Global Coffee And Tea Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

206.10 Billion

USD

310.36 Billion

2025

2033

USD

206.10 Billion

USD

310.36 Billion

2025

2033

| 2026 –2033 | |

| USD 206.10 Billion | |

| USD 310.36 Billion | |

|

|

|

|

Coffee and Tea Manufacturing Market Size

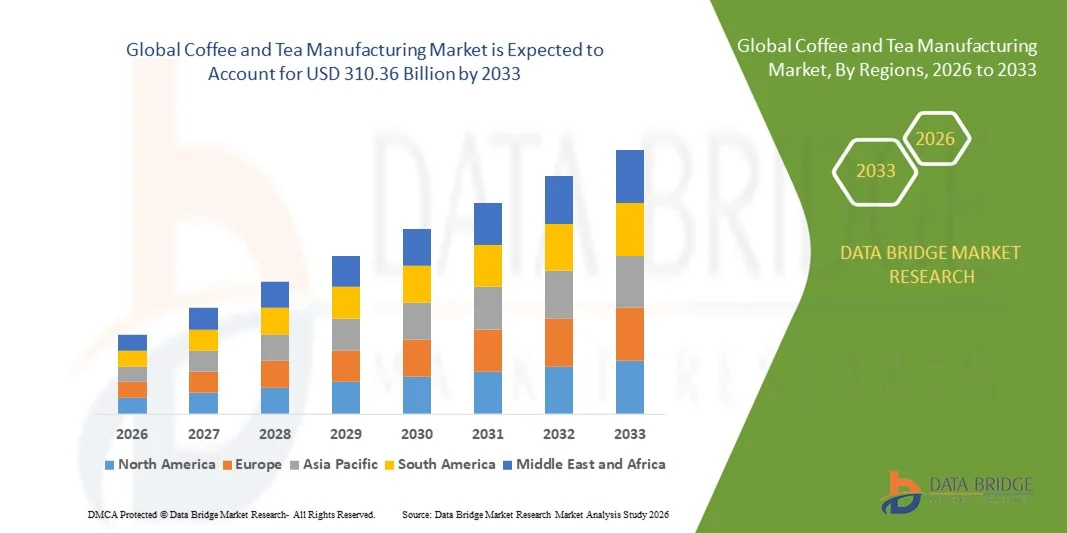

- The global coffee and tea manufacturing market size was valued at USD 206.10 billion in 2025 and is expected to reach USD 310.36 billion by 2033, at a CAGR of 5.25% during the forecast period

- The market growth is largely fuelled by the increasing consumer preference for premium, organic, and specialty beverages that offer unique flavor profiles and health benefits

- Rising café culture, urbanization, and growing demand for ready-to-drink (RTD) beverages are further accelerating consumption across both developed and emerging markets

Coffee and Tea Manufacturing Market Analysis

- The coffee and tea manufacturing market is witnessing a significant shift toward sustainable sourcing, ethical production practices, and traceability across the supply chain. Consumers are increasingly seeking products that align with environmental and social responsibility standards

- Manufacturers are focusing on innovation in flavor blends, plant-based infusions, and functional beverages infused with ingredients such as adaptogens, collagen, and probiotics to meet evolving health-conscious demands

- North America dominated the coffee and tea manufacturing market with the largest revenue share of 38.64% in 2025, driven by the strong café culture, rising consumption of premium beverages, and the growing popularity of specialty coffee and tea products among health-conscious consumers

- Asia-Pacific region is expected to witness the highest growth rate in the global coffee and tea manufacturing market, driven by increasing disposable incomes, rapid urbanization, and a rising trend of modern retail and e-commerce channels

- The coffee segment held the largest market revenue share in 2025, driven by its strong global consumption, growing café culture, and increasing demand for premium and specialty coffee varieties. The rising popularity of cold brews, instant coffee, and ready-to-drink (RTD) beverages further supports segment growth, especially among younger consumers seeking convenience and flavor diversity

Report Scope and Coffee and Tea Manufacturing Market Segmentation

|

Attributes |

Coffee and Tea Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Coffee and Tea Manufacturing Market Trends

Rising Demand For Premium And Specialty Beverages

- The growing consumer preference for high-quality, artisanal, and specialty coffee and tea products is reshaping the global beverage industry. Consumers are increasingly willing to pay more for superior taste, ethical sourcing, and distinctive flavor profiles, driving strong growth in the premium segment. This trend is particularly prominent in urban areas where café culture continues to thrive, especially in developed markets such as the U.S., Japan, and Western Europe where demand for luxury beverages is steadily rising

