Global Coating Resins Market

Market Size in USD Billion

CAGR :

%

USD

45.28 Billion

USD

66.49 Billion

2024

2032

USD

45.28 Billion

USD

66.49 Billion

2024

2032

| 2025 –2032 | |

| USD 45.28 Billion | |

| USD 66.49 Billion | |

|

|

|

|

Coating Resins Market Size

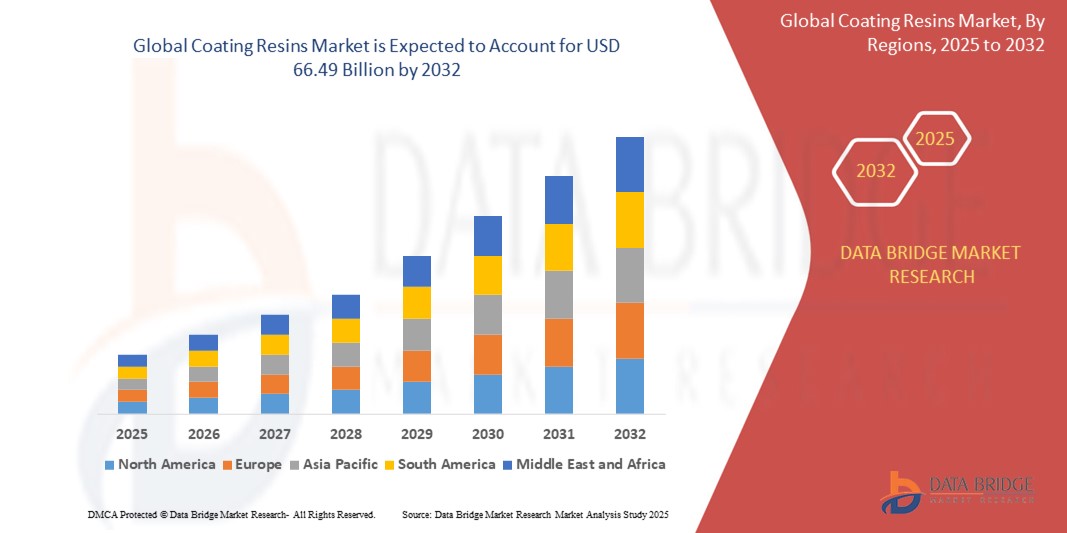

- The global coating resins market was valued at USD 45.28 billion in 2024 and is expected to reach USD 66.49 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.92%, primarily driven by the increasing demand for high-performance and sustainable coatings

- This growth is driven by factors such as rising construction activities, expanding automotive production, and advancements in eco-friendly coating technologies

Coating Resins Market Analysis

- Coating resins are essential components in the formulation of paints, coatings, and adhesives, providing durability, adhesion, and protective properties to various surfaces. They are widely used in industries such as construction, automotive, industrial, and packaging

- The demand for coating resins is significantly driven by the growing infrastructure development, increasing automotive production, and rising demand for eco-friendly coatings. The shift towards water-based and UV-curable coatings is particularly influencing market growth, as regulatory bodies push for low-VOC and sustainable solutions

- The Asia-Pacific region stands out as one of the dominant regions for the coating resins market, driven by rapid industrialization, urbanization, and strong manufacturing bases in countries like China, India, and Japan

- For instance, China's booming construction sector and expanding automotive manufacturing industry have fueled the demand for high-performance coating resins, making it the largest consumer of coating resins globally

- Globally, acrylic resins rank as the most widely used type of coating resins, followed by epoxy and polyurethane resins, due to their versatility, durability, and superior weather resistance, making them crucial for various industrial and commercial applications

Report Scope and Coating Resin Market Segmentation

|

Attributes |

Coating Resin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Coating Resins Market Trends

“Growing Demand for Sustainable and High-Performance Coatings”

- One prominent trend in the global coating resins market is the growing demand for sustainable and high-performance coatings, driven by stringent environmental regulations and the shift toward eco-friendly formulations

