Global Cocoa Nibs Market

Market Size in USD Billion

CAGR :

%

USD

1.87 Billion

USD

3.38 Billion

2025

2033

USD

1.87 Billion

USD

3.38 Billion

2025

2033

| 2026 –2033 | |

| USD 1.87 Billion | |

| USD 3.38 Billion | |

|

|

|

|

Cocoa Nibs Market Size

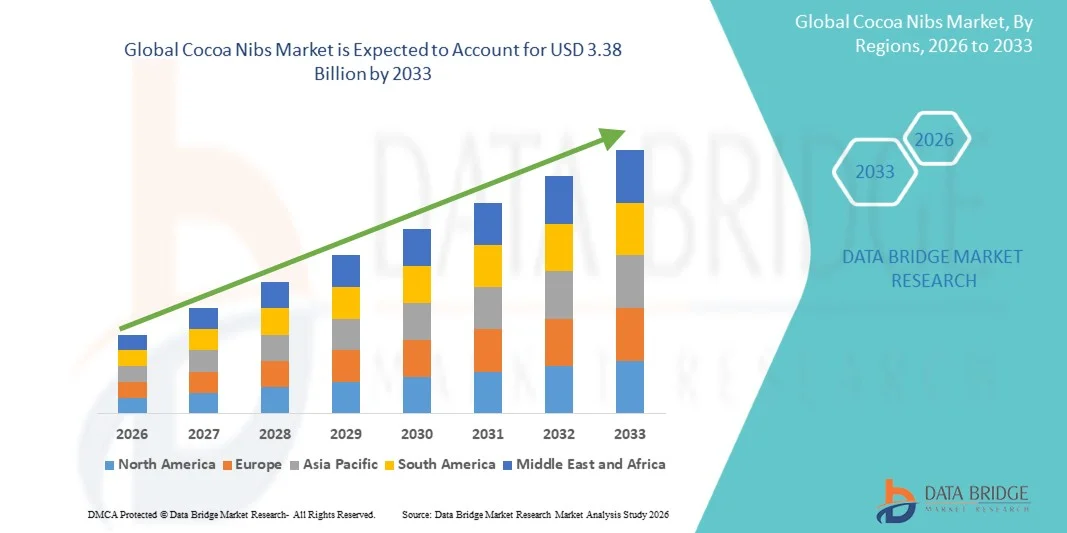

- The global cocoa nibs market size was valued at USD 1.87 billion in 2025 and is expected to reach USD 3.38 billion by 2033, at a CAGR of 7.68% during the forecast period

- The market growth is largely fueled by the rising consumer preference for natural, minimally processed, and nutrient-rich food ingredients, positioning cocoa nibs as a clean-label alternative to conventional chocolate products across food and beverage applications

- Furthermore, increasing demand for functional foods, premium chocolates, and plant-based formulations, combined with growing awareness of the antioxidant and health benefits of cocoa nibs, is accelerating their adoption across both industrial and household consumption, thereby supporting sustained market expansion

Cocoa Nibs Market Analysis

- Cocoa nibs, derived from crushed cocoa beans and retaining a high concentration of flavonoids and natural cocoa solids, are increasingly recognized as a versatile ingredient across bakery, confectionery, beverages, and health-focused food products due to their intense flavor and nutritional profile

- The escalating demand for cocoa nibs is primarily driven by the expansion of premium and artisanal food segments, growing health consciousness among consumers, and rising incorporation of cocoa-based ingredients in functional foods and clean-label product formulations

- North America dominated the cocoa nibs market with a share of 35% in 2025, due to strong demand for natural and minimally processed ingredients across the food and beverage industry

- Asia-Pacific is expected to be the fastest growing region in the cocoa nibs market during the forecast period due to rising urbanization, expanding middle-class population, and increasing awareness of functional and healthy foods

- Food industry segment dominated the market with a market share of 49.1% in 2025, due to the extensive use of cocoa nibs in bakery products, confectionery, cereals, snacks, and artisanal chocolates. Growing consumer preference for minimally processed, natural, and antioxidant-rich ingredients has strengthened the adoption of cocoa nibs as a healthier alternative to conventional chocolate chips. Food manufacturers increasingly incorporate cocoa nibs to enhance texture, flavor intensity, and nutritional value, supporting sustained demand. The versatility of cocoa nibs across both mass-market and premium food formulations further reinforces the segment’s leading position

Report Scope and Cocoa Nibs Market Segmentation

|

Attributes |

Cocoa Nibs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cocoa Nibs Market Trends

“Rising Demand for Clean-Label and Minimally Processed Cocoa Ingredients”