- The surge in single-origin coffee and specialty tea consumption has encouraged manufacturers to expand their product portfolios with gourmet offerings. Companies are investing in advanced brewing techniques and sustainable packaging solutions to attract environmentally conscious consumers while enhancing brand value. The shift toward traceability and ethical farming practices also plays a crucial role in maintaining customer trust and supporting sustainable growth

- In addition, the growing influence of social media and digital marketing campaigns has amplified awareness of specialty beverages, inspiring consumers to explore unique blends and limited-edition variants. The rise of direct-to-consumer (D2C) brands is also making premium coffee and tea more accessible across regions. Subscription models and online marketplaces have further simplified access, offering consumers personalized beverage experiences at their convenience

- For instance, in 2024, major beverage brands introduced limited-edition cold brew coffee lines and matcha-based teas targeting young professionals seeking convenient yet indulgent refreshment options. These innovations have boosted retail and online sales while promoting consumer experimentation. Furthermore, collaborations between coffee roasters and tea blenders are creating hybrid beverages that cater to evolving taste preferences and seasonal demand

- While the demand for premium beverages is rising steadily, manufacturers must focus on consistent quality, transparent sourcing, and innovative product formats to sustain long-term consumer loyalty and competitive differentiation. Maintaining authenticity and cultural connection to origin countries is also vital for retaining brand integrity in an increasingly competitive global market

Coffee and Tea Manufacturing Market Dynamics

Driver

Growing Health Awareness and Shift Toward Natural Beverages

- The rising global health consciousness is driving consumers toward natural, antioxidant-rich beverages such as coffee and tea. Both drinks are perceived as healthier alternatives to sugary sodas and energy drinks, which has significantly boosted their consumption among health-focused populations. Functional beverages with added health benefits such as digestion support and mental clarity are gaining attention in both developed and emerging markets

- The popularity of green tea, herbal infusions, and low-caffeine blends has surged as consumers seek functional benefits, including improved metabolism, stress relief, and immune support. This trend is especially strong among millennials and Gen Z, who are shaping future consumption patterns. These consumers are also seeking clean, natural products with minimal additives, encouraging brands to reformulate existing offerings with plant-based ingredients

- Beverage companies are actively promoting the health attributes of their products through clean-label marketing and transparent ingredient sourcing. The use of organic, fair-trade, and pesticide-free raw materials has further strengthened consumer trust and brand loyalty. In addition, many brands are emphasizing sustainable farming and ethical trade practices, aligning health-focused consumption with environmental responsibility

- For instance, in 2023, several tea producers in Japan and India launched wellness-focused blends infused with adaptogenic herbs, resulting in a substantial rise in global exports and retail demand for herbal teas. The integration of Ayurvedic and traditional Chinese medicine-inspired formulations has also created new opportunities for product differentiation. These blends are increasingly available through online health platforms and specialized retail stores

- Although health awareness continues to drive the market forward, producers must ensure scientific validation of health claims and maintain affordability to attract a wider customer base across developing regions. As competition intensifies, balancing product innovation with accessibility will remain key to achieving sustainable growth and maintaining consumer confidence globally

Restraint/Challenge

Volatility in Raw Material Prices and Supply Chain Disruptions

- Fluctuations in coffee and tea crop yields due to changing climatic conditions significantly impact global supply stability and pricing. Extreme weather events, such as droughts and heavy rainfall, often lead to reduced harvests and increased procurement costs for manufacturers. Climate change has also altered traditional growing regions, forcing producers to adapt to new agronomic practices and invest in resilient crop varieties

- Smallholder farmers, who contribute to a major portion of global coffee and tea production, are particularly vulnerable to price instability. As a result, inconsistent raw material availability can disrupt production planning and profitability for beverage producers. This dependency has led to efforts toward cooperative farming models and contract farming agreements to ensure more stable supply chains and equitable returns

- The rising cost of transportation, energy, and packaging materials further adds to operational challenges. Supply chain disruptions caused by geopolitical tensions and trade restrictions can also delay shipments, affecting product availability in key markets. Manufacturers are therefore diversifying sourcing networks and adopting regional processing hubs to reduce dependency on single-country suppliers