- These advanced resins enhance the durability, weather resistance, and performance of coatings while reducing volatile organic compound (VOC) emissions, making them highly preferred in construction, automotive, and industrial applications

- For instance, bio-based and waterborne coating resins are gaining popularity due to their low environmental impact, providing excellent adhesion, chemical resistance, and long-term protection, which is crucial for architectural coatings and automotive finishes

- The integration of nanotechnology in coating resins is also enabling the development of self-healing, anti-microbial, and anti-corrosion coatings, revolutionizing the market by offering enhanced functionality and extended lifespan

- This trend is reshaping the coating resins industry, encouraging technological advancements, increased R&D investments, and widespread adoption of sustainable coatings, thereby driving market growth globally

Coating Resins Market Dynamics

Driver

“Increasing Demand for High-Performance and Sustainable Coatings”

- The growing demand for high-performance, durable, and sustainable coatings across industries such as automotive, construction, and packaging is significantly driving the need for advanced coating resins

- As environmental regulations tighten, industries are shifting toward eco-friendly and low-VOC (volatile organic compound) coatings, increasing the adoption of waterborne, UV-curable, and bio-based coating resins

- Automotive and industrial applications require high-quality coatings that offer corrosion resistance, durability, and weatherability, fueling the market for innovative resin formulations.

- Continuous advancements in resin technologies, such as nanotechnology-based coatings and self-healing coatings, further drive demand for specialized resins that enhance performance and longevity

- The increasing emphasis on energy-efficient and sustainable coatings in the construction sector, particularly for green buildings and infrastructure projects, is also propelling market growth

For instance,

- In September 2023, according to an article published by Coatings World, the waterborne coatings segment is experiencing strong growth due to stringent regulations limiting solvent-based coatings, boosting the demand for waterborne acrylic and epoxy resins

- In June 2022, according to the European Coatings Journal, the increasing investments in bio-based resins for sustainable coatings are reshaping the market, as companies focus on reducing carbon footprints and enhancing product performance

- As industries prioritize high-performance and sustainable coatings, the demand for advanced coating resins continues to rise, driving innovations in formulations, durability, and environmental compliance

Opportunity

“Enhancing Coating Technologies with Smart and Sustainable Innovations”

- The integration of smart technologies and sustainable materials in coating resins is creating significant growth opportunities in industries such as automotive, construction, and packaging.

- Nanotechnology-based coatings and self-healing resins are revolutionizing protective coatings by enhancing durability, scratch resistance, and environmental adaptability.

- Additionally, the development of bio-based and waterborne resins is gaining traction, as manufacturers focus on reducing volatile organic compounds (VOCs) and meeting stringent environmental regulations.

For instance,

- In February 2025, according to an article published by CoatingsTech Journal, the adoption of AI-driven formulation processes in resin manufacturing is optimizing coating performance, reducing waste, and enabling the customization of coatings for various applications. AI-powered predictive modeling is also improving the efficiency of coating application processes

- In September 2023, according to an article by the European Coatings Journal, bio-based acrylic and epoxy resins are gaining popularity as industries seek sustainable alternatives. Companies are investing in plant-derived raw materials and biodegradable coatings to align with sustainability goals

- The integration of smart and sustainable innovations in coating resins is reshaping the industry, leading to improved performance, environmental benefits, and greater efficiency in various end-use sectors

Restraint/Challenge

“High Raw Material Costs Limiting Market Expansion”

- The high cost of raw materials used in coating resins, such as petrochemical-based monomers, additives, and curing agents, poses a significant challenge to market growth, particularly impacting manufacturers in price-sensitive regions

- Key resin types, including epoxy, acrylic, polyurethane, and alkyd resins, rely on raw materials derived from crude oil, making their prices highly volatile due to fluctuations in global oil prices and supply chain disruptions

- This financial burden can increase production costs, leading to higher product prices, which may discourage end-users from adopting premium coatings, especially in cost-sensitive markets