- A key trend in the cocoa nibs market is the rising demand for clean-label and minimally processed cocoa ingredients, driven by increasing consumer awareness around natural foods, transparency, and reduced processing. Cocoa nibs, produced by crushing roasted cocoa beans without extensive refining, align strongly with consumer preferences for products perceived as closer to their natural source and free from artificial additives

- For instance, companies such as Navitas Organics and Terrasoul Superfoods actively market organic cocoa nibs emphasizing non-alkalized processing and clean ingredient lists. Their positioning supports demand from health-conscious consumers seeking authentic cocoa flavor with minimal processing intervention

- The expanding use of cocoa nibs in premium bakery, confectionery, and snack products is reinforcing this trend as manufacturers aim to differentiate offerings through ingredient authenticity. Cocoa nibs provide texture and intense cocoa notes while supporting clean-label product claims

- Growth in the natural and organic food retail segment is further supporting adoption of cocoa nibs as staple ingredients in health-focused formulations. Retailers specializing in organic foods are increasing shelf space for cocoa nib-based products

- Artisanal chocolate makers are incorporating cocoa nibs into bars and inclusions to highlight origin-specific cocoa characteristics and processing transparency. This strengthens consumer trust and supports premium pricing strategies

- The sustained focus on ingredient simplicity and minimal processing is reinforcing cocoa nibs as a preferred cocoa format across health, gourmet, and specialty food segments, supporting long-term market expansion

Cocoa Nibs Market Dynamics

Driver

“Growing Preference for Functional Foods with Nutritional Benefits”

- The growing preference for functional foods with nutritional benefits is a major driver for the cocoa nibs market, supported by rising interest in products offering antioxidants, fiber, and plant-based nutrients. Cocoa nibs are naturally rich in flavonoids, minerals, and healthy fats, positioning them well within functional and wellness-oriented diets

- For instance, Barry Callebaut promotes cocoa ingredients with documented flavanol content to support health-focused applications in snacks and beverages. This approach encourages food manufacturers to incorporate cocoa nibs into functional product portfolios

- Increasing consumer focus on heart health, energy support, and mood enhancement is contributing to demand for cocoa nibs as a functional ingredient. Their association with natural cocoa benefits enhances appeal among wellness-driven consumers

- The growth of plant-based and clean nutrition trends is expanding the use of cocoa nibs in smoothies, granola, protein bars, and dairy alternatives. These applications strengthen cocoa nib relevance across multiple functional food categories

- The continued convergence of nutrition and indulgence is reinforcing this driver and positioning cocoa nibs as a functional yet flavorful ingredient supporting sustained market growth

Restraint/Challenge

“Volatility in Cocoa Bean Prices and Supply Chain Disruptions”

- The cocoa nibs market faces challenges from volatility in cocoa bean prices and recurring supply chain disruptions, largely influenced by climatic conditions, crop diseases, and geopolitical factors in major cocoa-producing regions. These fluctuations directly affect raw material availability and cost structures for cocoa nib manufacturers

- For instance, organizations such as the International Cocoa Organization regularly report supply constraints linked to weather variability in West Africa, impacting global cocoa pricing. Such conditions create uncertainty for companies sourcing cocoa beans for nib production

- Rising input costs place pressure on manufacturers to balance pricing competitiveness with margin stability. Smaller processors and specialty brands are particularly exposed to prolonged periods of high cocoa prices

- Logistical disruptions and transportation delays further complicate consistent supply, affecting production planning and inventory management. These challenges can limit the ability of suppliers to meet growing demand in a timely manner

- Ongoing price volatility and supply risks continue to restrain market predictability, requiring manufacturers to adopt risk mitigation strategies to sustain operations and market growth

Cocoa Nibs Market Scope

The market is segmented on the basis of application, end use, type, and packaging type.

• By Application

On the basis of application, the cocoa nibs market is segmented into food industry, beverage industry, and cosmetics. The food industry segment dominated the market with the largest revenue share of 49.1% in 2025, driven by the extensive use of cocoa nibs in bakery products, confectionery, cereals, snacks, and artisanal chocolates. Growing consumer preference for minimally processed, natural, and antioxidant-rich ingredients has strengthened the adoption of cocoa nibs as a healthier alternative to conventional chocolate chips. Food manufacturers increasingly incorporate cocoa nibs to enhance texture, flavor intensity, and nutritional value, supporting sustained demand. The versatility of cocoa nibs across both mass-market and premium food formulations further reinforces the segment’s leading position.