- For instance, in 2023, the global coffee industry experienced price spikes following poor harvests in Brazil and logistical bottlenecks in shipping routes, leading to higher retail prices across North America and Europe. Similar effects were seen in the tea sector due to port congestion and fertilizer shortages in Asia, underscoring the fragility of global trade networks. These fluctuations have intensified the need for flexible procurement strategies

- While volatility remains a major concern, investments in climate-resilient agriculture, diversified sourcing strategies, and long-term supplier partnerships are essential to mitigate risks and ensure consistent product supply. Developing digital traceability systems and supporting farmer training programs can also strengthen resilience and transparency across the global coffee and tea value chain

Coffee and Tea Manufacturing Market Scope

The market is segmented on the basis of type, distribution channel, form, and packaging.

- By Type

On the basis of type, the coffee and tea manufacturing market is segmented into coffee and tea. The coffee segment held the largest market revenue share in 2025, driven by its strong global consumption, growing café culture, and increasing demand for premium and specialty coffee varieties. The rising popularity of cold brews, instant coffee, and ready-to-drink (RTD) beverages further supports segment growth, especially among younger consumers seeking convenience and flavor diversity.

The tea segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising health awareness and the growing preference for herbal and functional teas. The demand for green, black, and specialty teas is expanding rapidly across both developed and emerging economies, supported by innovations in flavor, packaging, and organic product offerings.

- By Distribution Channel

On the basis of distribution channel, the coffee and tea manufacturing market is segmented into supermarkets/hypermarkets, convenience stores, e-commerce, and others. The supermarkets/hypermarkets segment held the largest market revenue share in 2025, attributed to the wide product variety, strong brand visibility, and promotional offers available through these retail formats. Consumers prefer in-store purchases for their ability to compare multiple brands and access fresh stock conveniently.

The e-commerce segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rapid adoption of online shopping platforms and subscription-based coffee and tea delivery services. Increasing internet penetration and the expansion of direct-to-consumer (D2C) brands are making premium and niche beverage products more accessible to global consumers.

- By Form

On the basis of form, the coffee and tea manufacturing market is segmented into liquid, powder, and capsules. The liquid segment held the largest market revenue share in 2025, owing to the surge in demand for ready-to-drink (RTD) beverages and bottled cold brews. The convenience and portability of liquid coffee and tea products have made them highly popular in urban settings, especially among on-the-go consumers.

The capsules segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing adoption of single-serve brewing systems and home coffee machines. Capsule-based beverages offer consistent quality, variety, and minimal preparation time, making them ideal for premium and household consumption.

- By Packaging

On the basis of packaging, the coffee and tea manufacturing market is segmented into containers, bags, packets, and pouches. The containers segment held the largest market revenue share in 2025 due to their durability, reusability, and ability to preserve product freshness and aroma over extended periods. These are widely used for premium and bulk coffee and tea products, especially in retail and commercial applications.

The pouches segment is expected to witness the fastest growth rate from 2026 to 2033, propelled by increasing demand for lightweight, cost-effective, and sustainable packaging solutions. The flexibility and convenience offered by pouches make them suitable for single-use or travel-friendly portions, aligning with modern consumer lifestyles and eco-conscious preferences.

Coffee and Tea Manufacturing Market Regional Analysis

- North America dominated the coffee and tea manufacturing market with the largest revenue share of 38.64% in 2025, driven by the strong café culture, rising consumption of premium beverages, and the growing popularity of specialty coffee and tea products among health-conscious consumers

- Consumers in the region highly value ethically sourced, sustainably produced beverages, and are increasingly drawn to organic and fair-trade options. The demand for convenient, ready-to-drink formats and single-serve capsules is further accelerating market growth across urban populations

- This robust consumption trend is supported by the presence of leading global brands, well-established retail networks, and high disposable incomes, making North America a key hub for innovation and product diversification within the coffee and tea industry

U.S. Coffee and Tea Manufacturing Market Insight

The U.S. coffee and tea manufacturing market captured the largest revenue share in 2025 within North America, fuelled by the growing demand for premium, artisanal beverages and an expanding café and coffeehouse culture. Consumers are increasingly embracing cold brews, flavored teas, and organic blends, reflecting a strong shift toward healthier and customizable options. The market is also benefitting from rapid e-commerce expansion and the rising influence of specialty roasters. In addition, strategic collaborations between beverage brands and online delivery platforms are boosting sales and accessibility across diverse demographics.