For instance,

- In October 2024, according to an article published by Chemical & Engineering News, the rising cost of petrochemical feedstocks has significantly impacted the coatings industry, forcing manufacturers to either absorb the costs or pass them on to consumers, thereby affecting profitability and market penetration

- Consequently, such cost limitations can hinder innovation, slow down market expansion, and create pricing pressures that may restrict the adoption of high-performance and eco-friendly coating resins across various industries

Coating Resins Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Resin Type |

|

|

By Technology |

|

|

By Application |

|

Coating Resins Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Coating Resins Market”

- Asia-Pacific is expected to dominate the global coating resins market, driven by rapid industrialization, growing construction activities, and expanding automotive and electronics sectors, particularly in countries like China, India, and Japan

- China holds a significant share due to the presence of a vast manufacturing base, increased infrastructure development, and rising demand for high-performance coatings in construction and automotive applications

- The availability of low-cost raw materials, favorable government policies, and significant foreign direct investments (FDIs) in industrial projects further boost market growth across the region

- In addition, the rising use of eco-friendly and sustainable coating solutions, coupled with technological advancements in resin formulations and growing consumer demand for aesthetically appealing and durable products, is propelling market expansion throughout Asia-Pacific

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is expected to witness the highest growth rate in the coating resins market, driven by rapid industrialization, increasing construction activities, and rising demand for high-performance coatings across various industries

- Countries such as China, India, and Japan are emerging as key markets due to expanding automotive, building & construction, and packaging sectors, which rely heavily on advanced coating solutions

- Japan, with its strong technological advancements and focus on sustainable coating solutions, remains a crucial market for high-performance and eco-friendly resins. The country continues to lead in the adoption of low-VOC and bio-based coatings to meet stringent environmental regulations

- China and India, with their growing manufacturing sectors and increasing infrastructure projects, are witnessing large-scale investments in modern coating technologies. The expansion of global coating resin manufacturers and the rising adoption of innovative resin formulations further contribute to market growth in the region

Coating Resins Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DowDuPont (U.S.)

- Covestro AG (Germany)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Reichhold LLC 2 (U.S.)

- Arkema (France)

- Koninklijke DSM N.V. (Netherlands)

- ALLNEX NETHERLANDS B.V. (Netherlands)

- Huntsman International LLC (U.S.)

- The Sherwin-Williams Company (U.S.)

- Qualipoly Chemical Corp. (Taiwan)

- Jiangsu Sanmu Group Co., Ltd. (China)

- Arakawa Chemical Industries, Ltd. (Japan)

- Alberdingk Boley (Germany)

- The Nippon Synthetic Chemical Industry Co., Ltd. (Japan)

- Eternal Materials Co., Ltd. (Taiwan)

- CBC Co., Ltd. (Japan)

- Perstorp Orgnr (Sweden)

- Wanhua Chemical Group Co., Ltd. (China)

- DIC CORPORATION (Japan)

- Wacker Chemie AG (Germany)

Latest Developments in Global Coating Resins Market

- In March 2024, DIC Corporation inaugurated a new Application Lab in India to assess the application of coating resins in infrastructure development and the automotive sector. The facility aims to enhance customer support by offering localized solutions and strengthening the company's market presence

- In October 2023, Arkema doubled its production capacity of Sartomer UV/LED curing resins at its expanded Nansha facility in China. The expansion supports sustainable solutions in the rapidly growing Asian renewable energy and 5G device markets

- In May 2023, Polynt Group expanded its alkyds, urethanes, and water-based technologies capacity to meet the rising coatings market demand. The company achieved this by constructing a new plant in Canada and expanding resin production across North America

- In April 2021, Covestro completed the acquisition of the Resins & Functional Materials (RFM) business from the Dutch company Royal DSM. The transaction, approved by regulators after the September 2020 acquisition agreement, significantly expanded Covestro's portfolio of sustainable coating resins, establishing it as a leading global supplier in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL COATING RESINS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL COATING RESINS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TOP TO BOTTOM ANALYSIS