The beverage industry segment is anticipated to register the fastest growth during the forecast period, supported by rising demand for functional beverages, plant-based drinks, and specialty cocoa-infused beverages. Cocoa nibs are gaining traction in smoothies, dairy alternatives, and craft beverages due to their natural cocoa flavor and perceived health benefits. Increasing innovation by beverage brands focused on clean-label and superfood positioning is expected to accelerate growth in this segment.

• By End Use

On the basis of end use, the cocoa nibs market is segmented into retail, food services, and online sales. The retail segment accounted for the largest market share in 2025, driven by the wide availability of cocoa nibs through supermarkets, specialty food stores, and health food retailers. Growing consumer awareness regarding the nutritional benefits of cocoa nibs and their use in home baking and cooking has supported strong retail sales. Attractive packaging, private-label offerings, and increased shelf presence in premium and organic food sections continue to boost this segment.

The online sales segment is expected to witness the fastest growth rate over the forecast period, driven by expanding e-commerce penetration and rising consumer preference for convenient purchasing options. Online platforms enable access to a broader range of product variants, including organic, single-origin, and flavored cocoa nibs. Competitive pricing, subscription models, and direct-to-consumer strategies adopted by manufacturers are further accelerating growth in this segment.

• By Type

On the basis of type, the cocoa nibs market is segmented into raw cocoa nibs, roasted cocoa nibs, and flavored cocoa nibs. The roasted cocoa nibs segment dominated the market in 2025, driven by their enhanced flavor profile, reduced bitterness, and wider acceptance across food and beverage applications. Roasting improves aroma and taste, making these nibs highly preferred by chocolatiers, bakers, and beverage manufacturers. Consistent quality, longer shelf life, and ease of incorporation into formulations further contribute to the dominance of this segment.

The flavored cocoa nibs segment is projected to grow at the fastest pace during the forecast period, supported by increasing consumer interest in innovative and indulgent flavor combinations. Variants infused with spices, fruits, and natural sweeteners appeal to younger consumers and premium product categories. The rising demand for differentiated snack toppings and gourmet food products is expected to drive rapid expansion of this segment.

• By Packaging Type

On the basis of packaging type, the cocoa nibs market is segmented into bulk packaging, retail packaging, and custom packaging. The bulk packaging segment held the largest revenue share in 2025, driven by high demand from food manufacturers, bakeries, and food service providers purchasing cocoa nibs in large volumes. Bulk packaging offers cost efficiency, reduced packaging waste, and streamlined supply chain operations, making it the preferred choice for commercial users. Long-term supply contracts and consistent industrial demand further strengthen this segment’s position.

The retail packaging segment is expected to witness the fastest growth during the forecast period, driven by rising household consumption and increasing demand for conveniently packaged, ready-to-use cocoa nibs. Attractive labeling, resealable packs, and portion-controlled formats appeal to health-conscious and premium consumers. Growth in specialty retail and online channels is expected to further support rapid expansion of retail packaging solutions.

Cocoa Nibs Market Regional Analysis

- North America dominated the cocoa nibs market with the largest revenue share of 35% in 2025, driven by strong demand for natural and minimally processed ingredients across the food and beverage industry

- Consumers in the region increasingly prefer cocoa nibs due to their antioxidant content, clean-label appeal, and versatility in bakery, snacks, cereals, and functional foods

- This widespread adoption is further supported by high health awareness, strong presence of premium chocolate manufacturers, and rising consumption of plant-based and organic food products, reinforcing North America’s leadership position

U.S. Cocoa Nibs Market Insight

The U.S. cocoa nibs market captured the largest revenue share in 2025 within North America, supported by robust demand from artisanal chocolate makers, health-focused food brands, and home bakers. Growing interest in superfoods, dark chocolate formulations, and protein-rich snacks is accelerating cocoa nib adoption. The strong retail network, coupled with rapid growth in online specialty food platforms, continues to propel market expansion in the country.

Europe Cocoa Nibs Market Insight

The Europe cocoa nibs market is projected to expand at a substantial CAGR during the forecast period, driven by increasing consumption of premium chocolate, bakery products, and organic foods. Strong regulatory emphasis on food quality and clean ingredients supports the use of cocoa nibs across food processing industries. Rising demand from countries with established chocolate cultures is further supporting regional growth.

U.K. Cocoa Nibs Market Insight

The U.K. cocoa nibs market is anticipated to grow at a notable CAGR, driven by increasing demand for healthy snacking options and plant-based diets. Consumers are increasingly incorporating cocoa nibs into breakfast foods, desserts, and beverages. The country’s strong specialty retail and e-commerce ecosystem further supports product accessibility and market growth.