Europe Coffee and Tea Manufacturing Market Insight

The Europe coffee and tea manufacturing market is expected to witness steady growth from 2026 to 2033, primarily driven by the region’s strong cultural association with tea consumption and the growing popularity of specialty coffee. The increasing focus on sustainable sourcing and environmentally friendly packaging is further shaping consumer preferences. European consumers are also gravitating toward organic and low-caffeine options, encouraging manufacturers to expand wellness-oriented product portfolios. The rise in café chains, ready-to-drink products, and home brewing technologies is further stimulating market expansion across major European economies.

U.K. Coffee and Tea Manufacturing Market Insight

The U.K. coffee and tea manufacturing market is expected to witness significant growth from 2026 to 2033, fuelled by evolving consumer preferences toward premium coffee experiences and functional tea products. The growing café culture and demand for health-oriented beverages are contributing to market expansion. Furthermore, the increasing adoption of e-commerce channels and subscription-based coffee delivery services has enhanced accessibility for consumers. The U.K. market’s focus on ethical sourcing and sustainable packaging continues to attract environmentally conscious buyers.

Germany Coffee and Tea Manufacturing Market Insight

The Germany coffee and tea manufacturing market is expected to witness robust growth from 2026 to 2033, driven by a rising preference for organic, fair-trade, and specialty coffee varieties. German consumers are highly focused on product quality, aroma, and environmental impact, prompting manufacturers to adopt sustainable farming and production practices. The increasing demand for plant-based and functional beverages is also creating new opportunities for innovative product launches. The strong presence of local roasters and premium tea brands further supports market development in the country.

Asia-Pacific Coffee and Tea Manufacturing Market Insight

The Asia-Pacific coffee and tea manufacturing market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising disposable incomes, rapid urbanization, and increasing consumption of Western-style beverages. Countries such as China, India, and Japan are leading the regional demand due to their expanding café culture and growing interest in premium and health-oriented drinks. Government initiatives promoting agricultural modernization and sustainable farming practices are further strengthening the market. In addition, APAC’s growing middle-class population and online retail growth are making specialty coffee and tea products more accessible.

Japan Coffee and Tea Manufacturing Market Insight

The Japan coffee and tea manufacturing market is expected to witness steady growth from 2026 to 2033, supported by the country’s deep-rooted tea culture and the rising popularity of premium coffee products. The Japanese market emphasizes product innovation, with manufacturers offering unique blends and ready-to-drink formats tailored to busy consumers. The demand for matcha-based beverages, cold brews, and sugar-free tea variants continues to increase. Moreover, the combination of traditional tea preferences and modern coffee trends is expanding market diversity across the region.

China Coffee and Tea Manufacturing Market Insight

The China coffee and tea manufacturing market accounted for the largest revenue share in Asia-Pacific in 2025, driven by the country’s strong tea heritage and growing adoption of coffee among younger consumers. Urbanization and the rise of specialty coffee shops are transforming beverage consumption patterns. Consumers are showing a growing interest in premium, flavored, and health-focused products, such as green and oolong teas. Furthermore, the increasing presence of international brands and e-commerce platforms is enhancing accessibility, making China a key growth market for both tea and coffee manufacturers.

Coffee and Tea Manufacturing Market Share

The Coffee and Tea Manufacturing industry is primarily led by well-established companies, including:

• PepsiCo (U.S.)

• HNC Healthy Nutrition Company (U.K.)

• Glanbia plc (Ireland)

• Farmer Bros. Co. (U.S.)

• Keurig Dr Pepper Inc. (U.S.)

• The J.M. Smucker Company (U.S.)

• ITO EN, LTD. (Japan)

• Nestlé (Switzerland)

• maxingvest ag (Germany)

• Starbucks Coffee Company (U.S.)

• Strauss Coffee B.V. (Netherlands)

• Unilever (U.K.)

• SUNTORY HOLDINGS LIMITED. (Japan)

• Louis Dreyfus Company (Netherlands)

• Tata Sons Private Limited (India)

• The Kraft Heinz Company (U.S.)

• Uni-President (Taiwan)

• Monster Energy Company (U.S.)

• Danone (France)

• Asahi Group Holdings, Ltd. (Japan)

• AriZona Beverages USA (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coffee And Tea Manufacturing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coffee And Tea Manufacturing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coffee And Tea Manufacturing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.