2.1 STANDARDS OF MEASUREMENT

2.11 VENDOR SHARE ANALYSIS

2.12 IMPORT DATA

2.13 EXPORT DATA

2.14 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.15 DATA POINTS FROM KEY SECONDARY DATABASES

2.16 GLOBAL COATING RESINS MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 GLOBAL COATING RESINS MARKET, BY RESIN TYPE, 2022-2031 (USD MILLION) (KILO TONS)

9.1 OVERVIEW

9.2 THERMOSETTING RESINS

9.2.1 THERMOSETTING RESINS, BY TYPE

9.2.1.1. ACRYLIC

9.2.1.2. ALKYD

9.2.1.3. POLYURETHANE

9.2.1.4. VINYL

9.2.1.5. EPOXY

9.2.1.6. POLYESTER

9.2.1.7. UNSATURATED POLYESTER RESINS

9.2.1.8. SATURATED POLYESTER RESINS

9.2.1.9. PHENOLIC

9.2.1.10. OTHERS

9.3 THERMOPLASTIC RESINS

9.3.1 THERMOPLASTIC RESINS, BY TYPE

9.3.1.1. POLYVINYL CHLORIDE

9.3.1.2. POLYETHYLENE

9.3.1.3. CELLULOSE ACETATE BUTYRATE(CAB)

9.3.1.4. NYLON

9.3.1.5. ACRYLIC

9.3.1.6. ABS

9.3.1.7. POLYSTYRENE

9.3.1.8. POLYCARBONATE

9.3.1.9. CELLULOSE ACETATE PROPIONATE (CAP)

9.3.1.10. FLUOROPLASTICS

9.3.1.11. ALKYD RESINS

9.3.1.12. OTHERS

9.4 AMINO RESINS

9.4.1 AMINO RESINS, BY TYPE

9.4.1.1. UREA-FORMALDEHYDE (UF)

9.4.1.2. MELAMINE-FORMALDEHYDE (MF)

9.4.1.3. OTHERS

9.5 OTHERS

10 GLOBAL COATING RESINS MARKET, BY TECHNOLOGY, 2022-2031 (USD MILLION)

10.1 OVERVIEW

10.2 WATERBORNE

10.3 SOLVENT-BORNE

10.4 POWDER COATING

10.5 HIGH SOLIDS

10.6 UV CURVED

10.7 RADITION CURABLE COATINGS

10.8 HOT MELT BASED

10.9 OTHERS

11 GLOBAL COATING RESINS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 ARCHITECTURAL COATINGS

11.2.1 ARCHITECTURAL COATINGS, BY RESIN TYPE

11.2.1.1. THERMOSETTING

11.2.1.2. THERMOPLASTIC

11.2.1.3. AMINO RESINS

11.2.1.4. OTHERS

11.3 MARINE & PROTECTIVE COATINGS

11.3.1 MARINE & PROTECTIVE COATINGS, BY RESIN TYPE

11.3.1.1. THERMOSETTING

11.3.1.2. THERMOPLASTIC

11.3.1.3. AMINO RESINS

11.3.1.4. OTHERS

11.4 GENERAL INDUSTRIAL COATINGS

11.4.1 GENERAL INDUSTRIAL COATINGS, BY RESIN TYPE

11.4.1.1. THERMOSETTING

11.4.1.2. THERMOPLASTIC

11.4.1.3. AMINO RESINS

11.4.1.4. OTHERS

11.5 AUTOMOTIVE COATINGS

11.5.1 AUTOMOTIVE COATINGS, BY RESIN TYPE