Germany Cocoa Nibs Market Insight

The Germany cocoa nibs market is expected to grow steadily during the forecast period, supported by high consumption of bakery and confectionery products and a strong preference for organic and sustainably sourced ingredients. Germany’s well-established food processing industry and focus on premium quality products are encouraging the use of cocoa nibs in both industrial and artisanal applications.

Asia-Pacific Cocoa Nibs Market Insight

The Asia-Pacific cocoa nibs market is expected to grow at the fastest CAGR during the forecast period, driven by rising urbanization, expanding middle-class population, and increasing awareness of functional and healthy foods. Growth in bakery, confectionery, and beverage industries across emerging economies is significantly contributing to market expansion.

Japan Cocoa Nibs Market Insight

The Japan cocoa nibs market is witnessing steady growth due to increasing demand for premium chocolates, functional foods, and innovative confectionery products. Japanese consumers value high-quality, nutrient-rich ingredients, supporting the adoption of cocoa nibs. The integration of cocoa nibs into health-oriented snacks and desserts is further driving market growth.

China Cocoa Nibs Market Insight

The China cocoa nibs market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, growing disposable incomes, and expanding demand for premium and imported food products. Increasing consumption of chocolate-based snacks, bakery products, and health foods is accelerating cocoa nib adoption. Strong growth in e-commerce and domestic food manufacturing continues to support market expansion in China.

Cocoa Nibs Market Share

The cocoa nibs industry is primarily led by well-established companies, including:

- Cargill Incorporated (U.S.)

- Urban Platter (India)

- Barry Callebaut (Switzerland)

- NOW Foods (U.S.)

- Puratos Group (Belgium)

- Cocoa Family (U.S.)

- Valrhona (France)

- BMV Cocoa (Netherlands)

- Sunfood (U.S.)

- Olam Group (Singapore)

- Navitas Organics (U.S.)

- ECOM Agroindustrial Corp. Limited (Switzerland)

- United Cocoa Processor, Inc. (U.S.)

- Viva Naturals (U.S.)

- CocoaSupply – Fine Cocoa Products Corp. (U.S.)

Latest Developments in Global Cocoa Nibs Market

- In July 2024, Lindt & Sprüngli completed a USD 105.2 million expansion of its Cocoa Center in Olten, Switzerland, significantly strengthening its cocoa processing and supply capabilities across Europe. The expansion doubled production capacity compared to 2017 levels and enhances the company’s ability to supply cocoa mass to multiple European manufacturing sites. The use of roasted cocoa nibs processed through proprietary techniques before milling highlights the strategic importance of nib quality and processing efficiency, supporting consistent product quality and reinforcing Lindt’s position in the premium chocolate and cocoa ingredients market

- In April 2024, Barry Callebaut launched MALEO, an intensely colored cocoa powder with a rich flavor profile, at an event in Kuala Lumpur, Malaysia, marking a strategic innovation in cocoa-based ingredients. The product enables manufacturers to achieve greater indulgence with lower usage levels, improving cost efficiency while enhancing sensory appeal. This launch strengthens Barry Callebaut’s premium ingredient portfolio and supports demand from food and beverage manufacturers seeking high-performance cocoa products, indirectly boosting the value proposition of cocoa-derived inputs, including cocoa nibs

- In January 2024, PRONATEC AG announced the acquisition of a second ball mill for cocoa mass production and expanded its portfolio to include roasted, cleaned cocoa nibs. This development increases the company’s processing capacity and broadens its organic cocoa product offerings, catering to rising demand for traceable and sustainably produced cocoa ingredients. The move reinforces PRONATEC’s position in the organic cocoa value chain and supports growing market demand for high-quality cocoa nibs in food manufacturing

- In June 2022, PRONATEC Swiss Cocoa Production completed the test phase of Switzerland’s first fully organic cocoa-processing plant, dedicated exclusively to organic and fair-trade certified semi-finished cocoa products. The facility’s focus on producing organic cocoa mass, cocoa butter, cocoa powder, and cocoa nibs strengthens supply availability for certified organic ingredients. This milestone supports the long-term growth of the organic cocoa nibs segment by ensuring consistent production aligned with sustainability and ethical sourcing standards

- In December 2021, Montano’s Chocolate Co Ltd launched its Chocolate Factory in Arouca, Trinidad and Tobago, to enhance production of dark chocolate, cocoa powder, cocoa butter, and cocoa nibs. The facility expansion supports greater value addition at origin and strengthens local cocoa processing capabilities. This development contributes to regional market growth by increasing the availability of premium cocoa nibs and reinforcing the role of origin-based processing in the global cocoa nibs supply chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cocoa Nibs Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cocoa Nibs Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cocoa Nibs Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.