated fabrics, rubber-coated fabrics, and fabric-backed wall coverings. The polymer-coated fabrics segment dominates the largest market revenue share of 46.1% in 2025, driven by its wide use across transportation, protective clothing, and industrial applications. These fabrics are valued for their water resistance, durability, and cost-effectiveness, making them ideal for automotive interiors and tarpaulins. Additionally, advancements in polymer coating technologies are enhancing performance features, further fueling adoption.

The rubber-coated fabrics segment is anticipated to witness the fastest growth rate of 19.4% from 2025 to 2032, supported by growing demand in protective gear and industrial settings. These fabrics provide superior resistance to abrasion, chemicals, and extreme conditions. Increasing safety standards and demand for robust materials in oil & gas, mining, and heavy machinery sectors drive this segment's expansion. Environmental compliance and the shift toward sustainable rubber compounds are also fostering growth.

- By Application

On the basis of application, the Coated Fabric Market is segmented into transportation, protective clothing, industrial, roofing, awnings and canopies, furniture and seating, and others. The transportation segment held the largest market revenue share in 2025, driven by the extensive use of coated fabrics in automotive seat covers, airbags, truck covers, and marine upholstery. OEMs are adopting lightweight and durable materials to enhance fuel efficiency and aesthetics, driving coated fabric usage in the sector.

The protective clothing segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising workplace safety regulations and the need for durable, chemical-resistant, and fire-retardant fabrics. Growing investments in PPE, especially in healthcare, defense, and manufacturing industries, are boosting demand. Innovations in breathable and flexible coated fabrics are further enabling comfort and compliance in protective apparel design.

Coated fabric market Regional Analysis

- North America dominates the coated fabric market with the largest revenue share of 39.8% in 2024, driven by heightened demand across automotive, industrial, and protective clothing sectors.

- The region’s focus on worker safety and stringent regulatory frameworks related to occupational hazards is fueling the use of coated fabrics in personal protective equipment (PPE), tarpaulins, and upholstery applications.

- Consumers in North America increasingly favor coated fabrics for their durability, flame resistance, and waterproofing features, particularly in automotive interiors and industrial settings.

- The integration of sustainable coatings and advanced manufacturing methods is reinforcing market growth. Additionally, high disposable incomes and consistent investments in infrastructure and defense contribute to increased demand.

U.S. Coated fabric market Insight

The U.S. coated fabric market captured the largest revenue share of 81.04% within North America in 2025, fueled by the significant consumption in automotive OEMs and aftermarket applications. The use of coated fabrics in airbags, seat covers, and truck covers is expanding rapidly. Moreover, the U.S. government's emphasis on workplace safety and advancements in polymer technologies are accelerating the adoption of coated fabrics across key industrial applications. Sustainability-driven innovations, such as bio-based and PVC-free coatings, are also gaining ground.

Europe Coated fabric market Insight

The European coated fabric market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by regulations promoting fire-retardant, environmentally friendly, and recyclable materials. Growth in the region is anchored by strong automotive production in Germany, France, and Italy, alongside rising investments in building and construction. The adoption of coated fabrics in public transport interiors, medical textiles, and eco-friendly furnishings is on the rise due to increasing consumer preference for sustainable solutions.

U.K. Coated fabric market Insight

The U.K. coated fabric market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by for lightweight and high-performance materials in transportation, healthcare, and military sectors. With growing concerns around fire safety and environmental compliance, coated fabrics with low-VOC and REACH-compliant formulations are seeing accelerated uptake. Moreover, the U.K.’s push towards greener infrastructure and urban mobility is stimulating demand in both construction and public transit applications.

Germany Coated fabric market Insight

The German coated fabric market is expected to expand at a considerable CAGR during the forecast period, fueled by its leadership in automotive manufacturing and industrial machinery. Demand is rising for coated textiles used in car interiors, convertible roofs, and seat components. Germany’s stringent quality standards and preference for technologically advanced, eco-conscious materials drive innovation in polymer coatings. The country also demonstrates strong momentum in using coated fabrics for awnings, architectural membranes, and industrial covers.

Asia-Pacific Coated fabric market Insight

The Asia-Pacific Coated fabric market is poised to grow at the fastest CAGR of over 23.17% in 2025, driven by rapid industrialization, infrastructure development, and expanding automotive industries in China, India, and Southeast Asia. Governments in the region are emphasizing industrial safety and public transport modernization, contributing to increased demand. Furthermore, local production capabilities and low-cost manufacturing make APAC a vital export and consumption hub for coated fabrics.

Japan Coated fabric market Insight

The Japan Coated fabric market is gaining momentum due to the country’s innovation in technical textiles and strong demand for high-spec coatings in healthcare and transport sectors. Coated fabrics are extensively used in medical beds, wheelchair cushions, and commuter train seating. Japan’s mature manufacturing base, coupled with its focus on eco-friendly, antimicrobial, and easy-clean coatings, continues to drive demand in both public and private sector applications.

China Coated fabric market Insight

The China Coated fabric market accounted for the largest market revenue share in Asia Pacific in 2025, driven by the country’s robust textile production, growing automotive sector, and major investments in infrastructure and protective gear. Coated fabrics are used in truck tarpaulins, rainwear, construction membranes, and PPE. China’s government policies supporting industrial modernization and the presence of domestic coating technology providers are contributing to its leadership in the regional coated fabrics market.

Coated Fabric Market Share

The coated fabric industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- Sioen Industries NV (Belgium)

- Saint-Gobain Performance Plastics (France)

- Trelleborg Group (Sweden)

- SergeFerrari Group (France)

- Low & Bonar (U.K.)

- SRF Limited (India)

- OMNOVA Solutions Inc. (U.S.)

- SPRADLING GROUP (U.S.)

- Cooley Group Holdings, Inc. (U.S.)

- Bo-Tex America (U.S.)

- Mauritzon, Inc. (U.S.)

- Graniteville (U.S.)

- Santex Rimar Group (Italy)

- ENDUTEX COATED TECHNICAL TEXTILES (Portugal)

- The Haartz Corporation (U.S.)

- Heytex Gruppe (Germany)

- Morbern Europe (Belgium)

- Obeikan Investment Group (Saudi Arabia)

- Uniroyal Global Engineered Products Inc. (U.S.)

Latest Developments in Global Coated Fabric Market

- In August 2024, Carnegie, a company specializing in sustainable textiles and acoustic solutions for commercial spaces, expanded its range of silicone hybrid-coated upholstery. The new additions, Botanic Print and Embellish Print, are part of the Conscious Collection and utilize digital printing to deliver improved durability, easy maintenance, and a visually rich, hand-embroidered look inspired by historical embroidery.

- In December 2021, Trelleborg AB acquired a business unit from the privately held U.S.-based company Alpha Engineered Composites. This acquisition involved operations centered on polymer-coated fabrics used in specialized applications. By November 2022, Trelleborg had turned its attention to innovation in healthcare and medical textiles, launching the Dartex Zoned Coatings fabric. This product enables varying stretch properties across its surface without requiring a change in textile material.

- In May 2020, Continental AG introduced a new application for timing belts in wind turbines, replacing traditional gearboxes. The belts incorporate fabric that enhances resistance to wear and tear, supports structural stability, and reduces operational noise.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coated Fabric Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coated Fabric Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coated Fabric Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.