11.5.1.1. THERMOSETTING

11.5.1.2. THERMOPLASTIC

11.5.1.3. AMINO RESINS

11.5.1.4. OTHERS

11.6 WOOD COATINGS

11.6.1 WOOD COATINGS, BY RESIN TYPE

11.6.1.1. THERMOSETTING

11.6.1.2. THERMOPLASTIC

11.6.1.3. AMINO RESINS

11.6.1.4. OTHERS

11.7 PACKAGING COATINGS

11.7.1 PACKAGING COATINGS, BY RESIN TYPE

11.7.1.1. THERMOSETTING

11.7.1.2. THERMOPLASTIC

11.7.1.3. AMINO RESINS

11.7.1.4. OTHERS

11.8 COIL COATINGS

11.8.1 COIL COATINGS, BY RESIN TYPE

11.8.1.1. THERMOSETTING

11.8.1.2. THERMOPLASTIC

11.8.1.3. AMINO RESINS

11.8.1.4. OTHERS

11.9 AEROSPACE

11.9.1 AEROSPACE, BY RESIN TYPE

11.9.1.1. THERMOSETTING

11.9.1.2. THERMOPLASTIC

11.9.1.3. AMINO RESINS

11.9.1.4. OTHERS

11.1 GRAPHIC ARTS

11.10.1 GRAPHIC ARTS, BY RESIN TYPE

11.10.1.1. THERMOSETTING

11.10.1.2. THERMOPLASTIC

11.10.1.3. AMINO RESINS

11.10.1.4. OTHERS

11.11 METAL COATINGS

11.11.1 METAL COATINGS, BY RESIN TYPE

11.11.1.1. THERMOSETTING

11.11.1.2. THERMOPLASTIC

11.11.1.3. AMINO RESINS

11.11.1.4. OTHERS

11.12 CONCRETE COATINGS

11.12.1 CONCRETE COATINGS, BY RESIN TYPE

11.12.1.1. THERMOSETTING

11.12.1.2. THERMOPLASTIC

11.12.1.3. AMINO RESINS

11.12.1.4. OTHERS

11.13 OTHERS

12 GLOBAL COATING RESINS MARKET, BY GEOGRAPHY , 2022-2031 (USD MILLION) (KILO TONS)

GLOBAL COATING RESINS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 U.K.

12.2.3 ITALY

12.2.4 FRANCE

12.2.5 SPAIN

12.2.6 SWITZERLAND

12.2.7 RUSSIA

12.2.8 TURKEY

12.2.9 BELGIUM

12.2.10 NETHERLANDS

12.2.11 REST OF EUROPE

12.3 ASIA-PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 AUSTRALIA & NEW ZEALAND

12.3.6 HONG KONG

12.3.7 TAIWAN

12.3.8 SINGAPORE

12.3.9 THAILAND

12.3.10 INDONESIA

12.3.11 MALAYSIA

12.3.12 PHILIPPINES

12.3.13 REST OF ASIA-PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 UNITED ARAB EMIRATES

12.5.5 ISRAEL

12.5.6 QATAR

12.5.7 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL COATING RESINS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL COATING RESINS MARKET, COMPANY PROFILES

(NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST)

14.1 ARKEMA

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 REVENUE ANALYSIS

14.1.4 SWOT AALYSIS

14.1.5 PRODUCTION CAPACITY OVERVIEW

14.1.6 RECENT DEVELOPMENTS

14.2 BASF SE

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 REVENUE ANALYSIS

14.2.4 SWOT AALYSIS

14.2.5 PRODUCTION CAPACITY OVERVIEW

14.2.6 RECENT DEVELOPMENTS

14.3 COVESTRO AG

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 REVENUE ANALYSIS

14.3.4 SWOT AALYSIS

14.3.5 PRODUCTION CAPACITY OVERVIEW

14.3.6 RECENT DEVELOPMENTS

14.4 ALLNEX NETHERLANDS B.V.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 REVENUE ANALYSIS

14.4.4 SWOT AALYSIS

14.4.5 PRODUCTION CAPACITY OVERVIEW

14.4.6 RECENT DEVELOPMENTS

14.5 DOW

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 REVENUE ANALYSIS

14.5.4 SWOT AALYSIS

14.5.5 PRODUCTION CAPACITY OVERVIEW

14.5.6 RECENT DEVELOPMENTS

14.6 THE SHERWIN WILLIAMS COMPANY

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 REVENUE ANALYSIS

14.6.4 SWOT AALYSIS

14.6.5 PRODUCTION CAPACITY OVERVIEW

14.6.6 RECENT DEVELOPMENTS

14.7 EVONIK INDUSTRIES AG

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 REVENUE ANALYSIS

14.7.4 SWOT AALYSIS

14.7.5 PRODUCTION CAPACITY OVERVIEW

14.7.6 RECENT DEVELOPMENTS

14.8 REICHHOLD LLC

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 REVENUE ANALYSIS

14.8.4 SWOT AALYSIS

14.8.5 PRODUCTION CAPACITY OVERVIEW

14.8.6 RECENT DEVELOPMENTS

14.9 HUNTSMAN INTERNATIONAL LLC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 REVENUE ANALYSIS

14.9.4 SWOT AALYSIS

14.9.5 PRODUCTION CAPACITY OVERVIEW

14.9.6 RECENT DEVELOPMENTS

14.1 MITSUBISHI CHEMICAL CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 REVENUE ANALYSIS

14.10.4 SWOT AALYSIS

14.10.5 PRODUCTION CAPACITY OVERVIEW

14.10.6 RECENT DEVELOPMENTS

14.11 TORAY INDUSTRIES INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 REVENUE ANALYSIS

14.11.4 SWOT AALYSIS

14.11.5 PRODUCTION CAPACITY OVERVIEW

14.11.6 RECENT DEVELOPMENTS

14.12 SOLVAY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 REVENUE ANALYSIS

14.12.4 SWOT AALYSIS

14.12.5 PRODUCTION CAPACITY OVERVIEW

14.12.6 RECENT DEVELOPMENTS

14.13 EASTMAN CHEMICAL CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 REVENUE ANALYSIS

14.13.4 SWOT AALYSIS

14.13.5 PRODUCTION CAPACITY OVERVIEW

14.13.6 RECENT DEVELOPMENTS

14.14 DIC CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 REVENUE ANALYSIS

14.14.4 SWOT AALYSIS

14.14.5 PRODUCTION CAPACITY OVERVIEW

14.14.6 RECENT DEVELOPMENTS

14.15 THE LUBRIZOL CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 REVENUE ANALYSIS

14.15.4 SWOT AALYSIS

14.15.5 PRODUCTION CAPACITY OVERVIEW

14.15.6 RECENT DEVELOPMENTS

14.16 MOMENTIVE PERFORMANCE MATERIALS INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 REVENUE ANALYSIS

14.16.4 SWOT AALYSIS

14.16.5 PRODUCTION CAPACITY OVERVIEW

14.16.6 RECENT DEVELOPMENTS

14.17 CELANESE CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 REVENUE ANALYSIS

14.17.4 SWOT AALYSIS

14.17.5 PRODUCTION CAPACITY OVERVIEW

14.17.6 RECENT DEVELOPMENTS

14.18 OLIN CORPORATION

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 REVENUE ANALYSIS

14.18.4 SWOT AALYSIS

14.18.5 PRODUCTION CAPACITY OVERVIEW

14.18.6 RECENT DEVELOPMENTS

14.19 WACKER CHEMIE AG

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 REVENUE ANALYSIS

14.19.4 SWOT AALYSIS

14.19.5 PRODUCTION CAPACITY OVERVIEW

14.19.6 RECENT DEVELOPMENTS

14.2 HEXION INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 REVENUE ANALYSIS

14.20.4 SWOT AALYSIS

14.20.5 PRODUCTION CAPACITY OVERVIEW

14.20.6 RECENT DEVELOPMENTS

15 RELATED REPORTS

16 QUESTIONNAIRE

17 ABOUT DATA BRIDGE MARKET RESEARCH

Global Coating Resins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coating Resins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coating Resins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.